Marks completion of the conversion of the

BlackRock High Yield Municipal Fund into the iShares High Yield

Muni Active ETF

Today, BlackRock announced the conversion of the BlackRock High

Yield Municipal Fund into an active ETF, creating the iShares® High

Yield Muni Active ETF (CBOE: HIMU). HIMU harnesses the expertise of

BlackRock’s Municipal Bond Group to provide more choice and

flexibility to clients seeking high yield, tax-exempt solutions in

the convenience of an ETF.

“Today’s higher interest rate environment provides a

generational opportunity to capture income, particularly in the

municipal bond market,” said Pat Haskell, Head of the Municipal

Bond Group at BlackRock. “Through the ETF wrapper, HIMU aims to

take advantage of the attractive yield levels and strong credit

quality in municipal bonds, delivering alpha to our clients in an

efficient and transparent manner.”

The new ETF seeks to maintain identical investment objectives

and fundamental investment policies as its predecessor mutual fund.

HIMU aims to maximize federal tax-exempt current income and capital

appreciation by investing in high yield municipal securities across

a variety of sectors. The mutual fund was launched in 2006 and

delivered top quartile performance over the one-, five-, ten- and

fifteen-year periods as of December 31, 2024.1

HIMU leverages the scale of BlackRock’s Municipal Bond Group,

which manages over $182 billion in assets across a wide range of

diversified strategies, including regions, states, local

governments, sectors, sub-sectors and issuers.2

iShares® High Yield Muni

Active ETF

Ticker

HIMU

Performance Benchmark

A customized weighted index comprised of

20% Bloomberg Municipal Bond Rated Baa Index/60% Bloomberg

Municipal Bond: High Yield (non-Investment Grade) Total Return

Index/20% Bloomberg Municipal Investment Grade ex BBB (the “High

Yield Customized Reference Benchmark”)

Portfolio Managers

Pat Haskell, Kevin Maloney, Ryan McDonald,

Phillip Soccio, Walter O’Connor

Furthers BlackRock’s Commitment to Active ETFs

“The growth of active ETFs is driving innovation and unlocking

new opportunities for investors globally,” said Jorge del Valle

Papic, Americas Head of Active Investments within Global Product

Solutions at BlackRock. “This conversion underscores the

strength of our product platform and our dedication to offering

access to BlackRock’s premier active management capabilities

through an investment vehicle that aligns with our clients’

evolving needs.”

BlackRock projects that global active ETF assets under

management will surge to $4 trillion by 2030, a more than four-fold

increase from $900 billion through June 2024.3 BlackRock manages

$37 billion in assets across 50 active ETFs in the U.S.4

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1500+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of December 31, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or

www.blackrock.com. Read the prospectus carefully before

investing.

Investing involves risks, including possible loss of

principal.

Prior to close of business on 02/07/2025, the Fund operated as

an open-end mutual fund. The Fund has an identical investment

objective and substantially similar investment strategies and

investment risk profiles as the predecessor mutual fund.

Performance for the periods prior to 02/10/2025 discussed above

is based upon the results of the predecessor mutual fund, the

BlackRock High Yield Municipal Fund. Please refer to the current

prospectus for further information.

Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding

decline in the value of debt securities. Credit risk refers to the

possibility that the debt issuer will not be able to make principal

and interest payments.

There may be less information on the financial condition of

municipal issuers than for public corporations. The market for

municipal bonds may be less liquid than for taxable bonds. Some

investors may be subject to federal or state income taxes or the

Alternative Minimum Tax (AMT). Capital gains distributions, if any,

are taxable.

Municipal securities risks include the ability of the issuer to

repay the obligation, the relative lack of information about

certain issuers of municipal securities, and the possibility of

future legislative changes which could affect the market for and

value of municipal securities. Budgetary constraints of local,

state, and federal governments upon which the issuers may be

relying for funding may also impact municipal securities.

Non-investment-grade debt securities (high-yield/junk bonds) may

be subject to greater market fluctuations, risk of default or loss

of income and principal than higher-rated securities.

Funds that concentrate investments in specific industries,

sectors, markets or asset classes may underperform or be more

volatile than other industries, sectors, markets or asset classes

and than the general securities market.

Transactions in shares of ETFs may result in brokerage

commissions and will generate tax consequences. All regulated

investment companies are obliged to distribute portfolio gains to

shareholders. Diversification and asset allocation may not protect

against market risk or loss of principal.

Actively managed funds do not seek to replicate the performance

of a specified index, may have higher portfolio turnover, and may

charge higher fees than index funds due to increased trading and

research expenses.

There can be no assurance that an active trading market for

shares of an ETF will develop or be maintained.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK and iSHARES are trademark of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

_______________________________ 1 Past performance does not

guarantee future results; BlackRock, as of 12/31/2024;

Morningstar, as of 1/30/2025. The Morningstar peer group is the

High Yield Muni fund category comprised of 193 funds for the 1-year

period, 175 funds for the 5-year period, 119 funds for the 10-year

period, and 80 funds for the 15-year period. The Morningstar

category average is designed to represent the average return of

funds within a category for a period. 2 BlackRock, as of

12/31/2024. 3 BlackRock, as of March 31, 2024. Estimates are for

global figures and include 2027 and 2030 scenario calculations

based on proprietary research by BlackRock Global Product

Solutions. Subject to change. The figures are for illustrative

purposes only and there is no guarantee the projections will come

to pass. 4 BlackRock, as of 1/28/2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210199143/en/

Media Jenna Merchant Jenna.merchant@blackrock.com

914-329-5684

Caitlyn Guntle Caitlyn.guntle@blackrock.com

212-810-5528

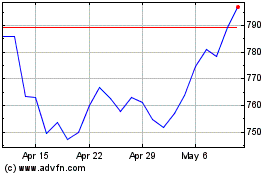

BlackRock (NYSE:BLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

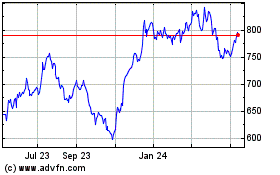

BlackRock (NYSE:BLK)

Historical Stock Chart

From Feb 2024 to Feb 2025