The new fund aims to increase investor access

to harder-to-reach fixed income sectors

Today, BlackRock expanded its active ETF platform with the

launch of the iShares BBB-B CLO Active ETF (Nasdaq: BCLO). The ETF

leverages the expertise of BlackRock’s CLO team to provide access

to a hard-to-reach asset class in the convenience and efficiency of

an ETF.

“CLOs present one of the most compelling opportunities in fixed

income today, offering lower correlation to traditional fixed

income assets and the potential for higher yields,” said Saffet

Ozbalci, Global Head of Structured Credit at BlackRock. “In the

convenience of an ETF, BCLO aims to generate income and capture

alpha opportunities, driven by the wide dispersion across

CLOs.”

BCLO aims to deliver capital preservation and current income by

investing primarily in a portfolio composed of CLOs rated from BBB+

to B-. The Fund is managed by BlackRock’s dedicated CLO investment

team that manages over $30 billion in assets globally1, including

the $680 million iShares AAA CLO Active ETF (CLOA).2

Fund Name

Ticker

Portfolio Managers

Total Expense Ratio

Benchmark

iShares BBB-B CLO Active ETF

BCLO

Saffet Ozbalci, Jason Choi, Nidhi

Patel

0.45%

JP Morgan CLO High Quality

Mezzanine Index

Furthers BlackRock’s commitment to active ETFs

BlackRock projects that global active ETF assets under

management will surge to $4 trillion by 2030 — a more than

four-fold increase in about six years.3

Advisors are continuing to use active ETFs as building blocks in

model portfolios, with fixed income ETFs making up the largest

segment of active ETF model usage.4 In addition, active ETFs can

help enable portfolio managers to react to changing market

conditions, providing flexibility to adjust their holdings as they

seek to outperform benchmarks or target certain investment

outcomes.

“Active ETFs have earned a place in portfolios by offering

investors a broader range of strategies and differentiated returns

through the convenience of the ETF wrapper,” said Steve Laipply,

Global Co-Head of iShares Fixed Income ETFs for BlackRock. “By

providing access to BBB-B rated CLOs, BCLO can help investors

modulate credit quality and income profiles based on the evolving

macro environment.”

BlackRock manages $37 billion in assets across over 40 active

ETFs in the U.S.5

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1500+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of December 31, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Important Information

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or

www.blackrock.com. Read the prospectus carefully before

investing.

Investing involves risk, including possible loss of

principal.

While the iShares BBB-B CLO Active ETF (the “Fund”) will invest

primarily in CLO tranches that are rated BBB -B, such ratings do

not constitute a guarantee of credit quality and may be downgraded.

In stressed market conditions, it is possible that even senior CLO

debt tranches could experience losses due to actual or perceived

defaults, and rating downgrades and forced liquidations of

underlying collateral. CLO securities may be less liquid than other

types of securities and there is no guarantee that an active

secondary market will exist or be maintained. The CLO securities in

which the Fund invests are managed by investment advisers

independent of BlackRock Fund Advisors, the Fund’s investment

manager, and an affiliate of BlackRock Investments, LLC. Any

adverse developments with respect to the CLO manager may adversely

impact the CLO securities held within the Fund.

The Fund is actively managed and does not seek to replicate the

performance of a specified index. The Fund may have a higher

portfolio turnover than funds that seek to replicate the

performance of an index.

Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding

decline in the value of debt securities. Credit risk refers to the

possibility that the debt issuer will not be able to make principal

and interest payments.

Securities with floating or variable interest rates may decline

in value if their coupon rates do not keep pace with comparable

market interest rates. The Fund’s income may decline when interest

rates fall because most of the debt instruments held by the Fund

will have floating or variable rates

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change.

The iShares and BlackRock Funds are distributed by BlackRock

Investments, LLC (together with its affiliates, “BlackRock”).

©2025 BlackRock, Inc. or its affiliates. All rights reserved.

iSHARES and BLACKROCK are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

_______________________________________ 1 Source: BlackRock, as

of December 31, 2024 2 Source: BlackRock, as of January 23, 2025. 3

Source: BlackRock, as of March 31, 2024. Estimates are for global

figures and include 2027 and 2030 scenario calculations based on

proprietary research by BlackRock Global Product Solutions. Subject

to change. The figures are for illustrative purposes only and there

is no guarantee the projections will come to pass 4 Based on the

number of model providers that use active fixed income ETFs (49)

vs. the number that use active equity ETFs (38) in the Morningstar

Categories Conservative Allocation, Moderately Conservative

Allocation, Moderate Allocation, Moderately Aggressive Allocation,

and Aggressive Allocation as of June 30, 2024. 5 BlackRock, as of

January 23, 2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130826677/en/

Media Contacts

Jenna Merchant Jenna.merchant@blackrock.com 929-348-0152

Catherine Sperl Catherine.sperl@blackrock.com 631-951-1599

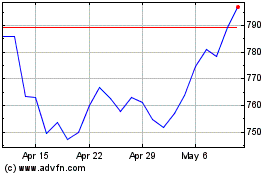

BlackRock (NYSE:BLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

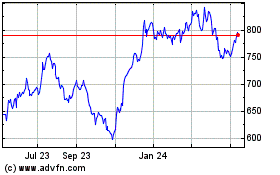

BlackRock (NYSE:BLK)

Historical Stock Chart

From Feb 2024 to Feb 2025