Blackstone Infrastructure to Acquire Safe Harbor Marinas in $5.65B Transaction

25 February 2025 - 1:24AM

Business Wire

Blackstone (NYSE: BX) announced today that funds managed by

Blackstone Infrastructure (“Blackstone”) have agreed to acquire

Safe Harbor Marinas (“Safe Harbor”), the largest marina and

superyacht servicing business in the United States, from Sun

Communities, Inc (NYSE: SUI) for $5.65 billion.

Safe Harbor owns and operates 138 marinas across the U.S. and

Puerto Rico and is the industry leader in the boat storage and

servicing industry.

Commenting on the announcement, Heidi Boyd, Senior Managing

Director in Blackstone’s infrastructure business said, “Marinas

benefit from key long-term thematic tailwinds including the growth

of travel and leisure as well as population inflows into coastal

cities. We believe Safe Harbor is the best positioned company in

this sector, and we look forward to working with their terrific

team to invest behind their existing marinas and to expand their

footprint.”

This transaction builds on Blackstone Infrastructure’s diverse

portfolio and speaks to the strong momentum of the business, which

has grown approximately 40% year-over-year since inception, now

managing $55 billion of assets (figures as of December 31, 2024).

Blackstone Infrastructure invests in leading companies in sectors

with strong tailwinds, and its portfolio companies include: QTS,

the largest data center provider in the US; AirTrunk, the largest

data center platform in the Asia-Pacific region; Carrix, the

largest marine terminal operator in North America; Invenergy, the

largest private renewables developer in the United States, among

many others.

Wells Fargo served as lead financial advisor to Blackstone

Infrastructure and provided committed financing for the

transaction, while Gibson, Dunn & Crutcher LLP and Simpson

Thacher & Bartlett LLP served as legal advisors.

About Blackstone Infrastructure

Blackstone Infrastructure is an active investor across energy,

transportation, digital infrastructure and water and waste

infrastructure sectors. We seek to apply a long-term buy-and-hold

strategy to large-scale infrastructure assets with a focus on

delivering stable, long-term capital appreciation together with a

predictable annual cash flow yield. Our approach to infrastructure

investing is one that focuses on responsible stewardship and

stakeholder engagement to create value for our investors and the

communities we serve.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224590051/en/

Paula Chirhart Paula.Chirhart@Blackstone.com 347-463-5453

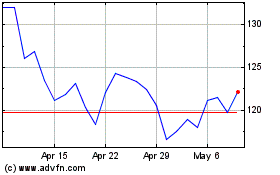

Blackstone (NYSE:BX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Blackstone (NYSE:BX)

Historical Stock Chart

From Feb 2024 to Feb 2025