0001301787false2024FYoneP1YP1Yiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesbxc:daybxc:unitbxc:reporting_unitbxc:statebxc:segmentxbrli:purebxc:planbxc:propertybxc:optionbxc:employeebxc:agreement00013017872023-12-312024-12-2800013017872024-06-2900013017872025-02-1400013017872023-01-012023-12-3000013017872022-01-022022-12-3100013017872024-12-2800013017872023-12-300001301787us-gaap:CommonStockMember2022-01-010001301787us-gaap:AdditionalPaidInCapitalMember2022-01-010001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-010001301787us-gaap:RetainedEarningsMember2022-01-0100013017872022-01-010001301787us-gaap:RetainedEarningsMember2022-01-022022-12-310001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-022022-12-310001301787us-gaap:CommonStockMember2022-01-022022-12-310001301787us-gaap:AdditionalPaidInCapitalMember2022-01-022022-12-310001301787us-gaap:CommonStockMember2022-12-310001301787us-gaap:AdditionalPaidInCapitalMember2022-12-310001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001301787us-gaap:RetainedEarningsMember2022-12-3100013017872022-12-310001301787us-gaap:RetainedEarningsMember2023-01-012023-12-300001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-300001301787us-gaap:CommonStockMember2023-01-012023-12-300001301787us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-300001301787us-gaap:CommonStockMember2023-12-300001301787us-gaap:AdditionalPaidInCapitalMember2023-12-300001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-300001301787us-gaap:RetainedEarningsMember2023-12-300001301787us-gaap:RetainedEarningsMember2023-12-312024-12-280001301787us-gaap:CommonStockMember2023-12-312024-12-280001301787us-gaap:AdditionalPaidInCapitalMember2023-12-312024-12-280001301787us-gaap:CommonStockMember2024-12-280001301787us-gaap:AdditionalPaidInCapitalMember2024-12-280001301787us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-280001301787us-gaap:RetainedEarningsMember2024-12-280001301787us-gaap:OtherNoncurrentAssetsMember2024-12-280001301787us-gaap:OtherNoncurrentAssetsMember2023-12-300001301787srt:MinimumMemberus-gaap:LandImprovementsMember2024-12-280001301787srt:MaximumMemberus-gaap:LandImprovementsMember2024-12-280001301787srt:MinimumMemberus-gaap:BuildingMember2024-12-280001301787srt:MaximumMemberus-gaap:BuildingMember2024-12-280001301787srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-280001301787srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-280001301787us-gaap:LeaseholdImprovementsMember2024-12-280001301787us-gaap:WorkersCompensationInsuranceMember2024-12-280001301787us-gaap:GeneralLiabilityMember2024-12-280001301787bxc:AutoLiabilityMember2024-12-2800013017872023-10-310001301787bxc:VandermeerForestProductsIncMember2022-10-032022-10-030001301787bxc:VandermeerForestProductsIncMemberbxc:DistributionFacilityAndRealEstateMember2022-10-030001301787bxc:VandermeerForestProductsIncMember2023-12-312024-03-300001301787bxc:VandermeerForestProductsIncMember2022-10-032022-12-310001301787bxc:VandermeerForestProductsIncMember2024-03-300001301787bxc:VandermeerForestProductsIncMemberus-gaap:CustomerRelationshipsMember2024-03-300001301787bxc:VandermeerForestProductsIncMemberus-gaap:TradeNamesMember2024-03-300001301787bxc:VandermeerForestProductsIncMemberus-gaap:NoncompeteAgreementsMember2024-03-300001301787bxc:VandermeerForestProductsIncMemberus-gaap:CustomerRelationshipsMember2023-12-312024-12-280001301787bxc:VandermeerForestProductsIncMemberus-gaap:TradeNamesMember2023-12-312024-12-280001301787bxc:VandermeerForestProductsIncMemberus-gaap:NoncompeteAgreementsMember2023-12-312024-12-280001301787bxc:SpecialtyProductsMember2023-12-312024-12-280001301787bxc:SpecialtyProductsMember2023-01-012023-12-300001301787bxc:SpecialtyProductsMember2022-01-022022-12-310001301787bxc:StructuralProductsMember2023-12-312024-12-280001301787bxc:StructuralProductsMember2023-01-012023-12-300001301787bxc:StructuralProductsMember2022-01-022022-12-310001301787bxc:SalesChannelWarehouseMember2023-12-312024-12-280001301787bxc:SalesChannelWarehouseMember2023-01-012023-12-300001301787bxc:SalesChannelWarehouseMember2022-01-022022-12-310001301787bxc:SalesChannelDirectMember2023-12-312024-12-280001301787bxc:SalesChannelDirectMember2023-01-012023-12-300001301787bxc:SalesChannelDirectMember2022-01-022022-12-310001301787bxc:AdjustmentForSalesDiscountsReturnsAndAllowancesGoodsMember2023-12-312024-12-280001301787bxc:AdjustmentForSalesDiscountsReturnsAndAllowancesGoodsMember2023-01-012023-12-300001301787bxc:AdjustmentForSalesDiscountsReturnsAndAllowancesGoodsMember2022-01-022022-12-310001301787us-gaap:ShippingAndHandlingMember2023-12-312024-12-280001301787us-gaap:ShippingAndHandlingMember2023-01-012023-12-300001301787us-gaap:ShippingAndHandlingMember2022-01-022022-12-310001301787bxc:CedarCreekMember2024-12-280001301787bxc:VandermeerForestProductsIncMember2024-12-280001301787us-gaap:CustomerRelationshipsMember2024-12-280001301787us-gaap:NoncompeteAgreementsMember2024-12-280001301787us-gaap:TradeNamesMember2024-12-280001301787us-gaap:CustomerRelationshipsMember2023-12-300001301787us-gaap:NoncompeteAgreementsMember2023-12-300001301787us-gaap:TradeNamesMember2023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:OperatingSegmentsMemberbxc:SpecialtyProductsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:SpecialtyProductsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:SpecialtyProductsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:OperatingSegmentsMemberbxc:StructuralProductsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:StructuralProductsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:StructuralProductsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:OperatingSegmentsMemberbxc:DeliveryAndLogisticsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:DeliveryAndLogisticsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:DeliveryAndLogisticsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:OperatingSegmentsMemberbxc:SalesCostsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:SalesCostsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:SalesCostsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:OperatingSegmentsMemberbxc:OtherMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:OperatingSegmentsMemberbxc:OtherMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:OperatingSegmentsMemberbxc:OtherMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:MaterialReconcilingItemsMemberbxc:ReportableSegmentMember2023-12-312024-12-280001301787us-gaap:MaterialReconcilingItemsMemberbxc:ReportableSegmentMember2023-01-012023-12-300001301787us-gaap:MaterialReconcilingItemsMemberbxc:ReportableSegmentMember2022-01-022022-12-310001301787bxc:ReportableSegmentMember2023-12-312024-12-280001301787bxc:ReportableSegmentMember2023-01-012023-12-300001301787bxc:ReportableSegmentMember2022-01-022022-12-310001301787us-gaap:LandAndLandImprovementsMember2024-12-280001301787us-gaap:LandAndLandImprovementsMember2023-12-300001301787us-gaap:BuildingMember2024-12-280001301787us-gaap:BuildingMember2023-12-300001301787us-gaap:MachineryAndEquipmentMember2024-12-280001301787us-gaap:MachineryAndEquipmentMember2023-12-300001301787us-gaap:ConstructionInProgressMember2024-12-280001301787us-gaap:ConstructionInProgressMember2023-12-300001301787us-gaap:StateAndLocalJurisdictionMember2024-12-280001301787us-gaap:StateAndLocalJurisdictionMember2023-12-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-280001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-300001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2021-10-310001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2023-01-012023-12-300001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2022-01-022022-12-310001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-312024-12-280001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-08-310001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-10-310001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2018-04-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2023-06-302023-06-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2023-06-302023-06-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2023-06-302023-06-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MinimumMember2023-06-302023-06-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2023-06-302023-06-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberbxc:LondonInterbankOfferedRateLIBOR1Membersrt:MinimumMember2018-04-012018-04-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberbxc:LondonInterbankOfferedRateLIBOR1Membersrt:MaximumMember2018-04-012018-04-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MinimumMember2018-04-012018-04-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2018-04-012018-04-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-300001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-01-022022-12-310001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-312024-12-280001301787us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-280001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-280001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-300001301787bxc:A60SeniorSecuredNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-300001301787bxc:CentralStatesSoutheastandSouthwestAreasPensionFundMember2023-12-312024-12-280001301787bxc:CentralStatesSoutheastandSouthwestAreasPensionFundMember2023-01-012023-12-300001301787bxc:CentralStatesSoutheastandSouthwestAreasPensionFundMember2022-01-022022-12-310001301787srt:MaximumMember2023-12-312024-12-280001301787bxc:CentralStatesSoutheastandSouthwestAreasPensionFundMember2024-12-280001301787bxc:HourlySavingsPlanMember2023-12-312024-12-280001301787bxc:HourlySavingsPlanMember2023-01-012023-12-300001301787bxc:HourlySavingsPlanMember2022-01-022022-12-310001301787bxc:SalariedSavingsPlanMember2023-12-312024-12-280001301787bxc:SalariedSavingsPlanMember2023-01-012023-12-300001301787bxc:SalariedSavingsPlanMember2022-01-022022-12-310001301787bxc:SalariedSavingsPlanMember2021-01-032022-01-0100013017872023-12-0500013017872023-12-0400013017872023-12-042023-12-0400013017872023-10-012023-12-3000013017872014-01-040001301787bxc:A2021LongTermIncentivePlanMember2021-05-200001301787bxc:A2021LongTermIncentivePlanMember2024-12-280001301787us-gaap:RestrictedStockUnitsRSUMembersrt:BoardOfDirectorsChairmanMember2023-12-312024-12-280001301787us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-12-312024-12-280001301787us-gaap:RestrictedStockUnitsRSUMember2022-12-310001301787us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-300001301787us-gaap:RestrictedStockUnitsRSUMember2023-12-300001301787us-gaap:RestrictedStockUnitsRSUMember2023-12-312024-12-280001301787us-gaap:RestrictedStockUnitsRSUMember2024-12-280001301787us-gaap:RestrictedStockUnitsRSUMember2022-01-022022-12-310001301787us-gaap:PerformanceSharesMember2023-12-312024-12-2800013017872024-03-312024-06-290001301787us-gaap:PerformanceSharesMember2022-12-310001301787us-gaap:PerformanceSharesMember2023-01-012023-12-300001301787us-gaap:PerformanceSharesMember2023-12-300001301787us-gaap:PerformanceSharesMember2024-12-2800013017872021-08-2300013017872022-01-022022-04-0200013017872022-05-0300013017872022-05-032022-05-0300013017872023-01-012023-10-3100013017872023-11-012024-12-280001301787srt:MinimumMember2024-12-280001301787srt:MaximumMember2024-12-280001301787bxc:EquipmentAndVehiclesMember2024-12-280001301787bxc:EquipmentAndVehiclesMember2023-12-300001301787us-gaap:RealEstateMember2024-12-280001301787us-gaap:RealEstateMember2023-12-300001301787bxc:UnpaidDutiesMember2024-12-280001301787bxc:UnpaidDutiesMember2023-12-312024-12-280001301787us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-010001301787bxc:AccumulatedOtherAdjustmentNetOfTaxMember2022-01-010001301787us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-022022-12-310001301787bxc:AccumulatedOtherAdjustmentNetOfTaxMember2022-01-022022-12-310001301787us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-12-310001301787bxc:AccumulatedOtherAdjustmentNetOfTaxMember2022-12-310001301787us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-12-300001301787bxc:AccumulatedOtherAdjustmentNetOfTaxMember2023-01-012023-12-300001301787us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-12-300001301787bxc:AccumulatedOtherAdjustmentNetOfTaxMember2023-12-3000013017872024-09-292024-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 28, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from___________to ___________

Commission file number: 001-32383

| | | | | | | | |

| BlueLinx Holdings Inc. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | |

| Delaware | 77-0627356 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| | | |

| 1950 Spectrum Circle, Suite 300 | |

| Marietta | GA | 30067 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 770-953-7000

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | BXC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the fling reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §232.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

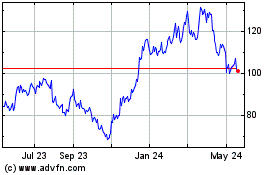

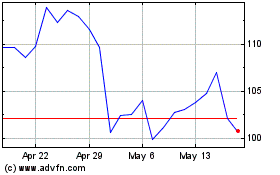

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 29, 2024, was $785,683,882, based on the closing price on the New York Stock Exchange of $93.09 per share on June 28, 2024.

As of February 14, 2025, the registrant had 8,294,928 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specifically identified portions of Part III of this Annual Report on Form 10-K incorporate by reference to the registrant’s definitive Proxy Statement for the 2025 annual meeting of shareholders, to be filed with the Securities and Exchange Commission within 120 days of the close of the fiscal year ended December 28, 2024.

BLUELINX HOLDINGS INC.

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 28, 2024

TABLE OF CONTENTS

As used herein, unless the context otherwise requires, “BlueLinx,” the “Company,” “we,” “us,” and “our” refer to BlueLinx Holdings Inc. and its wholly-owned subsidiaries. Reference to “fiscal 2024” refers to the 52-week period ending December 28, 2024. Reference to “fiscal 2023” refers to the 52-week period ended December 30, 2023. Reference to “fiscal 2022” refers to the 52-week period ended December 31, 2022.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report” or “Form 10-K”) contains forward-looking statements. Forward-looking statements include, without limitation, any statements that predict, forecast, indicate or imply future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “could,” “expect,” “estimate,” “intend,” “may,” “project,” “plan,” “should,” “will,” “will be,” “will likely continue,” “will likely result,” “would,” or words or phrases of similar meaning. Forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed under the heading “Risk Factors” in Part I, Item 1A, those discussed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7, and those discussed elsewhere in this report and in future reports that we file with the Securities and Exchange Commission. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. All forward-looking statements are made only as of the date hereof, and we expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

PART I

ITEM 1. BUSINESS

General

BlueLinx is a leading wholesale distributor of residential and commercial building products in the United States. We are a “two-step” distributor. Two-step distributors purchase products from manufacturers and distribute those products to dealers and other suppliers in local markets, who then sell those products to end users. We carry a broad portfolio of both branded and private-label stock keeping units (“SKUs”) across two principal product categories: specialty products and structural products. Specialty products include items such as engineered wood, siding, millwork, outdoor living products, specialty lumber and panels, and industrial products. Structural products include items such as lumber, plywood, oriented strand board, rebar, and remesh. We also provide a wide range of value-added services and solutions aimed at relieving distribution and logistics challenges for our customers and suppliers, while enhancing their marketing and inventory management capabilities.

We have a strong market position and a broad geographic coverage footprint servicing all 50 states. We operate our business from 65 warehouse and storage facilities, allowing us to serve 75 percent of the highest growth metropolitan statistical areas as it relates to forecasted housing starts and repair and remodel spend. We also have a corporate headquarters facility located near Atlanta in Marietta, GA. With the strength of a locally focused sales force, we distribute a comprehensive range of products from over 750 suppliers. Our suppliers include some of the leading manufacturers in the industry, such as Allura, Arauco, Fiberon, Georgia-Pacific, Huber Engineered Woods, Louisiana-Pacific, Oldcastle APG, Ply Gem, Roseburg, Royal and Weyerhaeuser. We supply products to a broad base of customers including national home centers, pro dealers, cooperatives, specialty distributors, regional and local dealers and industrial manufacturers. Many of our customers serve residential and commercial builders, contractors and remodelers in their respective geographic areas and local markets.

As a value-added partner in a complex and demanding building products supply chain, we play a critical role in enabling our customers to offer a broad range of products and brands, as most of our customers do not have the capability to purchase warehouse products directly from manufacturers for such a large set of SKUs or do not have enough space to store large bulky building materials that we sell. The depth of our geographic footprint supports meaningful customer proximity across all the markets in which we operate, enabling faster and more efficient service. Similarly, we provide value to our supplier partners by enabling access to the large and fragmented network of lumber yards and dealers these suppliers could not adequately serve directly. Our position in this distribution model for building products provides easy access to the marketplace for our suppliers and a value proposition of rapid delivery on an as-needed basis to our customers from our network of warehouse facilities.

Our Strategy

We remain committed to driving profitable sales growth within new and existing product lines and geographies, while positioning our Company for long-term value creation. The following strategic initiatives represent key areas of our management team’s focus:

1.Growing our higher-margin specialty product categories. We continue to pursue a revenue mix weighted towards higher-margin, specialty product categories such as engineered wood, siding, millwork, outdoor living products, specialty lumber and panels, and industrial products. Additionally, we are expanding our value-added service offerings designed to simplify complex customer sourcing requirements.

2.Increase share gain in local and national markets. We continue to pursue multi-family project growth, expand our product lines with key national accounts, expand branded product lines into new geographic markets, and launch new product lines. With our expanded product categories, and our strategic vendor relationships, we seek to be an extension of our customers’ business in a scalable way.

3.Foster a performance-driven culture committed to business excellence and profitable growth to be the provider of choice for both suppliers and customers. We seek to improve the customer experience through enhanced tools, value-added services, and technology enablement, accelerating organic growth within specific product and solutions offerings where we are uniquely advantaged; increase our performance by leveraging our scale and national footprint together with pricing, operational and procurement capabilities, and deploy capital to drive sustained margin expansion, grow cash flow and maintain continued profitable growth.

4.Maintain a disciplined capital structure and pursue strategic investments that increase the value of our Company. We continue to strategically target acquisition opportunities that grow our higher-margin specialty products business, expand our geographic reach, or complement our existing capabilities. We also continue to evaluate and identify additional markets that are potential opportunities for new market development. We further seek to maintain a disciplined capital structure while at the same time investing in our business to modernize our distribution facilities, as well as our tractor and trailer fleet, and to improve operational performance. During the 2024 fiscal year, we allocated $85.1 million of capital towards the following transactions, both of which were funded with the Company’s cash and cash equivalents:

•We invested $40.1 million in capital for our business to improve operational performance and productivity.

•We repurchased 428,630 shares of our common stock for $45.0 million under our share repurchase programs at an average price of $104.90 per share, including broker commissions but excluding federal excise tax.

We distribute products in two principal categories: specialty products and structural products. Specialty products, which represented approximately 69 percent, 70 percent, and 65 percent of our fiscal 2024, fiscal 2023, and fiscal 2022 net sales, respectively, include primarily engineered wood, siding, millwork, outdoor living products, specialty lumber and panels, and industrial products. In some cases, these products are branded by us. Structural products, which represented approximately 31 percent, 30 percent, and 35 percent of our fiscal 2024, fiscal 2023, and fiscal 2022 net sales, respectively, include lumber, plywood, oriented strand board, rebar, and remesh and other wood products primarily used for structural support in construction projects. Our structural products are commodity products.

We also provide a wide range of value-added services and solutions to our customers and suppliers including:

•providing “less-than-truckload” delivery services;

•job site delivery services;

•pre-negotiated program pricing plans;

•inventory stocking;

•automated order processing through an electronic data interchange, or “EDI,” that provides a direct link between us and our customers;

•intermodal distribution services, including railcar unloading and cargo reloading onto customers’ trucks;

•milling and fabrication services; and

•backhaul services, when otherwise empty trucks are returning from customer deliveries.

Distribution Channels

We sell products through three main distribution channels, consisting of warehouse sales, reload sales, and direct sales. Warehouse sales generate the majority of our sales, are delivered from our warehouses to our customers. Reload sales are similar to warehouse sales but are shipped from non-warehouse locations, most of which are operated by third parties, where

we store owned products to enhance operating efficiencies. This channel is employed primarily to service strategic customers that would be less economical to service from our warehouses, and to distribute large volumes of imported products from port facilities. Together, warehouse and reload sales accounted for approximately 80 percent, 83 percent, and 82 percent of our fiscal 2024, fiscal 2023 and fiscal 2022 Net sales, respectively.

Direct sales are shipped from the manufacturer to the customer without our taking physical possession of the inventory and, as a result, typically generate lower margins than our warehouse and reload distribution channels. This distribution channel, however, requires the lowest amount of committed capital and fixed costs. Direct sales accounted for approximately 20 percent, 17 percent, and 18 percent of our fiscal 2024, fiscal 2023, and fiscal 2022 Net sales, respectively.

Human Capital

Our Associates

Our associates are the foundation of our business and are critical to the execution of our strategy. BlueLinx has a high-performance culture where associates are expected to live every day by our core values of collaboration, respect, integrity, grit, and being customer centric .

As of December 28, 2024, we employed approximately 2,000 associates and less than one percent of our associates is employed on a part-time basis. Approximately 20% of our associates are represented by various local labor unions with terms and conditions of employment governed by Collective Bargaining Agreements (“CBAs”). Six CBAs covering approximately six percent of our associates are up for renewal in fiscal year 2025, of which one is currently in the renegotiation process. We expect to renegotiate the remainder before their renewal dates.

We are committed to ensuring that our associates feel like they matter to BlueLinx, and we manage the business in a manner that fosters this commitment. We strongly believe that our corporate culture depends on our associates’ engagement and understanding of their contribution to the fulfillment of our purpose and the achievement of our strategic imperatives, vision, and mission. Annually, we conduct a comprehensive employee survey that addresses our progress on these matters. In the most recent annual employee survey, nearly 75% of our associates elected to participate, and this population represented a wide cross section of our associates.

Our CEO, along with other executives, conducts periodic leadership town halls where associates are invited to engage with senior leadership. Additionally, our leaders engage directly with associates through facility visits.

We also use our compensation review process, our compensation framework, and third-party compensation data in an effort to compensate associates in the same job, level and location fairly regardless of gender, race and ethnicity. If we identify discrepancies between actual compensation and our policies, we take action to make pay adjustments to close identified gaps. In addition, we support several employee resource groups that facilitate social, development, and community interaction in our workforce.

Safety

We are committed to providing a safe and healthy working environment for our associates. We have established uniform safety and compliance procedures for our operations and implemented measures designed to prevent workplace injuries. Our proactive safety programs focus on job hazard identification and prevention, coupled with extensive on-going job-specific training. For example, material handlers and Department of Transportation (“DOT”) registered drivers follow a monthly individualized training curriculum, including knowledge testing, for injury and accident prevention. In addition, depending on the nature and requirements of their role, new hires and contract employees undergo safety training along with specific hands-on training during their initial onboarding. We also administer post injury/accident corrective action supplemental training as needed and dictated by our root cause investigations. Accidents and injuries are investigated with corrective actions implemented locally and communicated to key operations personnel across the enterprise to help prevent future occurrences. In order to enhance the safety of our material handling fleet, during fiscal 2024 and 2023 we made significant investments in refreshing our forklifts across our network. These enhancements allow more efficient operations and include enhanced safety features such as clean electric technology, automated collision detection systems, blue spotlights and multi-facing cameras. Our newest tractors are equipped with collision avoidance systems, dashboard cameras, speed monitoring, blind spot detection and lane departure warning technology. Our newest tractors and trailers are both equipped with disc-type brakes to improve stopping distance and driver control. We plan to continue to make significant investments in upgrading our over-the-road and material handling fleet into fiscal 2025 and beyond.

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors common in the building products distribution industry, such as weather conditions and other seasonal factors. The first and fourth quarters are typically our lower volume quarters due to the impact of unfavorable weather on residential repair and remodel activity and the residential new home construction market. Our second and third quarters are typically our higher volume quarters, reflecting an increase in repair and remodel activity and residential new home construction due to more favorable weather conditions.

Sustainability

In addition to participating in the Forestry Stewardship Council, an organization promoting environmentally appropriate, socially beneficial, and economically viable management of the world’s forests, we invested in electric forklifts during fiscal 2024 and 2023 in certain locations and expect to purchase more in fiscal 2025. We continue to make progress on utilizing more fuel-efficient tractors in our fleet. We are also replacing our warehouse lighting systems with more environmentally friendly lighting solutions and reducing our landfill waste by prioritizing recycling options, where available.

Competition

The U.S. building products distribution market is a highly fragmented market, served by national and multi-regional distributors, regionally focused distributors, and independent local distributors. Local and regional distributors tend to be closely held and often specialize in a limited number of product segments, in which they may offer a broader selection of products. Some of our national and multi-regional competitors are part of larger companies and, therefore, may have access to greater financial and other resources than those to which we have access. We compete on the basis of breadth of product offering, consistent availability of product, product price and quality, reputation, service, and distribution facility location. Three of our largest competitors are Boise Cascade Company, Weyerhaeuser Company, and Specialty Building Products. Most major markets in which we operate are served by the distribution arm of at least one of these companies.

Governmental Regulations

The Company is subject to various federal, state, provincial, and local laws, rules, and regulations. We are subject to the requirements of the U.S. Department of Labor Occupational Safety and Health Administration (“OSHA”). In order to maintain compliance with applicable OSHA requirements, we have established uniform safety and compliance procedures for our operations, and implemented measures designed to prevent workplace injuries. Our safety programs focus on job hazard identification and prevention, coupled with extensive on-going job-specific training. For example, material handlers and DOT-registered drivers follow a monthly individualized training curriculum, with knowledge testing, for injury and accident prevention. In addition, new hires and contract employees undergo safety training during their initial onboarding. We also administer post injury/accident corrective action supplemental training as needed and dictated by our investigations. Accidents and injuries are investigated with corrective actions implemented locally and communicated to key operations personnel across the enterprise to help prevent future occurrences. As discussed above, in order to enhance the safety and capabilities of our fleet, we made investments in upgrading our fleet in fiscal 2024 and 2023.

The U.S. Department of Transportation (“DOT”) regulates our operations in domestic interstate commerce. We are subject to safety requirements governing interstate operations prescribed by DOT. We are also subject to the oversight of the Federal Motor Carrier Safety Administration (“FMCSA”). Additionally, vehicle dimensions and driver hours of service, among other things, are subject to both federal and state regulation. Through a partnership with their local DOT enforcement agencies, our branches continue to host DOT troopers to conduct training walk-around inspections of our equipment to supplement our internal driver training efforts. The DOT troopers cover all dimensions of DOT compliance with specific focus on vehicle maintenance and load securement safety requirements.

We also are subject to environmental laws, rules, and regulations that limit discharges into the environment, establish standards for the handling, generation, emission, release, discharge, treatment, storage, and disposal of hazardous materials, substances, and wastes, and require cleanup of contaminated soil and groundwater. These laws, ordinances, and regulations are complex, can change frequently, and have become more stringent over time. Many of them provide for substantial fines and penalties, orders (including orders to cease operations), and criminal sanctions for violations. They may also impose liability for property damage and personal injury stemming from the presence of, or exposure to, hazardous substances. In addition, certain of our operations require us to obtain, maintain compliance with, and periodically renew, environmental permits. We also continue to proactively replace our diesel underground storage tanks based on their age to reduce the chance of fuel releases to the environment.

Certain of these environmental laws, including the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), may require the investigation and cleanup of an entity’s or its predecessor’s current or former properties, even if

the associated contamination was caused by the operations of a third party. These laws also may require the investigation and cleanup of third-party sites at which an entity or its predecessor sent hazardous waste for disposal, notwithstanding that the original disposal activity accorded with applicable requirements. Liability under such laws may be imposed jointly and severally, and regardless of fault.

We have incurred and will continue to incur costs to comply with the requirements of health and safety, transportation, and environmental laws, ordinances, and regulations. These requirements could become more stringent in the future, and compliance costs may become material.

Climate Change

Climate change presents potential risks and uncertainties for us. Weather-related events, such as hurricanes, tornadoes or extreme temperature changes, can impact our operations and result in lost production, supply chain disruptions and increased material costs. Some of our distribution centers are located in areas at greater risk of tornadoes, hurricanes, and floods. In addition, the availability and price of the products we buy and sell may fluctuate during prolonged periods of heavy rain or drought, fires or other unpredictable weather events. While unpredictable weather and other changes in climate can have a negative impact on our business, changes in climate also could result in more accommodating weather patterns for longer periods of time in certain areas. Extended periods of favorable weather can result in an increase in construction, and a corresponding increase in the demand for our products. In addition, our operations could in the future be subject to regulations related to climate change. To the extent that climate-related risks materialize, and if we are unprepared for them, we may incur unexpected costs, which could have a material effect on our financial position, results of operations and cash flows. See Item 1A, Risk Factors for further discussion of the risks posed by climate change.

Securities Exchange Act Reports

The Company maintains a website at www.BlueLinxCo.com. The information on the Company’s website is not incorporated by reference in this Annual Report on Form 10-K. We make available on or through our website certain reports, and amendments to those reports, that we file with or furnish to the U.S. Securities and Exchange Commission (the “SEC”) in accordance with the Securities Exchange Act of 1934, as amended. These include our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and proxy statements. Additionally, our code of conduct, the board committee charter for each of our audit committee, human capital and compensation committee, and nominating and corporate governance committee, and our corporate governance guidelines are available on our website. If we amend our code of conduct, or grant any waiver, including any implicit waiver, for any board member, our chief executive officer, our chief financial officer, our interim principal financial officer, or any other executive officer, we will disclose such amendment or waiver on our website.

We make information available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC. In addition, copies of this information will be made available, free of charge, on written request, by writing to BlueLinx Holdings Inc., Attn: Corporate Secretary, 1950 Spectrum Circle, Suite 300, Marietta, Georgia, 30067.

ITEM 1A. RISK FACTORS

In addition to the other information contained in this Form 10-K, including the information set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition, or results of operations could be materially adversely affected by any of these risks. Additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Industry Risks

Adverse housing market conditions may negatively impact our business, liquidity, and results of operations, and increase the credit risk from our customers.

Our business depends on residential repair and remodel activity levels. Historically, residential repair and remodeling activity has decreased in slow economic periods. General economic weakness, inflation, elevated unemployment levels, mortgage delinquency and foreclosure rates, limitations in the availability of mortgage and home improvement financing, home equity value declines and lower housing turnover all limit consumers’ spending, particularly on discretionary items, and affect their confidence level leading to reduced spending on home improvement projects. Depressed activity levels in consumer spending for home improvement construction would adversely affect our business, liquidity, results of operations, and financial position. Furthermore, economic weakness causes unanticipated shifts in consumer preferences and purchasing practices and in the business models and strategies of our customers. Such shifts may alter the nature and prices of products demanded by the end consumer, and, in turn, our customers and could adversely affect our operating performance.

Our business is also dependent on the new residential construction market and, in particular, single family home construction. Factors impacting the level of activity in the residential new construction markets include increases in interest rates, inflation, unemployment rates, housing inventory, high foreclosure rates and unsold/foreclosure inventory, availability of financing and mortgages, labor costs and availability, vacancy rates, local, state and federal government regulation (including mortgage interest deductibility and other tax laws), weakening in the U.S. economy or of any regional or local economy in which we operate, availability of supplies, consumer demand and preferences, and shifts in populations away from the markets that we serve, all of which are beyond our control. Weakness in new residential construction due to any or all of these factors would have a material adverse effect on our business, financial condition, and operating results, and these factors may also result in fluctuations in our operating results. As a result, our results for any historical period may not be indicative of results for any future period.

In addition, we extend credit to numerous customers who are generally susceptible to the same economic business risks that we are. Unfavorable housing market conditions could result in financial failures of one or more of our significant customers. Furthermore, we may not be aware of deterioration in our customers’ financial position. If our larger customers’ financial positions were to become impaired, our ability to fully collect receivables from such customers could be impaired and negatively affect our operating results, cash flows, and liquidity.

Consolidation among competitors, suppliers, and customers could negatively impact our business.

Our competitors continue to consolidate. Among other things, this consolidation is being driven in part by customer needs and supplier capabilities, which could cause markets to become more competitive as greater economies of scale are achieved by distributors. Customers are increasingly aware of the total costs of fulfillment and of the need to have consistent sources of supply at multiple locations. We believe these customer needs could result in fewer distributors as the remaining distributors become larger and capable of being consistent sources of supply. There can be no assurance that we will be able to take advantage effectively of this trend toward consolidation. The trend in our industry toward consolidation could make it more difficult for us to gain or retain market share or maintain operating margins.

Our customers and suppliers also continue to consolidate, and this consolidation could result in the loss of existing customers and suppliers to our competitors. Furthermore, continued consolidation among our suppliers may makes it more difficult for us to negotiate favorable pricing, consignment arrangements, and discount programs with our suppliers, thereby resulting in reduced margins and profits.

We are subject to disintermediation risk.

As customers continue to consolidate or otherwise increase their purchasing power, they are better able, and may choose, to purchase products directly from the same suppliers that use us for distribution. In addition, our suppliers may elect to distribute some or all of their products directly to end-customers in one or more markets. This process of disintermediation can put us at

risk of losing business from a customer, or of losing entire product lines or categories, or distribution territories, from suppliers. Disintermediation also may also adversely impact our ability to obtain favorable pricing from suppliers and optimize margins and revenue with respect to our customers. As a result, continued disintermediation could have a negative impact on our financial condition and operating results.

Our dependence on international suppliers and manufacturers for certain products exposes us to risks of new or increased tariffs and other risks that could affect our financial condition and expose us to certain additional risks.

Many of our suppliers and manufacturers are located outside of the United States. Thus, compliance with federal laws and regulations regarding the importation of products, import taxes or costs, including new or increased tariffs, anti-dumping duties, countervailing duties, or similar duties, some of which could be applied retroactively, and modification to or withdrawal from free trade agreements or trade relationships, could increase the cost of the products that we distribute. For example, the U.S. has recently signaled its intention to change U.S. trade policy, including potentially renegotiating or terminating existing trade agreements and leveraging tariffs. In February 2025, the U.S. imposed additional tariffs on imports from China and announced and subsequently paused implementation of tariffs on imports from Canada and Mexico. These additional tariffs, as well as a government’s adoption of “buy national” policies or retaliation by another government against such tariffs or policies may have introduced significant uncertainty into the market and may affect the prices of and supply of the products available to us. In addition, quotas, embargoes, sanctions, safeguards, and customs restrictions, as well as foreign labor strikes, work stoppages, or boycotts, could reduce the supply of the products available to us. Geopolitical events, including war and terrorism, could also cause a reduction in the supply or increase the costs of the products available to us. If we become subject to a reduction in available supply of imported products and we are unable to mitigate that reduction through alternative sources, or if the costs of our imported products increase and we are not able to pass along those increased costs to our customers, then our business, financial condition, and results of operations could be adversely affected.

We may experience pricing and product cost variability.

Prices for our products are driven and influenced by many factors, including general economic conditions, demand for our products and competitive and other conditions in the industries within which we compete. Prices that we pay and charge for our products can be unpredictable and volatile. The factors that influence prices and costs also include, among others:

•National and international economic conditions, including inflationary conditions;

•Government regulations, trade policies, and market speculation;

•Consolidation among customers, particularly dealers, and their customers (i.e., home builders), and resulting changes in purchasing policies and payment practices;

•The use of auction markets, which are based on participants’ perceptions of short-term supply and demand, to determine prices and volumes for many commodities building products;

•The use of published indices (including those published by Random Lengths), which may not accurately reflect changes in market conditions, to set selling prices for products;

•Labor and freight costs, curtailments, periodic delays in the delivery of products and inventory levels in various distribution channels; and

•The ability of large customers to influence prices of outside building materials suppliers and distributors in a highly fragmented industry.

If supply exceeds demand, prices for our products could decline, and our results of operations, cash flows, and financial condition could be adversely affected. These factors can cause short-term fluctuations in the price of our products, or costs related to our products. We may be limited in our ability to pass on any increases to our customers.

In addition, economic conditions and market factors may make it difficult for us to raise our prices enough to keep up with the rate of inflation, which could reduce our profit margins or reduce the number of customers who can purchase our products and adversely impact our results of operations and cash flows.

A decline in the prices of the products we distribute could also adversely impact our operating results. When the prices of the products we distribute decline, customer demand for lower prices could result in lower sales prices and, to the extent that our inventory at the time was purchased at higher costs, lower margins. Alternatively, in a rising price environment, our suppliers may increase prices or reduce discounts on the products we distribute, and we may be unable to pass on any cost increase to our customers, thereby resulting in reduced margins and profits.

Our earnings are highly dependent on sales volumes.

Our earnings are highly dependent on sales volumes, which are dependent on both the housing cycle, as well as our execution. In addition, selling commoditized products that are subject to fluctuating prices makes it difficult to predict our financial results with any degree of certainty. Commodity and specialty product price inflation or deflation can increase or decrease our gross margins on relatively consistent year over year structural sales volumes, depending on the degree of commodity price change. Any failure to maintain, or increase sales volumes, alone or combined with margin fluctuations due to price inflation or deflation, which would impact the purchase and/or selling price of our products, could adversely affect our results of operations, cash flows, and financial condition.

Our industry is highly fragmented and competitive. If we are unable to compete effectively, our net sales and operating results may be reduced.

The building products distribution industry is highly fragmented and competitive, and the barriers to entry for local competitors are relatively low. Competitive factors in our industry include pricing, availability of products, service, delivery capabilities, customer relationships, geographic coverage, and breadth of product offerings. Also, financial stability is important to suppliers and customers in choosing distributors for their products, and it affects the favorability of the terms on which we are able to obtain our products from our suppliers and sell our products to our customers.

Some of our competitors may have less financial leverage or are part of larger companies, and may therefore have access to greater financial and other resources than those to which we have access. Finally, we may not be able to maintain our costs at a level sufficiently low enough for us to compete effectively. If we are unable to compete effectively, our net sales and net income may be reduced.

Our industry is highly cyclical, and prolonged periods of weak demand or excess supply may reduce our net sales and/or margins, which may cause us to incur losses or reduce our net income.

The building products distribution industry is subject to cyclical market pressures and market prices of building products historically have been volatile and cyclical. Prices of building products are determined by overall supply and demand in the market and we have limited ability to control the timing and amount of pricing changes. Demand for building products is driven mainly by factors outside of our control, such as general economic and political conditions, interest rates, availability of mortgage financing, inflation, the construction, repair and remodeling markets, industrial markets, housing supply, weather, and population growth. The supply of building products fluctuates based on available manufacturing capacity, and excess capacity in the industry can result in significant declines in market prices for those products. To the extent that prices and volumes experience a sustained or sharp decline, our net sales and margins likely would decline as well. Because we have meaningful fixed costs, a decrease in sales and margin generally may have a significant adverse impact on our financial condition, operating results, and cash flows.

Loss of key products or key suppliers and manufacturers could affect our financial health.

Our ability to offer a wide variety of products to our customers, including our private label products, is dependent upon our ability to obtain adequate product supply from manufacturers and other suppliers. Generally, our products are obtainable from various sources and in sufficient quantities subject to then current market conditions. However, the loss of, or a substantial decrease in the availability of, key products from our suppliers, or the loss of key supplier arrangements, could adversely impact our financial condition, operating results, and cash flows. Although in many instances we have agreements with our suppliers, these agreements are generally terminable by either party on limited notice. Failure by our suppliers to continue to supply us with products on commercially reasonable terms, or at all, could have a material adverse effect on our financial condition, operating results, and cash flows.

Operating Risks

We are subject to information technology security risks and business interruption risks and may incur increasing costs in an effort to minimize and/or respond to those risks.

Our business employs information technology systems to secure confidential information, such as employee personal data, but with the rapidly evolving sophistication of cyberattacks, we may not be able to anticipate, prevent or mitigate our cybersecurity risks. Any compromise of our security could result in a loss or misuse of our confidential information or confidential information of our customers or suppliers, violation of applicable privacy and other laws, significant legal and financial exposure, theft, damage to our reputation, interruption of our business operations, and a loss of confidence in our security measures, any of which could harm our business. We may also be susceptible to phishing attacks, malware, ransomware, denial of service, and other attacks that could adversely affect our information technology systems. Although we utilize various procedures and controls to monitor and mitigate these threats, there can be no assurance that these procedures and controls will be sufficient to prevent security threats from materializing. As cyberattacks become more sophisticated, we may incur significant costs to strengthen our systems from outside intrusions, and/or obtain insurance coverage related to the threat of such attacks.

Additionally, our business is reliant upon information technology systems to, among other things, manage and route our sales calls, manage inventories and accounts receivable, make purchasing decisions, monitor our results of operations, place orders with our vendors and process orders from our customers. These systems may be vulnerable to natural disasters, telecommunications or equipment failures, power outages and similar events, employee errors or to intentional acts of misconduct, such as security breaches or cyberattacks. The occurrence of any of these events or acts, or any other unanticipated problems, could result in damage to or the unavailability of these systems. Such damage or unavailability could, despite any existing disaster recovery and business continuity arrangements, interrupt the availability of one or more of our information technology systems. We have from time to time experienced such disruptions, and while such disruptions did not materially affect our business, they may occur in the future. Future disruptions in these systems could materially impact our ability to buy and sell our products, as well as generally operate our business, which could reduce our revenue.

We may be unable to effectively manage our inventory relative to our sales volume or as the prices of the products we distribute fluctuate, which could affect our business, financial condition, and operating results.

We purchase most of our products directly from manufacturers, which are then sold and distributed to customers. We must maintain, and have adequate working capital to purchase, sufficient inventory to meet customer demand. Due to the lead times required by our suppliers, we order products in advance of expected sales. As a result, we are required to forecast our sales and purchases accordingly. In periods characterized by significant changes in the overall economy and activity in the residential and commercial building and home repair and remodel industries, it can be especially difficult to forecast our sales accurately. We must also manage our working capital to fund our inventory purchases. Such issues and risks can be magnified by the diversity of product mix our distribution centers carry across multiple major product categories. Excessive increases in the market prices of certain building products can put negative pressure on our operating cash flows by requiring us to invest more in inventory. In the future, if we are unable to effectively manage our inventory, our cash flows may be negatively affected, which could have a material adverse effect on our business, financial condition, and operating results.

Our success depends on our ability to attract, train, and retain highly qualified associates and other key personnel while controlling related labor costs.

In order to be successful, we must attract, train, and retain a large number of highly qualified associates while controlling related labor costs. Our ability to control labor costs is subject to numerous external factors, including labor availability, prevailing wage rates and health and other insurance costs.

In many of our markets, highly qualified associates are in high demand and we compete with other businesses for these associates and invest resources in training and incentivizing them. In particular, there continues to be significant competition for qualified drivers in the transportation industry and increasingly more stringent regulatory requirements relating to drivers. There can be no assurance that we will be able to attract or retain highly qualified associates in the future, including those employed by companies we may acquire.

As a result of labor shortages, particularly among our drivers and material handlers, we could be required to utilize temporary or contract labor. Using temporary or contract labor typically requires higher cost, and temporary or contract labor may be less productive than full-time associates. In addition, a shortage of qualified drivers could require us to increase driver

compensation, let trucks sit idle, utilize third-party freight more so than normal, utilize less experienced drivers, or face difficulty meeting customer demands, all of which could adversely affect our growth and profitability.

Furthermore, our success is highly dependent on the continued services of our management team. The loss of services of one or more key members of our senior management team could have a material adverse effect on us.

Our strategy includes pursuing acquisitions. We may be unsuccessful in making and integrating mergers, acquisitions and investments.

As part of our overall strategy, we may make acquisitions or investments in the future. Acquisitions and investments involve significant risks and uncertainties, including uncertainties as to the future financial performance of the acquired business, the achievement of expected synergies, or exposure to unforeseen liabilities of acquired companies.

In addition, the integration of acquisitions can involve significant anticipated and unanticipated operational challenges, including integrating different computer, enterprise resource planning, and accounting systems, integrating physical facilities and inventories, and integrating businesses and corporate cultures into our business. Addressing the risks and challenges associated with acquisitions and investments requires the attention of management and the diversion of resources from existing operations. Our failure to manage these risks and challenges effectively and at anticipated costs, or to manage other consequences of an acquisition or investment, could result in a failure to achieve anticipated benefits and synergies from an acquisition or investment, could cause disruptions in overall operating performance and deficiencies in customer service of the combined business, and could adversely affect our financial condition, operating results and cash flows. Disruptions and deficiencies associated with integrating an acquired business could also lead to increased costs, order and delivery errors, inventory and billing errors, the loss of employees, or the loss of customers, suppliers, or products either overall or in certain markets, which could adversely affect our financial condition, operating results, and cash flows.

We may incur business disruptions resulting from a variety of possible causes.

While we maintain insurance covering our facilities and equipment, including business interruption insurance, the operations at our distribution facilities may be interrupted or impaired by various operating risks, including, but not limited to, risks associated with catastrophic events, such as war, fires, floods, earthquakes, explosions, natural disasters, severe weather, including hurricanes, tornados and droughts, whether a result of climate change or otherwise, pandemics, or other similar occurrences, interruptions in the delivery of products via railroad or other inbound transportation means, adverse government regulations, civil unrest, condemnation, equipment breakdowns or failures, prolonged power failures, unscheduled maintenance outages, information system disruptions or failures due to any number of causes, violations of our permit requirements or revocation of permits, releases of pollutants and hazardous substances to air, soil, surface water or ground water; disruptions in transportation infrastructure, including roads, bridges, railroad tracks and tunnels, shortages of equipment or spare parts, and labor disputes and shortages. For example, one of our owned warehouse facilities located in Erwin, Tennessee was damaged by Hurricane Helene in late September 2024. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/or suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition, and results of operations. In addition, war, terrorism, geopolitical uncertainties, and public health issues could cause damage or disruption to the global economy, and thus could have a material adverse effect on our financial condition, operating results and cash flows, our suppliers and our customers.

We are exposed to product liability and other claims and legal proceedings related to our business and the products we distribute, which may exceed the coverage of our insurance.

The building products industry has been subject to personal injury and property damage claims arising from alleged exposure to raw materials contained in building products as well as claims for incidents of catastrophic loss, such as building fires. As a distributor of building materials, we face an inherent risk of exposure to product liability claims in the event that the use of the products we have distributed in the past or may in the future distribute is alleged to have resulted in economic loss, personal injury or property damage, or violated environmental, health or safety, or other laws. Such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product, negligence, strict liability, or a breach of warranties. We rely on manufacturers and other suppliers, including manufacturers and suppliers located outside of the United States, to provide us with the products we sell or distribute. Since we do not have direct control over the quality of products that are manufactured or supplied to us by third parties, we are particularly vulnerable to risks relating to the quality of such products.

We are also from time to time subject to casualty, contract, tort, and other claims relating to our business, the products we have distributed in the past or may in the future distribute, and the services we have provided in the past or may in the future provide,

either directly or through third parties. In addition, operating hazards, such as delivering and unloading products, operating large machinery and driving hazards, which are inherent in our business and some of which may be outside of our control, can cause personal injury and loss of life, damage to or destruction of property and equipment and environmental damage.

We cannot predict or, in some cases, control the costs to defend or resolve such claims. We cannot assure our ability to maintain suitable and adequate insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities, and the cost of any product liability or other proceeding, even if resolved in our favor, could be substantial. Additionally, we do not carry insurance for all categories of risk that our business may encounter. Any significant uninsured liability may require us to pay substantial amounts. There can be no assurance that any current or future claims will not adversely affect our financial position, cash flows, or results of operations.

Our business operations and financial results could suffer from the impacts of climate change.

Climate change, and its effects on weather patterns, the frequency and severity of weather-related events, and temperatures, could adversely impact our business. Extreme weather and temperatures could affect the availability of raw materials for the products that we distribute, the ability of our suppliers to deliver products to our distribution facilities and our ability to deliver those products to our customers. They could also result in lost production, supply chain disruption and increased transportation costs. Unpredictable weather and climate changes could also cause the price of the products we buy and sell to fluctuate significantly, including during and as a result of prolonged periods of heavy rain or drought, fires or other unpredictable weather events. Any or all of these effects could materially and adversely impact our business or results of operations.

Our operating results depend on the successful implementation of our strategy. We may not be able to implement our strategic initiatives successfully, on a timely basis, or at all.

We regularly evaluate the performance of our business and, as a result of such evaluations, we have in the past undertaken and may in the future undertake strategic initiatives within our businesses, including initiatives to migrate our sales mix toward higher‑margin specialty product categories, foster a performance-driven culture committed to business excellence and profitable growth, and maintain a disciplined capital structure and pursue investments that increase the value of the Company. Strategic initiatives that we may implement now or in the future may not result in improvements in future financial performance and could result in additional unanticipated costs. If we are unable to realize the benefits of our strategic initiatives, our business, financial condition, cash flows, or results of operations could be adversely affected.

A significant percentage of our employees are unionized. Wage increases or work stoppages by our unionized employees may reduce our results of operations.

As of December 28, 2024, we employed approximately 2,000 associates and less than one percent of our associates are employed on a part-time basis. Approximately 20 percent of our associates are represented by various local labor unions with terms and conditions of employment governed by Collective Bargaining Agreements (“CBAs”). Six CBAs covering approximately six percent of our associates are up for renewal in fiscal year 2025, of which one is currently in the renegotiation process. We expect to renegotiate the remainder before their renewal dates.

Although we have generally had good relations with our unionized employees and expect to renew collective bargaining agreements as they expire, no assurances can be provided that we will be able to reach a timely agreement as to the renewal of the agreements, and their expiration or continued work under an expired agreement, as applicable, could result in a work stoppage. In addition, we may become subject to material wage increases, or additional work rules imposed by agreements with labor unions. The foregoing could increase our selling, general, and administrative expenses in absolute terms and/or as a percentage of net sales. In addition, work stoppages or other labor disturbances may occur in the future, which could adversely impact our net sales and/or selling, general, and administrative expenses. Wage increases could also be significant in an inflationary environment even in our non-unionized locations. All or some of these factors could negatively impact our operating results and cash flows.

Federal, state, local, and other regulations could impose substantial costs and restrictions on our operations that would reduce our net income.

We are subject to various federal, state, local, and other laws and regulations, including, among other things, transportation regulations promulgated by the Department of Transportation (“DOT”) and Federal Motor Carrier Safety Administration (“FMCSA”), work safety regulations promulgated by Occupational Safety and Health Administration, employment regulations promulgated by the U.S. Equal Employment Opportunity Commission, regulations of the U.S. Department of Labor and Federal Trade Commission, regulations issued by the SEC, accounting standards issued by the Financial Accounting Standards Board (“FASB”) or similar entities, and state and local zoning restrictions, building codes and contractors’ licensing regulations. More burdensome regulatory requirements in these or other areas may increase our general and administrative costs

and adversely affect our financial condition, operating results, and cash flows. Moreover, failure to comply with the regulatory requirements applicable to our business could expose us to litigation and substantial fines and penalties that could adversely affect our financial condition, operating results, and cash flows.

Our transportation operations, upon which we depend to distribute products from our distribution centers, are subject to the regulatory jurisdiction of the DOT and the FMCSA, which have broad administrative powers with respect to our transportation operations. More restrictive regulatory limitations, including those on vehicle weight and size, trailer length and configuration, or driver hours of service would increase our costs, which, if we are unable to pass these cost increases on to our customers, may increase our selling, general and administrative expenses and adversely affect our financial condition, operating results, and cash flows. If we fail to comply adequately with such regulations or such regulations become more stringent, we could experience increased inspections, regulatory authorities could take remedial action, including imposing fines or shutting down our operations, or we could be subject to increased audit and compliance costs. If any of these events were to occur, our financial condition, operating results, and cash flows could be adversely affected.

In addition, the residential and commercial construction industries are subject to various local, state and federal statutes, ordinances, codes, rules and regulations concerning zoning, building design and safety, construction, contractor licensing, energy conservation, and similar matters, including regulations that impose restrictive zoning and density requirements on the residential new construction industry or that limit the number of homes or other buildings that can be built within the boundaries of a particular area. Regulatory restrictions may increase our operating expenses and limit the availability of suitable building lots for our customers, any of which could negatively affect our business, financial condition and results of operations.

We are subject to federal, state, and local environmental protection laws and may have to incur significant costs to comply with these laws and regulations in the future.