false000130178700013017872025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2025

BlueLinx Holdings Inc.

(Exact name of registrant specified in its charter)

| | | | | | | | |

| Delaware | 001-32383 | 77-0627356 |

| (State or other | (Commission | (I.R.S. Employer |

jurisdiction of

incorporation) | File Number) | Identification No.) |

| | | | | |

1950 Spectrum Circle, Suite 300, Marietta, Georgia | 30067 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (770) 953-7000

_________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

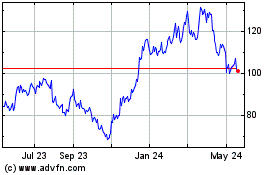

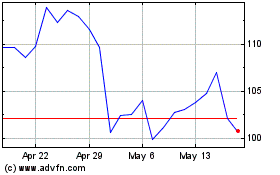

| Common Stock, par value $0.01 per share | BXC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 18, 2025, BlueLinx Holdings Inc. ("BlueLinx" or "the Company”) issued a press release announcing its financial results for the fiscal fourth quarter and year ended December 28, 2024. A copy of BlueLinx's press release is furnished as Exhibit 99.1 hereto.

On February 19, 2025, as previously announced, BlueLinx will hold a teleconference and audio webcast to discuss its financial results from the fiscal fourth quarter and year ended December 28, 2024. A copy of supplementary materials that will be referred to in the teleconference and webcast, and which will be posted to the Company's website, is furnished as Exhibit 99.2 hereto.

The information included in this Item 2.02, as well as Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

The following exhibits are attached with this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | | BlueLinx Holdings Inc. | |

| | | (Registrant) | |

| | | | |

| Dated: February 18, 2025 | By: | /s/ Kimberly DeBrock | |

| | | Kimberly DeBrock | |

| | | Vice President, Chief Accounting Officer, and Interim Principal Financial Officer | |

BlueLinx Announces Fourth Quarter and Full Year 2024 Results

ATLANTA, February 18, 2025 – BlueLinx Holdings Inc. (NYSE: BXC), a leading U.S. wholesale distributor of building products, today reported financial results for the three months and twelve months ended December 28, 2024.

FOURTH QUARTER 2024 HIGHLIGHTS

•Net sales of $711 million

•Gross profit of $113 million, gross margin of 15.9% and specialty gross margin of 18.4%

•Net income of $5.3 million, or $0.62 diluted earnings per share

•Adjusted net income of $5.2 million, or $0.61 adjusted diluted earnings per share

•Adjusted EBITDA of $22 million, or 3.0% of net sales

•Operating cash flow of $19 million

•Completion of $15 million in share repurchases

FULL YEAR 2024 HIGHLIGHTS

•Net sales of $3.0 billion

•Gross profit of $489 million, gross margin of 16.6%, and specialty gross margin of 19.4%

•Net income of $53 million, or $6.19 diluted earnings per share

•Adjusted net income of $55 million, or $6.44 adjusted diluted earnings per share

•Adjusted EBITDA of $131 million, or 4.4% of net sales

•Operating cash flow of $85 million and free cash flow of $45 million

•Available liquidity of $852 million, including $506 million cash/cash equivalents on hand

•Completion of $45 million in share repurchases

“Our fourth quarter and full year 2024 were highlighted by strong margin performance, clearly showing our ability to generate solid results due to the strength of our customer service proposition and the continued focus on our strategy,” said Shyam Reddy, President, and CEO of BlueLinx. “Specialty products continued its strong performance with gross margins of 18.4% and solid volume growth during the quarter. Structural products also performed well with gross margins of 10.8%, largely due to improved lumber pricing during the quarter. With strong liquidity and minimal net debt, we remain well-positioned to execute on our long-term sales growth strategy and to return capital to shareholders. During the fourth quarter, we returned $15 million to shareholders, bringing the total to $45 million in share repurchases for the year.”

FOURTH QUARTER 2024 FINANCIAL PERFORMANCE

In the fourth quarter of 2024, net sales were $711 million, a decrease of $1.9 million, or 0.3% when compared to the fourth quarter of 2023. Gross profit was $113 million, a decrease of $5.1 million, or 4.3%, year-over-year, and gross margin was 15.9%, down 70 basis points from the prior year period.

Net sales of specialty products, which includes products such as engineered wood, siding, millwork, outdoor living, specialty lumber and panels, and industrial products, decreased $3.0 million, or 0.6%, to $484 million. This decline was primarily due to price deflation driven by external market conditions, partially offset by volume gains. Gross profit from specialty product sales was $88.7 million, a decrease of $5.7 million, or 6.1%, compared to the fourth quarter last year. Gross margin was 18.4% compared to 19.4% in the prior year period.

Net sales of structural products, which includes products such as lumber, plywood, oriented strand board, rebar, and remesh, increased $1.1 million, or 0.5%, to $227 million in the fourth quarter of fiscal 2024 and gross profit from sales of structural products increased $0.6 million from $24.0 million in the prior year period. The increases in structural sales and gross profit were due primarily to improved pricing for framing lumber, partially offset by slight volume decreases. Compared to 4Q 2023, average composite pricing for lumber increased 12% while panel prices decreased 6%. Gross margin on structural product sales was 10.8% in the fourth quarter, up slightly from 10.6% in the prior year period.

Selling, general and administrative (“SG&A”) expenses were $92.6 million in the fourth quarter, an increase of $8.1 million from $84.5 million for the fourth quarter of 2023. The year-over-year increase in the dollar amount of SG&A was due primarily to increased payroll and payroll-related expenses, partially driven by increased logistics expenses due to higher volumes, and expenses associated with our digital transformation.

Net income for the current quarter was $5.3 million, or $0.62 per diluted share, versus a net loss of $18.1 million, or $(2.08) per diluted share, in the prior year period. The 2023 period reflects a one-time charge of $30.4 million related to the settlement of our defined benefit pension plan. Adjusted Net Income for the fourth quarter was $5.2 million, or $0.61 per diluted share.

Adjusted EBITDA was $21.5 million, or 3.0% of net sales, compared to $36.5 million, or 5.1% of net sales in the prior period.

Net cash generated from operating activities was $18.7 million in the fourth quarter of 2024 compared to $75.9 million in the prior year period. The decrease in cash generated from operating activities was driven primarily by changes in working capital. Additionally, net income in the fourth quarter 2023 included the non-cash reclassification from accumulated other comprehensive loss of $30.4 million, affecting the net income comparison between the quarters. We allocated $20.3 million to cash capital investments related to our distribution facilities, fleet, and technology during the current quarter.

FULL YEAR 2024 FINANCIAL PERFORMANCE

For the fiscal year ended December 28, 2024, net sales were $3.0 billion, a decrease of $183.8 million, or 5.9% year-over-year. Gross profit was $489.1 million, a decrease of $37.9 million, or 7.2% year-over-year, and gross margin was 16.6%, down 20 basis points. The decreases in sales and gross profit reflect declines of 6.3% and 4.8% in specialty product net sales and structural product net sales, respectively. Full year 2024 included a net benefit of $12.7 million for import duty-related items from prior periods. Excluding this benefit, gross margin would have been 16.1%. The duty items were related to changes in retroactive rates for anti-dumping duties and to classification adjustments for certain goods imported by the Company.

Net sales of specialty products decreased $138.3 million, or 6.3% to $2.0 billion in the fiscal year ended December 28, 2024. The overall decrease in specialty products net sales was due to price deflation, partially offset by volume increases. Gross profit from specialty product sales was $397.6 million in the current year, a decrease of $23.2 million, or 5.5%, year-over-year and gross margin in the current year was 19.4% compared to 19.3% in the prior year. The current year included the aforementioned net benefit of $12.7 million for import duty-related items from prior periods. Excluding this benefit, gross margin for specialty products would have been 18.8% for the current year.

Net sales of structural products decreased $45.5 million, or 4.8%, to $906.6 million in the fiscal year ended December 28, 2024, and gross profit from sales of structural products decreased $14.7 million to $91.5 million. The decreases in structural products net sales and gross profit were due primarily to market-based price deflation and lower volume for lumber, partially offset by volume gains for panels. Compared to fiscal year 2023, average composite pricing for lumber in the U.S. decreased 2.5% while panel prices increased 1.2%. Gross margin on structural product sales was 10.1% compared to 11.2% for the prior year.

SG&A expenses were $365.5 million during fiscal year 2024, up $9.7 million, or 2.7%, compared to the prior year. In the current year, higher technology expenses associated with our digital transformation and legal expenses associated with duty-related matters were partially offset by lower variable compensation expense and lower share-based compensation expense.

Net income was $53.1 million, or $6.19 per diluted share, versus $48.5 million, or $5.39 per diluted share in the prior year. Fiscal 2023 reflects the aforementioned one-time charge of $30.4 million related to the settlement of our legacy defined benefit pension plan. Adjusted net income was $55.2 million and adjusted earnings diluted per share was $6.44 in the current year, compared to $102.6 million or adjusted diluted earnings per share of $11.41 in the prior year.

Adjusted EBITDA was $131.4 million, or 4.4% of net sales, compared to $182.8 million, or 5.8% of net sales in 2023.

Net cash generated from operating activities was $85.2 million for fiscal year 2024 compared to $306.3 million in fiscal year 2023. This decrease in cash provided by operating activities during fiscal 2024 was primarily a result of changes in net cash provided by working capital, particularly for inventory. Additionally, net income in fiscal 2023 included the non-cash reclassification from accumulated other comprehensive loss of $30.4 million, affecting the net income comparison between the fiscal years. Free cash flow was $45.1 million in fiscal 2024 compared to $278.8 million in the prior year.

CAPITAL ALLOCATION AND FINANCIAL POSITION

During the full year 2024, we invested $40.1 million to improve and upgrade our distribution facilities, technology infrastructure, and our fleet, compared to $27.5 million in 2023. Since the beginning of fiscal 2022, we used a total of $154 million to buy back and retire approximately 1.8 million shares of our common stock. Currently, we have $46.5 million remaining under our $100 million share repurchase authorization that was approved by our Board of Directors in October 2023. We plan to continue to be opportunistic in the market when repurchasing shares.

As of December 28, 2024, total debt outstanding was $593 million, including $300 million of senior secured notes that mature in 2029 and $293 million of finance leases. Available liquidity was $852 million which included an undrawn revolving credit facility that had $346 million of availability plus cash and cash equivalents of $506 million. Net Debt was $(156) million, which consisted of total debt and finance lease obligations, less real property finance lease obligations of $243 million, and less cash and cash equivalents of $506 million, resulting in a net leverage ratio of (1.2x) using a trailing twelve-month Adjusted EBITDA of $131 million.

FIRST QUARTER 2025 OUTLOOK

Through the first seven weeks of the first quarter of fiscal 2025, specialty product gross margin was in the range of 18% to 19%, and structural product gross margin was in the range of 8% to 9%. Average daily sales volumes were down approximately 12% versus the fourth quarter of 2024 due primarily to severe weather conditions which impacted a significant portion of our distribution footprint in January.

CONFERENCE CALL INFORMATION

BlueLinx will host a conference call on February 19, 2025, at 10:00 a.m. Eastern Time, accompanied by a supporting slide presentation.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of the BlueLinx website at https://investors.bluelinxco.com, and a replay of the webcast will be available at the same site shortly after the webcast is complete.

To participate in the live teleconference:

Domestic Live: 1-888-660-6392

Passcode: 9140086

To listen to a replay of the teleconference, which will be available through March 5, 2025:

Domestic Replay: 1-800-770-2030

Passcode: 9140086

ABOUT BLUELINX

BlueLinx (NYSE: BXC) is a leading U.S. wholesale distributor of residential and commercial building products with both branded and private-label SKUs across product categories such as lumber, panels, engineered wood, siding, millwork, and industrial products. With a strong market position, broad geographic coverage footprint servicing 50 states, and the strength of a locally focused sales force, we distribute a comprehensive range of products to our customers which include national home centers, pro dealers, cooperatives, specialty distributors, regional and local dealers and industrial manufacturers. BlueLinx provides a wide range of value-added services and solutions to our customers and suppliers, and we operate our business through a broad network of distribution centers. To learn more about BlueLinx, please visit www.bluelinxco.com.

CONTACT

Tom Morabito

Investor Relations Officer

(470) 394-0099

investor@bluelinxco.com

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “could,” “expect,” “estimate,” “intend,” “may,” “project,” “plan,” “should,” “will,” “will be,” “will likely continue,” “will likely result,” “would,” or words or phrases of similar meaning.

The forward-looking statements in this press release include statements about our strategy, liquidity, and debt, our long-run positioning relative to industry conditions, future share repurchases, and the information set forth under the heading “First Quarter 2025 Outlook”.

Forward-looking statements in this press release are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed in greater detail in our filings with the Securities and Exchange Commission. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: adverse housing market conditions; disintermediation risk; consolidation among competitors, suppliers, and customers; our dependence on international suppliers and manufacturers for certain products which exposes us to risks of new or increased tariffs and other risks that could affect our financial condition; pricing and product cost variability; volumes of product sold; competition; the cyclical nature of the industry in which we operate; loss of products or key suppliers and manufacturers; information technology security risks and business interruption risks; effective inventory management relative to our sales volume or the prices of the products we produce; the ability to attract, train, and retain highly qualified associates and other key personnel while controlling related labor costs; potential acquisitions and the integration and completion of such acquisitions; business disruptions; exposure to product liability and other claims and legal proceedings related to our business and the products we distribute; the impacts of climate change; successful implementation of our strategy; wage increases or work stoppages by our union employees; costs imposed by federal, state, local, and other regulations; compliance costs associated with federal, state, and local environmental protection laws; the effects of epidemics, global pandemics or other widespread public health crises and governmental rules and regulations; fluctuations in our operating results; our level of indebtedness and our ability to incur additional debt to fund future needs; the covenants of the instruments governing our indebtedness limiting the discretion of our management in operating the business; the potential to incur more debt; the fact that we have consummated certain sale leaseback transactions with resulting long-term non-cancelable leases, many of which are or will be finance leases; the fact that we lease many of our distribution centers, and we would still be obligated under these leases even if we close a leased distribution center; inability to raise funds necessary to finance a required repurchase of our senior secured notes; a lowering or withdrawal of debt ratings; changes in our product mix; increases in fuel and other energy prices or availability of third-party freight providers; changes in insurance-related deductible/retention reserves based on actual loss development experience; the possibility that the value of our deferred tax assets could become impaired; changes in our expected annual effective tax rate could be volatile; the costs and liabilities related to our participation in multi-employer pension plans could increase; the risk that our cash flows and capital resources may be insufficient to service our existing or future indebtedness; interest rate risk, which could cause our debt service obligations to increase; and changes in, or interpretation of, accounting principles.

Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

NON-GAAP MEASURES AND SUPPLEMENTAL FINANCIAL INFORMATION

The Company reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein in the “Reconciliation of Non-GAAP Measurements” table later in this release. The Company cautions that non-GAAP measures are not intended to present superior measures of our financial condition from those measures determined under GAAP and should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. The Company further cautions that its non-GAAP measures, as used herein, are not necessarily comparable to other similarly titled measures of other companies due to differences in methods of calculation.

Adjusted EBITDA and Adjusted EBITDA Margin. BlueLinx defines Adjusted EBITDA as an amount equal to net income (loss) plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to our merger and acquisition activities, gains or losses on sales of properties, amortization of deferred gains on real estate, and expense associated with our restructuring activities, such as severance, in addition to other significant and/or one-time, nonrecurring, non-operating items.

The Company presents Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance. Management believes this metric helps to enhance investors’ overall understanding of the financial performance and cash flows of the business. Management also believes Adjusted EBITDA is helpful in highlighting operating trends. Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results.

We determine our Adjusted EBITDA Margin, which we sometimes refer to as our Adjusted EBITDA as a percentage of net sales, by dividing our Adjusted EBITDA for the applicable period by our net sales for the applicable period. We believe that this ratio is useful to investors because it more clearly defines the quality of earnings and operational efficiency of translating sales to profitability.

Adjusted Net Income and Adjusted Earnings Per Share. BlueLinx defines Adjusted Net Income as Net Income adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to our merger and acquisition activities, gains or losses on sales of properties, amortization of deferred gains on real estate, and expense associated with our restructuring activities, such as severance, in addition to other significant and/or one-time, nonrecurring, non-operating items, further adjusted for the tax impacts of such reconciling items. BlueLinx defines Adjusted Earnings Per Share (basic and/or diluted) as the Adjusted Net Income for the period divided by the weighted average outstanding shares (basic and/or diluted) for the periods presented. We believe that Adjusted Net Income and Adjusted Earnings Per Share (basic and/or diluted) are useful to investors to enhance investors’ overall understanding of the financial performance of the business. Management also believes Adjusted Net Income and Adjusted Earnings Per Share (basic and/or diluted) are helpful in highlighting operating trends.

Our Adjusted Net Income and Adjusted Earnings Per Share (basic and/or diluted) are not presentations made in accordance with GAAP and are not intended to present superior measures of our financial condition from those measures determined under GAAP. Adjusted Net Income and Adjusted Earnings Per Share (basic or diluted), as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. These non-GAAP measures are reconciled in the “Reconciliation of Non-GAAP Measurements” table later in this release.

Free Cash Flow. BlueLinx defines free cash flow as net cash provided by operating activities less total capital expenditures. Free cash flow is a measure used by management to assess our financial performance, and we believe it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures that can be used for, among other things, investment in our business, strengthening our balance sheet, and repayment of our debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow is not a presentation made in accordance with GAAP and is not intended to present a superior measure of financial condition from those determined under GAAP. Free cash flow, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. This non-GAAP measure is reconciled in the “Reconciliation of Non-GAAP Measurements” table later in this release.

Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities. BlueLinx calculates Net Debt as its total short- and long-term debt, including outstanding balances under our term loan and revolving credit facility and the total amount of its obligations under finance leases, less cash and cash equivalents. Net Debt Excluding Real Property Finance Lease Liabilities is calculated in the same manner as Net Debt, except the total amount of obligations under real estate finance leases are excluded. Although our credit agreements do not contain leverage covenants, a net leverage ratio excluding finance lease obligations for real property is included within the terms of our revolving credit agreement. We believe that Net Debt and Net Debt Excluding Real Property Finance Lease Liabilities are useful to investors because our management reviews both metrics as part of its management of overall liquidity, financial flexibility, capital structure and leverage, and creditors and credit analysts monitor our net debt as part of their assessments of our business. We determine our Overall Net Leverage Ratio by dividing our Net Debt by Twelve-Month Trailing Adjusted EBITDA. Our calculation of Net Leverage Ratio Excluding Real Property Finance Lease Liabilities is determined by dividing our Net Debt Excluding Real Property Finance Lease Liabilities by Twelve-Month Trailing Adjusted

EBITDA. We believe that these ratios are useful to investors because they are indicators of our ability to meet our future financial obligations. In addition, our Net Leverage Ratio is a measure that is frequently used by investors and creditors. Our Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities are not made in accordance with GAAP and are not intended to present a superior measure of our financial condition from measures and ratios determined under GAAP. The calculations of our Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities are presented in the table on page 8. Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation.

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended |

| | December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 |

| (In thousands, except per share amounts) | | | | | | | |

| Net sales | $ | 710,637 | | | $ | 712,529 | | | $ | 2,952,532 | | | $ | 3,136,381 | |

| Cost of products sold | 597,292 | | | 594,100 | | | 2,463,393 | | | 2,609,364 | |

| Gross profit | 113,345 | | | 118,429 | | | 489,139 | | | 527,017 | |

| Gross margin percentage | 15.9 | % | | 16.6 | % | | 16.6 | % | | 16.8 | % |

| Operating expenses (income): | | | | | | | |

| Selling, general, and administrative | 92,619 | | | 84,541 | | | 365,532 | | | 355,819 | |

| Depreciation and amortization | 9,405 | | | 8,285 | | | 38,488 | | | 32,043 | |

| Amortization of deferred gains on real estate | (982) | | | (982) | | | (3,934) | | | (3,934) | |

| Gain from sale of properties, net | — | | | — | | | (272) | | | — | |

| Other operating expenses, net | 273 | | | (600) | | | 1,755 | | | 4,640 | |

| Total operating expenses | 101,315 | | | 91,244 | | | 401,569 | | | 388,568 | |

| Operating income | 12,030 | | | 27,185 | | | 87,570 | | | 138,449 | |

| Non-operating expenses: | | | | | | | |

| Interest expense, net | 5,320 | | | 4,171 | | | 19,364 | | | 23,746 | |

| Settlement of defined benefit pension plan | (255) | | | 30,440 | | | (2,481) | | | 30,440 | |

| Other expense, net | — | | | 595 | | | — | | | 2,377 | |

| Income before provision for income taxes | 6,965 | | | (8,021) | | | 70,687 | | | 81,886 | |

| Provision for income taxes | 1,693 | | | 10,103 | | | 17,571 | | | 33,350 | |

| Net income (loss) | $ | 5,272 | | | $ | (18,124) | | | $ | 53,116 | | | $ | 48,536 | |

| | | | | | | |

| Basic earnings (loss) per share | $ | 0.63 | | | $ | (2.08) | | | $ | 6.22 | | | $ | 5.40 | |

| Diluted earnings (loss) per share | $ | 0.62 | | | $ | (2.08) | | | $ | 6.19 | | | $ | 5.39 | |

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| | December 28, 2024 | | December 30, 2023 |

| (In thousands, except share data) | |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 505,622 | | | $ | 521,743 | |

Accounts receivable, less allowances of $4,344 and $3,398, respectively | 225,837 | | | 228,410 | |

| Inventories, net | 355,909 | | | 343,638 | |

| Other current assets | 46,620 | | | 26,608 | |

| Total current assets | 1,133,988 | | | 1,120,399 | |

| Property and equipment, at cost | 443,628 | | | 396,321 | |

| Accumulated depreciation | (194,072) | | | (170,334) | |

| Property and equipment, net | 249,556 | | | 225,987 | |

| Operating lease right-of-use assets | 47,221 | | | 37,227 | |

| Goodwill | 55,372 | | | 55,372 | |

| Intangible assets, net | 26,881 | | | 30,792 | |

| Deferred income tax asset, net | 50,578 | | | 53,256 | |

| Other non-current assets | 14,121 | | | 14,568 | |

| Total assets | $ | 1,577,717 | | | $ | 1,537,601 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 170,202 | | | $ | 157,931 | |

| Accrued compensation | 16,706 | | | 14,273 | |

| | | |

| | | |

| Finance lease liabilities - current | 12,541 | | | 11,178 | |

| Operating lease liabilities - current | 8,478 | | | 6,284 | |

| Real estate deferred gains - current | 3,935 | | | 3,935 | |

| | | |

| Other current liabilities | 21,862 | | | 24,961 | |

| Total current liabilities | 233,724 | | | 218,562 | |

| Non-current liabilities: | | | |

| Long-term debt | 295,061 | | | 293,743 | |

| Finance lease liabilities - less current portion | 280,002 | | | 274,248 | |

| Operating lease liabilities - less current portion | 40,114 | | | 32,519 | |

| Real estate deferred gains - less current portion | 63,296 | | | 66,599 | |

| | | |

| Other non-current liabilities | 19,079 | | | 17,644 | |

| Total liabilities | 931,276 | | | 903,315 | |

| Commitments and contingencies | | | |

| STOCKHOLDERS' EQUITY: |

Preferred Stock, $0.01 par value, 30,000,000 shares authorized, none outstanding | — | | | — | |

Common Stock, $0.01 par value, 20,000,000 shares authorized, 8,294,798 and 8,650,046 outstanding, respectively | 83 | | | 87 | |

| Additional paid-in capital | 124,103 | | | 165,060 | |

| | | |

| Retained earnings | 522,255 | | | 469,139 | |

| Total stockholders’ equity | 646,441 | | | 634,286 | |

| Total liabilities and stockholders’ equity | $ | 1,577,717 | | | $ | 1,537,601 | |

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 |

| (In thousands) | |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 5,272 | | | $ | (18,124) | | | $ | 53,116 | | | $ | 48,536 | |

| Adjustments to reconcile net income (loss) to cash provided by operations: | | | | | | | |

| | | | | | | |

| Depreciation and amortization | 9,405 | | | 8,285 | | | 38,488 | | | 32,043 | |

| Amortization of debt discount and issuance costs | 328 | | | 330 | | | 1,318 | | | 1,319 | |

| Settlement of frozen defined benefit pension plan | — | | | 30,440 | | | — | | | 30,440 | |

| Gains from sales of property | — | | | — | | | (272) | | | — | |

| Amortization of deferred gains from real estate | (982) | | | (982) | | | (3,934) | | | (3,934) | |

| Share-based compensation | 808 | | | 2,580 | | | 7,749 | | | 12,055 | |

| Provision for deferred income taxes | 728 | | | 6,639 | | | 2,678 | | | 7,756 | |

| Other income statement items | — | | | (909) | | | — | | | (909) | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | 52,212 | | | 69,158 | | | 2,573 | | | 23,145 | |

| Inventories, net | (15,368) | | | 20,724 | | | (12,271) | | | 140,875 | |

| Accounts payable | (14,930) | | | (43,818) | | | 13,002 | | | 5,973 | |

| | | | | | | |

| Employer contributions due to the single-employer defined benefit pension plan | — | | | (6,900) | | | — | | | (6,900) | |

| Other current assets | (10,120) | | | 12,892 | | | (20,012) | | | 15,513 | |

| Other assets and liabilities | (8,609) | | | (4,454) | | | 2,743 | | | 373 | |

| Net cash provided by operating activities | 18,744 | | | 75,861 | | | 85,178 | | | 306,285 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Proceeds from sales of assets and properties | 60 | | | 166 | | | 899 | | | 357 | |

| Property and equipment investments | (20,279) | | | (8,582) | | | (40,109) | | | (27,520) | |

| Other investing activities | — | | | — | | | — | | | 300 | |

| | | | | | | |

| Net cash used in investing activities | (20,219) | | | (8,416) | | | (39,210) | | | (26,863) | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Common stock repurchases | (15,315) | | | (12,814) | | | (45,297) | | | (42,135) | |

| | | | | | | |

| Repurchase of shares to satisfy employee tax withholdings | (108) | | | (122) | | | (3,365) | | | (5,279) | |

| Principal payments on finance lease liabilities | (3,761) | | | (2,549) | | | (13,427) | | | (9,208) | |

| | | | | | | |

| Net cash used in financing activities | (19,184) | | | (15,485) | | | (62,089) | | | (56,622) | |

| Net change in cash and cash equivalents | (20,659) | | | 51,960 | | | (16,121) | | | 222,800 | |

| Cash and cash equivalents at beginning of period | 526,281 | | | 469,783 | | | 521,743 | | | 298,943 | |

| Cash and cash equivalents at end of period | $ | 505,622 | | | $ | 521,743 | | | $ | 505,622 | | | $ | 521,743 | |

The following schedule presents our revenues disaggregated by specialty and structural product category:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 |

| (Dollar amounts in thousands) | | | | | | | |

| Net sales by product category | | | | | | | |

| Specialty products | $ | 483,610 | | | $ | 486,561 | | | $ | 2,045,910 | | | $ | 2,184,240 | |

| Structural products | 227,027 | | | 225,968 | | | 906,622 | | | 952,141 | |

| Total net sales | $ | 710,637 | | | $ | 712,529 | | | $ | 2,952,532 | | | $ | 3,136,381 | |

| | | | | | | |

| Gross profit by product category | | | | | | | |

| Specialty products | $ | 88,747 | | | $ | 94,466 | | | $ | 397,625 | | | $ | 420,794 | |

| Structural products | 24,598 | | | 23,963 | | | 91,514 | | | 106,223 | |

| Total gross profit | $ | 113,345 | | | $ | 118,429 | | | $ | 489,139 | | | $ | 527,017 | |

| | | | | | | |

| Gross margin % by product category | | | | | | | |

| Specialty products | 18.4 | % | | 19.4 | % | | 19.4 | % | | 19.3 | % |

| Structural products | 10.8 | % | | 10.6 | % | | 10.1 | % | | 11.2 | % |

| Company gross margin % | 15.9 | % | | 16.6 | % | | 16.6 | % | | 16.8 | % |

BLUELINX HOLDINGS INC.

RECONCILIATION OF NON-GAAP MEASUREMENTS

(Unaudited)

The following table reconciles Net income (loss) to Adjusted EBITDA (non-GAAP) for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended | | |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 | | | | |

| (In thousands) | |

| Net income (loss) | $ | 5,272 | | | $ | (18,124) | | | $ | 53,116 | | | $ | 48,536 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Depreciation and amortization | 9,405 | | | 8,285 | | | 38,488 | | | 32,043 | | | | | |

| Interest expense, net | 5,320 | | | 4,171 | | | 19,364 | | | 23,746 | | | | | |

| | | | | | | | | | | |

| Provision for income taxes | 1,693 | | | 10,103 | | | 17,571 | | | 33,350 | | | | | |

| Share-based compensation expense | 808 | | | 2,580 | | | 7,749 | | | 12,055 | | | | | |

| Amortization of deferred gains on real estate | (982) | | | (982) | | | (3,934) | | | (3,934) | | | | | |

Gains from sales of property(1) | — | | | — | | | (272) | | | — | | | | | |

Pension settlement and withdrawal costs(1)(2) | (255) | | | 31,034 | | | (2,481) | | | 32,817 | | | | | |

Acquisition-related costs(1)(3) | — | | | 186 | | | — | | | 278 | | | | | |

Restructuring and other(1)(4) | 274 | | | (784) | | | 1,755 | | | 3,913 | | | | | |

| Adjusted EBITDA | $ | 21,535 | | | $ | 36,469 | | | $ | 131,356 | | | $ | 182,804 | | | | | |

| | | | | | | | | | | |

(1) Reflects non-recurring beneficial items of $30.4 million in the prior quarterly period, $1.0 million of non-beneficial items in the current fiscal year period, and $37.0 million of net beneficial items in the prior fiscal year period.

(2) Reflects expenses and related adjustments related to our previously disclosed settlement of the BlueLinx Corporation Hourly Retirement Defined Benefit Plan.

(3) Reflects primarily legal, professional, technology and other integration costs.

(4) Reflects net losses related to Hurricane Helene in 3Q 2024, our restructuring efforts, such as severance, net of other one-time non-operating items in 2024 and 2023.

The following table reconciles Net income (loss) and Diluted earnings (loss) per share to Adjusted net income (non-GAAP) and Adjusted diluted earnings per share (non-GAAP):

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 |

| (In thousands, except per share data) | |

| Net income (loss) | $ | 5,272 | | | $ | (18,124) | | | $ | 53,116 | | | $ | 48,536 | |

| Adjustments: | | | | | | | |

| Share-based compensation expense | 808 | | | 2,580 | | | 7,749 | | | 12,055 | |

| Amortization of deferred gains on real estate | (982) | | | (982) | | | (3,934) | | | (3,934) | |

| Gain from sales of property | — | | | — | | | (272) | | | — | |

Pension settlement and withdrawal costs(1) | (255) | | | 31,034 | | | (2,481) | | | 32,817 | |

| Acquisition-related costs | — | | | 186 | | | — | | | 278 | |

| Restructuring and other | 274 | | | (784) | | | 1,755 | | | 3,913 | |

Tax impacts of reconciling items above (1) | 38 | | | 11,891 | | | (701) | | | 8,962 | |

| Adjusted net income (non-GAAP) | $ | 5,155 | | | $ | 25,801 | | | $ | 55,232 | | | $ | 102,627 | |

| | | | | | | |

| Basic earnings (loss) per share | $ | 0.63 | | | $ | (2.08) | | | $ | 6.22 | | | $ | 5.40 | |

| Diluted earnings (loss) per share | $ | 0.62 | | | (2.08) | | | $ | 6.19 | | | $ | 5.39 | |

| | | | | | | |

| Weighted average shares outstanding - Basic | 8,356 | | | 8,704 | | | 8,531 | | | 8,987 | |

| Weighted average shares outstanding - Diluted | 8,431 | | | 8,757 | | | 8,572 | | | 8,994 | |

| | | | | | | |

| Adjusted basic EPS (non-GAAP) | $ | 0.61 | | | $ | 2.96 | | | $ | 6.47 | | | $ | 11.41 | |

| Adjusted diluted EPS (non-GAAP) | $ | 0.61 | | | $ | 2.94 | | | $ | 6.44 | | | $ | 11.41 | |

| | | | | | | |

(1) Tax impact calculated based on the effective tax rate for the respective fiscal quarterly periods and fiscal year periods presented. The fiscal quarter and fiscal year ended December 30, 2023 exclude the non-cash tax effects for the one-time charge for settlement of the frozen defined benefit pension plan.

In the following table, our Adjusted EBITDA margin (non-GAAP) is calculated and compared to Net income (loss) as a percentage of Net sales:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended | | |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 | | | | |

| (Dollar amounts in thousands) | |

| | | | | | | | | | | |

| Net sales | $ | 710,637 | | | $ | 712,529 | | | $ | 2,952,532 | | | $ | 3,136,381 | | | | | |

| Net income (loss) | 5,272 | | | (18,124) | | | 53,116 | | | 48,536 | | | | | |

| Net income (loss) as a percentage of Net sales | 0.7 | % | | (2.5) | % | | 1.8 | % | | 1.5 | % | | | | |

| | | | | | | | | | | |

| Net sales | $ | 710,637 | | | $ | 712,529 | | | $ | 2,952,532 | | | $ | 3,136,381 | | | | | |

Adjusted EBITDA (non-GAAP)(1) | 21,535 | | | 36,469 | | | 131,356 | | | 182,804 | | | | | |

| Adjusted EBITDA margin (non-GAAP) | 3.0 | % | | 5.1 | % | | 4.4 | % | | 5.8 | % | | | | |

(1)See the table that reconciles Net income to Adjusted EBITDA (non-GAAP)

The following table shows the calculations of our “Net Debt,” “Net Leverage Ratio,” and our “Net Leverage Ratio Excluding Real Property Finance Lease Liabilities,” as those non-GAAP measures are used and presented within the terms of our revolving credit agreement.

| | | | | | | | | | | |

| As of |

| ($ amounts in thousands) | December 28, 2024 | | December 30, 2023 |

| |

Long term debt (1) | $ | 300,000 | | | $ | 300,000 | |

| Finance lease liabilities for equipment and vehicles | 49,785 | | | 42,252 | |

| Finance lease liabilities for real property | 242,758 | | | 243,174 | |

| Total debt and finance leases | 592,543 | | | 585,426 | |

| Less: available cash and cash equivalents | 505,622 | | | 521,743 | |

| Net Debt | $ | 86,921 | | | $ | 63,683 | |

| | | |

| Net Debt, excluding finance lease liabilities for real property | $ | (155,837) | | | $ | (179,491) | |

| | | |

| Twelve-month trailing adjusted EBITDA (see above reconciliations) | $ | 131,356 | | | $ | 182,804 | |

| | | |

| Net Leverage Ratio | 0.7x | | 0.3x |

| Net Leverage Ratio Excluding Real Property Finance Lease Liabilities | (1.2x) | | (1.0x) |

(1) As of December 28, 2024 and December 30, 2023, our long-term debt is comprised of $300.0 million of senior-secured notes issued in October 2021. These notes are presented under the long-term debt caption of our consolidated balance sheet, and as of December 28, 2024 were $295.1 million which is net of unamortized debt discount of $2.5 million and unamortized debt issuance costs of $2.4 million. As of December 30, 2023, these notes were reported on our consolidated balance sheet at $293.7 million, which is net of unamortized discount of $3.0 million and unamortized debt issuance costs of $3.2 million. Our senior secured notes are presented in this table at their face value for the purposes of calculating our net leverage ratio.

The following schedule reconciles Net cash provided by operating activities to Free cash flow (non-GAAP):

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Quarter Ended | | Fiscal Year Ended |

| December 28, 2024 | | December 30, 2023 | | December 28, 2024 | | December 30, 2023 |

| (In thousands) | |

| Net cash provided by operating activities | $ | 18,744 | | | $ | 75,861 | | | $ | 85,178 | | | $ | 306,285 | |

| Less: property and equipment investments | (20,279) | | | (8,582) | | | (40,109) | | | (27,520) | |

| Free cash flow - non-GAAP | $ | (1,535) | | | $ | 67,279 | | | $ | 45,069 | | | $ | 278,765 | |

| | | | | | | |

BlueLinx Q4 and Full Year 2024 Results Delivering What Matters February 19, 2025 © BlueLinx 2025. All Rights Reserved. 1 EXHIBIT 99.2

This presentation contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “could,” “expect,” “estimate,” “intend,” “may,” “project,” “plan,” “should,” “will,” “will be,” “will likely continue,” “will likely result,” “would,” or words or phrases of similar meaning. The forward-looking statements in this presentation include statements about our strategy, liquidity, and debt, our long-run positioning relative to industry conditions, future share repurchases, and the information set forth under the heading “First Quarter 2025 Update”. Forward-looking statements in this presentation are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward- looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed in greater detail in our filings with the Securities and Exchange Commission. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: adverse housing market conditions; disintermediation risk; consolidation among competitors, suppliers, and customers; our dependence on international suppliers and manufacturers for certain products which exposes us to risks of new or increased tariffs and other risks that could affect our financial condition; pricing and product cost variability; volumes of product sold; competition; the cyclical nature of the industry in which we operate; loss of products or key suppliers and manufacturers; information technology security risks and business interruption risks; effective inventory management relative to our sales volume or the prices of the products we produce; the ability to attract, train, and retain highly qualified associates and other key personnel while controlling related labor costs; potential acquisitions and the integration and completion of such acquisitions; business disruptions; exposure to product liability and other claims and legal proceedings related to our business and the products we distribute; natural disasters, catastrophes, fire, wars or other unexpected events; the impacts of climate change; successful implementation of our strategy; wage increases or work stoppages by our union employees; costs imposed by federal, state, local, and other regulations; compliance costs associated with federal, state, and local environmental protection laws; the effects of epidemics, global pandemics or other widespread public health crises and governmental rules and regulations; fluctuations in our operating results; our level of indebtedness and our ability to incur additional debt to fund future needs; the covenants of the instruments governing our indebtedness limiting the discretion of our management in operating the business; the potential to incur more debt; the fact that we have consummated certain sale leaseback transactions with resulting long-term non-cancelable leases, many of which are or will be finance leases; the fact that we lease many of our distribution centers, and we would still be obligated under these leases even if we close a leased distribution center; inability to raise funds necessary to finance a required repurchase of our senior secured notes; a lowering or withdrawal of debt ratings; changes in our product mix; increases in fuel and other energy prices or availability of third-party freight providers; changes in insurance-related deductible/retention reserves based on actual loss development experience; the possibility that the value of our deferred tax assets could become impaired; changes in our expected annual effective tax rate could be volatile; the costs and liabilities related to our participation in multi-employer pension plans could increase; the risk that our cash flows and capital resources may be insufficient to service our existing or future indebtedness; interest rate risk, which could cause our debt service obligations to increase; and changes in, or interpretation of, accounting principles. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. 2 Safe Harbor Statement

Opening Remarks 3 Shyam Reddy President & CEO

4 BlueLinx: Delivering What Matters BLUELINX STRATEGIC PRIORITIES

5 ▪ FY 2024 Net sales of $3.0B ▪ FY 2024 Adjusted EBITDA of $131M (1) ▪ Q4 2024 Net Sales of $711M ▪ Adjusted EBITDA of $22M (1) ▪ Specialty products gross margin of 18.4%; structural products gross margin of 10.8% ▪ Specialty product sales comprised approximately 70% of sales and 80% of gross profit in for both Q4 2024 and full year 2024 ▪ Implementing a new master data platform ▪ Launching an e-commerce platform ▪ Establishing our new transportation management system ▪ Portland, OR announced in November 2024 ▪ Limited Capex; EBITDA positive in 2 years ▪ $40-100 million in net sales at maturity • $852M of liquidity – including $506M of cash/cash equivalents • $45M in share repurchases for 2024 ▪ Net leverage ratio of (1.2x) (2) q Delivered strong full year 2022 results q Solid Q4 results highlighted by record cash generation q Remain focused on specialty product growth q Executed strategic capital allocation actions q Further strengthened our financial position ü Delivered solid full year 2024 results given the challenging environment ü Solid Q4 results highlighted by strong gross margins ü Remain focused on specialty product sales growth ü Our digital transformation is well underway ü We announced our first Greenfield with more on the way ü Strong financial position ü (1) See appendix for reconciliations to all non-GAAP measures (2) Does not include finance leases for real property, per the terms of out credit agreement DELIVERING WHAT MATTERS

n Net sales of $3.0B, down 5.9% year-over-year q Full year volume increases offset by market-related pricing pressures n Gross profit of $489M, down 7.2% year-over-year q 16.6% of net sales q 81% of gross profit from specialty products n Gross margin of 16.6%, down 20 bps year-over-year q 19.4% specialty products gross margin q 10.1% structural products gross margin n Net income of $53M and Diluted EPS of $6.19 n Adjusted net income of $55M and Adjusted Diluted EPS of $6.44 (1) n Adjusted EBITDA of $131M, or 4.4% of sales (1) n Generated operating cash of $85M q Free cash flow of $45M (1) q Net leverage ratio of (1.2x) (2) Explosive profitable growth with a highly engaged team 6 FULL YEAR 2024 RESULTS FY 24 Sales by Product Category Specialty Products 69% Structural Products 31% FY 24 Gross Profit by Product Category Specialty Products 81% Structural Products 19% (1) See appendix for reconciliations to all non-GAAP measures (2) Does not include finance leases for real property, per the terms of our credit agreement

n New home starts continue to be volatile q Single-family housing starts expected to be flat to down in 2025 q Multi-family starts expected to decline but at a lower rate than 2024 levels n Home affordability remains challenging q Mortgage rates off historic highs, but still elevated q Home price appreciation n Repair and remodel market expected to improve slightly in 2025(1) q 2024 spending lower than peak 2022 levels q Existing home sales remain low n Long-term trends remain positive Note: Management’s estimate by end market for two-step distribution of building materials (1) Source: Joint Center for Housing Studies at Harvard University 7 U.S. HOUSING INDUSTRY BLUELINX SALES BY END MARKET Repair & Remodel 45% New Home Construction 40% Commercial 15%

Financial Review 8 Kim DeBrock Vice President, Chief Accounting Officer and Interim Principal Financial Officer

n Net Sales decreased 0.3% to $711M q Specialty product sales down 1% q Structural product sales up 1% n Gross Margin of 15.9%, down 70 bps n Adjusted Diluted EPS of $0.61 (1) n Adjusted EBITDA of $22M (1) q Adjusted EBITDA(1) margin of 3.0% n Free Cash Flow of $(2)M (1) q Cash Flow from Operations $19M q Capital Expenditures of $20M 9 FOURTH QUARTER 2024 RESULTS (1) See Appendix for reconciliations for all non-GAAP figures (2) Does not include finance leases for real property, per terms of our credit agreement (( Q4 Commentary $ millions, except per share data and leverage ratios Q4 2024 Q4 2023 Variance Net Sales $711 $713 (0.3)% Gross Profit $113 118 (4.3)% Gross Margin % 15.9% 16.6% (70) bps Adjusted Net Income (1) $5 $26 (80)% Adjusted Diluted EPS (1) $0.61 $2.94 (79)% Adjusted EBITDA (1) $22 $36 (41)% Adjusted EBITDA(1) as a % of Net Sales 3.0% 5.1% (210) bps Free Cash Flow(1) $(2) $67 NA Net Leverage Ratio 0.7x 0.3x 0.4x Net Leverage Ratio per Credit Agreement (2) (1.2x) (1.0x) (0.2x)

$ in millions n Net sales of $484M, down 1% q Driven mainly by price deflation q Specialty is approximately 70% of total net sales n Gross profit of $89M, down 6% q Specialty gross profit 78% of total gross profit n Gross margin of 18.4%, down 100 bps q Within the expected 18% to 19% range Q4 Commentary 10 SPECIALTY PRODUCTS Q4 2024 RESULTS $592 $568 $571 $559 $487 $504 $539 $519 $484 21.1% 18.8% 19.1% 19.8% 19.4% 20.7% 19.3% 19.4% 18.4% Net Sales Gross Margin Rate 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24

$ in millions n Net sales of $227M, up 0.5% q Driven mainly by framing lumber pricing q Year-over-year average pricing for commodities was mixed: Ÿ 12% increase in average price of lumber Ÿ 6% decrease in average price of panels n Gross profit of $25M, up 3% q Structural gross profit 22% of total gross profit n Gross margin of 10.8%, up 20 bps q Above expectation of 9% to 10% Q4 Commentary 11 STRUCTURAL PRODUCTS Q4 2024 RESULTS $256 $230 $245 $251 $226 $222 $229 $228 $227 10.4% 11.7% 11.0% 11.3% 10.6% 10.6% 7.9% 11.0% 10.8% Net Sales Gross Margin Rate 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24

n Net Sales decreased 6% to $3.0B q Specialty product sales down 6% q Structural product sales down 5% n Gross Margin of 16.6%, down 20 bps n Adjusted Diluted EPS of $6.44 (1) n Adjusted EBITDA of $131M (1) q Adjusted EBITDA(1) margin of 4.4% n Free Cash Flow of $45M(1) q Cash Flow from Operations $85M q Capital Expenditures of $40M 12 FULL YEAR 2024 RESULTS (1) See Appendix for reconciliations for all non-GAAP figures (2) Does not include finance leases for real property, per the terms of our credit agreement FY 24 Commentary $ in millions, except per share data, leverage ratios, and Net Sales FY 2024 FY 2023 Variance Net Sales ($ billions) $3.0 $3.1 (6)% Gross Profit $489 $527 (7)% Gross Margin % 16.6% 16.8% (20) bps Adjusted Net Income(1) $55 $103 (46)% Adjusted Diluted EPS(1) $6.44 $11.41 (44)% Adjusted EBITDA(1) $131 $183 (28)% Adjusted EBITDA(1) as a % of Net Sales 4.4% 5.8% (140) bps Free Cash Flow(1) $45 $279 (84)% Net Leverage Ratio 0.7x 0.3x 0.4x Net Leverage Ratio per Credit Agreement(2) (1.2x) (1.0x) (0.2x)

* $350 million revolver less $4 million of reserves and letters of credit; $346 million of net availability n At the end of Q4 2024: § Cash/Cash Equivalents on hand of $506M § Total available liquidity of $852M § Net debt of $(156) million (1) § Net leverage of (1.2x) (1) n No debt maturities until 2029, excluding finance leases (1) Does not include finance leases for real property, per the terms of our credit agreement. See Appendix for reconciliations of non-GAAP measures. ($ millions) undrawn revolver Debt Maturity Schedule (In millions) Note: debt maturity schedule does not include finance lease obligations Net Leverage Ratio (1) 13 BALANCE SHEET $300 $273 $285 $293 $300 $300 $300 Finance Leases Senior Notes Q4 2022 Q4 2023 Q4 2024 0.1 (1.0) (1.2) Net Leverage Q4 2022 Q4 2023 Q4 2024 Gross Debt Structure (in millions)

FY 24 Free Cash Flow Walk $ in millions Net Working Capital Management(1) $ in millions Note: See Appendix for reconciliations for all non-GAAP figures (1) Net working capital includes accounts receivable, inventory, and accounts payable; Return on Working Capital is calculated by dividing trailing twelve month (TTM) Adjusted EBITDA by Net Working Capital as of the end of the period presented or discussed 14 WORKING CAPITAL AND FREE CASH FLOW $584 $531 $484 $459 $414 $487 $452 $432 $412 Total Net Working Capital Return on Working Capital 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 $200 $300 $400 $500 $600 $700 —% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

INVEST IN THE BUSINESS EXPAND GEOGRAPHIC FOOTPRINT SHARE REPURCHASES OPERATING CASH FLOW FREE CASH FLOW RETURN TO SHAREHOLDERSGROWTH AND MARGIN EXPANSION 15 CAPITAL ALLOCATION FRAMEWORK GUIDING PRINCIPLES n Maintain strong balance sheet and financial stability n Long-term net leverage could increase to at or around 2.0x when considering growth n Invest in business through fluctuating economic cycles n Acquisitions aligned to strategy n Opportunistic share repurchases

Q&A 16

Appendix 17

20-year average (1) Source: Historical data is U.S. Census Bureau; Forecast from John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution (2) Source: Joint Center for Housing Studies at Harvard University. The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. (3) Source: Historical data is Freddie Mac; Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution. Mortgage rates expected to remain above 20-year average Starts expected to be around 20-year average and well above 2009-2011 levels 18 MACRO TRENDS Remodeling spend expected to improve slightly in 2025 20-year average 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 E 20 26 E 20 27 E — 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 Total U.S. Single Family Housing Starts (SFHS) Housing starts in thousands(1) 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 LIRA Remodeling Activity Index TTM Moving Total - Dollars in billions(2) 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 P 20 26 P 20 27 P —% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 30 Year Fixed Mortgage Rates As of February 2025(3)

Average Q4 24 lumber prices increased 12% year- over-year and increased 12% from Q3 24 (1) Source: Random Lengths and company analysis 19 WOOD-BASED COMMODITY PRICE TRENDS Average Q4 24 panel prices declined 6% year- over-year and increased 7% from Q3 24 484540467 347357344357368400 411 762687 987 1,243 466 702 1,244 797 587 449413408437383 403383385430 20 18 Q 1 20 18 Q 2 20 18 Q 3 20 18 Q 4 20 19 Q 1 20 19 Q 2 20 19 Q 3 20 19 Q 4 20 20 Q 1 20 20 Q 2 20 20 Q 3 20 20 Q 4 20 21 Q 1 20 21 Q 2 20 21 Q 3 20 21 Q 4 20 22 Q 1 20 22 Q 2 20 22 Q 3 20 22 Q 4 20 23 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 24 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 — 200 400 600 800 1,000 1,200 1,400 503 549 483 389373 350 337343 387 401 682713 1,003 1,566 766 715 1,232 874 671 528 499532 636 585 615599 515 549 20 18 Q 1 20 18 Q 2 20 18 Q 3 20 18 Q 4 20 19 Q 1 20 19 Q 2 20 19 Q 3 20 19 Q 4 20 20 Q 1 20 20 Q 2 20 20 Q 3 20 20 Q 4 20 21 Q 1 20 21 Q 2 20 21 Q 3 20 21 Q 4 20 22 Q 1 20 22 Q 2 20 22 Q 3 20 22 Q 4 20 23 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 24 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 — 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Framing Lumber Composite Index $/mbf, Quarterly Average Price(1) As of December 2024 Structural Panel Composite Index $/msf, Quarterly Average Price(1) As of December 2024

The Company reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein or in the financial tables accompanying this presentation. The Company cautions that non-GAAP measures are not presentations made in accordance with GAAP and are not intended to present superior measures of our financial condition from those measures determined under GAAP. Non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. The Company further cautions that its non-GAAP measures, as used herein, are not necessarily comparable to other similarly titled measures of other companies due to differences in methods of calculation. Adjusted EBITDA and Adjusted EBITDA Margin. BlueLinx defines Adjusted EBITDA as an amount equal to net income (loss) plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to our merger and acquisition activities, gains or losses on sales of properties, amortization of deferred gains on real estate, and expense associated with our restructuring activities, such as severance, in addition to other significant and/or one-time, nonrecurring, non-operating items. The Company presents Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance. Management believes this metric helps to enhance investors’ overall understanding of the financial performance and cash flows of the business. Management also believes Adjusted EBITDA is helpful in highlighting operating trends. Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. We determine our Adjusted EBITDA Margin, which we sometimes refer to as our Adjusted EBITDA as a percentage of net sales, by dividing our Adjusted EBITDA for the applicable period by our net sales for the applicable period. We believe that this ratio is useful to investors because it more clearly defines the quality of earnings and operational efficiency of translating sales to profitability. Adjusted Net Income and Adjusted Earnings Per Share. BlueLinx defines Adjusted Net Income as net income adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to our merger and acquisition activities, gains or losses on sales of properties, amortization of deferred gains on real estate, and expense associated with our restructuring activities, such as severance, in addition to other significant and/or one-time, nonrecurring, non-operating items, further adjusted for the tax impacts of such reconciling items. BlueLinx defines Adjusted Earnings Per Share (basic and/or diluted) as the Adjusted Net Income for the period divided by the weighted average outstanding shares (basic and/or diluted) for the periods presented. We believe that Adjusted Net Income and Adjusted Earnings Per Share (basic and/or diluted) are useful to investors to enhance investors’ overall understanding of the financial performance of the business. Management also believes Adjusted Net Income and Adjusted Earnings Per Share (basic and/or diluted) are helpful in highlighting operating trends. Free Cash Flow. BlueLinx defines free cash flow as net cash provided by operating activities less total capital expenditures. Free cash flow is a measure used by management to assess our financial performance, and we believe it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures that can be used for, among other things, investment in our business, strengthening our balance sheet, and repayment of our debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities. BlueLinx calculates Net Debt as its total short- and long-term debt, including outstanding balances under our term loan and revolving credit facility and the total amount of its obligations under finance leases, less cash and cash equivalents. Net Debt Excluding Real Property Finance Lease Liabilities is calculated in the same manner as Net Debt, except the total amount of obligations under real estate finance leases are excluded. Although our credit agreements do not contain leverage covenants, a net leverage ratio excluding finance lease obligations is included within the terms of our revolving credit agreement. We believe that Net Debt and Net Debt Excluding Real Property Finance Lease Liabilities are useful to investors because our management reviews both metrics as part of its management of overall liquidity, financial flexibility, capital structure and leverage, and creditors and credit analysts monitor our net debt as part of their assessments of our business. We determine our Overall Net Leverage Ratio by dividing our Net Debt by Twelve- Month Trailing Adjusted EBITDA. Our calculation of Net Leverage Ratio Excluding Real Property Finance Lease Liabilities is determined by dividing our Net Debt Excluding Real Property Finance Lease Liabilities by Twelve-Month Trailing Adjusted EBITDA. We believe that these ratios are useful to investors because they are indicators of our ability to meet our future financial obligations. In addition, our Net Leverage Ratio is a measure that is frequently used by investors and creditors. Our Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities are not made in accordance with GAAP and are not intended to present a superior measure of our financial condition from measures and ratios determined under GAAP. The calculations of our Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities are presented in the table on page 27. Net Debt, Net Debt Excluding Real Property Finance Lease Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property Finance Lease Liabilities, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. 20 Non-GAAP Measures and Supplemental Financial Information

Net sales, gross profit dollars, gross profit percentages, sales mix, and gross profit mix by product category by fiscal quarter, Q4 2021 – Q42024 In millions where dollars are presented 21 Supplementary Financial Information Quarter Ended December 2024 September 2024 June 2024 March 2024 December 2023 September 2023 June 2023 March 2023 December 2022 September 2022 June 2022 March 2022 December 2021 Net sales by category: Specialty products $ 484 $ 519 $ 539 $ 504 $ 487 $ 559 $ 571 $ 568 $ 592 $ 724 $ 788 $ 768 $ 641 Structural products 227 228 229 222 226 251 245 230 256 336 452 534 331 Net sales $ 711 $ 747 $ 768 $ 726 $ 713 $ 810 $ 816 $ 798 $ 848 $ 1,061 $ 1,239 $ 1,302 $ 973 Net sales mix by category: Specialty products 68 % 69 % 70 % 69 % 68 % 69 % 70 % 71 % 70 % 68 % 64 % 59 % 66 % Structural products 32 % 31 % 30 % 31 % 32 % 31 % 30 % 29 % 30 % 32 % 36 % 41 % 34 % Gross Profit by category: Specialty products 89 $ 100 $ 104 $ 104 $ 95 $ 111 $ 109 $ 107 $ 125 $ 151 $ 180 $ 184 $ 140 Structural products 25 25 18 24 24 28 27 27 27 38 21 107 53 Company gross profit $ 113 $ 126 $ 122 $ 128 $ 119 $ 139 $ 136 $ 134 $ 151 $ 189 $ 201 $ 291 $ 194 Gross Margin %: Specialty products 18 % 19 % 19 % 21 % 19 % 20 % 19 % 19 % 21 % 21 % 23 % 24 % 22 % Structural products 11 % 11 % 8 % 11 % 11 % 11 % 11 % 12 % 10 % 11 % 5 % 20 % 16 % Company gross margin % 16 % 17 % 16 % 18 % 17 % 17 % 17 % 17 % 18 % 18 % 16 % 22 % 20 % % of Gross Profit earned by: Specialty products 78 % 80 % 85 % 81 % 80 % 80 % 80 % 80 % 82 % 80 % 89 % 63 % 72 % Structural products 22 % 20 % 15 % 19 % 20 % 20 % 20 % 20 % 18 % 20 % 11 % 37 % 28 % Rounded figures in this presentation may not agree to presentation in other formats we have published such as earnings releases, earnings decks, or other similar materials presented elsewhere.

Adjusted EBITDA reconciliation by fiscal quarter, Q1 2022 – Q4 2024 In millions where dollars are presented 22 Non-GAAP Reconciliation / supplementary financial information (unaudited) (1) Reflects expenses related to our previously disclosed settlement of the BlueLinx Corporation Hourly Retirement Plan (defined benefit) in 4Q 2023. (2) Reflects primarily legal, professional, technology and other integration costs. Certain amounts for periods in fiscal 2023 have been reclassified for Acquisition-related costs and Restructuring and other. (3) Reflects net losses related to Hurricane Helene in 3Q 2024, severance expenses in 2023 and 2022, and other one-time non-operating items, net. Certain amounts for periods in fiscal 2023 have been reclassified for Acquisition-related costs and Restructuring and other.. Rounded figures in this presentation may not agree to presentation in other formats we have published such as earnings releases, earnings decks, or other similar materials presented elsewhere. Fiscal Quarter 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 3Q 2023 2Q 2023 1Q 2023 4Q 2022 3Q 2022 2Q 2022 1Q2022 Net income (loss) $ 5 $ 16 $ 14 $ 17 $ (18) $ 24 $ 24 $ 18 $ 32 $ 60 $ 71 $ 133 Adjustments: Depreciation and amortization 9 10 10 9 8 8 8 8 7 7 7 7 Interest expense, net 5 5 5 5 4 6 6 8 9 10 11 11 Provision for (benefit from) income taxes 2 6 5 6 10 9 8 6 9 21 21 48 Share-based compensation expense 1 3 1 2 3 3 2 4 4 2 2 2 Amortization of deferred gain on real estate (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) Gain from sales of property — — — — — — — — — — — — Pension settlement and related expenses(1) — (2) — — 31 1 1 1 — — — — Acquisition-related costs(2) — — — — — — — — 1 — — — Restructuring and other (3) — 1 — 1 (1) 1 1 3 2 1 1 2 Adjusted EBITDA $ 22 $ 37 $ 34 $ 39 $ 36 $ 50 $ 49 $ 47 $ 63 $ 100 $ 112 $ 202 Net Sales $ 711 $ 747 $ 768 $ 726 $ 713 $ 810 $ 816 $ 798 $ 848 $ 1,061 $ 1,239 $ 1,302 Adjusted EBITDA $ 22 $ 37 $ 34 $ 39 $ 36 $ 50 $ 49 $ 47 $ 63 $ 100 $ 112 $ 202 Adjusted EBITDA Margin 3.0 % 4.9 % 4.5 % 5.4 % 5.1 % 6.2 % 6.0 % 5.9 % 7.4 % 9.4 % 9.1 % 15.5 %

Trailing 12-Months Adjusted EBITDA through the end of each fiscal quarter, Q1 2022 – Q4 2024 In millions where dollars are presented 23 Non-GAAP Reconciliation (unaudited) (1) Reflects expenses related to our previously disclosed settlement of the BlueLinx Corporation Hourly Retirement Plan (defined benefit) in 4Q 2023. (2) Reflects primarily legal, professional, technology and other integration costs. Certain amounts for periods in fiscal 2023 have been reclassified for Acquisition-related costs and Restructuring and other. (3) Reflects net losses related to Hurricane Helene in 3Q 2024, severance expenses in 2023 and 2022, and other one-time non-operating items, net. Certain amounts for periods in fiscal 2023 have been reclassified for Acquisition-related costs and Restructuring and other. Rounded figures in this presentation may not agree to presentation in other formats we have published such as earnings releases, earnings decks, or other similar materials presented elsewhere. Trailing Twelve Months as of the End of Fiscal Quarter 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 3Q 2023 2Q 2023 1Q 2023 4Q 2022 Net income (loss) $ 53 $ 30 $ 38 $ 48 $ 49 $ 99 $ 134 $ 181 $ 296 Adjustments: Depreciation and amortization 38 37 36 34 32 31 30 29 28 Interest expense, net 19 18 19 21 24 29 34 39 42 Provision for (benefit from) income taxes 18 26 29 32 33 32 44 58 99 Share-based compensation expense 8 10 9 10 12 13 12 12 10 Amortization of deferred gain on real estate (4) (4) (4) (4) (4) (4) (4) (4) (4) Gain from sales of property — — — — — — — — — Pension termination and related expenses(1) (2) 29 32 32 33 2 1 1 — Acquisition-related costs(2) — — — — — 1 1 1 1 Restructuring and other (3) 2 1 — 1 4 6 7 7 6 Adjusted EBITDA $ 131 $ 146 $ 160 $ 174 $ 183 $ 209 $ 259 $ 324 $ 478

Free Cash Flow for fiscal year 2024, 2023 and 2022 In millions 24 Non-GAAP Reconciliation (unaudited) Fiscal Year Ended December 28, 2024 December 30, 2023 December 31, 2022 Net cash provided by operating activities $ 85.2 $ 306.3 $ 400.3 Less: Property and equipment investments (40.1) (27.5) (35.9) Free cash flow $ 45.1 $ 278.8 $ 364.4 Rounding in this table may not agree to presentations in other formats we've published such as earnings news releases, earnings decks, or other similar materials presented elsewhere.