0001406666FALSE00014066662024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

CALIX, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-34674 | | 68-0438710 |

(State or other jurisdiction

of incorporation) | | (Commission

File No.) | | (I.R.S. Employer

Identification No.) |

| | |

2777 Orchard Parkway, San Jose, California | | 95134 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(408) 514-3000 |

| (Registrant’s telephone number, including area code) |

| | |

| Not Applicable |

| (Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.025 per share | | CALX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Director

On August 8, 2024, the Board of Directors (“Board”) of Calix, Inc. (the “Company”), acting upon the recommendation of the Nominating and Corporate Governance Committee of the Board, approved an increase in the number of authorized directors on the Board from eight to nine and appointed Wade Oosterman to the Board as a Class II director with a term expiring at the 2027 annual meeting of stockholders, to fill the newly created directorship.

Pursuant to the Company’s director compensation policies, as a non-employee director, Mr. Oosterman will receive (i) a $50,000 annual retainer for his service on the Board, plus additional amounts for service on committees, pro-rated for the remainder of 2024 and paid in quarterly installments, and (ii) upon his appointment, an automatic initial grant of 7,317 director stock options under the Company’s Amended and Restated 2019 Equity Incentive Award Plan that will vest in full on the earlier of the one-year anniversary of the date of grant or the day immediately preceding the date of the Company’s 2025 annual meeting of stockholders. The foregoing description is qualified in its entirety by reference to the text of (i) the Company’s Non-Employee Director Cash Compensation Policy, as amended February 9, 2023, which was filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on July 24, 2023, and (ii) the Company’s Non-Employee Director Equity Compensation Policy, as amended February 9, 2023, which was filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on July 24, 2023.

In connection with Mr. Oosterman’s appointment to the Board, the Company and Mr. Oosterman will enter into the Company’s standard indemnification agreement, the form of which was filed with the SEC as Exhibit 10.5 to the Company’s Registration Statement on Form S-1 filed with the SEC on March 8, 2010.

There is no arrangement or understanding between Mr. Oosterman and any other persons pursuant to which Mr. Oosterman was selected as a director, and Mr. Oosterman has no reportable transactions under Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

A copy of the Company’s press release, dated August 12, 2024, announcing the appointment of Mr. Oosterman is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit No. | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Date: | August 12, 2024 | | | | | Calix, Inc. |

| | | | |

| | | | | | By: | | /s/ Doug McNitt |

| | | | | | | | Doug McNitt |

| | | | | | | | EVP, General Counsel |

Former Vice Chairman of Bell Canada Wade Oosterman Joins Calix Board of Directors

Telecommunications luminary Wade Oosterman brings three decades of expertise driving transformation and profitable growth at Canada’s largest telecom companies, further strengthening Calix market leadership amid the ongoing broadband industry disruption

SAN JOSE, CA—August 12, 2024—Calix, Inc. (NYSE: CALX) today announced that Wade Oosterman, former vice chairman of Bell Canada and president of Bell Media, BCE Inc. (NYSE: BCE), has been appointed to its board of directors. Highly regarded as an influential figure in telecommunications, Oosterman will provide valuable counsel as Calix continues transforming the broadband industry with its award-winning innovation portfolio. With the addition of Oosterman to its board, Calix is well positioned to continue its mission of helping broadband service providers (BSPs) of any size simplify their business, innovate for their subscribers, and grow value to benefit their communities for generations.

Oosterman’s experience serving on the boards of Stagwell, Inc. (NASDAQ: STGW), Telephone Data Systems Inc. (NYSE: TDS), EnStream, Ingram Micro, and Virgin Mobile Canada demonstrates his broad perspective and ability to lead strategic decision-making at the highest levels.

With over 30 years of experience and a reputation for driving profitable growth, Oosterman has played pivotal roles at major Canadian telecom companies:

•His leadership was core to the transformative success of BCE, which now holds a commanding position in Canada's telecom industry with a market capitalization of $31 billion.

•Serving as vice chairman of Bell Canada and president of Bell Media, Oosterman led the transformation of overhauling operations across wireless, residential services, and brand management. His strategy in branding, pricing, product development, and marketing contributed to industry-leading financial results.

•With roles as chief brand officer at Bell Canada and chief marketing and brand officer at TELUS Corp, he has extensive knowledge of winning media and messaging strategies.

Currently Oosterman is president and chief executive officer of Peyden Inc., a private investment company with holdings in technology, real estate, and media.

“I worked for Wade while he was the president of Bell Mobility, and we had the opportunity to lead a significant divisional transformation,” said Calix president and chief executive officer, Michael Weening. “Wade inspired me and our team to embrace disruption, change, and outside-the-box thinking to maximize the opportunities and challenges that we faced. With his support, the division went from five years of decline to years of double-digit growth in net subscribers, revenue, and subscriber satisfaction. Today, the broadband industry is being disrupted as legacy network operators grapple with the commoditization of fiber. Every market has multiple fast broadband choices, thereby eliminating speed as a differentiator. In this disruptive paradigm, Wade is the perfect addition to our board. He will support and challenge our team with his unique views and insights as we push legacy boundaries to enable our BSP customers to differentiate and transform through the power of our unique platform, cloud, and managed services. It is an honor to work with Wade again as he joins the Calix board."

“I’m incredibly pleased to join the Calix board of directors,” said Oosterman. “The power of its platform, cloud, and managed services model, evidenced in the company’s ongoing fiscal results and success of its customers, speaks for itself. The Calix leadership team understands that leading its customers through a transformation is hard work but necessary for long-term success in a disrupted market. Together, we will continue to enable BSPs of all sizes to seize this moment of opportunity and build winning business models designed to transform society, one community at a time, for decades to come.”

“Wade has a clear view of the future winning BSP model, and he brings professional experience from startups to large transformations,” said Calix board chairman Carl Russo. “In sum, he is perfectly placed to help us accelerate the transformation that is sweeping through our industry.”

Learn more about the Calix board of directors.

About Calix

Calix, Inc. (NYSE: CALX) – Calix is a platform, cloud, and managed services company. Broadband service providers leverage Calix’s broadband platform, cloud, and managed services to simplify their operations, subscriber engagement, and services; innovate for their consumer, business, and municipal subscribers; and grow their value for members, investors, and the communities they serve.

Our end-to-end platform and managed services democratize the use of data—enabling our customers of any size to operate efficiently, acquire subscribers, and deliver exceptional experiences. Calix is dedicated to driving continuous improvement in partnership with our

growing ecosystem to support the transformation of our customers and their communities.

This press release contains forward-looking statements that are based upon management’s current expectations and are inherently uncertain. Forward-looking statements are based upon information available to us as of the date of this release, and we assume no obligation to revise or update any such forward-looking statement to reflect any event or circumstance after the date of this release, except as required by law. Actual results and the timing of events could differ materially from current expectations based on risks and uncertainties affecting Calix’s business. The reader is cautioned not to rely on the forward-looking statements contained in this press release. Additional information on potential factors that could affect Calix’s results and other risks and uncertainties are detailed in its quarterly reports on Form 10-Q and Annual Report on Form 10-K filed with the SEC and available at www.sec.gov.

Calix and the Calix logo are trademarks or registered trademarks of Calix and/or its affiliates in the U.S. and other countries. A listing of Calix’s trademarks can be found at https://www.calix.com/legal/trademarks.html. Third-party trademarks mentioned are the property of their respective owners.

Press Inquiries:

Alison Crisci

919-353-4323

alison.crisci@calix.com

Investor Inquiries:

Jim Fanucchi

investorrelations@calix.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

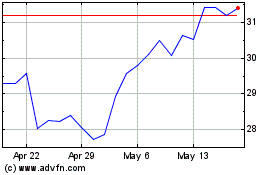

Calix (NYSE:CALX)

Historical Stock Chart

From Mar 2025 to Apr 2025

Calix (NYSE:CALX)

Historical Stock Chart

From Apr 2024 to Apr 2025