CBRE Group, Inc. (NYSE:CBRE) today reported financial results

for the fourth quarter and year ended December 31, 2024.

Key Highlights:

- Q4 GAAP EPS of $1.58; Core EPS of $2.32 and 2024 GAAP EPS of

$3.14; Core EPS of $5.10

- Revenue up 16% for Q4 and 12% for 2024; net revenue up 18% for

Q4 and 14% for 2024

- Resilient Business (1) net revenue increased 16% for Q4 and 14%

for 2024

- $1.7 billion net cash flow from operations and $1.5 billion

free cash flow for all of 2024

- Repurchased more than $800 million worth of shares since the

end of third-quarter 2024

- Expect to achieve 2025 Core EPS of $5.80 to $6.10 - reflecting

mid-teens growth at the midpoint

“The fourth quarter was CBRE’s best quarter ever for core

earnings and free cash flow with broad strength across our

business,” said Bob Sulentic, CBRE’s chair and chief executive

officer. “We also made significant progress in executing our

strategy, positioning CBRE to continue delivering double-digit

earnings growth on an enduring basis.”

“Our confidence in CBRE’s future has never been higher, as

evidenced by the more than $800 million worth of shares we

repurchased since the end of the third quarter,” Mr. Sulentic

added. “Despite the strong appreciation of our shares over the past

year, we believe the market is undervaluing our business relative

to both its growth profile and dramatically enhanced

resiliency.”

Among the company’s notable strategic gains are integrating

CBRE’s project management capabilities into Turner & Townsend,

its subsidiary, and acquiring full ownership of Industrious, a

provider of premium flexible workplace solutions. As a result of

these moves, the company will establish new business segments this

year: Building Operations & Experience, comprised of enterprise

and local facilities management and property management, which will

include flexible workplace solutions, and Project Management,

consisting of the combined Turner & Townsend/CBRE project

management business. Historical non-GAAP financial information for

the new segments is presented at the end of this press release. The

company will provide historical quarterly financial information by

lines of business based on the new segments prior to releasing Q1

2025 financial results.

Consolidated Financial Results

Overview

The following table presents highlights of CBRE performance

(dollars in millions, except per share data; totals may not add due

to rounding):

% Change

% Change

Q4 2024

Q4 2023

USD

LC (2)

FY 2024

FY 2023

USD

LC (2)

Operating Results

Revenue

$

10,404

$

8,950

16.2

%

15.5

%

$

35,767

$

31,949

12.0

%

12.0

%

Net revenue (3)

6,134

5,187

18.3

%

17.4

%

20,868

18,276

14.2

%

14.2

%

GAAP net income

487

477

2.1

%

2.1

%

968

986

(1.8

)%

(0.2

)%

GAAP EPS

1.58

1.55

1.9

%

1.9

%

3.14

3.15

(0.3

)%

1.3

%

Core adjusted net income (4)

712

426

67.1

%

67.1

%

1,571

1,199

31.0

%

32.3

%

Core EBITDA (5)

1,086

737

47.4

%

45.6

%

2,704

2,209

22.4

%

22.4

%

Core EPS (4)

2.32

1.38

68.1

%

68.1

%

5.10

3.84

32.8

%

34.1

%

Cash Flow Results

Cash flow provided by operations

$

1,340

$

853

57.1

%

$

1,708

$

480

NM

Add: Gain on disposition of real

estate

130

10

NM

142

27

NM

Less: Capital expenditures

93

94

(1.1

)%

307

305

0.7

%

Free cash flow (6)

$

1,377

$

769

79.1

%

$

1,543

$

202

NM

Advisory Services

Segment

The following table presents highlights of the Advisory Services

segment performance (dollars in millions; totals may not add due to

rounding):

% Change

Q4 2024

Q4 2023

USD

LC

Revenue

$

3,088

$

2,591

19.2

%

18.8

%

Net revenue

3,061

2,567

19.2

%

18.8

%

Segment operating profit (7)

674

502

34.3

%

34.3

%

Segment operating profit on revenue margin

(8)

21.8

%

19.4

%

2.4 pts

2.6 pts

Segment operating profit on net revenue

margin (8)

22.0

%

19.5

%

2.5 pts

2.6 pts

Note: all percent changes cited are vs. fourth-quarter 2023,

except where noted.

Leasing

- Global leasing revenue increased 15% (same local currency), in

line with expectations.

- The Americas was strong, with leasing revenue up 15% (same

local currency), driven by an 18% increase in the United

States.

- Growth was especially strong in Asia-Pacific (APAC), where

leasing revenue surged 22% (21% local currency).

- Europe, the Middle East and Africa (EMEA) leasing revenue rose

9% (6% local currency).

- Office leasing revenue growth was strong in every global

region, paced by a 28% gain in the United States. Occupiers are

increasingly comfortable making long-term decisions given improved

return-to-office momentum and a healthy economic outlook. While

major gateway markets showed continued strength, other large

markets like Dallas, Atlanta and Seattle grew even faster, and

certain smaller Midwest markets picked up considerably.

Capital Markets

- Growth was very strong for both property sales and loan

origination activity around the world.

- Global property sales revenue growth accelerated to 35% (34%

local currency), above expectations.

- In the Americas, property sales revenue jumped 30% (31% local

currency). The United States led the way with 37% growth, with

strength across all major asset classes.

- Property sales revenue also increased strongly in both EMEA, up

53% (51% local currency), and APAC, up 29% (27% local

currency).

- Mortgage origination revenue rose 37% (same local currency).

Growth was fueled by a 76% increase in loan origination fees,

partly offset by lower escrow income. This reflected a strong

pickup in loan origination volume across financing sources, most

notably from Government-Sponsored Enterprises and banks.

Other Advisory Business Lines

- Property management net revenue rose 16% (same local currency),

driven by the United States, reflecting the addition of the

Brookfield office portfolio.

- Loan servicing revenue increased 6% (5% local currency). The

servicing portfolio ended 2024 at approximately $433 billion, up 5%

for the year.

- Valuations revenue increased 7% (6% local currency), led by the

United States.

Global Workplace Solutions

(GWS) Segment

The following table presents highlights of the GWS segment

performance (dollars in millions; totals may not add due to

rounding):

% Change

Q4 2024

Q4 2023

USD

LC

Revenue

$

7,042

$

6,103

15.4

%

14.6

%

Net revenue

2,799

2,363

18.5

%

17.4

%

Segment operating profit

393

292

34.6

%

33.2

%

Segment operating profit on revenue

margin

5.6

%

4.8

%

0.8 pts

0.8 pts

Segment operating profit on net revenue

margin

14.0

%

12.4

%

1.6 pts

1.6 pts

Note: all percent changes cited are vs. fourth-quarter 2023,

except where noted.

- Facilities management net revenue increased 24% (23% local

currency), with strength across the enterprise and local

businesses. Growth has been particularly strong in the technology,

industrial, data center and healthcare sectors.

- Project management net revenue rose 9% (7% local currency).

Turner & Townsend’s revenue rose 20% (17% local currency) with

particular strength in North America and the UK, led by growth in

Real Estate and Infrastructure.

- Margin on net revenue improved 160 basis points from

fourth-quarter 2023 and 30 basis points for all of 2024, reflecting

cost efforts and a focus on contract profitability.

Real Estate Investments (REI)

Segment

The following table presents highlights of the REI segment

performance (dollars in millions):

% Change

Q4 2024

Q4 2023

USD

LC

Revenue

$

275

$

262

5.0

%

3.1

%

Segment operating profit

150

68

120.6

%

120.6

%

Note: all percent changes cited are vs. fourth-quarter 2023,

except where noted.

Real Estate Development

- Global development operating profit (9) climbed to $123 million

from $27 million in last year’s fourth quarter. The company

monetized significant assets prior to year-end, most prominently

several data center development sites.

- The in-process portfolio ended 2024 at $18.8 billion, up $3.0

billion for the year. The pipeline increased $0.4 billion during

2024 to end the year at $13.7 billion.

Investment Management

- Revenue edged up 1% (down 1% local currency).

- As expected, investment management operating profit (9) was

down for the quarter, totaling approximately $27 million. The

decline was partly driven by a ramp up of costs in anticipation of

increased capital raising.

- Assets Under Management (AUM) totaled $146.2 billion, a

decrease of $1.3 billion for the year, mostly attributable to

adverse foreign currency movement. Absent currency effects, AUM was

up more than $2 billion for the year.

Core Corporate Segment

- Core corporate operating loss increased by approximately $7

million versus prior-year fourth quarter, driven by higher

incentive compensation, reflecting improved business

performance.

Capital Allocation

Overview

- Free Cash Flow – During the fourth quarter, free cash

flow improved significantly to $1.4 billion. This reflected cash

provided by operating activities of $1.5 billion (including the

gain on sale of real estate assets), adjusted for total capital

expenditures of $93 million. For all of 2024, free cash flow

totaled more than $1.5 billion and free cash flow conversion

improved to almost 100%, exceeding the target range of 75% to

85%.

- Stock Repurchase Program – The company has repurchased

approximately 6.05 million shares for $806 million ($133.32 average

price per share) since the end of third-quarter 2024. There was

more than $5.5 billion remaining under the company’s authorized

stock repurchase program as of February 11, 2025.

- Acquisitions and Investments – The company did not make

any material acquisitions during the fourth quarter.

Leverage and Financing

Overview

- Leverage – CBRE’s net leverage ratio (net debt (10) to

trailing twelve-month core EBITDA) was 0.93x as of December 31,

2024, which is substantially below the company’s primary debt

covenant of 4.25x. The net leverage ratio is computed as follows

(dollars in millions):

As of

December 31, 2024

Total debt

$

3,635

Less: Cash (11)

1,114

Net debt (10)

$

2,521

Divided by: Trailing twelve-month Core

EBITDA

$

2,704

Net leverage ratio

0.93x

- Liquidity – As of December 31, 2024, the company had

approximately $4.4 billion of total liquidity, consisting of $1.1

billion in cash, plus the ability to borrow an aggregate of

approximately $3.3 billion under its revolving credit facilities

and commercial paper program, net of any outstanding letters of

credit.

Conference Call Details

The company’s fourth quarter earnings webcast and conference

call will be held today, Thursday, February 13, 2025 at 8:30 a.m.

Eastern Time. Investors are encouraged to access the webcast via

this link, or they can click this link beginning at

8:15 a.m. Eastern Time for automated access to the conference

call.

Alternatively, investors may dial into the conference call using

these operator-assisted phone numbers: 877.407.8037 (U.S.) or

201.689.8037 (International). A replay of the call will be

available starting at 1:00 p.m. Eastern Time on February 13, 2025.

The replay is accessible by dialing 877.660.6853 (U.S.) or

201.612.7415 (International) and using the access code: 13750845#.

A transcript of the call will be available on the company’s

Investor Relations website at https://ir.cbre.com.

About CBRE Group,

Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500

company headquartered in Dallas, is the world’s largest commercial

real estate services and investment firm (based on 2024 revenue).

The company has more than 140,000 employees (including Turner &

Townsend employees) serving clients in more than 100 countries.

CBRE serves a diverse range of clients with an integrated suite of

services, including facilities, transaction and project management;

property management; investment management; appraisal and

valuation; property leasing; strategic consulting; property sales;

mortgage services and development services. Please visit our

website at www.cbre.com. We routinely post important

information on our website, including corporate and investor

presentations and financial information. We intend to use our

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Such disclosures will be included in the Investor Relations

section of our website at https://ir.cbre.com. Accordingly,

investors should monitor such portion of our website, in addition

to following our press releases, Securities and Exchange Commission

filings and public conference calls and webcasts.

Safe Harbor and

Footnotes

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including statements

regarding the economic outlook, the company’s future growth

momentum, operations and business outlook. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the company’s actual results and performance

in future periods to be materially different from any future

results or performance suggested in forward-looking statements in

this press release. Any forward-looking statements speak only as of

the date of this press release and, except to the extent required

by applicable securities laws, the company expressly disclaims any

obligation to update or revise any of them to reflect actual

results, any changes in expectations or any change in events. If

the company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements. Factors that

could cause results to differ materially include, but are not

limited to: disruptions in general economic, political and

regulatory conditions and significant public health events,

particularly in geographies or industry sectors where our business

may be concentrated; volatility or adverse developments in the

securities, capital or credit markets, interest rate increases and

conditions affecting the value of real estate assets, inside and

outside the United States; poor performance of real estate

investments or other conditions that negatively impact clients’

willingness to make real estate or long-term contractual

commitments and the cost and availability of capital for investment

in real estate; foreign currency fluctuations and changes in

currency restrictions, trade sanctions and import/export and

transfer pricing rules; our ability to compete globally, or in

specific geographic markets or business segments that are material

to us; our ability to identify, acquire and integrate accretive

businesses; costs and potential future capital requirements

relating to businesses we may acquire; integration challenges

arising out of companies we may acquire; increases in unemployment

and general slowdowns in commercial activity; trends in pricing and

risk assumption for commercial real estate services; the effect of

significant changes in capitalization rates across different

property types; a reduction by companies in their reliance on

outsourcing for their commercial real estate needs, which would

affect our revenues and operating performance; client actions to

restrain project spending and reduce outsourced staffing levels;

our ability to further diversify our revenue model to offset

cyclical economic trends in the commercial real estate industry;

our ability to attract new user and investor clients; our ability

to retain major clients and renew related contracts; our ability to

leverage our global services platform to maximize and sustain

long-term cash flow; our ability to continue investing in our

platform and client service offerings; our ability to maintain

expense discipline; the emergence of disruptive business models and

technologies; negative publicity or harm to our brand and

reputation; the failure by third parties to comply with service

level agreements or regulatory or legal requirements; the ability

of our investment management business to maintain and grow assets

under management and achieve desired investment returns for our

investors, and any potential related litigation, liabilities or

reputational harm possible if we fail to do so; our ability to

manage fluctuations in net earnings and cash flow, which could

result from poor performance in our investment programs, including

our participation as a principal in real estate investments; the

ability of our indirect wholly-owned subsidiary, CBRE Capital

Markets, Inc. to periodically amend, or replace, on satisfactory

terms, the agreements for its warehouse lines of credit; declines

in lending activity of U.S. Government Sponsored Enterprises,

regulatory oversight of such activity and our mortgage servicing

revenue from the commercial real estate mortgage market; changes in

U.S. and international law and regulatory environments (including

relating to anti-corruption, anti-money laundering, trade

sanctions, tariffs, currency controls and other trade control

laws), particularly in Asia, Africa, Russia, Eastern Europe and the

Middle East, due to the level of political instability in those

regions; litigation and its financial and reputational risks to us;

our exposure to liabilities in connection with real estate advisory

and property management activities and our ability to procure

sufficient insurance coverage on acceptable terms; our ability to

retain, attract and incentivize key personnel; our ability to

manage organizational challenges associated with our size;

liabilities under guarantees, or for construction defects, that we

incur in our development services business; our leverage under our

debt instruments as well as the limited restrictions therein on our

ability to incur additional debt, and the potential increased

borrowing costs to us from a credit-ratings downgrade; our and our

employees’ ability to execute on, and adapt to, information

technology strategies and trends; cybersecurity threats or other

threats to our information technology networks, including the

potential misappropriation of assets or sensitive information,

corruption of data or operational disruption; our ability to comply

with laws and regulations related to our global operations,

including real estate licensure, tax, labor and employment laws and

regulations, fire and safety building requirements and regulations,

as well as data privacy and protection regulations and

sustainability matters, and the anti-corruption laws and trade

sanctions of the U.S. and other countries; changes in applicable

tax or accounting requirements; any inability for us to implement

and maintain effective internal controls over financial reporting;

the effect of implementation of new accounting rules and standards

or the impairment of our goodwill and intangible assets; and the

performance of our equity investments in companies we do not

control.

Additional information concerning factors that may influence the

company’s financial information is discussed under “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” “Quantitative and Qualitative Disclosures

About Market Risk” and “Cautionary Note on Forward-Looking

Statements” in our Annual Report on Form 10-K for the year ended

December 31, 2023, our quarterly report on Form 10-Q for the

quarterly period ended September 30, 2024, as well as in the

company’s press releases and other periodic filings with the

Securities and Exchange Commission (SEC). Such filings are

available publicly and may be obtained on the company’s website at

www.cbre.com or upon written request from CBRE’s Investor Relations

Department at investorrelations@cbre.com.

The terms “net revenue,” “core adjusted net income,” “core

EBITDA,” “core EPS,” “business line operating profit (loss),”

“segment operating profit on revenue margin,” “segment operating

profit on net revenue margin,” “net debt” and “free cash flow,” all

of which CBRE uses in this press release, are non-GAAP financial

measures under SEC guidelines, and you should refer to the

footnotes below as well as the “Non-GAAP Financial Measures”

section in this press release for a further explanation of these

measures. We have also included in that section reconciliations of

these measures in specific periods to their most directly

comparable financial measure calculated and presented in accordance

with GAAP for those periods.

Totals may not sum in tables in millions included in this

release due to rounding.

Note: We have not reconciled the (non-GAAP) core earnings per

share forward-looking guidance included in this release to the most

directly comparable GAAP measure because this cannot be done

without unreasonable effort due to the variability and low

visibility with respect to costs related to acquisitions, carried

interest incentive compensation and financing costs, which are

potential adjustments to future earnings. We expect the variability

of these items to have a potentially unpredictable, and a

potentially significant, impact on our future GAAP financial

results.

(1)

Resilient businesses include the

facilities management, project management, loan servicing,

valuation, property management, and recurring investment management

fees.

(2)

Local currency percentage change is

calculated by comparing current-period results at prior-period

exchange rates versus prior-period results.

(3)

Net revenue is gross revenue less costs

largely associated with subcontracted vendor work performed for

clients. These costs are reimbursable by clients and generally have

no margin.

(4)

Core adjusted net income and core earnings

per diluted share (or core EPS) exclude the effect of select items

from GAAP net income and GAAP earnings per diluted share as well as

adjust the provision for income taxes and impact on non-controlling

interest for such charges. Adjustments during the periods presented

included non-cash depreciation and amortization expense related to

certain assets attributable to acquisitions and restructuring

activities, certain carried interest incentive compensation

(reversal) expense to align with the timing of associated revenue,

the impact of fair value adjustments to real estate assets acquired

in the acquisition of Telford Homes plc in 2019 (the Telford

acquisition) (purchase accounting) that were sold in the period,

costs incurred related to legal entity restructuring, write-off of

financing costs on extinguished debt, integration and other costs

related to acquisitions, asset impairments, provision associated

with Telford’s fire safety remediation efforts, costs associated

with efficiency and cost-reduction initiatives, and a one-time gain

associated with remeasuring an investment in an unconsolidated

subsidiary to fair value as of the date the remaining controlling

interest was acquired. It also removes the fair value changes and

related tax impact of certain strategic non-core non-controlling

equity investments that are not directly related to our business

segments (including venture capital “VC” related investments).

(5)

Core EBITDA represents earnings, inclusive

of non-controlling interest, before net interest expense, write-off

of financing costs on extinguished debt, income taxes, depreciation

and amortization, asset impairments, adjustments related to certain

carried interest incentive compensation expense (reversal) to align

with the timing of associated revenue, fair value adjustments to

real estate assets acquired in the Telford acquisition (purchase

accounting) that were sold in the period, costs incurred related to

legal entity restructuring, integration and other costs related to

acquisitions, provision associated with Telford’s fire safety

remediation efforts, costs associated with efficiency and

cost-reduction initiatives, and a one-time gain associated with

remeasuring an investment in an unconsolidated subsidiary to fair

value as of the date the remaining controlling interest was

acquired. It also removes the fair value changes, on a pre-tax

basis, of certain strategic non-core non-controlling equity

investments that are not directly related to our business segments

(including venture capital “VC” related investments).

(6)

Free cash flow is calculated as cash flow

provided by operations, plus gain on sale of real estate assets,

less capital expenditures (reflected in the investing section of

the consolidated statement of cash flows). We have adjusted the

definition of free cash flow to include the gain on sale of real

estate assets to reflect the net impact on the company’s cash flows

related to real estate investment and development activities.

(7)

Segment operating profit is the measure

reported to the chief operating decision maker (CODM) for purposes

of making decisions about allocating resources to each segment and

assessing performance of each segment. Segment operating profit

represents earnings, inclusive of non-controlling interest, before

net interest expense, write-off of financing costs on extinguished

debt, income taxes, depreciation and amortization and asset

impairments, as well as adjustments related to the following:

certain carried interest incentive compensation expense (reversal)

to align with the timing of associated revenue, fair value

adjustments to real estate assets acquired in the Telford

acquisition (purchase accounting) that were sold in the period,

costs incurred related to legal entity restructuring, integration

and other costs related to acquisitions, provision associated with

Telford’s fire safety remediation efforts, costs associated with

efficiency and cost-reduction initiatives, and a one-time gain

associated with remeasuring an investment in an unconsolidated

subsidiary to fair value as of the date the remaining controlling

interest was acquired.

(8)

Segment operating profit on revenue and

net revenue margins represent segment operating profit divided by

revenue and net revenue, respectively.

(9)

Represents line of business

profitability/losses, as adjusted.

(10)

Net debt is calculated as total debt

(excluding non-recourse debt) less cash and cash equivalents.

(11)

Cash represents cash and cash equivalents

(excluding restricted cash).

CBRE GROUP, INC.

OPERATING RESULTS

FOR THE THREE AND TWELVE

MONTHS ENDED DECEMBER 31, 2024 AND 2023

(in millions, except share and

per share data)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Revenue:

Net revenue

$

6,134

$

5,187

$

20,868

$

18,276

Pass-through costs also recognized as

revenue

4,270

3,763

14,899

13,673

Total revenue

10,404

8,950

35,767

31,949

Costs and expenses:

Cost of revenue

8,290

7,093

28,811

25,675

Operating, administrative and other

1,473

1,207

5,011

4,562

Depreciation and amortization

177

156

674

622

Total costs and expenses

9,940

8,456

34,496

30,859

Gain on disposition of real estate

130

10

142

27

Operating income

594

504

1,413

1,117

Equity income (loss) from unconsolidated

subsidiaries

58

128

(19

)

248

Other income

14

39

39

61

Interest expense, net of interest

income

53

40

215

149

Income before provision for income

taxes

613

631

1,218

1,277

Provision for income taxes

112

136

182

250

Net income

501

495

1,036

1,027

Less: Net income attributable to

non-controlling interests

14

18

68

41

Net income attributable to CBRE Group,

Inc.

$

487

$

477

$

968

$

986

Basic income per share:

Net income per share attributable to CBRE

Group, Inc.

$

1.60

$

1.56

$

3.16

$

3.20

Weighted average shares outstanding for

basic income per share

304,638,633

304,728,400

305,859,458

308,430,080

Diluted income per share:

Net income per share attributable to CBRE

Group, Inc.

$

1.58

$

1.55

$

3.14

$

3.15

Weighted average shares outstanding for

diluted income per share

307,299,709

308,526,651

308,033,612

312,550,942

Core EBITDA

$

1,086

$

737

$

2,704

$

2,209

CBRE GROUP, INC.

SEGMENT RESULTS

FOR THE THREE MONTHS ENDED

DECEMBER 31, 2024

(in millions, totals may not

add due to rounding)

(Unaudited)

Three Months Ended December

31, 2024

Advisory

Services

Global Workplace

Solutions

Real Estate

Investments

Corporate (1)

Total Core

Other

Total

Consolidated

Revenue:

Net revenue

$

3,061

$

2,799

$

275

$

(1

)

$

6,134

$

—

$

6,134

Pass-through costs also recognized as

revenue

27

4,243

—

—

4,270

—

4,270

Total revenue

3,088

7,042

275

(1

)

10,404

—

10,404

Costs and expenses:

Cost of revenue

1,872

6,333

63

22

8,290

—

8,290

Operating, administrative and other

570

347

276

280

1,473

—

1,473

Depreciation and amortization

70

90

3

14

177

—

177

Total costs and expenses

2,512

6,770

342

316

9,940

—

9,940

Gain on disposition of real estate

—

—

130

—

130

—

130

Operating income (loss)

576

272

63

(317

)

594

—

594

Equity income (loss) from unconsolidated

subsidiaries

—

1

88

—

89

(31

)

58

Other income

2

1

—

5

8

6

14

Add-back: Depreciation and

amortization

70

90

3

14

177

—

177

Adjustments:

Carried interest incentive compensation

reversal to align with the timing of associated revenue

—

—

(4

)

—

(4

)

—

(4

)

Integration and other costs related to

acquisitions

—

4

—

59

63

—

63

Costs associated with efficiency and

cost-reduction initiatives

26

25

—

71

122

—

122

Charges related to indirect tax audits and

settlements

—

—

—

37

37

—

37

Total segment operating profit (loss)

$

674

$

393

$

150

$

(131

)

$

(25

)

$

1,061

Core EBITDA

$

1,086

_______________

(1)

Includes elimination of inter-segment revenue.

CBRE GROUP, INC.

SEGMENT

RESULTS—(CONTINUED)

FOR THE THREE MONTHS ENDED

DECEMBER 31, 2023

(in millions, totals may not

add due to rounding)

(Unaudited)

Three Months Ended December

31, 2023

Advisory

Services

Global Workplace

Solutions

Real Estate

Investments

Corporate (1)

Total Core

Other

Total

Consolidated

Revenue:

Net revenue

$

2,567

$

2,363

$

262

$

(6

)

$

5,187

$

—

$

5,187

Pass-through costs also recognized as

revenue

23

3,740

—

—

3,763

—

3,763

Total revenue

2,591

6,103

262

(6

)

8,950

—

8,950

Costs and expenses:

Cost of revenue

1,533

5,503

53

4

7,093

—

7,093

Operating, administrative and other

560

310

202

135

1,207

—

1,207

Depreciation and amortization

73

65

3

15

156

—

156

Total costs and expenses

2,166

5,878

258

154

8,456

—

8,456

Gain on disposition of real estate

—

—

10

—

10

—

10

Operating income (loss)

425

225

14

(160

)

504

—

504

Equity income from unconsolidated

subsidiaries

1

—

56

—

57

71

128

Other income

31

—

—

3

34

5

39

Add-back: Depreciation and

amortization

73

65

3

15

156

—

156

Adjustments:

Carried interest incentive compensation

reversal to align with the timing of associated revenue

—

—

(5

)

—

(5

)

—

(5

)

Integration and other costs related to

acquisitions

—

2

—

—

2

—

2

Costs incurred related to legal entity

restructuring

—

—

—

9

9

—

9

Costs associated with efficiency and

cost-reduction initiatives

5

—

—

9

14

—

14

One-time gain associated with remeasuring

an investment in an unconsolidated subsidiary to fair value as of

the date the remaining controlling interest was acquired

(34

)

—

—

—

(34

)

—

(34

)

Total segment operating profit (loss)

$

502

$

292

$

68

$

(124

)

$

76

$

813

Core EBITDA

$

737

_____________

(1)

Includes elimination of inter-segment

revenue.

CBRE GROUP, INC.

CONSOLIDATED BALANCE

SHEETS

(in millions)

December 31, 2024

December 31, 2023

ASSETS

Current Assets:

Cash and cash equivalents

$

1,114

$

1,265

Restricted cash

107

106

Receivables, net

7,005

6,370

Warehouse receivables (1)

561

675

Contract assets

400

443

Prepaid expenses

332

333

Income taxes receivable

130

159

Other current assets

321

315

Total Current Assets

9,970

9,666

Property and equipment, net

914

907

Goodwill

5,621

5,129

Other intangible assets, net

2,298

2,081

Operating lease assets

1,198

1,030

Investments in unconsolidated

subsidiaries

1,295

1,374

Non-current contract assets

89

75

Real estate under development

505

300

Non-current income taxes receivable

75

78

Deferred tax assets, net

538

361

Other assets, net

1,880

1,547

Total Assets

$

24,383

$

22,548

LIABILITIES AND EQUITY

Current Liabilities:

Accounts payable and accrued expenses

$

4,102

$

3,562

Compensation and employee benefits

payable

1,419

1,459

Accrued bonus and profit sharing

1,695

1,556

Operating lease liabilities

200

242

Contract liabilities

375

298

Income taxes payable

209

217

Warehouse lines of credit (which fund

loans that U.S. Government Sponsored Enterprises have committed to

purchase) (1)

552

666

Revolving credit facility

132

—

Other short-term borrowings

222

16

Current maturities of long-term debt

36

9

Other current liabilities

345

218

Total Current Liabilities

9,287

8,243

Long-term debt, net of current

maturities

3,245

2,804

Non-current operating lease

liabilities

1,307

1,089

Non-current income taxes payable

—

30

Non-current tax liabilities

160

157

Deferred tax liabilities, net

247

255

Other liabilities

945

903

Total Liabilities

15,191

13,481

Equity:

CBRE Group, Inc. Stockholders’ Equity:

Class A common stock

3

3

Additional paid-in capital

—

—

Accumulated earnings

9,567

9,188

Accumulated other comprehensive loss

(1,159

)

(924

)

Total CBRE Group, Inc. Stockholders’

Equity

8,411

8,267

Non-controlling interests

781

800

Total Equity

9,192

9,067

Total Liabilities and Equity

$

24,383

$

22,548

_____________

(1)

Represents loan receivables, the majority

of which are offset by borrowings under related warehouse line of

credit facilities.

CBRE GROUP, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in millions)

Twelve Months Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

1,036

$

1,027

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

674

622

Gains related to mortgage servicing

rights, premiums on loan sales and sales of other assets

(162

)

(102

)

Gain on disposition of real estate

assets

(142

)

(27

)

Net compensation expense for equity

awards

146

96

Equity loss (income) from unconsolidated

subsidiaries

19

(248

)

Other non-cash adjustments to net

income

8

(18

)

Distribution of earnings from

unconsolidated subsidiaries

132

256

Proceeds from sale of mortgage loans

12,817

9,714

Origination of mortgage loans

(12,668

)

(9,905

)

(Decrease) increase in warehouse lines of

credit

(114

)

218

Purchase of equity securities

(51

)

(15

)

Proceeds from sale of equity

securities

76

14

(Increase) decrease in real estate under

development

(6

)

81

Increase in receivables, prepaid expenses

and other assets (including contract and lease assets)

(572

)

(860

)

Increase in accounts payable and accrued

expenses and other liabilities (including contract and lease

liabilities)

538

22

Increase (decrease) in compensation and

employee benefits payable and accrued bonus and profit sharing

206

(173

)

Increase in net income taxes

receivable/payable

(8

)

(97

)

Other operating activities, net

(221

)

(125

)

Net cash provided by operating

activities

1,708

480

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(307

)

(305

)

Acquisition of businesses, including net

assets acquired, intangibles and goodwill, net of cash acquired

(1,067

)

(203

)

Contributions to unconsolidated

subsidiaries

(136

)

(127

)

Distributions from unconsolidated

subsidiaries

91

54

Acquisition and development of real estate

assets

(389

)

(171

)

Proceeds from disposition of real estate

assets

235

77

Other investing activities, net

59

(6

)

Net cash used in investing activities

(1,514

)

(681

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from revolving credit

facility

4,173

4,006

Repayment of revolving credit facility

(4,041

)

(4,184

)

Proceeds from commercial paper

175

—

Proceeds from senior term loans

—

748

Repayment of senior term loans

(9

)

(437

)

Proceeds from issuance of senior notes

495

975

Repurchase of common stock

(627

)

(665

)

Acquisition of businesses (cash paid for

acquisitions more than three months after purchase date)

(281

)

(145

)

Units repurchased for payment of taxes on

equity awards

(105

)

(72

)

Other financing activities, net

(1

)

(72

)

Net cash (used in) provided by financing

activities

(221

)

154

Effect of currency exchange rate changes

on cash and cash equivalents and restricted cash

(123

)

13

NET DECREASE IN CASH AND CASH

EQUIVALENTS AND RESTRICTED CASH

(150

)

(34

)

CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH, AT BEGINNING OF YEAR

1,371

1,405

CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH, AT END OF YEAR

$

1,221

$

1,371

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the year for:

Interest

$

396

$

191

Income tax payments, net

$

467

$

467

Non-cash investing and financing

activities:

Deferred and/or contingent

consideration

$

19

$

54

Non-GAAP Financial

Measures

The following measures are considered “non-GAAP financial

measures” under SEC guidelines:

(i)

Net revenue

(ii)

Core EBITDA

(iii)

Business line operating profit/loss

(iv)

Segment operating profit on revenue and

net revenue margins

(v)

Free cash flow

(vi)

Net debt

(vii)

Core net income attributable to CBRE

Group, Inc. stockholders, as adjusted (which we also refer to as

“core adjusted net income”)

(viii)

Core EPS

These measures are not recognized measurements under United

States generally accepted accounting principles (GAAP). When

analyzing our operating performance, investors should use these

measures in addition to, and not as an alternative for, their most

directly comparable financial measure calculated and presented in

accordance with GAAP. Because not all companies use identical

calculations, our presentation of these measures may not be

comparable to similarly titled measures of other companies.

Our management generally uses these non-GAAP financial measures

to evaluate operating performance and for other discretionary

purposes. The company believes these measures provide a more

complete understanding of ongoing operations, enhance comparability

of current results to prior periods and may be useful for investors

to analyze our financial performance because they eliminate the

impact of selected charges that may obscure trends in the

underlying performance of our business. The company further uses

certain of these measures, and believes that they are useful to

investors, for purposes described below.

With respect to net revenue, net revenue is gross revenue less

costs largely associated with subcontracted vendor work performed

for clients. We believe that investors may find this measure useful

to analyze the company’s overall financial performance because it

excludes costs reimbursable by clients that generally have no

margin, and as such provides greater visibility into the underlying

performance of our business.

With respect to Core EBITDA, business line operating

profit/loss, and segment operating profit on revenue and net

revenue margins, the company believes that investors may find these

measures useful in evaluating our operating performance compared to

that of other companies in our industry because their calculations

generally eliminate the accounting effects of acquisitions, which

would include impairment charges of goodwill and intangibles

created from acquisitions, the effects of financings and income tax

and the accounting effects of capital spending. All of these

measures may vary for different companies for reasons unrelated to

overall operating performance. In the case of Core EBITDA, this

measure is not intended to be a measure of free cash flow for our

management’s discretionary use because it does not consider cash

requirements such as tax and debt service payments. The Core EBITDA

measure calculated herein may also differ from the amounts

calculated under similarly titled definitions in our credit

facilities and debt instruments, which amounts are further adjusted

to reflect certain other cash and non-cash charges and are used by

us to determine compliance with financial covenants therein and our

ability to engage in certain activities, such as incurring

additional debt. The company also uses segment operating profit and

core EPS as significant components when measuring our operating

performance under our employee incentive compensation programs.

With respect to free cash flow, the company believes that

investors may find this measure useful to analyze the cash flow

generated from operations and real estate investment and

development activities after accounting for cash outflows to

support operations and capital expenditures. With respect to net

debt, the company believes that investors use this measure when

calculating the company’s net leverage ratio.

With respect to core EBITDA, core EPS and core adjusted net

income, the company believes that investors may find these measures

useful to analyze the underlying performance of operations without

the impact of strategic non-core equity investments (Altus Power,

Inc. and certain other investments) that are not directly related

to our business segments. These can be volatile and are often

non-cash in nature.

Core net income attributable to CBRE Group, Inc. stockholders,

as adjusted (or core adjusted net income), and core EPS, are

calculated as follows (in millions, except share and per share

data):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net income attributable to CBRE Group,

Inc.

$

487

$

477

$

968

$

986

Adjustments:

Non-cash depreciation and amortization

expense related to certain assets attributable to acquisitions

54

38

199

167

Interest expense related to indirect tax

audits and settlements

5

—

16

—

Impact of adjustments on non-controlling

interest

(6

)

(6

)

(18

)

(33

)

Net fair value adjustments on strategic

non-core investments

25

(76

)

117

(32

)

Carried interest incentive compensation

(reversal) expense to align with the timing of associated

revenue

(4

)

(5

)

8

(7

)

Integration and other costs related to

acquisitions

63

2

93

62

Costs incurred related to legal entity

restructuring

—

9

2

13

Costs associated with efficiency and

cost-reduction initiatives

122

14

259

159

Impact of fair value non-cash adjustments

related to unconsolidated equity investments

—

—

9

—

Provision associated with Telford’s fire

safety remediation efforts

—

—

33

—

Charges related to indirect tax audits and

settlements

37

—

76

—

One-time gain associated with remeasuring

an investment in an unconsolidated subsidiary to fair value as of

the date the remaining controlling interest was acquired

—

(34

)

—

(34

)

Tax impact of adjusted items, tax benefit

attributable to legal entity restructuring, and strategic non-core

investments

(71

)

7

(191

)

(82

)

Core net income attributable to CBRE

Group, Inc., as adjusted

$

712

$

426

$

1,571

$

1,199

Core diluted income per share attributable

to CBRE Group, Inc., as adjusted

$

2.32

$

1.38

$

5.10

$

3.84

Weighted average shares outstanding for

diluted income per share

307,299,709

308,526,651

308,033,612

312,550,942

Core EBITDA is calculated as follows (in millions, totals may

not add due to rounding):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net income attributable to CBRE Group,

Inc.

$

487

$

477

$

968

$

986

Net income attributable to non-controlling

interests

14

18

68

41

Net income

501

495

1,036

1,027

Adjustments:

Depreciation and amortization

177

156

674

622

Interest expense, net of interest

income

53

40

215

149

Provision for income taxes

112

136

182

250

Carried interest incentive compensation

(reversal) expense to align with the timing of associated

revenue

(4

)

(5

)

8

(7

)

Integration and other costs related to

acquisitions

63

2

93

62

Costs incurred related to legal entity

restructuring

—

9

2

13

Costs associated with efficiency and

cost-reduction initiatives

122

14

259

159

Impact of fair value non-cash adjustments

related to unconsolidated equity investments

—

—

9

—

Provision associated with Telford’s fire

safety remediation efforts

—

—

33

—

Charges related to indirect tax audits and

settlements

37

—

76

—

One-time gain associated with remeasuring

an investment in an unconsolidated subsidiary to fair value as of

the date the remaining controlling interest was acquired

—

(34

)

—

(34

)

Net fair value adjustments on strategic

non-core investments

25

(76

)

117

(32

)

Core EBITDA

$

1,086

$

737

$

2,704

$

2,209

Revenue includes client reimbursed pass-through costs largely

associated with employees that are dedicated to client facilities

and subcontracted vendor work performed for clients. Reimbursement

related to subcontracted vendor work generally has no margin and

has been excluded from net revenue. Reconciliations are shown below

(dollars in millions):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Consolidated

Revenue

$

10,404

$

8,950

$

35,767

$

31,949

Less: Pass-through costs also recognized

as revenue

4,270

3,763

14,899

13,673

Net revenue

$

6,134

$

5,187

$

20,868

$

18,276

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Property

Management Revenue

Revenue

$

603

$

519

$

2,222

$

1,928

Less: Pass-through costs also recognized

as revenue

27

23

99

88

Net revenue

$

576

$

496

$

2,123

$

1,840

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

GWS

Revenue

Revenue

$

7,042

$

6,103

$

25,140

$

22,515

Less: Pass-through costs also recognized

as revenue

4,243

3,740

14,800

13,585

Net revenue

$

2,799

$

2,363

$

10,340

$

8,930

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Facilities

Management Revenue

Revenue

$

4,664

$

3,995

$

17,227

$

15,205

Less: Pass-through costs also recognized

as revenue

2,786

2,479

10,320

9,399

Net revenue

$

1,878

$

1,516

$

6,907

$

5,806

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Project

Management Revenue

Revenue

$

2,378

$

2,108

$

7,913

$

7,310

Less: Pass-through costs also recognized

as revenue

1,457

1,261

4,480

4,186

Net revenue

$

921

$

847

$

3,433

$

3,124

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net revenue from

Resilient Business lines

Revenue

$

8,089

$

7,046

$

28,981

$

26,015

Less: Pass-through costs also recognized

as revenue

4,270

3,763

14,899

13,673

Net revenue

$

3,819

$

3,283

$

14,082

$

12,342

Below represents a reconciliation of REI business line operating

profitability/loss to REI segment operating profit (in

millions):

Three Months Ended December

31,

Real Estate

Investments

2024

2023

Investment management operating profit

$

27

$

42

Global real estate development operating

profit

123

27

Segment overhead (and related

adjustments)

—

(1

)

Real estate investments segment operating

profit

$

150

$

68

Supplemental Non-GAAP Segment Financial

Information

In early January 2025, we combined our project management

business with our Turner & Townsend subsidiary and will

publicly report financial results for a fourth business segment,

Project Management, beginning in the first quarter of 2025. In

early January 2025, we also acquired the remaining equity interest

in Industrious, a provider of premium flexible workplace solutions,

and will establish a new business segment, Building Operations

& Experience, in 2025, comprised of enterprise and local

facilities management and property management, which will include

flexible workplace solutions. Our four business segments beginning

in 2025 will be (1) Advisory Services; (2) Building Operations

& Experience; (3) Project Management; and (4) Real Estate

Investments.

The following tables have been presented as Supplemental

Non-GAAP financial information to provide investors with a view of

historical results based on the new reportable segment structure.

These results are not considered to be prepared in accordance with

GAAP, as our CEO continued to manage our business based on our

historical segments through December 31, 2024. Management believes

that this financial information is meaningful to investors as it

reflects performance trends over time of the new four reportable

segments. Beginning in the first quarter of 2025, comparative

segment disclosures will be recast to reflect the new presentation.

Accordingly, in addition to presenting our results of operations as

reported in our Consolidated Financial Statements in accordance

with GAAP, the tables below present results for years ended

December 2024, 2023 and 2022 with the new reportable segments. The

company will provide historical quarterly financial information by

lines of business based on the new segments prior to releasing Q1

2025 financial results.

CBRE GROUP, INC.

SUPPLEMENTAL NON-GAAP

FINANCIAL MEASURES

(in millions, totals may not

add due to rounding)

(Unaudited)

The following tables highlight Non-GAAP

Financial Information based on the new segments (dollars in

millions; totals may not add due to rounding):

Year Ended December 31, 2024

Advisory

Services

Building Operations &

Experience

Project Management

Real Estate

Investments

Corporate,

other and eliminations

(1)

Consolidated

Net revenue

$

7,668

$

9,040

$

3,139

$

1,038

$

(17

)

$

20,868

Pass-through costs also recognized as

revenue

61

11,168

3,670

—

—

14,899

Total revenue

7,729

20,208

6,809

1,038

(17

)

35,767

Segment operating profit (loss)

1,501

894

500

261

(569

)

2,587

Segment operating profit on net revenue

margin

19.6

%

9.9

%

15.9

%

25.1

%

Net fair value adjustments on strategic

non-core investments

117

117

Core EBITDA

$

2,704

Year Ended December 31, 2023

Advisory

Services

Building Operations &

Experience

Project Management

Real Estate

Investments

Corporate,

other and eliminations

(1)

Consolidated

Net revenue

$

6,856

$

7,630

$

2,855

$

952

$

(17

)

$

18,276

Pass-through costs also recognized as

revenue

51

10,177

3,445

—

—

13,673

Total revenue

6,907

17,807

6,300

952

(17

)

31,949

Segment operating profit (loss)

1,226

715

429

239

(368

)

2,241

Segment operating profit on net revenue

margin

17.9

%

9.4

%

15.0

%

25.1

%

Net fair value adjustments on strategic

non-core investments

(32

)

(32

)

Core EBITDA

$

2,209

Year Ended December 31, 2022

Advisory

Services

Building Operations &

Experience

Project Management

Real Estate

Investments

Corporate,

other and eliminations

(1)

Consolidated

Net revenue

$

8,382

$

6,867

$

2,434

$

1,110

$

(16

)

$

18,777

Pass-through costs also recognized as

revenue

124

10,625

1,302

—

—

12,051

Total revenue

8,506

17,492

3,736

1,110

(16

)

30,828

Segment operating profit (loss)

1,760

688

361

518

(578

)

2,749

Segment operating profit on net revenue

margin

21.0

%

10.0

%

14.8

%

46.7

%

Net fair value adjustments on strategic

non-core investments

175

175

Core EBITDA

$

2,924

_______________

(1)

Includes elimination of inter-segment revenue.

Reconciliation of total reportable segment operating profit and

Core EBITDA to net income is as follows (dollars in millions):

Year Ended December

31,

2024

2023

2022

Net income attributable to CBRE Group,

Inc.

$

968

$

986

$

1,407

Net income attributable to non-controlling

interests

68

41

17

Net income

1,036

1,027

1,424

Adjustments to increase (decrease) net

income:

Depreciation and amortization

674

622

613

Asset impairments

—

—

59

Interest expense, net of interest

income

215

149

69

Write-off of financing costs on

extinguished debt

—

—

2

Provision for income taxes

182

250

234

Carried interest incentive compensation

expense (reversal) to align with the timing of associated

revenue

8

(7

)

(4

)

Integration and other costs related to

acquisitions

93

62

40

Costs incurred related to legal entity

restructuring

2

13

13

Costs associated with efficiency and

cost-reduction initiatives

259

159

118

Impact of fair value non-cash adjustments

related to unconsolidated equity investments

9

—

—

Provision associated with Telford’s fire

safety remediation efforts

33

—

186

Charges related to indirect tax audits and

settlements

76

—

—

One-time gain associated with remeasuring

an investment in an unconsolidated subsidiary to fair value as of

the date the remaining controlling interest was acquired

—

(34

)

—

Impact of fair value adjustments to real

estate assets acquired in the Telford Acquisition (purchase

accounting) that were sold in period

—

—

(5

)

Total segment operating profit

$

2,587

$

2,241

$

2,749

Net fair value adjustments on strategic

non-core investments

117

(32

)

175

Core EBITDA

$

2,704

$

2,209

$

2,924

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213201713/en/

For further information: Chandni Luthra - Investors

212.984.8113 Chandni.Luthra@cbre.com

Steve Iaco - Media 212.984.6535 Steven.Iaco@cbre.com

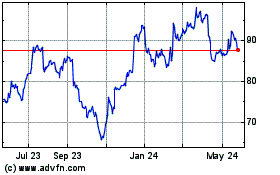

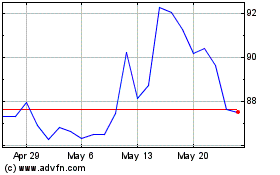

CBRE (NYSE:CBRE)

Historical Stock Chart

From Jan 2025 to Feb 2025

CBRE (NYSE:CBRE)

Historical Stock Chart

From Feb 2024 to Feb 2025