0000715957false00007159572025-02-032025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 03, 2025 |

DOMINION ENERGY, INC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-08489 |

54-1229715 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

120 Tredegar Street |

|

Richmond, Virginia |

|

23219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (804) 819-2284 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

D |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On February 3, 2025, Dominion Energy, Inc. (Dominion Energy) issued a press release and posted a presentation to its investor relations website concerning certain updates on the Coastal Virginia Offshore Wind (CVOW) project. Copies of the press release and presentation are furnished herewith as Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference.

The information in this Item 7.01 and Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On February 3, 2025, Dominion Energy provided an update for the Coastal Virginia Offshore Wind (CVOW) project including a change in total project cost that reflects a revised estimate of network upgrade costs assigned by PJM to CVOW. Estimated total project costs for CVOW, inclusive of contingency and excluding financing costs, have increased from approximately $9.8 billion to approximately $10.7 billion. After accounting for the cost sharing provisions approved by the Virginia State Corporation Commission, the expected average impact of this change on the typical residential customer bill using 1,000 kWh per month over the project’s lifetime is 43 cents per month. There is no change to the project’s expected on-time completion at the end of 2026.

The expected total project cost reflects increases in projections for onshore electrical interconnection costs and network upgrade costs assigned to the project by PJM, specifically incorporating consideration of PJM’s December 2024 publication of potential transmission network upgrades required for certain generation projects and related cost allocations, including those attributable to CVOW. The Company’s estimate for the 2.6 GW project’s projected levelized cost of energy, including renewable energy credits, is approximately $62/MWh, compared to the initial filing submission of $80-90/MWh. As discussed in Note 11 to the Consolidated Financial Statements in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024, the Company closed on the sale of a 50% noncontrolling interest in CVOW to Stonepeak Partners, LLC (Stonepeak) pursuant to which Stonepeak will contribute 50% of the remaining capital necessary to fund construction of the CVOW provided the total project cost, excluding financing costs, is less than $11.3 billion.

Item 9.01 Financial Statements and Exhibits.

* Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DOMINION ENERGY, INC.

Registrant |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

February 3, 2025 |

By: |

/s/ David M. McFarland |

|

|

|

David M. McFarland

Vice President - Investor Relations

and Treasurer |

NEWS RELEASE

February 3, 2025

Coastal Virginia Offshore Wind (CVOW) project, part of comprehensive “all of the above” energy strategy to affordably meet growing energy needs, continues on schedule, cost updated

•No change to expected on-time project completion at end of 2026

•Project achieving significant construction milestones including the successful installation of the first 16 transition pieces

•Updated project cost reflects revised estimate of network upgrade costs assigned by PJM to CVOW which represented the largest unfixed cost input for the project; contingency now reflects ~5% of remaining project investment

•Robust cost sharing mechanisms protect customers and shareholders

•Expected average impact over the life of the project to a typical residential customer bill is 43 cents per month

•Project has robust bipartisan support from Virginia government and congressional leaders, local communities, defense interests, commercial marine industry, civic, educational, environmental, labor and community partners

•Dominion Energy reaffirms its existing guidance for 2025 operating EPS (non-GAAP), long-term operating EPS growth rate, and credit

RICHMOND, Va. – Dominion Energy, Inc. (NYSE: D), today provided several updates for the Coastal Virginia Offshore Wind (CVOW) project. The 2.6 GW, fully permitted project is now approximately 50% complete and remains on track for on-time completion at the end of 2026. CVOW is credited with creating 2,000 direct and indirect American jobs and $2 billion of economic activity.

Significant construction progress supports on-time completion

CVOW continues to achieve significant construction milestones including the successful installation of the first 16 transition pieces which serve as the junction between the foundation and tower for each of the 176 wind turbines. Delivery of the first of three 4,300-ton offshore substations to the Portsmouth Marine Terminal in Virginia Beach occurred at the end of January. Fully fabricated monopiles, transition pieces, undersea cable and other major components continue to be delivered in preparation for on-schedule installation. Wind turbine tower and blade fabrication is now underway, with nacelle fabrication to begin later this quarter. SiemensGamesa, the project’s wind turbine supplier, is manufacturing the same turbine model for CVOW as has been successfully fabricated, installed, and is now operating at the Moray West offshore wind project. Charybdis, the American built, flagged, and crewed, wind turbine installation vessel (WTIG) is now 96% complete and has commenced sea trials in Brownsville, Texas.

Project cost updated

Estimated total project costs, inclusive of contingency and excluding financing costs, have increased ~9 percent, from $9.8 billion to $10.7 billion. This is the first and only increase since the original project budget was submitted to the Virginia State Corporation Commission (SCC) in November 2021, approximately 39 months ago. Relative to the original budget of $9.8 billion, the cost increase is attributable to higher network upgrade costs which are assigned by PJM, the regional electric grid operator, to CVOW as part of the generator interconnect process and higher onshore electrical interconnection costs. New electric generation resources constructed within PJM, like CVOW, are assigned costs by PJM that are deemed necessary to effectively integrate these resources and ensure the reliability and stability of the electric grid. Higher network upgrade cost estimates by PJM reflect the significant increase in demand growth that require incremental generation and transmission resources across the system. Network upgrades do not impact project construction or timeline and represented the largest unfixed cost input for the project. Aside from changes to onshore costs, aggregate costs for other project costs, including offshore, have remained in-line with the original budget. The project’s current unused contingency of $222 million, up ~$100 million from last update, now represents ~5% of remaining project costs.

Robust cost sharing mechanisms protect customers

The project remains an affordable source of electricity for Dominion Energy Virginia customers with robust cost sharing mechanisms that protect customers and shareholders. As a result of the comprehensive stakeholder settlement approved by the SCC in December 2022, 50% of the updated total project costs above $10.3 billion are unrecoverable from customers and borne by the project owners. As a result of the total project cost update, the expected average impact over the life of the project to a typical residential customer bill using 1,000 kWh per month is a 43 cent per month increase. The project’s updated levelized cost of energy (“LCOE”) of ~$62 (vs. the prior estimate in November 2024 of $56) continues to benchmark very favorably with new generation alternatives including solar, battery and gas-fired generation.

Business review significantly reduced project risk for shareholders

In addition to the existence of robust cost sharing mechanisms for customers, as part of the comprehensive business review, Dominion Energy successfully completed a non-controlling equity financing with Stonepeak. Under terms of that agreement, Stonepeak agreed to fund 50% of project costs up to $11.3 billion, with additional sharing of costs in excess of $11.3 billion. As a result, Stonepeak will fund half, or ~$450 million, of the ~$900 million increase in total project costs. Further, Stonepeak and Dominion Energy will each absorb 50% of increased total projects costs that are not expected to be recovered from customers under the December 2022 settlement order. As a result, Dominion Energy expects its Q4 2024 results will include an ~$100 million charge, which will be excluded from operating earnings (non-GAAP), for such amount. Additional information may be found on the company’s Investor Relations website at https://investors.dominionenergy.com/events-and-presentations

Fourth quarter 2024 earnings call

The company will host its fourth quarter 2024 investor call, as originally scheduled, on February 12, 2025 at 10:00 AM ET. During the call, management will discuss matters of interest to financial and other stakeholders including recent financial results, updated capital investment expectations and financing plans. The company reaffirms its existing 2025 operating earnings per share (EPS) guidance, as well as its long-term operating earnings per share growth guidance of 5% to 7% through 2029 off of 2025 operating earnings per share midpoint excluding RNG 45Z ($3.30). The company also reaffirms its existing credit guidance.

Important note to investors regarding operating, reported earnings

Dominion Energy uses operating earnings (non-GAAP) as the primary performance measurement of its results for public communications with analysts and investors. Operating earnings are defined as reported earnings adjusted for certain items. Dominion Energy also uses operating earnings internally for budgeting, for reporting to the Board of Directors, for the company's incentive compensation plans, and for its targeted dividend payouts and other purposes. Dominion Energy management believes operating earnings provide a more meaningful representation of the company's fundamental earnings power.

About Dominion Energy

Dominion Energy (NYSE: D), headquartered in Richmond, Va., provides regulated electricity service to 3.6 million homes and businesses in Virginia, North Carolina, and South Carolina, and regulated natural gas service to 500,000 customers in South Carolina. The company is one of the nation's leading developers and operators of regulated offshore wind and solar power and the largest producer of carbon-free electricity in New England. The company's mission is to provide the reliable, affordable, and increasingly clean energy that powers its customers every day. Please visit DominionEnergy.com to learn more.

This release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to various risks and uncertainties. These factors are identified in Dominion Energy's Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission. Dominion Energy refers readers to those reports for further information. Any forward-looking statement speaks only as of the date on which it is made, and Dominion Energy undertakes no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

#####

For further information: Media: Jeremy Slayton, (804) 297-5247 or Jeremy.L.Slayton@dominionenergy.com;

Investor Relations: David McFarland, (804) 819-2438 or David.M.McFarland@dominionenergy.com

Coastal Virginia Offshore Wind �Project Update�February 3, 2025

Important note for investors This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Dominion Energy. The statements relate to, among other things, expectations, estimates and projections concerning the business and operations of Dominion Energy. We have used the words “path”, "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", “outlook”, "predict", "project", “should”, “strategy”, “target”, "will“, “potential” and similar terms and phrases to identify forward-looking statements in this presentation. Such forward-looking statements, including operating earnings per share information and guidance, projected dividends, projected debt and equity issuances, projected cash flow, capital expenditures, operating expenses and debt information, shareholder return, and long-term growth or value, are subject to various risks and uncertainties. As outlined in our SEC filings, factors that could cause actual results to differ include, but are not limited to: the direct and indirect impacts of implementing recommendations from the business review concluded in March 2024; unusual weather conditions and their effect on energy sales to customers and energy commodity prices; extreme weather events and other natural disasters; extraordinary external events, such as the pandemic health event resulting from COVID-19; federal, state and local legislative and regulatory developments; changes to regulated rates collected by Dominion Energy; risks associated with entities in which Dominion Energy shares ownership with third parties, such as a 50% noncontrolling interest in the Coastal Virginia Offshore Wind (CVOW) Commercial Project, including risks that result from lack of sole decision making authority, disputes that may arise between Dominion Energy and third party participants and difficulties in exiting these arrangements; timing and receipt of regulatory approvals necessary for planned construction or expansion projects and compliance with conditions associated with such regulatory approvals; the inability to complete planned construction projects within time frames initially anticipated; risks and uncertainties that may impact the ability to construct the CVOW Commercial Project within the currently proposed timeline, or at all, and consistent with current cost estimates along with the ability to recover such costs from customers; risks and uncertainties associated with the timely receipt of future capital contributions, including optional capital contributions, if any, from the noncontrolling financing partner associated with the construction of the CVOW Commercial Project; changes to federal, state and local environmental laws and regulations, including those related to climate change; cost of environmental strategy and compliance, including cost related to climate change; changes in implementation and enforcement practices of regulators relating to environmental standards and litigation exposure for remedial activities; changes in operating, maintenance and construction costs; the availability of nuclear fuel, natural gas, purchased power or other materials utilized by Dominion Energy to provide electric generation, transmission and distribution and/or gas distribution services; additional competition in Dominion Energy’s industries; changes in demand for Dominion Energy’s services; risks and uncertainties associated with increased energy demand or significant accelerated growth in demand due to new data centers, including the concentration of data centers primarily in Loudoun County, Virginia and the ability to obtain regulatory approvals, environmental and other permits to construct new facilities in a timely manner; the technological and economic feasibility of large-scale battery storage, carbon capture and storage, small modular reactors, hydrogen and/or other clean energy technologies; receipt of approvals for, and timing of, closing dates for acquisitions and divestitures; impacts of acquisitions, divestitures, transfers of assets by Dominion Energy to joint ventures, and retirements of assets based on asset portfolio reviews; adverse outcomes in litigation matters or regulatory proceedings; fluctuations in interest rates; the effectiveness to which existing economic hedging instruments mitigate fluctuations in currency exchange rates of the Euro and Danish Krone associated with certain fixed price contracts for the major offshore construction and equipment components of the CVOW Commercial Project; changes in rating agency requirements or credit ratings and their effect on availability and cost of capital; and capital market conditions, including the availability of credit and the ability to obtain financing on reasonable terms. Other risk factors are detailed from time to time in Dominion Energy’s quarterly reports on Form 10-Q and most recent annual report on Form 10-K filed with the U.S. Securities and Exchange Commission. The information in this presentation was prepared as of February 3, 2025. Dominion Energy undertakes no obligation to update any forward-looking information statement to reflect developments after the statement is made. Projections or forecasts shown in this document are based on the assumptions listed in this document and are subject to change at any time. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities. Any offers to sell or solicitations of offers to buy securities will be made in accordance with the requirements of the Securities Act of 1933, as amended. This presentation has been prepared primarily for security analysts and investors in the hope that it will serve as a convenient and useful reference document. The format of this document may change in the future as we continue to try to meet the needs of security analysts and investors. This document is not intended for use in connection with any sale, offer to sell or solicitation of any offer to buy securities. This presentation references the following financial measure that is not prepared in accordance with U.S. generally accepted accounting principles (GAAP); operating earnings (non-GAAP) which has a GAAP equivalent of reported net income and is defined as reported net income adjusted for certain items. Please continue to regularly check Dominion Energy’s website at http://investors.dominionenergy.com/

Coastal Virginia Offshore Wind (CVOW)�Table of contents CVOW well-aligned with focus on American energy dominance Significant construction progress supports on-time completion at end of 2026 (no change) Project cost update Robust cost sharing mechanisms protect customers, preserve affordability Business review significantly reduced project risk for shareholders 1 2 3 4 5

Coastal Virginia Offshore Wind (CVOW)� CVOW well-aligned with focus on American energy dominance The Coastal Virginia Offshore Wind project: Remains on-track for an on-time completion at the end of 2026 (no change) Continues to achieve major project milestones and is fully state and federally permitted (no change) Plays a critical part of a comprehensive “all-of-the-above” energy supply strategy Supports America’s AI preeminence serving the world’s largest concentration of data centers Is necessary to ensure grid reliability, economic growth and growing energy demand across VA/NC Provides affordable electricity for customers Has the robust bipartisan support of Virginia’s state and federal elected leaders Has strong support from local communities, defense interests, commercial marine industry, civic, educational, environmental, labor and community partners Has created ~2,000 direct and indirect American jobs and generated ~$2B in American economic activity 1

~50% complete (previously 43%) First 8 monopiles completed and shipped ROD published COP approved First monopile installed¹ First �transition piece installed First turbine installed Last monopile installed¹ Last transition piece installed Final EIS issued by BOEM First cable laid First OSS installed Coastal Virginia Offshore Wind (CVOW)� Project remains on schedule, end of 2026 completion ¹ Second piling season: May 1 to October 31, 2025 (no change) Last turbine installed / project COD 2

Note: Awaiting installation includes components that are completely fabricated and awaiting transport or en route presently to Virginia Coastal Virginia Offshore Wind (CVOW)� Project remains on schedule, end of 2026 completion Significant progress reduces project risk: ~50% complete and on schedule, end of 2026 completion ~96% % installed or awaiting installation Project scope: 176 monopiles Installed: 78 Awaiting installation: +52 In fabrication: +46 Expected�completion: �Early 2025 (no change) ~75% % installed or being installed ~56% Project scope: 9 deepwater cables Installed: 4 Being installed: +1 Project scope: 176 TPs Installed: 16 Awaiting install: +53 Completed �final assembly: +83 % installed or awaiting installation ~40% Charybdis contracted to CVOW Initial sea trials underway Sea fastener installation pending sea trials % installed ~60% All activities remain on track % fabricated ~53% Project scope: 3 OSS OSS #1: Arrived at PMT January 2025 OSS #2/#3: Expected to arrive by YE2025 % fabricated ~49% Project scope: �260 miles Fabricated, awaiting installation: ~50% % towers fabricated or�in fabrication ~22% Project scope: �176 WTG Towers: 2 fabricated,�37 in fabrication Blades: Fabrication �commenced Feb 2025 Nacelles: Fabrication �commencing Q1 2025 % complete Expected�final delivery: �Q3 2025 Expected�completion: �Early 2026 Expected�final delivery: �Q2 2025 Expected�completion: �YE 2025 Expected�final delivery: �Q4 2025 2

Coastal Virginia Offshore Wind (CVOW)� Achieving major construction milestones Portsmouth Marine Terminal (January 2025) 2

Offshore Substation #1 arriving in Virginia (January 2025) Coastal Virginia Offshore Wind (CVOW)� Achieving major construction milestones 2

Transition piece installation (January 2025) Coastal Virginia Offshore Wind (CVOW)� Achieving major construction milestones 2

Charybdis (January 2025) Coastal Virginia Offshore Wind (CVOW)� Achieving major construction milestones 2

$9.8B +$0.6B¹ +$0.3B² Prior total project costs (+) PJM network upgrade +�electrical interconnect costs (+) Offshore adjustments (=) Updated total project costs: $10.7B (includes $222M contingency) Starting point:�Original budget�(Nov 2021) $9.8B +$0.9B +$0.0B Starting point:�Latest budget�(Nov 2024) Commentary ¹ Nov. 2024 budget already included $0.3B of PJM and other electrical interconnect costs that were higher than the original budget. This increase was offset (in the November 2024 budget) by downward cost variances relative to the original budget including offshore construction and equipment costs that were forecasted to be under budget due to cost help associated with contract currency hedging. ² Includes higher costs related to UXO removal, undersea cable protection system enhancements, transportation fuel, sea fastener fabrication/installation and other construction and equipment supplier costs 3 Coastal Virginia Offshore Wind (CVOW)� Project cost update Total project costs increased to $10.7B from $9.8B, representing a $0.9B or 9% increase This is the first and only increase since the original project budget was submitted to the Virginia State Corporation Commission 39 months ago Increased network upgrade costs are the major driver. These costs: Represented the largest unfixed cost input for the project Are assigned by PJM Do not impact project construction or schedule Were updated based on revised PJM estimate All other costs in aggregate have remained in-line with the original budget Contingency: Increased by $101M since last quarter, now equal to ~5% of remaining project costs Current unfixed costs include finalization of network upgrades by PJM (updated), fuel for transport/installation (no change) and certain project oversight costs (no change)

¹ In 2027 dollars 2 Over project estimated lifetime for a typical residential customer bill using 1,000 kWh per month Original filing (Nov 2021) Prior update (Nov 2024) Current (Feb 2025) LCOE excluding REC ($/MWh)¹ $97 $85 $91 REC ($/MWh) $10 $29 $29 LCOE including REC ($/MWh)¹ $80—$90 $56 $62 LCOE (updated): $62/MWh¹ compared to initial filing submission of $80 to $90/MWh¹ Legislative prudency cap (no change): $125/MWh (in 2018 dollars); $149/MWh (in 2027 dollars) Coastal Virginia Offshore Wind (CVOW)� Robust cost sharing mechanisms protect customers, preserve affordability Monthly Description Original filing (Nov 2021) Prior update (Nov 2024) Current�(Feb 2025) Costs to customers Revenue requirement (net of tax credits) $9.19 $7.92 $8.35 (-) benefits/credits to customers Includes project energy, capacity, and REC value ($4.47) ($9.36) ($9.36) Residential customer bill Net bill impact $4.72 ($1.44) ($1.01) Levelized cost of electricity (LCOE) Estimated project lifetime average monthly bill for typical residential customer bill attributable to CVOW2 4 December 2022 comprehensive settlement, approved by State Corporation Commission, provides significant customer protections 50% of project costs between $10.3B and $11.3B are unrecoverable from customers and borne by project owners

Coastal Virginia Offshore Wind (CVOW)� Business review significantly reduced project risk for shareholders Updated project cost $10.7B Updated project cost above $10.3B² $0.4B (x) % of prudently incurred project cost between $10.3B and $11.3B borne by project owners 50% (=) Cost shared by project owners (Dominion Energy and Stonepeak) $0.2B (x) % shared by Stonepeak via non-controlling equity financing 50% (=) Amount borne by Dominion Energy³ $0.1B Robust cost sharing mechanisms protect shareholders Dominion Energy’s successful non-controlling equity financing protects Dominion Energy shareholders Stonepeak will fund half, or ~$450 million, of the ~$900 million increase in total project costs 50% of unrecoverable costs between $10.3B and $11.3B are borne by Stonepeak¹ ¹ See appendix for additional cost sharing detail including sharing for project costs in excess of $11.3B ² Prudently incurred costs up to $10.3B are 100% recoverable from customers per settlement agreement. See appendix for additional detail ³ Dominion Energy expects its Q4 2024 results will include a charge, which will be excluded from operating earnings (non-GAAP), for its portion of updated project costs not expected to be recovered from customers under the December 2022 settlement order 5

Appendix

Coastal Virginia Offshore Wind (CVOW)� Cost update ¹ Remaining project costs (100%) expected to be ~$3.1B investment in 2025, ~$1.1B in 2026 and ~$0.5B in 2027+ Updated total project cost $10.7B Project-to-date investment as of 12/31/2024 ~$6.0B Remaining project costs¹ ~$4.7B % to be funded by Stonepeak via non-controlling equity financing 50% Remaining amount to be funded by Dominion Energy ~$2.4B Current capital budget 3

Cost-sharing thresholds Customers Shareholders Capital budget of ~$9.8B 100% 0% Costs between $9.8B – $10.3B 100% 0% Costs between $10.3B – $11.3B 50% 50% Costs between $11.3B – $13.7B 0% 100% There is no cost-sharing agreement for any costs that exceed $13.7B Significant customer benefits Protection from unforeseen increases in construction costs (including explicit mention of PJM network upgrade costs) above the project’s budget Enhanced SCC review of operating performance Balances customer and shareholder concerns regarding affordability and financial viability DEV, OAG, Walmart, Sierra Club, and Appalachian Voices filed a settlement agreement in the company’s 2022 petition to the SCC to reconsider the performance guarantee; approved by the SCC in December 2022, providing significant customer benefits. The approved settlement agreement provides a balanced and reasonable approach that supports continued investment in CVOW to meet the Commonwealth’s public policy and economic development priorities and the needs of our customers. Coastal Virginia Offshore Wind (CVOW)� Customer cost sharing overview Approved settlement in Virginia for balanced and reasonable cost-sharing 4

Note: The ownership percentages within the ownership columns exclude the net initial withholding ¹ Existing cost-sharing thresholds per the settlement agreement in DEV’s 2022 petition to the SCC to reconsider the performance guarantee; approved by the SCC in December 2022 Construction budget Regulatory recovery¹ CVOW partnership capital calls DEV funding of capital calls DEV ownership of CVOW partnership Stonepeak funding of capital calls Stonepeak ownership of CVOW partnership Up to ~$9.8B 100% Mandatory 50% 50% 50% 50% $9.8B – $10.3B 100% Mandatory 50% 50% 50% 50% $10.3B – $11.3B 50% Mandatory 50% 50% 50% 50% $11.3B – $11.8B 0% Non-mandatory 67% 50% 33% 50% $11.8B – $12.7B 0% Non-mandatory 75% 50% 25% 50% $12.7B – $13.7B 0% Non-mandatory 83% 50% 17% 50% Equity partnership pro rata cost and risk sharing at illustrative project cost levels Represents percentage of capital funding applicable to the capital solely within that tier;�does not represent cumulative funding levels Coastal Virginia Offshore Wind (CVOW)� Stonepeak partnership cost sharing overview 5

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

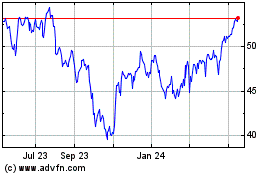

Dominion Energy (NYSE:D)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dominion Energy (NYSE:D)

Historical Stock Chart

From Feb 2024 to Feb 2025