Coastal Virginia Offshore Wind (CVOW) Project, Part of Comprehensive “All of the Above” Energy Strategy to Affordably Meet Growing Energy Needs, Continues on Schedule, Cost Updated

04 February 2025 - 8:30AM

Business Wire

- No change to expected on-time project completion at end of

2026

- Project achieving significant construction milestones including

the successful installation of the first 16 transition pieces

- Updated project cost reflects revised estimate of network

upgrade costs assigned by PJM to CVOW which represented the largest

unfixed cost input for the project; contingency now reflects ~5% of

remaining project investment

- Robust cost sharing mechanisms protect customers and

shareholders

- Expected average impact over the life of the project to a

typical residential customer bill is 43 cents per month

- Project has robust bipartisan support from Virginia government

and congressional leaders, local communities, defense interests,

commercial marine industry, civic, educational, environmental,

labor and community partners

- Dominion Energy reaffirms its existing guidance for 2025

operating EPS (non-GAAP), long-term operating EPS growth rate, and

credit

Dominion Energy, Inc. (NYSE: D), today provided several updates

for the Coastal Virginia Offshore Wind (CVOW) project. The 2.6 GW,

fully permitted project is now approximately 50% complete and

remains on track for on-time completion at the end of 2026. CVOW is

credited with creating 2,000 direct and indirect American jobs and

$2 billion of economic activity.

Significant construction progress supports on-time

completion

CVOW continues to achieve significant construction milestones

including the successful installation of the first 16 transition

pieces which serve as the junction between the foundation and tower

for each of the 176 wind turbines. Delivery of the first of three

4,300-ton offshore substations to the Portsmouth Marine Terminal in

Virginia Beach occurred at the end of January. Fully fabricated

monopiles, transition pieces, undersea cable and other major

components continue to be delivered in preparation for on-schedule

installation. Wind turbine tower and blade fabrication is now

underway, with nacelle fabrication to begin later this quarter.

SiemensGamesa, the project’s wind turbine supplier, is

manufacturing the same turbine model for CVOW as has been

successfully fabricated, installed, and is now operating at the

Moray West offshore wind project. Charybdis, the American built,

flagged, and crewed, wind turbine installation vessel (WTIG) is now

96% complete and has commenced sea trials in Brownsville,

Texas.

Project cost updated

Estimated total project costs, inclusive of contingency and

excluding financing costs, have increased ~9 percent, from $9.8

billion to $10.7 billion. This is the first and only increase since

the original project budget was submitted to the Virginia State

Corporation Commission (SCC) in November 2021, approximately 39

months ago. Relative to the original budget of $9.8 billion, the

cost increase is attributable to higher network upgrade costs which

are assigned by PJM, the regional electric grid operator, to CVOW

as part of the generator interconnect process and higher onshore

electrical interconnection costs. New electric generation resources

constructed within PJM, like CVOW, are assigned costs by PJM that

are deemed necessary to effectively integrate these resources and

ensure the reliability and stability of the electric grid. Higher

network upgrade cost estimates by PJM reflect the significant

increase in demand growth that require incremental generation and

transmission resources across the system. Network upgrades do not

impact project construction or timeline and represented the largest

unfixed cost input for the project. Aside from changes to onshore

costs, aggregate costs for other project costs, including offshore,

have remained in-line with the original budget. The project’s

current unused contingency of $222 million, up ~$100 million from

last update, now represents ~5% of remaining project costs.

Robust cost sharing mechanisms protect customers

The project remains an affordable source of electricity for

Dominion Energy Virginia customers with robust cost sharing

mechanisms that protect customers and shareholders. As a result of

the comprehensive stakeholder settlement approved by the SCC in

December 2022, 50% of the updated total project costs above $10.3

billion are unrecoverable from customers and borne by the project

owners. As a result of the total project cost update, the expected

average impact over the life of the project to a typical

residential customer bill using 1,000 kWh per month is a 43 cent

per month increase. The project’s updated levelized cost of energy

(“LCOE”) of ~$62 (vs. the prior estimate in November 2024 of $56)

continues to benchmark very favorably with new generation

alternatives including solar, battery and gas-fired generation.

Business review significantly reduced project risk for

shareholders

In addition to the existence of robust cost sharing mechanisms

for customers, as part of the comprehensive business review,

Dominion Energy successfully completed a non-controlling equity

financing with Stonepeak. Under terms of that agreement, Stonepeak

agreed to fund 50% of project costs up to $11.3 billion, with

additional sharing of costs in excess of $11.3 billion. As a

result, Stonepeak will fund half, or ~$450 million, of the ~$900

million increase in total project costs. Further, Stonepeak and

Dominion Energy will each absorb 50% of increased total projects

costs that are not expected to be recovered from customers under

the December 2022 settlement order. As a result, Dominion Energy

expects its Q4 2024 results will include an ~$100 million charge,

which will be excluded from operating earnings (non-GAAP), for such

amount. Additional information may be found on the company’s

Investor Relations website at

https://investors.dominionenergy.com/events-and-presentations

Fourth quarter 2024 earnings call

The company will host its fourth quarter 2024 investor call, as

originally scheduled, on February 12, 2025 at 10:00 AM ET. During

the call, management will discuss matters of interest to financial

and other stakeholders including recent financial results, updated

capital investment expectations and financing plans. The company

reaffirms its existing 2025 operating earnings per share (EPS)

guidance, as well as its long-term operating earnings per share

growth guidance of 5% to 7% through 2029 off of 2025 operating

earnings per share midpoint excluding RNG 45Z ($3.30). The company

also reaffirms its existing credit guidance.

Important note to investors regarding operating, reported

earnings

Dominion Energy uses operating earnings (non-GAAP) as the

primary performance measurement of its results for public

communications with analysts and investors. Operating earnings are

defined as reported earnings adjusted for certain items. Dominion

Energy also uses operating earnings internally for budgeting, for

reporting to the Board of Directors, for the company's incentive

compensation plans, and for its targeted dividend payouts and other

purposes. Dominion Energy management believes operating earnings

provide a more meaningful representation of the company's

fundamental earnings power.

About Dominion Energy

Dominion Energy (NYSE: D), headquartered in Richmond, Va.,

provides regulated electricity service to 3.6 million homes and

businesses in Virginia, North Carolina, and South Carolina, and

regulated natural gas service to 500,000 customers in South

Carolina. The company is one of the nation's leading developers and

operators of regulated offshore wind and solar power and the

largest producer of carbon-free electricity in New England. The

company's mission is to provide the reliable, affordable, and

increasingly clean energy that powers its customers every day.

Please visit DominionEnergy.com to learn more.

This release contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are subject to various risks and uncertainties. These factors

are identified in Dominion Energy's Forms 10-K and 10-Q filed with

the U.S. Securities and Exchange Commission. Dominion Energy refers

readers to those reports for further information. Any

forward-looking statement speaks only as of the date on which it is

made, and Dominion Energy undertakes no obligation to update any

forward-looking statement to reflect events or circumstances

occurring after the date on which it is made.

News Category: Virginia & North Carolina

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203137970/en/

For further information: Media: Jeremy Slayton, (804) 297-5247

or Jeremy.L.Slayton@dominionenergy.com; Investor Relations: David

McFarland, (804) 819-2438 or

David.M.McFarland@dominionenergy.com

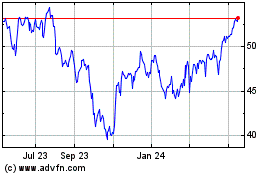

Dominion Energy (NYSE:D)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dominion Energy (NYSE:D)

Historical Stock Chart

From Feb 2024 to Feb 2025