Ellington Financial Inc. (NYSE: EFC) (the "Company") today

announced that its Board of Directors has authorized the redemption

of all 957,133 outstanding shares of its Series E Fixed-to-Floating

Rate Cumulative Redeemable Preferred Stock (the "Series E Preferred

Stock") (NYSE: EFC PRE).

The anticipated redemption date is December 13, 2024 (the

“Redemption Date”). The Series E Preferred Stock redemption price

is estimated to be $25.540558 per share of Series E Preferred

Stock, which is equal to the liquidation preference of $25.00 per

share plus $0.540558 per share representing estimated accrued and

unpaid dividends to the Redemption Date. Once redeemed, the Series

E Preferred Stock will no longer be deemed outstanding, dividends

will cease to accumulate and all rights of the holders of the

Series E Preferred Stock with respect to the Series E Preferred

Stock will cease.

In conjunction with the planned redemption, the Series E

Preferred Stock will be suspended from the New York Stock Exchange

(“NYSE”) before market open on the anticipated redemption date of

December 13, 2024. A Form 25 will be filed with the Securities and

Exchange Commission to effect the withdrawal of the listing of the

Series E Preferred Stock from the NYSE.

All shares of the Series E Preferred Stock are held through the

Depository Trust Company ("DTC") and shares will be redeemed in

accordance with the procedures of DTC. Payment to DTC for the

Series E Preferred Stock will be made by Equiniti Trust Company,

LLC, as redemption agent (the "Redemption Agent") in the usual

manner. The address for the Redemption Agent is as follows:

Equiniti Trust Company, LLC Operations Center, Attn:

Reorganization Department 55 Challenger Road, Suite 200 Ridgefield

Park, New Jersey 07660

Any questions may be directed to the Redemption Agent toll-free

at 718-921-8317.

This press release does not constitute a notice of redemption

under the certificate of designation governing the Series E

Preferred Stock.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

numerous risks and uncertainties. The Company's actual results may

differ from its beliefs, expectations, estimates, and projections

and, consequently, you should not rely on these forward-looking

statements as predictions of future events. Forward-looking

statements are not historical in nature and can be identified by

words such as "believe," "expect," "anticipate," "estimate,"

"project," "plan," "continue," "intend," "should," "would,"

"could," "goal," "objective," "will," "may," "seek" or similar

expressions or their negative forms, or by references to strategy,

plans, or intentions. Forward-looking statements are based on our

beliefs, assumptions and expectations of our future operations,

business strategies, performance, financial condition, liquidity

and prospects, taking into account information currently available

to us. These beliefs, assumptions, and expectations are subject to

risks and uncertainties and can change as a result of many possible

events or factors, not all of which are known to us. If a change

occurs, our business, financial condition, liquidity, results of

operations and strategies may vary materially from those expressed

or implied in our forward-looking statements. The following factors

are examples of those that could cause actual results to vary from

our forward-looking statements: changes in interest rates and the

market value of the Company's investments, market volatility,

changes in mortgage default rates and prepayment rates, the

Company's ability to borrow to finance its assets, changes in

government regulations affecting the Company's business, the

Company's ability to maintain its exclusion from registration under

the Investment Company Act of 1940, the Company's ability to

maintain its qualification as a real estate investment trust, or

"REIT," and other changes in market conditions and economic trends,

such as changes to fiscal or monetary policy, heightened inflation,

slower growth or recession, and currency fluctuations. Furthermore,

forward-looking statements are subject to risks and uncertainties,

including, among other things, those described under Item 1A of the

Company's Annual Report on Form 10-K, which can be accessed through

the Company's website at www.ellingtonfinancial.com or at the SEC's

website (www.sec.gov). Other risks, uncertainties, and factors that

could cause actual results to differ materially from those

projected or implied may be described from time to time in reports

the Company files with the SEC, including reports on Forms 10-Q,

10-K and 8-K. The Company undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

This release and the information contained herein do not

constitute an offer of any securities or solicitation of an offer

to purchase securities.

About Ellington Financial

Ellington Financial invests in a diverse array of financial

assets, including residential and commercial mortgage loans and

mortgage-backed securities, reverse mortgage loans, mortgage

servicing rights and related investments, consumer loans,

asset-backed securities, collateralized loan obligations,

non-mortgage and mortgage-related derivatives, debt and equity

investments in loan origination companies, and other strategic

investments. Ellington Financial is externally managed and advised

by Ellington Financial Management LLC, an affiliate of Ellington

Management Group, L.L.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106221931/en/

Investors: Ellington Financial Investor Relations (203) 409-3575

info@ellingtonfinancial.com

or

Media: Amanda Shpiner/Grace Cartwright Gasthalter & Co. for

Ellington Financial (212) 257-4170 ellington@gasthalter.com

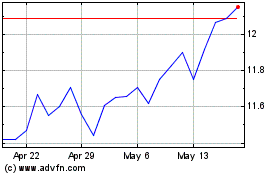

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From Feb 2025 to Mar 2025

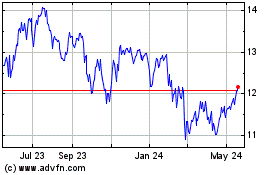

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From Mar 2024 to Mar 2025