FICO Survey: Brits Call for Stronger Protection as One in Four Report Scam Losses

18 November 2024 - 11:01AM

Business Wire

As real-time payments surge in the UK, FICO

research reveals that 26% of consumers have reported losses to

their bank

(International Fraud Awareness Week) — A new study of

12,000 consumers across 14 countries by global analytics software

leader FICO has underscored the need for banks to strike a better

balance between customer satisfaction and fraud mitigation as

real-time payments (RTP) surge in popularity. In the survey, 26%

percent of UK consumers said that they have reported actual or

suspected scam losses to their bank.

More information:

https://www.fico.com/en/latest-thinking/ebook/2024-scams-impact-survey-uk

About three-quarters of consumers in the UK say they have sent

(79%) and received (73%) RTP and more than a quarter (28%) plan to

increase their RTP usage in the next 12 months. However,

RTP-related scams, such as Authorised Push Payment (APP) fraud, are

following in the shadows. In addition to the quarter of Brits who

say they have reported losses, an alarming 41% of respondents said

their friends or family members have been scammed. 70% say they

have received a text, email or call that was part of a scam.

“The need to stop scams has never been more urgent,” said

Matt Cox, vice president and general manager for FICO in

EMEA. “In our study, more than half of UK consumers want their

banks to deploy better fraud detection systems. And the stakes have

been raised by the new rules that came into force last month, from

the Payment Systems Regulator and the Bank of England. Both sending

and receiving institutions must reimburse APP fraud victims in most

cases.”

Key findings:

- More than a quarter of consumers (26%) say they’ve reported

losses from a scam to their bank

- 54% of consumers say they believe they should be responsible if

they fell for a scam; nearly a third blame either the sending bank

(19%) or the receiving bank (13%)

- 73% of consumers thought banks should refund scam victims

always (31%) or most of the time (42%)

- 58% of consumers ranked having better fraud detection systems

as the most or second-most impactful action that banks can take to

protect them from scams

- Nearly two-thirds of consumers say they would complain to their

bank and 23% to regulators if they are unhappy with how a scam

incident is handled.

Taking Steps to Stop Scams

Unscrupulous criminals will go to great lengths to con bank

customers, often socially engineering personal information from

their victims to commit APP fraud. Yet, according to the FICO

research, over half of consumers (54%) feel they are responsible if

they fall for a scam; only 9% blame the scammer. Add to this the

fact that 73% of consumers in the UK think banks should refund scam

victims most of the time or always, and the potential reputational

and cost fallout from APP fraud is massive.

“Financial institutions should focus on mitigating fraud at the

front end. They play a crucial role in identifying and intervening

in scam transactions,” Cox said. “It’s vital that consumers

remain confident enough to take advantage of the benefits of

real-time payments, such as immediate transfers and instant funds

availability.”

As RTP usage continues to soar, consumers expect their banks to

equip them with the tools, education, and automated fail-safes to

help prevent scam losses. “One of the most fundamental ways banks

can help to prevent losses is by knowing how their customers want

the bank to communicate with them,” Cox said. “The good news

is that more UK consumers prefer to receive sensitive

communications through their bank’s app than any other method

(37%). As banking apps provide a much more secure channel for

communications and transactions than text messages or emails, they

can be a key channel for banks to help consumers fight scams. But

no one channel is right for every customer, and banks should be

able to select the most effective channel for each person.”

Cox cited the need for fraud detection capabilities such as data

ingestion across multiple sources with behavioural profiling to

provide rich context about RTP transactions, applying sophisticated

analytic techniques capable of detecting suspicious transactions,

and automating decisioning to determine the best course of

treatment or level of intervention.

“By automating fraud detection at scale, banks can really help

to defend their customers’ interests, protect their own bottom line

and importantly, build greater trust in the all-important customer

relationship,” Cox said.

A new solution from FICO and Jersey Telecom (JT) received the

Anti-Fraud Solution award at the Credit & Collections

Technology Awards on November 7 in Manchester. The FICO® Customer

Communications Service Scam Signal uses telephony signals to detect

potential scams.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241117899413/en/

For further comment contact: FICO UK PR Team Wendy

Harrison/Parm Heer ficoteam@harrisonsadler.com 0208 977 9132

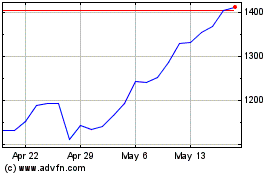

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Jan 2025 to Feb 2025

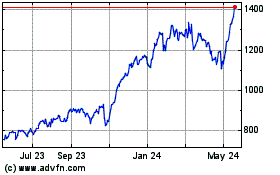

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Feb 2024 to Feb 2025