New FICO Survey: 88% of Customers Consider Customer Experience of Equal Importance to Product Offerings When Choosing Their Bank

13 February 2025 - 12:00AM

Business Wire

Banks that offer high-quality customer

experience across all touchpoints and channels better compete with

fintechs, drive growth, and secure loyalty

FICO (NYSE: FICO)

Highlights:

- A new FICO survey finds that 88% of bank customer respondents

report that customer experience is as important or more important

than its products and services.

- 33% of respondents have only changed their primary banking

providers 1-2 times.

- Traditional banks are still popular among older demographics

(85% of ages 65+), while younger demographics (53% of those ages

18–24 and 55% of those ages 25–35) increasingly use digital

apps.

Global analytics software leader, FICO announced new research

regarding customer opinions about their banking experiences and

whether financial institutions are meeting their needs. The 2024

Bank Customer Experience Survey: US showcases findings and

perspective on the implications for the financial industry. 88% of

respondents report that a bank’s customer experience is as

important or more important than its products and services. Banks

need to remain in tune with ever-evolving customer behaviors,

experiences, and preferences.

Customers want their banks to meet them on their

terms

Positive customer service is one of the main reasons why

customers choose a bank to be their main provider in the first

place. Most respondents say that their primary bank experience is

positive, with 39% overall answering ‘excellent’ and approximately

half answering ‘generally good.’

Customers are generally loyal to one traditional bank above all

others. Banks that capture new customers early on are likely to

retain their loyalty for years to come—provided they meet their

expectations. Over 90% of respondents confirmed that they have a

primary provider. Of these, young people are the least likely to

have a primary bank account (only 77%), while 90% of all other

older demographics all have a primary.

As customers continue to demand a more personalized customer

experience, it is essential for banks to choose the appropriate

communication channels based on customer preferences, use context

to provide personalized customer interactions, and prioritize

fostering lifetime customer loyalty. Banks should be utilizing data

and analytics to gain insights into customers to build optimal

customer experiences across all channels.

“Customers will stay with their banks if loyalty and safety are

established,” said Darryl Knopp, head of customer insights at

FICO. “The survey found that 33% of customers have only changed

their primary banking providers 1-2 times. Banks need to prioritize

choosing the appropriate communication channels to provide

customers with personalized interactions and foster long-term

relationships.”

Gen Z and Millennials favor digital banks

Most respondents (66%) still receive their banking services from

a traditional bank, followed by credit unions (21%), and digital

banks (11%). Of this overall percentage, the survey found that

young people are less likely to rely on a traditional bank. About

50% of 18-35-year-olds cite a traditional bank as their primary

provider, compared with 85% of people over the age of 65. In

addition, lower-income customers are more likely to use an app

(24%) versus medium (7%) and high-income customers (13%), showing

that digital services can better reach untapped markets of

lower-income earners.

For more details and insights regarding the survey results,

download the 2024 Bank Customer Experience Survey: US. This

survey was issued to 1,000 U.S. bank customers across age and

income demographics in the West, Midwest, Northeast, and South

regions.

For more information on how FICO can help organizations exceed

customer needs and expectations, visit

https://www.fico.com/en/fico-platform.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting four billion

payment cards from fraud, to improving financial inclusion, to

increasing supply chain resiliency. The FICO® Score, used by 90% of

top US lenders, is the standard measure of consumer credit risk in

the US and has been made available in over 40 other countries,

improving risk management, credit access and transparency.

Learn more at https://www.fico.com/en.

Join the conversation at https://x.com/FICO_corp &

https://www.fico.com/blogs/

For FICO news and media resources, visit

https://www.fico.com/en/newsroom.

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212136123/en/

Julie Huang press@fico.com

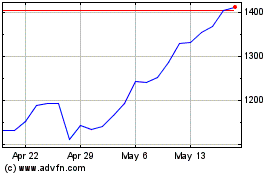

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Jan 2025 to Feb 2025

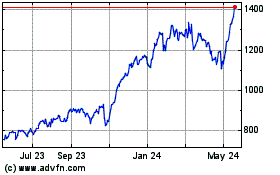

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Feb 2024 to Feb 2025