Company raises 2023-2027 sales CAGR from 25%

to 30% in Optical Communications’ Enterprise business, driven by

continued strong adoption of new Gen AI products for inside data

centers

Company launches a new Solar Market-Access

Platform that is expected to increase sales, profit, and cash flow

beginning in the third quarter

Management raises first-quarter guidance;

now expects sales to exceed $3.6 billion and EPS to come in at the

high end of the range of $0.48 to $0.52

(1) In 2024, Corning shared details on its original

high-confidence Springboard plan to add more than $3 billion in

annualized sales, and to achieve operating margin of 20%, by the

end of 2026. The starting point for Springboard is the annualized

sales run rate of Q4 2023.

Corning Incorporated (NYSE: GLW) today announced an upgrade to

its Springboard plan, along with details on the key milestones

achieved across the company, at an investor event in New York

City.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250317478788/en/

Wendell P. Weeks, chairman and chief executive officer,

said, “Today, we upgraded our high-confidence Springboard plan

to now add more than $4 billion in annualized sales, and to achieve

operating margin of 20%, by the end of 2026. We expect our upgraded

sales to come with higher EPS and stronger cash flow and ROIC than

we originally anticipated at the start of Springboard.”

Weeks continued, “Overall, we’re making great progress on

Springboard across the company. Our strategies are working, and our

customers are loving our innovations. As a result, in addition to

upgrading our Springboard plan, we are raising our first-quarter

guidance. We are also excited to launch a new Solar Market-Access

Platform, which we expect to be a $2.5 billion business by 2028,

with a positive impact on sales, profit, and cash flow later this

year.”

Ed Schlesinger, executive vice president and chief financial

officer, said, “When we introduced Springboard one year ago, we

laid out a compelling financial plan to deliver robust sales,

profit, and cash flow. Since the start of Springboard, we have

grown core sales 18% and core EPS 46%, while expanding core

operating margin to 18.5%. We also expanded core ROIC 390 basis

points. Additionally, we grew adjusted free cash flow by 42% for

full-year 2024.”

Schlesinger continued, “Today, we’re providing a

significant upgrade to what was already a quite attractive

investment thesis. We’ve upgraded our high-confidence Springboard

plan by $1 billion. We now expect to add more than $4 billion in

annualized sales, and to achieve a 20% operating margin, by the end

of 2026.”

Highlights from Springboard Investor Event

- Company upgrades Springboard plan

- Management upgrades its high-confidence Springboard plan to now

add more than $4 billion in annualized sales, and to achieve

operating margin of 20%, by the end of 2026. The company expects

the upgraded sales to come with higher EPS and stronger cash flow

and ROIC than originally anticipated at the start of

Springboard.

- Management also upgrades its internal Springboard plan to now

add $6 billion in annualized sales by the end of 2026. The internal

plan reflects the actual business plans of each Market-Access

Platform without corporate-level risk adjustment.

- Management raises first-quarter guidance

- Management now expects full-company sales to exceed $3.6

billion and EPS to come in at the high end of the range of $0.48 to

$0.52.

- Gen AI products driving faster growth in Optical

Communications

- Management raises expected Enterprise 2023-2027 sales CAGR from

25% to 30%, driven by the continued strong adoption of new Gen AI

products for inside data centers.

- Corning introduced a new Gen AI fiber and cable system last

year to interconnect AI data centers, enabling from two-to-four

times the amount of fiber into an existing conduit. The company’s

Carrier business has now fully commercialized these products, with

production tripling every month in Q1, as three industry-leading

customers adopt the technology.

- Company announces launch of new Solar Market-Access

Platform

- The company is contributing to U.S. energy independence by

helping build a domestic solar supply chain.

- Management expects the new Solar Market-Access Platform to grow

from a ~$1 billion revenue stream in 2024 to a $2.5 billion revenue

stream by 2028.

- Corning is commercializing new made-in-America wafer products

this year, with committed customer agreements, and management

expects these products to have a positive impact on sales, profits,

and cash flow starting in the second half of 2025.

- Display Technologies on track to maintain stable U.S. dollar

net income

- Display Technologies successfully implemented price increases

in the second half of 2024 to deliver consistent profitability in a

weaker yen environment.

- Management remains confident that Display is on track to

deliver net income of $900 million to $950 million this year and to

deliver net income margin of 25%.

Presentation of Information in this News Release In this

news release, when describing the outlook for future periods,

“sales”, “EPS”, “ROIC” and “operating margin," refer to the

company's core net sales, core EPS, core ROIC, and core operating

margin, which are non-GAAP measures. Non-GAAP financial measures

are not in accordance with, or an alternative to, GAAP. Corning’s

non-GAAP financial measures exclude the impact of items that are

driven by general economic conditions and events that do not

reflect the underlying fundamentals and trends in the company’s

operations. The company believes presenting non-GAAP financial

measures assists in analyzing financial performance without the

impact of items that may obscure trends in the company’s underlying

performance. Definitions of these non-GAAP financial measures and

reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures for completed financial

reporting periods can be found on the company’s website by going to

the Investor Relations page and clicking “Quarterly Results” under

the “Financials and Filings” tab.

With respect to the outlook for future periods, it is not

possible to provide reconciliations for these non-GAAP measures

because management does not forecast the movement of foreign

currencies against the U.S. dollar, or other items that do not

reflect ongoing operations, nor does it forecast items that have

not yet occurred or are out of management’s control. As a result,

management is unable to provide outlook information on a GAAP

basis. Non-GAAP measures used in outlook for future periods reflect

estimates, and GAAP financial measures ultimately achieved may vary

materially.

Caution Concerning Forward-Looking Statements The

statements contained in this release and related comments by

management that are not historical facts or information and contain

words such as “will,” “believe,” “anticipate,” “expect,” “intend,”

“plan,” “seek,” “see,” “would,” “target,” “estimate,” “forecast” or

similar expressions are forward-looking statements. These

forward-looking statements are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and include estimates and assumptions related to economic,

competitive and legislative developments. Such statements relate to

future events that by their nature address matters that are, to

different degrees, uncertain. These forward-looking statements

relate to, among other things, the company’s Springboard plan, the

company’s future operating performance, the company’s share of new

and existing markets, the company’s revenue and earnings growth

rates, the company’s ability to innovate and commercialize new

products, the company’s expected capital expenditure and the

company’s implementation of cost-reduction initiatives and measures

to improve pricing, including the optimization of the company’s

manufacturing capacity.

Although the company believes that these forward-looking

statements are based upon reasonable assumptions regarding, among

other things, current estimates and forecasts, general economic

conditions, its knowledge of its business and key performance

indicators that impact the company, there can be no assurance that

these forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. The company undertakes no

obligation to update forward-looking statements if circumstances or

management’s estimates or opinions should change except as required

by applicable securities laws.

Some of the risks, uncertainties and other factors that could

cause actual results to differ materially from those expressed in

or implied by the forward-looking statements include, but are not

limited to: global economic trends, competition and geopolitical

risks, or an escalation of sanctions, tariffs or other trade

tensions between the U.S. and other countries, and related impacts

on our businesses’ global supply chains and strategies; changes in

macroeconomic and market conditions and market volatility,

including developments and volatility arising from health crisis

events, inflation, interest rates, the value of securities and

other financial assets, precious metals, oil, natural gas, raw

materials and other commodity prices and exchange rates

(particularly between the U.S. dollar and the Japanese yen, New

Taiwan dollar, euro, Chinese yuan, South Korean won and Mexican

peso), decreases or sudden increases of consumer demand, and the

impact of such changes and volatility on our financial position and

businesses; the availability of or adverse changes relating to

government grants, tax credits or other government incentives; the

duration and severity of health crisis events, such as an epidemic

or pandemic, and its impact across our businesses on demand,

personnel, operations, our global supply chains and stock price;

possible disruption in commercial activities or our supply chain

due to terrorist activity, cyber-attack, armed conflict, political

or financial instability, natural disasters, international trade

disputes or major health concerns; loss of intellectual property

due to theft, cyber-attack, or disruption to our information

technology infrastructure; ability to enforce patents and protect

intellectual property and trade secrets; disruption to Corning’s,

our suppliers’ and manufacturers’ supply chain, equipment,

facilities, IT systems or operations; product demand and industry

capacity; competitive products and pricing; availability and costs

of critical components, materials, equipment, natural resources and

utilities; new product development and commercialization; order

activity and demand from major customers; the amount and timing of

our cash flows and earnings and other conditions, which may affect

our ability to pay our quarterly dividend at the planned level or

to repurchase shares at planned levels; the amount and timing of

any future dividends; the effects of acquisitions, dispositions and

other similar transactions; the effect of regulatory and legal

developments; ability to pace capital spending to anticipated

levels of customer demand; our ability to increase margins through

implementation of operational changes, pricing actions and cost

reduction measures; rate of technology change; adverse litigation;

product and component performance issues; retention of key

personnel; customer ability to maintain profitable operations and

obtain financing to fund ongoing operations and manufacturing

expansions and pay receivables when due; loss of significant

customers; changes in tax laws, regulations and international tax

standards; the impacts of audits by taxing authorities; the

potential impact of legislation, government regulations, and other

government action and investigations; and other risks detailed in

Corning’s SEC filings.

For a complete listing of risks and other factors, please

reference the risk factors and forward-looking statements described

in our annual reports on Form 10-K and quarterly reports on Form

10-Q.

Web Disclosure In accordance with guidance provided by

the SEC regarding the use of company websites and social media

channels to disclose material information, Corning Incorporated

(“Corning”) wishes to notify investors, media, and other interested

parties that it uses its website

(https://www.corning.com/worldwide/en/about-us/news-events.html) to

publish important information about the company, including

information that may be deemed material to investors, or

supplemental to information contained in this or other press

releases. The list of websites and social media channels that the

company uses may be updated on Corning’s media and website from

time to time. Corning encourages investors, media, and other

interested parties to review the information Corning may publish

through its website and social media channels as described above,

in addition to the company’s SEC filings, press releases,

conference calls, and webcasts.

About Corning Incorporated Corning (www.corning.com) is

one of the world’s leading innovators in materials science, with a

170-year track record of life-changing inventions. Corning applies

its unparalleled expertise in glass science, ceramic science, and

optical physics along with its deep manufacturing and engineering

capabilities to develop category-defining products that transform

industries and enhance people’s lives. Corning succeeds through

sustained investment in RD&E, a unique combination of material

and process innovation, and deep, trust-based relationships with

customers who are global leaders in their industries. Corning’s

capabilities are versatile and synergistic, which allows the

company to evolve to meet changing market needs, while also helping

its customers capture new opportunities in dynamic industries.

Today, Corning’s markets include optical communications, mobile

consumer electronics, display, automotive, solar, semiconductors,

and life sciences.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250317478788/en/

Media Relations Contact: Gabrielle Bailey (607) 684-4557

baileygr@corning.com Investor Relations Contact: Ann H.S.

Nicholson (607) 974-6716 nicholsoas@corning.com

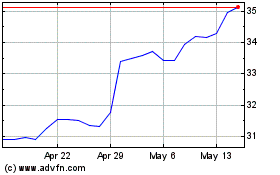

Corning (NYSE:GLW)

Historical Stock Chart

From Mar 2025 to Apr 2025

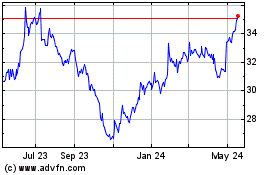

Corning (NYSE:GLW)

Historical Stock Chart

From Apr 2024 to Apr 2025