false000182014400018201442024-05-092024-05-090001820144us-gaap:CommonStockMember2024-05-092024-05-090001820144us-gaap:WarrantMember2024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2024

________________________

Grindr Inc.

(Exact name of registrant as specified in its charter)

________________________

Commission file number 001-39714

________________________

| | | | | | | | |

| Delaware | | 92-1079067 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | |

PO Box 69176, 750 N. San Vicente Blvd., Suite RE 1400 West Hollywood, California | | 90069 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 776-6680

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | GRND | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | GRND.WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 9, 2024, Grindr Inc. (the “Company”) issued a press release and posted a shareholder letter and an investor presentation to its website announcing its financial results for the first fiscal quarter ended March 31, 2024. A copy of the Company’s press release dated May 9, 2024, the shareholder letter dated May 9, 2024 is attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information contained herein and the accompanying Exhibit 99.1 and Exhibit 99.2 is being furnished under “Item 2.02 Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated May 9, 2024 |

| | Shareholder Letter dated May 9, 2024 |

| 104 | | Cover Page Interactive Data File, formatted in inline XBRL (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 9, 2024

| | | | | | | | |

| | | GRINDR INC. |

| | | |

| | | By: |

| | | |

| | | /s/ Vandana Mehta-Krantz |

| | | Vandana Mehta-Krantz |

| | | Chief Financial Officer |

Exhibit 99.1

Grindr Inc. Reports First Quarter 2024 Revenue Growth of 35%

First Quarter 2024 Revenue $75 Million, Operating Income of $19 Million

Net Loss Margin of 12.5% and Adjusted EBITDA Margin of 41.9%

LOS ANGELES, CA – May 9, 2024 – Grindr Inc. (NYSE: GRND), the premiere LGBTQ+ social connector, today posted its financial results for the first fiscal quarter ended March 31, 2024 in a Letter to Shareholders. The Letter to Shareholders can be accessed on Grindr’s Investor Relations website.

“Grindr is off to an outstanding start to 2024, highlighted by revenue growth of 35% year-over-year and strong margins in our first quarter,” said George Arison, Grindr’s Chief Executive Officer. “Results were excellent across the business. We’re making good progress on our strategic priorities for the year, highlighted by our product roadmap with two new products in development built with user intent in mind. We are excited about the opportunities ahead in 2024 and beyond as we execute on our long-term vision to build the ‘Global Gayborhood in Your Pocket’.”

Earnings Webcast Information

Grindr will host a live webcast today at 2:00 p.m. Pacific Time to discuss the Company’s first quarter 2024 financial results. The webcast of the conference call can be accessed as follows:

Event: Grindr First Quarter 2024 Earnings Conference Call

Date: Thursday, May 9, 2024

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investors.grindr.com/

An archived webcast of the conference call will also be accessible on Grindr’s Investor Relations page, https://investors.grindr.com

Forward Looking Statements

This press release contains statements that may constitute as forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These forward-looking statements include statements regarding our intentions, beliefs, current expectations or projections concerning, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the markets in which we operate. In some cases, you can identify these forward-looking statements by the use of terminology such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “upcoming,” “will” or the negative version of these words or other comparable words or phrases.

The forward-looking statements, including statements regarding strategic priorities, product roadmap, new products and long term vision, reflect our current views about our business and future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ materially from those expressed in any forward-looking statement. There are no guarantees that any transactions or events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth in or contemplated by the forward-looking statements:

•our ability to retain existing users and add new users;

•the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy, data protection, and user safety laws and regulations;

•our ability to address privacy concerns and protect systems and infrastructure from cyber-attacks and prevent unauthorized data access;

•our success in retaining or recruiting our directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles;

•our ability to respond to general economic conditions;

•competition in the dating and social networking products and services industry;

•our ability to adapt to changes in technology and user preferences in a timely and cost-effective manner;

•our dependence on the integrity of third-party systems and infrastructure;

•our ability to protect our intellectual property rights from unauthorized use by third parties;

•whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters; and

•the effects of macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters, and wars or other regional conflicts.

In addition, statements that “Grindr believes” or “we believe” and similar statements reflect our beliefs and opinions on the relevant subjects as of the date of any such statement. These statements are based upon information available to us as of the date they are made, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements whether as a result of new information, future events, or otherwise. For a further discussion of these and other factors that could cause our future results, performance, or transactions to differ significantly from those expressed in any forward-looking statement, please see the section titled “Risk Factors.” in annual reports on Form 10-K and quarterly reports on Form 10-Q that we file with the Securities and Exchange Commission from time to time. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

Non-GAAP Financial Measures

We use Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Adjusted EBITDA adjusts for the impact of items that we do not consider indicative of the operational performance of our business. We define Adjusted EBITDA as net income (loss) excluding income tax provision; interest expense, net; depreciation and amortization; stock-based compensation expense; transaction-related costs; gain (loss) in fair value of warrant liability; and severance expense, litigation-related costs, and other items, in each case that are unrelated to our core ongoing business operations. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period.

Our management uses this measure internally to evaluate the performance of our business and this measure is one of the primary metrics by which management and other employees are compensated. We exclude the above items as some are non-cash in nature and others may not be representative of normal operating results. While we believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP.

A reconciliation of net loss and net loss margin to Adjusted EBITDA and Adjusted EBITDA margin for the three months ended March 31, 2024 and 2023 are presented below. We are not able to estimate net income (loss) or net income (loss) margin on a forward-looking basis or reconcile the guidance provided for Adjusted EBITDA margin to net income (loss) margin on a forward-looking basis without unreasonable efforts due to the variability and complexity with respect to the charges excluded from Adjusted EBITDA margin. In particular, the measures and effects of our stock-based compensation related to equity grants and the gain (loss) on changes in fair value of our warrant liability that, in each case, are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could have a significant and potentially unpredictable impact on our future GAAP financial results.

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| ($ in thousands) | 2024 | | 2023 |

| Reconciliation of net loss to Adjusted EBITDA | | | |

| Net loss | $ | (9,406) | | | $ | (32,899) | |

| Interest expense, net | 7,185 | | | 10,793 | |

| Income tax provision | 2,680 | | | 15,503 | |

| Depreciation and amortization | 4,119 | | | 7,952 | |

| | | |

Litigation-related costs (1) | 422 | | | 1,211 | |

| Stock-based compensation expense | 7,869 | | | 3,341 | |

Severance expense (2) | 58 | | | 676 | |

| | | |

Change in fair value of warrant liability (3) | 18,680 | | | 15,317 | |

Others (4) | — | | | 105 | |

| Adjusted EBITDA | $ | 31,607 | | | $ | 21,999 | |

| Revenue | $ | 75,345 | | | $ | 55,809 | |

| Net loss margin | (12.5) | % | | (58.9) | % |

| Adjusted EBITDA Margin | 41.9 | % | | 39.4 | % |

(1)Litigation-related costs primarily represent external legal fees associated with the outstanding litigation or regulatory matters, including fees incurred in connection with the potential Norwegian Data Protection Authority fine and employee unionization.

(2)Severance expense relates to severance incurred for employees who elected not to relocate or participate in our hybrid working model involving a multi-phase return-to-office plan and other severance arrangements.

(3)Change in fair value of warrant liability relates to our warrants that were remeasured as of March 31, 2024 due to the increase in our public warrant price since December 31, 2023.

(4)Other represents other costs that are unrelated to our core ongoing business operations.

About Grindr Inc.

With more than 13.5 million monthly active users, Grindr has grown to become the Global Gayborhood in Your Pocket, on a mission to make a world where the lives of our global community are free, equal, and just. Available in 190 countries and territories, Grindr is often the primary way for its users to connect, express themselves, and discover the world around them. Since 2015 Grindr for Equality has advanced human rights, health, and safety for millions of LGBTQ+ people in partnership with organizations in every region of the world. Grindr has offices in West Hollywood, the Bay Area, Chicago, and New York. The Grindr app is available on the App Store and Google Play.

Investors:

IR@grindr.com

Media:

Press@grindr.com

1LETTER TO SHAREHOLDERS Q1 2024 Shareholder Letter First Quarter 2024 May 9, 2024

2LETTER TO SHAREHOLDERS Q1 2024 Grindr is off to a great start in 2024, delivering year-over-year revenue growth of 35% and an Adjusted EBITDA margin of 42% in Q1 2024. These results, along with continued strength in our key metrics and momentum in product development, are setting us up for a strong year. As previously indicated, we expect to see elevated revenue growth rates in the first half of 2024 due to our XTRA Weekly subscription offering, which was fully rolled out in May 2023. Our 2024 strategic priorities are focused not only on driving continued growth this year but also on positioning Grindr for long-term success as the Global Gayborhood in Your Pocket, with products and features focused on serving users’ varying intents; a lean and nimble team with an exceptional performance-driven culture; and a brand narrative that is true to the important role we play in the community. This quarter, we made good progress on our priorities. Our next products on tap, Right Now and Roam, are built with user intent in mind. Similarly, our new chat system will allow us to build new intentionality-focused features that were not possible when chats were hosted locally on users’ devices. The new chat system was built on a completely new architecture and represents Grindr’s most complex technical undertaking in nearly a decade. It is an exciting step forward for our user experience, given how heavily chat is used—with over 121 billion chats in 2023—and the vital role it plays in our user community. Dear Grindr Shareholders, Q1 2024 $75.3M revenue $31.6M adj. EBITDA +35% YoY growth 42% of revenue

3LETTER TO SHAREHOLDERS Q1 2024 We also continue to make great additions to our Grindr team. We’ve increased our engineering headcount by more than 50% quarter-over-quarter in Q1, adding key skills to our product development team. Overall, our growing team is energized and focused, and this has contributed to our strong financial performance. All of these developments set us up for a bright future. In April, at the Web Summit in Rio de Janeiro, we marked our 15th anniversary by laying out our new long-term vision of Grindr as the Global Gayborhood in Your Pocket. Physical Gayborhoods are hubs for the gay community, long-established in large cities, where LGBTQ+ people can interact safely and comfortably with businesses, resources, bars, restaurants, and shops specifically catered to us. However, not everyone has the luxury of being in or near a physical Gayborhood, and for many of us, Grindr has come to represent it in a digital way. We see this in workarounds our users have developed to use our app for travel recommendations, health information, and making professional connections. Our product is often one of the only ways to connect and even access important health and safety information, specifically targeted to gay, bi, and trans people and our specific needs. Our vision of Grindr as the Global Gayborhood in Your Pocket is about tapping into what our community wants. It will be a multi-year journey to achieve this vision, and we are excited about what is possible for the app and how it can become an even more integral part of the community. We’re excited to share more about our business, strategy, and long-term vision at our upcoming Investor Day in New York City on June 26th. George Arison, CEO Grindr has become an integral part of the gay community all over the world, including many countries where it is still illegal to be gay.

4LETTER TO SHAREHOLDERS Q1 2024 Q1 Business Highlights Our new chat system, which encompasses step change improvements in this critical user feature, was 100% rolled out globally at the end of Q1. Rebuilding our chat infrastructure, which the team has worked on for the last couple of years, represents our most complex technical launch in nearly a decade. We have been actively addressing bugs in the early phase of the launch and are nearing completion of that process. As our users know, the prior chat system stored messages on users’ mobile devices, causing users to lose all chats if they switched devices. Users were vocal about this issue and have been asking for a fix for years. We’ve now transitioned storage of all messages to the cloud, reducing risk of lost chats and enabling secure encryption of all messages. Moving forward, users will see several new products and features that were not possible when chats were locally hosted. We also rolled out Unlimited Weekly globally in Q1. Unlimited Weekly gives users access to all of the exclusive features in our Unlimited subscription offer, such as Viewed Me, Incognito, unlimited profiles, and more – all at a lower price point and for a shorter commitment period. We are progressing well on our next two product rollouts, Right Now and Roam. Both are squarely tied to our core product development focus on understanding and addressing our users’ intentions when they are on the app. Innovating with a Focus on User Intent

5LETTER TO SHAREHOLDERS Q1 2024 Right Now is a multi-phased product we are building in response to strong user demand for our core use case. Phase one features are currently in testing with more to be launched later this year and next year. Right Now adds a further monetizable dimension to our product by making it easier and quicker for users to find connections. Right Now will ultimately have a comprehensive, robust feature set facilitating better user engagement and capabilities for more seamless, easy communication between users, both 1-1 and in groups. Roam, which targets the travel intention, is in later-stage development and testing after we updated the product with useful and encouraging user feedback from earlier testing. The simple premise of Roam is to enable users to transport their profile into a different market for a period of time, where they plan to travel in the near future. Once virtually there, users can chat with locals, indicate their travel plans, learn more about local activities, etc. Roamers are identified as such on the grid at their digital destination to ensure transparency. We are now in-market in select regions, with a 100% rollout planned for later this year. Right Now NEW FEATURE Roam NEW FEATURE

6LETTER TO SHAREHOLDERS Q1 2024 As we accelerate our product roadmap, we’ve continued to add top talent to the Grindr team. Though still far from our early 2023 employment level, as of March 31, 2024, our team has grown to 129 employees globally. We will be hiring deliberately to bring in talent aligned with our mission and operating principles and are focused on ensuring we have the resources and expertise to deliver the best user experience, ultimately contributing to our continued financial success. Q1 saw the successful launch of our new podcast content series, WTA. Hosted by community star Katya Zamolodchikova, the new interview series focuses on key behaviors, successes, and learnings from the online Grindr world and has featured celebrities such as Orville Peck and Saucy Santana, telling their personal stories of using our app. In its inaugural season, the content, which is hosted on our owned social media channels (as well as all large podcast platforms), has achieved substantial reach and positive sentiment. It has achieved further reach through positive media coverage in the likes of Forbes and Rolling Stone, among many others. Season two is already in the making. To amplify Grindr’s travel use case and promote our new Roam functionality, as well as reinforce our vision of Grindr as the Global Gayborhood in Your Pocket, a six-episode travel series is currently in the making. Much like our podcast, the plan is for this series to reach and tell our brand story to our audiences solely through our owned and earned media channels. As part of Grindr for Equality’s audacious goal of bringing easy access to at-home HIV testing through the Grindr app worldwide, in March, we launched this capability in New Zealand, joining the U.S., Ireland, and the country of Georgia. We look forward to further expansion later this year. Grindr for Equality also supported multiple movements for decriminalization and marriage equality, including in Thailand, which in March took a historic legislative step toward becoming the first country in Southeast Asia to legalize same-sex marriage. Building a Performance-Driven Culture Telling Our Brand Story WTA NEW PODCAST

7LETTER TO SHAREHOLDERS Q1 2024 Q1 Financial & Operating Performance Our first quarter financial results were outstanding and primarily driven by the continued strong performance of our XTRA Weekly subscription offering. Total revenue for the first quarter increased by 35% year-over-year to $75 million, operating income was $19 million, net loss was $9 million, representing a net loss margin of 12%, and Adjusted EBITDA was $32 million, representing a margin of 42%. In Q1 2024, Average Monthly Active Users (“ Average MAU”) were up 7% year-over- year, and Average Paying Users increased 17% year-over-year to 1 million, with both metrics reflecting domestic and international growth. The strength of our subscription plans, including XTRA Weekly, led to a 15% increase year-over-year in Average Direct Revenue per Paying User (“ARPPU”), reaching $21.25. AVG MAUs 13.7M +7% YOY GROWTH 1M +17% YOY GROWTH AVG PAYING USERS ARPPU $21.25 +15% YOY GROWTH Q1 2024 Operational Highlights

8LETTER TO SHAREHOLDERS Q1 2024 Revenue Revenue for Q1 2024 was $75 million, up 35% year- over-year from $56 million. Growth in revenue was driven by both an increase in the number of paying users and ARPPU underpinned by the growth in our subscription product offerings. Direct Revenue increased by 34% year-over-year to $64 million. Indirect Revenue increased 43% year-over-year to $11 million. Operating Expenses Operating expenses for Q1 2024, excluding cost of revenue, were $36 million, up 13% year-over-year versus Q1 2023 operating expenses, excluding cost of revenue, of $32 million, with the increase driven by higher stock-based compensation expense offset by lower depreciation & amortization costs. Operating Income Operating income for Q1 2024 was $19 million, or 26% of revenue, versus operating income for Q1 2023 of $9 million, or 15% of revenue. *The graphs presented above are for illustrative purposes and are not to scale. Revenue ($ in millions) $56M $62M $70M $72M $75M Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024

9LETTER TO SHAREHOLDERS Q1 2024 Net Loss Our net loss for Q1 2024 of $9 million included the loss of $19 million related to the change in fair value of our warrant liability. Including this impact, net loss margin was 12% for Q1 versus the prior period net loss margin of 59%. Adjusted EBITDA We achieved Adjusted EBITDA of $32 million, or 42% of total revenue, in Q1 2024. This represents an increase of $10 million, or 44% improvement versus Q1 2023. The increase was driven by growth in revenue as more Grindr users converted to paid users. Outlook Grindr’s strong Q1 performance increases our confidence in our 2024 outlook, which calls for revenue growth of at least 23% and Adjusted EBITDA margin of at least 40%. *The graphs presented above are for illustrative purposes and are not to scale. Adjusted EBITDA ($ in millions) $22M $27M $33M $29M $32M 39% 44% 46% 40% 42% 35% 40% 45% 50% $10 $15 $20 $25 $30 $35 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Adj. EBITDA Adj. EBITDA margin (% of Total Revenue) 23%+ Revenue Growth Adjusted EBITDA Margin 40%+ 2024 Guidance

10LETTER TO SHAREHOLDERS Q1 2024 Conference Call Grindr will host a conference call to discuss these results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time), May 9, 2024. The live audio webcast, along with the press release, will be accessible at https://investors.grindr.com/. A recording of the webcast will also be available on our website following the conference call. Grindr to Host Investor Day Grindr will host its inaugural Investor Day on Wednesday, June 26, 2024, in New York City. Interested investors and analysts are encourage to email ir@grindr.com for an invitation. A live audio webcast and presentation slides will be posted on the day of the event to the Company’s Investor Relations page at https://investors.grindr.com/. To register for the live webcast, please visit the Events & Presentations section of Grindr’s Investor Relations website. A replay of the live webcast and presentations will also be available on Grindr’s Investor Relations website following the conclusion of the event. Average Paying Users 1.0M Q1 2024 Average MAUs 13.7M Average Paying User Penetration 7.4% ARPPU $21.25 Performance Metrics

11LETTER TO SHAREHOLDERS Q1 2024 Condensed Consolidated Balance Sheets (unaudited) (in thousands, except share data) Grindr Inc. and subsidiaries Condensed Consolidated Balance Sheets (unaudited) (in thousands, except share data) March 31, December 31, 2024 2023 Assets Current Assets Cash and cash equivalents ............................................................................................... $ 21,548 $ 27,606 Accounts receivable, net of allowance of $470 and $757, at March 31, 2024, and December 31, 2023, respectively ...................................................................... 35,733 33,906 Prepaid expenses ............................................................................................................... 6,791 4,190 Deferred charges ............................................................................................................... 3,578 3,635 Other current assets ......................................................................................................... 765 2,413 Total current assets ............................................................................................................. 68,415 71,750 Restricted cash................................................................................................................... 605 1,392 Property and equipment, net ........................................................................................... 1,575 1,576 Capitalized software development costs, net................................................................ 8,132 7,433 Intangible assets, net......................................................................................................... 79,217 82,332 Goodwill .............................................................................................................................. 275,703 275,703 Right-of-use assets ............................................................................................................ 3,046 3,362 Other assets ....................................................................................................................... 1,052 1,047 Total assets ........................................................................................................................... $ 437,745 $ 444,595 Liabilities and Stockholders’ Equity Current liabilities Accounts payable .............................................................................................................. $ 3,466 $ 3,526 Accrued expenses and other current liabilities ............................................................. 25,493 22,934 Current maturities of long-term debt, net ..................................................................... 15,000 15,000 Deferred revenue .............................................................................................................. 19,070 19,181 Total current liabilities ......................................................................................................... 63,029 60,641 Long-term debt, net .......................................................................................................... 300,049 325,600 Warrant liability ................................................................................................................. 86,302 67,622 Lease liability ...................................................................................................................... 1,856 2,241 Deferred tax liability ......................................................................................................... 4,558 4,665 Other non-current liabilities............................................................................................. 3,968 2,118 Total liabilities ...................................................................................................................... $ 459,762 $ 462,887 Stockholders’ Deficit Preferred stock, par value $0.0001; 100,000,000 shares authorized; none issued and outstanding at March 31, 2024, and December 31, 2023, respectively ..................................................................................................................... — — Common stock, par value $0.0001; 1,000,000,000 shares authorized; 175,905,799 and 175,377,711 shares issued at March 31, 2024, and December 31, 2023, respectively; 175,391,283 and 175,020,471 outstanding at March 31, 2024, and December 31, 2023, respectively ..................................... 18 18 Treasury Stock ................................................................................................................... (3,648) (2,154) Additional paid-in capital .................................................................................................. 51,830 44,655 Accumulated deficit .......................................................................................................... (70,217) (60,811) Total stockholders’ deficit .................................................................................................. $ (22,017) $ (18,292) Total liabilities and stockholders’ deficit ......................................................................... $ 437,745 $ 444,595

12LETTER TO SHAREHOLDERS Q1 2024 Consolidated Statements of Operations and Comprehensive (Loss) Income (unaudited) (in thousands, except per share and share data) Grindr Inc. and Subsidiaries Consolidated Statements of Operations and Comprehensive Loss (unaudited) (in thousands, except per share and share data) Three Months Ended March 31, 2024 2023 Revenue ................................................................................................................................ $ 75,345 $ 55,809 Operating costs and expenses Cost of revenue (exclusive of depreciation and amortization shown separately below) .................................................................................................................................... 19,620 14,815 Selling, general and administrative expense..................................................................... 26,609 18,945 Product development expense .......................................................................................... 5,741 5,506 Depreciation and amortization .......................................................................................... 4,119 7,952 Total operating expenses ................................................................................................... 56,089 47,218 Income from operations ..................................................................................................... 19,256 8,591 Other income (expense) Interest expense, net ........................................................................................................... (7,185) (10,793) Other (expense) income, net .............................................................................................. (117) 123 Loss in fair value of warrant liability .................................................................................. (18,680) (15,317) Total other expense, net .................................................................................................... (25,982) (25,987) Net loss before income tax ................................................................................................ (6,726) (17,396) Income tax provision........................................................................................................... 2,680 15,503 Net loss and comprehensive loss....................................................................................... $ (9,406) $ (32,899) Net loss per share Basic .................................................................................................................................... $ (0.05) $ (0.19) Diluted ................................................................................................................................ $ (0.05) $ (0.19) Weighted-average shares outstanding: Basic .................................................................................................................................... 175,516,307 173,599,925 Diluted ................................................................................................................................ 175,516,307 173,599,925

13LETTER TO SHAREHOLDERS Q1 2024 Condensed Consolidated Statements of Cash Flows (unaudited) (in thousands) Grindr Inc. and subsidiaries Condensed Consolidated Statements of Cash Flows (unaudited) (in thousands) Three Months Ended March 31, 2024 2023 Operating activities Net loss and comprehensive loss ..................................................................................................... (9,406) (32,899) Adjustments to reconcile net loss to net cash provided by operating activities: ...................... Stock-based compensation ............................................................................................................... 7,869 3,341 Loss in fair value of warrant liability ................................................................................................ 18,680 15,317 Amortization of debt discount and issuance costs ........................................................................ 231 512 Interest income on promissory note from member ....................................................................... — (282) Depreciation and amortization ......................................................................................................... 4,119 7,952 Provision for expected credit losses ................................................................................................ (287) 206 Deferred income taxes ...................................................................................................................... (107) (2,274) Non-cash lease expense .................................................................................................................... 316 280 Changes in operating assets and liabilities:..................................................................................... Accounts receivable ................................................................................................................... (1,540) (6,319) Prepaid expenses and deferred charges ................................................................................. (2,544) (169) Other current assets .................................................................................................................. 1,648 206 Other assets ................................................................................................................................ (37) (29) Accounts payable ....................................................................................................................... (398) 1,790 Accrued expenses and other current liabilities ...................................................................... 2,390 21,954 Deferred revenue ....................................................................................................................... (111) (754) Lease liability............................................................................................................................... (385) (331) Other liabilities ........................................................................................................................... 11 — Net cash provided by operating activities ..................................................................................... 20,449 8,501 Investing activities Purchase of property and equipment ...................................................................................... (195) (32) Additions to capitalized software ............................................................................................ (953) (1,461) Net cash used in investing activities ............................................................................................... (1,148) (1,493) Financing activities Proceeds from the exercise of stock options ......................................................................... 916 1,010 Principal payments on debt ...................................................................................................... (25,750) (1,063) Withholding taxes paid on stock-based compensation ........................................................ (1,312) — Transaction costs paid in connection with the Business Combination ............................... — (1,196) Proceeds from the repayment of promissory note to a member including interest ......... — 19,353 Net cash (used in) provided by financing activities ...................................................................... (26,146) 18,104 Net (decrease) increase in cash, cash equivalents and restricted cash ..................................... (6,845) 25,112 Cash, cash equivalents and restricted cash, beginning of the period ........................................ 28,998 10,117 Cash, cash equivalents and restricted cash, end of the period ................................................... 22,153 35,229 Reconciliation of cash, cash equivalents and restricted cash Cash and cash equivalents ........................................................................................................ 21,548 33,837 Restricted cash ........................................................................................................................... 605 1,392 Cash, cash equivalents and restricted cash ................................................................................... 22,153 35,229 Supplemental disclosure of cash flow information: Cash interest paid....................................................................................................................... $ 2,672 $ 5,172 Income taxes paid ...................................................................................................................... $ 4 $ 725 Supplemental disclosure of non-cash investing activities: Capitalized software development costs accrued but not paid ........................................... $ 522 $ — Supplemental disclosure of non-cash financing activities: Repurchase of common stock for net settlement of equity awards ................................... $ 182 $ —

14LETTER TO SHAREHOLDERS Q1 2024 Adjusted EBITDA Grindr Inc. and subsidiaries Adjusted EBITDA (in thousands) Three Months Ended March 31, ($ in thousands) 2024 2023 Reconciliation of net loss to Adjusted EBITDA Net loss ..................................................................................................................................... $ (9,406) $ (32,899) Interest expense, net ............................................................................................................... 7,185 10,793 Income tax provision ............................................................................................................... 2,680 15,503 Depreciation and amortization .............................................................................................. 4,119 7,952 Litigation-related costs (1)........................................................................................................ 422 1,211 Stock-based compensation expense ..................................................................................... 7,869 3,341 Severance expenses (2) ............................................................................................................ 58 676 Change in fair value of warrant liability (3) ............................................................................ 18,680 15,317 Others (4) .................................................................................................................................... — 105 Adjusted EBITDA .................................................................................................................... $ 31,607 $ 21,999 Revenue .................................................................................................................................... $ 75,345 $ 55,809 Net loss margin ........................................................................................................................ (12.5) % (58.9) % Adjusted EBITDA Margin ....................................................................................................... 41.9 % 39.4 % _________________ (1) Litigation-related costs primarily represent external legal fees associated with the outstanding litigation or regulatory matters, including fees incurred in connection with the potential NDPA fine, employee union campaign, and Business Combination. (2) Severance expenses related to severance incurred for employees who elected not to relocate or participate in our hybrid working model involving a multi-phase return-to-office plan and other severance arrangements. (3) Change in fair value of warrant liability relates to our warrants that were remeasured as of March 31, 2024 due to the increase in our public warrant price since December 31, 2023. (4) Other represents other costs that are unrelated to Grindr's core ongoing business operations.

15LETTER TO SHAREHOLDERS Q1 2024 Forward Looking Statements This letter contains “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 regarding Grindr’s current views with respect to our industry, operations, and future business plans, expectations and performance. These forward-looking statements can generally be identified by the use of forward-looking terminology, such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “upcoming,” “will” or the negative version of these words or other comparable words or phrases, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, among others, statements regarding strategic priorities and growth opportunities, product roadmap, new products and long-term vision, expectations for 2024, and our full-year 2024 guidance. Forward-looking statements, including guidance related to revenue growth and adjusted EBITDA margin, are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from our expectations discussed in the forward-looking statements. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our ability to retain existing users and add new users; (ii) the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy, data protection, and user safety laws and regulations; (iii) our ability to address privacy concerns and protect systems and infrastructure from cyber-attacks and prevent unauthorized data access; (iv) our success in retaining or recruiting our directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles; (v) our ability to respond to general economic conditions; (vi) competition in the dating and social networking products and services industry; (vii) our ability to adapt to changes in technology and user preferences in a timely and cost-effective manner; (viii) our dependence on the integrity of third-party systems and infrastructure; and (ix) our ability to protect our intellectual property rights from unauthorized use by third parties; (x) whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters; and (xi) the effects of macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters and wars or other regional conflicts. The foregoing list of factors is not exhaustive. Further information on these and additional risks, uncertainties and other factors that could cause actual outcomes and results to differ materially from those included in or contemplated by the forward-looking statements contained in this press release are included in the section titled “Risk Factors’’ included under Part I, Item 1A in our Annual Report on Form 10-K, as amended, for the year ended December 31, 2023. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on forward-looking statements, and Grindr assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

16LETTER TO SHAREHOLDERS Q1 2024 Non-GAAP Financial Measures Grindr uses Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of Grindr’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Adjusted EBITDA adjusts for the impact of items that Grindr does not consider indicative of the operational performance of its business. Grindr defines Adjusted EBITDA as net income (loss) excluding income tax provision; interest expense, net; depreciation and amortization; stock-based compensation expense; transaction-related costs; gain (loss) in fair value of warrant liability; and severance expense, litigation-related costs, and other items, in each case that are unrelated to Grindr’s core ongoing business operations. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period. Grindr’s management uses this measure internally to evaluate the performance of our business, and this measure is one of the primary metrics by which management and other employees are compensated. Grindr excludes the above items as some are non- cash in nature, and others may not be representative of normal operating results. While Grindr believes that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP. A reconciliation of net loss and net loss margin to Adjusted EBITDA and Adjusted EBITDA margin for the three months and year ended March 31, 2024 and 2023 are presented above. We are not able to estimate net income (loss) or net income (loss) margin on a forward-looking basis or reconcile the guidance provided for Adjusted EBITDA margin to net income (loss) margin on a forward-looking basis without unreasonable efforts due to the variability and complexity with respect to the charges excluded from Adjusted EBITDA margin. In particular, the measures and effects of our stock-based compensation related to equity grants and the gain (loss) on changes in fair value of our warrant liability that, in each case, are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could have a significant and potentially unpredictable impact on our future GAAP financial results. About Grindr With more than 13.5 million monthly active users, Grindr has grown to become the Global Gayborhood in Your Pocket, on a mission to make a world where the lives of our global community are free, equal, and just. Available in 190 countries and territories, Grindr is often the primary way for its users to connect, express themselves, and discover the world around them. Since 2015 Grindr for Equality has advanced human rights, health, and safety for millions of LGBTQ+ people in partnership with organizations in every region of the world. Grindr has offices in West Hollywood, the Bay Area, Chicago, and New York. The Grindr app is available on the App Store and Google Play.

v3.24.1.u1

Cover

|

May 09, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

Grindr Inc.

|

| Entity File Number |

001-39714

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

92-1079067

|

| Entity Address, Address Line One |

PO Box 69176

|

| Entity Address, Address Line Two |

750 N. San Vicente Blvd.

|

| Entity Address, Address Line Three |

Suite RE 1400

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90069

|

| City Area Code |

310

|

| Local Phone Number |

776-6680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001820144

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GRND

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

GRND.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

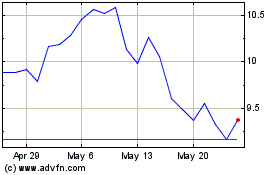

Grindr (NYSE:GRND)

Historical Stock Chart

From May 2024 to Jun 2024

Grindr (NYSE:GRND)

Historical Stock Chart

From Jun 2023 to Jun 2024