Global Ship Lease Announces Agreement to Acquire Four High-Reefer ECO Containerships on Multi-Year Charters, with 10-Year Financing Committed

05 December 2024 - 12:30AM

Global Ship Lease, Inc. (NYSE:GSL) (“GSL” or the “Company”), an

owner of containerships, announced today that it has contracted to

purchase four high-reefer ECO-9,115 TEU containerships (the “Newly

Acquired Vessels”) with an average age of 8.5 years for an

aggregate purchase price of $274 million. The Newly Acquired

Vessels are currently on time charters to a leading liner operator,

with varied median firm durations extending for an average of 1.7

years, or up to an average of 5.0 years if all charterer’s options

are exercised. Assuming all options are exercised, the charters are

expected to generate aggregate EBITDA of up to approximately $184

million. With these additions, the Company’s fleet will comprise 72

vessels with a total capacity of 413,183 TEU.

The Newly Acquired Vessels are scheduled for phased delivery

between December 2024 and January 2025. The Company expects to pay

for the ships with a combination of cash-on-hand and debt. The

Company has received in-principle commitments for ten-year

financings to be priced at SOFR + 2.50%, and benefiting from the

balance of the Company’s outstanding 0.64% SOFR caps. Including

these financings, the Company’s weighted average debt maturity

would be extended to 5.3 years. We expect that the financings will

contain financial and other covenants that are similar to those

contained in our other financing agreements. The financings are

subject to the negotiation and execution of definitive

documentation and the satisfaction of certain customary closing

conditions.

“In line with our clear goal of renewing the GSL fleet on a

disciplined and selective basis, we are pleased to announce the

acquisition of these four modern, high-reefer, ECO post-panamax

vessels on very compelling terms,” said George Youroukos, Executive

Chairman of Global Ship Lease. “As sisters to three high-performing

vessels already in the GSL fleet, the Newly Acquired Vessels are

tried and tested high-earners, and will carry forward the economic

runway of the cash cows in our existing fleet. We were able to

capitalize on this excellent opportunity because of our balance

sheet strength, flexibility, and ability to move fast, while also

maintaining our usual discipline and strict investment criteria.

Buying these ships for an en bloc price of $274 million, against an

aggregate open-market charter-free value of close to $400 million,

allows us to de-risk this deal right out of the gate. We are very

pleased to have established this new relationship with the seller,

and to have secured access to great assets, which are allowing us

to put in place 10-year financings while also forming a blueprint

to utilize if similarly compelling opportunities should emerge in

the future.”

About Global Ship

Lease

Global Ship Lease is a leading independent owner

of containerships with a diversified fleet of mid-sized and smaller

containerships. Incorporated in the Marshall Islands, Global Ship

Lease commenced operations in December 2007 with a business of

owning and chartering out containerships under fixed-rate charters

to top tier container liner companies. It was listed on the New

York Stock Exchange in August 2008.

As of September 30, 2024, and before adjusting

for the Newly Acquired Vessels, Global Ship Lease owned 68

containerships ranging from 2,207 to 11,040 TEU, with an aggregate

capacity of 376,723 TEU. 36 ships are wide-beam Post-Panamax.

As of September 30, 2024, and before adjusting

for the Newly Acquired Vessels, the average remaining term of the

Company’s charters, to the mid-point of redelivery, including

options under the Company’s control and other than if a redelivery

notice has been received, was 2.3 years on a TEU-weighted basis.

Contracted revenue on the same basis was $1.78 billion.

Contracted revenue was $2.15 billion, including options under

charterers’ control and with latest redelivery date, representing a

weighted average remaining term of 2.8 years.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements provide the Company’s

current expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts. Words or phrases such as

“anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. These forward-looking statements

are based on assumptions that may be incorrect, and the Company

cannot assure you that the events or expectations included in these

forward-looking statements will come to pass. Actual results could

differ materially from those expressed or implied by the

forward-looking statements as a result of various factors,

including the factors described in “Risk Factors” in the Company’s

Annual Report on Form 20-F and the factors and risks the Company

describes in subsequent reports filed from time to time with the

U.S. Securities and Exchange Commission. Accordingly, you should

not unduly rely on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to publicly revise any forward-looking statement to

reflect circumstances or events after the date of this press

release or to reflect the occurrence of unanticipated events.

Investor and Media Contact: The IGB GroupBryan

Degnan646-673-9701or Leon Berman 212-477-8438

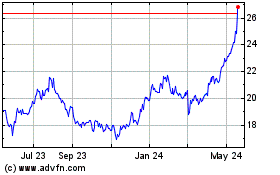

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

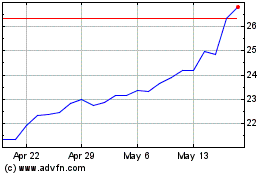

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Dec 2023 to Dec 2024