false000136447900013644792024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2024

HERC HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-33139 | | 20-3530539 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S Employer Identification No.) |

27500 Riverview Center Blvd.

Bonita Springs, Florida 34134

(Address of principal executive offices and zip code)

(239) 301-1000

(Registrant's telephone number,

including area code)

N/A

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

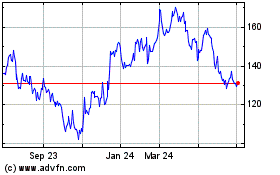

| Common Stock, par value $0.01 per share | | HRI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 23, 2024, Herc Holdings Inc. (the “Company”) issued a press release regarding its financial results for its second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

On July 23, 2024, the Company will conduct an earnings webcast relating to the Company’s financial results for the second quarter of 2024. The earnings webcast will be made available to the public via a link on the Investor Relations section of the Company's website, IR.HercRentals.com, as well as via telephone dial-in, and the slides that will accompany the presentation will be available to the public at the time of the earnings webcast through the Company’s website. Certain financial information relating to completed fiscal periods that will be part of the earnings webcast is included in the set of slides that will accompany the earnings webcast, a copy of which is furnished as Exhibit 99.2 to this Form 8-K.

The information in this Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. | | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| HERC HOLDINGS INC. |

| (Registrant) |

| | |

| | |

| By: | /s/ MARK HUMPHREY |

| Name: | Mark Humphrey |

| Title: | Senior Vice President and Chief Financial Officer |

Date: July 23, 2024

Herc Holdings Reports First Half 2024 Results and

Reaffirms 2024 Full Year Guidance

Second Quarter 2024 Highlights

–Record equipment rental revenue of $765 million, an increase of 9%

–Record total revenues of $848 million, an increase of 6%

–Rental pricing increased 3.5% year-over-year

–M&A and greenfield openings offset impact from decelerating local-market revenue growth

–Net income decreased 8% to $70 million, or $2.46 per diluted share

–Adjusted EBITDA of $360 million increased 2%; adjusted EBITDA margin of 42.5%

–Free cash flow of $148 million for the six months ended June 30, 2024

Bonita Springs, Fla., July 23, 2024 -- Herc Holdings Inc. (NYSE: HRI) ("Herc Holdings" or the "Company") today reported financial results for the quarter ended June 30, 2024.

“In the second quarter, we benefited from positive rental pricing, increasing fleet efficiency, and expanding market share, as we continue to significantly outpace rental-industry growth. Overall, our record second quarter revenue results came in according to our expectations. However, while national mega projects are on plan, we saw a greater deceleration in the local market's growth trajectory versus our forecast, primarily driven by the persistently higher interest-rate environment. The local-revenue deficit was essentially offset by contributions from acquisitions that added 21 locations year to date, including 10 in the second quarter,” said Larry Silber, president and chief executive officer of Herc Rentals. "As is typical, these new acquisitions and greenfields initially generate lower incremental margins than our established local-account business, which reflected an unfavorable trade-off in profitability in the second quarter.

"Looking to the second half of the year, mega project activity is ramping up into the peak season as anticipated. Higher revenue growth for the rest of the year and incremental adjustments made in the second quarter to better align our local cost structure should support more normal margin and REBITDA flow through for the back half of 2024," said Silber. “Based on current line-of-sight to market trends, we expect to deliver record full year results and are reaffirming our annual performance targets. Despite temporarily slower growth in the more rate-sensitive local market this year, the outlook for rental demand long-term is robust as the pipeline for mega projects remains strong, data center construction is accelerating, federal infrastructure spending continues to roll out, and rental penetration increases.”

2024 Second Quarter Financial Results

•Total revenues increased 6% to $848 million compared to $802 million in the prior-year period. The year-over-year increase of $46 million primarily related to an increase in equipment rental revenue of $63 million, reflecting positive pricing of 3.5% and increased volume of 6.4%, partially offset by unfavorable mix driven primarily by inflation. Sales of rental equipment decreased by $18 million during the period.

•Dollar utilization increased to 41.0% in the second quarter compared to 40.3% in the prior-year period.

•Direct operating expenses were $326 million, or 42.6% of equipment rental revenue, compared to $282 million, or 40.2% in the prior-year period. The slower than planned revenue growth in the local market created inefficiencies related to headcount and facilities expenses and actions were taken within the quarter to reduce variable costs to align with the moderating local market demand. Additionally, delivery expenses were higher due to internal transfers of equipment to branches in higher growth regions to drive fleet efficiency. Finally, insurance expense nearly doubled, primarily related to increased self insurance reserves due to claims development attributable to unsettled cases.

•Depreciation of rental equipment increased 2% to $165 million due to higher year-over-year average fleet size. Non-rental depreciation and amortization increased 7% to $30 million primarily due to amortization of acquisition intangible assets.

•Selling, general and administrative expenses was $120 million, or 15.7% of equipment rental revenue, compared to $111 million, or 15.8% in the prior-year period due to continued focus on improving operating leverage while expanding revenues.

•Interest expense increased to $63 million compared with $54 million in the prior-year period due to increased borrowings on the ABL Credit Facility, primarily to fund acquisition growth and invest in rental equipment, and higher interest rates on floating-rate debt.

•Net income was $70 million compared to $76 million in the prior-year period. Adjusted net income decreased 4% to $74 million, or $2.60 per diluted share, compared to $77 million, or $2.69 per diluted share, in the prior-year period. The effective tax rate was 25% compared to 26% in the prior-year period.

•Adjusted EBITDA increased 2% to $360 million compared to $352 million in the prior-year period and adjusted EBITDA margin was 42.5% compared to 43.9% in the prior-year period. Moderating local-market demand coupled with increased operating expenses and a reduction in margin on sales of used equipment impacted EBITDA margin during the quarter.

2024 First Half Financial Results

•Total revenues increased 7% to $1,652 million compared to $1,542 million in the prior-year period. The year-over-year increase of $110 million primarily related to an increase in equipment rental revenue of $128 million, reflecting positive pricing of 4.3% and increased volume of 7.2%, partially offset by unfavorable mix driven primarily by inflation. Sales of rental equipment decreased by $20 million during the period.

•Dollar utilization increased to 40.4% compared to 40.0% in the prior-year period.

•Direct operating expenses were $633 million, or 42.7% of equipment rental revenue, compared to $563 million, or 41.5% in the prior-year period. The slower than planned revenue growth in the local market created inefficiencies related to headcount and facilities expenses and actions were taken within the quarter to reduce variable costs to align with the moderating local market demand. Additionally, delivery expenses were higher due to internal transfers of equipment to branches in higher growth regions to drive fleet efficiency. Finally, insurance expense increased, primarily related to increased self insurance reserves due to claims development attributable to unsettled cases.

•Depreciation of rental equipment increased 4% to $325 million due to higher year-over-year average fleet size. Non-rental depreciation and amortization increased 9% to $59 million primarily due to amortization of acquisition intangible assets.

•Selling, general and administrative expenses was $235 million, or 15.8% of equipment rental revenue, compared to $217 million, or 16.0% in the prior-year period due to continued focus on improving operating leverage while expanding revenues.

•Interest expense increased to $124 million compared with $102 million in the prior-year period due to increased borrowings on the ABL Credit Facility primarily to fund acquisition growth and invest in rental equipment and higher interest rates on floating-rate debt.

•Net income was $135 million compared to $143 million in the prior-year period. Adjusted net income decreased 3% to $141 million, or $4.96 per diluted share, compared to $146 million, or $5.03 per diluted share, in the prior-year period. The effective tax rate was 22% compared to 20% in the prior-year period.

•Adjusted EBITDA increased 6% to $699 million compared to $660 million in the prior-year period and adjusted EBITDA margin was 42.3% compared to 42.8% in the prior-year period.

Rental Fleet

•Net rental equipment capital expenditures were as follows (in millions):

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Rental equipment expenditures | $ | 468 | | | $ | 703 | |

| Proceeds from disposal of rental equipment | (125) | | | (131) | |

| Net rental equipment capital expenditures | $ | 343 | | | $ | 572 | |

•As of June 30, 2024, the Company's total fleet was approximately $6.7 billion at OEC.

•Average fleet at OEC in the second quarter increased 8% compared to the prior-year period.

•Average fleet age was 47 months as of June 30, 2024 compared to 46 months in the comparable prior-year period.

Disciplined Capital Management

•The Company completed 6 acquisitions with a total of 21 locations and opened 11 new greenfield locations during the first half of 2024.

•Net debt was $3.8 billion as of June 30, 2024, with net leverage of 2.6x compared to 2.5x in the same prior-year period. Cash and cash equivalents and unused commitments under the ABL Credit Facility contributed to approximately $2.1 billion of liquidity as of June 30, 2024.

•The Company declared its quarterly dividend of $0.665 paid to shareholders of record as of May 31, 2024 on June 14, 2024.

•On June 7, 2024, the Company issued $800 million aggregate principal amount of 2029 Notes. The funds were used to repay a portion of the indebtedness outstanding under the Company’s senior secured asset-based revolving credit agreement and to pay related fees and expenses.

Subsequent Event

In July 2024, the Company acquired the assets of Otay Mesa Sales ("Otay") for approximately $264 million. Otay was a full-service general equipment rental company comprising approximately 135 employees with four locations serving construction and industrial customers throughout the metropolitan areas of San Diego, California and Phoenix and Yuma, Arizona.

Outlook

The Company is reaffirming its full year 2024 equipment rental revenue growth, adjusted EBITDA, and gross and net rental capital expenditures guidance ranges presented below, excluding Cinelease studio entertainment and lighting and grip equipment rental business. The guidance range for the full year 2024 adjusted EBITDA reflects an increase of 6% to 9% compared to full year 2023 results, excluding Cinelease. The sale process for the Cinelease studio entertainment business is ongoing.

| | | | | | | | |

| Equipment rental revenue growth: | | 7% to 10% |

| Adjusted EBITDA: | | $1.55 billion to $1.60 billion |

| Net rental equipment capital expenditures after gross capex: | | $500 million to $700 million, after gross capex of $750 million to $1 billion |

As a leader in an industry where scale matters, the Company expects to continue to gain share by capturing an outsized position of the forecasted higher construction spending in 2024 by investing in its fleet, optimizing its existing fleet, capitalizing on strategic acquisitions and greenfield opportunities, and cross-selling a diversified product portfolio.

Earnings Call and Webcast Information

Herc Holdings' second quarter 2024 earnings webcast will be held today at 8:30 a.m. U.S. Eastern Time. Interested U.S. parties may call +1-800-715-9871 and international participants should call the country specific dial in numbers listed at https://registrations.events/directory/international/itfs.html, using the access code: 9128891. Please dial in at least 10 minutes before the call start time to ensure that you are connected to the call and to register your name and company.

Those who wish to listen to the live conference call and view the accompanying presentation slides should visit the Events and Presentations tab of the Investor Relations section of the Company's website at IR.HercRentals.com. The press release and presentation slides for the call will be posted to this section of the website prior to the call.

A replay of the conference call will be available via webcast on the Company website at IR.HercRentals.com, where it will be archived for 12 months after the call.

About Herc Holdings Inc.

Founded in 1965, Herc Holdings Inc., which operates through its Herc Rentals Inc. subsidiary, is a full-line rental supplier with 428 locations across North America, and 2023 total revenues were approximately $3.3 billion. We offer products and services aimed at helping customers work more efficiently, effectively, and safely. Our classic fleet includes aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment. Our ProSolutions® offering includes industry-specific, solutions-based services in tandem with power generation, climate control, remediation and restoration, pumps, and trench shorting equipment as well as our ProContractor professional grade tools. We employ approximately 7,600 employees, who equip our customers and communities to build a brighter future. Learn more at www.HercRentals.com and follow us on Instagram, Facebook and LinkedIn.

Certain Additional Information

In this release we refer to the following operating measures:

•Dollar utilization: calculated by dividing rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on the guidelines of the American Rental Association (ARA).

•OEC: original equipment cost based on the guidelines of the ARA, which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date).

Forward-Looking Statements

This press release includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy, projected profitability, performance or cash flows, future capital expenditures, our growth strategy, including our ability to grow organically and through M&A, anticipated financing needs, business trends, our capital allocation strategy, liquidity and capital management, exploring strategic alternatives for Cinelease, including the timing of the review process, the outcome of the process and the costs and benefits of the process, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Information Regarding Non-GAAP Financial Measures

In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this release that is not calculated according to GAAP (“non-GAAP”), such as EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per diluted common share, free cash flow and certain results excluding the Cinelease studio entertainment business. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the supplemental schedules that accompany this release.

(See Accompanying Tables)

HERC HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Equipment rental | $ | 765 | | | $ | 702 | | | $ | 1,484 | | | $ | 1,356 | |

| Sales of rental equipment | 65 | | | 83 | | | 134 | | | 154 | |

| Sales of new equipment, parts and supplies | 10 | | | 10 | | | 19 | | | 18 | |

| Service and other revenue | 8 | | | 7 | | | 15 | | | 14 | |

| Total revenues | 848 | | | 802 | | | 1,652 | | | 1,542 | |

| Expenses: | | | | | | | |

| Direct operating | 326 | | | 282 | | | 633 | | | 563 | |

| Depreciation of rental equipment | 165 | | | 161 | | | 325 | | | 313 | |

| Cost of sales of rental equipment | 45 | | | 56 | | | 91 | | | 102 | |

| Cost of sales of new equipment, parts and supplies | 6 | | | 7 | | | 12 | | | 12 | |

| Selling, general and administrative | 120 | | | 111 | | | 235 | | | 217 | |

| | | | | | | |

| Non-rental depreciation and amortization | 30 | | | 28 | | | 59 | | | 54 | |

| Interest expense, net | 63 | | | 54 | | | 124 | | | 102 | |

| Other expense (income), net | — | | | — | | | (1) | | | 1 | |

| Total expenses | 755 | | | 699 | | | 1,478 | | | 1,364 | |

| Income before income taxes | 93 | | | 103 | | | 174 | | | 178 | |

| Income tax provision | (23) | | | (27) | | | (39) | | | (35) | |

| Net income | $ | 70 | | | $ | 76 | | | $ | 135 | | | $ | 143 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 28.4 | | | 28.4 | | | 28.3 | | | 28.7 | |

| Diluted | 28.5 | | | 28.6 | | | 28.4 | | | 29.0 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 2.46 | | | $ | 2.68 | | | $ | 4.77 | | | $ | 4.98 | |

| Diluted | $ | 2.46 | | | $ | 2.66 | | | $ | 4.75 | | | $ | 4.93 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS | (unaudited) | | |

| Cash and cash equivalents | $ | 70 | | | $ | 71 | |

| Receivables, net of allowances | 570 | | | 563 | |

| Other current assets | 55 | | | 77 | |

| Current assets held for sale | 22 | | | 21 | |

| Total current assets | 717 | | | 732 | |

| Rental equipment, net | 4,013 | | | 3,831 | |

| Property and equipment, net | 517 | | | 465 | |

| Right-of-use lease assets | 803 | | | 665 | |

| Goodwill and intangible assets, net | 1,104 | | | 950 | |

| Other long-term assets | 9 | | | 10 | |

| Long-term assets held for sale | 412 | | | 408 | |

| Total assets | $ | 7,575 | | | $ | 7,061 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current maturities of long-term debt and financing obligations | $ | 19 | | | $ | 19 | |

| Current maturities of operating lease liabilities | 38 | | | 37 | |

| Accounts payable | 286 | | | 212 | |

| Accrued liabilities | 221 | | | 221 | |

| Current liabilities held for sale | 21 | | | 19 | |

| Total current liabilities | 585 | | | 508 | |

| Long-term debt, net | 3,864 | | | 3,673 | |

| Financing obligations, net | 102 | | | 104 | |

| Operating lease liabilities | 789 | | | 646 | |

| Deferred tax liabilities | 761 | | | 743 | |

| Other long term liabilities | 49 | | | 46 | |

| Long-term liabilities held for sale | 63 | | | 68 | |

| Total liabilities | 6,213 | | | 5,788 | |

| Total equity | 1,362 | | | 1,273 | |

| Total liabilities and equity | $ | 7,575 | | | $ | 7,061 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

(In millions) | | | | | | | | | | | |

| Six Months Ended June 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 135 | | | $ | 143 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation of rental equipment | 325 | | | 313 | |

| Depreciation of property and equipment | 39 | | | 34 | |

| Amortization of intangible assets | 20 | | | 20 | |

| Amortization of deferred debt and financing obligations costs | 2 | | | 2 | |

| Stock-based compensation charges | 9 | | | 9 | |

| | | |

| Provision for receivables allowances | 28 | | | 30 | |

| Deferred taxes | 20 | | | 20 | |

| Gain on sale of rental equipment | (43) | | | (52) | |

| Other | 6 | | | 3 | |

| Changes in assets and liabilities: | | | |

| Receivables | (22) | | | (24) | |

| Other assets | 9 | | | 1 | |

| Accounts payable | 13 | | | (6) | |

| Accrued liabilities and other long-term liabilities | 17 | | | 23 | |

| Net cash provided by operating activities | 558 | | | 516 | |

| Cash flows from investing activities: | | | |

| Rental equipment expenditures | (468) | | | (703) | |

| Proceeds from disposal of rental equipment | 125 | | | 131 | |

| Non-rental capital expenditures | (71) | | | (77) | |

| Proceeds from disposal of property and equipment | 4 | | | 6 | |

| Acquisitions, net of cash acquired | (290) | | | (272) | |

| Other investing activities | — | | | (15) | |

| Net cash used in investing activities | (700) | | | (930) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | 800 | | | — | |

| Proceeds from revolving lines of credit and securitization | 840 | | | 1,290 | |

| Repayments on revolving lines of credit and securitization | (1,433) | | | (719) | |

| Principal payments under finance lease and financing obligations | (10) | | | (8) | |

| Dividends paid | (39) | | | (38) | |

| Repurchase of common stock | — | | | (107) | |

| Other financing activities, net | (17) | | | (21) | |

| Net cash provided by financing activities | 141 | | | 397 | |

| Effect of foreign exchange rate changes on cash and cash equivalents | — | | | — | |

| Net change in cash and cash equivalents during the period | (1) | | | (17) | |

| Cash and cash equivalents at beginning of period | 71 | | | 54 | |

| Cash and cash equivalents at end of period | $ | 70 | | | $ | 37 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

EBITDA AND ADJUSTED EBITDA RECONCILIATIONS

Unaudited

(In millions)

EBITDA and adjusted EBITDA - EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock-based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on the disposal of a business and certain other items. EBITDA and adjusted EBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, neither measure purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments.

Adjusted EBITDA Margin - Adjusted EBITDA Margin, calculated by dividing Adjusted EBITDA by Total Revenues, is a commonly used profitability ratio.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 70 | | | $ | 76 | | | $ | 135 | | | $ | 143 | |

| Income tax provision | 23 | | | 27 | | | 39 | | | 35 | |

| Interest expense, net | 63 | | | 54 | | | 124 | | | 102 | |

| Depreciation of rental equipment | 165 | | | 161 | | | 325 | | | 313 | |

| Non-rental depreciation and amortization | 30 | | | 28 | | | 59 | | | 54 | |

| EBITDA | 351 | | | 346 | | | 682 | | | 647 | |

| Non-cash stock-based compensation charges | 4 | | | 5 | | | 9 | | | 9 | |

| | | | | | | |

| Transaction related costs | 3 | | | 1 | | | 6 | | | 3 | |

Other(1) | 2 | | | — | | | 2 | | | 1 | |

| Adjusted EBITDA | $ | 360 | | | $ | 352 | | | $ | 699 | | | $ | 660 | |

| | | | | | | |

| Total revenues | $ | 848 | | | $ | 802 | | | $ | 1,652 | | | $ | 1,542 | |

| Adjusted EBITDA | $ | 360 | | | $ | 352 | | | $ | 699 | | | $ | 660 | |

| Adjusted EBITDA margin | 42.5 | % | | 43.9 | % | | 42.3 | % | | 42.8 | % |

(1) Other consists of restructuring charges and spin-off costs.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

EBITDA, ADJUSTED EBITDA AND ADJUSTED REBITDA

EXCLUDING STUDIO ENTERTAINMENT RECONCILIATIONS

Unaudited

(in millions)

EBITDA, Adjusted EBITDA, REBITDA, Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through Excluding Studio Entertainment - Each metric below has been adjusted to exclude the studio entertainment business due to the intent to sell that business and provides the operating performance of the remaining business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Herc | Studio | Ex-Studio | | Herc | Studio | Ex-Studio |

| Equipment rental revenue | $ | 765 | | $ | 26 | | $ | 739 | | | $ | 702 | | $ | 16 | | $ | 686 | |

| Total revenues | 848 | | 29 | | 819 | | | 802 | | 18 | | 784 | |

| Total expenses | 755 | | 21 | | 734 | | | 699 | | 27 | | 672 | |

| Income (loss) before income taxes | 93 | | 8 | | 85 | | | 103 | | (9) | | 112 | |

| Income tax (provision) benefit | (23) | | (4) | | (19) | | | (27) | | 2 | | (29) | |

| Net income | 70 | | 4 | | 66 | | | 76 | | (7) | | 83 | |

| Income tax provision | 23 | | 4 | | 19 | | | 27 | | (2) | | 29 | |

| Interest expense, net | 63 | | — | | 63 | | | 54 | | — | | 54 | |

| Depreciation of rental equipment | 165 | | — | | 165 | | | 161 | | 8 | | 153 | |

| Non-rental depreciation and amortization | 30 | | — | | 30 | | | 28 | | 1 | | 27 | |

| EBITDA | 351 | | 8 | | 343 | | | 346 | | — | | 346 | |

| Non-cash stock-based compensation charges | 4 | | — | | 4 | | | 5 | | — | | 5 | |

| | | | | | | |

| Transaction related costs | 3 | | — | | 3 | | | 1 | | — | | 1 | |

| Other | 2 | | — | | 2 | | | — | | — | | — | |

| Adjusted EBITDA | 360 | | 8 | | 352 | | | 352 | | — | | 352 | |

| Less: Gain (loss) on sales of rental equipment | 20 | | 1 | | 19 | | | 27 | | — | | 27 | |

| Less: Gain (loss) on sales of new equipment, parts and supplies | 4 | | 1 | | 3 | | | 3 | | — | | 3 | |

| Rental Adjusted EBITDA (REBITDA) | $ | 336 | | $ | 6 | | $ | 330 | | | $ | 322 | | $ | — | | $ | 322 | |

| | | | | | | |

| Total revenues | $ | 848 | | $ | 29 | | $ | 819 | | | $ | 802 | | $ | 18 | | $ | 784 | |

| Adjusted EBITDA | $ | 360 | | $ | 8 | | $ | 352 | | | $ | 352 | | $ | — | | $ | 352 | |

| Adjusted EBITDA margin | 42.5 | % | 27.6 | % | 43.0 | % | | 43.9 | % | — | % | 44.9 | % |

| | | | | | | |

| Total revenues | $ | 848 | | $ | 29 | | $ | 819 | | | $ | 802 | | $ | 18 | | $ | 784 | |

| Less: Sales of rental equipment | 65 | | — | | 65 | | | 83 | | — | | 83 | |

| Less: Sales of new equipment, parts and supplies | 10 | | 2 | | 8 | | | 10 | | — | | 10 | |

| Equipment rental, service and other revenues | $ | 773 | | $ | 27 | | $ | 746 | | | $ | 709 | | $ | 18 | | $ | 691 | |

| | | | | | | |

| Equipment rental, service and other revenues | $ | 773 | | $ | 27 | | $ | 746 | | | $ | 709 | | $ | 18 | | $ | 691 | |

| Adjusted REBITDA | $ | 336 | | $ | 6 | | $ | 330 | | | $ | 322 | | $ | — | | $ | 322 | |

| Adjusted REBITDA Margin | 43.5 | % | 22.2 | % | 44.2 | % | | 45.4 | % | — | % | 46.6 | % |

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

EBITDA, ADJUSTED EBITDA AND ADJUSTED REBITDA

EXCLUDING STUDIO ENTERTAINMENT RECONCILIATIONS

Unaudited

(In millions)

EBITDA, Adjusted EBITDA, REBITDA, Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through Excluding Studio Entertainment - Each metric below has been adjusted to exclude the studio entertainment business due to the intent to sell that business and provides the operating performance of the remaining business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Herc | Studio | Ex-Studio | | Herc | Studio | Ex-Studio |

| Equipment rental revenue | $ | 1,484 | | $ | 55 | | $ | 1,429 | | | $ | 1,356 | | $ | 35 | | $ | 1,321 | |

| Total revenues | 1,652 | | 59 | | 1,593 | | | 1,542 | | 38 | | 1,504 | |

| Total expenses | 1,478 | | 42 | | 1,436 | | | 1,364 | | 55 | | 1,309 | |

| Income (loss) before income taxes | 174 | | 17 | | 157 | | | 178 | | (17) | | 195 | |

| Income tax (provision) benefit | (39) | | (6) | | (33) | | | (35) | | 4 | | (39) | |

| Net income | 135 | | 11 | | 124 | | | 143 | | (13) | | 156 | |

| Income tax provision | 39 | | 6 | | 33 | | | 35 | | (4) | | 39 | |

| Interest expense, net | 124 | | — | | 124 | | | 102 | | — | | 102 | |

| Depreciation of rental equipment | 325 | | — | | 325 | | | 313 | | 16 | | 297 | |

| Non-rental depreciation and amortization | 59 | | — | | 59 | | | 54 | | 2 | | 52 | |

| EBITDA | 682 | | 17 | | 665 | | | 647 | | 1 | | 646 | |

| Non-cash stock-based compensation charges | 9 | | — | | 9 | | | 9 | | — | | 9 | |

| | | | | | | |

| Transaction related costs | 6 | | 1 | | 5 | | | 3 | | — | | 3 | |

| Other | 2 | | — | | 2 | | | 1 | | 1 | | — | |

| Adjusted EBITDA | 699 | | 18 | | 681 | | | 660 | | 2 | | 658 | |

| Less: Gain (loss) on sales of rental equipment | 43 | | 1 | | 42 | | | 52 | | — | | 52 | |

| Less: Gain (loss) on sales of new equipment, parts and supplies | 7 | | 2 | | 5 | | | 6 | | — | | 6 | |

| Rental Adjusted EBITDA (REBITDA) | $ | 649 | | $ | 15 | | $ | 634 | | | $ | 602 | | $ | 2 | | $ | 600 | |

| | | | | | | |

| Total revenues | $ | 1,652 | | $ | 59 | | $ | 1,593 | | | $ | 1,542 | | $ | 38 | | $ | 1,504 | |

| Adjusted EBITDA | $ | 699 | | $ | 18 | | $ | 681 | | | $ | 660 | | $ | 2 | | $ | 658 | |

| Adjusted EBITDA margin | 42.3 | % | 30.5 | % | 42.7 | % | | 42.8 | % | 5.3 | % | 43.8 | % |

| | | | | | | |

| Total revenues | $ | 1,652 | | $ | 59 | | $ | 1,593 | | | $ | 1,542 | | $ | 38 | | $ | 1,504 | |

| Less: Sales of rental equipment | 134 | | — | | 134 | | | 154 | | — | | 154 | |

| Less: Sales of new equipment, parts and supplies | 19 | | 3 | | 16 | | | 18 | | — | | 18 | |

| Equipment rental, service and other revenues | $ | 1,499 | | $ | 56 | | $ | 1,443 | | | $ | 1,370 | | $ | 38 | | $ | 1,332 | |

| | | | | | | |

| Equipment rental, service and other revenues | $ | 1,499 | | $ | 56 | | $ | 1,443 | | | $ | 1,370 | | $ | 38 | | $ | 1,332 | |

| Adjusted REBITDA | $ | 649 | | $ | 15 | | $ | 634 | | | $ | 602 | | $ | 2 | | $ | 600 | |

| Adjusted REBITDA Margin | 43.3 | % | 26.8 | % | 43.9 | % | | 43.9 | % | 5.3 | % | 45.0 | % |

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER DILUTED SHARE

Unaudited

(In millions)

Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income (loss), restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, transaction related costs, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 70 | | | $ | 76 | | | $ | 135 | | | $ | 143 | |

| | | | | | | |

| Transaction related costs | 3 | | | 1 | | | 6 | | | 3 | |

Other(1) | 2 | | | — | | | 2 | | | 1 | |

Tax impact of adjustments(2) | (1) | | | — | | | (2) | | | (1) | |

| Adjusted net income | $ | 74 | | | $ | 77 | | | $ | 141 | | | $ | 146 | |

| | | | | | | |

| Diluted shares outstanding | 28.5 | | | 28.6 | | | 28.4 | | | 29.0 | |

| | | | | | | |

| Adjusted earnings per diluted share | $ | 2.60 | | | $ | 2.69 | | | $ | 4.96 | | | $ | 5.03 | |

(1) Other consists of restructuring charges and spin-off costs.

(2) The tax rate applied for adjustments is 25.5% in the three and six months ended June 30, 2024 and 25.7% in the three and six months ended June 30, 2023 and reflects the statutory rates in the applicable entities.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

FREE CASH FLOW

Unaudited

(In millions)

Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures.

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Net cash provided by operating activities | $ | 558 | | | $ | 516 | |

| | | |

| Rental equipment expenditures | (468) | | | (703) | |

| Proceeds from disposal of rental equipment | 125 | | | 131 | |

| Net rental equipment expenditures | (343) | | | (572) | |

| | | |

| Non-rental capital expenditures | (71) | | | (77) | |

| Proceeds from disposal of property and equipment | 4 | | | 6 | |

| Other | — | | | (15) | |

| Free cash flow | $ | 148 | | | $ | (142) | |

| | | |

| Acquisitions, net of cash acquired | (290) | | | (272) | |

| Increase in net debt, excluding financing activities | $ | (142) | | | $ | (414) | |

Scaling for Sustainable Growth Q2 2024 EARNINGS CONFERENCE CALL July 23, 2024

Q2 2024Herc Holdings Inc. NYSE: HRI 2 Herc Rentals Team and Agenda Agenda Safe Harbor Q2 2024 Overview Q2 Operations Review Q2 Financial Review 2024 Outlook Q&A Larry Silber President & Chief Executive Officer Aaron Birnbaum Senior Vice President & Chief Operating Officer Mark Humphrey Senior Vice President & Chief Financial Officer Leslie Hunziker Senior Vice President Investor Relations, Communications & Sustainability

Q2 2024Herc Holdings Inc. NYSE: HRI 3 Safe Harbor Statements and Non-GAAP Financial Measures Forward-Looking Statements This presentation includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy, projected profitability, performance or cash flows, future capital expenditures, our growth strategy, including our ability to grow organically and through M&A, anticipated financing needs, business trends, our capital allocation strategy, liquidity and capital management, exploring strategic alternatives for Cinelease, including the timing of the review process, the outcome of the process and the costs and benefits of the process, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward- looking statements are based upon our current expectations and various assumptions and, there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward- looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Information Regarding Non-GAAP Financial Measures In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this presentation that is not calculated according to GAAP (“non-GAAP”), such as adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA, adjusted EBITDA margin, REBITDA, REBITDA margin, REBITDA flow-through and free cash flow. Additionally, certain results are presented excluding the Cinelease studio entertainment business. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the appendix that accompanies this presentation.

Q2 2024Herc Holdings Inc. NYSE: HRI 4 Second Quarter 2024: Delivering on Growth Strategies Optimize branch network for fleet / operating efficiencies at scale • Completed 2 acquisitions—10 locations; opened 7 greenfield locations Enhance fleet mix • Expanded OEC specialty fleet YoY Support customers’ efficiency goals through data and telematics • Advanced our industry leading digital capabilities: ProControl Next Gen™ Prioritize Capital and Invest Responsibly • Continued disciplined investments in fleet and strategic M&A • Declared regular dividend Lead through continuous improvement with E3OS • Standardized processes • Committed to superior customer experiences Strategies to Accelerate ROIC and Increase Shareholder Returns: Grow the Core Expand Specialty Elevate Technology Allocate Capital Execute at Highest Level

Q2 2024Herc Holdings Inc. NYSE: HRI 5 First Half 2024: Financial Performance 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 2. The company’s ROIC metric uses after-tax operating income for the trailing 12 months divided by average stockholders’ equity, debt and deferred taxes, net of average cash. To mitigate the volatility related to fluctuations in the company’s tax rate from period to period, the U.S. federal corporate statutory tax rate of 21% was used to calculate after-tax operating income. Equipment Rental Revenue $715 $848 $1,132 $1,356 $1,484 2020 2021 2022 2023 2024 9% $ in millions Total Revenues $804 $944 $1,208 $1,542 $1,652 2020 2021 2022 2023 2024 Adjusted EBITDA¹ $297 $391 $521 $660 $699 2020 2021 2022 2023 2024 7% 6% $ in millions $ in millions Earnings Per Diluted Share $2.64 $4.30 $4.93 $4.75 Adjusted EBITDA Margin¹ 36.9% 41.5% 43.1% 42.8% 42.3% 2020 2021 2022 2023 2024 5.7% 7.7% 10.1% 10.5% 9.7% 2020 2021 2022 2023 2024 ROIC2 2020 2021 2022 2023 2024 ($0.06)

Q2 2024Herc Holdings Inc. NYSE: HRI 6 Second Half 2024 Outlook Full Year 2024 guidance reaffirmed, results expected to be back-half weighted Revenue • Historically local/national demand accelerates into peak season through October ◦ Now expect same-store local-market growth for FY:24 to be low-single digit, down from previous forecast of mid- single digit growth YoY • Acquisitions and greenfield openings in 1H:24 should continue to offset slower growth in local markets in 2H:24 • Existing mega projects ramp up • New mega projects kicking off ◦ Capturing 10-15% of total mega project activity, as planned Adjusted EBITDA • Anticipate returning to REBITDA flow-through range of ~50% for 2H:24 ◦ Higher expenses for freight in second quarter not expected to repeat in 2H:24 ◦ Incremental benefit in 2H:24 from second-quarter adjustments to operating cost structure ◦ Fleet efficiency turned positive in June, expected to remain favorable Net Fleet Capex • Continue disciplined investments in fleet • Beginning to onboard growth fleet for accelerating mega project work and pick up in seasonal activity • FY net capex guide reaffirmed, preserving optionality as acquired fleet is absorbed and 3Q:24 market demand firms

Q2 2024Herc Holdings Inc. NYSE: HRI 7 Operations Review Aaron Birnbaum Senior Vice President and Chief Operating Officer

Q2 2024Herc Holdings Inc. NYSE: HRI 8 Focusing on Safety Q2 2024: Continuing focus on Perfect Days • All branches reported > 97% Perfect Days • Perfect Days are those with no: • OSHA reportable incidents • At-fault moving vehicle accidents • DOT violations Total Recordable Incident Rate is 0.72 — favorable to industry standard of 1.0 Proven safety record is a must-have for customers Herc's Safety Program is integrated into all acquisitions

Q2 2024Herc Holdings Inc. NYSE: HRI 9 Scaling for Sustainable Growth Expanding Through Acquisitions and Greenfields Adding locations increases density and share in urban markets • 428 locations at June 30, 2024, +15% YoY Targeting Top 100 metropolitan markets • Q2: 2 acquisitions - 10 locations; 7 greenfield locations • YTD: 6 acquisitions - 21 locations; 11 greenfield locations ◦ Invested $290 million through June 30, 2024 on M&A • Q3 to date: 1 acquisition - 4 locations in Top 25 markets Synergized multiple opportunity 3.5x - 4.5x through cross selling adjacent product lines, fleet efficiencies and rate improvement Strategic M&A Opportunity ~$500 million per year Pipeline of acquisition opportunities remains strong

Q2 2024Herc Holdings Inc. NYSE: HRI 10 Optimizing Fleet Mix and Lifecycle Performance 1. Original equipment cost based on ARA guidelines. 2. End fleet as of June 30, 2024 $348 $400 $274 $196$167 $344 2023 2024 Q1 Q2 Q3 Q4 Fleet Expenditures at OEC1 $ in millions $144 $186 $309 $174$150 $139 2023 2024 Q1 Q2 Q3 Q4 Fleet Disposals at OEC1 $ in millions 23% 25% 11% 19% 22% • Q2 24 net fleet investment $9M lower YoY ◦ On-rent priority: 2023 carryover fleet ◦ 25% fewer dispositions at OEC, as planned • Q2 24 disposals generated proceeds of ~48% of OEC • Average age of disposals was 90 months in Q2 24 • Average fleet age of 47 months at June 30, 2024 $6.7 billion at OEC1,2 Fleet Composition Specialty Aerial Earthmoving Material Handling Other

Q2 2024Herc Holdings Inc. NYSE: HRI 11 Delivering Growth and Resiliency through Diversification Q2 Local vs. National Mix 44% 56% NationalQ2 Revenue by Customer1 35% 27% 16%13% 9% Local Commercial Facilities Contractors Infrastructure & Government Other Industrial • Local account revenue increased due to acquisitions and greenfields, and a focus on growth markets • National account revenue continues to benefit from general growth and mega project activity ◦ Vertical sales strategy provides for end-market expertise and creates more diverse revenue mix ◦ Project pipeline remains strong; still in early innings of federal-funding opportunities • Long-term, balanced target of 60% local / 40% national accounts 1. Refer to our 10-K for description of industries related to each customer classification.

Q2 2024Herc Holdings Inc. NYSE: HRI 12 Capitalizing on Growth Trends Across Diverse Customer and Project Base Pipeline of new construction and maintenance projects offers wide spectrum of growth opportunities • Banks • Casinos • Hospitality (hotel & motel) • Parking Garages • Religious Building • Retail Facilities • Commercial Warehousing • Education • Facility Maintenance • Healthcare • Data Centers • Sporting Events • Theater • TV, Film & Radio • Homeowners • Live Events Contractors (35%) Industrial (27%) Commercial Facilities (13%) Other (9%) • Aerospace • Alternative • Automotive/EV • Energy/ Renewables • Food & Beverage • Agriculture • Chemical Processing • Industrial Manufacturing • Metals & Minerals • Oil & Gas Production • Oil & Gas Pipeline • Oil & Gas Refineries • Pharmaceutical • Power • Pulp. Paper & Wood • Shipbuilding/Yards • Electrical • General Contractors • Mechanical • Remediation & Environmental • Residential • Restoration • Specialty Contractors • Airports • Bridge • Federal Government • Local & State Government • Military Base • Prisons • Railroad & Mass Transportation • Streets, Road &Highway • Sewer & Waste Disposal • Water Supply & Distribution • Utilities Infrastructure & Gov. Direct (16%) Herc Rentals is Well Positioned with Current Trending Opportunities EV/Battery Chip Plants Data Centers LNG PlantRenewables Utilities Healthcare Infrastructure New verticals since 2016 in bold.

Financial Review Mark Humphrey Senior Vice President and Chief Financial Officer

Q2 2024Herc Holdings Inc. NYSE: HRI 14 Q2 2024 Financial Results 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 21 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines Three Months Ended June 30, Six Months Ended June 30, $ in millions, except per share data 2024 2023 2024 vs 2023 % Change 2024 2023 2024 vs 2023 % Change Equipment Rental Revenue $765 $702 9.0% $1,484 $1,356 9.4% Total Revenues $848 $802 5.7% $1,652 $1,542 7.1% Net Income $70 $76 (7.9)% $135 $143 (5.6)% Earnings Per Diluted Share $2.46 $2.66 (7.5)% $4.75 $4.93 (3.7)% Adjusted Net Income1 $74 $77 (3.9)% $141 $146 (3.4)% Adjusted Earnings Per Diluted Share1 $2.60 $2.69 (3.3)% $4.96 $5.03 (1.4)% Adjusted EBITDA1 $360 $352 2.3% $699 $660 5.9% Adjusted EBITDA Margin1 42.5% 43.9% (140) bps 42.3% 42.8% (50) bps REBITDA1,2 $336 $322 4.3% $649 $602 7.8% REBITDA Margin1,2 43.5% 45.4% (190) bps 43.3% 43.9% (60) bps REBITDA YoY Flow-Through1,2 21.9% 48.5% (2660) bps 36.4% 45.1% (870) bps Average Fleet3 (YoY) 7.7% 24.5% 8.9% 26.8% Pricing3 (YoY) 3.5% 7.8% 4.3% 7.4% Dollar Utilization3 41.0% 40.3% 70 bps 40.4% 40.0% 40 bps ROIC 9.7% 10.5% (80) bps

Q2 2024Herc Holdings Inc. NYSE: HRI 15 Q2 2024 Financial Results Excluding Cinelease Studio Entertainment1 1. Results excluding the Cinelease studio entertainment business is referred to as "core" business. For a reconciliation to the most comparable GAAP financial measures, see the Appendix beginning on Slide 21 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines Three Months Ended June 30, Six Months Ended June 30, $ in millions 2024 2023 2024 vs 2023 % Change 2024 2023 2024 vs 2023 % Change Core Equipment Rental Revenue $739 $686 7.7% $1,429 $1,321 8.2% Core Total Revenues $819 $784 4.5% $1,593 $1,504 5.9% Core Net Income $66 $83 (20.5)% $124 $156 (20.5)% Core Adjusted EBITDA $352 $352 —% $681 $658 3.5% Core Adjusted EBITDA Margin 43.0% 44.9% (190) bps 42.7% 43.8% (110) bps Core REBITDA2 $330 $322 2.5% $634 $600 5.7% Core REBITDA Margin2 44.2% 46.6% (240) bps 43.9% 45.0% (110) bps Core REBITDA YoY Flow-Through2 14.5% 53.2% (3870) bps 30.6% 50.2% (1960) bps Core Average Fleet3 (YoY) 8.2% 25.6% 9.7% 27.4% Core Dollar Utilization3 41.6% 41.7% (10) bps 40.9% 41.4% (50) bps Core ROIC 10.3% 11.3% (100) bps

Q2 2024Herc Holdings Inc. NYSE: HRI 16 Q2 24 YoY Results Bridge Excluding Cinelease Studio Entertainment1 Equipment Rental Revenue $686 $739 2023 Pricing OEC on Rent Mix Ancillary 2024 Adjusted EBITDA $352 $352 2023 Equipment Rental Revenue Gain on Sale of Rental Equipment DOE SG&A Other 2024 Adjusted EBITDA Margin drivers: • New acquisition, greenfield revenue at lower incremental margin offset slowdown in higher margin local-account growth • DOE impacted by increase in transportation charges for internal fleet redeployment and self insurance reserves • SG&A as a % of rental revenue YoY was positive contributor 1. For a reconciliation to the most comparable GAAP financial measures, see the Appendix beginning on Slide 21

Q2 2024Herc Holdings Inc. NYSE: HRI 17 Disciplined Capital Management 1. The AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to consummate refinancing and extend the term of the agreement 2. Total liquidity includes cash and cash equivalents and the unused commitments under the ABL Credit Facility and AR Facility 3. For a definition and calculation, see the Appendix beginning on Slide 21 • No near-term maturities and ample liquidity2 of $2.1 billion provide financial flexibility • Issued $800 million aggregate principal amount of 6.625% senior unsecured notes on June 7; proceeds used to repay a portion of ABL borrowings • Free cash flow of $148 million for the six months ended June 30, 2024 • Net leverage3 of 2.6x, compared with 2.5x in December 2023 and within target range of 2.0x to 3.0x • Quarterly dividend of $0.665 per share paid on June 14, 2024 to shareholders of record as of May 31, 2024 Credit Ratings: Moody’s CFR Ba2 S&P BB/Stable Maturities As of June 30, 2024 $ in millions $1,200 $800 $1,502 $319 2024 2025 2026 2027 2028 2029 $71 Finance Leases 2024-2031 2027 Senior Unsecured Notes ABL Credit Facility AR Facility1 2029 Senior Unsecured Notes ABL Credit Facility

Q2 2024Herc Holdings Inc. NYSE: HRI 18 Continued Strength in Key End Markets 1. Source: ARA / IHS Global Insights as of May 2024 2. Source: IIR as of May 2024 3. Source: American Institute of Architects (AIA) as of June 2024 4. Source: Dodge Analytics U.S. as of June 2024 N.A. Equipment Rental Market1 $52 $56 $60 $55 $61 $69 $77 $85 $89 $92 $96 17 18 19 20 21 22 23 24E 25E 26E 27E $ in billions Industrial Spending2 $310 $317 $328 $309 $298 $315 $368 $372 $367 $365 $372 17 18 19 20 21 22 23 24E 25E 26E 27E $ in billions Non-Residential Starts4 $288 $298 $314 $260 $305 $444 $420 $449 $469 $494 $520 17 18 19 20 21 22 23 24E 25E 26E 27E $ in billions — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — Architecture Billings Index3 17 18 19 20 21 22 23 Jan-24 50 May 42.4

Q2 2024Herc Holdings Inc. NYSE: HRI 19 Reaffirming 2024 Guidance Excluding Cinelease Key Assumptions Full-Year 2024 excluding Cinelease: • Local market affected by prolonged higher interest rates; 2024 acquisitions and greenfields provide rental revenue offset • Mega project revenue accelerates in 2H:24, as expected • Pricing remains disciplined • Beginning fleet of $6.0 billion at OEC • Fleet efficiency a priority • Adjusted EBITDA assumption includes 20-30% less OEC dispositions YoY • Shift to higher-return used-equipment retail and wholesale channels • REBITDA Flow Through rebounds in 2H:24 on operating leverage • Tax rate ~25% Metric 2023 Excluding Cinelease 2024 Full Year Guidance Equipment Rental Revenue $2,820 million +7% to 10% Adjusted EBITDA $1,462 million $1.55 billion to $1.60 billion Net Rental Equipment Expenditures after Gross Capex $995 million $500 to $700 million after gross capex of $750 million to $1 billion

Q2 2024Herc Holdings Inc. NYSE: HRI 20 Purpose, Vision, Mission and Values We equip our customers and communities to build a brighter future

Appendix

Q2 2024Herc Holdings Inc. NYSE: HRI 22 Glossary of Terms Commonly Use in the Industry OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental Association (ARA), which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date). Fleet Age: The OEC weighted age of the entire fleet, based on ARA guidelines. Net Fleet Capital Expenditures: Capital expenditures of rental equipment minus the proceeds from disposal of rental equipment. Dollar Utilization ($ UT): Dollar utilization is an operating measure calculated by dividing equipment rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on ARA guidelines. Pricing: Change in pure pricing achieved in one period versus another period. This is applied both to year-over-year and sequential comparisons. Rental rates are based on ARA guidelines and are calculated based on the category class rate variance achieved either year-over-year or sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

Q2 2024Herc Holdings Inc. NYSE: HRI 23 Cinelease Studio Entertainment Assets Held for Sale Cinelease is Herc's studio management and lighting and grip business • Market preference for lighting and grip equipment to be part of studio ownership • Owning studio real estate does not align with Herc strategy • Lighting and grip equipment represents ~5% of OEC Cinelease sale process underway Herc Entertainment Services (HES) will continue to provide rentals to entertainment industry Equipment Types • aerial equipment, • forklifts, • carts, • generators, • climate solutions Cinelease assets held for sale HES to continue to service market Project Types • in-studio TV & Film productions • off-location TV & Film productions • live entertainment venues

Q2 2024Herc Holdings Inc. NYSE: HRI 24 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through EBITDA, Adjusted EBITDA, and REBITDA—EBITDA represents the sum of net income, provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on disposal of a business and certain other items. REBITDA represents Adjusted EBITDA excluding the gain (loss) on sales of rental equipment and new equipment, parts and supplies. EBITDA, Adjusted EBITDA and REBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, none of these measures purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments. Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through—Adjusted EBITDA Margin (Adjusted EBITDA / Total Revenues) is a commonly used profitability ratio. REBITDA Margin (REBITDA / Equipment rental, service and other revenues) and REBITDA Flow- Through (the year-over-year change in REBITDA/the year-over-year change in Equipment rental, service, and other revenues) are useful operating profitability ratios to management and investors. EBITDA, Adjusted EBITDA, REBITDA, Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through Excluding Studio Entertainment—On slides 26 and 27, each metric has been adjusted to exclude the studio entertainment business due to the intent to sell that business and provides the operating performance of the remaining business.

Q2 2024Herc Holdings Inc. NYSE: HRI 25 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through Three Months Ended June 30, Six Months Ended June 30, $ in millions 2024 2023 2024 2023 Net income $70 $76 $135 $143 Income tax provision 23 27 39 35 Interest expense, net 63 54 124 102 Depreciation of rental equipment 165 161 325 313 Non-rental depreciation and amortization 30 28 59 54 EBITDA 351 346 682 647 Non-cash stock-based compensation charges 4 5 9 9 Transaction related costs 3 1 6 3 Other 2 — 2 1 Adjusted EBITDA 360 352 699 660 Less: Gain (loss) on sales of rental equipment 20 27 43 52 Less: Gain (loss) on sales of new equipment, parts and supplies 4 3 7 6 Rental Adjusted EBITDA (REBITDA) $336 $322 $649 $602 Total revenues $848 $802 $1,652 $1,542 Less: Sales of rental equipment 65 83 134 154 Less: Sales of new equipment, parts and supplies 10 10 19 18 Equipment rental, service and other revenues $773 $709 $1,499 $1,370 Total revenues $848 $802 $1,652 $1,542 Adjusted EBITDA $360 $352 $699 $660 Adjusted EBITDA Margin 42.5 % 43.9 % 42.3 % 42.8 % Equipment rental, service and other revenues $773 $709 $1,499 $1,370 REBITDA $336 $322 $649 $602 REBITDA Margin 43.5 % 45.4 % 43.3 % 43.9 % YOY Change in REBITDA $14 $47 YOY Change in Equipment rental, service and other revenues $64 $129 YOY REBITDA Flow-Through 21.9 % 36.4 %

Q2 2024Herc Holdings Inc. NYSE: HRI 26 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment Three Months Ended June 30, 2024 2023 $ in millions Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $765 $26 $739 $702 $16 $686 Total revenues 848 29 819 802 18 784 Total expenses 755 21 734 699 27 672 Income (loss) before income taxes 93 8 85 103 (9) 112 Income tax (provision) benefit (23) (4) (19) (27) 2 (29) Net income $70 $4 $66 $76 ($7) $83 Income tax provision 23 4 19 27 (2) 29 Interest expense, net 63 — 63 54 — 54 Depreciation of rental equipment 165 — 165 161 8 153 Non-rental depreciation and amortization 30 — 30 28 1 27 EBITDA 351 8 343 346 — 346 Non-cash stock-based compensation charges 4 — 4 5 — 5 Transaction related costs 3 — 3 1 — 1 Other 2 — 2 — — — Adjusted EBITDA 360 8 352 352 — 352 Less: Gain (loss) on sales of rental equipment 20 1 19 27 — 27 Less: Gain (loss) on sales of new equipment, parts and supplies 4 1 3 3 — 3 Rental Adjusted EBITDA (REBITDA) $336 $6 $330 $322 $— $322 Total revenues $848 $29 $819 $802 $18 $784 Less: Sales of rental equipment 65 — 65 83 — 83 Less: Sales of new equipment, parts and supplies 10 2 8 10 — 10 Equipment rental, service and other revenues $773 $27 $746 $709 $18 $691 Total revenues $848 $29 $819 $802 $18 $784 Adjusted EBITDA $360 $8 $352 $352 $— $352 Adjusted EBITDA Margin 42.5 % 27.6 % 43.0 % 43.9 % — % 44.9 % Equipment rental, service and other revenues $773 $27 $746 $709 $18 $691 REBITDA $336 $6 $330 $322 $— $322 REBITDA Margin 43.5 % 22.2 % 44.2 % 45.4 % — % 46.6 % YOY Change in REBITDA $14 $6 $8 $47 ($12) $59 YOY Change in Equipment rental, service and other revenues $64 $9 $55 $97 ($14) $111 YOY REBITDA Flow-Through 21.9 % 66.7 % 14.5 % 48.5 % 85.7 % 53.2 %

Q2 2024Herc Holdings Inc. NYSE: HRI 27 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment Six Months Ended June 30, 2024 2023 $ in millions Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $1,484 $55 $1,429 $1,356 $35 $1,321 Total revenues 1,652 59 1,593 1,542 38 1,504 Total expenses 1,478 42 1,436 1,364 55 1,309 Income (loss) before income taxes 174 17 157 178 (17) 195 Income tax (provision) benefit (39) (6) (33) (35) 4 (39) Net income $135 $11 $124 $143 ($13) $156 Income tax provision 39 6 33 35 (4) 39 Interest expense, net 124 — 124 102 — 102 Depreciation of rental equipment 325 — 325 313 16 297 Non-rental depreciation and amortization 59 — 59 54 2 52 EBITDA 682 17 665 647 1 646 Non-cash stock-based compensation charges 9 — 9 9 — 9 Transaction related costs 6 1 5 3 — 3 Other 2 — 2 1 1 — Adjusted EBITDA 699 18 681 660 2 658 Less: Gain (loss) on sales of rental equipment 43 1 42 52 — 52 Less: Gain (loss) on sales of new equipment, parts and supplies 7 2 5 6 — 6 Rental Adjusted EBITDA (REBITDA) $649 $15 $634 $602 $2 $600 Total revenues $1,652 $59 $1,593 $1,542 $38 $1,504 Less: Sales of rental equipment 134 — 134 154 — 154 Less: Sales of new equipment, parts and supplies 19 3 16 18 — 18 Equipment rental, service and other revenues $1,499 $56 $1,443 $1,370 $38 $1,332 Total revenues $1,652 $59 $1,593 $1,542 $38 $1,504 Adjusted EBITDA $699 $18 $681 $660 $2 $658 Adjusted EBITDA Margin 42.3 % 30.5 % 42.7 % 42.8 % 5.3 % 43.8 % Equipment rental, service and other revenues $1,499 $56 $1,443 $1,370 $38 $1,332 REBITDA $649 $15 $634 $602 $2 $600 REBITDA Margin 43.3 % 26.8 % 43.9 % 43.9 % 5.3 % 45.0 % YOY Change in REBITDA $47 $13 $34 $102 ($20) $122 YOY Change in Equipment rental, service and other revenues $129 $18 $111 $226 ($17) $243 YOY REBITDA Flow-Through 36.4 % 72.2 % 30.6 % 45.1 % 117.6 % 50.2 %

Q2 2024Herc Holdings Inc. NYSE: HRI 28 REBITDA Margin and Flow-Through Quarterly Trend $ in millions Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 Q1 2024 Q2 2024 Net income $67 $76 $113 $91 $347 $65 $70 Income tax provision 8 27 33 32 100 16 23 Interest expense, net 48 54 60 62 224 61 63 Depreciation of rental equipment 152 161 167 163 643 160 165 Non-rental depreciation and amortization 26 28 29 29 112 29 30 EBITDA 301 346 402 377 1,426 331 351 Non-cash stock-based compensation charges 4 5 6 3 18 5 4 Transaction related costs 2 1 2 3 8 3 3 Other 1 — — (1) — — 2 Adjusted EBITDA 308 352 410 382 1,452 339 360 Less: Gain (loss) on sales of rental equipment 25 27 25 17 94 23 20 Less: Gain (loss) on sales of new equipment, parts and supplies 3 3 4 3 13 3 4 Rental Adjusted EBITDA (REBITDA) $280 $322 $381 $362 $1,345 $313 $336 Total revenues $740 $802 $908 $831 $3,282 $804 $848 Less: Sales of rental equipment 71 83 124 68 346 69 65 Less: Sales of new equipment, parts and supplies 8 10 11 9 38 9 10 Equipment rental, service and other revenues $661 $709 $773 $754 $2,898 $726 $773 REBITDA Margin 42.4 % 45.4 % 49.3 % 48.0 % 46.4 % 43.1 % 43.5 % YOY REBITDA Flow-Through 42.6 % 48.5 % 76.3 % 64.7 % 53.0 % 50.8 % 21.9 %

Q2 2024Herc Holdings Inc. NYSE: HRI 29 REBITDA Margin and Flow-Through Annual Trend $ in millions 2019 2020 2021 2022 2023 Net income $47 $74 $224 $330 $347 Income tax provision 16 20 67 104 100 Interest expense, net 174 93 86 122 224 Depreciation of rental equipment 410 403 420 536 643 Non-rental depreciation and amortization 62 63 68 95 112 EBITDA 709 653 865 1,187 1,426 Non-cash stock-based compensation charges 19 16 23 27 18 Restructuring 8 1 — — — Impairment 4 15 3 3 — Transaction related costs — — 4 7 8 Loss on disposal of business — 3 — — — Other 1 1 — 3 — Adjusted EBITDA 741 689 895 1,227 1,452 Less: Gain (loss) on sales of rental equipment (1) (5) 19 36 94 Less: Gain (loss) on sales of new equipment, parts and supplies 11 8 10 15 13 Rental Adjusted EBITDA (REBITDA) $731 $686 $866 $1,176 $1,345 Total revenues $1,999 $1,780 $2,073 $2,740 $3,282 Less: Sales of rental equipment 243 198 113 125 346 Less: Sales of new equipment, parts and supplies 44 28 31 36 38 Equipment rental, service and other revenues $1,712 $1,554 $1,929 $2,579 $2,898 REBITDA Margin 42.7 % 44.2 % 44.8 % 45.7 % 46.4 % YOY REBITDA Flow-Through 169.3 % 27.9 % 47.5 % 48.1 % 53.0 %

Q2 2024Herc Holdings Inc. NYSE: HRI 30 Reconciliation of Net Income and Adjusted Earnings Per Diluted Share Three Months Ended June 30, Six Months Ended June 30, $ in millions 2024 2023 2024 2023 Net income $70 $76 $135 $143 Transaction related costs 3 1 6 3 Other(1) 2 — 2 1 Tax impact of adjustments(2) (1) — (2) (1) Adjusted net income $74 $77 $141 $146 Diluted common shares 28.5 28.6 28.4 29.0 Adjusted earnings per diluted share $2.60 $2.69 $4.96 $5.03 Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income, transaction related costs, restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. (1) Other consists of restructuring charges and spin-off costs. (2) The tax rate applied for adjustments is 25.5% in the three and six months ended June 30, 2024 and 25.7% in the three and six months ended June 30, 2023 and reflects the statutory rates in the applicable entities.

Q2 2024Herc Holdings Inc. NYSE: HRI 31 Calculation of Net Leverage Ratio $ in millions Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Long-Term Debt, Net $3,215 $3,493 $3,665 $3,673 $3,753 $3,864 (Plus) Current maturities of long-term debt 12 12 14 15 15 15 (Plus) Unamortized debt issuance costs 5 5 5 5 5 13 (Less) Cash and Cash Equivalents (40) (37) (71) (71) (63) (70) Net Debt 3,192 3,473 3,613 3,622 3,710 3,822 Trailing Twelve-Month Adjusted EBITDA 1,298 1,366 1,431 1,452 1,483 1,491 Net Leverage 2.5 x 2.5 x 2.5 x 2.5 x 2.5 x 2.6 x Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve- month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies.

Q2 2024Herc Holdings Inc. NYSE: HRI 32 Reconciliation of Free Cash Flow Six Months Ended June 30, Year Ended December 31, $ in millions 2024 2023 2023 2022 2021 Net cash provided by operating activities $558 $516 $1,086 $917 $743 Rental equipment expenditures (468) (703) (1,320) (1,168) (594) Proceeds from disposal of rental equipment 125 131 325 121 107 Net Fleet Capital Expenditures (343) (572) (995) (1,047) (487) Non-rental capital expenditures (71) (77) (156) (104) (47) Proceeds from disposal of property and equipment 4 6 15 7 5 Other — (15) (15) (23) — Free Cash Flow 148 (142) (65) (250) 214 Acquisitions, net of cash acquired (290) (272) (430) (515) (431) (Increase) decrease in Net Debt, excluding financing activities ($142) ($414) ($495) ($765) ($217) Free cash flow is not a recognized term under GAAP and should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP. Further, since all companies do not use identical calculations, our definition and presentation of this measure may not be comparable to similarly titled measures reported by other companies. Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non- discretionary expenditures.

Q2 2024Herc Holdings Inc. NYSE: HRI 33 Historical Fleet at OEC1 $ in millions FY 2019 FY 2020 FY 2021 FY 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 Q1 2024 Q2 2024 Beginning Balance $3,777 $3,822 $3,589 $4,381 $5,637 $5,915 $6,211 $6,217 $5,637 $6,328 $6,416 Expenditures 627 348 725 1,218 348 400 274 196 1,218 167 344 Disposals (593) (552) (281) (322) (144) (186) (309) (174) (813) (150) (139) Acquisitions — 28 346 395 77 88 55 83 303 76 100 Foreign Currency / Other 11 (57) 2 (35) (3) (6) (14) 6 (17) (5) (7) Ending Balance $3,822 $3,589 $4,381 $5,637 $5,915 $6,211 $6,217 $6,328 $6,328 $6,416 $6,714 Proceeds as a percent of OEC 40.9 % 37.0 % 41.8 % 44.4 % 51.5 % 47.0 % 39.4 % 44.3 % 44.2 % 49.5 % 47.9 % 1. Original equipment cost based on ARA guidelines.

Q2 2024Herc Holdings Inc. NYSE: HRI 34 For additional information, please contact: Leslie Hunziker SVP Investor Relations, Communications & Sustainability leslie.hunziker@hercrentals.com 239-301-1675

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |