UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of

the Securities Exchange

Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy

Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive Additional

Materials

¨ Soliciting

Material under §240.14a-12

JOHNSON

CONTROLS INTERNATIONAL PUBLIC LIMITED COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee

required.

¨ Fee paid

previously with preliminary materials.

¨ Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| Date of Report (Date of Earliest Event Reported): |

February 3, 2025 |

JOHNSON CONTROLS INTERNATIONAL PLC

(Exact name of registrant as specified in its charter)

| Ireland |

|

001-13836 |

|

98-0390500 |

| (State or Other Jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

One

Albert Quay. Cork, Ireland, T12 X8N6

(Address of principal executive offices and postal

code)

| (353) |

21-423-5000 |

Not Applicable |

| (Registrant’s telephone number) |

(Former name, former address and former fiscal year, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Ordinary Shares, Par Value $0.01 |

JCI |

New York Stock Exchange |

| 1.375% Notes due 2025 |

JCI25A |

New York Stock Exchange |

| 3.900% Notes due 2026 |

JCI26A |

New York Stock Exchange |

| 0.375% Senior Notes due 2027 |

JCI27 |

New York Stock Exchange |

| 3.000% Senior Notes due 2028 |

JCI28 |

New York Stock Exchange |

| 5.500% Senior Notes due 2029 |

JCI29 |

New York Stock Exchange |

| 1.750% Senior Notes due 2030 |

JCI30 |

New York Stock Exchange |

| 2.000% Sustainability-Linked Senior Notes due 2031 |

JCI31 |

New York Stock Exchange |

| 1.000% Senior Notes due 2032 |

JCI32 |

New York Stock Exchange |

| 4.900% Senior Notes due 2032 |

JCI32A |

New York Stock Exchange |

| 3.125% Senior Notes due 2033 |

JCI33 |

New York Stock Exchange |

| 4.250% Senior Notes due 2035 |

JCI35 |

New York Stock Exchange |

| 6.000% Notes due 2036 |

JCI36A |

New York Stock Exchange |

| 5.70% Senior Notes due 2041 |

JCI41B |

New York Stock Exchange |

| 5.250% Senior Notes due 2041 |

JCI41C |

New York Stock Exchange |

| 4.625% Senior Notes due 2044 |

JCI44A |

New York Stock Exchange |

| 5.125% Notes due 2045 |

JCI45B |

New York Stock Exchange |

| 6.950% Debentures due December 1, 2045 |

JCI45A |

New York Stock Exchange |

| 4.500% Senior Notes due 2047 |

JCI47 |

New York Stock Exchange |

| 4.950% Senior Notes due 2064 |

JCI64A |

New York Stock Exchange |

| Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

|

| |

|

|

| |

Emerging growth company |

☐ |

| |

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Chief Executive Officer Succession

On February 5, 2025, Johnson Controls International

plc (the “Company”) announced that Joakim Weidemanis, 55, will join the Company and succeed George Oliver as the Company’s

Chief Executive Officer and principal executive officer. Mr. Weidemanis is expected to join the Company and assume the role of Chief

Executive Officer on March 12, 2025, immediately following the Company’s Annual General Meeting of Shareholders. The Company

expects that Mr. Weidemanis will be appointed as a member of the Board of Directors following his succession to the role of Chief

Executive Officer. Following this transition, Mr. Oliver will continue to serve as the Chairman of the Board of Directors of the

Company until July 31, 2025, and will retire from the Board of Directors on that date. Following Mr. Oliver’s retirement

from the Board of Directors, Mark Vergnano will serve as the independent Chairman of the Board of Directors.

Mr. Weidemanis previously served as Executive

Vice President of Danaher Corporation, a global science and technology company, a position he held from 2017 until 2024. In this

role, Mr. Weidemanis was most recently responsible for Danaher’s Diagnostics group of businesses, as well as all of Danaher’s

operations in China. Prior to this, Mr. Weidemanis was responsible for the Product ID and Water Quality groups of businesses. Prior

to becoming Executive Vice President, Mr. Weidemanis held various management positions within Danaher from 2011 until 2017. Prior

to joining Danaher, Mr. Weidemanis served as Head of Product Inspection Division of Mettler Toledo from 2005 until 2011. From 1995

until 2005, Mr. Weidemanis served in various operating and corporate development roles at ABB Ltd. Mr. Weidemanis has served

as a director on the board of Assa Abloy, a global leader in access solutions, since 2020.

In connection with Mr. Weidemanis’ appointment,

he will (1) receive a base salary of $1,500,000, (2) participate in the Company’s Annual Incentive Performance Program

for fiscal year 2025, with a maximum bonus capped at 320% of his base salary and pro-rated for his start date and (3) receive pro-rated

long-term equity incentive awards consistent with the awards granted to the Company’s senior executives, consisting of a mix of

performance share units, share options and restricted share units. For fiscal year 2025, Mr. Weidemanis will receive pro-rated long

term incentive award grants with a total aggregate value of $10,000,000 consisting of three-year performance share units with a value

of $5,000,000, restricted share units with a value of $2,500,000 and share options with a value of $2,500,000. For fiscal year 2026, Mr. Weidemanis

will receive long term incentive award grants with a total aggregate value of $12,000,000 consisting of performance share units with a

value of $6,000,000, restricted share units with a value of $3,000,000 and share options with a value of $3,000,000, in each case, to

be granted in accordance with the Company’s annual long term award practices in the first quarter of fiscal year 2026. In connection

with his appointment as CEO, Mr. Weidemanis will also receive a one-time equity grant on March 12, 2025 with a grant date value

of $5,000,000 consisting of (1) 75% performance share units under the Company’s fiscal year 2024-2026 Long-Term Incentive Performance

Program that will vest in December 2026 contingent on the achievement of the performance goals established under such program, and

(2) 25% in share options that will vest 50% after one year from date of grant and the remaining 50% on December 7, 2026 and

can be exercised up to 10 years from the date of grant. Mr. Weidemanis will be eligible to participate in all employee benefit plans

generally available to senior executives of the Company, which are more fully described in the Company’s definitive proxy statement

(“Proxy Statement”) on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on January 21,

2025. Mr. Weidemanis will also be subject to the Company’s Severance and Change in Control Policy, which is described in the

Company’s Proxy Statement.

Each

of the Company and its wholly owned subsidiary, Tyco Fire & Security (US) Management, LLC (“Tyco F&S”), will

indemnify Mr. Weidemanis pursuant to Indemnification Agreements in the same form as used with other directors and officers of the

Company. The form indemnification agreements provide that, to the fullest extent permitted by law, the Company and/or Tyco F&S will

indemnify each officer against expenses (including attorneys’ fees, judgments, fines and amounts paid in settlement) actually and

reasonably incurred by the officer in connection with any claim against the officer as a result of the officer’s service as an officer

or director of the Company. The summaries of the material terms of the form indemnification agreements set forth above are qualified in

their entirety by reference to the full text of the applicable agreements. (See Exhibit 10.7 and Exhibit 10.8,

respectively, to the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on November 19, 2024, which exhibits are incorporated herein by reference).

There are no transactions since the beginning of

the Company’s last fiscal year in which the Company is a participant and in which Mr. Weidemanis or any members of his immediate

family have any interest that are required to be reported under Item 404(a) of Regulation S-K. No family relationships exist between

Mr. Weidemanis and any of the Company’s directors or executive officers. The appointment of Mr. Weidemanis was not pursuant

to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his

or her official capacity.

George Oliver Employment Transition Agreement

On February 5, 2025, the Company entered into

an Employment Transition Agreement with Mr. Oliver. Pursuant to the Employment Transition Agreement, Mr. Oliver will retire

as Chief Executive Officer of the Company immediately following the Company’s Annual General Meeting of Shareholders on March 12,

2025 (the “Retirement Date”). Following the Retirement Date through July 31, 2025, Mr. Oliver will continue in the

role of Chairman of the Board of Directors of the Company and receive compensation consisting of an annual cash retainer of $145,000,

pro-rated for the period between the Retirement Date and Mr. Oliver’s retirement from the Board of Directors. In addition,

to compensate Mr. Oliver for serving as non-executive Chairman, the Company will pay Mr. Oliver a supplemental annual cash retainer

with an annualized value of $200,000, pro-rated for the period between the Retirement Date and Mr. Oliver’s retirement from

the Board of Directors.

Following Mr. Oliver’s retirement from

the Board of Directors, Mr. Oliver will serve as an advisor to the Company from August 1, 2025 until December 31, 2025

or until such earlier termination date as specified by Mr. Oliver or the Company pursuant to the Employment Transition Agreement.

Mr. Oliver will receive a fee of $75,000 per month for his advisory services beginning August 1, 2025 and pro-rated for any

partial period of monthly service.

Pursuant to the Employment Transition Agreement,

Mr. Oliver will be entitled to a pro-rated award under the Company’s fiscal year 2025 Annual Incentive Performance Program

for the period from October 1, 2024 until the Retirement Date, contingent on the achievement of the performance goals established

for the program. In addition, while Mr. Oliver is in service with the Company in any capacity, (1) any performance share units

held by Mr. Oliver that are outstanding as of the Retirement Date shall remain eligible to vest and be earned, and a pro rata portion

of any remaining unvested and unearned portion of such units at the time of Mr. Oliver’s separation from service shall remain

eligible to vest and be earned based on actual performance following the end of the applicable three-fiscal-year performance period, (2) any

unvested restricted share units held by Mr. Oliver that are outstanding as of the Retirement Date will continue to vest on their

regular vesting schedule, and upon Mr. Oliver’s separation from service with the Company, any then-remaining unvested portion

of such units shall vest on a pro rata basis and (3) any unvested Company share options held by Mr. Oliver that are outstanding

as of the Retirement Date will continue to vest on their regular vesting schedule, and upon Mr. Oliver’s separation from service

from the Company, any remaining unvested portion of such options shall vest on a pro rata basis and remain exercisable until the tenth

anniversary of the options’ respective grant dates.

The description of the Employment Transition Agreement

herein is a summary and is qualified in its entirety by the terms of the Employment Transition Agreement. A copy of the Employment Transition

Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Marc Vandiepenbeeck Retention Award

On

February 3, 2025, the Compensation and Talent Development Committee of the Board approved a special retention restricted stock unit

(RSU) award (the “Retention Award”) for Marc Vandiepenbeeck, the Company’s Executive Vice President and Chief Financial

Officer. The Retention Award consists of a grant of RSUs with a grant date of March 12, 2025 and a grant date fair value of $5,000,000.

The Retention Award will cliff vest on the fifth anniversary of the date of grant, subject to continued employment until such date. In

the event of an involuntary not for cause termination prior to the vesting date, the Retention Award will vest on a pro-rata basis based

on the number of full months actively employed in the vesting term. In the event of a termination as a result of death or disability prior

to the vesting date, the Retention Award will vest in full. In the event of any other termination, including retirement, voluntary and

termination “for cause”, the Retention Award will be forfeited. The terms of the Retention Award are governed by the Company’s

standard terms of and conditions for restricted share/unit awards, filed as Exhibit 10.1 to the Company’s

Quarterly Report on Form 10-Q for the quarter ended December 31, 2022, as filed with the SEC on February 1, 2023, which

is incorporated herein by reference.

Item 7.01. Regulation

FD Disclosure.

On February 5, 2025, the Company issued a

press release announcing that Mr. Weidemanis will serve as the next Chief Executive Officer of the Company. A copy of the press release

announcing the appointment of Mr. Weidemanis is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Item 7.01, including

the accompanying Exhibit 99.1, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934 (the

“Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed incorporated by reference

into any filing under the Exchange Act or the Securities Act of 1933, except as shall be expressly set forth by specific reference in

such filing.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits:

| Exhibit No. |

Description |

| |

|

| 10.1 |

Employment Transition Agreement, dated February 5, 2025, between the Company and Mr. Oliver (filed herewith) |

| |

|

| 10.2 |

Form of Deed of Indemnification between Johnson Controls International plc and certain of its directors and officers (incorporated by reference to Exhibit 10.7 of the Company’s Annual Report on Form 10-K filed on December 14, 2023) |

| |

|

| 10.3 |

Form of Indemnification Agreement between Tyco Fire & Security (US) Management, LLC and certain directors and officers of Johnson Controls International plc (incorporated by reference to Exhibit 10.8 of the Company’s Annual Report on Form 10-K filed on December 14, 2023) |

| |

|

| 10.4 |

Form of terms and conditions for Option / SAR Awards, Restricted Stock / Unit Awards, Performance Share Awards under the Johnson Controls International plc 2021 Equity and Incentive Plan for fiscal 2023 (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on February 1, 2023) |

| |

|

| 99.1 |

Press release issued by Johnson Controls International plc, dated February 5, 2025, relating to the Company’s Chief Executive Officer succession (incorporated by reference to Exhibit 99.2 to the Company’s Current Report on Form 8-K filed on February 5, 2025) |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

JOHNSON CONTROLS INTERNATIONAL PLC |

| |

|

|

|

| Date: February 5, 2025 |

By: |

/s/ Richard J. Dancy |

| |

|

Name: |

Richard J. Dancy |

| |

|

Title: |

Vice President and Corporate Secretary |

Exhibit 10.1

Execution Version

EMPLOYMENT TRANSITION AGREEMENT

THIS EMPLOYMENT TRANSITION AGREEMENT (“Agreement”),

dated as of February 5, 2025, is by and between Johnson Controls International plc (the “Company”), and George R. Oliver

(“Executive”).

WHEREAS, Executive is currently employed as the

Chief Executive Officer of the Company and currently serves as the Chairman of the Board of Directors of the Company (the “Board”);

WHEREAS, Executive has announced his intent to

retire, and the Board believes that executing a successful CEO succession and transition process is in the best interests of the Company

and its shareholders and is a core function of the Board;

WHEREAS, as part of its succession

and transition planning process, the Board and Executive have mutually agreed that Executive will retire from his role as Chief Executive

Officer of the Company, effective March 12, 2025, immediately following the Company’s annual general meeting of shareholders;

WHEREAS, the Board (excluding Executive) has requested

that Executive continue to serve on the Board in the role of Chairman following his retirement on March 12, 2025, until July 31,

2025 (the “Non-Executive Chairman Service”) to facilitate the transition to the new Chief Executive Officer;

WHEREAS, the Board (excluding Executive) has requested

that Executive serve as an advisor to the Company from August 1, 2025, until no later than December 31, 2025 (the “Advisor

Service”) to facilitate the transition to the new Chief Executive Officer (the “New CEO”); and

WHEREAS, the Company and Executive desire to set

forth their respective rights and obligations regarding Executive’s pending retirement from, and other service with, the Company.

NOW, THEREFORE, in consideration of the covenants

and conditions set forth herein and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged,

the parties, intending to be legally bound, agree as follows:

1. Retirement

from the Company. Executive and the Company agree that, effective immediately following the Company’s annual general meeting

of shareholders on March 12, 2025 (the “Retirement Date”), Executive shall retire from employment with the Company and

simultaneously resign from his position as Chief Executive Officer of the Company and from any and all other positions held by Executive

with the Company and its direct and indirect subsidiaries and affiliates, other than his role as a director of the Company and Chairman

of the Board, which position Executive shall continue to hold from March 12, 2025 through July 31, 2025, upon which date Executive

shall be deemed to have resigned from the Board as a director and as Chairman of the Board. Executive agrees to execute and deliver such

documentation as may be reasonably required to effectuate the resignations detailed in the immediately preceding sentence.

2. Advisor

Service. From August 1, 2025 through December 31, 2025, or such earlier termination date as is specified by at least thirty

(30) days’ advance written notice from one party to the other, Executive shall provide advisory services to the New CEO as may be

reasonably requested by the Board or the New CEO to advise the Board and facilitate the transition the New CEO to such role.

3. Retirement

Benefits.

| a. | Pro Rata Bonus. Subject to (i) Executive’s continued employment through the Retirement Date and (ii) Executive’s

compliance with any applicable restrictive covenants contained in agreements between Executive and the Company, Executive shall be entitled

to an award under the Company’s Annual Incentive Performance Program (“AIPP”) for fiscal year 2025 previously established

by the Board with respect to Executive, based on Executive’s existing target award and the Company’s actual performance for

the full fiscal year, but pro-rated based on the number of days Executive was employed from October 1, 2024 through and including

the Retirement Date relative to the number of days in the full performance period. The award so determined shall be payable following

the end of fiscal year 2025 in accordance with the Company’s normal AIPP payment cycle. |

| b. | Long-Term Incentive Awards. Subject to (i) Executive’s continued employment through the Retirement Date, and (ii) Executive’s

compliance with any applicable restrictive covenants contained in agreements between Executive and the Company and in the Company’s

severance programs for executive officers, Executive’s long-term incentive awards shall be treated as follows, and these provisions

shall override any contrary provisions in the applicable equity award agreements: |

i. Any

Company performance share units held by Executive that are outstanding as of the Retirement Date shall remain eligible to vest and be

earned while Executive is in service with the Company in any capacity, and a pro rata portion of any remaining unvested and unearned portion

of such units at the time of Executive’s separation from service shall remain eligible to vest and be earned based on actual performance

following the end of the applicable three-fiscal-year performance period. The pro rata number of units that Executive shall be eligible

to earn shall be calculated as follows: (A) the total number of units subject to the applicable performance share unit award multiplied

by (B) a fraction, the numerator of which equals the number of full months that Executive was in service with the Company in any

capacity during the applicable performance period and the denominator of which equals the total number of months in the applicable performance

period.

ii. Any

unvested Company restricted share units held by Executive that are outstanding as of the Retirement Date will continue to vest on their

regular vesting schedule while Executive is in service with the Company in any capacity, and upon Executive’s separation from service

with the Company, any then-remaining unvested portion of such units shall vest on a pro rata basis and be settled upon Executive’s

separation from service with the Company, subject to any six (6) month delay or other time and form of payment required for compliance

with Section 409A of the Internal Revenue Code of 1986, as amended. The pro rata number of units that shall vest shall be calculated

as follows: (A) the total number of units subject to the applicable restricted share unit award multiplied by (B) a fraction,

the numerator of which equals the number of full months that Executive was in service with the Company in any capacity during the applicable

service period and the denominator of which equals the total number of months in the applicable service period, less (C) any units

that previously vested in the normal course as of the separation from service.

iii. Any

unvested Company share options held by Executive that are outstanding as of the Retirement Date will continue to vest on their regular

vesting schedule while Executive is in service with the Company in any capacity, and upon Executive’s separation from service from

the Company, any remaining unvested portion of such options shall vest on a pro rata basis. The pro rata number of options that shall

vest shall be calculated as follows: (A) the total number of shares subject to the applicable option award multiplied by (B) a

fraction, the numerator of which equals the number of full months that Executive was in service with the Company in any capacity during

the applicable service period and the denominator of which equals the total number of months in the applicable service period, less (C) any

options that previously vested in the normal course as of the separation from service.

iv. All

vested Company options held by Executive (including those that vest under this Agreement) will remain exercisable until the tenth anniversary

of the options’ respective grant dates.

4. Compensation

for Board Service. Consistent with the Company’s director compensation program for non-employee directors, during Executive’s

period of service on the Board following the Retirement Date, the Company will pay Executive an annual cash retainer of $145,000, pro-rated

for the period between the Retirement Date and Executive’s separation from the Board relative to a full annual period and paid quarterly

in accordance with the Company’s regular director compensation practices. In addition, to compensate Executive for his Non-Executive

Chairman Service, the Company will pay Executive a supplemental annual cash retainer of $200,000, pro-rated for the period of the Non-Executive

Chairman Service relative to a full annual period, and paid quarterly in accordance with the Company’s regular director compensation

practices. For the avoidance of doubt, Executive shall not receive the equity portion of the non-employee director retainer.

5. Compensation

for Advisor Service. To compensate Executive for his Advisor Service, during the period of such service, he will receive a $75,000

cash payment each month, commencing August 1, 2025, to be paid monthly in arrears, and pro-rated for any partial period of monthly

service. The Company shall also reimburse Executive for any reasonable business expenses incurred by Executive in the performance of his

Advisor Service in accordance with the Company’s expense reimbursement policy.

6. Accrued

Obligations. Following the Retirement Date, Executive shall be entitled to such compensation and benefits as are provided by the terms

of the Company’s or its affiliates’ compensation and benefits plans and policies, including, without limitation, his accrued

vested benefits under the Company’s Retirement Restoration Plan and the Company’s Senior Executive Deferred Compensation Plan,

payable in accordance with the terms of such plans and in compliance with Section 409A of the Internal Revenue Code of 1986, as amended,

his vested account in the 401(k) plan, and any COBRA continuation coverage under the employer-provided group health plans.

7. Full

Settlement; No Obligation to Mitigate; Indemnification and D&O Coverage.

| a. | Full Settlement. Executive agrees that the payments and benefits contemplated by Sections 3 and 6 of this Agreement shall be

in full satisfaction of any rights and benefits due to Executive upon a termination of Executive’s employment with the Company.

Executive acknowledges that the payments and benefits to which he becomes entitled under Sections 3, 4, 5 and 6 of this Agreement shall

not be considered in determining his benefits under any plan, agreement, policy or arrangement of the Company unless otherwise required

thereunder. |

| b. | No Obligation to Mitigate. In no event shall Executive be obligated to seek other employment or take any other action by way

of mitigation of the amounts payable to Executive under the provisions of this Agreement, and such amounts shall not be reduced even if

Executive obtains other employment. |

| c. | Indemnification and D&O Coverage. Executive shall continue to be indemnified by the Company to the maximum extent permitted

by applicable law and by the Company’s Memorandum and Articles of Association as well as the Deed of Indemnification between the

Company and Executive and shall continue to be covered as an officer and as a director of the Company under the Company’s applicable

directors’ and officers’ or other third party liability insurance, including any “tail” coverage following termination

of his employment. |

8. Tax

Withholding. All payments and benefits provided to Executive under this Agreement will be less applicable withholdings for federal,

state and local taxes.

9. Press

Release. The Company and Executive shall jointly agree in good faith on the terms of a press release and/or other public filing describing

the arrangements provided herein.

10. Entire

Agreement. This Agreement and Executive’s letter agreement, dated as of December 8, 2017, with the Company constitute the

entire agreement between the parties with respect to the subject matter hereof (other than regarding any equity- or cash-based incentive

awards referenced herein), and supersede all prior agreements or understandings between the parties arising out of or relating to Executive’s

employment and the cessation thereof. Executive agrees that neither the entry into this Agreement nor the actions or events contemplated

by this Agreement shall constitute a basis for a “Good Reason Resignation” under, and as defined in, the Company’s Severance

and Change in Control Policy for Officers.

11. Governing

Law; Arbitration Policy. This Agreement shall be governed by the internal laws of the State of Wisconsin (without reference to conflict

of law principles thereof) and construed in accordance therewith. Notwithstanding anything to the contrary herein, any disputes related

to this Agreement shall be subject to the Company’s arbitration policy, as in effect from time to time, and Executive agrees to

be bound by such arbitration policy.

12. Severability

of Provisions. Each section in this Agreement shall be enforceable independently of every other section, and the invalidity or non-enforceability

of any section shall not invalidate or render unenforceable any other section in this Agreement.

13. Successors

and Assigns. This Agreement shall be binding upon and inure to the benefit of the successors and assigns of the Company, including

as a result of a merger or sale of all or substantially all of the Company’s assets or similar corporate transaction. This Agreement

shall not be assignable by Executive. If Executive shall die before after a cash payment hereunder has accrued but before its payment,

then such cash payment shall be made to Executive’s surviving spouse or if none, to Executive’s estate.

14. Waivers.

No failure by either party to exercise, and no delay in exercising, any right or remedy under this Agreement shall operate as a waiver

thereof; nor shall any single or partial exercise of any right or remedy preclude any other or further exercise thereof or the exercise

of any other right or remedy granted hereby or by any related document or by law.

15. Modification.

No supplement, modification, or amendment of this Agreement shall be binding unless executed in writing by both Executive and the Company.

16. Counterparts.

This Agreement may be executed in one or more counterparts, which may be delivered in .pdf format, each of which shall be deemed an original

and which together shall be the same instrument.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, the parties have executed this

Agreement as of the day and year first above written.

| |

JOHNSON CONTROLS INTERNATIONAL PLC |

| |

|

| |

By: |

/s/ John Donofrio |

| |

Name: |

John Donofrio |

| Title: | Executive Vice President and General Counsel |

| |

/s/ George R. Oliver |

| |

George R. Oliver |

[Signature Page to Employment Transition

Agreement]

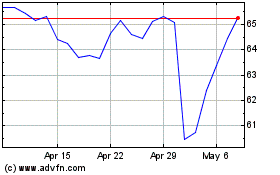

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

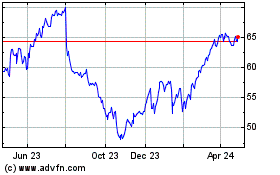

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Feb 2024 to Feb 2025