– Strong Leasing Volume Drives Growth in

Occupancy and Leasing Spreads –

– Lowers Leverage with Ongoing Monetization of

Albertsons Investment –

– Board Declares Quarterly Dividend –

– Updates 2023 Outlook –

Kimco Realty® (NYSE: KIM), North America’s largest publicly

traded owner and operator of open-air, grocery-anchored shopping

centers, including mixed-use assets, today reported results for the

first quarter ended March 31, 2023. For the three months ended

March 31, 2023, and 2022, Kimco Realty’s net income available to

the company’s common shareholders was $0.46 per diluted share and

$0.37 per diluted share, respectively.

First Quarter Highlights

- Reported Funds From Operations* (FFO) of $0.39 per diluted

share.

- Leased a total of 4.5 million square feet including 3.7 million

square feet of renewals and option exercises.

- Increased pro-rata portfolio occupancy 110 basis points

year-over-year to 95.8%.

- Grew small shop occupancy 70 basis points sequentially to

90.7%.

- Generated pro-rata cash rent spreads of 44.0% for new leases on

comparable spaces, representing the highest new lease spread in the

past five years.

- Produced 1.4% growth in Same-Property Net Operating Income*

(NOI) over the same period a year ago.

- Received a $194.1 million special dividend from Albertsons

Companies (NYSE: ACI) related to the 28.3 million shares the

company held.

- Generated $137.4 million in proceeds on the sale of 7.1 million

shares of ACI.

- Subsequent to quarter end, received $144.9 million in net

proceeds on sale of 7.0 million shares of ACI.

*Reconciliations of non-GAAP measures to the most directly

comparable GAAP measure are provided in the tables accompanying

this press release.

“Our team continues to drive strong leasing performance, with

the 4.5 million square feet leased this quarter further validating

the demand for our well-located, high-quality portfolio of

open-air, grocery-anchored shopping centers in the most coveted

locations across the country,” stated Kimco CEO Conor Flynn.

“Furthermore, we could not be more excited about our ability to

extract meaningful value from our long-term investment in

Albertsons. The combination of strong cash flow from our operating

portfolio and the cash coming from the monetization of Albertsons

has resulted in further reduction in leverage levels to support

future growth opportunities. With our first-ring suburban portfolio

surrounding the top major metropolitan markets, we are

well-equipped to keep driving value for our stockholders.”

Financial Results

Net income available to the company’s common shareholders for

the first quarter of 2023 was $283.5 million, or $0.46 per diluted

share, compared to $230.9 million, or $0.37 per diluted share, for

the first quarter of 2022. The year-over-year change is primarily

attributable to a $194.1 million ACI special dividend. This was

offset by a $131.9 million mark-to-market reduction on marketable

securities, primarily stemming from a change in the value of ACI

common stock held by the company, as well as a $31.0 million

increase in provision for income taxes, net, primarily due to the

capital gains from the monetization of 7.1 million shares of ACI

during the first quarter of 2023. Other items impacting the

year-over-year change included $23.5 million in higher gains on

sale of consolidated properties, net of impairments, during the

first quarter of 2023.

FFO was $238.1 million, or $0.39 per diluted share, for the

first quarter of 2023, compared to $240.6 million, or $0.39 per

diluted share, for the first quarter 2022. The company excludes

from FFO all gains and losses, whether realized or unrealized,

related to its investment in ACI, as well as gains and losses from

the sale of operating properties, real estate-related depreciation,

and profit participations from other investments. Special dividends

are also excluded from FFO.

Operating Results

- Signed 600 leases totaling 4.5 million square feet, generating

blended pro-rata rent spreads on comparable spaces of 10.3%, with

pro-rata rental rates for new leases up 44.0% and renewals and

options growing 7.7%.

- Reported a 280-basis-point spread between leased (reported)

occupancy versus economic occupancy at the end of the first

quarter, representing approximately $46 million in annual base

rent.

- Pro-rata portfolio occupancy rose 10 basis points sequentially

and 110 basis points year over year to 95.8%.

- Ended the quarter with pro-rata anchor occupancy of 97.8% and

small shop occupancy of 90.7%, representing year-over-year

increases of 50 basis points and 230 basis points,

respectively.

- Produced 1.4% growth in Same-Property NOI over the same period

a year ago, driven by a 4.3% increase in minimum rent.

Investment Activities

- Acquired the remaining 85% interest in three California

grocery-anchored shopping centers for a combined $127.5 million. In

addition, the company acquired two improved, adjacent parcels at

existing shopping centers for a combined purchase price of $14.6

million.

- Sold three power centers and two land parcels totaling 592,000

square feet for $98.9 million during the first quarter. The

company’s pro-rata share of the sales price was $96.9 million.

- Made an $11.2 million subordinate loan on a grocery-anchored

shopping center in Orlando, Florida under the company’s structured

investment program.

Capital Market

Activities

- Entered into a new $2.0 billion unsecured revolving credit

facility with an initial maturity date of March 17, 2027 with two

additional six-month extension options. The new “green” facility is

priced at Adjusted SOFR plus 77.5 basis points with the ability to

increase or decrease the spread by four basis points based on our

success in reducing scope 1 and 2 greenhouse gas emissions.

- As previously announced, Kimco received a $194.1 million

special dividend payment from ACI. As a result, the company

anticipates it may need to make a special dividend payment to

maintain its compliance with REIT distribution requirements. If the

company determines to declare a special dividend, the payment may

be in the form of cash, common stock or some combination

thereof.

- Sold 7.1 million shares of ACI common stock during the first

quarter resulting in $137.4 million in net proceeds. In order to

maximize the level of proceeds for general corporate purposes, the

company recorded a $30.0 million provision for income taxes.

- Subsequent to quarter end, Kimco sold an additional 7.0 million

shares of ACI common stock resulting in net proceeds of $144.9

million. The company will record a $32.7 million provision for

income taxes during the second quarter of 2023.

- As of April 27, 2023, Kimco held 14.2 million shares of ACI

common stock valued at approximately $300 million.

- Ended the first quarter with over $2.3 billion of immediate

liquidity, including full availability of the company’s $2.0

billion unsecured revolving credit facility and $329.2 million of

cash and cash equivalents on the balance sheet.

Dividend Declarations

- Kimco’s board of directors declared a cash dividend of $0.23

per common share, representing a 15% increase over the quarterly

dividend in the corresponding period of the prior year. The

quarterly cash dividend on common shares is payable on June 22,

2023 to shareholders of record on June 8, 2023.

- The board of directors also declared quarterly dividends with

respect to each of the company’s Class L and Class M series of

cumulative redeemable preferred shares. These dividends on the

preferred shares will be paid on July 17, 2023 to shareholders of

record on July 3, 2023.

2023 Full Year Outlook

The company has revised its assumption for lease termination

income for the full year to $4 million to $6 million from the

previous level of $14 million to $16 million. All other assumptions

for 2023 provided with the company’s fourth quarter 2022 earnings

results remain the same.

Based on the actual results of the first quarter, including

gains, net of impairments and other charges impacting net income

available to the company’s common shareholders, the change in

assumption for lease termination income, and outlook for the

remainder of 2023, the company has updated its full-year guidance

ranges as follows:

Current

Previous

Net income available to the company’s

common shareholders (per diluted share):

$0.92 to $0.96

$0.93 to $0.97

FFO (per diluted share)*:

$1.54 to $1.57

$1.53 to $1.57

*The tables accompanying this press release provide a

reconciliation for the Current forward-looking non-GAAP

measure.

Conference Call

Information

When:

8:30 AM ET, April 27, 2023

Live Webcast:

1Q23 Kimco Realty Earnings Conference Call

or on Kimco Realty’s website investors.kimcorealty.com (replay

available through July 27, 2023)

Dial #:

1-888-317-6003 (International:

1-412-317-6061). Passcode: 0387972

About Kimco Realty®

Kimco Realty® (NYSE:KIM) is a real estate investment trust

(REIT) headquartered in Jericho, N.Y. that is North America’s

largest publicly traded owner and operator of open-air,

grocery-anchored shopping centers, and a growing portfolio of

mixed-use assets. The company’s portfolio is primarily concentrated

in the first-ring suburbs of the top major metropolitan markets,

including those in high-barrier-to-entry coastal markets and

rapidly expanding Sun Belt cities, with a tenant mix focused on

essential, necessity-based goods and services that drive multiple

shopping trips per week. Kimco Realty is also committed to

leadership in environmental, social and governance (ESG) issues and

is a recognized industry leader in these areas. Publicly traded on

the NYSE since 1991, and included in the S&P 500 Index, the

company has specialized in shopping center ownership, management,

acquisitions, and value enhancing redevelopment activities for more

than 60 years. As of March 31, 2023, the company owned interests in

529 U.S. shopping centers and mixed-use assets comprising 90

million square feet of gross leasable space. For further

information, please visit www.kimcorealty.com.

The company announces material information to its investors

using the company’s investor relations website

(investors.kimcorealty.com), SEC filings, press releases, public

conference calls, and webcasts. The company also uses social media

to communicate with its investors and the public, and the

information the company posts on social media may be deemed

material information. Therefore, the company encourages investors,

the media, and others interested in the company to review the

information that it posts on the social media channels, including

Facebook (www.facebook.com/kimcorealty), Twitter

(www.twitter.com/kimcorealty) and LinkedIn

(www.linkedin.com/company/kimco-realty-corporation). The list of

social media channels that the company uses may be updated on its

investor relations website from time to time.

Safe Harbor Statement

This communication contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The company intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and includes this statement for purposes of complying

with the safe harbor provisions. Forward-looking statements, which

are based on certain assumptions and describe the company’s future

plans, strategies and expectations, are generally identifiable by

use of the words “believe,” “expect,” “intend,” “commit,”

“anticipate,” “estimate,” “project,” “will,” “target,” “plan,”

“forecast” or similar expressions. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which, in some cases, are

beyond the company’s control and could materially affect actual

results, performances or achievements. Factors which may cause

actual results to differ materially from current expectations

include, but are not limited to, (i) general adverse economic and

local real estate conditions, (ii) the impact of competition,

including the availability of acquisition or development

opportunities and the costs associated with purchasing and

maintaining assets, (iii)the inability of major tenants to continue

paying their rent obligations due to bankruptcy, insolvency or a

general downturn in their business, (iv) the reduction in the

company’s income in the event of multiple lease terminations by

tenants or a failure of multiple tenants to occupy their premises

in a shopping center, (v) the potential impact of e-commerce and

other changes in consumer buying practices, and changing trends in

the retail industry and perceptions by retailers or shoppers,

including safety and convenience, (vi) the availability of suitable

acquisition, disposition, development and redevelopment

opportunities, and risks related to acquisitions not performing in

accordance with our expectations, (vii) the company’s ability to

raise capital by selling its assets, (viii) disruptions and

increases in operating costs due to inflation and supply chain

issues, (ix) risks associated with the development of mixed-use

commercial properties, including risks associated with the

development and ownership of non-retail real estate, (x) changes in

governmental laws and regulations, including, but not limited to,

changes in data privacy, environmental (including climate change),

safety and health laws, and management’s ability to estimate the

impact of such changes, (xi) valuation and risks related to the

company’s joint venture and preferred equity investments and other

investments, (xii) valuation of marketable securities and other

investments, including the shares of Albertsons Companies, Inc.

common stock held by the company, (xiii) impairment charges, (xiv)

criminal cybersecurity attacks disruption, data loss or other

security incidents and breaches, (xv) impact of natural disasters

and weather and climate-related events, (xvi) pandemics or other

health crises, such as coronavirus disease 2019 (“COVID-19”),

(xvii) our ability to attract, retain and motivate key personnel,

(xviii) financing risks, such as the inability to obtain equity,

debt or other sources of financing or refinancing on favorable

terms to the company, (xix) the level and volatility of interest

rates and management’s ability to estimate the impact thereof, (xx)

changes in the dividend policy for the company’s common and

preferred stock and the company’s ability to pay dividends at

current levels, (xxi) unanticipated changes in the company’s

intention or ability to prepay certain debt prior to maturity

and/or hold certain securities until maturity, (xxii) the company’s

ability to continue to maintain its status as a REIT for federal

income tax purposes and potential risks and uncertainties in

connection with its UPREIT structure, and (xxiii) the other risks

and uncertainties identified under Item 1A, “Risk Factors” and

elsewhere in our Annual Report on Form 10-K for the year-ended

December 31, 2022 and in the company’s other filings with the

Securities and Exchange Commission (“SEC”). Accordingly, there is

no assurance that the company’s expectations will be realized. The

company disclaims any intention or obligation to update the

forward-looking statements, whether as a result of new information,

future events or otherwise. You are advised to refer to any further

disclosures the company makes or related subjects in the company’s

quarterly reports on Form 10-Q and current reports on Form 8-K that

the company files with the SEC.

Condensed Consolidated Balance Sheets (in thousands,

except share data) (unaudited) March 31, 2023 December 31,

2022

Assets: Real estate, net of accumulated depreciation

and amortization of $3,523,503 and $3,417,414, respectively

$

15,108,018

$

15,039,828

Investments in and advances to real estate joint ventures

1,092,477

1,091,551

Other investments

132,935

107,581

Cash and cash equivalents

329,177

149,829

Marketable securities

451,583

597,732

Accounts and notes receivable, net

303,063

304,226

Operating lease right-of-use assets, net

132,020

133,733

Other assets

411,956

401,642

Total assets

$

17,961,229

$

17,826,122

Liabilities: Notes payable, net

$

6,778,050

$

6,780,969

Mortgages payable, net

374,285

376,917

Accounts payable and accrued expenses

203,053

207,815

Dividends payable

5,322

5,326

Operating lease liabilities

112,413

113,679

Other liabilities

609,266

601,574

Total liabilities

8,082,389

8,086,280

Redeemable noncontrolling interests

92,933

92,933

Stockholders' Equity: Preferred stock, $1.00 par

value, authorized 7,054,000 shares; Issued and outstanding (in

series) 19,421 and 19,435 shares, respectively; Aggregate

liquidation preference $485,536 and $485,868, respectively

19

19

Common stock, $.01 par value, authorized 750,000,000 shares; issued

and outstanding 619,891,809 and 618,483,565 shares, respectively

6,199

6,185

Paid-in capital

9,614,913

9,618,271

Retained earnings/(cumulative distributions in excess of net

income)

21,390

(119,548

)

Accumulated other comprehensive income

10,581

10,581

Total stockholders' equity

9,653,102

9,515,508

Noncontrolling interests

132,805

131,401

Total equity

9,785,907

9,646,909

Total liabilities and equity

$

17,961,229

$

17,826,122

Condensed Consolidated Statements of Income (in

thousands, except per share data) (unaudited) Three Months

Ended March 31,

2023

2022

Revenues Revenues from rental properties, net

$

438,338

$

422,654

Management and other fee income

4,554

4,595

Total revenues

442,892

427,249

Operating expenses Rent

(4,013

)

(4,081

)

Real estate taxes

(57,506

)

(54,314

)

Operating and maintenance

(75,242

)

(69,225

)

General and administrative

(34,749

)

(29,948

)

Impairment charges

(11,806

)

(272

)

Depreciation and amortization

(126,301

)

(130,294

)

Total operating expenses

(309,617

)

(288,134

)

Gain on sale of properties

39,206

4,193

Operating income

172,481

143,308

Other income/(expense) Special dividend income

194,116

-

Other income, net

3,132

5,983

(Loss)/gain on marketable securities, net

(10,144

)

121,764

Interest expense

(61,306

)

(57,019

)

Early extinguishment of debt charges

-

(7,173

)

Income before income taxes, net, equity in income of joint

ventures, net, and equity in income from other investments, net

298,279

206,863

(Provision)/benefit for income taxes, net

(30,829

)

153

Equity in income of joint ventures, net

24,204

23,570

Equity in income of other investments, net

2,122

5,373

Net income

293,776

235,959

Net (income)/loss attributable to noncontrolling interests

(4,013

)

1,343

Net income attributable to the company

289,763

237,302

Preferred dividends, net

(6,251

)

(6,354

)

Net income available to the company's common shareholders

$

283,512

$

230,948

Per common share: Net income available to the company's

common shareholders: (1) Basic

$

0.46

$

0.37

Diluted (2)

$

0.46

$

0.37

Weighted average shares: Basic

616,489

614,767

Diluted

619,628

616,758

(1) Adjusted for earnings attributable from participating

securities of ($1,766) and ($1,360) for the three months ended

March 31, 2023 and 2022, respectively.

(2)

Reflects the potential impact if certain units were converted to

common stock at the beginning of the period. The impact of the

conversion would have an antidilutive effect on net income and

therefore have not been included. Adjusted for distributions on

convertible units of $1,118 and $11 for the three months ended

March 31, 2023 and 2022, respectively.

Reconciliation of Net Income Available to the Company's Common

Shareholders to FFO Available to the Company's Common

Shareholders (1) (in thousands, except per share data)

(unaudited) Three Months Ended March 31,

2023

2022

Net income available to the company's common shareholders

$

283,512

$

230,948

Gain on sale of properties

(39,206

)

(4,193

)

Gain on sale of joint venture properties

(7,710

)

(2,986

)

Depreciation and amortization - real estate related

125,278

129,461

Depreciation and amortization - real estate joint ventures

16,547

16,885

Impairment charges (including real estate joint ventures)

11,803

700

Profit participation from other investments, net

31

(3,663

)

Special dividend income

(194,116

)

-

Loss/(gain) on marketable securities, net

10,144

(121,764

)

Provision/(benefit) for income taxes, net (2)

30,873

(11

)

Noncontrolling interests (2)

931

(4,730

)

FFO available to the company's common shareholders

$

238,087

$

240,647

(4

)

Weighted average shares outstanding for FFO calculations:

Basic

616,489

614,767

Units

2,555

2,546

Dilutive effect of equity awards

584

1,874

Diluted

619,628

619,187

FFO per common share - basic

$

0.39

$

0.39

FFO per common share - diluted (3)

$

0.39

$

0.39

(1)

The company considers FFO to be an

important supplemental measure of its operating performance and

believes it is frequently used by securities analysts, investors

and other interested parties in the evaluation of REITs, many of

which present FFO when reporting results. Comparison of the

company's presentation of FFO to similarly titled measures for

other REITs may not necessarily be meaningful due to possible

differences in the application of the NAREIT definition used by

such REITs

(2)

Related to gains, impairments and

depreciation on properties, and gains/(losses) on sales of

marketable securities, where applicable.

(3)

Reflects the potential impact if certain

units were converted to common stock at the beginning of the

period. FFO available to the company’s common shareholders would be

increased by $584 and $473 for the three months ended March 31,

2023 and 2022, respectively. The effect of other certain

convertible units would have an anti-dilutive effect upon the

calculation of FFO available to the company’s common shareholders

per share. Accordingly, the impact of such conversion has not been

included in the determination of diluted earnings per share

calculations.

(4) Includes Early extinguishment of debt charges of $7.2

million recognized during the three months ended March 31, 2022.

Reconciliation of Net Income Available to the Company's

Common Shareholders to Same Property NOI (1)(2) (in

thousands) (unaudited) Three Months Ended March 31,

2023

2022

Net income available to the Company's common shareholders

$

283,512

$

230,948

Adjustments: Management and other fee income

(4,554

)

(4,595

)

General and administrative

34,749

29,948

Impairment charges

11,806

272

Depreciation and amortization

126,301

130,294

Gain on sale of properties

(39,206

)

(4,193

)

Special dividend income

(194,116

)

-

Interest and other income, net

58,174

58,209

Loss/(gain) on marketable securities, net

10,144

(121,764

)

Provision/(benefit) for income taxes, net

30,829

(153

)

Equity in income of other investments, net

(2,122

)

(5,373

)

Net income/(loss) attributable to noncontrolling interests

4,013

(1,343

)

Preferred dividends, net

6,251

6,354

Non same property net operating income

(15,613

)

(16,535

)

Non-operational expense from joint ventures, net

16,039

19,684

Same Property NOI

$

326,207

$

321,753

(1)

The company considers same property NOI as

an important operating performance measure because it is frequently

used by securities analysts and investors to measure only the net

operating income of properties that have been owned by the company

for the entire current and prior year reporting periods. It

excludes properties under redevelopment, development and pending

stabilization; properties are deemed stabilized at the earlier of

(i) reaching 90% leased or (ii) one year following a project’s

inclusion in operating real estate. Same property NOI assists in

eliminating disparities in net income due to the development,

acquisition or disposition of properties during the particular

period presented, and thus provides a more consistent performance

measure for the comparison of the company's properties. The

company’s method of calculating Same property NOI may differ from

methods used by other REITs and, accordingly, may not be comparable

to such other REITs.

(2)

Amounts represent Kimco Realty's pro-rata

share.

Reconciliation of the

Projected Range of Net Income Available to the Company's Common

Shareholders

to Funds From Operations Available to the Company's Common

Shareholders (unaudited, all amounts shown are per diluted

share) Projected Range Full Year 2023

Low High Net income

available to the company's common shareholders

$

0.92

$

0.96

Gain on sale of properties

(0.06

)

(0.09

)

Gain on sale of joint venture properties

(0.01

)

(0.02

)

Depreciation & amortization - real estate related

0.81

0.83

Depreciation & amortization - real estate joint ventures

0.10

0.11

Impairment charges (including real estate joint ventures)

0.02

0.02

Special dividend income (1)

(0.31

)

(0.31

)

Loss/(gain) on marketable securities, net

0.02

0.02

Provision for income taxes (2)

0.05

0.05

FFO available to the company's common shareholders

$

1.54

$

1.57

(1)

Related to the special cash dividend from ACI.

(2)

Related to gains, impairments, depreciation on properties and

gains/(losses) on sales of marketable securities, where applicable.

Projections involve numerous assumptions such as rental income

(including assumptions on percentage rent), interest rates, tenant

defaults, occupancy rates, selling prices of properties held for

disposition, expenses (including salaries and employee costs),

insurance costs and numerous other factors. Not all of these

factors are determinable at this time and actual results may vary

from the projected results, and may be above or below the range

indicated. The above range represents management’s estimate of

results based upon these assumptions as of the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230427005211/en/

David F. Bujnicki Senior Vice President, Investor Relations and

Strategy Kimco Realty Corp. 1-866-831-4297

dbujnicki@kimcorealty.com

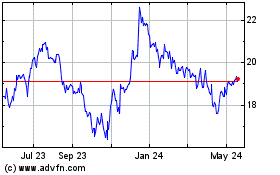

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

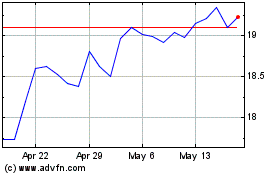

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Jan 2024 to Jan 2025