Morgan Stanley Investment Management (“MSIM”) today announced

the launch of its latest ETF, Parametric Equity Plus ETF (Ticker:

“PEPS”), a US large-cap equity strategy. Since the introduction of

MSIM’s first ETFs in 2023, the platform has grown to over $3.3

billion in ETF assets with 16 total strategies that span asset

classes and themes. Listed on the Nasdaq, the latest addition to

the platform is the third Parametric ETF brought to market and

follows the conversion of three active fixed income mutual funds to

Eaton Vance ETFs earlier this year.

“MSIM’s ETF platform continues to expand by introducing

differentiated strategies that address the range of investor needs

for accessing market exposures within an ETF structure,” said Brian

Weinstein, Head of Global Markets at MSIM. “We are pleased with the

strong growth to over $3.3 billion in ETF assets from both

institutional and retail investors in less than two years and

remain focused on building a comprehensive platform that reflects

our distinct capabilities across asset classes.”

The Fund seeks to provide long term capital appreciation by

investing in an underlying portfolio of US large cap equities

through Parametric’s direct indexing capabilities, which seeks to

minimize tracking error versus the benchmark index. The equity

portfolio is then enhanced with a rules-based options strategy and

a risk management strategy. PEPS potentially offers investors

equity market outperformance with similar volatility and drawdown

risk to the benchmark. Additionally, the strategy may utilize

Parametric’s well-known active tax management techniques.

“This latest ETF strategy combines Parametric’s industry-leading

capabilities in options-based strategies and direct indexing to

offer US large-cap equity exposure plus additional upside

potential,” said Thomas Lee, Co-President and Chief Investment

Officer at Parametric. “We are pleased to add to the MSIM ETF

platform and meet client demand for our investment expertise in a

vehicle that offers daily liquidity at a lower cost.”

MSIM’s ETF platform is comprised of 16 total products including

the three Parametric-branded equity- and options-based strategies,

six Calvert-branded ETFs, and seven Eaton Vance-branded fixed

income strategies. Launched in early 2023, the platform has grown

to over $3.3 billion in assets.

About Morgan Stanley Investment Management

Morgan Stanley Investment Management, together with its

investment advisory affiliates, has more than 1,400 investment

professionals around the world and $1.6 trillion in assets under

management or supervision as of September 30, 2024. Morgan Stanley

Investment Management strives to provide outstanding long-term

investment performance, service, and a comprehensive suite of

investment management solutions to a diverse client base, which

includes governments, institutions, corporations and individuals

worldwide. For further information about Morgan Stanley Investment

Management, please visit www.morganstanley.com/im.

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services

firm providing a wide range of investment banking, securities,

wealth management and investment management services. With offices

in 42 countries, the Firm's employees serve clients worldwide

including corporations, governments, institutions and individuals.

For more information about Morgan Stanley, please visit

www.morganstanley.com.

Please consider the investment objective, risks, charges and

expenses of the fund carefully before investing. The prospectus

contains this and other information about the fund. To obtain a

prospectus (which includes the applicable fund's current fees and

expenses, if different from those in effect as of the date of this

material), download one at eatonvance.com or contact your

financial professional. Please read the prospectus carefully before

investing.

Risk Considerations: Equity - In general,

equities securities’ values also fluctuate in response to

activities specific to a company. Liquidity - Illiquid

Securities. The fund may make investments in securities that

are or become illiquid or less liquid and which may be more

difficult to sell and value(liquidity risk). Information

Technology Sector Risk. To the extent the Fund invests a

substantial portion of its assets in the information technology

sector, the value of Fund shares may be particularly impacted by

events that adversely affect the information technology sector,

such as rapid changes in technology product cycles, product

obsolescence, government regulation, and competition, and may

fluctuate more than that of a fund that does not invest

significantly in companies in the technology sector. Market

& Geopolitical - Funds are subject to market risk, which is

the possibility that the market values of securities owned by the

fund will decline. Market values can change daily due to economic

and other events (e.g. natural disasters, health crises, terrorism,

conflicts and social unrest) that affect markets, countries,

companies or governments. It is difficult to predict the timing,

duration, and potential adverse effects (e.g. portfolio liquidity)

of events. Accordingly, you can lose money investing in this fund.

Please be aware that this fund may be subject to certain additional

risks. Derivative Instruments. The use of derivatives may

disproportionately increase losses and have a significant impact on

performance. They also may be subject to counterparty, liquidity,

valuation, correlation and market risks. Call Option Writing

Risk. Writing call options involves the risk that the Fund may

be required to sell the underlying security or instrument (or

settle in cash an amount of equal value) at a disadvantageous price

or below the market price of such underlying security or

instrument, at the time the option is exercised. As the writer of a

call option, the Fund forgoes, during the option’s life, the

opportunity to profit from increases in the market value of the

underlying security or instrument covering the option above the sum

of the premium and the exercise price, potentially causing

underperformance in rising markets, but retains the risk of loss

should the price of the underlying security or instrument decline.

The Fund’s call option writing strategy may not fully protect it

against declines in the value of the market. The use of call

options could increase the volatility of the Fund’s returns and may

increase the risk of loss to the Fund. There are special risks

associated with uncovered option writing which expose the Fund to

potentially significant loss. FLEX Options. The Fund

utilizes FLEX Options guaranteed for settlement by the Options

Clearing Corporation (“OCC”). The Fund may suffer significant

losses if the OCC is unable or unwilling to perform its obligations

or becomes insolvent or otherwise unable to meet its obligations.

FLEX Options may be less liquid than other securities or options.

The Fund may be negatively impacted if market participants are not

willing or able to enter into transactions involving FLEX Options

with the Fund in relation to creation and redemption transactions.

The Fund may experience losses from certain FLEX Option positions

and certain FLEX Option positions may expire with little to no

value. Authorized Participant Concentration Risk. The Fund

has a limited number of intermediaries that act as authorized

participants and none of these authorized participants is or will

be obligated to engage in creation or redemption transactions. As a

result, shares may trade at a discount to net asset value (“NAV”)

and possibly face trading halts and/or delisting. Trading

Risk. The market prices of shares of the Fund are expected to

fluctuate, in some cases materially, in response to changes in the

Fund's NAV, the intra-day value of holdings, and supply and demand

for Shares. The adviser and subadviser cannot predict whether

shares will trade above, below or at their NAV. Buying or selling

shares in the secondary market may require paying brokerage

commissions or other charges imposed by brokers as determined by

that broker. Active Management Risk. In pursuing the Fund’s

investment objective, the adviser and/or sub adviser has

considerable leeway in deciding which investments to buy, hold or

sell on a day-to-day basis, and which trading strategies to use.

For example, the adviser and/or subadviser, in its discretion, may

determine to use some permitted trading strategies while not using

others. The success or failure of such decisions will affect the

Fund’s performance. New Fund Risk. A new fund's performance

may not represent how the fund is expected to or may perform in the

long term. In addition, there is a limited operating history for

investors to evaluate and the fund may not attract sufficient

assets to achieve investment and trading efficiencies.

Underlying Index and ETF Risk. The Fund invests in options

and futures that derive their value from an underlying index or

underlying ETF, and therefore, in addition to the performance of

the Equity Portfolio, the Fund’s investment performance at least

partially depends on the investment performance of the Underlying

Index or Underlying ETF. The value of the Underlying Index or

Underlying ETF will fluctuate over time based on fluctuations in

the values of the securities that comprise the Underlying Index or

Underlying ETF, which may be affected by changes to general

economic conditions, expectations for future growth and profits,

interest rates and the supply and demand for those securities.

Correlation Risk. As an option approaches its expiration

date, its value typically will increasingly move with the value of

the Underlying Index or the Underlying ETF. However, the value of

the options may vary prior to the expiration date because of

related factors other than the value of the Underlying Index or the

Underlying ETF, including the value of the options include interest

rate changes and implied volatility levels of the Underlying Index

or the Underlying ETF, among others. Clearing Member Risk.

Transactions in some types of derivatives, including FLEX Options,

are required to be centrally cleared (“cleared derivatives”). In a

transaction involving cleared derivatives, the Fund’s counterparty

is a clearing house, such as the OCC, rather than a bank or broker

and the Fund will hold cleared derivatives through accounts at

clearing members. The Fund is also subject to the risk that a

limited number of clearing members are willing to transact on the

Fund’s behalf, which heightens the risks associated with a clearing

member’s default. If a clearing member defaults, the Fund could

lose some or all of the benefits of a transaction entered into by

the Fund with the clearing member. The loss of a clearing member

for the Fund to transact with could result in increased transaction

costs and other operational issues that could impede the Fund’s

ability to implement its investment strategy. Counterparty.

Counterparty risk generally refers to the risk that a counterparty

on a derivatives transaction may not be willing or able to perform

its obligations under the derivatives contract, and the related

risks of having concentrated exposure to such a counterparty. If an

OCC clearing member or OCC becomes insolvent, the Fund may have its

positions closed or experience delays or difficulties in closing or

exercising its FLEX Options positions and the Fund could suffer

significant losses. Tax Risk. The Fund intends to limit the

overlap between its stock holdings and the stock holdings of the

underlying ETF or underlying index of options to less than 70% on

an ongoing basis in an effort to avoid being subject to the

“straddle rules” under federal income tax law. The Fund expects

that the option contracts it writes will not be considered

straddles. Under certain circumstances, however, the Fund may enter

into options transactions or certain other investments that may

constitute positions in a straddle. The straddle rules may affect

the character of gains (or losses) realized by the Fund.

Eaton Vance, Parametric and Calvert are part of Morgan Stanley

Investment Management, the asset management division of Morgan

Stanley. Morgan Stanley Investment Management Inc. is the adviser

to the ETFs. Parametric Portfolio Associates LLC is the subadviser

to the Parametric ETFs.

ETFs are distributed by Foreside Fund Services LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107183786/en/

Media Contact: Lauren Bellmare

Lauren.Bellmare@MorganStanley.com

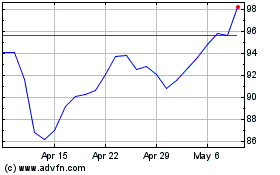

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Jan 2025 to Feb 2025

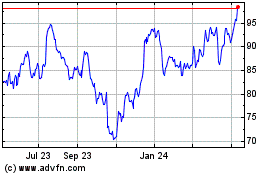

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Feb 2024 to Feb 2025