Tech Enhancements from Morgan Stanley at Work Drive Scale and Chart Path for Integrated Experience in 2025

29 January 2025 - 2:00AM

Business Wire

Suite of platform enhancements drive increased automation and

intuitive user experience across Morgan Stanley at Work platforms

for 2025

Morgan Stanley at Work announced a series of technology

enhancements that continue to deliver automation and intuitive user

experiences across its range of workplace benefits

platforms—including equity compensation, retirement and executive

services, as well as savings and giving programs.

Together, Morgan Stanley at Work platforms Equity Edge Online®

(EEO) and Shareworks serve roughly 40% of the S&P 500 in the

US.1 Similar to Shareworks, EEO clients can now:

- Customize incentive award packages and let participants select

their award type allocations within a single, integrated E*TRADE

retail platform.

- Leverage data points to define automated rules for including or

removing participant populations from ESPP eligibility.

- Streamline trade restriction and blackout management for

specific groups of participants, helping with regulatory compliance

and allowing administrators to target their controls and oversight

during sensitive trading windows.

- Enhanced ability for administrators to approve and implement

international tax rates, mitigating manual intervention and

supporting greater scale and accuracy for a global workforce.

And on the Shareworks platform:

- The introduction of user-friendly stock certificate filtering

and sorting features, allowing Private Markets participants to

organize and select specific stock certificates for sale according

to their personal financial goals.

- Increased flexibility in the tender offer workflow through

customizable tables that are specifically designed for different

types of equity, allowing issuers to easily display and adjust

information and move custom fields into the letter of transmittal

for a smoother, more precise participant experience.

- New digital in-platform spousal consent and streamlined

reporting provide increased clarity and auditability in authorizing

who can sign liquidity event documents.

- Consolidated tax mobility engine for easier onboarding and

feature upgrades, including migration of cost basis reporting to

Morgan Stanley’s centralized system for more efficient and reliable

year-end tax procedures.

“As we continue to innovate, our focus remains on delivering

greater scale and ease for those managing a mobile, global

workforce,” said Mark Mitchell, Chief Product Officer of Morgan

Stanley at Work. “We’re investing heavily in performance

enhancements across all our platforms—saving time for critical

tasks and taking our cutting-edge administrative experiences to the

next level. There’s much to look forward to in 2025 as we chart a

path toward a more fully integrated user experience.”

About Morgan Stanley at Work Morgan Stanley at Work

provides workplace financial benefits that build financial

confidence and foster loyalty—helping companies attract and retain

top talent. Our end-to-end solutions support your organization at

any stage of growth through a powerful combination of modern

technology, insightful guidance, and dedicated service; they

include Equity, Retirement, Deferred Compensation, Executive

Services, and Saving and Giving solutions. And while we’re

fulfilling your company’s benefits needs, we’re also enhancing your

employees’ financial well-being. Each benefit solution also

includes our engaging Financial Wellness program, which provides

employees with knowledge, tools, and support to help them make the

most of their benefits and achieve their life goals.

About Morgan Stanley Wealth Management Morgan Stanley

Wealth Management is a leading financial services firm that

provides access to a wide range of products and services to

individuals, businesses, and institutions, including brokerage and

investment advisory services, financial and wealth planning, cash

management and lending products and services, annuities and

insurance, retirement, and trust services.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its

Financial Advisors and Private Wealth Advisors do not provide any

tax/legal advice. Consult your own tax/legal advisor before making

any tax or legal-related investment decisions.

About Morgan Stanley Morgan Stanley is a leading global

financial services firm providing a wide range of investment

banking, securities, wealth management and investment management

services. With offices in 42 countries, the Firm’s employees serve

clients worldwide including corporations, governments, institutions

and individuals. For further information about Morgan Stanley,

please visit www.morganstanley.com.

Content and services available to non-US participants may be

different than those available to US participants. Morgan Stanley

Wealth Management is the trade name of Morgan Stanley Smith Barney

LLC, a registered broker-dealer in the United States.

© 2025 Morgan Stanley at Work services are provided by Morgan

Stanley Smith Barney LLC, member SIPC, and its affiliates, all

wholly owned subsidiaries of Morgan Stanley.

____________________________ 1 S&P 500 Companies Represented

includes companies for which Morgan Stanley provides equity

compensation solutions as of July 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128819033/en/

Media Relations: Lynn Cocchiola,

Lynn.Cocchiola@morganstanley.com Jeanne Joe Perrone,

Jeanne.Perrone@morganstanley.com

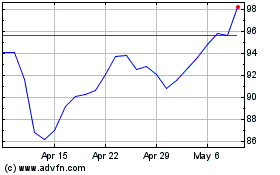

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Dec 2024 to Jan 2025

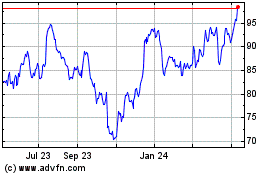

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Jan 2024 to Jan 2025