Nu Skin Enterprises Inc. (NYSE: NUS) today announced third

quarter results in line with guidance.

Executive Summary Q3 2024 vs. Prior-year

Quarter

Revenue

$430.1 million; (13.8)%

- (3.4)% FX impact or $(16.7) million

- Rhyz revenue $73.1 million; 20.9%

Earnings Per Share

(EPS)

$0.17 compared to $(0.74) or $0.56

excluding an inventory write-off

Customers

831,768; (15)%

Paid Affiliates

149,264; (20)% or (11)% excluding an

adjustment to eligibility requirements

Sales Leaders

38,284; (19)%

“During the third quarter, we achieved results within our

previous guidance range with challenges in the core business

partially offset by continued strong growth in our Rhyz segment,”

said Ryan Napierski, Nu Skin president and CEO. “While we continue

to face macroeconomic pressures and challenges within the direct

selling industry, our immediate focus is to strengthen the Nu Skin

core with a revised business model intended to improve channel

activation and customer growth beginning with North America and

South Korea this quarter. In addition, we are introducing a

streamlined operating framework to improve profitability with an

adjusted pricing model to improve customer penetration in

developing markets starting with Latin America and certain markets

in Southeast Asia, and an accelerated product portfolio

optimization plan to improve overall gross margin globally. We also

continue to empower growth in our Rhyz businesses with impressive

results coming from Mavely and our manufacturing companies.”

Q3 2024 Year-over-year Operating Results

Revenue

$430.1 million compared to $498.8

million

- (3.4)% FX impact or $(16.7) million

- Rhyz revenue $73.1 million; 20.9%

Gross Margin

70.1% compared to 58.6% or 71.8% excluding

an inventory write-off

- Nu Skin business was 76.5% compared to 61.8% or 76.8% excluding

an inventory write-off

Selling Expenses

39.0% compared to 37.6%

- Nu Skin business was 43.5% compared to 41.7%

- Includes expense for biannual sales conferences

G&A Expenses

26.9% compared to 26.2%

Operating Margin

4.2% compared to (5.3)% or 7.9% excluding

an inventory write-off

Interest Expense

$6.5 million compared to $7.5 million

Other Income/(Expense)

$1.6 million compared to $(0.6)

million

Income Tax Rate

37.6% compared to (7.3)% or 10.1%

excluding an inventory write-off

EPS

$0.17 compared to $(0.74) or $0.56

excluding an inventory write-off

Stockholder Value

Dividend Payments

$3.0 million

Stock Repurchases

$0.0 million

- $162.4 million remaining in authorization

Q4 and Full-year 2024 Outlook

Q4 2024 Revenue

$410 to $445 million; (16)% to (9)%

- Approximately (2) to (1)% FX impact

Q4 2024 EPS

$(0.09) to $0.01 or $0.19 to $0.29

non-GAAP

2024 Revenue

$1.70 to $1.73 billion; (14)% to (12)%

- Approximately (4) to (3)% FX impact

2024 EPS

$(2.32) to $(2.22) or $0.65 to $0.75

non-GAAP

“As part of our cost-efficiency program, during the quarter we

saved an additional $15 million in general and administrative

expense and remain on track to meet the high end of our range of

$45 to $65 million for 2024,” said James D. Thomas, chief financial

officer. “During the quarter, we generated $31.4 million in cash

from operations, reduced inventory levels $43 million year over

year and paid down debt to further strengthen our balance sheet.

Given ongoing pressures in the core Nu Skin business, we are

adjusting our 2024 outlook. We now anticipate 2024 revenue in the

range of $1.70 to $1.73 billion, with earnings per share of $(2.32)

to $(2.22) or $0.65 to $0.75 excluding restructuring and impairment

charges. For Q4, we are forecasting projected revenue of $410 to

$445 million and earnings per share of $(0.09) to $0.01 or $0.19 to

$0.29 excluding planned restructuring charges.”

Conference Call

The Nu Skin Enterprises management team will host a conference

call with the investment community today at 5 p.m. (ET). Those

wishing to access the webcast, as well as the financial information

presented during the call, can visit the Investor Relations page on

the company's website at ir.nuskin.com. A replay of the webcast

will be available on the same page through Nov. 21, 2024.

About Nu Skin Enterprises Inc.

The Nu Skin Enterprises Inc. (NYSE: NUS) family of companies

includes Nu Skin and Rhyz Inc. Nu Skin is an integrated beauty and

wellness company, powered by a dynamic affiliate opportunity

platform, which operates in nearly 50 markets worldwide. Backed by

40 years of scientific research, the company’s products help people

look, feel and live their best with brands including Nu Skin®

personal care, Pharmanex® nutrition and ageLOC® anti-aging, which

includes an award-winning line of beauty device systems. Formed in

2018, Rhyz is a synergistic ecosystem of consumer, technology and

manufacturing companies focused on innovation within the beauty,

wellness and lifestyle categories.

Important Information Regarding Forward-Looking

Statements: This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that represent the company’s current

expectations and beliefs. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws and include, but are not limited

to, statements of management’s expectations regarding the macro

environment and the company’s performance, growth and growth

opportunities, strategies, initiatives, areas of focus, sales

force, shareholder value, product previews and launches, product

portfolio optimization, transformation, evolution, operational and

financial initiatives, digital tools and initiatives, new market

expansion, and plans for developing and emerging markets;

projections regarding revenue, expenses, margins, tax rates,

earnings per share, foreign currency fluctuations, future

dividends, uses of cash, financial position and other financial

items; statements of belief; and statements of assumptions

underlying any of the foregoing. In some cases, you can identify

these statements by forward-looking words such as “believe,”

“expect,” “anticipate,” “become,” “plan,” accelerate,” “project,”

“continue,” “outlook,” “guidance,” “improve,” “enhance,” “will,”

“would,” “could,” “may,” “might,” the negative of these words and

other similar words.

The forward-looking statements and related assumptions involve

risks and uncertainties that could cause actual results and

outcomes to differ materially from any forward-looking statements

or views expressed herein. These risks and uncertainties include,

but are not limited to, the following:

- any failure of current or planned initiatives or products to

generate interest among the company’s sales force and customers and

generate sponsoring and selling activities on a sustained

basis;

- risk that direct selling laws and regulations in any of the

company’s markets, including the United States and Mainland China,

may be modified, interpreted or enforced in a manner that results

in negative changes to the company’s business model or negatively

impacts its revenue, sales force or business, including through the

interruption of sales activities, loss of licenses, increased

scrutiny of sales force actions, imposition of fines, or any other

adverse actions or events;

- economic conditions and events globally;

- competitive pressures in the company’s markets;

- risk that epidemics, including COVID-19 and related

disruptions, or other crises could negatively impact our

business;

- adverse publicity related to the company’s business, products,

industry or any legal actions or complaints by the company’s sales

force or others;

- political, legal, tax and regulatory uncertainties, including

trade policies, associated with operating in Mainland China and

other international markets;

- uncertainty regarding meeting restrictions and other government

scrutiny in Mainland China, as well as negative media and consumer

sentiment in Mainland China on our business operations and

results;

- risk of foreign-currency fluctuations and the currency

translation impact on the company’s business associated with these

fluctuations;

- uncertainties regarding the future financial performance of the

businesses the company has acquired;

- risks related to accurately predicting, delivering or

maintaining sufficient quantities of products to support planned

initiatives or launch strategies, and increased risk of inventory

write-offs if the company over-forecasts demand for a product or

changes its planned initiatives or launch strategies;

- regulatory risks associated with the company’s products, which

could require the company to modify its claims or inhibit its

ability to import or continue selling a product in a market if the

product is determined to be a medical device or if the company is

unable to register the product in a timely manner under applicable

regulatory requirements; and

- the company’s future tax-planning initiatives, any prospective

or retrospective increases in duties or tariffs on the company’s

products imported into the company’s markets outside of the United

States, and any adverse results of tax audits or unfavorable

changes to tax laws in the company’s various markets.

The company’s financial performance and the forward-looking

statements contained herein are further qualified by a detailed

discussion of associated risks set forth in the documents filed by

the company with the Securities and Exchange Commission. The

forward-looking statements set forth the company’s beliefs as of

the date that such information was first provided, and the company

assumes no duty to update the forward-looking statements contained

in this release to reflect any change except as required by

law.

Non-GAAP Financial Measures: Constant-currency revenue

change is a non-GAAP financial measure that removes the impact of

fluctuations in foreign-currency exchange rates, thereby

facilitating period-to-period comparisons of the company’s

performance. It is calculated by translating the current period’s

revenue at the same average exchange rates in effect during the

applicable prior-year period and then comparing that amount to the

prior-year period’s revenue. The company believes that

constant-currency revenue change is useful to investors, lenders

and analysts because such information enables them to gauge the

impact of foreign-currency fluctuations on the company’s revenue

from period to period.

Earnings per share, gross margin, operating margin and income

tax rate, each excluding restructuring and impairment charges

and/or inventory write-off charges, also are non-GAAP financial

measures. Restructuring and impairment charges and inventory

write-off charges are not part of the ongoing operations of our

underlying business. The company believes that these non-GAAP

financial measures are useful to investors, lenders and analysts

because removing the impact of these charges facilitates

period-to-period comparisons of the company’s performance. Please

see the reconciliations of these items to our earnings per share,

gross margin, operating margin and income tax rate calculated under

GAAP, below.

The following table sets forth revenue for the three-month

periods ended September 30, 2024, and 2023 for each of our

reportable segments (U.S. dollars in thousands):

Three Months Ended

September 30,

Constant-

Currency

2024

2023

Change

Change

Nu Skin

Americas

$

77,194

$

91,671

(15.8)%

0.1%

Southeast Asia/Pacific

59,515

68,743

(13.4)%

(13.2)%

Mainland China

53,020

70,225

(24.5)%

(25.4)%

Japan

47,222

53,399

(11.6)%

(8.9)%

South Korea

45,201

63,709

(29.1)%

(27.1)%

Europe & Africa

38,577

50,048

(22.9)%

(23.6)%

Hong Kong/Taiwan

33,749

40,724

(17.1)%

(16.4)%

Nu Skin other

2,518

(274)

1,019.0%

1,019.0%

Total Nu Skin

356,996

438,245

(18.5)%

(14.7)%

Rhyz Investments

Manufacturing

51,773

49,714

4.1%

4.1%

Rhyz other

21,376

10,813

97.7%

97.7%

Total Rhyz Investments

73,149

60,527

20.9%

20.9%

Total

$

430,145

$

498,772

(13.8)%

(10.4)%

The following table sets forth revenue for the nine-month

periods ended September 30, 2024, and 2023 for each of our

reportable segments (U.S. dollars in thousands):

Nine Months Ended

September 30,

Constant-

Currency

2024

2023

Change

Change

Nu Skin

Americas

$

237,160

$

300,469

(21.1)%

(12.1)%

Southeast Asia/Pacific

179,921

200,317

(10.2)%

(7.4)%

Mainland China

178,797

226,563

(21.1)%

(19.2)%

Japan

134,045

156,867

(14.5)%

(6.5)%

South Korea

130,283

187,719

(30.6)%

(28.0)%

Europe & Africa

121,564

144,460

(15.8)%

(16.0)%

Hong Kong/Taiwan

98,061

112,380

(12.7)%

(10.8)%

Nu Skin other

3,186

208

1,431.7%

1,431.7%

Total Nu Skin

1,083,017

1,328,983

(18.5)%

(14.3)%

Rhyz Investments

Manufacturing

153,548

131,032

17.2%

17.2%

Rhyz other

49,967

20,476

144.0%

144.0%

Total Rhyz Investments

203,515

151,508

34.3%

34.3%

Total

$

1,286,532

$

1,480,491

(13.1)%

(9.3)%

The following table provides information concerning the number

of Customers, Paid Affiliates and Sales Leaders in our core Nu Skin

business for the three-month periods ended September 30, 2024, and

2023:

Three Months Ended

September 30,

2024

2023

Change

Customers

Americas

211,583

231,215

(8)%

Southeast Asia/Pacific

86,307

111,151

(22)%

Mainland China

148,402

189,221

(22)%

Japan

112,257

114,316

(2)%

South Korea

90,248

109,550

(18)%

Europe & Africa

135,291

169,320

(20)%

Hong Kong/Taiwan

47,680

54,134

(12)%

Total Customers

831,768

978,907

(15)%

Paid Affiliates

Americas

28,772

32,769

(12)%

Southeast Asia/Pacific(1)

26,749

33,574

(20)%

Mainland China

22,843

27,509

(17)%

Japan(1)

22,623

37,695

(40)%

South Korea

20,774

24,110

(14)%

Europe & Africa

16,556

19,254

(14)%

Hong Kong/Taiwan

10,947

11,251

(3)%

Total Paid Affiliates

149,264

186,162

(20)%

Sales Leaders

Americas

6,450

7,537

(14)%

Southeast Asia/Pacific

5,398

6,351

(15)%

Mainland China

9,348

12,647

(26)%

Japan

6,866

7,087

(3)%

South Korea

4,388

6,436

(32)%

Europe & Africa

3,318

4,105

(19)%

Hong Kong/Taiwan

2,516

2,868

(12)%

Total Sales Leaders

38,284

47,031

(19)%

(1) The September 30, 2024, number is

affected by a change in eligibility requirements for receiving

certain rewards within our compensation structure. We plan to

implement these changes in additional segments over the next

several quarters.

- “Customers” are persons who have purchased directly from the

Company during the three months ended as of the date indicated. Our

Customer numbers include members of our sales force who made such a

purchase, including Paid Affiliates and those who qualify as Sales

Leaders, but they do not include consumers who purchase directly

from members of our sales force.

- “Paid Affiliates” are any Brand Affiliates, as well as members

of our sales force in Mainland China, who earned sales compensation

during the three-month period. In all of our markets besides

Mainland China, we refer to members of our independent sales force

as “Brand Affiliates” because their primary role is to promote our

brand and products through their personal social networks.

- “Sales Leaders” are the three-month average of our monthly

Brand Affiliates, as well as sales employees and independent

marketers in Mainland China, who achieved certain qualification

requirements as of the end of each month of the quarter.

NU SKIN ENTERPRISES,

INC.

Consolidated Statements of

Income (Unaudited)

(U.S. dollars in thousands,

except per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

430,145

$

498,772

$

1,286,532

$

1,480,491

Cost of sales

128,682

206,505

383,828

475,635

Gross profit

301,463

292,267

902,704

1,004,856

Operating expenses:

Selling expenses

167,612

187,750

486,617

561,039

General and administrative expenses

115,620

130,882

358,107

401,825

Restructuring and impairment expenses

—

—

156,484

9,787

Total operating expenses

283,232

318,632

1,001,208

972,651

Operating income (loss)

18,231

(26,365)

(98,504)

32,205

Interest expense

6,500

7,535

20,545

18,192

Other income (expense), net

1,567

(551)

1,800

3,237

Income (loss) before provision for income

taxes

13,298

(34,451)

(117,249)

17,250

Provision (benefit) for income taxes

4,996

2,504

(6,760)

15,937

Net income (loss)

$

8,302

$

(36,955)

$

(110,489)

$

1,313

Net income (loss) per share:

Basic

$

0.17

$

(0.74)

$

(2.23)

$

0.03

Diluted

$

0.17

$

(0.74)

$

(2.23)

$

0.03

Weighted-average common shares outstanding

(000s):

Basic

49,707

49,859

49,645

49,812

Diluted

49,733

49,859

49,645

50,029

NU SKIN ENTERPRISES,

INC.

Consolidated Balance Sheets

(Unaudited)

(U.S. dollars in thousands)

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

227,751

$

256,057

Current investments

10,077

11,759

Accounts receivable, net

68,812

72,879

Inventories, net

247,789

279,978

Prepaid expenses and other

98,942

81,198

Total current assets

653,371

701,871

Property and equipment, net

410,673

432,965

Operating lease right-of-use assets

85,550

90,107

Goodwill

99,885

230,768

Other intangible assets, net

85,266

105,309

Other assets

248,150

245,443

Total assets

$

1,590,895

$

1,806,463

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

32,736

$

43,505

Accrued expenses

246,615

260,366

Current portion of long-term debt

60,000

25,000

Total current liabilities

339,351

328,871

Operating lease liabilities

68,351

70,943

Long-term debt

373,470

478,040

Other liabilities

94,848

106,641

Total liabilities

876,020

984,495

Commitments and contingencies

Stockholders’ equity:

Class A common stock – 500 million shares

authorized, $0.001 par value, 90.6 million shares issued

91

91

Additional paid-in capital

624,665

621,853

Treasury stock, at cost – 40.9 million and

41.1 million shares

(1,563,878)

(1,570,440)

Accumulated other comprehensive loss

(105,040)

(100,006)

Retained earnings

1,751,037

1,870,470

Total stockholders' equity

706,875

821,968

Total liabilities and stockholders’

equity

$

1,582,895

$

1,806,463

NU SKIN ENTERPRISES,

INC.

Reconciliation of Gross Margin

Excluding Impact of Inventory Write-off to GAAP Gross

Margin

(in thousands, except for per

share amounts)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Gross Profit

$

301,463

$

292,267

$

902,704

$

1,004,856

Impact of inventory write-off

-

65,728

-

65,728

Adjusted Gross Profit

$

301,463

$

357,995

$

902,704

$

1,070,584

Gross Margin

70.1%

58.6%

70.2%

67.9%

Gross Margin, excluding inventory

write-off impact

70.1%

71.8%

70.2%

72.3%

Revenue

$

430,145

$

498,772

$

1,286,532

$

1,480,491

NU SKIN ENTERPRISES,

INC.

Reconciliation of Core Nu Skin

Business Gross Margin Excluding Impact of Inventory Write-off to

GAAP Gross Margin

(in thousands, except for per

share amounts)

Three months ended

September 30,

2024

2023

Gross Profit

$

273,155

$

270,630

Impact of inventory write-off

-

65,728

Adjusted Gross Profit

$

273,155

$

336,358

Gross Margin

76.5%

61.8%

Gross Margin, excluding inventory

write-off impact

76.5%

76.8%

Revenue

$

356,996

$

438,245

NU SKIN ENTERPRISES,

INC.

Reconciliation of

Operating Margin Excluding Impact of Inventory Write-off,

Restructuring and Impairment to GAAP Operating Margin

(in thousands, except for per

share amounts)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Operating Income

$

18,231

$

(26,365)

$

(98,504)

$

32,205

Impact of restructuring and impairment

-

-

156,484

9,787

Impact of inventory write-off

-

65,728

-

65,728

Adjusted operating income

$

18,231

$

39,363

$

57,980

$

107,720

Operating margin

4.2%

(5.3)%

(7.7)%

2.2%

Operating margin, excluding inventory

write-off, restructuring and impairment impact

4.2%

7.9%

4.5%

7.3%

Revenue

$

430,145

$

498,772

$

1,286,532

$

1,480,491

NU SKIN ENTERPRISES,

INC.

Reconciliation of Effective

Tax Rate Excluding Impact of Inventory Write-off, Restructuring and

Impairment to GAAP Effective Tax Rate

(in thousands, except for per

share amounts)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Provision (benefit) for income taxes

$

4,996

$

2,504

$

(6,760)

$

15,937

Impact of inventory write-off,

restructuring and impairment on provision for income taxes

-

650

23,071

3,243

Provision for income taxes, excluding

impact of inventory write-off, restructuring and impairment

$

4,996

$

3,154

$

16,311

$

19,180

Income before provision for income

taxes

13,298

(34,451)

(117,249)

17,250

Impact of inventory write-off

-

65,728

-

65,728

Impact of restructuring and impairment

-

-

156,484

9,787

Income before provision for income taxes,

excluding impact of inventory write-off, restructuring and

impairment

$

13,298

$

31,277

$

39,235

$

92,765

Effective tax rate

37.6%

(7.3)%

5.8%

92.4%

Effective tax rate, excluding impact of

inventory write-off, restructuring and impairment

37.6%

10.1%

41.6%

20.7%

NU SKIN ENTERPRISES,

INC.

Reconciliation of Earnings Per

Share Excluding Impact of Inventory Write-off, Restructuring and

Impairment to GAAP Earnings Per Share

(in thousands, except for per

share amounts)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Net income

$

8,302

$

(36,955)

$

(110,489)

$

1,313

Impact of inventory write-off

-

65,728

-

65,728

Impact of restructuring and impairment

-

-

156,484

9,787

Tax impact

-

(650)

(23,071)

(3,243)

Adjusted net income

$

8,302

$

28,123

$

22,924

$

73,585

Diluted earnings per share

$

0.17

$

(0.74)

$

(2.23)

$

0.03

Diluted earnings per share, excluding

inventory write-off, restructuring and impairment impact

$

0.17

$

0.56

$

0.46

$

1.47

Weighted-average common shares outstanding

(000)

49,733

49,859

49,645

50,029

NU SKIN ENTERPRISES,

INC.

Reconciliation of Earnings Per

Share Excluding Impact of Restructuring and Impairment to GAAP

Earnings Per Share

Three months ended

December 31, 2024

Year ended

December 31, 2024

Low end

High end

Low end

High end

Earnings Per Share

$

(0.09)

$

0.01

$

(2.32)

$

(2.22)

Impact of restructuring and impairment

expense:

Restructuring and impairment

0.40

0.40

3.55

3.55

Tax impact

(0.12)

(0.12)

(0.58)

(0.58)

Adjusted EPS

$

0.19

$

0.29

$

0.65

$

0.75

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107526723/en/

Media: media@nuskin.com, (801) 345-6397 Investors:

investorrelations@nuskin.com, (801) 345-3577

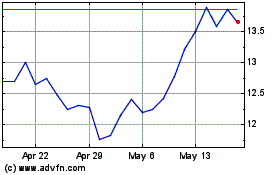

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Dec 2024 to Dec 2024

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Dec 2023 to Dec 2024