OppFi Upsizes Revolving Credit Facility with Affiliates of Blue Owl Capital to $300 Million

19 February 2025 - 12:00AM

Business Wire

OppFi Inc. (NYSE:OPFI) (“OppFi ” or the “Company”), a

tech-enabled, mission-driven specialty finance platform that

broadens the reach of community banks to extend credit access to

everyday Americans, today announced the Company increased the

existing revolving credit facility among one of the Company’s

subsidiaries and affiliates of Blue Owl Capital Inc. (“Blue Owl”)

to $300 million, up from $250 million. Blue Owl acquired Atalaya

Capital Management in September 2024.

“The increase in our credit facility with Blue Owl is a

testament to the strength of our business and our commitment to

facilitating credit access for hard-working consumers,” said Todd

Schwartz, Chief Executive Officer and Executive Chairman of OppFi.

“As we continue to scale and serve a growing number of customers,

it is important that our financing capabilities increase with us.

The expansion of this credit facility will aid our ability to

continue to meet increases in loan demand and deliver on our

mission of financial inclusion and profitable growth,” Schwartz

added.

OppFi increased the total capacity under this revolving credit

facility from $250 million to $300 million. The amended agreement

extends the maturity date to February 2029, increases funds

available for growth, and provides the Company the flexibility to

use balance sheet capital to extinguish corporate debt ahead of

schedule.

About OppFi

OppFi (NYSE: OPFI) is a tech-enabled, mission-driven specialty

finance platform that broadens the reach of community banks to

extend credit access to everyday Americans. Through a transparent

and responsible lending platform, which includes financial

inclusion and an excellent customer experience, the Company

supports consumers who are turned away by mainstream options to

build better financial health. OppLoans by OppFi maintains a

4.5/5.0 star rating on Trustpilot with more than 4,400 reviews,

making the Company one of the top consumer-rated financial

platforms online. OppFi also holds a 35% equity interest in Bitty

Advance, a credit access company that offers small businesses

revenue-based financing and other working capital solutions. For

more information, please visit oppfi.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. OppFi’s actual results

may differ from its expectations, estimates and projections and

consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “possible,” “continue,” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements include, without

limitation, statements regarding OppFi’s expectations with respect

to the future performance of OppFi’s platform and OppFi’s

expectations for its growth. These forward-looking statements are

based on OppFi’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. These forward-looking

statements involve significant risks and uncertainties that could

cause the actual results to differ materially from the expected

results. Most of these factors are outside OppFi’s control and are

difficult to predict. Factors that may cause such differences

include, but are not limited to: the impact of general economic

conditions, including economic slowdowns, inflation, interest rate

changes, recessions, and tightening of credit markets on OppFi’s

business; the impact of challenging macroeconomic and marketplace

conditions; the impact of stimulus or other government programs;

whether OppFi will be successful in obtaining declaratory relief

against the Commissioner of the Department of Financial Protection

and Innovation for the State of California; whether OppFi will be

subject to AB 539; whether OppFi’s bank partners will continue to

lend in California and whether OppFi’s financing sources will

continue to finance the purchase of participation rights in loans

originated by OppFi’s bank partners in California; the impact that

events involving financial institutions or the financial services

industry generally, such as actual concerns or events involving

liquidity, defaults, or non-performance, may have on OppFi’s

business; risks related to the material weakness in OppFi’s

internal controls over financial reporting; the ability of OppFi to

grow and manage growth profitably and retain its key employees;

risks related to new products; risks related to evaluating and

potentially consummating acquisitions; concentration risk; risks

related to OppFi’s ability to comply with various covenants in its

corporate and warehouse credit facilities; costs related to the

business combination; changes in applicable laws or regulations;

the possibility that OppFi may be adversely affected by other

economic, business, and/or competitive factors; risks related to

management transitions; risks related to the restatement of OppFi’s

financial statements and any accounting deficiencies or weaknesses

related thereto; and other risks and uncertainties indicated from

time to time in OppFi’s filings with the United States Securities

and Exchange Commission, in particular, contained in the section or

sections captioned “Risk Factors.” OppFi cautions that the

foregoing list of factors is not exclusive, and readers should not

place undue reliance upon any forward-looking statements, which

speak only as of the date made. OppFi does not undertake or accept

any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218241534/en/

Investor Relations: Mike Gallentine Head of Investor Relations

mgallentine@opploans.com

Media Relations: media@oppfi.com

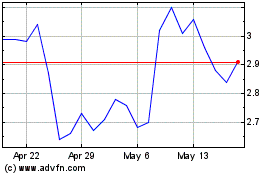

OppFi (NYSE:OPFI)

Historical Stock Chart

From Feb 2025 to Mar 2025

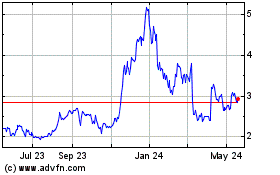

OppFi (NYSE:OPFI)

Historical Stock Chart

From Mar 2024 to Mar 2025