Saratoga Investment Corp. (NYSE: SAR) (“Saratoga Investment” or

“the Company”), a business development company (“BDC”), today

announced financial results for its 2025 fiscal third quarter ended

November 30, 2024.

Summary Financial Information

The Company’s summarized financial information

is as follows:

|

|

For the three months ended and as of |

|

($ in thousands, except per share) |

November 30, 2024 |

|

August 31, 2024 |

|

November 30, 2023 |

|

|

Assets Under Management (AUM) |

960,093 |

|

1,040,711 |

|

1,114,039 |

|

|

Net Asset Value (NAV) |

374,866 |

|

372,054 |

|

359,559 |

|

|

NAV per share |

26.95 |

|

27.07 |

|

27.42 |

|

|

Total Investment Income |

35,879 |

|

43,003 |

|

36,340 |

|

|

Net Investment Income (NII) per share |

0.90 |

|

1.33 |

|

1.09 |

|

|

Adjusted NII per share |

0.90 |

|

1.33 |

|

1.01 |

|

|

Earnings per share |

0.64 |

|

0.97 |

|

(0.31) |

|

|

Dividends per share (declared) |

0.74* |

|

0.74 |

|

0.72 |

|

|

Return on Equity – last twelve months |

9.2% |

|

5.8% |

|

6.6% |

|

|

– annualized quarter |

9.5% |

|

14.4% |

|

(4.5%) |

|

|

Originations |

84,490 |

|

2,584 |

|

35,612 |

|

|

Repayments |

160,404 |

|

60,140 |

|

2,144 |

|

|

|

* Actual dividend of $1.09 per share, including

the additional special dividend of $0.35 per share declared this

quarter in conjunction with the regular dividend.

Christian L. Oberbeck, Chairman and Chief

Executive Officer of Saratoga Investment, commented, “Highlights

this quarter include sequential quarterly increase of adjusted NII

excluding the effect of the one-time Knowland interest reserve

reversal, improved LTM ROE of 9.2%, another increase in NAV and

steady NAV per share, healthy originations in both new and existing

portfolio companies while also experiencing outsized redemptions of

successful investments, including some large ones, and continued

overearning of our dividends. From an overall investment value and

current yield perspective, our annualized third quarter dividend of

$0.74 per share implies a 12.2% dividend yield based on the stock

price of $24.21 per share on January 7, 2025. The substantial

overearning of the dividend this quarter continues to support the

current level of dividends, increases NAV, supports increased

portfolio growth and provides a cushion against adverse events.

This quarter’s earnings reflect the impact of the past six month

trend of decreasing levels of short-term interest rates and spreads

on Saratoga Investment’s largely floating rate assets, while not

yet recognizing the full period impact of the recent outsized

repayments experienced this quarter. The costs of most long-term

balance sheet liabilities are largely fixed though callable either

now or in the near future. In the context of the significant level

of available cash currently creating a negative arbitrage,

management is evaluating the use of such calls prospectively to

reduce current debt.”

“During the quarter, we began to see the early

stages of a potential increase in M&A in the lower middle

market, reflected in multiple repayments during the quarter, in

addition to significant new originations. As was the case in

previous quarters, our strong reputation and differentiated market

positioning, combined with our ongoing development of sponsor

relationships, continues to create attractive investment

opportunities from high quality sponsors.”

“Saratoga’s solid overall performance is

reflected in our continued strong key performance indicators this

past quarter, including: (i) quarterly ROE of 9.5% and LTM ROE of

9.2%, (ii) NAV increase of $2.8 million ($372.1 million to $374.9

million), (iii) adjusted NII per share increase of $0.01 per share

($0.89 to $0.90 per share) excluding the $7.6 million ($0.44 per

share) net impact of the one-time Knowland investment interest

reserve release in the previous and current quarter, (iv) dividend

of $0.74 per share, up 2.8% from $0.72 per share in the third

quarter of fiscal 2024, and (v) continued over-earning of the

current dividend, most recently resulting in the $0.35 per share

special dividend paid in December.”

“At the foundation of our strong operating

performance is the high-quality nature, resilience and balance of

our $960.1 million portfolio in the current environment. Where we

had encountered significant challenges in four of our portfolio

companies over the past year, we have completed decisive action and

resolved all four of these situations through two sales and two

restructurings. Our current core non-CLO portfolio was marked down

by $1.4 million this quarter, and the CLO and JV were marked down

by $4.0 million. This was offset by net realized gains of $1.2

million in the quarter on various repayments, and $0.7 million of

escrow realized gains, for a total net reduction in portfolio value

related to marks of $3.5 million this quarter. Our total portfolio

fair value is now 0.7% below cost, while our core non-CLO portfolio

is 3.0% above cost. The overall financial performance and strong

earnings power of our current portfolio reflects strong

underwriting in our solid, growing portfolio companies and sponsors

in well-selected industry segments.”

“We continue to remain prudent and discerning in

terms of new commitments in the current volatile environment.

Originations of $84.5 million this quarter were elevated as we

began to see the effect of declining interest rates and increased

M&A activity in the market. During the quarter, we originated

two new portfolio company investments while benefitting from eight

follow-on investments in existing portfolio companies that we know

well with strong business models and balance sheets.”

“Our quarter-end cash position grew to $250.2

million, largely due to an outsized $160.4 million of repayments in

five portfolio companies and amortizations, exceeding the

substantial $84.5 million of originations. The repayments included

the recognition of a $4.8 million realized gain on our Invita

investment, along with the repayment of $67 million of debt from

this successful five-year investment. This increase in cash and

cash equivalents has improved our effective leverage from 160.1%

regulatory leverage to 183.2% net leverage, netting available cash

against outstanding debt.”

“Our overall credit quality for this quarter

remained steady at 99.7% of credits rated in our highest category,

with the two investments remaining on non-accrual status being

Zollege and Pepper Palace, both of which have been successfully

restructured, representing only 0.3% and 0.3% of fair value and

cost, respectively. With 86.8% of our investments at quarter-end in

first lien debt and generally supported by strong enterprise values

and balance sheets in industries that have historically performed

well in stressed situations, we believe our portfolio and company

leverage is well structured for future economic conditions and

uncertainty.”

Mr. Oberbeck concluded, “As we navigate through

a reshaped yield curve environment with decreasing short-term and

increasing long-term rates, and an uncertain economic outlook, we

remain confident in our experienced management team, robust

pipeline, strong leverage structure, and high underwriting

standards to continue to steadily increase our portfolio size,

quality and investment performance over the long-term to deliver

exceptional risk adjusted returns to shareholders.”

Discussion of Financial Results for the

Quarter ended November 30, 2024:

-

AUM as of November 30, 2024, was $960.1 million, a

decrease of 13.8% from $1.114 billion as of November 30, 2023, and

a decrease of 7.7% from $1.041 billion as of last quarter.

-

Total investment income for the three months ended

November 30, 2024, was $35.9 million, a decrease of $0.4 million,

or 1.3%, from $36.3 million in the three months ended November 30,

2023, and $7.1 million, or 16.6%, as compared to $43.0 million for

the quarter ended August 31, 2024. This quarter’s investment income

decrease as compared to the previous quarter was primarily due to

the impact of the non-recurring Knowland interest reserve reversal

of $7.9 million, that was previously on non-accrual status,

following the investment’s full repayment, including accrued

interest, being recognized last quarter, offset by the final

interest of $0.3 million received this quarter. Investment income

reflects a weighted average interest rate on the core BDC portfolio

of 11.8%, as compared to 12.5% as of November 30, 2023 and 12.6% as

of August 31, 2024. Approximately two thirds of the interest rate

reduction is due to SOFR base rate decreases, and one third due to

the higher yields of the recent repayments.

-

Total expenses for fiscal third quarter 2025,

excluding interest and debt financing expenses, base management

fees and incentive fees, and income and excise taxes, increased

$0.5 million to $2.8 million as compared to $2.3 million

in the third quarter of fiscal year 2023, and increased $0.6

million as compared to $2.2 million for the quarter ended August

31, 2024. This represented 0.9% of average total assets on an

annualized basis, up from 0.7% last quarter and 0.8% last

year.

-

Adjusted NII for the quarter ended November 30,

2024, was $12.4 million, a decrease of $0.7 million, or 5.3%, from

$13.1 million in the period ended November 30, 2023, and a decrease

of $5.8 million, or 31.7%, from $18.2 million in the prior quarter.

This quarter’s decrease in investment income as compared to

last quarter was primarily due to the impact of the non-recurring

Knowland interest reserve reversal last quarter as previously

noted, offset by higher prepayment and structuring and advisory

fees this quarter reflective of the high level of originations and

repayments.

-

NII Yield as a percentage of average net asset

value was 13.3% for the quarter ended November 30, 2024. Adjusted

for the incentive fee accrual related to net capital gains, the NII

Yield was also 13.3%. In comparison, adjusted NII Yield was 14.6%

for the quarter ended November 30, 2023, and 19.7% for the quarter

ended August 31, 2024.

-

NAV was $374.9 million as

of November 30, 2024, an increase of $15.3

million from $359.6 million as of November 30, 2023,

and an increase of $2.8 million from $372.1 million as of August

31, 2024.

-

NAV per share was $26.95 as

of November 30, 2024, compared to $27.42 as

of November 30, 2023, and $27.07 as of August

31, 2024.

-

Return on equity (“ROE”) for the last twelve

months ended November 30, 2024, was 9.2%, up from 6.6%

for the comparable period last year, and up from 5.8% for the

twelve months ended August 31, 2024. ROE on an annualized basis for

the quarter ended November 30, 2024 was 9.5%.

-

The weighted average common shares outstanding for

the quarter ended November 30, 2024 was 13.8 million, increasing

from 13.7 million and 13.1 million for the quarters ended August

31, 2024 and November 30, 2023, respectively.

Portfolio and Investment Activity as of

November 30, 2024

- Fair value of Saratoga

Investment’s portfolio was $960.1 million, excluding

$250.2 million in cash and cash equivalents, principally invested

in 48 portfolio companies, one collateralized loan obligation fund

(the “CLO”) and one joint venture fund (the “JV”).

- Cost of investments made

during the period: $84.5 million, including eight

follow-ons and two investments in new portfolio companies.

- Principal repayments during

the period: $160.4 million, including five full repayments

of existing investments, plus amortization.

-

The fair value of the portfolio also decreased by $3.5

million of net realized gains and unrealized depreciation,

consisting of $4.0 million net depreciation in the CLO and JV and

$1.4 million net unrealized depreciation in our core non-CLO

portfolio, including Pepper Palace and Zollege, offset by net

realized gains of $1.2 million on the various repayments and

realizations in the quarter, most notably the Invita investment,

and $0.7 million of various escrow realized gains, most notably the

former Netreo investment.

-

Since taking over management of the BDC, the Company has generated

$1.20 billion of repayments and sales of investments originated by

Saratoga Investment, generating a gross unlevered IRR of 15.0%.

Total investments originated by Saratoga are $2.24 billion in 119

portfolio companies.

- The overall portfolio

composition consisted of 86.8% of first lien term loans,

0.6% of second lien term loans, 1.7% of unsecured term loans, 1.9%

of structured finance securities, and 9.0% of common equity.

-

The weighted average current yield on Saratoga

Investment’s portfolio based on current fair values was 10.8%,

which was comprised of a weighted average current yield of 11.6% on

first lien term loans, 16.8% on second lien term loans, 10.9% on

unsecured term loans, 16.7% on CLO subordinated notes and 0.0% on

equity interests.

Liquidity and Capital

Resources

Outstanding Borrowings:

-

As of November 30, 2024, Saratoga Investment had a combined $52.5

million in outstanding combined borrowings under its

$65.0 million senior secured revolving credit facility with

Encina and its $75.0 million senior secured revolving credit

facility with Live Oak.

-

At the same time, Saratoga Investment had $175 million SBA

debentures in its SBIC II license outstanding, $39.0 million SBA

debentures in its SBIC III license outstanding, $269.4 million of

listed baby bonds issued, $250.0 million of unsecured unlisted

institutional bond issuances, five unlisted issuances of $52.0

million in total, and an aggregate of $250.2 million in cash and

cash equivalents.

Undrawn Borrowing Capacity:

-

With $87.5 million available under the two credit

facilities and $250.2 million of cash and cash equivalents as

of November 30, 2024, Saratoga Investment has a total

of $337.7 million of undrawn credit facility borrowing

capacity and cash and cash equivalents to be used for new

investments or to support existing portfolio companies in the BDC

and the SBIC.

-

In addition, Saratoga Investment has $136.0 million

in undrawn SBA debentures available from its existing SBIC III

license.

-

Availability under the Encina and Live Oak credit facilities can

change depending on portfolio company performance and valuation. In

addition, certain follow-on investments in SBIC II and the BDC will

not qualify for SBIC III funding. Overall outstanding SBIC

debentures are limited to $350.0 million across all active SBIC

licenses.

-

Total Saratoga Investment undrawn borrowing capacity is therefore

$473.7 million.

-

As of fiscal 2025 third quarter-end, Saratoga

Investment had $52.3 million of committed undrawn lending

commitments and $75.7 million of discretionary funding

commitments.

Additionally:

-

Saratoga Investment has an active equity distribution agreement

with Ladenburg Thalmann & Co. Inc., Raymond James and

Associates, Inc, Lucid Capital Markets, LLC and Compass Point

Research and Trading, LLC, through which the Company may offer for

sale, from time to time, up to $300.0 million of common stock

through an ATM offering.

-

As of November 30, 2024, Saratoga Investment has sold 6,652,316

shares for gross proceeds of $175.5 million at an average price of

$26.37 for aggregate net proceeds of $173.9 million (net of

transaction costs). During both the three and nine months ended

November 30, 2024, Saratoga Investment sold a total of 108,438

shares for gross proceeds of $2.9 million at an average price of

$27.07 for aggregate net proceeds of $2.9 million (net of

transaction costs).

Dividend

On November 7, 2024, Saratoga Investment

announced that its Board of Directors declared a quarterly dividend

of $0.74 per share for the fiscal quarter ended November 30, 2024,

and an additional special dividend of $0.35 per share, fulfilling

its fiscal 2024 distribution requirements. Both dividends were paid

on December 19, 2024, to all stockholders of record at the close of

business on December 4, 2024.

Shareholders have the option to receive payment

of dividends in cash or receive shares of common stock, pursuant to

the Company’s DRIP. Shares issued under the Company’s DRIP is

issued at a 5% discount to the average market price per share at

the close of trading on the ten trading days immediately preceding

(and including) the payment date.

The following table highlights Saratoga

Investment’s dividend history over the past eleven quarters:

|

Period (Fiscal Year ends Feb 28) |

|

Base Dividend Per Share |

|

Special Dividend Per Share |

|

Total Dividend Per Share |

|

Fiscal Q3 2025 |

|

$0.74 |

|

$0.35 |

|

$1.09 |

|

Fiscal Q2 2025 |

|

$0.74 |

|

|

- |

|

$0.74 |

|

Fiscal Q1 2025 |

|

$0.74 |

|

|

- |

|

$0.74 |

| Year-to-Date Fiscal

2025 |

|

$2.22 |

|

$0.35 |

|

$2.57 |

|

Fiscal Q4 2024 |

|

$0.73 |

|

|

- |

|

$0.73 |

|

Fiscal Q3 2024 |

|

$0.72 |

|

|

- |

|

$0.72 |

|

Fiscal Q2 2024 |

|

$0.71 |

|

|

- |

|

$0.71 |

|

Fiscal Q1 2023 |

|

$0.70 |

|

|

- |

|

$0.70 |

|

Full Year Fiscal 2024 |

|

$2.86 |

|

|

- |

|

$2.86 |

|

Fiscal Q4 2023 |

|

$0.69 |

|

|

- |

|

$0.69 |

|

Fiscal Q3 2023 |

|

$0.68 |

|

|

- |

|

$0.68 |

|

Fiscal Q2 2023 |

|

$0.54 |

|

|

- |

|

$0.54 |

|

Fiscal Q1 2023 |

|

$0.53 |

|

|

- |

|

$0.53 |

|

Full Year Fiscal 2023 |

|

$2.44 |

|

|

- |

|

$2.44 |

|

|

Share Repurchase Plan

As of November 30, 2024, the Company purchased

1,035,203 shares of common stock, at the average price of $22.05

for approximately $22.8 million pursuant to its existing Share

Repurchase Plan. During the three and nine months ended November

30, 2024, the Company did not purchase any shares of common stock

pursuant to its Share Repurchase Plan.

Of note, in fiscal year 2015, the Company

announced the approval of an open market share repurchase plan that

allows it to repurchase up to 200,000 shares of its common stock at

prices below its NAV as reported in its then most recently

published financial statements. Since then, the Share Repurchase

Plan has been extended annually, and the Company has periodically

increased the amount of shares of common stock that may be

purchased under the Share Repurchase Plan, most recently to 1.7

million shares of common stock. On January 7, 2025, its board of

directors extended the Share Repurchase Plan for another year to

January 15, 2026.

2025 Fiscal Third Quarter Conference

Call/Webcast Information

|

When: |

Thursday, January 9, 2025 |

| |

10:00 a.m. Eastern Time (ET) |

| |

|

| How: |

Webcast: Interested parties may access a live

webcast of the call and find the Q3 2025 presentation by going to

the “Events & Presentations” section of Saratoga Investment

Corp.’s investor relations website (Saratoga events and

presentations). A replay of the webcast will also be available for

a limited time at Saratoga events and presentations. |

| |

|

| Call: |

To access the call by phone, please go to this

link (registration link) and you will be provided with dial in

details. To avoid delays, we encourage participants to dial into

the conference call fifteen minutes ahead of the scheduled start

time |

| |

|

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance

company that provides customized financing solutions to U.S.

middle-market businesses. The Company invests primarily in senior

and unitranche leveraged loans and mezzanine debt, and, to a lesser

extent, equity to provide financing for change of ownership

transactions, strategic acquisitions, recapitalizations and growth

initiatives in partnership with business owners, management teams

and financial sponsors. Saratoga Investment’s objective is to

create attractive risk-adjusted returns by generating current

income and long-term capital appreciation from its debt and equity

investments. Saratoga Investment has elected to be regulated as a

business development company under the Investment Company Act of

1940 and is externally managed by Saratoga Investment Advisors,

LLC, an SEC-registered investment advisor focusing on credit-driven

strategies. Saratoga Investment Corp. owns two active

SBIC-licensed subsidiaries, having surrendered its first license

after repaying all debentures for that fund following the end of

its investment period and subsequent wind-down. Furthermore, it

manages a $650 million collateralized loan obligation

(“CLO”) fund that is in wind-down and co-manages a joint venture

(“JV”) fund that owns a $400 million collateralized loan

obligation (“JV CLO”) fund. It also owns 52% of the Class F and

100% of the subordinated notes of the CLO, 87.5% of both the

unsecured loans and membership interests of the JV and 87.5% of the

Class E notes of the JV CLO. The Company’s diverse funding sources,

combined with a permanent capital base, enable Saratoga Investment

to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of the Company, including, but not limited

to, the statements about future events or our future

performance or financial condition. Forward-looking statements can

be identified by the use of forward looking words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “approximately,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates” or negative versions of those

words, other comparable words or other statements that do not

relate to historical or factual matters. The forward-looking

statements are based on our beliefs, assumptions and expectations

of our future performance, taking into account all information

currently available to us. These statements are not guarantees of

future performance, condition or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including, but not limited to: changes in the markets

in which we invest; changes in the financial, capital, and lending

markets; an economic downturn and its impact on the ability of our

portfolio companies to operate and the investment opportunities

available to us; the impact of interest rate volatility on our

business and our portfolio companies; the impact of supply chain

constraints and labor shortages on our portfolio companies; and the

elevated levels of inflation and its impact on our portfolio

companies and the industries in which we invests, as well as those

described from time to time in our filings with the Securities

and Exchange Commission.

Any forward-looking statement speaks only as of

the date on which it is made. The Company undertakes no duty to

update any forward-looking statements made herein or on the

webcast/conference call, whether as a result of new information,

future developments or otherwise, except as required by

law. Readers should not place undue reliance on any

forward-looking statements and are encouraged to review the

Company’s Annual Report on Form 10-Q for the fiscal quarter ended

November 30, 2024 and subsequent filings, including the “Risk

Factors” sections therein, with the Securities and Exchange

Commission for a more complete discussion of the risks and other

factors that could affect any forward-looking statements.

Contacts:Saratoga Investment Corporation535

Madison Avenue, 4th FloorNew York, NY 10022

Henri SteenkampChief Financial OfficerSaratoga Investment

Corp.212-906-7800

Lena CatiThe Equity Group Inc.212-836-9611

Val FerraroThe Equity Group Inc.212-836-9633Financials

|

Saratoga Investment Corp. |

|

Consolidated Statements of Assets and

Liabilities |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 30, 2024 |

|

February 29, 2024 |

|

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Investments at fair value |

|

|

|

|

|

|

Non-control/Non-affiliate investments (amortized cost of

$852,158,089 and $1,035,879,751, respectively) |

|

$ |

875,707,680 |

|

|

$ |

1,019,774,616 |

|

|

|

Affiliate investments (amortized cost of $37,627,241 and

$26,707,415, respectively) |

|

|

39,803,456 |

|

|

|

27,749,137 |

|

|

|

Control investments (amortized cost of $77,556,847 and

$117,196,571, respectively) |

|

|

44,582,096 |

|

|

|

91,270,036 |

|

|

|

Total investments at fair value (amortized cost of $967,342,177 and

$1,179,783,737, respectively) |

|

|

960,093,232 |

|

|

|

1,138,793,789 |

|

|

|

Cash and cash equivalents |

|

|

147,614,810 |

|

|

|

8,692,846 |

|

|

|

Cash and cash equivalents, reserve accounts |

|

|

102,549,213 |

|

|

|

31,814,278 |

|

|

|

Interest receivable (net of reserve of $68,735 and $9,490,340,

respectively) |

|

|

7,462,134 |

|

|

|

10,298,998 |

|

|

|

Management fee receivable |

|

|

327,368 |

|

|

|

343,023 |

|

|

|

Other assets |

|

|

1,871,192 |

|

|

|

1,163,225 |

|

|

|

Current income tax receivable |

|

|

1,931 |

|

|

|

99,676 |

|

|

|

Total assets |

|

$ |

1,219,919,880 |

|

|

$ |

1,191,205,835 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Revolving credit facilities |

|

$ |

52,500,000 |

|

|

$ |

35,000,000 |

|

|

|

Deferred debt financing costs, revolving credit facilities |

|

|

(1,467,001 |

) |

|

|

(882,122 |

) |

|

|

SBA debentures payable |

|

|

214,000,000 |

|

|

|

214,000,000 |

|

|

|

Deferred debt financing costs, SBA debentures payable |

|

|

(5,072,871 |

) |

|

|

(5,779,892 |

) |

|

|

8.75% Notes Payable 2025 |

|

|

20,000,000 |

|

|

|

20,000,000 |

|

|

|

Discount on 8.75% notes payable 2025 |

|

|

(35,045 |

) |

|

|

(112,894 |

) |

|

|

Deferred debt financing costs, 8.75% notes payable 2025 |

|

|

(1,460 |

) |

|

|

(4,777 |

) |

|

|

7.00% Notes Payable 2025 |

|

|

12,000,000 |

|

|

|

12,000,000 |

|

|

|

Discount on 7.00% notes payable 2025 |

|

|

(100,675 |

) |

|

|

(193,175 |

) |

|

|

Deferred debt financing costs, 7.00% notes payable 2025 |

|

|

(12,257 |

) |

|

|

(24,210 |

) |

|

|

7.75% Notes Payable 2025 |

|

|

5,000,000 |

|

|

|

5,000,000 |

|

|

|

Deferred debt financing costs, 7.75% notes payable 2025 |

|

|

(33,209 |

) |

|

|

(74,531 |

) |

|

|

4.375% Notes Payable 2026 |

|

|

175,000,000 |

|

|

|

175,000,000 |

|

|

|

Premium on 4.375% notes payable 2026 |

|

|

363,367 |

|

|

|

564,260 |

|

|

|

Deferred debt financing costs, 4.375% notes payable 2026 |

|

|

(1,073,336 |

) |

|

|

(1,708,104 |

) |

|

|

4.35% Notes Payable 2027 |

|

|

75,000,000 |

|

|

|

75,000,000 |

|

|

|

Discount on 4.35% notes payable 2027 |

|

|

(233,940 |

) |

|

|

(313,010 |

) |

|

|

Deferred debt financing costs, 4.35% notes payable 2027 |

|

|

(773,704 |

) |

|

|

(1,033,178 |

) |

|

|

6.25% Notes Payable 2027 |

|

|

15,000,000 |

|

|

|

15,000,000 |

|

|

|

Deferred debt financing costs, 6.25% notes payable 2027 |

|

|

(219,726 |

) |

|

|

(273,449 |

) |

|

|

6.00% Notes Payable 2027 |

|

|

105,500,000 |

|

|

|

105,500,000 |

|

|

|

Discount on 6.00% notes payable 2027 |

|

|

(96,638 |

) |

|

|

(123,782 |

) |

|

|

Deferred debt financing costs, 6.00% notes payable 2027 |

|

|

(1,696,769 |

) |

|

|

(2,224,403 |

) |

|

|

8.00% Notes Payable 2027 |

|

|

46,000,000 |

|

|

|

46,000,000 |

|

|

|

Deferred debt financing costs, 8.00% notes payable 2027 |

|

|

(1,013,039 |

) |

|

|

(1,274,455 |

) |

|

|

8.125% Notes Payable 2027 |

|

|

60,375,000 |

|

|

|

60,375,000 |

|

|

|

Deferred debt financing costs, 8.125% notes payable 2027 |

|

|

(1,256,679 |

) |

|

|

(1,563,594 |

) |

|

|

8.50% Notes Payable 2028 |

|

|

57,500,000 |

|

|

|

57,500,000 |

|

|

|

Deferred debt financing costs, 8.50% notes payable 2028 |

|

|

(1,373,467 |

) |

|

|

(1,680,039 |

) |

|

|

Base management and incentive fees payable |

|

|

7,521,835 |

|

|

|

8,147,217 |

|

|

|

Deferred tax liability |

|

|

4,581,381 |

|

|

|

3,791,150 |

|

|

|

Accounts payable and accrued expenses |

|

|

2,500,210 |

|

|

|

1,337,542 |

|

|

|

Interest and debt fees payable |

|

|

5,875,852 |

|

|

|

3,582,173 |

|

|

|

Due to Manager |

|

|

796,396 |

|

|

|

450,000 |

|

|

|

Total liabilities |

|

|

845,054,225 |

|

|

|

820,981,727 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

Common stock, par value $0.001, 100,000,000 common shares |

|

|

|

|

|

|

authorized, 13,909,206 and 13,653,476 common shares issued and

outstanding, respectively |

|

|

13,909 |

|

|

|

13,654 |

|

|

|

Capital in excess of par value |

|

|

377,235,609 |

|

|

|

371,081,199 |

|

|

|

Total distributable deficit |

|

|

(2,383,863 |

) |

|

|

(870,745 |

) |

|

|

Total net assets |

|

|

374,865,655 |

|

|

|

370,224,108 |

|

|

|

Total liabilities and net assets |

|

$ |

1,219,919,880 |

|

|

$ |

1,191,205,835 |

|

|

|

NET ASSET VALUE PER SHARE |

|

$ |

26.95 |

|

|

$ |

27.12 |

|

|

|

|

|

|

|

|

|

|

Asset Coverage Ratio |

|

|

160.1 |

% |

|

|

161.1 |

% |

|

|

|

|

|

|

|

|

|

Saratoga Investment Corp. |

|

|

Consolidated Statements of Operations |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

|

|

November 30, 2024 |

|

November 30, 2023 |

|

|

INVESTMENT INCOME |

|

|

|

|

|

|

|

Interest from investments |

|

|

|

|

|

|

|

Interest income: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

$ |

28,301,622 |

|

|

$ |

28,741,745 |

|

|

|

Affiliate investments |

|

|

|

458,765 |

|

|

|

1,165,585 |

|

|

|

Control investments |

|

|

|

1,220,769 |

|

|

|

2,183,242 |

|

|

|

Payment in kind interest income: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

355,161 |

|

|

|

88,106 |

|

|

|

Affiliate investments |

|

|

|

424,357 |

|

|

|

221,348 |

|

|

|

Control investments |

|

|

|

- |

|

|

|

258,729 |

|

|

|

Total interest from investments |

|

|

|

30,760,674 |

|

|

|

32,658,755 |

|

|

|

Interest from cash and cash equivalents |

|

|

|

1,627,718 |

|

|

|

521,574 |

|

|

|

Management fee income |

|

|

|

775,398 |

|

|

|

819,929 |

|

|

|

Dividend income(*): |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

172,557 |

|

|

|

509,365 |

|

|

|

Control investments |

|

|

|

948,102 |

|

|

|

1,319,219 |

|

|

|

Total dividend from investments |

|

|

|

1,120,659 |

|

|

|

1,828,584 |

|

|

|

Structuring and advisory fee income |

|

|

|

740,705 |

|

|

|

312,135 |

|

|

|

Other income |

|

|

|

853,481 |

|

|

|

199,368 |

|

|

|

Total investment income |

|

|

|

35,878,635 |

|

|

|

36,340,345 |

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

Interest and debt financing expenses |

|

|

|

13,044,000 |

|

|

|

12,522,357 |

|

|

|

Base management fees |

|

|

|

4,412,000 |

|

|

|

4,857,059 |

|

|

|

Incentive management fees expense (benefit) |

|

|

|

3,109,834 |

|

|

|

2,243,621 |

|

|

|

Professional fees |

|

|

|

670,376 |

|

|

|

434,552 |

|

|

|

Administrator expenses |

|

|

|

1,250,000 |

|

|

|

1,075,000 |

|

|

|

Insurance |

|

|

|

76,743 |

|

|

|

81,002 |

|

|

|

Directors fees and expenses |

|

|

|

83,500 |

|

|

|

80,729 |

|

|

|

General and administrative |

|

|

|

759,902 |

|

|

|

660,062 |

|

|

|

Income tax expense (benefit) |

|

|

|

36,625 |

|

|

|

219,900 |

|

|

|

Total operating expenses |

|

|

|

23,442,980 |

|

|

|

22,174,282 |

|

|

|

NET INVESTMENT INCOME |

|

|

|

12,435,655 |

|

|

|

14,166,063 |

|

|

|

|

|

|

|

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|

|

|

|

|

|

|

Net realized gain (loss) from investments: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

4,806,390 |

|

|

|

60,565 |

|

|

|

Control investments |

|

|

|

638,355 |

|

|

|

- |

|

|

|

Net realized gain (loss) from investments |

|

|

|

5,444,745 |

|

|

|

60,565 |

|

|

|

Net change in unrealized appreciation (depreciation) on

investments: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

(7,026,951 |

) |

|

|

(1,948,502 |

) |

|

|

Affiliate investments |

|

|

|

179,825 |

|

|

|

(1,084,259 |

) |

|

|

Control investments |

|

|

|

(2,071,457 |

) |

|

|

(14,833,592 |

) |

|

|

Net change in unrealized appreciation (depreciation) on

investments |

|

|

|

(8,918,583 |

) |

|

|

(17,866,353 |

) |

|

|

Net change in provision for deferred taxes on unrealized

(appreciation) depreciation on investments |

|

|

|

(126,875 |

) |

|

|

(415,894 |

) |

|

|

Net realized and unrealized gain (loss) on investments |

|

|

|

(3,600,713 |

) |

|

|

(18,221,682 |

) |

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM

OPERATIONS |

|

|

$ |

8,834,942 |

|

|

$ |

(4,055,619 |

) |

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE - BASIC AND DILUTED EARNINGS (LOSS) PER COMMON

SHARE |

|

|

$ |

0.64 |

|

|

$ |

(0.31 |

) |

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

|

|

13,789,951 |

|

|

|

13,052,896 |

|

|

|

|

|

|

|

|

|

|

|

* Certain prior period amounts have been reclassified to conform to

current period presentation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Saratoga Investment Corp. |

|

|

Consolidated Statements of Operations |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended |

|

|

|

|

|

November 30, 2024 |

|

November 30, 2023 |

|

|

INVESTMENT INCOME |

|

|

|

|

|

|

|

Interest from investments |

|

|

|

|

|

|

|

Interest income: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

$ |

95,247,113 |

|

|

$ |

83,542,257 |

|

|

|

Affiliate investments |

|

|

|

1,446,620 |

|

|

|

2,799,735 |

|

|

|

Control investments |

|

|

|

4,465,137 |

|

|

|

6,314,550 |

|

|

|

Payment in kind interest income: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

2,073,035 |

|

|

|

706,339 |

|

|

|

Affiliate investments |

|

|

|

915,807 |

|

|

|

644,484 |

|

|

|

Control investments |

|

|

|

284,590 |

|

|

|

542,581 |

|

|

|

Total interest from investments |

|

|

|

104,432,302 |

|

|

|

94,549,946 |

|

|

|

Interest from cash and cash equivalents |

|

|

|

3,923,380 |

|

|

|

1,864,956 |

|

|

|

Management fee income |

|

|

|

2,372,177 |

|

|

|

2,453,967 |

|

|

|

Dividend income(*): |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

584,827 |

|

|

|

621,398 |

|

|

|

Control investments |

|

|

|

3,160,742 |

|

|

|

4,679,699 |

|

|

|

Total dividend from investments |

|

|

|

3,745,569 |

|

|

|

5,301,097 |

|

|

|

Structuring and advisory fee income |

|

|

|

1,186,548 |

|

|

|

1,786,357 |

|

|

|

Other income |

|

|

|

1,900,184 |

|

|

|

530,210 |

|

|

|

Total investment income |

|

|

|

117,560,160 |

|

|

|

106,486,533 |

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

Interest and debt financing expenses |

|

|

|

39,135,022 |

|

|

|

36,628,641 |

|

|

|

Base management fees |

|

|

|

14,161,025 |

|

|

|

14,262,147 |

|

|

|

Incentive management fees expense (benefit) |

|

|

|

11,244,838 |

|

|

|

4,828,442 |

|

|

|

Professional fees |

|

|

|

1,795,572 |

|

|

|

1,407,275 |

|

|

|

Administrator expenses |

|

|

|

3,458,333 |

|

|

|

2,797,917 |

|

|

|

Insurance |

|

|

|

231,936 |

|

|

|

244,804 |

|

|

|

Directors fees and expenses |

|

|

|

276,500 |

|

|

|

280,797 |

|

|

|

General and administrative |

|

|

|

2,190,613 |

|

|

|

1,957,906 |

|

|

|

Income tax expense (benefit) |

|

|

|

98,263 |

|

|

|

(11,193 |

) |

|

|

Total operating expenses |

|

|

|

72,592,102 |

|

|

|

62,396,736 |

|

|

|

NET INVESTMENT INCOME |

|

|

|

44,968,058 |

|

|

|

44,089,797 |

|

|

|

|

|

|

|

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|

|

|

|

|

|

|

Net realized gain (loss) from investments: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

5,365,091 |

|

|

|

151,256 |

|

|

|

Control investments |

|

|

|

(54,564,070 |

) |

|

|

- |

|

|

|

Net realized gain (loss) from investments |

|

|

|

(49,198,979 |

) |

|

|

151,256 |

|

|

|

Net change in unrealized appreciation (depreciation) on

investments: |

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

|

|

39,654,726 |

|

|

|

(15,334,087 |

) |

|

|

Affiliate investments |

|

|

|

1,134,493 |

|

|

|

(1,289,895 |

) |

|

|

Control investments |

|

|

|

(7,048,216 |

) |

|

|

(23,302,249 |

) |

|

|

Net change in unrealized appreciation (depreciation) on

investments |

|

|

|

33,741,003 |

|

|

|

(39,926,231 |

) |

|

|

Net change in provision for deferred taxes on unrealized

(appreciation) depreciation on investments |

|

|

|

(747,063 |

) |

|

|

(577,693 |

) |

|

|

Net realized and unrealized gain (loss) on investments |

|

|

|

(16,205,039 |

) |

|

|

(40,352,668 |

) |

|

|

Realized losses on extinguishment of debt |

|

|

|

- |

|

|

|

(110,056 |

) |

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM

OPERATIONS |

|

|

$ |

28,763,019 |

|

|

$ |

3,627,073 |

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE - BASIC AND DILUTED EARNINGS (LOSS) PER COMMON

SHARE |

|

|

$ |

2.09 |

|

|

$ |

0.29 |

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

|

|

13,733,008 |

|

|

|

12,355,815 |

|

|

|

|

|

|

|

|

|

|

|

* Certain prior period amounts have been reclassified to conform to

current period presentation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Information Regarding Adjusted Net

Investment Income, Adjusted Net Investment Income Yield and

Adjusted Net Investment Income per Share

On a supplemental basis, Saratoga Investment

provides information relating to adjusted net investment income,

adjusted net investment income yield and adjusted net investment

income per share, which are non-GAAP measures. These measures are

provided in addition to, but not as a substitute for, net

investment income, net investment income yield and net investment

income per share. Adjusted net investment income represents net

investment income excluding any capital gains incentive fee expense

or reversal attributable to realized and unrealized gains. The

management agreement with the Company’s advisor provides that a

capital gains incentive fee is determined and paid annually with

respect to cumulative realized capital gains (but not unrealized

capital gains) to the extent such realized capital gains exceed

realized and unrealized losses for such year. In addition, Saratoga

Investment accrues, but does not pay, a capital gains incentive fee

in connection with any unrealized capital appreciation, as

appropriate. All capital gains incentive fees are presented within

net investment income within the Consolidated Statements of

Operations, but the associated realized and unrealized gains and

losses that these incentive fees relate to, are excluded. As such,

Saratoga Investment believes that adjusted net investment income,

adjusted net investment income yield and adjusted net investment

income per share is a useful indicator of operations exclusive of

any capital gains incentive fee expense or reversal attributable to

gains. The presentation of this additional information is not meant

to be considered in isolation or as a substitute for financial

results prepared in accordance with GAAP. The following table

provides a reconciliation of net investment income to adjusted net

investment income, net investment income yield to adjusted net

investment income yield and net investment income per share to

adjusted net investment income per share for the three and nine

months ended November 30, 2024 and November 30, 2023.

| |

For the Three Months Ended |

|

| |

November 30, 2024 |

November 30, 2023 |

|

| |

|

|

Net Investment Income |

$ |

12,435,655 |

|

$ |

14,166,063 |

|

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(1,039,033 |

) |

|

| Adjusted net investment

income |

$ |

12,435,655 |

|

$ |

13,127,030 |

|

|

| |

|

|

|

| Net investment income

yield |

|

13.3 |

% |

|

15.7 |

% |

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(1.1 |

)% |

|

| Adjusted net investment income

yield (1) |

|

13.3 |

% |

|

14.6 |

% |

|

| |

|

|

|

| Net investment income per

share |

$ |

0.90 |

|

$ |

1.09 |

|

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(0.08 |

) |

|

| Adjusted net investment income

per share (2) |

$ |

0.90 |

|

$ |

1.01 |

|

|

(1) Adjusted net investment income yield is

calculated as adjusted net investment income divided by average net

asset value.

(2) Adjusted net investment income per share is

calculated as adjusted net investment income divided by weighted

average common shares outstanding.

| |

For the Nine Months Ended |

|

| |

November 30, 2024 |

November 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

| Net Investment Income |

$ |

44,968,058 |

|

$ |

44,089,797 |

|

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(4,957,306 |

) |

|

| Adjusted net investment

income |

$ |

44,968,058 |

|

$ |

39,132,491 |

|

|

| |

|

|

|

| Net investment income

yield |

|

16.2 |

% |

|

16.7 |

% |

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(1.7 |

)% |

|

| Adjusted net investment income

yield (3) |

|

16.2 |

% |

|

15.0 |

% |

|

| |

|

|

|

| Net investment income per

share |

$ |

3.27 |

|

$ |

3.57 |

|

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

- |

|

|

(0.40 |

) |

|

| Adjusted net investment income

per share (4) |

$ |

3.27 |

|

$ |

3.17 |

|

|

(3) Adjusted net investment income yield is

calculated as adjusted net investment income divided by average net

asset value.

(4) Adjusted net investment income per share is

calculated as adjusted net investment income divided by weighted

average common shares outstanding.

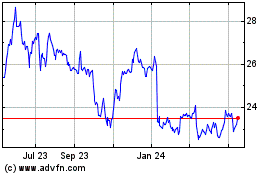

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

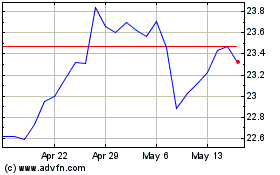

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Jan 2024 to Jan 2025