Saratoga Investment Corp. Announces Quarterly Dividend of $0.74 Per Share for the Fiscal Third Quarter Ending November 30, 2024

08 November 2024 - 12:30AM

Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the

Company”), a business development company, today announced that its

Board of Directors has declared a base quarterly dividend of $0.74

per share for the fiscal third quarter ending November 30, 2024,

and an additional special dividend of $0.35 per share fulfilling

our fiscal 2024 distribution requirements. Both dividends are

payable on December 19, 2024, to all stockholders of record at the

close of business on December 4, 2024. “As a result of the

strong overall performance of our portfolio during the fiscal

second and third quarters, the board of directors approved a

dividend of $0.74 per share, equivalent to the highest in our

history, while maintaining industry leading dividend coverage and

yield. Annualizing this dividend rate implies a 12.7% dividend

yield based on Saratoga’s recent stock price of $23.31 per share on

November 5, 2024” said Christian L. Oberbeck, Chairman and Chief

Executive Officer of Saratoga Investment. Mr. Oberbeck

continued, “Additionally, we are pleased to declare an additional

special distribution of $0.35 per share, which was driven by the

substantial overearning of our dividend during the previous fiscal

year. By distributing this dividend at this stage, we have

fulfilled our fiscal 2024 spillover requirements, with new

spillover starting to build commencing March 1, 2024, generated

from our quarterly earnings. We believe the diligent execution of

our strategy, and the highly diversified nature and solid

performance of our portfolio has allowed us to continue delivering

attractive returns to our shareholders via solid and consistent

base dividends, further enhanced with this special distribution.

This dividend strategy provides a cushion against potential adverse

events, including the possible effects of further cuts in interest

rates.”This is the third dividend declared in fiscal year

2025.

Historical Dividend Distributions

|

Period (Fiscal Year ends Feb 28) |

|

Base Dividend Per Share |

|

Special Dividend Per Share |

|

Total Dividend Per Share |

| Fiscal Q3

2025 |

|

$0.74 |

|

$0.35 |

|

$1.09 |

| Fiscal Q2

2025 |

|

$0.74 |

|

- |

|

$0.74 |

| Fiscal Q1

2025 |

|

$0.74 |

|

- |

|

$0.74 |

| Year-to-Date Fiscal 2025(including

pending dividend) |

|

$2.22 |

|

$0.35 |

|

$2.57 |

| Fiscal Q4

2024 |

|

$0.73 |

|

- |

|

$0.73 |

| Fiscal Q3

2024 |

|

$0.72 |

|

- |

|

$0.72 |

| Fiscal Q2

2024 |

|

$0.71 |

|

- |

|

$0.71 |

| Fiscal Q1

2023 |

|

$0.70 |

|

- |

|

$0.70 |

|

Full Year Fiscal 2024 |

|

$2.86 |

|

- |

|

$2.86 |

| Fiscal Q4

2023 |

|

$0.69 |

|

- |

|

$0.69 |

| Fiscal Q3

2023 |

|

$0.68 |

|

- |

|

$0.68 |

| Fiscal Q2

2023 |

|

$0.54 |

|

- |

|

$0.54 |

| Fiscal Q1

2023 |

|

$0.53 |

|

- |

|

$0.53 |

|

Full Year Fiscal 2023 |

|

$2.44 |

|

- |

|

$2.44 |

Shareholders will have the option to receive

payment of the dividend in cash or receive shares of common stock

pursuant to the Company’s dividend reinvestment plan (“DRIP”).

Saratoga Investment shareholders who hold their shares with a

broker must affirmatively instruct their brokers prior to the

record date if they prefer to receive this dividend, and future

dividends, in common stock. The number of shares of common

stock to be delivered shall be determined by dividing the total

dollar amount by 95% of the average of the market prices per share

at the close of trading on the ten (10) trading days immediately

preceding (and including) the payment date.

About Saratoga Investment Saratoga

Investment is a specialty finance company that provides customized

financing solutions to U.S. middle-market businesses. The Company

invests primarily in senior and unitranche leveraged loans and

mezzanine debt, and, to a lesser extent, equity to provide

financing for change of ownership transactions, strategic

acquisitions, recapitalizations and growth initiatives in

partnership with business owners, management teams and financial

sponsors. Saratoga Investment’s objective is to create attractive

risk-adjusted returns by generating current income and long-term

capital appreciation from its debt and equity investments. Saratoga

Investment has elected to be regulated as a business development

company under the Investment Company Act of 1940 and is externally

managed by Saratoga Investment Advisors, LLC, an SEC-registered

investment advisor focusing on credit-driven strategies. Saratoga

Investment Corp. owns two active SBIC-licensed subsidiaries, having

surrendered its first license after repaying all debentures for

that fund following the end of its investment period and subsequent

wind-down. Furthermore, it manages a $600 million collateralized

loan obligation (“CLO”) fund and co-manages a joint venture (“JV”)

fund that owns a $400 million collateralized loan obligation (“JV

CLO”) fund. It also owns 52% of the Class F and 100% of the

subordinated notes of the CLO, 87.5% of both the unsecured loans

and membership interests of the JV and 87.5% of the Class E notes

of the JV CLO. The Company’s diverse funding sources, combined with

a permanent capital base, enable Saratoga Investment to provide a

broad range of financing solutions.Forward Looking

StatementsStatements included herein contain certain

“forward-looking statements” within the meaning of the federal

securities laws, which relate to future events or our future

performance or financial condition. Forward-looking statements can

be identified by the use of forward looking words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “approximately,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates” or negative versions of those

words, other comparable words or other statements that do not

relate to historical or factual matters. The forward-looking

statements are based on our beliefs, assumptions and expectations

of future events and our future performance, taking into account

all information currently available to us. These statements are not

guarantees of future events, performance, condition or results and

involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including but not limited to:

changes in the markets in which the Company invests; changes in the

financial, capital, and lending markets; a rising interest rate

environment and its impact on the Company’s business and its

portfolio companies; regulatory changes; tax treatments; an

economic downturn and its impact on the ability of our portfolio

companies to operate and the investment opportunities available to

the Company; the impact of supply chain constraints and labor

shortages on our portfolio companies; and the elevated levels of

inflation and its impact on our portfolio companies and the

industries in which we invest; and those described from time to

time in our filings with the SEC. Any forward-looking statement

speaks only as of the date on which it is made. Saratoga Investment

Corp. undertakes no duty to update any forward-looking statements

made herein, whether as a result of new information, future

developments or otherwise, except as required by

law.Contacts:Saratoga Investment Corporation535

Madison Avenue, 4th FloorNew York, NY 10022Henri SteenkampChief

Financial OfficerSaratoga Investment Corp.212-906-7800

Lena CatiThe Equity Group Inc.212-836-9611 /

lcati@equityny.com

Val FerraroThe Equity Group Inc.212-836-9633 /

vferraro@equityny.com

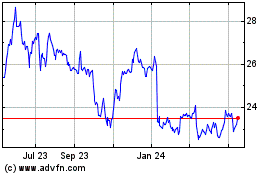

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

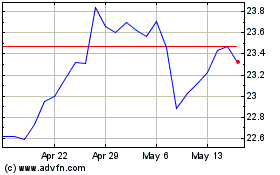

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Feb 2024 to Feb 2025