Raises Fiscal Year 2024 Outlook on Key

Metrics

SharkNinja, Inc. (“SharkNinja” or the “Company”) (NYSE: SN), a

global product design and technology company, today announced its

financial results for the third quarter ended September 30,

2024.

Highlights for the Third Quarter 2024 as compared to the

Third Quarter 2023

- Net sales increased 33.2% to $1,426.6 million and Adjusted Net

Sales increased 34.9% to $1,426.6 million.

- Gross margin and Adjusted Gross Margin increased 320 and 160

basis points, respectively.

- Net income increased 606.8% to $132.3 million. Adjusted Net

Income increased 28.2% to $170.5 million.

- Adjusted EBITDA increased 25.7% to $262.4 million, or 18.4% of

Adjusted Net Sales.

Mark Barrocas, Chief Executive Officer, commented: “SharkNinja

delivered another quarter of outstanding top and bottom-line

performance, demonstrating the continued success of our

three-pillar growth strategy. Our robust innovation pipeline,

unparalleled consumer insights, and strong demand creation engine

are driving strong double-digit growth across our portfolio,

enabling us to gain share in existing categories, enter new

categories, and expand globally. As we enter the holiday season, we

are pleased with the momentum in our business, despite the ongoing

challenges in the global operating environment. We remain confident

in our ability to deliver sustainable long-term profitable growth

as we capture increasing share in our large and growing addressable

market.”

Three Months Ended September 30, 2024

Net sales increased 33.2% to $1,426.6 million, compared to

$1,070.6 million during the same period last year. Adjusted Net

Sales increased 34.9% to $1,426.6 million, compared to $1,057.4

million during the same period last year, or 33.9% on a constant

currency basis. The increase in net sales and Adjusted Net Sales

resulted from growth in each of our four major product categories

of Food Preparation Appliances, Cooking and Beverage Appliances,

Cleaning Appliances and Other, which includes beauty and home

environment products.

- Cleaning Appliances net sales increased by $78.1 million, or

17.4%, to $527.5 million, compared to $449.3 million in the prior

year quarter. Adjusted Net Sales of Cleaning Appliances increased

by $85.0 million, or 19.2%, from $442.5 million to $527.5 million,

driven by the carpet extractor and cordless vacuums

sub-categories.

- Cooking and Beverage Appliances net sales increased by $72.1

million, or 21.3%, to $411.5 million, compared to $339.3 million in

the prior year quarter. Adjusted Net Sales of Cooking and Beverage

Appliances increased by $73.3 million, or 21.7%, from $338.1

million to $411.5 million, driven by growth in Europe and the

continued momentum within heated cooking.

- Food Preparation Appliances net sales increased by $155.4

million, or 73.5%, to $366.8 million, compared to $211.5 million in

the prior year quarter. Adjusted Net Sales of Food Preparation

Appliances increased by $157.5 million, or 75.2%, from $209.3

million to $366.8 million, driven by strong sales of our ice cream

makers and the launch of frozen drink appliances.

- Net sales in the Other category increased by $50.3 million, or

71.4%, to $120.8 million, compared to $70.5 million in the prior

year quarter. Adjusted Net Sales in the Other category increased by

$53.4 million, or 79.1%, from $67.5 million to $120.8 million,

primarily driven by strength of haircare products and air

purifiers.

Gross profit increased 42.6% to $695.0 million, or 48.7% of net

sales, compared to $487.5 million, or 45.5% of net sales, in the

third quarter of 2023. Adjusted Gross Profit increased 39.4% to

$704.6 million, or 49.4% of Adjusted Net Sales, compared to $505.5

million, or 47.8% of Adjusted Net Sales in the third quarter of

2023. The increase in gross margin and Adjusted Gross Margin of 320

and 160 basis points, respectively, was derived from optimizations

within our supply chain, sourcing and costing strategy and foreign

exchange benefit, partially offset by the impact of tariffs.

Research and development expenses increased 56.2% to $94.8

million, or 6.6% of net sales, compared to $60.7 million, or 5.7%

of net sales, in the prior year quarter. This increase was

primarily driven by incremental personnel-related expenses of $12.7

million to support new product categories and new market expansion.

The overall increase was also driven by an increase of $8.8 million

in prototype and testing costs, an increase of $4.5 million in

professional and consulting fees and an increase of $4.5 million in

depreciation and amortization expense.

Sales and marketing expenses increased 44.9% to $300.8 million,

or 21.1% of net sales, compared to $207.6 million, or 19.4% of net

sales, in the prior year quarter. This increase was primarily

attributable to increases of $42.1 million in advertising-related

expenses; an increase of $33.4 million in delivery and distribution

costs driven by higher volumes, particularly in our

direct-to-consumer (“DTC”) business; $14.5 million in

personnel-related expenses to support new product launches and

expansion into new markets; an increase of $5.4 million in

professional and consulting fees; offset by a decrease in

depreciation and amortization expense of $4.4 million.

General and administrative expenses decreased 4.5% to $119.1

million, or 8.3% of net sales, compared to $124.7 million, or 11.6%

of net sales, in the prior year quarter. This decrease was

primarily driven by transaction costs incurred in the prior year

quarter related to the separation and distribution from JS Global

of $41.5 million. The decrease was offset by an increase of $27.9

million in legal fees, including a $13.5 million legal settlement

reserve related to certain patent infringement claims and an

increase of $3.9 million in professional and consulting fees.

Operating income increased 90.7% to $180.3 million, or 12.6% of

net sales, compared to $94.5 million, or 8.8% of net sales, during

the prior year quarter. Adjusted Operating Income increased 25.0%

to $237.5 million, or 16.7% of Adjusted Net Sales, compared to

$190.1 million, or 18.0% of Adjusted Net Sales, in the third

quarter of 2023.

Net income increased 606.8% to $132.3 million, or 9.3% of net

sales, compared to $18.7 million, or 1.7% of net sales, in the

prior year quarter. Net income per diluted share increased 623.1%

to $0.94, compared to $0.13 in the prior year quarter.

Adjusted Net Income increased 28.2% to $170.5 million, or 11.9%

of Adjusted Net Sales, compared to $133.0 million, or 12.6% of

Adjusted Net Sales, in the prior year quarter. Adjusted Net Income

per diluted share increased 27.4% to $1.21, compared to $0.95 in

the prior year quarter.

Adjusted EBITDA increased 25.7% to $262.4 million, or 18.4% of

Adjusted Net Sales, compared to $208.7 million, or 19.7% of

Adjusted Net Sales in the prior year quarter.

Nine Months Ended September 30, 2024

Net sales increased 30.1% to $3,741.5 million, compared to

$2,876.2 million during the same period last year. Adjusted Net

Sales increased 33.7% to $3,741.5 million, compared to $2,798.7

million during the same period last year, or 32.6% on a constant

currency basis. The increase in net sales and Adjusted Net Sales

resulted from growth in each of our four major product categories

of Food Preparation Appliances, Cooking and Beverage Appliances,

Cleaning Appliances and Other, which includes beauty and home

environment products.

- Cleaning Appliances net sales increased by $137.5 million, or

10.8%, to $1,415.5 million, compared to $1,278.0 million during the

same period last year. Adjusted Net Sales of Cleaning Appliances

increased by $186.9 million, or 15.2%, from $1,228.6 million to

$1,415.5 million, driven by the carpet extractor and robotics

sub-categories.

- Cooking and Beverage Appliances net sales increased by $181.3

million, or 19.3%, to $1,120.4 million, compared to $939.1 million

during the same period last year. Adjusted Net Sales of Cooking and

Beverage Appliances increased by $187.5 million, or 20.1%, from

$932.9 million to $1,120.4 million, driven by growth in Europe.

Global growth was supported by the success of the outdoor grill and

outdoor oven across both the US and European markets.

- Food Preparation Appliances net sales increased by $364.1

million, or 77.0%, to $836.8 million, compared to $472.7 million

during the same period last year. Adjusted Net Sales of Food

Preparation Appliances increased by $372.4 million, or 80.2%, from

$464.4 million to $836.8 million, driven by strong sales of our ice

cream makers and compact blenders, specifically our portable

blenders.

- Net sales in the Other category increased by $182.3 million, or

97.8%, to $368.8 million, compared to $186.5 million during the

same period last year. Adjusted Net Sales in the Other category

increased by $196.0 million, or 113.5%, from $172.8 million to

$368.8 million, primarily driven by strength of haircare products,

our FlexBreeze fans, and air purifiers.

Gross profit increased 41.8% to $1,822.5 million, or 48.7% of

net sales, compared to $1,285.0 million, or 44.7% of net sales, in

the same period last year. Adjusted Gross Profit increased 42.5% to

$1,860.4 million, or 49.7% of Adjusted Net Sales, compared to

$1,305.9 million, or 46.7% of Adjusted Net Sales in the same period

last year. The increase in gross margin and Adjusted Gross Margin

of 400 and 300 basis points, respectively, was derived from

optimizations within our supply chain, sourcing and costing

strategy, regional expansion, and foreign exchange benefit.

Research and development expenses increased 41.0% to $254.5

million, or 6.8% of net sales, compared to $180.4 million, or 6.3%

of net sales, during the same period last year. This increase was

primarily driven by incremental personnel-related expenses of $33.4

million driven by increased headcount to support new product

categories and new market expansion, and includes an increase of

$3.6 million in share-based compensation. The remainder of the

increase was primarily driven by an increase of $20.4 million in

prototypes and testing costs, an increase of $12.9 million in

professional and consulting fees to support overall growth in the

business, an increase of $3.2 million in travel costs and an

increase of $3.0 million in consumer insight initiatives.

Sales and marketing expenses increased 44.1% to $818.6 million,

or 21.9% of net sales, compared to $568.0 million, or 19.7% of net

sales, during the same period last year. This increase was

primarily attributable to increases of $127.5 million in

advertising-related expenses; an increase of $79.1 million in

delivery and distribution costs driven by higher volumes,

particularly in our DTC business; $38.9 million in

personnel-related expenses to support new product launches and

expansion into new markets, which includes an incremental $5.1

million of share-based compensation; $4.0 million in travel costs;

$8.9 million in professional and consulting fees; offset by a

decrease in depreciation and amortization expense of $7.5

million.

General and administrative expenses increased 17.7% to $310.4

million, or 8.3% of net sales, compared to $263.7 million, or 9.2%

of net sales, during the same period last year. This increase was

primarily driven by an increase of $44.9 million in legal fees,

including a $13.5 million legal settlement reserve related to

certain patent infringement claims; an increase in

personnel-related expenses of $32.5 million, including a $14.2

million increase in share-based compensation; an increase of $17.3

million in professional and consulting fees; an increase of $11.9

million in technology support costs; an increase of $9.0 million in

credit card processing and merchant fees; an increase of $4.8

million in product liability and insurance; an increase of $3.4

million in depreciation and amortization; offset by a decrease in

transaction costs related to the separation and distribution from

JS Global and secondary offering of $76.5 million.

Operating income increased 60.9% to $439.0 million, or 11.7% of

net sales, compared to $272.8 million, or 9.5% of net sales, during

the same period last year. Adjusted Operating Income increased

33.1% to $583.0 million, or 15.6% of Adjusted Net Sales, compared

to $438.1 million, or 15.7% of Adjusted Net Sales, in the prior

year period.

Net income increased 163.3% to $310.0 million, or 8.3% of net

sales, compared to $117.8 million, or 4.1% of net sales, during the

same period last year. Net income per diluted share increased

158.8% to $2.20, compared to $0.85 in the prior year period.

Adjusted Net Income increased 32.0% to $418.6 million, or 11.2%

of Adjusted Net Sales, compared to $317.1 million, or 11.3% of

Adjusted Net Sales, during the same period last year. Adjusted Net

Income per diluted share increased 30.3% to $2.97, compared to

$2.28 in the prior year period.

Adjusted EBITDA increased 32.0% to $660.6 million, or 17.7% of

Adjusted Net Sales, compared to $500.4 million, or 17.9% of

Adjusted Net Sales, in the prior year period.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents decreased to $127.9 million, compared

to $154.1 million as of December 31, 2023.

Inventories increased 53.8% to $1,076.2 million, compared to

$699.7 million as of December 31, 2023.

Total debt, excluding unamortized deferred financing costs, was

$964.8 million, compared to $804.9 million as of December 31, 2023.

The existing credit facility provides for a $810.0 million term

loan and a $500.0 million revolving credit facility, which had an

available balance of $315.9 million as of September 30, 2024.

Fiscal 2024 Outlook

For fiscal year 2024, SharkNinja is increasing its outlook on

key metrics and now expects:

- Net sales to increase 25% to 26% compared to the prior

expectation of 20% to 22%.

- Adjusted Net Sales to increase between 27% and 28% compared to

the prior expectation of 22% to 24%.

- Adjusted Net Income per diluted share between $4.13 and $4.24,

reflecting a 28% to 32% increase, compared to the prior expectation

of between $4.05 and $4.21, reflecting a 26% to 31% increase.

- Adjusted EBITDA between $925 million and $945 million,

reflecting a 29% to 31% increase, compared to the prior expectation

of between $910 million and $940 million, reflecting a 26% to 31%

increase.

- A GAAP effective tax rate of approximately 24% to 25%.

- Diluted weighted average shares outstanding of approximately

141 million.

- Capital expenditures of $160 million to $180 million primarily

to support investments in new product launches, technology, and

incremental investments in tooling to support the diversification

of our sourcing outside of China.

Conference Call Details

A conference call to discuss the third quarter 2024 financial

results is scheduled for today, October 31, 2024, at 8:30 a.m.

Eastern Time. A live audio webcast of the conference call will be

available online at http://ir.sharkninja.com. Investors and

analysts interested in participating in the live call are invited

to dial 1-833-470-1428 or 1-404-975-4839 and enter confirmation

code 930420. The webcast will be archived and available for

replay.

About SharkNinja

SharkNinja is a global product design and technology company,

with a diversified portfolio of 5-star rated lifestyle solutions

that positively impact people’s lives in homes around the world.

Powered by two trusted, global brands, Shark and Ninja, the company

has a proven track record of bringing disruptive innovation to

market, and developing one consumer product after another has

allowed SharkNinja to enter multiple product categories, driving

significant growth and market share gains. Headquartered in

Needham, Massachusetts with more than 3,300 associates, the

company’s products are sold at key retailers, online and offline,

and through distributors around the world. For more information,

please visit SharkNinja.com.

Forward-looking statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our future

business, financial condition, results of operations and prospects

and Fiscal 2024 outlook. These statements are often, but not

always, made through the use of words or phrases such as “may,”

“should,” “could,” “predict,” “potential,” “believe,” “will likely

result,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would” and “outlook,”

or the negative version of those words or phrases or other

comparable words or phrases of a future or forward-looking nature.

These forward-looking statements are not statements of historical

fact, and are based on current expectations, estimates and

projections about our industry as well as certain assumptions made

by management, many of which, by their nature, are inherently

uncertain and beyond our control. These forward-looking statements

are subject to a number of known and unknown risks, uncertainties

and assumptions, which you should consider and read carefully,

including but not limited to:

- our ability to maintain and strengthen our brands to generate

and maintain ongoing demand for our products;

- our ability to commercialize a continuing stream of new

products and line extensions that create demand;

- our ability to effectively manage our future growth;

- general economic conditions and the level of discretionary

consumer spending;

- our ability to expand into additional consumer markets;

- our ability to maintain product quality and product performance

at an acceptable cost;

- our ability to compete with existing and new competitors in our

markets;

- problems with, or loss of, our supply chain or suppliers, or an

inability to obtain raw materials;

- the risks associated with doing business globally;

- inflation, changes in the cost or availability of raw

materials, energy, transportation and other necessary supplies and

services;

- our ability to hire, integrate and retain highly skilled

personnel;

- our ability to maintain, protect and enhance our intellectual

property;

- our ability to securely maintain consumer and other third-party

data;

- our ability to comply with ongoing regulatory

requirements;

- the increased expenses associated with being a public

company;

- our status as a “controlled company” within the meaning of the

rules of NYSE;

- our ability to achieve some or all of the anticipated benefits

of the separation; and

- the payment of any declared dividends.

This list of factors should not be construed as exhaustive and

should be read in conjunction with those described in our Annual

Report on Form 20-F filed with the SEC under “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and other filings we make with the SEC. We

operate in a very competitive and rapidly changing environment. New

risks emerge from time to time. It is not possible for us to

predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor or combination of

factors may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties and assumptions, the future events

and trends discussed in this press release, and our future levels

of activity and performance, may not occur and actual results could

differ materially and adversely from those described or implied in

the forward-looking statements. As a result, you should not regard

any of these forward-looking statements as a representation or

warranty by us or any other person or place undue reliance on any

such forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made, and we do not

undertake any obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law. In

addition, statements that contain “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based on information available to us

as of the date of this press release. While we believe that this

information provides a reasonable basis for these statements, this

information may be limited or incomplete. These statements are

inherently uncertain, and investors are cautioned not to unduly

rely on these statements. We qualify all of our forward-looking

statements by the cautionary statements contained in this press

release.

SHARKNINJA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

(unaudited)

As of

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

127,948

$

154,061

Accounts receivable, net

1,190,410

985,172

Inventories

1,076,246

699,740

Prepaid expenses and other current

assets

121,721

58,311

Total current assets

2,516,325

1,897,284

Property and equipment, net

196,002

166,252

Operating lease right-of-use assets

149,975

63,333

Intangible assets, net

466,826

477,816

Goodwill

834,781

834,203

Deferred tax assets

19,713

12

Other assets, noncurrent

53,703

48,170

Total assets

$

4,237,325

$

3,487,070

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

632,850

$

459,651

Accrued expenses and other current

liabilities

640,947

620,333

Tax payable

22,025

20,991

Debt, current

214,344

24,157

Total current liabilities

1,510,166

1,125,132

Debt, noncurrent

745,975

775,483

Operating lease liabilities,

noncurrent

152,100

63,043

Deferred tax liabilities

3,750

16,500

Other liabilities, noncurrent

30,795

28,019

Total liabilities

2,442,786

2,008,177

Shareholders’ equity:

Ordinary shares, $0.0001 par value per

share, 1,000,000,000 shares authorized; 140,219,933 and 139,083,369

shares issued and outstanding as of September 30, 2024 and December

31, 2023, respectively

14

14

Additional paid-in capital

1,012,407

1,009,590

Retained earnings

780,308

470,319

Accumulated other comprehensive income

(loss)

1,810

(1,030

)

Total shareholders’ equity

1,794,539

1,478,893

Total liabilities and shareholders’

equity

$

4,237,325

$

3,487,070

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net sales(1)

$

1,426,566

$

1,070,617

$

3,741,452

$

2,876,211

Cost of sales

731,559

583,124

1,918,929

1,591,254

Gross profit

695,007

487,493

1,822,523

1,284,957

Operating expenses:

Research and development

94,808

60,691

254,457

180,430

Sales and marketing

300,841

207,599

818,594

568,035

General and administrative

119,096

124,655

310,432

263,682

Total operating expenses

514,745

392,945

1,383,483

1,012,147

Operating income

180,262

94,548

439,040

272,810

Interest expense, net

(16,916

)

(13,003

)

(46,482

)

(28,523

)

Other income (expense), net

11,031

(5,865

)

14,968

(41,315

)

Income before income taxes

174,377

75,680

407,526

202,972

Provision for income taxes

42,048

56,958

97,537

85,218

Net income

$

132,329

$

18,722

$

309,989

$

117,754

Net income per share, basic

$

0.94

$

0.13

$

2.22

$

0.85

Net income per share, diluted

$

0.94

$

0.13

$

2.20

$

0.85

Weighted-average number of shares used in

computing net income per share, basic

140,114,282

139,073,181

139,818,196

139,059,206

Weighted-average number of shares used in

computing net income per share, diluted

141,305,999

139,430,805

140,974,062

139,179,724

(1)

Net sales in our product categories were

as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2024

2023

2024

2023

Cleaning Appliances

$

527,453

$

449,319

$

1,415,488

$

1,277,986

Cooking and Beverage Appliances

411,453

339,328

1,120,371

939,060

Food Preparation Appliances

366,834

211,461

836,782

472,685

Other

120,826

70,509

368,811

186,480

Total net sales

$

1,426,566

$

1,070,617

$

3,741,452

$

2,876,211

SHARKNINJA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income

$

309,989

$

117,754

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

86,870

77,394

Share-based compensation

47,341

24,502

Provision for credit losses

3,744

2,266

Non-cash lease expense

15,963

9,688

Deferred income taxes, net

(32,420

)

3,905

Other

1,631

1,662

Changes in operating assets and

liabilities:

Accounts receivable

(193,151

)

(192,209

)

Inventories

(357,114

)

(258,982

)

Prepaid expenses and other assets

(69,477

)

65,508

Accounts payable

162,019

343,603

Tax payable

1,034

883

Operating lease liabilities

(7,428

)

(9,280

)

Accrued expenses and other liabilities

(12,050

)

(90,914

)

Net cash (used in) provided by operating

activities

(43,049

)

95,780

Cash flows from investing

activities:

Purchase of property and equipment

(95,232

)

(70,501

)

Purchase of intangible asset

(6,571

)

(6,905

)

Capitalized internal-use software

development

(1,100

)

(683

)

Cash receipts on beneficial interest in

sold receivables

—

16,777

Other investing activities, net

—

(3,051

)

Net cash used in investing activities

(102,903

)

(64,363

)

Cash flows from financing

activities:

Proceeds from issuance of debt, net of

issuance cost

800,915

Repayment of debt

(15,188

)

(437,500

)

Net proceeds from borrowings under

revolving credit facility

175,000

—

Distribution paid to Former Parent

—

(435,292

)

Recharge from Former Parent for

share-based compensation

—

(3,165

)

Net ordinary shares withheld for taxes

upon issuance of restricted stock units

(50,011

)

—

Proceeds from shares issued under employee

stock purchase plan

5,487

—

Net cash provided by (used in) financing

activities

115,288

(75,042

)

Effect of exchange rates changes on

cash

4,551

(4,768

)

Net decrease in cash, cash equivalents,

and restricted cash

(26,113

)

(48,393

)

Cash, cash equivalents, and restricted

cash at beginning of period

154,061

218,770

Cash and cash equivalents at end of

period

$

127,948

$

170,377

Non-GAAP Financial Measures

In addition to the measures presented in our consolidated

financial statements, we regularly review other financial measures,

defined as non-GAAP financial measures by the SEC, to evaluate our

business, measure our performance, identify trends, prepare

financial forecasts, and make strategic decisions.

The key non-GAAP financial measures we consider are Adjusted Net

Sales, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted

Operating Income, Adjusted Net Income, Adjusted Net Income Per

Share, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, and

Adjusted Net Sales growth on a constant currency basis. These

non-GAAP financial measures are used by both management and our

Board, together with comparable GAAP information, in evaluating our

current performance and planning our future business activities.

These non-GAAP financial measures provide supplemental information

regarding our operating performance on a non-GAAP basis that

excludes certain gains, losses and charges of a non-cash nature or

which occur relatively infrequently and/or which management

considers to be unrelated to our core operations and excludes the

financial results from our former Japanese subsidiary, SharkNinja

Co., Ltd. (“SNJP”), and our Asia Pacific Region and Greater China

("APAC") distribution channels, both of which were transferred to

JS Global Lifestyle Company Limited (“JS Global”) concurrently with

the separation (the “Divestitures”), as well as the cost of sales

from (i) inventory markups that were eliminated as a result of the

transition of certain product procurement functions from a

subsidiary of JS Global to SharkNinja concurrently with the

separation and (ii) costs related to the transitional Sourcing

Services Agreement with JS Global that was entered into in

connection with the separation (collectively, the “Product

Procurement Adjustment”). Management believes that tracking and

presenting these non-GAAP financial measures provides management

and the investment community with valuable insight into our ongoing

core operations, our ability to generate cash and the underlying

business trends that are affecting our performance. We believe that

these non-GAAP measures, when used in conjunction with our GAAP

financial information, also allow investors to better evaluate our

financial performance in comparison to other periods and to other

companies in our industry and to better understand and interpret

the results of the ongoing business following the separation and

distribution. These non-GAAP financial measures should not be

viewed as a substitute for our financial results calculated in

accordance with GAAP and you are cautioned that other companies may

define these non-GAAP financial measures differently.

SharkNinja does not provide a reconciliation of forward-looking

Adjusted Net Income and Adjusted EBITDA to GAAP net income or of

Adjusted Net Income Per Share to net income per share, diluted

because such reconciliations are not available without unreasonable

efforts. This is due to the inherent difficulty in forecasting with

reasonable certainty certain amounts that are necessary for such

reconciliations, including, in particular, the realized and

unrealized foreign currency gains or losses reported within other

expense. For the same reasons, we are unable to forecast with

reasonable certainty all deductions and additions needed in order

to provide forward-looking GAAP net income at this time. The amount

of these deductions and additions may be material, and, therefore,

could result in forward-looking GAAP net income being materially

different or less than forward-looking Adjusted Net Income,

Adjusted EBITDA, and Adjusted Net Income Per Share. See

“Forward-looking statements” above.

We define Adjusted Net Sales as net sales as adjusted to exclude

certain items that we do not consider indicative of our ongoing

operating performance following the separation, including net sales

from our Divestitures. We believe that Adjusted Net Sales is an

appropriate measure of our performance because it eliminates the

impact of our Divestitures that do not relate to the ongoing

performance of our business.

The following table reconciles Adjusted Net Sales to the most

comparable GAAP measure, net sales, for the periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2024

2023

2024

2023

Net sales

$

1,426,566

$

1,070,617

$

3,741,452

$

2,876,211

Divested subsidiary net sales

adjustment(1)

—

(13,196

)

—

(77,544

)

Adjusted Net Sales(2)

$

1,426,566

$

1,057,421

$

3,741,452

$

2,798,667

(1)

Adjusted for net sales from SNJP and the

APAC distribution channels for the three and nine months ended

September 30, 2023, as if such Divestitures occurred on January 1,

2023.

(2)

The following tables reconcile Adjusted

Net Sales to net sales per product category, for the periods

presented:

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

($ in thousands, except %)

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Cleaning Appliances

$

527,453

$

—

$

527,453

$

449,319

$

(6,838

)

$

442,481

Cooking and Beverage Appliances

411,453

—

411,453

339,328

(1,190

)

338,138

Food Preparation Appliances

366,834

—

366,834

211,461

(2,133

)

209,328

Other

120,826

—

120,826

70,509

(3,035

)

67,474

Total net sales

$

1,426,566

$

—

$

1,426,566

$

1,070,617

$

(13,196

)

$

1,057,421

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

($ in thousands, except %)

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Net sales

Divested subsidiary

adjustment

Adjusted Net Sales

Cleaning Appliances

$

1,415,488

$

—

$

1,415,488

$

1,277,986

$

(49,392

)

$

1,228,594

Cooking and Beverage Appliances

1,120,371

—

1,120,371

939,060

(6,161

)

932,899

Food Preparation Appliances

836,782

—

836,782

472,685

(8,289

)

464,396

Other

368,811

—

368,811

186,480

(13,702

)

172,778

Total net sales

$

3,741,452

$

—

$

3,741,452

$

2,876,211

$

(77,544

)

$

2,798,667

We define Adjusted Gross Profit as gross profit as adjusted to

exclude certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

the net sales and cost of sales from our Divestitures and the cost

of sales from the Product Procurement Adjustment. We define

Adjusted Gross Margin as Adjusted Gross Profit divided by Adjusted

Net Sales. We believe that Adjusted Gross Profit and Adjusted Gross

Margin are appropriate measures of our operating performance

because each eliminates the impact our Divestitures and certain

other adjustments that do not relate to the ongoing performance of

our business.

The following table reconciles Adjusted Gross Profit and

Adjusted Gross Margin to the most comparable GAAP measure, gross

profit and gross margin, respectively, for the periods

presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2024

2023

2024

2023

Net sales

$

1,426,566

$

1,070,617

$

3,741,452

$

2,876,211

Cost of sales

(731,559

)

(583,124

)

(1,918,929

)

(1,591,254

)

Gross profit

695,007

487,493

1,822,523

1,284,957

Gross margin

48.7

%

45.5

%

48.7

%

44.7

%

Divested subsidiary net sales

adjustment(1)

—

(13,196

)

—

(77,544

)

Divested subsidiary cost of sales

adjustment(2)

—

7,628

—

45,116

Product Procurement Adjustment(3)

9,571

23,574

37,876

53,369

Adjusted Gross Profit

$

704,578

$

505,499

$

1,860,399

$

1,305,898

Adjusted Net Sales

$

1,426,566

$

1,057,421

$

3,741,452

$

2,798,667

Adjusted Gross Margin

49.4

%

47.8

%

49.7

%

46.7

%

(1)

Adjusted for net sales from SNJP and the

APAC distribution channels for the three and nine months ended

September 30, 2023, as if such Divestitures occurred on January 1,

2023.

(2)

Adjusted for cost of sales from SNJP and

the APAC distribution channels for the three and nine months ended

September 30, 2023, as if such Divestitures occurred on January 1,

2023.

(3)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SharkNinja (Hong Kong) Company Limited (“SNHK”), and

no longer purchase inventory from a purchasing office wholly owned

by JS Global. Thus, the markup on all inventory purchased

subsequent to the separation is completely eliminated in

consolidation. As a result of the separation, we pay JS Global a

sourcing service fee to provide value-added sourcing services on a

transitional basis under a Sourcing Services Agreement.

We define Adjusted Operating Income as operating income

excluding (i) share-based compensation, (ii) certain litigation

costs, (iii) amortization of certain acquired intangible assets,

(iv) certain transaction-related costs and (v) certain items that

we do not consider indicative of our ongoing operating performance

following the separation, including operating income from our

Divestitures and cost of sales from our Product Procurement

Adjustment.

The following table reconciles Adjusted Operating Income to the

most comparable GAAP measure, operating income, for the periods

presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands)

2024

2023

2024

2023

Operating income

$

180,262

$

94,548

$

439,040

$

272,810

Share-based compensation(1)

13,785

21,337

47,341

24,502

Litigation costs(2)

29,035

3,965

42,691

4,600

Amortization of acquired intangible

assets(3)

4,896

4,897

14,690

14,690

Transaction-related costs(4)

—

41,455

1,342

76,549

Product Procurement Adjustment(5)

9,571

23,574

37,876

53,369

Divested subsidiary operating income

adjustment(6)

—

287

—

(8,456

)

Adjusted Operating Income

$

237,549

$

190,063

$

582,980

$

438,064

(1)

Represents non-cash expense related to

awards issued from the SharkNinja and JS Global equity incentive

plans.

(2)

Represents litigation costs incurred and

related settlements for certain patent infringement claims, false

advertising claims, and any related settlement costs, which were

recorded in general and administrative expenses.

(3)

Represents amortization of acquired

intangible assets that we do not consider normal recurring

operating expenses, as the intangible assets relate to JS Global’s

acquisition of our business. We exclude amortization charges for

these acquisition-related intangible assets for purposes of

calculating Adjusted Operating Income, although revenue is

generated, in part, by these intangible assets, to eliminate the

impact of these non-cash charges that are significantly impacted by

the timing and valuation of JS Global’s acquisition of our

business, as well as the inherent subjective nature of purchase

price allocations. Of the amortization of acquired intangible

assets, $0.9 million for the three months ended September 30, 2024

and 2023, and $2.8 million for the nine months ended September 30,

2024 and 2023, was recorded to research and development expenses,

and $4.0 million for the three months ended September 30, 2024 and

2023, and $11.9 million for the nine months ended September 30,

2024 and 2023, was recorded to sales and marketing expenses.

(4)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(5)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(6)

Adjusted for operating income from SNJP

and the APAC distribution channels for the three and nine months

ended September 30, 2023, as if such Divestitures occurred on

January 1, 2023.

We define Adjusted Net Income as net income excluding (i)

share-based compensation, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net, (iv) amortization of

certain acquired intangible assets, (v) certain transaction-related

costs, (vi) certain items that we do not consider indicative of our

ongoing operating performance following the separation, including

net income from our Divestitures and cost of sales from our Product

Procurement Adjustment, (vii) the tax impact of the adjusted items

and (viii) certain withholding taxes.

Adjusted Net Income Per Share is defined as Adjusted Net Income

divided by the diluted weighted average number of ordinary

shares.

The following table reconciles Adjusted Net Income and Adjusted

Net Income Per Share to the most comparable GAAP measures, net

income and net income per share, diluted, respectively, for the

periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except share and per

share amounts)

2024

2023

2024

2023

Net income

$

132,329

$

18,722

$

309,989

$

117,754

Share-based compensation(1)

13,785

21,337

47,341

24,502

Litigation costs(2)

29,035

3,965

42,691

4,600

Foreign currency (gains) losses,

net(3)

(11,156

)

3,862

(9,569

)

43,479

Amortization of acquired intangible

assets(4)

4,896

4,897

14,690

14,690

Transaction-related costs(5)

—

41,455

1,342

76,549

Product Procurement Adjustment(6)

9,571

23,574

37,876

53,369

Tax impact of adjusting items(7)

(7,996

)

(4,704

)

(25,711

)

(30,686

)

Tax withholding adjustment(8)

—

19,474

—

19,474

Divested subsidiary net income

adjustment(9)

—

394

—

(6,586

)

Adjusted Net Income

$

170,464

$

132,976

$

418,649

$

317,145

Net income per share, diluted

$

0.94

$

0.13

$

2.20

$

0.85

Adjusted Net Income Per Share

$

1.21

$

0.95

$

2.97

$

2.28

Diluted weighted-average number of shares

used in computing net income per share and Adjusted Net Income Per

Share(10)

141,305,999

139,430,805

140,974,062

139,179,724

(1)

Represents non-cash expense related to

awards issued from the SharkNinja and JS Global equity incentive

plans.

(2)

Represents litigation costs incurred and

related settlements for certain patent infringement claims, false

advertising claims, and any related settlement costs, which were

recorded in general and administrative expenses.

(3)

Represents foreign currency transaction

gains and losses recognized from the remeasurement of transactions

that were not denominated in the local functional currency,

including gains and losses related to foreign currency derivatives

not designated as hedging instruments.

(4)

Represents amortization of acquired

intangible assets that we do not consider normal recurring

operating expenses, as the intangible assets relate to JS Global’s

acquisition of our business. We exclude amortization charges for

these acquisition-related intangible assets for purposes of

calculated Adjusted Net Income, although revenue is generated, in

part, by these intangible assets, to eliminate the impact of these

non-cash charges that are significantly impacted by the timing and

valuation of JS Global’s acquisition of our business, as well as

the inherent subjective nature of purchase price allocations. Of

the amortization of acquired intangible assets, $0.9 million for

the three months ended September 30, 2024 and 2023, and $2.8

million for the nine months ended September 30, 2024 and 2023, was

recorded to research and development expenses, and $4.0 million for

the three months ended September 30, 2024 and 2023, and $11.9

million for the nine months ended September 30, 2024 and 2023, was

recorded to sales and marketing expenses.

(5)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(6)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(7)

Represents the income tax effects of the

adjustments included in the reconciliation of net income to

Adjusted Net Income determined using the tax rate of 22.0%, which

approximates our effective tax rate, excluding (i) divested

subsidiary net income adjustment described in footnote (9), and

(ii) certain share-based compensation costs and separation and

distribution-related costs that are not tax deductible.

(8)

Represents withholding taxes associated

with the cash dividend paid to JS Global in connection with the

separation and related refinancing.

(9)

Adjusted for net income (loss) from SNJP

and the APAC distribution channels for the three and nine months

ended September 30, 2023, as if such Divestitures occurred on

January 1, 2023.

(10)

In calculating net income per share and

Adjusted Net Income Per Share, we used the number of shares

transferred in the separation and distribution for the denominator

for all periods prior to completion of the separation and

distribution on July 31, 2023.

We define EBITDA as net income excluding: (i) interest expense,

net, (ii) provision for income taxes and (iii) depreciation and

amortization. We define Adjusted EBITDA as EBITDA excluding (i)

share-based compensation cost, (ii) certain litigation costs, (iii)

foreign currency gains and losses, net, (iv) certain

transaction-related costs and (v) certain items that we do not

consider indicative of our ongoing operating performance following

the separation, including Adjusted EBITDA from our Divestitures and

cost of sales from our Product Procurement Adjustment. We define

Adjusted EBITDA Margin as Adjusted EBITDA divided by Adjusted Net

Sales. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA

Margin are appropriate measures because they facilitate a

comparison of our operating performance on a consistent basis from

period to period that, when viewed in combination with our results

according to GAAP, we believe provide a more complete understanding

of the factors and trends affecting our business than GAAP measures

alone.

The following table reconciles EBITDA, Adjusted EBITDA and

Adjusted EBITDA Margin to the most comparable GAAP measure, net

income, for the periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

($ in thousands, except %)

2024

2023

2024

2023

Net income

$

132,329

$

18,722

$

309,989

$

117,754

Interest expense, net

16,916

13,003

46,482

28,523

Provision for income taxes

42,048

56,958

97,537

85,218

Depreciation and amortization

29,828

25,602

86,870

77,394

EBITDA

221,121

114,285

540,878

308,889

Share-based compensation(1)

13,785

21,337

47,341

24,502

Litigation costs(2)

29,035

3,965

42,691

4,600

Foreign currency losses (gains),

net(3)

(11,156

)

3,862

(9,569

)

43,479

Transaction-related costs(4)

—

41,455

1,342

76,549

Product Procurement Adjustment(5)

9,571

23,574

37,876

53,369

Divested subsidiary Adjusted EBITDA

adjustment(6)

—

264

—

(11,020

)

Adjusted EBITDA

$

262,356

$

208,742

$

660,559

$

500,368

Adjusted Net Sales

$

1,426,566

$

1,057,421

$

3,741,452

$

2,798,667

Adjusted EBITDA Margin

18.4

%

19.7

%

17.7

%

17.9

%

(1)

Represents non-cash expense related to

awards issued from the SharkNinja and JS Global equity incentive

plans.

(2)

Represents litigation costs incurred and

related settlements for certain patent infringement claims, false

advertising claims, and any related settlement costs, which were

recorded in general and administrative expenses.

(3)

Represents foreign currency transaction

gains and losses recognized from the remeasurement of transactions

that were not denominated in the local functional currency,

including gains and losses related to foreign currency derivatives

not designated as hedging instruments.

(4)

Represents certain costs incurred related

to the separation and distribution from JS Global and the secondary

offering transactions.

(5)

Represents cost of sales incurred related

to the Product Procurement Adjustment. As a result of the

separation, we purchase 100% of our inventory from one of our

subsidiaries, SNHK, and no longer purchase inventory from a

purchasing office wholly owned by JS Global. Thus, the markup on

all inventory purchased subsequent to the separation is completely

eliminated in consolidation. As a result of the separation, we pay

JS Global a sourcing service fee to provide value-added sourcing

services on a transitional basis under a Sourcing Services

Agreement.

(6)

Adjusted for Adjusted EBITDA from SNJP and

the APAC distribution channels for the three and nine months ended

September 30, 2023, as if such Divestitures occurred on January 1,

2023. The divested subsidiary Adjusted EBITDA adjustment represents

net (loss) income from our Divestitures excluding interest expense,

income tax expense, depreciation and amortization expense and

foreign currency gains and losses recorded at the subsidiary

level.

We refer to growth rates in Adjusted Net Sales on a constant

currency basis so that results can be viewed without the impact of

fluctuations in foreign currency exchange rates. These amounts are

calculated by translating current year results at prior year

average exchange rates. We believe elimination of the foreign

currency translation impact provides useful information in

understanding and evaluating trends in our operating results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031991765/en/

Investor Relations: Arvind Bhatia, CFA SVP, Investor Relations

IR@sharkninja.com

Anna Kate Heller ICR SharkNinja@icrinc.com

Media Relations: Jane Carpenter SVP, Chief Communications

Officer PR@sharkninja.com

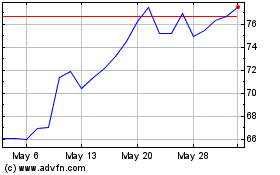

Sharkninja (NYSE:SN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sharkninja (NYSE:SN)

Historical Stock Chart

From Dec 2023 to Dec 2024