Form SD - Specialized disclosure report

24 September 2024 - 3:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

SUNCOR ENERGY INC.

(Exact name of the registrant as specified in its charter)

| | | | |

Canada | | 1-12384 | | 98-0343201 |

(State or other jurisdiction of | | (Commission file number) | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | | | |

150 - 6th Avenue S.W.

P.O. Box 2844

Calgary, Alberta

Canada, T2P 3E3

(Address of principal executive offices)

Shawn Poirier

(403) 296-8000

(Name and telephone number, including area code,

of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

☐ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, _______.

☒ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023.

SECTION 1 - CONFLICT MINERALS DISCLOSURE

Item 1.01 - Conflict Minerals Disclosure and Report

Not applicable.

ITEM 1.02 - Exhibit

Not applicable.

SECTION 2 - RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 - Resource Extraction Issuer Disclosure and Report

Suncor Energy Inc. (Suncor or the company) is subject to Canada’s Extractive Sector Transparency Measures Act (ESTMA). Suncor is relying on the alternative reporting provision of Item 2.01 and providing its ESTMA reports for the year end December 31, 2023 to satisfy the requirements of Item 2.01. Suncor’s ESTMA reports are available on the company’s website at https://www.suncor.com/en-ca/investors/financial-reports-and-guidance/estma-reports. The payment disclosures required for Suncor by Form SD are included as Exhibit 99.1 to this Form SD.

Suncor is also filing on behalf of its subsidiaries Fort Hills Energy Limited Partnership (Fort Hills) and Syncrude Canada Ltd. (Syncrude). Each of Fort Hills and Syncrude is relying on the alternative reporting provision of Item 2.01 and providing its ESTMA report for the year ended December 31, 2023 to satisfy the requirements of Item 2.01. Fort Hills’ and Syncrude’s ESTMA reports are available on Suncor’s website at https://www.suncor.com/en-ca/investors/financial-reports-and-guidance/estma-reports. The payment disclosures required by Form SD for Fort Hills and Syncrude are included as Exhibits 99.2 and 99.3 to this Form SD.

SECTION 3 - EXHIBITS

Item 3.01 - Exhibits

The following exhibits are filed as part of this Form SD.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| |

Date: September 23, 2024 | SUNCOR ENERGY INC. |

| |

| /s/ Shawn Poirier |

| Shawn Poirier Assistant Corporate Secretary |

| |

Exhibit 99.1

Extractive Sector Transparency Measures Act - Annual Report |

|

Reporting Entity Name | Suncor Energy Inc. | |

Reporting Year | From | 1/1/2023 | To: | 12/31/2023 | Date submitted | 5/28/2024 | |

Reporting Entity ESTMA Identification Number | E405435 | ◉ Original Submission | | |

| | ○ Amended Report | | |

Other Subsidiaries Included

(optional field) | | |

| |

For Consolidated Reports - Subsidiary Reporting Entities Included in Report: | Petro-Canada Terra Nova Partnership: E368056,

Petro-Canada Hibernia Partnership: E014222,

Petro-Canada Hebron Partnership: E294659,

Canadian Oil Sands Partnership: E984046,

Suncor Energy Oil Sands Limited Partnership: E761283,

Suncor Energy Offshore Exploration Partnership: E718793,

Suncor Energy Ventures Partnership: E895970 | |

| |

Not Substituted | | | | |

| |

Attestation by Reporting Entity | | | | | | | |

| | | | | | | |

In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| | | | | | | |

Full Name of Director or Officer of Reporting Entity | Kris Smith | Date | 5/27/2024 | |

Position Title | Chief Financial Officer | | | |

| | | | | | | | | | | | |

Extractive Sector Transparency Measures Act - Annual Report | |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | | | |

Reporting Entity Name | Suncor Energy Inc. | Currency of the Report | CAD | | | | |

Reporting Entity ESTMA Identification Number | E405435 | | | | | | |

Subsidiary Reporting Entities (if necessary) | Petro-Canada Terra Nova Partnership: E368056,

Petro-Canada Hibernia Partnership: E014222,

Petro-Canada Hebron Partnership: E294659,

Canadian Oil Sands Partnership: E984046,

Suncor Energy Oil Sands Limited Partnership: E761283,

Suncor Energy Offshore Exploration Partnership: E718793,

Suncor Energy Ventures Partnership: E895970 | | | | | | |

Payments by Payee | |

| | | | | | | | | | | | |

Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 | |

Canada | Government of Canada | | 1,490,070,000 | 38,400,000 | 310,000 | - | - | - | - | 1,528,780,000 | | |

Canada | Canada Newfoundland and Labrador Offshore Petroleum Board | | - | - | 4,540,000 | - | - | - | - | 4,540,000 | | |

Canada -Alberta | Athabasca Chipewyan First Nation | | - | - | 1,860,000 | - | - | - | - | 1,860,000 | | |

Canada -Alberta | Fort Chipewyan Metis Local 125 | | - | - | 670,000 | - | - | - | - | 670,000 | | |

Canada -Alberta | Fort McKay First Nation | | - | - | 4,460,000 | - | - | - | - | 4,460,000 | | |

Canada -Alberta | Fort McKay Metis Community Association | | - | - | 400,000 | - | - | - | - | 400,000 | | |

Canada -Alberta | Fort McMurray #468 First Nation | | - | - | 170,000 | - | - | - | - | 170,000 | | |

Canada -Alberta | Fort McMurray Metis Local 1935 | | - | - | 140,000 | - | - | - | - | 140,000 | | |

Canada -Alberta | Province of Alberta | | 704,650,000 | 1,652,510,000 | 30,850,000 | - | - | - | - | 2,388,010,000 | | |

Canada -Alberta | Mikisew Cree First Nation | | - | - | 800,000 | - | - | - | - | 800,000 | | |

Canada -Alberta | Municipality of Wood Buffalo | | 46,380,000 | - | 60,000 | - | - | - | - | 46,440,000 | | |

Canada -Alberta | Chipewyan Prairie First Nation | | - | - | 170,000 | - | - | - | - | 170,000 | | |

Canada -Alberta | Willow Lake Metis Association | | - | - | 140,000 | - | - | - | - | 140,000 | | |

Canada -Alberta | Conklin Metis Local #193 | | - | - | 140,000 | - | - | - | - | 140,000 | | |

Canada -Newfoundland and Labrador | Province of Newfoundland and Labrador | | - | 192,800,000 | - | - | - | - | - | 192,800,000 | Includes royalties paid in relation to the Hibernia Base, Hibernia Extenstion, Terra Nova, White Rose and Hebron projects. | |

Canada -Quebec | Province of Quebec | | 116,790,000 | - | - | - | - | - | - | 116,790,000 | | |

Libya | Government of Libya | National Oil Corporation | 247,250,000 | 282,010,000 | - | - | - | - | - | 529,260,000 | Taxes & Royalties taken in kind and converted to cash basis using the same methodology (fair market value) as Suncor Energy Inc.'s 2023 consolidated financial statements.

Translated using the financial year average foreign exchange rates: 1 USD : 1.3497 CAD. | |

United Kingdom of Great Britain and Northern Ireland | Her Majesty’s Government of the United Kingdom of Great Britain and Northern Ireland | Her Majesty's Revenue and Customs Cumbernauld | 216,360,000 | - | - | - | - | - | - | 216,360,000 | Translated using the financial year average foreign exchange rate: 1 GBP : 1.6784 CAD. | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

Additional Notes: | - All payments are reported in Canadian dollars.

- All amounts have been rounded to the nearest $10,000 CAD. | |

1 Enter the proper name of the Payee receiving the money (i.e. the municipality of x, the province of y, national government of z). |

2 Optional field. |

3 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

4 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the Additional notes row or the Notes column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| | | | | | | | | | | |

Extractive Sector Transparency Measures Act - Annual Report |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | | |

Reporting Entity Name | Suncor Energy Inc. | Currency of the Report | CAD | | | |

Reporting Entity ESTMA Identification Number | E405435 | | | | | |

Subsidiary Reporting Entities (if necessary) | Petro-Canada Terra Nova Partnership: E368056,

Petro-Canada Hibernia Partnership: E014222,

Petro-Canada Hebron Partnership: E294659,

Canadian Oil Sands Partnership: E984046,

Suncor Energy Oil Sands Limited Partnership: E761283,

Suncor Energy Offshore Exploration Partnership: E718793,

Suncor Energy Ventures Partnership: E895970 | | | | | |

Payments by Project | |

| | | | | | | | | | | |

Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 | |

Canada -Alberta | Base Mine | 16,840,000 | 372,120,000 | 12,390,000 | - | - | - | - | 401,350,000 | | |

Canada -Alberta | Firebag | 25,920,000 | 1,157,810,000 | 5,640,000 | - | - | - | - | 1,189,370,000 | | |

Canada -Alberta | MacKay River | 3,000,000 | 122,580,000 | 2,950,000 | - | - | - | - | 128,530,000 | | |

Canada -Newfoundland and Labrador | Hebron | - | 48,310,000 | - | - | - | - | - | 48,310,000 | | |

Canada -Newfoundland and Labrador | Hibernia | - | 175,460,000 | - | - | - | - | - | 175,460,000 | Hibernia Base and Extension projects have been combined for the purposes of this report. | |

Canada -Newfoundland and Labrador | Terra Nova | - | 210,000 | 4,540,000 | - | - | - | - | 4,750,000 | | |

Canada -Newfoundland and Labrador | White Rose | - | 7,220,000 | - | - | - | - | - | 7,220,000 | | |

Libya | Libya | 247,250,000 | 282,010,000 | - | - | - | - | - | 529,260,000 | Taxes & Royalties taken in kind and converted to cash basis using the same methodology (fair market value) as Suncor Energy Inc.'s 2023 consolidated financial statements.

Translated using the financial year average foreign exchange rates: 1 USD : 1.3497 CAD. | |

United Kingdom of Great Britain and Northern Ireland | U.K. Oil & Gas Taxes | 216,360,000 | - | - | - | - | - | - | 216,360,000 | Translated using the financial year average foreign exchange rate: 1 GBP : 1.6784 CAD. | |

Canada | Other | 620,000 | - | 19,190,000 | - | - | - | - | 19,810,000 | Includes Emerging properties in the Oil Sands business unit (Meadow Creek, Lewis, Voyageur, Chard, Dover, and Polaris) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | |

Additional Notes3: | - All payments are reported in Canadian dollars.

- All amounts have been rounded to the nearest $10,000 CAD. | |

1 Enter the project that the payment is attributed to. Some payments may not be attributable to a specific project, and do not need to be disclosed in the "Payments by Project" table. |

2 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

3 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the "Additional Notes" row or the "Notes" column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

Exhibit 99.2

Extractive Sector Transparency Measures Act - Annual Report |

|

Reporting Entity Name | Fort Hills Energy Limited Partnership | |

Reporting Year | From | 1/1/2023 | To: | 12/31/2023 | Date submitted | 5/28/2024 | |

Reporting Entity ESTMA Identification Number | E991999 | ◉ Original Submission ○ Amended Report | | |

| | | | |

Other Subsidiaries Included

(optional field) | | |

| |

Not Consolidated | | |

| |

Not Substituted | | | | |

| |

Attestation by Reporting Entity | | | | | | | |

In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| |

| |

| |

| |

| | | | | | | |

| | | | | | | |

Full Name of Director or Officer of Reporting Entity | Kris Smith | Date | 5/27/2024 | |

Position Title | Chief Financial Officer | | | |

| | | | | | | | | | | |

Extractive Sector Transparency Measures Act - Annual Report |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | | |

Reporting Entity Name | Fort Hills Energy Limited Partnership | Currency of the Report | CAD | | | |

Reporting Entity ESTMA Identification Number | E991999 | | | | | |

Subsidiary Reporting Entities (if necessary) | | | | | | |

| | | | | | | | | | | |

Payments by Payee |

Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 |

Canada | Government of Canada | | - | - | 180,000 | - | - | - | - | 180,000 | |

Canada -Alberta | Province of Alberta | | - | 212,390,000 | 13,650,000 | - | - | - | - | 226,040,000 | |

Canada -Alberta | Municipality of Wood Buffalo | | 63,760,000 | - | - | - | - | - | - | 63,760,000 | |

Canada -Alberta | Athabasca Chipewyan First Nation | | | | 170,000 | | | | | 170,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Additional Notes: | - All payments are reported in Canadian dollars.

- All amounts have been rounded to the nearest $10,000 CAD. |

1 Enter the proper name of the Payee receiving the money (i.e. the municipality of x, the province of y, national government of z). | |

2 Optional field. | |

3 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. | |

4 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the Additional notes row or the Notes column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. | |

Extractive Sector Transparency Measures Act - Annual Report |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | |

Reporting Entity Name | Fort Hills Energy Limited Partnership | Currency of the Report | CAD | | |

Reporting Entity ESTMA Identification Number | E991999 | | | | |

Subsidiary Reporting Entities (if necessary) | | | | | |

Payments by Project |

Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 |

Canada -Alberta | Fort Hills | 63,760,000 | 212,390,000 | 14,000,000 | - | - | - | - | 290,150,000 | |

| |

Additional Notes3: | - All payments are reported in Canadian dollars.

- All amounts have been rounded to the nearest $10,000 CAD. |

1 Enter the project that the payment is attributed to. Some payments may not be attributable to a specific project, and do not need to be disclosed in the "Payments by Project" table. |

2 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

3 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the "Additional Notes" row or the "Notes" column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

Exhibit 99.3

Extractive Sector Transparency Measures Act - Annual Report |

|

Reporting Entity Name | Syncrude Canada Ltd | |

Reporting Year | From | 1/1/2023 | To: | 12/31/2023 | Date submitted | 5/28/2024 | |

Reporting Entity ESTMA Identification Number | E953333 | ◉ Original Submission | | |

| | ○ Amended Report | | |

Other Subsidiaries Included

(optional field) | | |

| |

For Consolidated Reports - Subsidiary Reporting Entities Included in Report: | | |

| |

Not Substituted | | | | |

| |

Attestation by Reporting Entity | | | | | | | |

| | | | | | | |

In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| | | | | | | |

Full Name of Director or Officer of Reporting Entity | Kris Smith | Date | 5/27/2024 | |

Position Title | Chief Financial Officer | | | |

| | | | | | | | | | | | |

Extractive Sector Transparency Measures Act - Annual Report | |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | | | |

Reporting Entity Name | Syncrude Canada Ltd | Currency of the Report | CAD | | | | |

Reporting Entity ESTMA Identification Number | E953333 | | | | | | |

Subsidiary Reporting Entities (if necessary) | | | | | | | |

Payments by Payee | |

| | | | | | | | | | | | |

Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 | |

Canada -Alberta | Province of Alberta | | | 1,235,830,000 | 12,590,000 | | 760,000 | | | 1,249,180,000 | Bonus payments include social payments expressly required in a legal agreement. | |

Canada -Alberta | Municipality of Wood Buffalo | | 59,070,000 | | | | | | | 59,070,000 | | |

Canada -Alberta | Fort McKay First Nation | | 110,000 | | 1,160,000 | | | | | 1,270,000 | | |

Canada -Alberta | Athabasca Chipewyan First Nation | | | | 330,000 | | | | | 330,000 | | |

Canada -Alberta | Fort McKay Metis Community Association | | | | 100,000 | | | | | 100,000 | | |

Canada -Alberta | Fort McMurray 468 First Nation | | | | 130,000 | | | | | 130,000 | | |

Canada -Alberta | Mikisew Cree First Nation | | | | 2,580,000 | | | | | 2,580,000 | | |

Canada -Alberta | Chipewyan Prairie Dene First Nation | | | | 100,000 | | | | | 100,000 | | |

| | |

Additional Notes: | All payments are reported in Canadian dollars.

All amounts have been rounded to the nearest $10,000 CAD | |

1 Enter the proper name of the Payee receiving the money (i.e. the municipality of x, the province of y, national government of z). |

2 Optional field. |

3 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

4 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the Additional notes row or the Notes column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| | | | | | | | | | | |

Extractive Sector Transparency Measures Act - Annual Report | |

Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | | |

Reporting Entity Name | Syncrude Canada Ltd | Currency of the Report | CAD | | | |

Reporting Entity ESTMA Identification Number | E953333 | | | | | |

Subsidiary Reporting Entities (if necessary) | | | | | | |

Payments by Project | |

| | | | | | | | | | | |

Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 | |

Canada -Alberta | Syncrude Project | 59,180,000 | 1,235,830,000 | 16,990,000 | - | 760,000 | - | - | 1,312,760,000 | | |

| | |

Additional Notes3: | All payments are reported in Canadian dollars.

All amounts have been rounded to the rearest $10,000 CAD. | |

1 Enter the project that the payment is attributed to. Some payments may not be attributable to a specific project, and do not need to be disclosed in the "Payments by Project" table. |

2 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

3 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the "Additional Notes" row or the "Notes" column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Payments, by Category - 12 months ended Dec. 31, 2023 - CAD ($)

$ in Thousands |

Suncor Energy Inc |

Fort Hills Energy Limited Partnership |

Syncrude Canada Ltd |

| Payments: |

|

|

|

| Taxes |

$ 2,821,500

|

$ 63,760

|

$ 59,180

|

| Royalties |

2,165,720

|

212,390

|

1,235,830

|

| Fees |

44,710

|

14,000

|

16,990

|

| Bonuses |

|

|

760

|

| Total Payments |

$ 5,031,930

|

$ 290,150

|

$ 1,312,760

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection d

-Paragraph 9

-Subparagraph iii

-Clause E

| Name: |

rxp_Bonuses |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection d

-Paragraph 9

-Subparagraph iii

-Clause C

| Name: |

rxp_Fees |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection a

-Paragraph 5

| Name: |

rxp_PaymentsLineItems |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection d

-Paragraph 9

-Subparagraph iii

-Clause B

| Name: |

rxp_Royalties |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection d

-Paragraph 9

-Subparagraph iii

-Clause A

| Name: |

rxp_Taxes |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form SD

-Section 2.01

-Subsection d

-Paragraph 9

| Name: |

rxp_TotalPayments |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

v3.24.3

Payments, by Project - 12 months ended Dec. 31, 2023 - CAD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Bonuses |

Total Payments |

| Suncor Energy Inc |

|

|

|

|

|

| Total |

$ 2,821,500

|

$ 2,165,720

|

$ 44,710

|

|

$ 5,031,930

|

| Suncor Energy Inc | Base Mine |

|

|

|

|

|

| Total |

16,840

|

372,120

|

12,390

|

|

401,350

|

| Suncor Energy Inc | Firebag |

|

|

|

|

|

| Total |

25,920

|

1,157,810

|

5,640

|

|

1,189,370

|

| Suncor Energy Inc | MacKay River |

|

|

|

|

|

| Total |

3,000

|

122,580

|

2,950

|

|

128,530

|

| Suncor Energy Inc | Hebron |

|

|

|

|

|

| Total |

|

48,310

|

|

|

48,310

|

| Suncor Energy Inc | Hibernia |

|

|

|

|

|

| Total |

|

175,460

|

|

|

175,460

|

| Suncor Energy Inc | Terra Nova |

|

|

|

|

|

| Total |

|

210

|

4,540

|

|

4,750

|

| Suncor Energy Inc | White Rose |

|

|

|

|

|

| Total |

|

7,220

|

|

|

7,220

|

| Suncor Energy Inc | Libya |

|

|

|

|

|

| Total |

247,250

|

282,010

|

|

|

529,260

|

| Suncor Energy Inc | U.K. Oil & Gas Taxes |

|

|

|

|

|

| Total |

216,360

|

|

|

|

216,360

|

| Suncor Energy Inc | Other |

|

|

|

|

|

| Total |

620

|

|

19,190

|

|

19,810

|

| Fort Hills Energy Limited Partnership |

|

|

|

|

|

| Total |

63,760

|

212,390

|

14,000

|

|

290,150

|

| Fort Hills Energy Limited Partnership | Fort Hills |

|

|

|

|

|

| Total |

63,760

|

212,390

|

14,000

|

|

290,150

|

| Syncrude Canada Ltd |

|

|

|

|

|

| Total |

59,180

|

1,235,830

|

16,990

|

$ 760

|

1,312,760

|

| Syncrude Canada Ltd | Syncrude |

|

|

|

|

|

| Total |

$ 59,180

|

$ 1,235,830

|

$ 16,990

|

$ 760

|

$ 1,312,760

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=srt_ParentCompanyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_BaseMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_FirebagMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_MackayRiverMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_HebronMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_HiberniaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_TerraNovaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_WhiteRoseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_LibyaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_U.K.OilGasTaxesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_OtherMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_FortHillsEnergyLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_FortHillsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_SyncrudeCanadaLtdMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=su_SyncrudeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

Payments, by Government - 12 months ended Dec. 31, 2023 - CAD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Bonuses |

Total Payments |

| Suncor Energy Inc |

|

|

|

|

|

| Total |

$ 2,821,500

|

$ 2,165,720

|

$ 44,710

|

|

$ 5,031,930

|

| Suncor Energy Inc | Canada | Government of Canada |

|

|

|

|

|

| Total |

1,490,070

|

38,400

|

310

|

|

1,528,780

|

| Suncor Energy Inc | Canada | Canada Newfoundland and Labrador Offshore Petroleum Board |

|

|

|

|

|

| Total |

|

|

4,540

|

|

4,540

|

| Suncor Energy Inc | Canada | Athabasca Chipewyan First Nation |

|

|

|

|

|

| Total |

|

|

1,860

|

|

1,860

|

| Suncor Energy Inc | Canada | Fort Chipewyan Metis Local 125 |

|

|

|

|

|

| Total |

|

|

670

|

|

670

|

| Suncor Energy Inc | Canada | Fort McKay First Nation |

|

|

|

|

|

| Total |

|

|

4,460

|

|

4,460

|

| Suncor Energy Inc | Canada | Fort McKay Metis Community Association |

|

|

|

|

|

| Total |

|

|

400

|

|

400

|

| Suncor Energy Inc | Canada | Fort McMurray #468 First Nation |

|

|

|

|

|

| Total |

|

|

170

|

|

170

|

| Suncor Energy Inc | Canada | Fort McMurray Metis Local 1935 |

|

|

|

|

|

| Total |

|

|

140

|

|

140

|

| Suncor Energy Inc | Canada | Province of Alberta |

|

|

|

|

|

| Total |

704,650

|

1,652,510

|

30,850

|

|

2,388,010

|

| Suncor Energy Inc | Canada | Mikisew Cree First Nation |

|

|

|

|

|

| Total |

|

|

800

|

|

800

|

| Suncor Energy Inc | Canada | Municipality of Wood Buffalo |

|

|

|

|

|

| Total |

46,380

|

|

60

|

|

46,440

|

| Suncor Energy Inc | Canada | Chipewyan Prairie First Nation |

|

|

|

|

|

| Total |

|

|

170

|

|

170

|

| Suncor Energy Inc | Canada | Willow Lake Metis Association |

|

|

|

|

|

| Total |

|

|

140

|

|

140

|

| Suncor Energy Inc | Canada | Conklin Metis Local #193 |

|

|

|

|

|

| Total |

|

|

140

|

|

140

|

| Suncor Energy Inc | Canada | Province of Newfoundland and Labrador |

|

|

|

|

|

| Total |

|

192,800

|

|

|

192,800

|

| Suncor Energy Inc | Canada | Province of Quebec |

|

|

|

|

|

| Total |

116,790

|

|

|

|

116,790

|

| Suncor Energy Inc | Libya | Government of Libya, National Oil Corporation |

|

|

|

|

|

| Total |

247,250

|

282,010

|

|

|

529,260

|

| Suncor Energy Inc | United Kingdom of Great Britain and Northern Ireland | Her Majesty's Government of the United Kingdom of Great Britain and Northern Ireland, Her Majesty's Revenue and Customs Cumbernauld |

|

|

|

|

|

| Total |

216,360

|

|

|

|

216,360

|

| Fort Hills Energy Limited Partnership |

|

|

|

|

|

| Total |

63,760

|

212,390

|

14,000

|

|

290,150

|

| Fort Hills Energy Limited Partnership | Canada | Government of Canada |

|

|

|

|

|

| Total |

|

|

180

|

|

180

|

| Fort Hills Energy Limited Partnership | Canada | Athabasca Chipewyan First Nation |

|

|

|

|

|

| Total |

|

|

170

|

|

170

|

| Fort Hills Energy Limited Partnership | Canada | Province of Alberta |

|

|

|

|

|

| Total |

|

212,390

|

13,650

|

|

226,040

|

| Fort Hills Energy Limited Partnership | Canada | Municipality of Wood Buffalo |

|

|

|

|

|

| Total |

63,760

|

|

|

|

63,760

|

| Syncrude Canada Ltd |

|

|

|

|

|

| Total |

59,180

|

1,235,830

|

16,990

|

$ 760

|

1,312,760

|

| Syncrude Canada Ltd | Canada | Athabasca Chipewyan First Nation |

|

|

|

|

|

| Total |

|

|

330

|

|

330

|

| Syncrude Canada Ltd | Canada | Fort McKay First Nation |

|

|

|

|

|

| Total |

110

|

|

1,160

|

|

1,270

|

| Syncrude Canada Ltd | Canada | Fort McKay Metis Community Association |

|

|

|

|

|

| Total |

|

|

100

|

|

100

|

| Syncrude Canada Ltd | Canada | Fort McMurray #468 First Nation |

|

|

|

|

|

| Total |

|

|

130

|

|

130

|

| Syncrude Canada Ltd | Canada | Province of Alberta |

|

|

|

|

|

| Total |

|

$ 1,235,830

|

12,590

|

$ 760

|

1,249,180

|

| Syncrude Canada Ltd | Canada | Mikisew Cree First Nation |

|

|

|

|

|

| Total |

|

|

2,580

|

|

2,580

|

| Syncrude Canada Ltd | Canada | Municipality of Wood Buffalo |

|

|

|

|

|

| Total |

$ 59,070

|

|

|

|

59,070

|

| Syncrude Canada Ltd | Canada | Chipewyan Prairie Dene First Nation |

|

|

|

|

|

| Total |

|

|

$ 100

|

|

$ 100

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=srt_ParentCompanyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_CA |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_GovernmentOfCanadaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_CanadaNewfoundlandAndLabradorOffshorePetroleumBoardMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_AthabascaChipewyanFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_FortChipewyanMetisLocal125Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_FortMckayFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_FortMcmurray468FirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_FortMcmurrayMetisLocal1935Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ProvinceOfAlbertaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_MikisewCreeFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_MunicipalityOfWoodBuffaloMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ChipewyanPrairieFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_WillowLakeMetisAssociationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ConklinMetisLocal193Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ProvinceOfNewfoundlandAndLabradorMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ProvinceOfQuebecMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_LY |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_GovernmentOfLibyaNationalOilCorporationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_GB |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_HerMajestysGovernmentOfUnitedKingdomOfGreatBritainAndNorthernIrelandHerMajestysRevenueAndCustomsCumbernauldMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_FortHillsEnergyLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_SyncrudeCanadaLtdMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=su_ChipewyanPrairieDeneFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

Payments, Details - 12 months ended Dec. 31, 2023 - CAD ($)

$ in Thousands |

Amount |

Type |

Country |

Subnat. Juris. |

Govt. |

Project |

In-kind |

In-kind Calc. |

| Suncor Energy Inc | #: 1 |

|

|

|

|

|

|

|

|

|

$ 1,490,070

|

Taxes

|

Canada

|

|

Government of Canada

|

|

|

|

| Suncor Energy Inc | #: 2 |

|

|

|

|

|

|

|

|

|

38,400

|

Royalties

|

Canada

|

|

Government of Canada

|

|

|

|

| Suncor Energy Inc | #: 3 |

|

|

|

|

|

|

|

|

|

310

|

Fees

|

Canada

|

|

Government of Canada

|

|

|

|

| Suncor Energy Inc | #: 4 |

|

|

|

|

|

|

|

|

|

4,540

|

Fees

|

Canada

|

|

Canada Newfoundland and Labrador Offshore Petroleum Board

|

Terra Nova

|

|

|

| Suncor Energy Inc | #: 5 |

|

|

|

|

|

|

|

|

|

1,860

|

Fees

|

Canada

|

snj:CA-AB

|

Athabasca Chipewyan First Nation

|

|

|

|

| Suncor Energy Inc | #: 6 |

|

|

|

|

|

|

|

|

|

670

|

Fees

|

Canada

|

snj:CA-AB

|

Fort Chipewyan Metis Local 125

|

|

|

|

| Suncor Energy Inc | #: 7 |

|

|

|

|

|

|

|

|

|

4,460

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McKay First Nation

|

|

|

|

| Suncor Energy Inc | #: 8 |

|

|

|

|

|

|

|

|

|

400

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McKay Metis Community Association

|

|

|

|

| Suncor Energy Inc | #: 9 |

|

|

|

|

|

|

|

|

|

170

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McMurray #468 First Nation

|

|

|

|

| Suncor Energy Inc | #: 10 |

|

|

|

|

|

|

|

|

|

140

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McMurray Metis Local 1935

|

|

|

|

| Suncor Energy Inc | #: 11 |

|

|

|

|

|

|

|

|

|

704,650

|

Taxes

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

|

|

|

| Suncor Energy Inc | #: 12 |

|

|

|

|

|

|

|

|

|

1,652,510

|

Royalties

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

|

|

|

| Suncor Energy Inc | #: 13 |

|

|

|

|

|

|

|

|

|

30,850

|

Fees

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

|

|

|

| Suncor Energy Inc | #: 14 |

|

|

|

|

|

|

|

|

|

800

|

Fees

|

Canada

|

snj:CA-AB

|

Mikisew Cree First Nation

|

|

|

|

| Suncor Energy Inc | #: 15 |

|

|

|

|

|

|

|

|

|

46,380

|

Taxes

|

Canada

|

snj:CA-AB

|

Municipality of Wood Buffalo

|

|

|

|

| Suncor Energy Inc | #: 16 |

|

|

|

|

|

|

|

|

|

60

|

Fees

|

Canada

|

snj:CA-AB

|

Municipality of Wood Buffalo

|

|

|

|

| Suncor Energy Inc | #: 17 |

|

|

|

|

|

|

|

|

|

170

|

Fees

|

Canada

|

snj:CA-AB

|

Chipewyan Prairie First Nation

|

|

|

|

| Suncor Energy Inc | #: 18 |

|

|

|

|

|

|

|

|

|

140

|

Fees

|

Canada

|

snj:CA-AB

|

Willow Lake Metis Association

|

|

|

|

| Suncor Energy Inc | #: 19 |

|

|

|

|

|

|

|

|

|

140

|

Fees

|

Canada

|

snj:CA-AB

|

Conklin Metis Local #193

|

|

|

|

| Suncor Energy Inc | #: 20 |

|

|

|

|

|

|

|

|

|

192,800

|

Royalties

|

Canada

|

snj:CA-NL

|

Province of Newfoundland and Labrador

|

|

|

|

| Suncor Energy Inc | #: 21 |

|

|

|

|

|

|

|

|

|

116,790

|

Taxes

|

Canada

|

snj:CA-QC

|

Province of Quebec

|

|

|

|

| Suncor Energy Inc | #: 22 |

|

|

|

|

|

|

|

|

|

247,250

|

Taxes

|

Libya

|

|

Government of Libya, National Oil Corporation

|

Libya

|

Yes

|

fair market value

|

| Suncor Energy Inc | #: 23 |

|

|

|

|

|

|

|

|

|

282,010

|

Royalties

|

Libya

|

|

Government of Libya, National Oil Corporation

|

Libya

|

Yes

|

fair market value

|

| Suncor Energy Inc | #: 24 |

|

|

|

|

|

|

|

|

|

216,360

|

Taxes

|

United Kingdom of Great Britain and Northern Ireland

|

|

Her Majesty's Government of the United Kingdom of Great Britain and Northern Ireland, Her Majesty's Revenue and Customs Cumbernauld

|

U.K. Oil & Gas Taxes

|

|

|

| Fort Hills Energy Limited Partnership | #: 1 |

|

|

|

|

|

|

|

|

|

180

|

Fees

|

Canada

|

|

Government of Canada

|

Fort Hills

|

|

|

| Fort Hills Energy Limited Partnership | #: 2 |

|

|

|

|

|

|

|

|

|

212,390

|

Royalties

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

Fort Hills

|

|

|

| Fort Hills Energy Limited Partnership | #: 3 |

|

|

|

|

|

|

|

|

|

13,650

|

Fees

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

Fort Hills

|

|

|

| Fort Hills Energy Limited Partnership | #: 4 |

|

|

|

|

|

|

|

|

|

63,760

|

Taxes

|

Canada

|

snj:CA-AB

|

Municipality of Wood Buffalo

|

Fort Hills

|

|

|

| Fort Hills Energy Limited Partnership | #: 5 |

|

|

|

|

|

|

|

|

|

170

|

Fees

|

Canada

|

snj:CA-AB

|

Athabasca Chipewyan First Nation

|

Fort Hills

|

|

|

| Syncrude Canada Ltd | #: 1 |

|

|

|

|

|

|

|

|

|

1,235,830

|

Royalties

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 2 |

|

|

|

|

|

|

|

|

|

12,590

|

Fees

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 3 |

|

|

|

|

|

|

|

|

|

760

|

Bonuses

|

Canada

|

snj:CA-AB

|

Province of Alberta

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 4 |

|

|

|

|

|

|

|

|

|

59,070

|

Taxes

|

Canada

|

snj:CA-AB

|

Municipality of Wood Buffalo

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 5 |

|

|

|

|

|

|

|

|

|

110

|

Taxes

|

Canada

|

snj:CA-AB

|

Fort McKay First Nation

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 6 |

|

|

|

|

|

|

|

|

|

1,160

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McKay First Nation

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 7 |

|

|

|

|

|

|

|

|

|

330

|

Fees

|

Canada

|

snj:CA-AB

|

Athabasca Chipewyan First Nation

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 8 |

|

|

|

|

|

|

|

|

|

100

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McKay Metis Community Association

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 9 |

|

|

|

|

|

|

|

|

|

130

|

Fees

|

Canada

|

snj:CA-AB

|

Fort McMurray #468 First Nation

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 10 |

|

|

|

|

|

|

|

|

|

2,580

|

Fees

|

Canada

|

snj:CA-AB

|

Mikisew Cree First Nation

|

Syncrude

|

|

|

| Syncrude Canada Ltd | #: 11 |

|

|

|

|

|

|

|

|

|

$ 100

|

Fees

|

Canada

|

snj:CA-AB

|

Chipewyan Prairie Dene First Nation

|

Syncrude

|

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=srt_ParentCompanyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=3 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=4 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=5 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=6 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=7 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=8 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=9 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=10 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=11 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=12 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=13 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=14 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=15 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=16 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=17 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=18 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=19 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=20 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=21 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=22 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=23 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=24 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_FortHillsEnergyLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=su_SyncrudeCanadaLtdMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

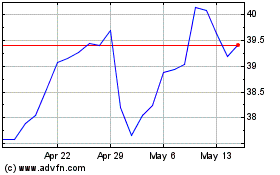

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Dec 2023 to Dec 2024