Tutor Perini Further Strengthens Balance Sheet with Payoff of its Term Loan B

20 February 2025 - 11:13AM

Business Wire

Tutor Perini Corporation (NYSE: TPC) (the “Company”), a leading

civil, building and specialty construction company, announced today

that the Company has paid off its remaining Term Loan B debt of

approximately $47 million. With this latest prepayment, Tutor

Perini has successfully accelerated the deleveraging of its balance

sheet, reducing total debt by $477 million, or 52%, since December

31, 2023.

“Our strong operating cash flow has enabled us to exceed our

debt reduction commitments, further strengthening our balance

sheet,” said Gary Smalley, Chief Executive Officer and President.

“Looking ahead, we expect to continue generating strong cash flow,

explore opportunities to further enhance our capital structure, and

consider capital allocation strategies that will drive shareholder

value. With our record backlog, we believe Tutor Perini’s business

is well-positioned for significant growth and substantially

improved profitability over the next several years. I will also

point out that we currently do not anticipate any significant

impacts related to recent federal funding or tariff concerns, based

on an assessment of our contractual terms and project execution

practices that involve buyouts of materials and equipment at the

onset of projects.”

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private customers and

public agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget, while adhering to strict quality control measures. We offer

general contracting, pre-construction planning and comprehensive

project management services, including planning and scheduling of

manpower, equipment, materials and subcontractors required for a

project. We also offer self-performed construction services

including site work, concrete forming and placement, steel

erection, electrical, mechanical, plumbing and heating, ventilation

and air conditioning (HVAC).

Forward-Looking Statements

The statements contained in this release that are not purely

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding the Company’s future

performance expectations and potential impacts due to changes in

federal funding or tariffs. These forward-looking statements are

based on the Company’s current expectations and beliefs concerning

future developments and their potential impacts on the Company.

While the Company’s expectations, beliefs and projections are

expressed in good faith and the Company believes there is a

reasonable basis for them, there can be no assurance that future

developments affecting the Company will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to: unfavorable outcomes

of existing or future litigation or dispute resolution proceedings

against us or customers (project owners, developers, general

contractors, etc.), subcontractors or suppliers, as well as failure

to promptly recover significant working capital invested in

projects subject to such matters; revisions of estimates of

contract risks, revenue or costs, economic factors such as

inflation, the timing of new awards, or the pace of project

execution, which has resulted and may continue to result in losses

or lower than anticipated profit; contract requirements to perform

extra work beyond the initial project scope, which has and in the

future could result in disputes or claims and adversely affect our

working capital, profits and cash flows; risks and other

uncertainties associated with estimates and assumptions used to

prepare our financial statements; failure to meet contractual

schedule requirements, which could result in higher costs and

reduced profits or, in some cases, exposure to financial liability

for liquidated damages and/or damages to customers, as well as

damage to our reputation; an inability to obtain bonding, which

could have a negative impact on our operations and results;

possible systems and information technology interruptions and

breaches in data security and/or privacy; inability to attract and

retain our key officers, and to adequately plan for their

succession, and hire and retain personnel required to execute and

perform on our contracts; the impact of inclement weather

conditions, disasters and other catastrophic events outside of our

control on projects; risks related to our international operations,

such as uncertainty of U.S. government funding, as well as

economic, political, regulatory and other risks, including risks of

loss due to acts of war, labor conditions, and other unforeseeable

events in countries where we do business, which could adversely

affect our revenue and earnings; increased competition and failure

to secure new contracts; a significant slowdown or decline in

economic conditions, such as those presented during a recession;

decreases in the level of federal, state and local government

spending for infrastructure and other public projects; client

cancellations of, or reductions in scope under, contracts reported

in our backlog; risks related to government contracts and related

procurement regulations; significant fluctuations in the market

price of our common stock, which could result in substantial losses

for stockholders and potentially subject us to securities

litigation; failure of our joint venture partners to perform their

venture obligations, which could impose additional financial and

performance obligations on us, resulting in reduced profits or

losses and/or reputational harm; violations of the U.S. Foreign

Corrupt Practices Act and similar worldwide anti-bribery laws;

failure to meet our obligations under our debt agreements

(especially in a high interest rate environment); downgrades in our

credit ratings; public health crises, such as COVID-19, which have

adversely impacted, and could in the future adversely impact, our

business, financial condition and results of operations by, among

other things, delaying the timing of project bids and/or awards and

the timing of dispute resolutions and associated collections;

physical and regulatory risks related to climate change; impairment

of our goodwill or other indefinite-lived intangible assets; the

exertion of influence over the Company by our chairman and chief

executive officer due to his position and significant ownership

interest; and other risks and uncertainties discussed under the

heading “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023 filed on February 28, 2024 and in

other reports that we file with the Securities and Exchange

Commission from time to time. The Company undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219572637/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations and Corporate Communications

www.tutorperini.com

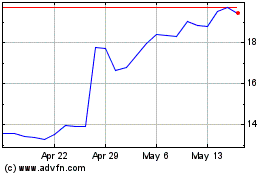

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Feb 2024 to Feb 2025