- Record operating cash flow of $503.5 million in 2024, up 63%

Y/Y

- Successfully accelerated debt reduction, reducing total debt

by $477 million, or 52%, from the end of 2023 through February 27,

2025, including the full payoff of the Term Loan B

- Record backlog of $18.7 billion as of December 31, 2024, up

84% Y/Y, driven by $12.8 billion of new awards and contract

adjustments in 2024; New awards continue strong in early

2025

- Revenue of $4.3 billion in 2024, up 12% Y/Y

- Company’s considerable progress in resolving many of its

largest legacy disputes generated significant operating cash flow

in 2024; however, these resolutions also resulted in net charges

that drove a diluted loss of $3.13 per share in 2024

- Provides 2025 guidance, including double-digit revenue

growth and EPS range of $1.50 to $1.90

- Preliminary estimates point to significantly stronger

earnings in 2026 and 2027 that are more than double the EPS

guidance for 2025

Tutor Perini Corporation (the “Company”) (NYSE: TPC), a leading

civil, building and specialty construction company, reported

results today for the fourth quarter and year ended December 31,

2024 (see attached tables).

Record Operating Cash Flow Enabled Substantial Debt

Reduction

Tutor Perini delivered a third consecutive year of record

operating cash flow, generating $503.5 million of net cash provided

by operating activities in 2024, which was up 63%, shattering the

previous record of $308.5 million set in 2023. Operating cash flow

in each of the past three years was higher than in any other year

since the merger between Tutor-Saliba Corporation and Perini

Corporation in 2008. The strong increase in 2024, as compared to

2023, was primarily driven by improved collection activities,

including collections associated with payments on new and existing

projects and the continued resolution of certain legacy claims,

disputes and unapproved change orders.

As anticipated, the Company generated very strong operating cash

flow of $329.6 million in the fourth quarter of 2024 alone, with

more than half of that amount derived from collections on new and

existing projects. The Company utilized much of its strong cash

flow in 2024 to pay down its total debt by $477 million, or 52%,

since the end of 2023, including the full payoff of its Term Loan B

in the first quarter of 2025, delivering on and exceeding its debt

reduction commitments.

Record Backlog Driven by a Massive Volume of New

Awards

Consolidated backlog grew to $18.7 billion as of December 31,

2024, up 84% compared to $10.2 billion as of December 31, 2023,

setting a new all-time record for the Company that far exceeded its

previous record backlog of $14.0 billion reported for the third

quarter of 2024. Backlog for the Civil, Building, and Specialty

Contractors segments as of December 31, 2024 also set new all-time

records.

New awards and contract adjustments in 2024 totaled $12.8

billion, and the largest additions included:

- $3.76 billion Manhattan Jail project in New York;

- $1.66 billion City Center Guideway and Stations project in

Hawaii;

- $1.4 billion healthcare campus project in California;

- $1.13 billion Newark AirTrain Replacement project in New

Jersey;

- $1.1 billion Kensico-Eastview Connection Tunnel project in New

York;

- $479 million of additional funding for certain mass-transit

projects in California;

- $449 million for two healthcare facility projects in

California;

- $331 million for the initial award of the Apra Harbor

Waterfront Repairs project in Guam;

- $229 million airport terminal connectors project at Fort

Lauderdale-Hollywood International Airport in Florida; and

- The Company’s proportionate share of the $1.3 billion

Connecticut River Bridge Replacement project in Connecticut.

New awards continue to be strong in the first quarter of 2025,

as highlighted by the Company’s recently announced awards of the

$1.18 billion Manhattan Tunnel project in New York and $232 million

for several owner-authorized additional scope options on the Apra

Harbor Waterfront Repairs project in Guam.

The Company still has considerable Civil and Building segment

bidding opportunities that it expects to pursue in 2025, including

the multi-billion-dollar Midtown Bus Terminal Replacement project

in New York that is expected to bid next month.

This record backlog enables Tutor Perini to be more selective

around future bidding as the Company prioritizes opportunities

focused on margin enhancement moving forward.

Management Remarks

“With an unprecedented $12.8 billion of new awards during the

year, we grew our backlog to a new record of $18.7 billion in 2024

and delivered a third consecutive year of record operating cash

flow that shattered our previous record by $200 million,” said Gary

Smalley, Chief Executive Officer and President. “We used that

record cash generation to pay down more than half of our total debt

since the end of 2023, and made considerable progress resolving

many of our outstanding disputes and strengthening our balance

sheet.”

“Our record backlog and ample future bidding opportunities

should serve as the catalyst for significant double-digit revenue

growth and a return to solid profitability in 2025, followed by

substantially higher earnings in 2026 and 2027,” added Mr. Smalley.

“With our short-term debt reduction goals attained and solid future

operating cash flow expected, our capital allocation priorities

will turn to creating long-term value through the return of capital

to shareholders.”

Revenue Growth Driven by Strength in Civil and Building

Markets

Revenue for 2024 was $4.3 billion, up 12% compared to 2023,

primarily due to increased project execution activities on various

Civil and Building segment projects. Revenue for the Civil and

Building segments grew 12% and 24%, respectively, in 2024 driven in

part by increased project execution activities on certain projects

in California, New York, British Columbia and the Asia-Pacific

region.

Significant Judgments and Settlements Resulted in an

Operating Loss

Loss from construction operations for 2024 was $103.8 million

compared to $114.6 million for 2023. Net loss attributable to the

Company for 2024 was $163.7 million, or a $3.13 diluted loss per

share, compared to net loss attributable to the Company of $171.2

million, or a $3.30 diluted loss per share, for 2023. The net

losses in both years largely resulted from the outcome of various

judgments and settlements associated with the resolution of

disputed matters, which negatively impacted the Company’s earnings

but significantly enhanced its operating cash flow. The negative

impact to earnings from judgments and settlements in both years

masked otherwise profitable earnings contributions from newer

projects.

The Company's loss from construction operations for 2024 was

also negatively impacted by $40.4 million ($0.56 per diluted share)

of share-based compensation expense, as compared to $12.3 million

($0.17 per diluted share) in 2023. The higher expense in 2024 was

primarily due to a substantial increase in the Company’s stock

price during 2024, which increased the expense recognized for

certain long-term incentive compensation awards with payouts that

are indexed to the Company's stock price.

2025 Outlook and Guidance

The Company’s record backlog provides excellent visibility and

confidence for significant revenue growth and improved

profitability over the next several years.

Based on its assessment of the current market and business

outlook, the Company anticipates double-digit revenue growth in

2025 and a return to solid earnings, with substantially higher

earnings expected in 2026 and 2027, by which time newer large

projects should be in the construction phase. For 2025, the Company

expects EPS of $1.50 to $1.90. As in prior years, earnings in 2025

are expected to be weighted more heavily in the second half of the

year due to the anticipated timing of more meaningful revenue

contributions from newer projects, as well as typical business

seasonality for weather.

The Company believes that its record backlog is setting the

stage for significantly better results over the next several years.

Based on its current projections, the Company’s preliminary EPS

estimates for 2026 and 2027 are more than double its EPS guidance

for 2025.

The Company also continues to expect strong operating cash

generation in 2025 and beyond as a result of increased project

execution activities and the anticipated resolution of remaining

legacy disputes.

Additionally, despite concerns in the market over federal budget

scrutiny and tariffs imposed by the Trump administration, customer

demand remains strong with substantial funding in place at the

state and local levels, boosted by the $1.2 trillion Bipartisan

Infrastructure Law at the federal level. The Company currently does

not anticipate any significant impacts related to federal budget

and tariff concerns, based on its assessment of contractual terms

and project execution practices that include buyouts of materials

and equipment at the onset of projects. Because of its record

backlog, the Company is in the enviable position to be highly

selective when bidding on additional attractive projects that

create value for shareholders, and expects to continue winning

additional projects in 2025.

Fourth Quarter 2024 Conference Call

The Company will host a conference call at 2:00 PM Pacific Time

on Thursday, February 27, 2025, to discuss the fourth quarter and

full year 2024 results. To participate in the conference call,

please dial 877-407-8293 five to ten minutes prior to the scheduled

time. International callers should dial +1-201-689-8349.

The conference call will be webcast live over the Internet and

can be accessed by all interested parties on Tutor Perini's website

at www.tutorperini.com. For those unable to participate during the

live call, the webcast will be available for replay shortly after

the call on the website.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private customers and

public agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget while adhering to strict safety and quality control

measures. We offer general contracting, pre-construction planning

and comprehensive project management services, and have strong

expertise in delivering design-bid-build, design-build,

construction management, and public-private partnership (P3)

projects. We often self-perform multiple project components,

including earthwork, excavation, concrete forming and placement,

steel erection, electrical, mechanical, plumbing, heating,

ventilation and air conditioning (HVAC), and fire protection.

Forward-Looking Statements

The statements contained in this release, including those set

forth in the section “Outlook and Guidance,” that are not purely

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding the Company’s

expectations, hopes, beliefs, intentions or strategies regarding

the future and statements regarding future guidance or estimates

and non-historical performance. These forward-looking statements

are based on the Company’s current expectations and beliefs

concerning future developments and their potential effects on the

Company. While the Company’s expectations, beliefs and projections

are expressed in good faith and the Company believes there is a

reasonable basis for them, there can be no assurance that future

developments affecting the Company will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to: unfavorable outcomes

of existing or future litigation or dispute resolution proceedings

against us or customers (project owners, developers, general

contractors, etc.), subcontractors or suppliers, as well as failure

to promptly recover significant working capital invested in

projects subject to such matters; revisions of estimates of

contract risks, revenue or costs, economic factors such as

inflation, tariffs, the timing of new awards, or the pace of

project execution, which has resulted and may continue to result in

losses or lower than anticipated profit; contract requirements to

perform extra work beyond the initial project scope, which has and

in the future could result in disputes or claims and adversely

affect our working capital, profits and cash flows; risks and other

uncertainties associated with estimates and assumptions used to

prepare our financial statements; inability to attract and retain

our key officers, and to adequately plan for their succession, and

hire and retain personnel required to execute and perform on our

contracts; failure to meet contractual schedule requirements, which

could result in higher costs and reduced profits or, in some cases,

exposure to financial liability for liquidated damages and/or

damages to customers, as well as damage to our reputation; possible

systems and information technology interruptions and breaches in

data security and/or privacy; the impact of inclement weather

conditions, disasters and other catastrophic events outside our

control on projects; risks related to our international operations,

such as uncertainty of U.S. government funding, as well as

economic, political, regulatory and other risks, including risks of

loss due to acts of war, labor conditions, and other unforeseeable

events in countries where we do business, which could adversely

affect our revenue and earnings; a significant slowdown or decline

in economic conditions, such as those presented during a recession;

decreases in the level of federal, state and local government

spending for infrastructure and other public projects; client

cancellations of, or reductions in scope under, contracts reported

in our backlog; increased competition and failure to secure new

contracts; risks related to government contracts and related

procurement regulations; failure of our joint venture partners to

perform their venture obligations, which could impose additional

financial and performance obligations on us, resulting in reduced

profits or losses and/or reputational harm; violations of the U.S.

Foreign Corrupt Practices Act and similar worldwide anti-bribery

laws; public health crises, such as COVID-19, have adversely

impacted, and could in the future adversely impact, our business,

financial condition and results of operations by, among other

things, delaying the timing of project bids and/or awards and the

timing of dispute resolutions and associated collections; physical

and regulatory risks related to climate change; impairment of our

goodwill or other indefinite-lived intangible assets; an inability

to obtain bonding could have a negative impact on our operations

and results; failure to meet our obligations under our debt

agreements (especially in a high interest rate environment);

downgrades in our credit ratings; the exertion of influence over

the Company by our executive chairman due to his position and

significant ownership interests; significant fluctuations in the

market price of our common stock, which could result in substantial

losses for stockholders and potentially subject us to securities

litigation; and other risks and uncertainties discussed under the

heading “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2024 filed on February 27, 2025 and in

other reports that we file with the Securities and Exchange

Commission from time to time. The Company undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

Tutor Perini

Corporation

Consolidated Statements of

Operations

Quarter Ended

December 31,

Year Ended

December 31,

(in thousands, except per common share

amounts)

2024

2023

2024

2023

REVENUE

$

1,067,649

$

1,021,471

$

4,326,922

$

3,880,227

COST OF OPERATIONS

(1,077,111

)

(972,552

)

(4,129,884

)

(3,739,603

)

GROSS PROFIT

(9,462

)

48,919

197,038

140,624

General and administrative expenses(a)

(76,783

)

(71,393

)

(300,791

)

(255,221

)

LOSS FROM CONSTRUCTION

OPERATIONS

(86,245

)

(22,474

)

(103,753

)

(114,597

)

Other income, net

4,242

4,758

19,878

17,200

Interest expense

(25,519

)

(21,315

)

(89,133

)

(85,157

)

LOSS BEFORE INCOME TAXES

(107,522

)

(39,031

)

(173,008

)

(182,554

)

Income tax benefit

31,314

2,953

50,669

54,957

NET LOSS

(76,208

)

(36,078

)

(122,339

)

(127,597

)

LESS: NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

3,223

11,451

41,382

43,558

NET LOSS ATTRIBUTABLE TO TUTOR PERINI

CORPORATION

$

(79,431

)

$

(47,529

)

$

(163,721

)

$

(171,155

)

BASIC LOSS PER COMMON SHARE

$

(1.51

)

$

(0.91

)

$

(3.13

)

$

(3.30

)

DILUTED LOSS PER COMMON SHARE

$

(1.51

)

$

(0.91

)

$

(3.13

)

$

(3.30

)

WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING:

BASIC

52,460

52,024

52,322

51,845

DILUTED

52,460

52,024

52,322

51,845

______________________________

(a)

General and administrative expenses for

the three and twelve months ended December 31, 2024 include

share-based compensation expense of $1.4 million ($1.0 million

after tax, or $0.02 per diluted share) and $40.4 million ($29.5

million after tax, or $0.56 per diluted share), respectively.

General and administrative expenses for the three and twelve months

ended December 31, 2023 include share-based compensation expense of

$3.2 million ($2.3 million after tax, or $0.04 per diluted share)

and $12.3 million ($9.0 million after tax, or $0.17 per diluted

share), respectively. The higher expense in the twelve months ended

December 31, 2024 was primarily due to a substantial increase in

the Company’s stock price during 2024, which increased the expense

recognized for certain long-term incentive compensation awards with

payouts that are indexed to the Company's stock price.

Tutor Perini

Corporation

Segment Information

Reportable Segments

(in thousands)

Civil

Building

Specialty

Contractors

Total

Corporate

Consolidated

Total

Quarter ended December 31, 2024

Total revenue

$

599,238

$

353,748

$

161,670

$

1,114,656

$

—

$

1,114,656

Elimination of intersegment revenue

(44,833

)

(1,734

)

(440

)

(47,007

)

—

(47,007

)

Revenue from external customers

$

554,405

$

352,014

$

161,230

$

1,067,649

$

—

$

1,067,649

Reconciliation of revenue to income

(loss) from construction operations

Less: Segment expenses(a)

$

549,929

$

393,423

$

181,506

$

1,124,858

$

29,036

$

1,153,894

Income (loss) from construction

operations

$

4,476

$

(41,409

)

$

(20,276

)

$

(57,209

)

$

(29,036

)(b)

$

(86,245

)

Capital expenditures

$

5,193

$

90

$

204

$

5,487

$

3,656

$

9,143

Depreciation and amortization(c)

$

10,822

$

521

$

592

$

11,935

$

754

$

12,689

Quarter ended December 31, 2023

Total revenue

$

493,641

$

383,168

$

186,034

$

1,062,843

$

—

$

1,062,843

Elimination of intersegment revenue

(34,263

)

(7,073

)

(36

)

(41,372

)

—

(41,372

)

Revenue from external customers

$

459,378

$

376,095

$

185,998

$

1,021,471

$

—

$

1,021,471

Reconciliation of revenue to income

(loss) from construction operations

Less: Segment expenses(a)

$

431,077

$

383,384

$

210,111

$

1,024,572

$

19,373

$

1,043,945

Income (loss) from construction

operations

$

28,301

$

(7,289

)

$

(24,113

)

$

(3,101

)

$

(19,373

)(b)

$

(22,474

)

Capital expenditures

$

4,669

$

216

$

159

$

5,044

$

2,319

$

7,363

Depreciation and amortization(c)

$

9,932

$

572

$

589

$

11,093

$

2,151

$

13,244

______________________________

(a)

Segment expenses include the total

expenses that are deducted from revenue to determine income (loss)

from construction operations.

(b)

Consists primarily of corporate general

and administrative expenses.

(c)

Depreciation and amortization is included

in income (loss) from construction operations.

Tutor Perini

Corporation

Segment Information

(continued)

Reportable Segments

(in thousands)

Civil

Building

Specialty

Contractors

Total

Corporate

Consolidated

Total

Year ended December 31, 2024

Total revenue

$

2,248,659

$

1,666,862

$

590,822

$

4,506,343

$

—

$

4,506,343

Elimination of intersegment revenue

(129,706

)

(49,325

)

(390

)

(179,421

)

—

(179,421

)

Revenue from external customers

$

2,118,953

$

1,617,537

$

590,432

$

4,326,922

$

—

$

4,326,922

Reconciliation of revenue to income

(loss) from construction operations

Less: Segment expenses(a)

$

1,980,692

$

1,641,674

$

693,777

$

4,316,143

$

114,532

$

4,430,675

Income (loss) from construction

operations

$

138,261

$

(24,137

)

$

(103,345

)

$

10,779

$

(114,532

)(b)

$

(103,753

)

Capital expenditures

$

27,040

$

613

$

530

$

28,183

$

9,226

$

37,409

Depreciation and amortization(c)

$

42,521

$

2,270

$

2,333

$

47,124

$

6,663

$

53,787

Year ended December 31, 2023

Total revenue

$

1,971,194

$

1,302,636

$

694,038

$

3,967,868

$

—

$

3,967,868

Elimination of intersegment revenue

(87,329

)

(97

)

(215

)

(87,641

)

—

(87,641

)

Revenue from external customers

$

1,883,865

$

1,302,539

$

693,823

$

3,880,227

$

—

$

3,880,227

Reconciliation of revenue to income

(loss) from construction operations

Less: Segment expenses(a)

$

1,685,256

$

1,393,745

$

838,645

$

3,917,646

$

77,178

$

3,994,824

Income (loss) from construction

operations

$

198,609

$

(91,206

)

$

(144,822

)

$

(37,419

)

$

(77,178

)(b)

$

(114,597

)

Capital expenditures

$

41,318

$

3,932

$

1,250

$

46,500

$

6,453

$

52,953

Depreciation and amortization(c)

$

31,685

$

2,227

$

2,445

$

36,357

$

8,872

$

45,229

______________________________

(a)

Segment expenses include the total

expenses that are deducted from revenue to determine income (loss)

from construction operations.

(b)

Consists primarily of corporate general

and administrative expenses.

(c)

Depreciation and amortization is included

in income (loss) from construction operations.

Tutor Perini

Corporation

Consolidated Balance

Sheets

As of December 31,

(in thousands, except share and per share

amounts)

2024

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents ($131,738 and

$173,118 related to variable interest entities (“VIEs”))

$

455,084

$

380,564

Restricted cash

9,104

14,116

Restricted investments

139,986

130,287

Accounts receivable ($51,953 and $84,014

related to VIEs)

986,893

1,054,014

Retention receivable ($171,704 and

$161,187 related to VIEs)

560,163

580,926

Costs and estimated earnings in excess of

billings ($95,219 and $58,089 related to VIEs)

942,522

1,143,846

Other current assets ($24,954 and $26,725

related to VIEs)

192,915

217,601

Total current assets

3,286,667

3,521,354

PROPERTY AND EQUIPMENT:

Land

44,132

44,127

Building and improvements

138,799

132,639

Construction equipment

609,495

613,166

Other equipment

196,870

185,530

989,296

975,462

Less accumulated depreciation

(566,308

)

(534,171

)

Total property and equipment, net ($19,876

and $35,135 related to VIEs)

422,988

441,291

GOODWILL

205,143

205,143

INTANGIBLE ASSETS, NET

66,069

68,305

DEFERRED INCOME TAXES

143,289

74,083

OTHER ASSETS

118,554

119,680

TOTAL ASSETS

$

4,242,710

$

4,429,856

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Current maturities of long-term debt

$

24,113

$

117,431

Accounts payable ($22,845 and $24,160

related to VIEs)

631,468

466,545

Retention payable ($19,744 and $22,841

related to VIEs)

240,971

223,138

Billings in excess of costs and estimated

earnings ($326,561 and $439,759 related to VIEs)

1,216,623

1,103,530

Accrued expenses and other current

liabilities ($16,391 and $18,206 related to VIEs)

219,525

214,309

Total current liabilities

2,332,700

2,124,953

LONG-TERM DEBT, less current

maturities, net of unamortized discount and debt issuance costs

totaling $21,977 and $11,000

510,025

782,314

DEFERRED INCOME TAXES

—

956

OTHER LONG-TERM LIABILITIES

241,379

237,722

TOTAL LIABILITIES

3,084,104

3,145,945

COMMITMENTS AND CONTINGENCIES

EQUITY

Stockholders' equity:

Preferred stock – authorized 1,000,000

shares ($1 par value), none issued

—

—

Common stock – authorized 112,500,000

shares ($1 par value), issued and outstanding 52,485,719 and

52,025,497 shares

52,486

52,025

Additional paid-in capital

1,146,800

1,146,204

Retained (deficit) earnings

(30,575

)

133,146

Accumulated other comprehensive loss

(33,988

)

(39,787

)

Total stockholders' equity

1,134,723

1,291,588

Noncontrolling interests

23,883

(7,677

)

TOTAL EQUITY

1,158,606

1,283,911

TOTAL LIABILITIES AND EQUITY

$

4,242,710

$

4,429,856

Tutor Perini

Corporation

Consolidated Statements of

Cash Flows

Year Ended December

31,

(in thousands)

2024

2023

Cash Flows from Operating

Activities:

Net loss

$

(122,339

)

$

(127,597

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation

51,551

42,992

Amortization of intangible assets

2,236

2,237

Share-based compensation expense

40,356

12,259

Change in debt discounts and deferred debt

issuance costs

14,068

5,458

Deferred income taxes

(78,008

)

(64,820

)

(Gain) loss on sale of property and

equipment

116

(5,016

)

Changes in other components of working

capital

589,124

428,910

Other long-term liabilities

14,898

3,754

Other, net

(8,458

)

10,294

NET CASH PROVIDED BY OPERATING

ACTIVITIES

503,544

308,471

Cash Flows from Investing

Activities:

Acquisition of property and equipment

(37,409

)

(52,953

)

Proceeds from sale of property and

equipment

4,752

10,062

Investments in securities

(35,643

)

(48,351

)

Proceeds from maturities and sales of

investments in securities

27,613

12,997

NET CASH USED IN INVESTING

ACTIVITIES

(40,687

)

(78,245

)

Cash Flows from Financing

Activities:

Proceeds from debt

787,135

712,324

Repayment of debt

(1,141,765

)

(773,999

)

Cash payments related to share-based

compensation

(5,556

)

(969

)

Distributions paid to noncontrolling

interests

(23,300

)

(46,500

)

Contributions from noncontrolling

interests

15,230

2,000

Debt issuance, extinguishment and

modification costs

(25,093

)

(2,233

)

NET CASH USED IN FINANCING

ACTIVITIES

(393,349

)

(109,377

)

Net increase in cash, cash equivalents

and restricted cash

69,508

120,849

Cash, cash equivalents and restricted

cash at beginning of year

394,680

273,831

Cash, cash equivalents and restricted

cash at end of year

$

464,188

$

394,680

Tutor Perini

Corporation

Backlog Information

Unaudited

(in millions)

Backlog at September

30, 2024

New Awards in the

Quarter Ended December 31, 2024(a)

Revenue Recognized in the

Quarter Ended December 31, 2024

Backlog at December 31,

2024

Civil

$

6,895.0

$

2,495.0

$

(554.4

)

$

8,835.6

Building

5,138.0

2,240.9

(352.0

)

7,026.9

Specialty Contractors

1,992.2

980.4

(161.2

)

2,811.4

Total

$

14,025.2

$

5,716.3

$

(1,067.6

)

$

18,673.9

(in millions)

Backlog at December 31,

2023

New Awards in the Year

Ended December 31, 2024(a)

Revenue Recognized in the

Year Ended December 31, 2024

Backlog at December 31,

2024

Civil

$

4,240.6

$

6,713.9

$

(2,118.9

)

$

8,835.6

Building

4,177.5

4,467.0

(1,617.6

)

7,026.9

Specialty Contractors

1,740.3

1,661.5

(590.4

)

2,811.4

Total

$

10,158.4

$

12,842.4

$

(4,326.9

)

$

18,673.9

______________________________

(a)

New awards consist of the original

contract price of projects added to our backlog plus or minus

subsequent changes to the estimated total contract price of

existing contracts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227210877/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations & Corporate Communications

www.tutorperini.com

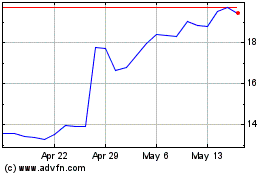

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Feb 2024 to Feb 2025