TransUnion Collaborates with Credit Sesame to Launch New Freemium Direct-to-Consumer Credit Education and Monitoring Offering

13 February 2025 - 10:22PM

TransUnion (NYSE:TRU) has announced the launch of its new

direct-to-consumer experience in the U.S., enabled by its strategic

collaboration with Credit Sesame, a leader in the credit management

space. This new offering is expected to enable TransUnion to more

fully serve the tens of millions of consumers who visit TransUnion

digital properties annually, with a highly engaging freemium credit

education solution that will be integrated with enhanced premium

credit monitoring services.

This new experience will provide consumers with access to a

suite of free credit education services, including a daily

TransUnion credit score and report, in addition to optional premium

credit monitoring services, available on TransUnion’s website and

app. Consumers will also have access to a network of third-party

financial offers, tailored to a consumer’s individual goals and

credit profile. TransUnion expects to launch the new offering in

phases throughout the first half of 2025.

“Personal empowerment is a key component of our commitment to

Information for Good®,” said Steve Chaouki,

President, U.S. Markets, TransUnion. “By providing a free-first

experience that includes financial offers, we engage with more

consumers, enabling them to better understand their financial

situations and take action to manage their financial futures. By

integrating our freemium offering with our enhanced premium credit

and identity monitoring services, we expect to deliver a more

expansive product offering to consumers and position our

direct-to-consumer business for sustainable growth.”

This initiative combines the unique capabilities of Credit

Sesame and TransUnion. Credit Sesame provides its expertise to

develop and manage a highly engaging product platform, mobile app

and integrated network of financial offers, all powered by

TransUnion data. TransUnion plans to upgrade its existing consumer

base in the U.S. onto the new platform and manage consumer

acquisition and consumer servicing, as well as ongoing operational

and compliance controls.

“We’re committed to empowering consumers to take charge of their

financial health,” said Adrian Nazari, CEO, Credit Sesame. “We have

a track record of success in the freemium credit space, helping

millions of Americans effectively manage their credit and create

better opportunities for themselves and their families. By

leveraging our Sesame platform, we expect that TransUnion will be

able to deeply engage consumers and support them in achieving their

financial goals.”

About TransUnion (NYSE: TRU)TransUnion is a

global information and insights company with over 13,000 associates

operating in more than 30 countries. We make trust possible by

ensuring each person is reliably represented in the marketplace. We

do this with a Tru™ picture of each person: an actionable view of

consumers, stewarded with care. Through our acquisitions and

technology investments we have developed innovative solutions that

extend beyond our strong foundation in core credit into areas such

as marketing, fraud, risk and advanced analytics. As a result,

consumers and businesses can transact with confidence and achieve

great things. We call this Information for Good® — and it

leads to economic opportunity, great experiences and personal

empowerment for millions of people around the

world. http://www.transunion.com/business

About Credit SesameCredit Sesame is a leading

financial wellness company dedicated to helping consumers achieve

better credit and financial health through cutting-edge technology

and data-driven solutions. With a decade of credit expertise and a

proven track record of serving over 18 million users, Credit Sesame

leverages AI and advanced analytics to empower individuals to

improve their credit scores, enhance approval odds, and reduce

credit costs.

The recently launched Sesame Credit Intelligence Platform

extends this mission by providing institutions with a turnkey

AI-powered credit intelligence solution. It enables businesses to

offer personalized credit and financial wellness experiences,

driving deeper customer engagement and growth.

Backed by leading institutional and strategic investors, Credit

Sesame operates across the U.S. For more information, visit

www.addsesame.com.

TransUnion Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on the current

beliefs and expectations of TransUnion’s management and are subject

to significant risks and uncertainties. Actual results may differ

materially from those described in the forward-looking statements.

Any statements made in this press release that are not statements

of historical fact, including statements about our beliefs and

expectations, are forward-looking statements. Forward-looking

statements include information concerning possible or assumed

future results of operations, including our guidance and

descriptions of our business plans and strategies. These statements

often include words such as “anticipate,” “expect,” “guidance,”

“suggest,” “plan,” “believe,” “intend,” “estimate,” “target,”

“project,” “should,” “could,” “would,” “may,” “will,” “forecast,”

“outlook,” “potential,” “continues,” “seeks,” “predicts,” or the

negatives of these words and other similar expressions. There may

be other factors, many of which are beyond our control, that may

cause our actual results to differ materially from the

forward-looking statements, including factors disclosed in our

Annual Report on Form 10-K for the year ended December 31, 2024,

and any subsequent Quarterly Report on Form 10-Q or Current Report

on Form 8-K filed with the Securities and Exchange Commission. You

should evaluate all forward-looking statements made in this report

in the context of these risks and uncertainties.

The forward-looking statements contained in this

press release speak only as of the date of this press release. We

undertake no obligation to publicly release the result of any

revisions to these forward-looking statements to reflect the impact

of events or circumstances that may arise after the date of this

press release.

|

Contact |

Dave BlumbergTransUnion |

| E-mail |

david.blumberg@transunion.com |

| Telephone |

312-972-6646 |

TransUnion (NYSE:TRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

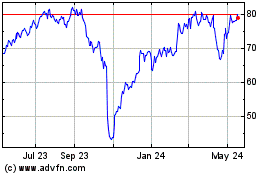

TransUnion (NYSE:TRU)

Historical Stock Chart

From Feb 2024 to Feb 2025