USA Compression Partners, LP (NYSE: USAC) (“USA Compression” or

the “Partnership”) announced today its financial and operating

results for third-quarter 2024.

Financial Highlights

- Record total revenues of $240.0 million for third-quarter 2024,

compared to $217.1 million for third-quarter 2023.

- Net income was $19.3 million for third-quarter 2024, compared

to $20.9 million for third-quarter 2023.

- Net cash provided by operating activities was $48.5 million for

third-quarter 2024, compared to $50.1 million for third-quarter

2023.

- Adjusted EBITDA was $145.7 million for third-quarter 2024,

compared to $130.2 million for third-quarter 2023.

- Distributable Cash Flow was $86.6 million for third-quarter

2024, compared to $71.6 million for third-quarter 2023.

- Distributable Cash Flow Coverage was 1.41x for third-quarter

2024, compared to 1.39x for third-quarter 2023.

- Paid cash distribution of $0.525 per common unit for

third-quarter 2024, consistent with third-quarter 2023.

Operational Highlights

- Record average revenue-generating horsepower of 3.56 million

for third-quarter 2024, compared to 3.36 million for third-quarter

2023.

- Record average revenue per revenue-generating horsepower per

month of $20.60 for third-quarter 2024, compared to $19.10 for

third-quarter 2023.

- Average horsepower utilization of 94.6% for third-quarter 2024,

compared to 93.6% for third-quarter 2023.

“Our third-quarter financial results represented another

record-setting quarter of revenues and Adjusted EBITDA. These

financial results were underpinned by strong operational execution

as we achieved record revenue-generating horsepower and record

average revenue per-horsepower, reflective of the continued

tightening in the compression service space, which we expect to

continue for the foreseeable future,” commented Clint Green, USA

Compression’s President and Chief Executive Officer.

“I want to thank Eric Long, who navigated USA Compression

through many cycles of our industry and grew it into one of the

leading and largest independent compression services companies. The

culture and focus on delivering safe and excellent customer service

at USA Compression has been clear during my time here so far, and I

look forward to building on where he left off.”

“Lastly, we are increasing our expansion capital expenditures

for the full-year 2024 to between $240.0 million and $250.0

million, primarily due to cost associated with preparing active

compression units that are returned by a customer for redeployment

and the increased cost on the idle to active fleet conversion.”

Expansion capital expenditures were $34.1 million, maintenance

capital expenditures were $9.1 million, and cash interest expense,

net was $47.1 million for third-quarter 2024.

On October 10, 2024, the Partnership announced a third-quarter

cash distribution of $0.525 per common unit, which corresponds to

an annualized distribution rate of $2.10 per common unit. The

distribution was paid on November 1, 2024, to common unitholders of

record as of the close of business on October 21, 2024.

Operational and Financial

Data

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Operational data:

Fleet horsepower (at period end) (1)

3,862,445

3,851,970

3,735,490

Revenue-generating horsepower (at period

end) (2)

3,570,508

3,538,683

3,395,630

Average revenue-generating horsepower

(3)

3,560,891

3,515,483

3,356,008

Revenue-generating compression units (at

period end)

4,270

4,251

4,251

Horsepower utilization (at period end)

(4)

94.4

%

95.0

%

93.9

%

Average horsepower utilization (for the

period) (4)

94.6

%

94.7

%

93.6

%

Financial data ($ in thousands, except

per horsepower data):

Contract operations revenue

$

233,919

$

229,091

$

209,841

Total revenues

$

239,968

$

235,313

$

217,085

Average revenue per revenue-generating

horsepower per month (5)

$

20.60

$

20.29

$

19.10

Net income

$

19,327

$

31,238

$

20,902

Operating income

$

75,676

$

77,372

$

60,954

Net cash provided by operating

activities

$

48,481

$

96,741

$

50,072

Gross margin

$

90,917

$

91,838

$

78,056

Adjusted gross margin (6)

$

158,154

$

157,151

$

142,157

Adjusted gross margin percentage (7)

65.9

%

66.8

%

65.5

%

Adjusted EBITDA (6)

$

145,690

$

143,673

$

130,164

Adjusted EBITDA percentage (7)

60.7

%

61.1

%

60.0

%

Distributable Cash Flow (6)

$

86,606

$

85,863

$

71,574

Distributable Cash Flow Coverage Ratio

(6)

1.41

x

1.40

x

1.39

x

____________________________________

(1)

Fleet horsepower is horsepower

for compression units that have been delivered to the

Partnership.

(2)

Revenue-generating horsepower is

horsepower under contract for which the Partnership is billing a

customer.

(3)

Calculated as the average of the

month-end revenue-generating horsepower for each of the months in

the period.

(4)

Horsepower utilization is

calculated as (i) the sum of (a) revenue-generating horsepower; (b)

horsepower in the Partnership’s fleet that is under contract but is

not yet generating revenue; and (c) horsepower not yet in the

Partnership’s fleet that is under contract but not yet generating

revenue and that is expected to be delivered, divided by (ii) total

available horsepower less idle horsepower that is under repair.

Horsepower utilization based on

revenue-generating horsepower and fleet horsepower was 92.4%,

91.9%, and 90.9% at September 30, 2024, June 30, 2024, and

September 30, 2023, respectively.

Average horsepower utilization

based on revenue-generating horsepower and fleet horsepower was

92.3%, 91.2%, and 90.0% for the three months ended September 30,

2024, June 30, 2024, and September 30, 2023, respectively.

(5)

Calculated as the average of the

result of dividing the contractual monthly rate, excluding standby

or other temporary rates, for all units at the end of each month in

the period by the sum of the revenue-generating horsepower at the

end of each month in the period.

(6)

Adjusted gross margin, Adjusted

EBITDA, Distributable Cash Flow, and Distributable Cash Flow

Coverage Ratio are all non-U.S. generally accepted accounting

principles (“Non-GAAP”) financial measures. For the definition of

each measure, as well as reconciliations of each measure to its

most directly comparable financial measures calculated and

presented in accordance with GAAP, see “Non-GAAP Financial

Measures” below.

(7)

Adjusted gross margin percentage

and Adjusted EBITDA percentage are calculated as a percentage of

revenue.

Liquidity and Long-Term

Debt

As of September 30, 2024, the Partnership was in compliance with

all covenants under its $1.6 billion revolving credit facility. As

of September 30, 2024, the Partnership had outstanding borrowings

under the revolving credit facility of $803.2 million and, after

accounting for outstanding letters of credit in the amount of $0.5

million, $796.3 million of remaining unused availability, of which,

due to restrictions related to compliance with the applicable

financial covenants, $641.8 million was available to be drawn. As

of September 30, 2024, the outstanding aggregate principal amount

of the Partnership’s 6.875% senior notes due 2027 and 7.125% senior

notes due 2029 was $750.0 million and $1.0 billion,

respectively.

Full-Year 2024 Outlook

USA Compression is confirming its full-year 2024 guidance as

follows:

- Net income range of $105.0 million to $125.0 million;

- A forward-looking estimate of net cash provided by operating

activities is not provided because the items necessary to estimate

net cash provided by operating activities, in particular the change

in operating assets and liabilities, are not accessible or

estimable at this time. The Partnership does not anticipate changes

in operating assets and liabilities to be material, but changes in

accounts receivable, accounts payable, accrued liabilities, and

deferred revenue could be significant, such that the amount of net

cash provided by operating activities would vary substantially from

the amount of projected Adjusted EBITDA and Distributable Cash

Flow;

- Adjusted EBITDA range of $565.0 million to $585.0 million;

and

- Distributable Cash Flow range of $345.0 million to $365.0

million.

Conference Call

The Partnership will host a conference call today beginning at

11:00 a.m. Eastern Time (10:00 a.m. Central Time) to discuss

third-quarter 2024 performance. The call will be broadcast live

over the internet. Investors may participate by audio webcast, or

if located in the U.S. or Canada, by phone. A replay will be

available shortly after the call via the “Events” page of USA

Compression’s Investor Relations website.

By Webcast:

Connect to the webcast via the “Events”

page of USA Compression’s Investor Relations website at

https://investors.usacompression.com. Please log in at least 10

minutes in advance to register and download any necessary

software.

By Phone:

Dial (888) 440-5655 at least 10 minutes

before the call and ask for the USA Compression Partners Earnings

Call or conference ID 8970064.

About USA Compression Partners,

LP

USA Compression Partners, LP is one of the nation’s largest

independent providers of natural gas compression services in terms

of total compression fleet horsepower. USA Compression partners

with a broad customer base composed of producers, processors,

gatherers, and transporters of natural gas and crude oil. USA

Compression focuses on providing midstream natural gas compression

services to infrastructure applications primarily in high-volume

gathering systems, processing facilities, and transportation

applications. More information is available at

usacompression.com.

Non-GAAP Financial

Measures

This news release includes the Non-GAAP financial measures of

Adjusted gross margin, Adjusted EBITDA, Distributable Cash Flow,

and Distributable Cash Flow Coverage Ratio.

Adjusted gross margin is defined as revenue less cost of

operations, exclusive of depreciation and amortization expense.

Management believes Adjusted gross margin is useful to investors as

a supplemental measure of the Partnership’s operating

profitability. Adjusted gross margin primarily is impacted by the

pricing trends for service operations and cost of operations,

including labor rates for service technicians, volume, and per-unit

costs for lubricant oils, quantity and pricing of routine

preventative maintenance on compression units, and property tax

rates on compression units. Adjusted gross margin should not be

considered an alternative to, or more meaningful than, gross margin

or any other measure presented in accordance with GAAP. Moreover,

the Partnership’s Adjusted gross margin, as presented, may not be

comparable to similarly titled measures of other companies. Because

the Partnership capitalizes assets, depreciation and amortization

of equipment is a necessary element of its cost structure. To

compensate for the limitations of Adjusted gross margin as a

measure of the Partnership’s performance, management believes it

important to consider gross margin determined under GAAP, as well

as Adjusted gross margin, to evaluate the Partnership’s operating

profitability.

Management views Adjusted EBITDA as one of its primary tools for

evaluating the Partnership’s results of operations, and the

Partnership tracks this item on a monthly basis as an absolute

amount and as a percentage of revenue compared to the prior month,

year-to-date, prior year, and budget. The Partnership defines

EBITDA as net income (loss) before net interest expense,

depreciation and amortization expense, and income tax expense

(benefit). The Partnership defines Adjusted EBITDA as EBITDA plus

impairment of compression equipment, impairment of goodwill,

interest income on capital leases, unit-based compensation expense

(benefit), severance charges, certain transaction expenses, loss

(gain) on disposition of assets, loss on extinguishment of debt,

loss (gain) on derivative instrument, and other. Adjusted EBITDA is

used as a supplemental financial measure by management and external

users of the Partnership’s financial statements, such as investors

and commercial banks, to assess:

- the financial performance of the Partnership’s assets without

regard to the impact of financing methods, capital structure, or

the historical cost basis of the Partnership’s assets;

- the viability of capital expenditure projects and the overall

rates of return on alternative investment opportunities;

- the ability of the Partnership’s assets to generate cash

sufficient to make debt payments and pay distributions; and

- the Partnership’s operating performance as compared to those of

other companies in its industry without regard to the impact of

financing methods and capital structure.

Management believes Adjusted EBITDA provides useful information

to investors because, when viewed in conjunction with the

Partnership’s GAAP results and the accompanying reconciliations, it

may provide a more complete assessment of the Partnership’s

performance as compared to considering solely GAAP results.

Management also believes that external users of the Partnership’s

financial statements benefit from having access to the same

financial measures that management uses to evaluate the results of

the Partnership’s business.

Adjusted EBITDA should not be considered an alternative to, or

more meaningful than, net income (loss), operating income (loss),

cash flows from operating activities, or any other measure

presented in accordance with GAAP. Moreover, the Partnership’s

Adjusted EBITDA, as presented, may not be comparable to similarly

titled measures of other companies.

Distributable Cash Flow is defined as net income (loss) plus

non-cash interest expense, non-cash income tax expense (benefit),

depreciation and amortization expense, unit-based compensation

expense (benefit), impairment of compression equipment, impairment

of goodwill, certain transaction expenses, severance charges, loss

(gain) on disposition of assets, loss on extinguishment of debt,

change in fair value of derivative instrument, proceeds from

insurance recovery, and other, less distributions on Preferred

Units and maintenance capital expenditures.

Distributable Cash Flow should not be considered an alternative

to, or more meaningful than, net income (loss), operating income

(loss), cash flows from operating activities, or any other measure

presented in accordance with GAAP. Moreover, the Partnership’s

Distributable Cash Flow, as presented, may not be comparable to

similarly titled measures of other companies.

Management believes Distributable Cash Flow is an important

measure of operating performance because it allows management,

investors, and others to compare the cash flows that the

Partnership generates (after distributions on Preferred Units but

prior to any retained cash reserves established by the

Partnership’s general partner and the effect of the Distribution

Reinvestment Plan) to the cash distributions that the Partnership

expects to pay its common unitholders.

Distributable Cash Flow Coverage Ratio is defined as the

period’s Distributable Cash Flow divided by distributions declared

to common unitholders in respect of such period. Management

believes Distributable Cash Flow Coverage Ratio is an important

measure of operating performance because it permits management,

investors, and others to assess the Partnership’s ability to pay

distributions to common unitholders out of the cash flows the

Partnership generates. The Partnership’s Distributable Cash Flow

Coverage Ratio, as presented, may not be comparable to similarly

titled measures of other companies.

This news release also contains a forward-looking estimate of

Adjusted EBITDA and Distributable Cash Flow projected to be

generated by the Partnership for its 2024 fiscal year. A

forward-looking estimate of net cash provided by operating

activities and reconciliations of the forward-looking estimates of

Adjusted EBITDA and Distributable Cash Flow to net cash provided by

operating activities are not provided because the items necessary

to estimate net cash provided by operating activities, in

particular the change in operating assets and liabilities, are not

accessible or estimable at this time. The Partnership does not

anticipate changes in operating assets and liabilities to be

material, but changes in accounts receivable, accounts payable,

accrued liabilities, and deferred revenue could be significant,

such that the amount of net cash provided by operating activities

would vary substantially from the amount of projected Adjusted

EBITDA and Distributable Cash Flow.

See “Reconciliation of Non-GAAP Financial Measures” for Adjusted

gross margin reconciled to gross margin, Adjusted EBITDA reconciled

to net income and net cash provided by operating activities, and

net income and net cash provided by operating activities reconciled

to Distributable Cash Flow and Distributable Cash Flow Coverage

Ratio.

Forward-Looking

Statements

Some of the information in this news release may contain

forward-looking statements. These statements can be identified by

the use of forward-looking terminology including “may,” “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “continue,” “if,”

“project,” “outlook,” “will,” “could,” “should,” or other similar

words or the negatives thereof, and include the Partnership’s

expectation of future performance contained herein, including as

described under “Full-Year 2024 Outlook.” These statements discuss

future expectations, contain projections of results of operations

or of financial condition, or state other “forward-looking”

information. You are cautioned not to place undue reliance on any

forward-looking statements, which can be affected by assumptions

used or by known risks or uncertainties. Consequently, no

forward-looking statements can be guaranteed. When considering

these forward-looking statements, you should keep in mind the risk

factors noted below and other cautionary statements in this news

release. The risk factors and other factors noted throughout this

news release could cause actual results to differ materially from

those contained in any forward-looking statement. Known material

factors that could cause the Partnership’s actual results to differ

materially from the results contemplated by such forward-looking

statements include:

- changes in economic conditions of the crude oil and natural gas

industries, including any impact from the ongoing military conflict

involving Russia and Ukraine or the conflict in the Middle

East;

- changes in general economic conditions, including inflation or

supply chain disruptions;

- changes in the long-term supply of and demand for crude oil and

natural gas, including as a result of, actions taken by

governmental authorities and other third parties in response to

world health events, and the resulting disruption in the oil and

gas industry and impact on demand for oil and gas;

- competitive conditions in the Partnership’s industry, including

competition for employees in a tight labor market;

- changes in the availability and cost of capital, including

changes to interest rates;

- renegotiation of material terms of customer contracts;

- actions taken by the Partnership’s customers, competitors, and

third-party operators;

- operating hazards, natural disasters, epidemics, pandemics,

weather-related impacts, casualty losses, and other matters beyond

the Partnership’s control;

- the deterioration of the financial condition of the

Partnership’s customers, which may result in the initiation of

bankruptcy proceedings with respect to certain customers;

- the restrictions on the Partnership’s business that are imposed

under the Partnership’s long-term debt agreements;

- information technology risks, including the risk from

cyberattacks, cybersecurity breaches, and other disruptions to the

Partnership’s information systems;

- the effects of existing and future laws and governmental

regulations;

- the effects of future litigation;

- factors described in Part I, Item 1A (“Risk Factors”) of the

Partnership’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the Securities and Exchange

Commission (the “SEC”) on February 13, 2024, and subsequently filed

reports; and

- other factors discussed in the Partnership’s filings with the

SEC.

All forward-looking statements speak only as of the date of this

news release and are expressly qualified in their entirety by the

foregoing cautionary statements. Unless legally required, the

Partnership undertakes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise. Unpredictable or unknown factors not

discussed herein also could have material adverse effects on

forward-looking statements.

USA COMPRESSION PARTNERS,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except for per

unit amounts – Unaudited)

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Revenues:

Contract operations

$

220,518

$

223,643

$

204,716

Parts and service

5,756

5,827

7,153

Related party

13,694

5,843

5,216

Total revenues

239,968

235,313

217,085

Costs and expenses:

Cost of operations, exclusive of

depreciation and amortization

81,814

78,162

74,928

Depreciation and amortization

67,237

65,313

64,101

Selling, general, and administrative

15,364

14,173

20,085

Gain on disposition of assets

(123

)

(18

)

(3,865

)

Impairment of compression equipment

—

311

882

Total costs and expenses

164,292

157,941

156,131

Operating income

75,676

77,372

60,954

Other income (expense):

Interest expense, net

(49,361

)

(48,828

)

(43,257

)

Gain (loss) on derivative instrument

(6,218

)

3,131

3,437

Other

23

26

23

Total other expense

(55,556

)

(45,671

)

(39,797

)

Net income before income tax expense

20,120

31,701

21,157

Income tax expense

793

463

255

Net income

19,327

31,238

20,902

Less: distributions on Preferred Units

(4,388

)

(4,387

)

(12,188

)

Net income attributable to common

unitholders’ interests

$

14,939

$

26,851

$

8,714

Weighted-average common units outstanding

– basic

117,017

116,849

98,292

Weighted-average common units outstanding

– diluted

118,256

117,972

100,263

Basic and diluted net income per common

unit

$

0.13

$

0.23

$

0.09

Distributions declared per common unit for

respective periods

$

0.525

$

0.525

$

0.525

USA COMPRESSION PARTNERS,

LP

SELECTED BALANCE SHEET

DATA

(In thousands, except unit

amounts – Unaudited)

September 30,

2024

Selected Balance Sheet data:

Total assets

$

2,803,627

Long-term debt, net

$

2,532,398

Total partners’ deficit

$

(107,254

)

Common units outstanding

117,022,833

USA COMPRESSION PARTNERS,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands —

Unaudited)

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Net cash provided by operating

activities

$

48,481

$

96,741

$

50,072

Net cash used in investing activities

(28,379

)

(48,142

)

(48,082

)

Net cash used in financing activities

(20,032

)

(48,598

)

(2,015

)

USA COMPRESSION PARTNERS,

LP

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED GROSS MARGIN TO GROSS

MARGIN

(In thousands —

Unaudited)

The following table reconciles Adjusted

gross margin to gross margin, its most directly comparable GAAP

financial measure, for each of the periods presented:

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Total revenues

$

239,968

$

235,313

$

217,085

Cost of operations, exclusive of

depreciation and amortization

(81,814

)

(78,162

)

(74,928

)

Depreciation and amortization

(67,237

)

(65,313

)

(64,101

)

Gross margin

$

90,917

$

91,838

$

78,056

Depreciation and amortization

67,237

65,313

64,101

Adjusted gross margin

$

158,154

$

157,151

$

142,157

USA COMPRESSION PARTNERS,

LP

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED EBITDA TO NET INCOME

AND NET CASH PROVIDED BY OPERATING ACTIVITIES

(In thousands —

Unaudited)

The following table reconciles Adjusted

EBITDA to net income and net cash provided by operating activities,

its most directly comparable GAAP financial measures, for each of

the periods presented:

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Net income

$

19,327

$

31,238

$

20,902

Interest expense, net

49,361

48,828

43,257

Depreciation and amortization

67,237

65,313

64,101

Income tax expense

793

463

255

EBITDA

$

136,718

$

145,842

$

128,515

Unit-based compensation expense (1)

2,669

562

8,024

Transaction expenses (2)

(15

)

63

—

Severance charges

223

44

45

Gain on disposition of assets

(123

)

(18

)

(3,865

)

Loss (gain) on derivative instrument

6,218

(3,131

)

(3,437

)

Impairment of compression equipment

(3)

—

311

882

Adjusted EBITDA

$

145,690

$

143,673

$

130,164

Interest expense, net

(49,361

)

(48,828

)

(43,257

)

Non-cash interest expense

2,251

2,257

1,819

Income tax expense

(793

)

(463

)

(255

)

Transaction expenses

15

(63

)

—

Severance charges

(223

)

(44

)

(45

)

Cash received on derivative instrument

2,000

2,466

2,528

Other

330

37

(65

)

Changes in operating assets and

liabilities

(51,428

)

(2,294

)

(40,817

)

Net cash provided by operating

activities

$

48,481

$

96,741

$

50,072

____________________________________

(1)

For the three months ended

September 30, 2024, June 30, 2024, and September 30, 2023,

unit-based compensation expense included $1.0 million, $1.0

million, and $1.1 million, respectively, of cash payments related

to quarterly payments of distribution equivalent rights on

outstanding phantom unit awards. The remainder of unit-based

compensation expense for all periods was related to non-cash

adjustments to the unit-based compensation liability.

(2)

Represents certain expenses

related to potential and completed transactions and other items.

The Partnership believes it is useful to investors to exclude these

expenses.

(3)

Represents non-cash charges

incurred to decrease the carrying value of long-lived assets with

recorded values that are not expected to be recovered through

future cash flows.

USA COMPRESSION PARTNERS,

LP

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

DISTRIBUTABLE CASH FLOW TO NET

INCOME AND NET CASH PROVIDED BY OPERATING ACTIVITIES

(Dollars in thousands —

Unaudited)

The following table reconciles

Distributable Cash Flow to net income and net cash provided by

operating activities, its most directly comparable GAAP financial

measures, for each of the periods presented:

Three Months Ended

September 30,

2024

June 30, 2024

September 30,

2023

Net income

$

19,327

$

31,238

$

20,902

Non-cash interest expense

2,251

2,257

1,819

Depreciation and amortization

67,237

65,313

64,101

Non-cash income tax expense (benefit)

330

37

(65

)

Unit-based compensation expense (1)

2,669

562

8,024

Transaction expenses (2)

(15

)

63

—

Severance charges

223

44

45

Gain on disposition of assets

(123

)

(18

)

(3,865

)

Change in fair value of derivative

instrument

8,218

(665

)

(909

)

Impairment of compression equipment

(3)

—

311

882

Distributions on Preferred Units (4)

(4,388

)

(4,387

)

(12,188

)

Maintenance capital expenditures (5)

(9,123

)

(8,892

)

(7,172

)

Distributable Cash Flow

$

86,606

$

85,863

$

71,574

Maintenance capital expenditures

9,123

8,892

7,172

Transaction expenses

15

(63

)

—

Severance charges

(223

)

(44

)

(45

)

Distributions on Preferred Units

4,388

4,387

12,188

Changes in operating assets and

liabilities

(51,428

)

(2,294

)

(40,817

)

Net cash provided by operating

activities

$

48,481

$

96,741

$

50,072

Distributable Cash Flow

$

86,606

$

85,863

$

71,574

Distributions for Distributable Cash Flow

Coverage Ratio (6)

$

61,437

$

61,429

$

51,608

Distributable Cash Flow Coverage Ratio

1.41

x

1.40

x

1.39

x

____________________________________

(1)

For the three months ended

September 30, 2024, June 30, 2024, and September 30, 2023,

unit-based compensation expense included $1.0 million, $1.0

million, and $1.1 million, respectively, of cash payments related

to quarterly payments of distribution equivalent rights on

outstanding phantom unit awards. The remainder of unit-based

compensation expense for all periods was related to non-cash

adjustments to the unit-based compensation liability.

(2)

Represents certain expenses

related to potential and completed transactions and other items.

The Partnership believes it is useful to investors to exclude these

expenses.

(3)

Represents non-cash charges

incurred to decrease the carrying value of long-lived assets with

recorded values that are not expected to be recovered through

future cash flows.

(4)

During 2024, 320,000 Preferred

Units were converted into 15,990,804 common units, all of which

occurred on or prior to the distribution record date for the first

quarter of 2024.

(5)

Reflects actual maintenance

capital expenditures for the periods presented. Maintenance capital

expenditures are capital expenditures made to maintain the

operating capacity of the Partnership’s assets and extend their

useful lives, replace partially or fully depreciated assets, or

other capital expenditures that are incurred in maintaining the

Partnership’s existing business and related cash flow.

(6)

Represents distributions to the

holders of the Partnership’s common units as of the record

date.

USA COMPRESSION PARTNERS,

LP

FULL-YEAR 2024 ADJUSTED EBITDA

AND DISTRIBUTABLE CASH FLOW GUIDANCE RANGE

RECONCILIATION TO NET

INCOME

(Unaudited)

Guidance

Net income

$105.0 million to $125.0

million

Plus: Interest expense, net

189.0 million to 186.0

million

Plus: Depreciation and amortization

259.0 million to 262.0

million

Plus: Income tax expense

2.0 million

EBITDA

$555.0 million to $575.0

million

Plus: Unit-based compensation expense and

other (1)

10.0 million

Plus: Loss on disposition of assets

1.0 million

Plus: Loss on extinguishment of debt

5.0 million

Less: Gain on derivative instrument

6.0 million

Adjusted EBITDA

$565.0 million to $585.0

million

Less: Cash interest expense

181.0 million to 178.0

million

Less: Current income tax expense

1.0 million

Less: Maintenance capital expenditures

27.0 million to 30.0 million

Less: Distributions on Preferred Units

18.0 million

Plus: Cash received on derivative

instrument

7.0 million

Distributable Cash Flow

$345.0 million to $365.0

million

____________________________________

(1)

Unit-based compensation expense

is based on the Partnership’s closing per unit price of $22.92 on

September 30, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105363529/en/

Investor Contact: USA

Compression Partners, LP Investor Relations

ir@usacompression.com

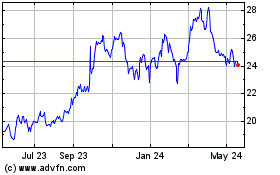

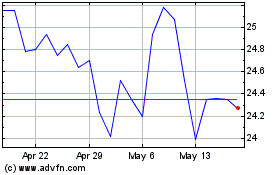

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Jan 2024 to Jan 2025