- Vista Outdoor Board of Directors Committed to Maximizing

Value to Stockholders Through Sales of The Kinetic Group and

Revelyst For an Expected Total Cash Consideration to Stockholders

of Approximately $45.001 per Share; Leading Independent Proxy

Advisory Firm Institutional Shareholder Services ("ISS") Recommends

Vista Outdoor Stockholders Vote "FOR" the Sale of The Kinetic Group

to CSG

- Vista Outdoor FY2025 Q2 Financial Results In-Line With

Expectations: Sales of $666 Million; Operating Income of $66

Million with 9.9 Percent Margin; Adj. EBITDA of $111 Million

Translating to 16.7 Percent Margin

- Revelyst FY2025 Q2 Financial Results Exceeded Expectations:

Sales of $315 Million; Operating Income of $21 Million With Margin

of 6.6 Percent, an Increase of 270 Basis Points Year-Over-Year and

720 Basis Points Sequentially; Adj. EBITDA More Than Doubled

Sequentially to $38 Million With Margin of 12.1 Percent

- The Kinetic Group FY2025 Q2 Sales of $351 Million; Operating

Income of $87 Million with 24.8 Percent Margin; Adj. EBITDA of $94

Million Translating to 26.7 Percent Margin

- Vista Outdoor Total Debt Decreased $45 Million Sequentially

to $590 Million; Net Debt of $553 Million and a Net Debt Leverage

Ratio of 1.3 Times

Vista Outdoor Inc. (NYSE: VSTO) today reported operating results

for the Second Quarter Fiscal Year 2025 (FY2025), which ended on

September 30, 2024.

"I am proud of the strong quarter the Vista Outdoor team

delivered as we move towards separation. Regarding the separation,

the Board underwent a thorough and competitive process, reviewing

numerous strategic and other alternatives over nearly three years

to maximize value to stockholders," said Mike Callahan, Chairman of

the Board of Directors. "At the conclusion of our review, the Board

determined that the transactions with CSG and SVP together maximize

value for Vista Outdoor stockholders. Based on our management

team's current estimates, the CSG and SVP transactions will

collectively deliver an estimated $45.001 per share of Vista

Outdoor common stock. We are pleased to see ISS is recommending

Vista Outdoor stockholders vote "FOR" the sale of The Kinetic Group

to CSG and recognizes the significant value that the CSG and SVP

transactions will deliver to stockholders. The Board continues to

recommend Vista Outdoor stockholders vote in favor of the proposal

to adopt the merger agreement with CSG at the special meeting of

stockholders which will be held on November 25, 2024."

“Our teams across Revelyst worked hard to deliver a terrific

second quarter, keeping us on track with our commitment to double

standalone adjusted EBITDA for the Fiscal Year,” said Eric Nyman,

Co-CEO of Vista Outdoor and CEO of Revelyst. "We saw Revelyst

adjusted EBITDA more than double sequentially in the quarter driven

largely by the demonstrable progress made in our GEAR Up

transformation. GEAR Up initiatives have now delivered $11.6

million of realized cost savings through the first half of Fiscal

Year 2025 across our key focus areas that include Organizational

Structure, Real Estate, Supply Chain and Operations and Direct and

Indirect Spend. Actioned initiatives include streamlining our

corporate real estate footprint, further optimization of our

distribution network and realizing efficiencies through the

consolidation of external vendor spend. We expect further

profitability improvements in the Fiscal Year primarily driven by

the $25 to $30 million of estimated realized cost savings

attributable to the GEAR Up transformation positioning us well for

the future.”

“Looking ahead, we are excited to partner with SVP to capitalize

on the momentum that we have built at Revelyst. The partnership

positions us well to continue to leverage our integrated

international house of brands and leadership in the outdoor

industry. We see accelerating growth and an ability to deliver

further innovation and top-tier products to outdoor enthusiasts

bolstered by the access to SVP’s full operating resources and

network. The future at Revelyst is bright, and I look forward to

the next step in our journey alongside SVP.”

“The Kinetic Group continues to demonstrate best-in-class

performance, while facing a tougher market than last year,” said

Jason Vanderbrink, Co-CEO of Vista Outdoor and CEO of The Kinetic

Group. “Our Adjusted EBITDA margin outpaces the competition at 26.7

percent, showing disciplined product management and demand for our

premium products. We were recently awarded key contracts from

Veterans Affairs and the Federal Reserve Bank, adding balance to

our customer portfolio. The team has also been celebrating the

success of our sponsored Olympic shooters, who brought home four

medals and a fourth-straight Men’s Skeet Gold from Paris. We look

forward to building on a winning strategy and growing the presence

of our ammunition brands as we move closer to closing the

transaction with CSG.”

Note that in the results below when referring to "Revelyst," it

comprises three new operating and reportable segments: Revelyst

Adventure Sports, Revelyst Precision Sports Technology and Revelyst

Outdoor Performance. Please see Vista Outdoor’s Annual Report on

Form 10-K for the year ended March 31, 2024, for additional

information.

________ 1 Based on management estimates, including an

assumption the SVP transaction closes on December 31, 2024.

Consolidated results for the three

months ended September 30, 2024, versus the three months ended

September 24, 2023:

- Sales decreased 1.6 percent to $666 million driven primarily by

lower volume at Revelyst Adventure Sports and divestitures within

Revelyst Outdoor Performance, partially offset by increased price

at The Kinetic Group and higher volume primarily driven by new

product introductions at Revelyst Precision Sports Technology.

- Gross profit increased 1.2 percent to $211 million due to

improved inventory health and increased price at Revelyst Adventure

Sports, divestitures within Revelyst Outdoor Performance and

increased price at The Kinetic Group, partially offset by increased

input costs for copper and powder at The Kinetic Group and lower

volume at Revelyst Adventure Sports.

- Operating expenses increased 9.5 percent driven primarily by

increased incentive compensation and increased restructuring costs

related to the GEAR Up initiative partially offset by lower

selling, general and administrative costs at Revelyst primarily

related to GEAR Up initiatives.

- Operating income declined 13.3 percent to $66 million and

operating income margin decreased 133 basis points to 9.9 percent.

Adjusted operating income was $88 million, down 3.6 percent.

Adjusted operating income margin decreased 27 basis points to 13.2

percent.

- Net income decreased to $42 million. Net income margin

decreased to 6.3 percent.

- Adjusted EBITDA declined 4.4 percent to $111 million. Adjusted

EBITDA margin decreased 48 basis points to 16.7 percent.

- Diluted Earnings per Share (EPS) was $0.71, down 6.6 percent,

compared with $0.76 in the prior fiscal year. Adjusted EPS

increased to $1.03, or up 7.3 percent, compared with $0.96 in the

prior fiscal year.

- Year to date cash provided by operating activities was $81

million, compared to $108 million in the prior fiscal year to date

period. Year to date adjusted free cash flow was $111 million.

For the three months ended September

30, 2024, versus the three months ended September 24,

2023:

Revelyst

- Sales declined 3.9 percent to $315 million driven by lower

volume at Revelyst Adventure Sports and divestitures within

Revelyst Outdoor Performance. The decline was partially offset by

increased volume within Revelyst Precision Sports Technology.

- Gross profit increased 5.0 percent to $98 million due to

improved inventory health and increased price at Revelyst Adventure

Sports and improved inventory health and divestitures at Revelyst

Outdoor Performance, partially offset by lower volume at Revelyst

Adventure Sports, manufacturing efficiency headwinds at Revelyst

Outdoor Performance and increased discounting at Revelyst Precision

Sports Technology.

- Operating income increased 67.1 percent to $21 million due to

higher gross profit and lower selling, general and administrative

costs related to GEAR Up initiatives across Revelyst Adventure

Sports and Revelyst Outdoor Performance, partially offset by

decreased gross profit and increased selling, general and

administrative costs at Revelyst Precision Sports Technology.

Operating income margin increased 270 basis points to 6.6

percent.

- Adjusted EBITDA increased 25.8 percent to $38 million. Adjusted

EBITDA margin increased 286 basis points to 12.1 percent.

The Kinetic Group

- Sales increased 0.5 percent to $351 million, due to increased

price.

- Gross profit declined 1.8 percent to $113 million driven

primarily by increased input costs of copper and powder, partially

offset by increased price.

- Operating income decreased 5.7 percent to $87 million due to

lower gross profit and increased incentive compensation. Operating

income margin decreased 163 basis points to 24.8 percent.

- Adjusted EBITDA decreased 5.1 percent to $94 million. Adjusted

EBITDA margin decreased 158 basis points to 26.7 percent.

Financial Update

“At Vista Outdoor, we delivered second quarter results in-line

with our expectations and our fundamentals remained strong,” said

Andrew Keegan, CFO of Vista Outdoor. “Our Revelyst business

exceeded expectations during the quarter with segment Adjusted

EBITDA more than doubling sequentially from the first quarter. The

improved profitability was driven in part by our GEAR Up

transformation program which has delivered $11.6 million in

realized cost savings in the first half of Fiscal Year 2025. We are

well-positioned and reaffirm our commitment to double Revelyst

standalone adjusted EBITDA and realize $25 to $30 million of cost

savings for the full Fiscal Year 2025 across our key focus

areas.

"We continue to prioritize a strong balance sheet and a healthy

inventory position. During the quarter we saw Revelyst inventory

decrease $87 million year-over-year and $22 million sequentially

from Q1. This reduction coupled with improved profitability drove

Vista Outdoor's year to date cash provided by operating activities

of $81 million and adjusted free cash flow of $111 million,

allowing us to decrease our net debt $26 million during the

quarter. Our net debt ended the second quarter at $553 million and

our net debt leverage ratio was 1.3x.

“Given the recently announced sale of both The Kinetic Group and

Revelyst businesses we have elected to withdraw our full year

Fiscal Year 2025 guidance. Upon the sale of The Kinetic Group, that

is expected to close prior to year-end 2024, Revelyst will become a

publicly traded company under the stock ticker GEAR. The Revelyst

sale to SVP is contingent on the completion of the CSG transaction

and is expected to close by the end of January 2025 at which point

Revelyst will become a privately held company. We are excited for

the future of both companies under new strategic ownership,” Keegan

concluded.

Earnings Conference Call Webcast Information

In light of the Company's pending sale of The Kinetic Group to

CZECHOSLOVAK GROUP a.s., as well as its pending sale of Revelyst to

Strategic Value Partners, as announced on October 4, 2024, the

Company will not hold a conference call to discuss its

second-quarter results.

Non-GAAP Financial Measures

Non-GAAP financial measures such as adjusted EBITDA, adjusted

EBITDA margin, adjusted operating expenses, adjusted operating

income, adjusted operating income margin, adjusted taxes, adjusted

tax rate, adjusted net income, adjusted EPS, adjusted free cash

flow, net debt and net debt leverage ratio as included in this

press release are supplemental measures that are not calculated in

accordance with Generally Accepted Accounting Principles (“GAAP”).

These non-GAAP measures should be considered in addition to, and

not as substitutes for, GAAP measures. Please see the tables below

for reconciliations of these non-GAAP measures to the most directly

comparable GAAP measures.

Reconciliation of Non-GAAP and Supplemental Financial

Measures

In addition to the results prepared in accordance with GAAP, we

are providing the information below on a non-GAAP basis, including,

adjusted operating expenses, adjusted operating income, adjusted

operating income margin, adjusted taxes, adjusted tax rate,

adjusted net income, and adjusted diluted earnings (loss) per share

(EPS). Vista Outdoor defines these measures as operating expenses,

operating income (loss), operating income margin, taxes, tax rate,

net income, and EPS excluding, where applicable, the impact of

costs incurred for post-acquisition compensation, transaction and

transition costs, executive transition costs, planned separation

costs, loss on divestiture, restructuring and GEAR Up

restructuring. Vista Outdoor management is presenting these

measures so a reader may compare gross profit, operating expenses,

operating income, operating income margin, other expense, net,

interest expense, taxes, tax rate, net income, and EPS excluding

these items, as the measures provide investors with an important

perspective on the operating results of the Company. Vista Outdoor

management uses these measurements internally to assess business

performance, and Vista Outdoor’s definitions may differ from those

used by other companies.

Three months

ended September 30, 2024

(in thousands except per share amounts and

percentages)

Gross profit

Operating expenses

Operating income

Operating income

margin

Other expense, net

Interest

Taxes

Tax rate

Net income

EPS (1)

As reported

$

211,429

$

145,704

$

65,725

9.9

%

$

255

$

(8,237

)

$

(15,945

)

27.6

%

$

41,798

$

0.71

Post acquisition compensation

—

(68

)

68

—

—

—

68

Transaction costs

—

132

(132

)

—

—

32

(100

)

Loss on divestiture

—

(872

)

872

—

—

1,473

2,345

Gear Up restructuring

—

(7,093

)

7,093

—

—

(1,702

)

5,391

Planned separation costs

—

(14,358

)

14,358

—

—

(3,446

)

10,912

As adjusted

$

211,429

$

123,445

$

87,984

13.2

%

$

255

$

(8,237

)

$

(19,588

)

24.5

%

$

60,414

$

1.03

(1) As reported net earnings per share and

adjusted net earnings per share are both calculated based on 58,641

diluted weighted average shares of common stock.

Three months

ended September 24, 2023

(in thousands except per share amounts and

percentages)

Gross profit

Operating expenses

Operating income

Operating income

margin

Other expense, net

Interest

Taxes

Tax rate

Net income

EPS (1)

As reported

$

208,870

$

133,085

$

75,785

11.2

%

$

(1,174

)

$

(16,643

)

$

(13,546

)

23.4

%

$

44,422

$

0.76

Post acquisition compensation

—

(160

)

160

—

—

—

160

Executive transition costs

—

(433

)

433

—

—

(218

)

215

Restructuring

—

(3,936

)

3,936

—

—

(945

)

2,991

Transition costs

—

(3,554

)

3,554

—

—

(854

)

2,700

Planned separation costs

—

(7,375

)

7,375

—

—

(1,770

)

5,605

As adjusted

$

208,870

$

117,627

$

91,243

13.5

%

$

(1,174

)

$

(16,643

)

$

(17,333

)

23.6

%

$

56,093

$

0.96

(1) As reported net earnings per share and

adjusted net earnings per share are both calculated based on 58,541

diluted weighted average shares of common stock.

During the three months ended September 30, 2024, we incurred

costs that we feel are not indicative of ongoing operations as

follows:

- post-acquisition compensation expense related to the Stone

Glacier acquisition;

- transaction costs associated with possible and actual

transactions, including advisor and legal fees and other

costs;

- loss on the divestiture of our Fiber Energy business;

- restructuring costs related to our GEAR Up transformation

program, including severance costs, contract terminations related

to location closures and professional fees; and

- costs associated with the planned separation of our Revelyst

and The Kinetic Group businesses into two separate companies,

including restructuring, and advisory and legal fees.

During the three months ended September 30, 2024, our reported

tax (expense) benefit of $(15,945) results in a tax rate of 27.6

percent and our adjusted tax (expense) benefit of $(19,588) results

in an adjusted tax rate of 24.5 percent.

During the three months ended September 24, 2023, we incurred

costs that we feel are not indicative of ongoing operations as

follows:

- transition costs for prior acquisitions to integrate into the

Company such as professional fees and travel costs;

- executive transition costs for executive search fees and

related costs for the transition of our CEO and General Counsel

executives;

- costs associated with the planned separation of our Revelyst

and The Kinetic Group businesses into two independent, publicly

traded companies, including restructuring, severance, advisory and

legal fees;

- restructuring costs related to a $50 million cost reduction and

earnings improvement program, announced during our fourth fiscal

quarter of 2023, which includes severance and asset impairments

related to product line reassessments, office closures, and

headcount reductions across our brands and corporate teams,

and;

- post-acquisition compensation expense related to the Stone

Glacier acquisition.

During the three months ended September 24, 2023, our reported

tax (expense) benefit of $(13,546) results in a tax rate of 23.4

percent and our adjusted tax (expense) benefit of $(17,333) results

in an adjusted tax rate of 23.6 percent.

Free Cash Flow

Free cash flow is defined as cash provided by operating

activities less capital expenditures. Vista Outdoor management

believes that free cash flow provides investors with an important

indication of the cash generated by our business for debt repayment

and acquisitions after making the capital investments required to

support ongoing business operations. Vista Outdoor management uses

free cash flow to assess overall liquidity. Vista Outdoor’s

definition of free cash flow may differ from those used by other

companies.

Adjusted free cash flow is defined as free cash flow eliminating

the cash impact of the following items that are adjusted in our

presentation of adjusted net income: post-acquisition compensation,

transaction costs, executive transition costs, restructuring, GEAR

Up restructuring, transition costs and planned separation costs.

Vista Outdoor management believes that adjusted free cash flow

enhances investors’ understanding of the liquidity of our ongoing

operations. Adjusted free cash flow is also used by Vista Outdoor

to assess employees’ performance and determine their annual

incentive payments. Vista Outdoor’s definition of adjusted free

cash flow may differ from those used by other companies.

Three months ended

Six months ended

(in thousands)

September 30, 2024

September 30, 2024

September 24, 2023

Cash provided by operating activities (as

reported)

$

26,778

$

80,543

$

107,540

Capital expenditures

(7,739

)

(10,023

)

(13,425

)

Free cash flow

19,039

70,520

94,115

Post acquisition compensation

84

167

166

Transaction costs

587

615

—

Executive transition costs

—

—

3,474

Restructuring

—

—

4,281

Gear Up restructuring

6,821

14,512

—

Transition costs

64

230

6,665

Planned separation costs

15,012

25,372

7,034

Adjusted free cash flow

$

41,607

$

111,416

$

115,735

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA is defined as net income before other expense,

net, interest, taxes, depreciation and amortization, and

amortization of cloud computing software, excluding the

non-recurring and non-cash items referenced above. We calculate

“Adjusted EBITDA margins” as Adjusted EBITDA divided by net sales.

Vista Outdoor management believes adjusted EBITDA and adjusted

EBITDA margin provide investors with an important perspective on

the Company’s core profitability and help investors analyze

underlying trends in the Company’s business and evaluate its

performance on an absolute basis and relative to its peers.

Adjusted EBITDA and adjusted EBITDA margin should be considered in

addition to, and not as a substitute for, GAAP net income and GAAP

net income margin. Vista Outdoor’s definitions may differ from

those used by other companies

Segment Adjusted EBITDA

Reconciliation

Three months ended September

30, 2024

(in thousands except percentages)

The Kinetic Group

Revelyst

Total

Segment operating income (1)

$

87,093

$

21,485

$

108,578

Depreciation and amortization

6,627

16,120

22,747

Amortization of cloud computing software

costs (2)

36

535

571

Adjusted segment EBITDA

$

93,756

$

38,140

$

131,896

Adjusted segment EBITDA margin

26.7

%

12.1

%

Three months ended September

24, 2023

(in thousands except percentages)

The Kinetic Group

Revelyst

Total

Segment operating income (1)

$

92,348

$

12,854

$

105,202

Depreciation and amortization

6,458

17,473

23,931

Amortization of cloud computing software

costs (2)

36

457

493

Adjusted segment EBITDA

$

98,842

$

30,784

$

129,626

Adjusted segment EBITDA margin

28.3

%

9.4

%

(1) We do not calculate GAAP net income at

the segment level, but have provided segment operating income as a

relevant measurement of profitability. Segment operating income

does not include interest expense and taxes as well as other

non-cash and non-recurring items. Segment operating income is

reconciled to our consolidated net income in the segment income to

consolidated net income reconciliation table included in this press

release.

(2) Amortization of cloud computing software costs consist of

expense recognized in selling, general and administrative expense

for capitalized implementation costs of IT. This expense is not

included in depreciation and amortization above.

Consolidated Adjusted EBITDA

Reconciliation

Three months ended

(in thousands except percentages)

September 30, 2024

September 24, 2023

Net income

$

41,798

$

44,422

Other expense, net

(255

)

1,174

Interest expense, net

8,237

16,643

Income tax provision

15,945

13,546

Depreciation and amortization

22,849

24,879

Amortization of cloud computing software

costs

544

324

Post acquisition compensation

68

160

Transaction costs

(132

)

—

Loss on divestiture

872

—

Gear Up restructuring

7,093

—

Transition costs

—

3,554

Planned separation costs

14,358

7,375

Executive transition costs

—

433

Restructuring

—

3,936

Adjusted EBITDA

$

111,377

$

116,446

Adjusted EBITDA margin

16.7

%

17.2

%

Segment Income to Consolidated Net

Income Reconciliation

Three months ended

(in thousands)

September 30, 2024

September 24, 2023

Segment income

$

108,578

$

105,202

Corporate costs and expenses (1)

(42,853

)

(29,417

)

Operating income

$

65,725

$

75,785

Other expense, net

255

(1,174

)

Interest expense, net

(8,237

)

(16,643

)

Income tax provision

(15,945

)

(13,546

)

Net Income

$

41,798

$

44,422

(1) Includes corporate overhead and

certain non-recurring items as described in the schedules to this

release

Net Debt and Net Debt Leverage Ratio

Net debt is defined as total debt less cash and cash

equivalents. Net debt leverage ratio is defined as net debt as of

the balance sheet date divided by adjusted EBITDA for the twelve

months then ended. We believe that using net debt is useful to

investors in determining our leverage ratio since we could choose

to use cash and cash equivalents to retire debt. Vista Outdoor’s

definitions may differ from those used by other companies.

Net Debt and Net Debt Leverage Ratio Reconciliation

(in thousands)

As of September 30,

2024

As of March 31, 2024

Total Debt Outstanding

$

590,000

$

720,000

Less: Cash

(36,925

)

(60,271

)

Net Debt

$

553,075

$

659,729

(in thousands except ratio)

Twelve months ended September

30, 2024

Twelve months ended March 31,

2024

Net loss

$

(9,109

)

$

(5,505

)

Other expense, net

95

1,988

Interest expense, net

47,746

62,949

Income tax benefit

(9,497

)

(8,979

)

Depreciation and amortization

96,026

99,291

Amortization of cloud computing software

costs

2,803

2,363

Post acquisition compensation

296

1,328

Transaction costs

802

755

Gain on divestitures

(18,787

)

—

Contingent consideration

5,888

5,888

Executive transition costs

250

1,342

Impairment

226,406

220,070

Restructuring

1,636

5,604

Gear Up restructuring

19,761

8,279

Transition costs

1,655

7,310

Planned separation costs

59,016

42,179

Adjusted EBITDA

$

424,987

$

444,862

Net debt leverage ratio

1.3

1.5

About Vista Outdoor Inc.

Vista Outdoor (NYSE: VSTO) is the parent company of more than

three dozen renowned brands that design, manufacture and market

sporting and outdoor products. Brands include Bushnell, CamelBak,

Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp

Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal

Ammunition, Remington Ammunition and more. Our Revelyst and The

Kinetic Group businesses provide consumers with a wide range of

performance-driven, high-quality and innovative outdoor and

sporting products. For news and information, visit our website at

www.VistaOutdoor.com.

Forward-Looking Statements

Some of the statements made and information contained in this

press release, excluding historical information, are

“forward-looking statements,” including those that discuss, among

other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or

“our”) plans, objectives, expectations, intentions, strategies,

goals, outlook or other non-historical matters; projections with

respect to future revenues, income, earnings per share or other

financial measures for Vista Outdoor; and the assumptions that

underlie these matters. The words “believe,” “expect,”

“anticipate,” “intend,” “aim,” “should” and similar expressions are

intended to identify such forward-looking statements. To the extent

that any such information is forward-looking, it is intended to fit

within the safe harbor for forward-looking information provided by

the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our

actual results to differ materially from the expectations described

in such forward-looking statements, including the following: risks

related to the previously announced transaction among Vista

Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG

Elevate III Inc. and CZECHOSLOVAK GROUP a.s. (the “CSG

Transaction”) and risks related to the previously announced

transaction among Vista Outdoor, Revelyst, Olibre LLC and Cabin

Ridge, Inc. (the “SVP Transaction”) including (i) the failure to

receive, on a timely basis or otherwise, the required approval of

the CSG Transaction by our stockholders, (ii) the possibility that

any or all of the various conditions to the consummation of the CSG

Transaction or the SVP Transaction may not be satisfied or waived,

including the failure to receive any required regulatory approvals

from any applicable governmental entities (or any conditions,

limitations or restrictions placed on such approvals), (iii) the

possibility that competing offers or acquisition proposals may be

made, (iv) the occurrence of any event, change or other

circumstance that could give rise to the termination of the merger

agreement relating to the CSG Transaction or the SVP Transaction,

including in circumstances which would require Vista Outdoor or

Revelyst, as applicable, to pay a termination fee, (v) the effect

of the announcement or pendency of the CSG Transaction or the SVP

Transaction on our ability to attract, motivate or retain key

executives and employees, our ability to maintain relationships

with our customers, vendors, service providers and others with whom

we do business, or our operating results and business generally,

(vi) risks related to the CSG Transaction or the SVP Transaction

diverting management’s attention from our ongoing business

operations, (vii) that the CSG Transaction or the SVP Transaction

may not achieve some or all of any anticipated benefits with

respect to either business segment and that the CSG Transaction or

the SVP Transaction may not be completed in accordance with our

expected plans or anticipated timelines, or at all, and (viii) that

the consideration paid to Revelyst stockholders in connection with

the SVP Transaction cannot be determined until the consummation of

the SVP Transaction as it is subject to certain adjustments related

to the net cash of Revelyst as of the closing of the SVP

Transaction and the management team’s current estimate of the

consideration may be higher or lower than the actual consideration

paid to Revelyst stockholders in connection with the SVP

Transaction due to the actual cash flows prior to the closing of

the SVP Transaction or other factors; impacts from the COVID-19

pandemic on our operations, the operations of our customers and

suppliers and general economic conditions; supplier capacity

constraints, production or shipping disruptions or quality or price

issues affecting our operating costs; the supply, availability and

costs of raw materials and components; increases in commodity,

energy, and production costs; seasonality and weather conditions;

our ability to complete acquisitions, realize expected benefits

from acquisitions and integrate acquired businesses; reductions in

or unexpected changes in or our inability to accurately forecast

demand for ammunition, accessories, or other outdoor sports and

recreation products; disruption in the service or significant

increase in the cost of our primary delivery and shipping services

for our products and components or a significant disruption at

shipping ports; risks associated with diversification into new

international and commercial markets, including regulatory

compliance; our ability to take advantage of growth opportunities

in international and commercial markets; our ability to obtain and

maintain licenses to third-party technology; our ability to attract

and retain key personnel; disruptions caused by catastrophic

events; risks associated with our sales to significant retail

customers, including unexpected cancellations, delays, and other

changes to purchase orders; our competitive environment; our

ability to adapt our products to changes in technology, the

marketplace and customer preferences, including our ability to

respond to shifting preferences of the end consumer from brick and

mortar retail to online retail; our ability to maintain and enhance

brand recognition and reputation; others’ use of social media to

disseminate negative commentary about us, our products, and

boycotts; the outcome of contingencies, including with respect to

litigation and other proceedings relating to intellectual property,

product liability, warranty liability, personal injury, and

environmental remediation; our ability to comply with extensive

federal, state and international laws, rules and regulations;

changes in laws, rules and regulations relating to our business,

such as federal and state ammunition regulations; risks associated

with cybersecurity and other industrial and physical security

threats; interest rate risk; changes in the current tariff

structures; changes in tax rules or pronouncements; capital market

volatility and the availability of financing; foreign currency

exchange rates and fluctuations in those rates; general economic

and business conditions in the United States and our markets

outside the United States, including as a result of the war in

Ukraine and the imposition of sanctions on Russia, the conflict in

the Gaza strip, the COVID-19 pandemic or other pandemic, conditions

affecting employment levels, consumer confidence and spending,

conditions in the retail environment, and other economic conditions

affecting demand for our products and the financial health of our

customers.

You are cautioned not to place undue reliance on any

forward-looking statements we make, which are based only on

information currently available to us and speak only as of the date

hereof. A more detailed description of risk factors that may affect

our operating results can be found in Part 1, Item 1A, Risk

Factors, of our Annual Report on Form 10-K for fiscal year 2024,

and in the filings we make with the SEC from time to time. We

undertake no obligation to update any forward-looking statements,

except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a

solicitation of an offer to buy any securities, the solicitation of

any vote, consent or approval in any jurisdiction pursuant to or in

connection with the CSG Transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended, and otherwise

in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in

respect of the CSG Transaction. In connection with the CSG

Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with

the SEC on January 16, 2024 a registration statement on Form S-4

(which was declared effective by the SEC on March 22, 2024 and was

subsequently amended by the post-effective amendment filed by

Revelyst on October 16, 2024 and declared effective by the SEC on

October 18, 2024) in connection with the proposed issuance of

shares of common stock of Revelyst to Vista Outdoor stockholders

pursuant to the CSG Transaction, which Form S-4 includes a proxy

statement of Vista Outdoor that also constitutes a prospectus of

Revelyst (the “proxy statement/prospectus”). INVESTORS AND

STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH

THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS AND ANY

AMENDMENTS AND SUPPLEMENTS THERETO, BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT THE CSG TRANSACTION, THE SVP TRANSACTION AND THE

PARTIES TO EACH TRANSACTION. We have mailed the definitive proxy

statement/prospectus to each of our stockholders entitled to vote

at the meeting relating to the approval of the CSG Transaction.

Investors and stockholders may obtain the proxy

statement/prospectus and any other documents free of charge through

the SEC’s website at www.sec.gov. Copies of the documents filed

with the SEC by Vista Outdoor are available free of charge on our

website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III

Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors,

executive officers and certain other members of management and

employees, under SEC rules, may be deemed to be “participants” in

the solicitation of proxies from our stockholders in respect of the

CSG Transaction. Information about our directors and executive

officers is set forth in our proxy statement on Schedule 14A for

our 2024 Annual Meeting of Stockholders, which was filed with the

SEC on July 24, 2024, and subsequent statements of changes in

beneficial ownership on file with the SEC. These documents are

available free of charge through the SEC’s website at www.sec.gov.

Additional information regarding the interests of potential

participants in the solicitation of proxies in connection with the

CSG Transaction, which may, in some cases, be different than those

of our stockholders generally, is also included in the proxy

statement/prospectus relating to the CSG Transaction.

VISTA OUTDOOR INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (preliminary and unaudited)

Three months ended

Six months ended

(Amounts in thousands except per share

data)

September 30, 2024

September 24, 2023

September 30, 2024

September 24, 2023

Sales, net

$

665,915

$

676,808

$

1,310,096

$

1,370,141

Cost of sales

454,486

467,938

887,510

934,514

Gross profit

211,429

208,870

422,586

435,627

Operating expenses:

Research and development

11,284

12,203

23,723

24,283

Selling, general, and administrative

133,548

120,882

270,897

243,373

(Gain) loss on divestitures

872

—

(18,787

)

—

Operating income

65,725

75,785

146,753

167,971

Other income (expense), net

255

(1,174

)

178

(1,715

)

Interest expense, net

(8,237

)

(16,643

)

(17,658

)

(32,861

)

Income before income taxes

57,743

57,968

129,273

133,395

Income tax provision

(15,945

)

(13,546

)

(30,355

)

(30,873

)

Net income

$

41,798

$

44,422

$

98,918

$

102,522

Earnings per common share:

Basic

$

0.72

$

0.77

$

1.69

$

1.78

Diluted

$

0.71

$

0.76

$

1.68

$

1.75

Weighted-average number of common shares

outstanding:

Basic

58,410

58,041

58,361

57,757

Diluted

58,786

58,299

58,714

58,426

VISTA OUTDOOR INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(preliminary and

unaudited)

(Amounts in thousands except share

data)

September 30, 2024

March 31, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

36,925

$

60,271

Net receivables

376,206

355,903

Net inventories

612,847

609,999

Income tax receivable

11,049

9,113

Other current assets

45,632

39,836

Total current assets

1,082,659

1,075,122

Net property, plant, and equipment

177,283

201,864

Operating lease assets

97,726

107,007

Goodwill

318,251

318,251

Net intangible assets

600,861

627,636

Deferred income tax assets

13,009

12,895

Deferred charges and other non-current

assets, net

63,844

59,605

Total assets

$

2,353,633

$

2,402,380

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

158,198

$

163,411

Accrued compensation

52,345

56,983

Federal excise, use, and other taxes

34,266

35,552

Other current liabilities

128,148

129,352

Total current liabilities

372,957

385,298

Long-term debt

587,519

717,238

Long-term operating lease liabilities

96,904

105,699

Accrued pension and postemployment

benefits

18,572

22,866

Other long-term liabilities

45,966

44,982

Total liabilities

1,121,918

1,276,083

Common stock—$.01 par value:

Authorized—500,000,000 shares

Issued and outstanding—58,425,417 shares

as of September 30, 2024 and 58,238,276 shares as of March 31,

2024

584

582

Additional paid-in-capital

1,651,441

1,653,089

Accumulated deficit

(137,115

)

(236,033

)

Accumulated other comprehensive loss

(73,454

)

(74,348

)

Common stock in treasury, at

cost—5,539,022 shares held as of September 30, 2024 and 5,726,163

shares held as of March 31, 2024

(209,741

)

(216,993

)

Total stockholders' equity

1,231,715

1,126,297

Total liabilities and stockholders'

equity

$

2,353,633

$

2,402,380

VISTA OUTDOOR INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(preliminary and

unaudited)

Six months ended

(Amounts in thousands)

September 30, 2024

September 24, 2023

Operating Activities

Net income

$

98,918

$

102,522

Adjustments to net income to arrive at

cash provided by operating activities:

Depreciation

21,576

24,470

Amortization of intangible assets

24,965

25,336

Amortization of deferred financing

costs

1,529

4,154

Impairment of long-lived assets

8,043

2,802

Gain on sale of business

(18,787

)

—

Deferred income taxes

(154

)

514

Gain on foreign exchange

(302

)

(240

)

Loss on disposal of property, plant, and

equipment

419

69

Share-based compensation

8,145

2,680

Changes in assets and liabilities:

Net receivables

(20,537

)

(57,128

)

Net inventories

(19,920

)

13,541

Accounts payable

(7,649

)

(5,104

)

Accrued compensation

(3,915

)

(8,859

)

Accrued income taxes

711

(17,125

)

Federal excise, use, and other taxes

(1,290

)

(5,027

)

Pension and other postretirement

benefits

(2,808

)

685

Other assets and liabilities

(8,401

)

24,250

Cash provided by operating activities

80,543

107,540

Investing Activities

Capital expenditures

(10,023

)

(13,425

)

Proceeds from the sale of businesses

39,538

—

Asset acquisition

(263

)

—

Proceeds from the disposition of property,

plant, and equipment

—

137

Cash provided by (used for) investing

activities

29,252

(13,288

)

Financing Activities

Proceeds from credit facility

103,000

102,000

Repayments of credit facility

(233,000

)

(162,000

)

Payments on long-term debt

—

(55,000

)

Payments made for debt issue costs and

prepayment premiums

—

(60

)

Proceeds from exercise of stock

options

36

39

Payments made for contingent

consideration

(750

)

(8,585

)

Payment of employee taxes related to

vested stock awards

(3,300

)

(16,200

)

Cash used for financing activities

(134,014

)

(139,806

)

Effect of foreign currency exchange rate

fluctuations on cash

873

(700

)

Decrease in cash and cash equivalents

(23,346

)

(46,254

)

Cash and cash equivalents at beginning of

period

60,271

86,208

Cash and cash equivalents at end of

period

$

36,925

$

39,954

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106481278/en/

Investor Contact: Tyler Lindwall Phone:

612-704-0147 E-mail:

investor.relations@vistaoutdoor.com

Media Contact: Eric Smith Phone:

720-772-0877 E-mail:

media.relations@vistaoutdoor.com

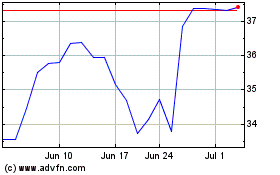

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

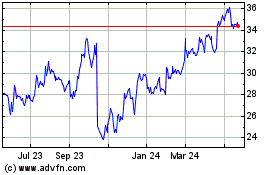

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Nov 2023 to Nov 2024