Strategic progress driving stronger margin

and improved cash conversion, despite top line pressures

WPP (NYSE: WPP) today reported its 2024 Preliminary Results.

Key figures (£m)

2024

+/(-) %

reported1

+/(-) %

LFL2

2023

Revenue

14,741

(0.7)

2.3

14,845

Revenue less pass-through costs

11,359

(4.2)

(1.0)

11,860

Reported:

Operating profit

1,325

149.5

531

Operating profit margin3

9.0%

3.6%

Profit before tax

1,031

198.0

346

Diluted EPS (p)

49.4

389.1

10.1

Dividends per share (p)

39.4*

–

39.4

Headline4:

Operating profit

1,707

(2.5)

2.0

1,750

Operating profit margin

15.0%

0.2pt

0.4pt

14.8%

Diluted EPS (p)

88.3

(5.9)

0.1

93.8

*including proposed final dividend.

Full year and Q4 financial highlights

- FY reported revenue -0.7%, LFL revenue +2.3%. FY revenue less

pass-through costs -4.2%, LFL revenue less pass-through costs

-1.0%

- Q4 LFL revenue less pass-through costs -2.3% with growth in

Western Continental Europe +1.4% offset by declines in North

America -1.4%, UK -5.1% and Rest of World -4.8%, including -21.2%

in China

- Global Integrated Agencies FY LFL revenue less pass-through

costs -0.8% (Q4: -2.2%): GroupM, our media planning and buying

business, +2.7% (Q4: +2.4%), offset by -3.9% in other Global

Integrated Agencies (Q4: -6.5%)

- FY headline operating profit £1,707m. Headline operating margin

of 15.0% (2023: 14.8%) a 0.4pt LFL improvement reflecting

structural cost savings of £85m from Burson, GroupM and VML

initiatives; disciplined cost control and continued investment in

our AI and data offer; with a 0.2pt FX drag. FY reported operating

profit £1,325m up 149.5% primarily reflecting lower amortisation

charges and higher gains on disposals

- Adjusted operating cash flow increased to £1,460m (2023:

£1,280m) and adjusted free cash flow rose to £738m (2023: £637m)

benefiting from strong working capital management

- Adjusted net debt at 31 December 2024 £1.7bn down £0.8bn

year-on-year

- Final dividend of 24.4p proposed (2023: 24.4p)

Delivering on strategic priorities

- Simpler client-facing structure: six agency networks represent

c92%5 of WPP; more integrated offer across creative, production,

commerce and media; improving new business performance in the

second half of 2024

- WPP Open: AI, data and technology increasingly central to the

way we serve our clients; critical to new business wins including

Amazon, J&J, Kimberly-Clark and Unilever; increasing annual

investment to £300m (from £250m)

- More efficient operations: stronger headline operating margin,

cash conversion and balance sheet

Focus and outlook for 2025

- Lead through AI, data and technology: Increase our investment

in WPP Open to keep it at the forefront of AI and further deploy it

across the business and our clients

- Accelerate growth through the power of creative transformation:

Drive transformation across our clients with an increasingly

integrated offer across creative, production, commerce and

media

- Build world-class, market-leading brands: Improve the

competitiveness of our media offer, globally, with a focus on the

US

- Execute efficiently to drive financial returns: Increase our

operational efficiency and optimise our investment allocation

- 2025 guidance: LFL revenue less pass-through costs of flat to

-2% with performance improving in the second half, and headline

operating profit margin expected to be around flat (excluding the

impact of FX)

Mark Read, Chief Executive Officer of WPP, said:

“We achieved significant progress against our strategy in 2024

with the creation of VML, Burson and the simplification of GroupM –

some 70% of our business. We sold our stake in FGS Global to create

significant value for shareholders. And we increased our margin,

while stepping up our investment in AI through WPP Open, which is

now used by 33,0006 people across WPP.

“The top line was lower, however, with Q4 impacted by weaker

client discretionary spend. We did see growth from our top 25

clients of 2.0% and an improving new business performance in the

second half of the year with wins from Amazon, J&J,

Kimberly-Clark and Unilever reflecting the strength of our

integrated offer.

“The actions we are taking across WPP will strengthen our

existing client relationships and drive our new business results.

We expect some improvement in the performance of our integrated

creative agencies in the year ahead. At the same time, we have

comprehensive efforts underway to improve our competitive

positioning through new leadership at GroupM, with further

investment in AI, data and proprietary media.

“Though we remain cautious given the overall macro environment,

we are confident in our medium-term targets and believe our focus

on innovation, a simpler client-facing offer and operational

excellence will support our growth and deliver greater value for

our shareholders.”

This announcement contains information that qualifies or may

qualify as inside information. The person responsible for arranging

the release of this announcement on behalf of WPP plc is Balbir

Kelly-Bisla, Company Secretary

To access WPP's 2024 preliminary results financial tables,

please visit www.wpp.com/investors

Strategic progress

We are one year into executing on the strategy we outlined in

January 2024 – ‘Innovating to Lead’ – and have made significant

progress on each of the four strategic pillars: leading through AI,

data and technology, accelerating growth through the power of

creative transformation, building world-class brands and executing

efficiently to drive financial returns.

Lead through AI, data and technology

The past year in AI has been marked by significant advancements

in AI technology with increasing capabilities, greater speed and

lower cost. This acceleration in the pace of innovation is

broadening the capabilities that we can deploy through WPP

Open.

These developments reinforce our conviction that AI will be the

single most transformational development in our industry since the

internet. It will impact every element of how we work, freeing up

our creative people to do better work, increasing the efficiency of

our production teams to produce much greater volumes of

high-quality work and empowering our media teams to develop and

deploy more effective plans in a fraction of the time.

To deliver on this potential, we are accelerating our investment

in WPP Open, our AI-powered marketing operating system, increasing

cash investment to £300m in 2025 from £250m in 2024. We are making

this investment to keep WPP Open at the forefront of our industry,

enabling us to use AI more effectively in our work and delivering

an end-to-end marketing platform that gets from ideas to results

more efficiently and quickly.

WPP Open is being broadly adopted by our people and our clients

are seeing tangible benefits. It is enabling our teams to generate

insights more rapidly, move seamlessly from idea to near-finished

executions and test these ideas on synthetic audiences. These are

just some of the capabilities built into WPP Open in the past year

and why 33,000 of our people are now active users.

As our people are increasingly embedding AI in the way that we

work this is resulting in increasing client adoption with major

clients including Google, IBM, L'Oréal, LVMH, Nestlé and The

Coca-Cola Company seeing benefits both in how we work and the

effectiveness of what we do together.

WPP Open Creative Studio has been rolling out a new user

interface, Canvas, which is augmenting our strategic and creative

teams with AI capabilities. Canvas empowers teams to leverage data

insights and WPP's knowledge to generate effective campaign ideas,

such as strategies to overcome audience barriers identified by AI

models, which can then be instantly visualised for clients as

storyboards and finished work.

WPP Open Media Studio continued its rollout to clients and was

central to our successful pitch at Amazon in 2024. Media Studio

provides an end-to-end media workflow solution accessing GroupM’s

scale and Choreograph data and technology.

GroupM and Choreograph’s approach to data leverages AI-powered

federated learning. Federated learning uses AI agents operating

across client, WPP and third-party data sources to create new

knowledge about customers. Establishing this data connectivity in

place of a dependence on legacy ID-first solutions and lookalike

models maintains data integrity and provides superior insight.

Accelerate growth through the power of creative

transformation

We continue to see growing demand from clients for more

integrated marketing solutions and WPP is moving quickly to be even

more effective in bringing together our many capabilities around

the world in teams to service clients. The reason for this is

clear. Managing multiple agency partners is complex, leads to

fragmentation of marketing efforts and smaller, more integrated

teams promise greater agility and speed. In our view, AI will only

accelerate this trend as clients face the challenge that complex

agency rosters, spread across multiple companies and independent

agencies, are unable to deliver the transformation required. The

simplest analogy is that procuring marketing services is becoming

more like procuring technology services, requiring greater

strategic focus, technology due diligence and attention to

long-term partnerships.

This trend has been reflected in the growth of WPP's top 25

clients in 2024 (+2.0%) and this demand for integration also aligns

with WPP’s position. We have a very well-balanced business with

strong geographic positions in critical markets combined with

strength in creativity, production commerce and influencer. When

powered by AI, data and technology and a world-leading global media

platform, this forms an unparalleled integrated offer to

clients.

As well as the relatively stronger growth we delivered across

WPP's largest clients in 2024, which included expanded scope for

many top clients, the quality of our offer is evidenced by recent

wins including creative assignments for Kimberly-Clark, media

assignments for Amazon and Johnson & Johnson, and creative and

commerce assignments for Unilever. 2024 net new billings were

$4.5bn (2023: $4.5bn).

WPP's commitment to creative excellence continues to garner

industry recognition, with the company being named 'Creative

Company of the Year' for 2024 at the Cannes Lions International

Festival of Creativity. Ogilvy took home ‘Creative Network of the

Year’ at Cannes and The Coca-Cola Company, whose global marketing

partner is WPP Open X, was named ‘Creative Brand of the Year’ for

the first time in its history. These awards underscore WPP's

ability to deliver innovative, integrated solutions that not only

meet but exceed client expectations, driving both growth and

expansion from across its client base.

Build world-class, market-leading brands

In 2024, we further simplified our structure making it easier

for clients to access our talent and allowing us to build a more

efficient operating model. WPP now has six powerful agency networks

– GroupM, VML, Ogilvy, AKQA, Hogarth and Burson – which

collectively account for around 92% of revenue less pass-through

costs.

2025 will be the first full year of operation for our two newly

created agencies: Burson, a leading global strategic communications

agency formed through the consolidation of BCW and Hill &

Knowlton, and VML, the world’s largest integrated creative agency,

bringing together VMLY&R and Wunderman Thompson. The swift

completion of these mergers in 2024 by the teams at VML and Burson

has strategically aligned our brands for continued progress,

leveraging their enhanced capabilities and global reach.

Brian Lesser joined as the Global CEO of GroupM, our media

planning and buying business, in September 2024, and is focused on

improving the competitiveness of our media offer, globally and in

the US, leveraging WPP Open Media Studio and Choreograph.

Under Brian’s leadership, GroupM will bring this differentiated

strategy together with next-generation proprietary trading media

products, WPP Open Media Studio and the power of WPP’s broader

integrated offer in creative, production and commerce to drive

media effectiveness and performance for our clients.

Execute efficiently to drive financial returns

Integral to our strategy over the past year has been the

imperative to execute more efficiently. Investing in AI through WPP

Open will allow us to work faster and with more discipline.

Integrating our offer for clients means that we can streamline the

marketing process and take out duplicate roles. As a simpler

company, with fewer brands, we are able to maximise our investments

in client-facing roles and take out unnecessary overhead.

As well as our success in delivering, at an accelerated pace,

the structural cost savings relating to the agency mergers and

GroupM simplification, we continue to make good progress in our

back-office efficiency programme across enterprise IT, finance,

procurement and real estate. This success is reflected in the

improved margin and cash conversion in 2024.

In enterprise IT, we successfully rolled out Maconomy ERP

in certain markets in EMEA and South America during 2024 and will

go live with Workday ERP in VML and Ogilvy in the UK in the first

half of 2025.

We have a targeted programme of work around our enterprise IT to

continue to modernise our estate, drive efficiencies and protect

our business and are making good progress with costs reducing

year-on-year in 2024. Our cloud migration continued to deliver

benefits as we migrate workloads to the cloud and decommission

legacy equipment and capacity.

Across IT and Finance, we continue to optimise our finance

shared service centres, offshoring more back-office processes and

driving further automation and efficiencies in the work we do.

WPP is also investing in Global Delivery Centres (GDCs) with a

capability hub headquartered in India, accessible to all WPP agency

teams around the world. Our GDCs play a critical role in WPP’s

business transformation and simplification strategy with

capabilities from hyper-personalisation and composable commerce to

cloud modernisation and product engineering. Prashant Mehta joined

WPP in 2024 from Accenture as Managing Director to lead the

GDCs.

Our category-led procurement model continues to consolidate

spend by sub-category to drive further savings. We are digitalising

our source-to-contract processes, enabling further automation as we

consolidate our ERP landscape.

In real estate, our ongoing campus programme and consolidation

of leases continues to deliver benefits. Seven new campuses opened

during the year, including WPP’s third London campus at One

Southwark Bridge and our third campus in India, located in

Chennai.

During 2024 we made further progress on the simplification of

our specialist agencies with the disposal of our stake in Two

Circles, the integration of BSG with Burson and other actions to

rationalise and improve the performance of the tail of smaller

agencies within WPP.

Purpose and ESG

WPP’s purpose is to use the power of creativity to build better

futures for our people, planet, clients and communities. Read more

on the ways WPP is working to deliver against its purpose in our

2023 Sustainability Report.

Full year overview

Revenue was £14.7bn, down 0.7% from £14.8bn in 2023, and up 2.3%

like-for-like. Revenue less pass-through costs was £11.4bn, down

4.2% from £11.9bn in 2023, and down 1.0% like-for-like.

Q4 2024

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

3,956

(3.9)

(0.3)

(3.7)

0.1

Revenue less pass-through costs

2,994

(6.7)

(0.8)

(3.6)

(2.3)

2024

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

14,741

(0.7)

0.2

(3.2)

2.3

Revenue less pass-through costs

11,359

(4.2)

(0.1)

(3.1)

(1.0)

Segmental review

Business segments - revenue less pass-through costs

% LFL +/(-)

Global

Integrated Agencies

Public Relations

Specialist Agencies

Q4 2024

(2.2)

(5.3)

(0.4)

2024

(0.8)

(1.7)

(2.3)

Global Integrated Agencies: GroupM, our media planning

and buying business, grew 2.7% in 2024 (2023: 4.9%), benefiting

from continued client investment in media, partially offset by the

impact of historical client losses and a more challenging

environment in China. GroupM saw an improved new business

performance in the second half of the year with the Amazon and

J&J wins and an important Unilever retention, despite some

losses, including Volvo.

GroupM’s growth was offset by a 3.9% LFL decline at other Global

Integrated Agencies. Mid-single digit growth in Hogarth in 2024 was

offset by weaker performance across integrated creative agencies,

which included the impact of the 2023 loss of assignments with a

large healthcare client and a challenging trading environment in

China. AKQA experienced a low double digit decline in revenue less

pass-through costs as spend on project-based work remained weak

throughout the year. Other Global Integrated Agencies declined 6.5%

in Q4 reflecting the continuation of those factors and weaker

client discretionary spend than is typically seen in the final

quarter, together with the lap of a particularly strong quarter for

variable client incentives in Q4 2023.

Public Relations: Burson, created in June from the merger

of BCW and Hill & Knowlton, made good progress with its

integration and launched additional AI-powered tools.

During Q4, Burson declined high single digits as the business

continued to be impacted by the 2023 loss of assignments with a

large healthcare client and a more challenging environment for

client discretionary spending. This was offset by continued strong

growth at FGS Global, which is reflected up to early December 2024

when its disposal to KKR completed.

Specialist Agencies: CMI Media Group, our specialist

healthcare media planning and buying agency, grew strongly, offset

by declines at Landor and Design Bridge and Partners. Our smaller

specialist agencies continued to be affected by more cautious

client spending, including delays in project-based work.

Regional segments - revenue less pass-through costs

% LFL +/(-)

North America

United Kingdom

Western Continental

Europe

Rest of World

Q4 2024

(1.4)

(5.1)

1.4

(4.8)

2024

(0.7)

(2.7)

1.7

(2.6)

North America declined by 0.7% in 2024 with good growth in

automotive, TME and financial services client spending, offset by

lower revenues in healthcare, due to a 2023 client loss, and a

tough comparison for CPG in 2023. Revenues from technology clients

continued to stabilise in the second half with good growth in North

America in Q4.

The United Kingdom declined in 2024 reflecting a strong

comparison (2023: +5.6%) and the impact of slower client spending

in Q4 with further weakness in project-based work across creative

and specialist agencies exacerbated by an uncertain macro outlook,

only partially offset by growth in GroupM and Ogilvy.

In Western Continental Europe, France, Spain and Italy grew

during 2024. Our largest market, Germany, declined 1.0% reflecting

macro pressures on client spending in automotive and travel &

leisure sectors, but saw stronger performance in Q4, growing 4.0%,

lapping a softer comparison (Q4 2023: -5.3%), benefiting from

growth in spend at financial services clients and a good overall

performance at GroupM.

The Rest of World declined 2.6%. India grew 2.8% with a decline

in Q4 lapping a tough comparison (Q4 2023: 22.0%) influenced by the

timing of sporting events. This was offset by China which declined

20.8% on client assignment losses and persistent macroeconomic

pressures impacting across our agencies.

The new management team in China is focused on stabilising

performance and evolving our offer to bring together the best of

our talent and capabilities and build on our leading market

position.

We expect performance to continue to be challenging in China in

the first half of 2025, with some improvement later in the year as

we begin to lap easier comparisons from the second quarter onwards.

We remain confident the actions we are taking in China will

strengthen our business over the medium-term in what is an

important strategic market for WPP.

Top five markets - revenue less pass-through costs

% LFL +/(-)

USA

UK

Germany

China

India

Q4 2024

(1.4)

(5.1)

4.0

(21.2)

(5.4)

2024

(0.6)

(2.7)

(1.0)

(20.8)

2.8

Client sector - revenue less pass-through costs

Q4 2024

% LFL +/(-)

2024

% LFL +/(-)

2024

% share,

revenue less

pass-through

costs†

CPG

(0.3)

5.1

28.4

Tech & Digital Services

2.5

(1.6)

17.3

Healthcare & Pharma

(3.1)

(7.2)

11.0

Automotive

(3.3)

1.3

10.4

Retail

(5.8)

(7.8)

8.8

Telecom, Media & Entertainment

4.6

3.7

6.9

Financial Services

5.8

3.1

6.3

Other

(13.3)

(14.8)

4.6

Travel & Leisure

(8.5)

1.7

3.6

Government, Public Sector &

Non-profit

2.9

(1.4)

2.7

†. Proportion of WPP group revenue less pass-through costs in 2024;

table made up of clients representing 79% of WPP total revenue less

pass-through costs.

Financial results

Unaudited headline income statement†:

£ million

2024

2023

+/(-) % reported

+/(-) % LFL

Revenue

14,741

14,845

(0.7)

2.3

Revenue less pass-through costs

11,359

11,860

(4.2)

(1.0)

Operating profit

1,707

1,750

(2.5)

2.0

Operating profit margin %

15.0%

14.8%

0.2pt*

0.4

Earnings from associates

40

37

8.1

PBIT

1,747

1,787

(2.2)

Net finance costs

(280)

(262)

(6.9)

Profit before taxation

1,467

1,525

(3.8)

Tax charge

(411)

(412)

0.2

Profit after taxation

1,056

1,113

(5.1)

Non-controlling interests

(87)

(87)

0.0

Profit attributable to shareholders

969

1,026

(5.6)

Diluted EPS

88.3p

93.8p

(5.9)

0.1

Reported:

Revenue

14,741

14,845

(0.7)

Operating profit

1,325

531

149.5

Profit before taxation

1,031

346

198.0

Diluted EPS

49.4p

10.1p

389.1

*margin points †Non-GAAP measures in this table are reconciled in

Appendix 4.

Operating profit

Headline operating profit was £1,707m (2023: £1,750m), with the

year-on-year decline reflecting lower revenue less pass-through

costs and investment in WPP Open, AI and data partially offset by

continued cost discipline and structural cost savings. Headline

operating profit margin was 15.0% (2023: 14.8%), equivalent to an

improvement of 0.4 points on a constant currency basis.

Total headline operating costs were down 4.5%, to £9,652m (2023:

£10,110m). Headline staff costs (excluding incentives) of £7,398m

were down 4.5% compared to the prior period (2023: £7,750m),

reflecting wage inflation offset by lower headcount, as a result of

the actions associated with our restructuring initiatives and our

swift response to softer top-line performance in certain markets.

Incentives of £363m were down 6.2% compared to the prior period

(2023: £387m). As a percentage of revenue less pass-though costs,

overall incentives were flat year on year at 3.2%.

Headline establishment costs of £472m were down 8.5% compared to

the prior period (2023: £516m) driven by benefits from the campus

programme and consolidation of leases. IT costs of £684m (2023:

£698m) were down 2.0%, reflecting our ongoing focus on driving

efficiencies to mitigate inflation. Personal costs of £209m (2023:

£223m) were down 6.3% driven by savings in travel and

entertainment, and other operating expenses of £526m (2023: £536m)

were down 1.9%.

On a like-for-like basis, the average number of people in the

Group in 2024 was 111,281 compared to 114,732 in 2023. The total

number of people as at 31 December 2024 was 108,044 compared to

114,173 as at 31 December 2023.

Headline EBITDA (including IFRS 16 depreciation) for the period

was down by 2.1% to £1,935m (2023: £1,977m).

Reported operating profit was £1,325m (2023: £531m) with the

increase primarily due to lower amortisation charges, as 2023

included accelerated brand amortisation charges following the

creation of VML, lower property-related restructuring costs and

higher gains on disposal of subsidiaries. Reported operating profit

included goodwill impairment charges of £237m (2023: £63m),

primarily relating to AKQA, and legal provision charges of £68m

(2023: £11m credit).

Restructuring and transformation costs included in reported

operating profit were £251m (2023: £196m). Restructuring and

transformation costs in 2024 include £90m (2023: £113m) in relation

to the Group’s ERP and IT transformation program and £144m (2023:

£73m) relating to the continuing transformation program including

the creation of VML and Burson and simplification of GroupM.

Net finance costs

Headline net finance costs of £280m were up 6.9% compared to the

prior period (2023: £262m), primarily due to the impact of

refinancing bonds at higher rates.

Reported net finance costs were £330m (2023: £255m), including

net charges of £50m (2023: net gains £7m) relating to the

revaluation and retranslation of financial instruments.

Tax

The headline effective tax rate (based on headline profit before

tax) was 28.0% (2023: 27.0%). The increase in the headline

effective tax rate is driven by changes in tax rates or tax bases

in the markets in which we operate. Given the Group’s geographic

mix of profits and the changing international tax environment, the

tax rate is expected to increase over the next few years.

The reported effective tax rate was 39.0% (2023: 43.1%). The

reported effective tax rate is higher than the headline effective

tax rate due to non-deductible goodwill impairment charges.

Earnings per share (“EPS”) and dividend

Headline diluted EPS was 88.3p (2023: 93.8p), a decrease of 5.9%

due to lower headline operating profit, higher headline net finance

costs and a higher headline effective tax rate.

Reported diluted EPS was 49.4p (2023: 10.1p), an increase of

389% due to higher reported operating profit.

The Board is proposing a final dividend for 2024 of 24.4 pence

per share, which together with the interim dividend paid in

November 2024 gives a full-year dividend of 39.4 pence per share.

The record date for the final dividend is 6 June 2025, and the

dividend will be payable on 4 July 2025.

Unaudited headline cash flow statement†

Twelve months ended (£ million)

31 December 2024

31 December 2023

Headline operating profit

1,707

1,750

Headline earnings from associates

40

37

Depreciation of property, plant and

equipment

156

165

Amortisation of other intangibles

32

25

Depreciation of right-of-use assets

213

257

Headline EBITDA

2,148

2,234

Less: headline earnings from

associates

(40)

(37)

Repayment of lease liabilities and related

interest

(377)

(362)

Non-cash compensation

109

140

Non-headline cash items (including

restructuring cost)

(261)

(218)

Capex

(236)

(217)

Working capital

117

(260)

Adjusted operating cash flow

1,460

1,280

% conversion of Headline operating

profit

86%

73%

Dividends (to minorities)/ from

associates

(36)

(58)

Contingent consideration liability

payments

(97)

(31)

Net interest

(197)

(159)

Cash tax

(392)

(395)

Adjusted free cash flow

738

637

Disposal proceeds

667

122

Net initial acquisition payments

(153)

(280)

Dividends

(425)

(423)

Share purchases

(82)

(54)

Adjusted net cash flow

745

2

_______________________________ †Non-GAAP measures in this table

are reconciled in Appendix 4.

Adjusted operating cash outflow was £1,460m (2023: £1,280m). The

main drivers of the larger cash inflow year on year was a working

capital inflow of £117m compared with an outflow of £260m in the

prior year, partially offset by an increase in non-headline cash

items to £261m (2023: £218m), mainly driven by costs related to the

previously announced restructuring plan, including the creation of

VML and Burson and the simplification of GroupM. Reported net cash

from operating activities (see Note 6) increased to £1,408m (2023:

£1,238m).

Cash restructuring and transformation costs of £275m, included

in non-headline cash items are slightly lower than the guidance

given in January 2024 and relate to actions shared at the January

Capital Markets Day, primarily the structural cost saving plan

relating to the creation of VML and Burson and the simplification

of GroupM (£135m). These structural savings are to deliver

annualised net cost savings of c.£125m in 2025, with £85m of that

saving achieved in 2024 (ahead of the original plan of 40-50%).

Adjusted free cash flow was £738m (2023: £637m) with the year on

year increase reflecting higher adjusted operating cash flow and

contingent consideration liability payments and higher cash

interest and taxes, offset by lower dividends to minorities.

Adjusted net cash flow of £745m was higher than the prior period

(2023: £2m), primarily due to higher disposal proceeds and lower

net acquisition payments.

A summary of the Group’s unaudited cash flow statement and notes

for the years to 31 December 2024 is provided in Appendix 1.

Unaudited balance sheet

As at 31 December 2024, the Group had total equity of £3,734m

(31 December 2023: £3,833m).

Non-current assets decreased by £831m to £11,848m (31 December

2023: £12,679m), primarily driven by a decrease in goodwill of

£779m. Lower goodwill is primarily due to goodwill derecognised on

disposal of FGS Global of £448m and goodwill impairment charges of

£237m.

Current assets of £13,661m decreased by £283m (31 December 2023:

£13,944m). The decrease is principally driven by lower trade and

other receivables, (decrease of £738m), partially offset by higher

cash and cash equivalents (increase of £420m).

Current liabilities of £15,516m decreased by £789m (31 December

2023: £16,305m), primarily due to lower borrowings and lower trade

and other payables. Lower borrowings is predominantly due to $750m

in bonds that were repaid in September 2024, partially offset by an

increase as a result of the reclassification from current

liabilities of €500m of bonds due within the next 12 months.

The decrease in both current trade and other receivables and

trade and other payables is primarily due to client activity and

timing of payments.

Non-current liabilities decreased by £226m, to £6,259m (31

December 2023: £6,485m). This reduction primarily reflects lower

long-term lease liabilities and non-current payables.

Recognised within total equity, other comprehensive loss of £62m

(2023: £329m loss) for the year includes a £72m loss (2023: £427m

loss) for foreign exchange differences on translation of foreign

operations, and a £3m loss (2023: gain of £108m) on the Group’s net

investment hedges. Other equity movements include the net decrease

in the movement in non-controlling interest of £218m (2023:

increase of £12m), in part from the derecognition of FGS Global

non-controlling interest.

A summary of the Group’s unaudited balance sheet and selected

notes as at 31 December 2024 is provided in Appendix 1.

Adjusted net debt

As at 31 December 2024, the Group had cash and cash equivalents

of £2.6bn (31 December 2023: £2.2bn) and borrowings of £4.3bn (31

December 2023: £4.7bn).

The Group has current liquidity of £4.5bn (31 December 2023:

£3.8bn), comprising cash and cash equivalents and bank overdrafts,

and undrawn credit facilities.

As at 31 December 2024 adjusted net debt was £1.7bn, against

£2.5bn as at 31 December 2023, down £0.8bn reflecting free cash

flow generation and disposal proceeds, including proceeds from the

disposal of FGS Global completed in December 2024. Average adjusted

net debt in 2024 was £3.5bn (31 December 2023: £3.6bn).

The average adjusted net debt to headline EBITDA ratio in the 12

months ended 31 December 2024 is 1.80x (12 months ended 31 December

2023: 1.83x).

In February 2024, we refinanced our five-year Revolving Credit

Facility of $2.5bn, with the new facility running for five years,

with two one-year extension options maturing in February 2029

(excluding options) and with no financial covenants. The first of

the two-year extension option was triggered in January 2025,

effective from February 2025 to extend the maturity to February

2030.

In March 2024, we refinanced $750m of 3.75% bonds due September

2024 and €500m of 1.375% bonds due March 2025 as planned, issuing

€600m of 3.625% bonds due September 2029 and €650m of 4.0% bonds

due September 2033.

In December 2024, we repurchased €200m of 4.125% bonds due May

2028, €249 million of 3.625% bonds due September 2029 and €150m of

4% bonds due September 2033.

Our bond portfolio as at 31 December 2024 had an average

maturity of 6.3 years (31 December 2023: 6.2 years).

Outlook

Our guidance for 2025 is as follows:

Like-for-like revenue less

pass-through costs growth of flat to -2%, with performance

improving in H2.

Headline operating margin

expected to be around flat (excluding the impact of FX)

Other 2025 financial indications:

- Mergers and acquisitions will reduce revenue less pass-through

costs by around 3.0 points primarily due to the disposal of FGS

Global, partially offset by anticipated M&A

- FX impact: current rates (at 18 February 2025) imply a c.0.1%

drag on FY 2025 revenue less pass-through costs, with no meaningful

impact expected on FY 2025 headline operating margin

- Headline earnings from associates around £40m

- Non-controlling interests around £65m

- Headline net finance costs of around £280m

- Effective tax rate (measured as headline tax as a % of headline

profit before tax) of around 29%. Cash taxes will include tax in

relation to the FGS Global disposal

- Capex of around £250m

- Cash restructuring costs of around £110m

- Adjusted operating cash flow before working capital of around

£1.4bn (2024: £1.3bn)

Medium-term targets

In January 2024 we presented updated medium-term financial

framework including the following three targets:

- 3%+ LFL growth in revenue less pass-through costs

- 16-17% headline operating profit margin

- Adjusted operating cash flow conversion of 85%+

Business sector and regional analysis

Business sector7

Revenue analysis

£ million

2024

2023

+/(-) %

reported

+/(-) % LFL

Global Int. Agencies

12,562

12,532

0.2

3.0

Public Relations

1,156

1,262

(8.4)

(2.6)

Specialist Agencies

1,023

1,051

(2.7)

(0.6)

Total Group

14,741

14,845

(0.7)

2.3

Revenue less pass-through costs analysis

£ million

2024

2023

+/(-) % reported

+/(-) % LFL

Global Int. Agencies

9,384

9,751

(3.8)

(0.8)

Public Relations

1,089

1,180

(7.7)

(1.7)

Specialist Agencies

886

929

(4.6)

(2.3)

Total Group

11,359

11,860

(4.2)

(1.0)

Headline operating profit analysis

£ million

2024

% margin*

2023

% margin*

Global Int. Agencies

1,482

15.8

1,480

15.2

Public Relations

166

15.2

191

16.2

Specialist Agencies

59

6.7

79

8.5

Total Group

1,707

15.0

1,750

14.8

* Headline operating profit as a percentage of revenue less

pass-through costs.

Regional

Revenue analysis

£ million

2024

2023

+/(-) % reported

+/(-) % LFL

N. America

5,567

5,528

0.7

2.9

United Kingdom

2,185

2,155

1.4

0.9

W Cont. Europe

3,013

3,037

(0.8)

2.7

AP, LA, AME, CEE8

3,976

4,125

(3.6)

1.8

Total Group

14,741

14,845

(0.7)

2.3

Revenue less pass-through costs analysis

£ million

2024

2023

+/(-) % reported

+/(-) % LFL

N. America

4,394

4,556

(3.6)

(0.7)

United Kingdom

1,588

1,626

(2.3)

(2.7)

W Cont. Europe

2,375

2,411

(1.5)

1.7

AP, LA, AME, CEE

3,002

3,267

(8.1)

(2.6)

Total Group

11,359

11,860

(4.2)

(1.0)

Headline operating profit analysis

£ million

2024

% margin*

2023

% margin*

N. America

825

18.8

834

18.3

United Kingdom

237

14.9

215

13.2

W Cont. Europe

259

10.9

258

10.7

AP, LA, AME, CEE

386

12.9

443

13.6

Total Group

1,707

15.0

1,750

14.8

* Headline operating profit as a percentage of revenue less

pass-through costs.

Cautionary statement regarding forward-looking

statements

This document contains statements that are, or may be deemed to

be, “forward-looking statements”. Forward- looking statements give

the Company’s current expectations or forecasts of future

events.

These forward-looking statements may include, among other

things, plans, objectives, beliefs, intentions, strategies,

projections and anticipated future economic performance based on

assumptions and the like that are subject to risks and

uncertainties. These statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

use words such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’,

‘expect’, ‘forecast’, ‘guidance’, ‘intend’, ‘may’, ‘will’,

‘should’, ‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’,

‘target’, and other words and similar references to future periods

but are not the exclusive means of identifying such statements. As

such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the control of the Company. Actual results or outcomes may

differ materially from those discussed or implied in the

forward-looking statements. Therefore, you should not rely on such

forward-looking statements, which speak only as of the date they

are made, as a prediction of actual results or otherwise. Important

factors which may cause actual results to differ include but are

not limited to: the unanticipated loss of a material client or key

personnel; delays, suspensions or reductions in client advertising

budgets; shifts in industry rates of compensation; regulatory

compliance costs or litigation; changes in competitive factors in

the industries in which we operate and demand for our products and

services; changes in client advertising, marketing and corporate

communications requirements; our inability to realise the future

anticipated benefits of acquisitions; failure to realise our

assumptions regarding goodwill and indefinite lived intangible

assets; natural disasters or acts of terrorism; the Company’s

ability to attract new clients; the economic and geopolitical

impact of the conflicts in Ukraine and the Middle East; the risk of

global economic downturn; slower growth, increasing interest rates

and high and sustained inflation; supply chain issues affecting the

distribution of our clients’ products; technological changes and

risks to the security of IT and operational infrastructure,

systems, data and information resulting from increased threat of

cyber and other attacks; effectively managing the risks, challenges

and efficiencies presented by using Artificial Intelligence (AI)

and Generative AI technologies and partnerships in our business;

risks related to our environmental, social and governance goals and

initiatives, including impacts from regulators and other

stakeholders, and the impact of factors outside of our control on

such goals and initiatives; the Company’s exposure to changes in

the values of other major currencies (because a substantial portion

of its revenues are derived and costs incurred outside of the UK);

and the overall level of economic activity in the Company’s major

markets (which varies depending on, among other things, regional,

national and international political and economic conditions and

government regulations in the world’s advertising markets). In

addition, you should consider the risks described in Item 3D,

captioned ‘Risk Factors’ in the Group’s Annual Report on Form 20-F

for 2023, which could also cause actual results to differ from

forward-looking information. Neither the Company, nor any of its

directors, officers or employees, provides any representation,

assurance or guarantee that the occurrence of any events

anticipated, expressed or implied in any forward-looking statements

will actually occur. Accordingly, no assurance can be given that

any particular expectation will be met and investors are cautioned

not to place undue reliance on the forward-looking statements.

Other than in accordance with its legal or regulatory

obligations (including under the Market Abuse Regulation, the UK

Listing Rules and the Disclosure and Transparency Rules of the

Financial Conduct Authority), the Company undertakes no obligation

to update or revise any such forward-looking statements, whether as

a result of new information, future events or otherwise.

Any forward-looking statements made by or on behalf of the Group

speak only as of the date they are made and are based upon the

knowledge and information available to the Directors at the

time.

______________________________

1.

Percentage change in reported sterling.

2.

Like-for-like. LFL comparisons are calculated as follows: current

year, constant currency actual results (which include acquisitions

from the relevant date of completion) are compared with prior year,

constant currency actual results, adjusted to include the results

of acquisitions and disposals for the commensurate period in the

prior year.

3.

Reported operating profit divided by revenue (including

pass-through costs).

4.

In this press release not all of the figures and ratios used are

readily available from the unaudited results included in Appendix

1. Management believes these non-GAAP measures, including constant

currency and like-for-like growth, revenue less pass-through costs

and headline profit measures, are both useful and necessary to

better understand the Group’s results. Details of how these have

been arrived at are shown in Appendix 4.

5.

2024 pro forma for the disposal of FGS Global.

6.

Monthly active users in December 2024.

7.

Prior year figures have been re-presented to reflect the

reallocation of a number of businesses between Global Integrated

Agencies and Specialist Agencies. The impact of the re-presentation

is not material.

8.

Asia Pacific, Latin America, Africa & Middle East and Central

& Eastern Europe.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226079314/en/

Media Chris Wade +44 20 7282 4600 Richard Oldworth, +44

7710 130 634 Burson Buchanan +44 20 7466 5000 press@wpp.com

Investors and analysts Thomas Singlehurst, CFA +44 7876

431922 Anthony Hamilton +44 7464 532903 Caitlin Holt +44 7392

280178 irteam@wpp.com wpp.com/investors

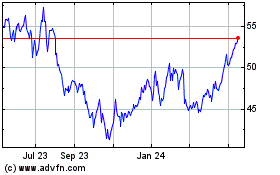

WPP (NYSE:WPP)

Historical Stock Chart

From Feb 2025 to Mar 2025

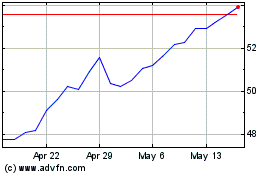

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Mar 2025