Condor Gold (AIM: CNR; TSX: COG) is pleased to announce its audited

results for the year ended 31 December 2021 and provides

notification that the Annual General Meeting of shareholders of the

Company will be held at 3:00 p.m. on 12 May 2022 at 7/8 Innovation

Place, Godalming, Surrey, GU7 1JX, United Kingdom.

The Company has published the formal notice of

meeting (the “Notice”) on its website (www.condorgold.com) together

with the related voting proxy form for use by shareholders. A copy

of the Notice, together with the proxy voting form, the Annual

Report for the year ended 31 December 2021 and the accompanying

Management’s Discussion and Analysis will be posted to all

shareholders who have elected to receive them in hard copy.

HIGHLIGHTS FOR THE YEAR ENDED 31

DECEMBER 2021

- Key findings of a Preliminary

Economic Assessment (“PEA”) Technical Report on its 100% owned La

India Project on 9 September. The open-pit plus underground

scenario reports a post-tax NPV of $418 million, an IRR of 54% with

average annual production of 150,000 ounces of gold for nine years

with a 12-month payback.

- Purchase of a brand new

Semiautogenous Grinding Mill (“SAG Mill”) package for total

consideration of US$6.5 million, including US$3.0 million payable

in shares of the Company. The SAG Mill package represents a key

item of the plant required to bring the Company’s La India Project

into production.

- Completion of a 3,500m infill

drilling program at the fully permitted La India “high grade”

starter pits; Results include 22.05 m (21.6 m true width) at 6.48

g/t gold from 24.75 m drill depth including 15.35 m (15.0 m true

width) at 8.68 g/t gold from 24.75 m drilled depth (drill hole

LIDC413).

- Completion of 3,500m of resource

expansion drilling on the Cacao prospect, interpreted as a fully

preserved epithermal gold system. A 10m plus true width mineralised

zone has been confirmed for a strike length of approximately 1,000m

beneath and along strike of the Cacao mineral resource. Results

include 14.9m true width at 3.94g/t gold (CCDC033).

- Completed the ground investigation

of 23 geotechnical drill holes and 58 test pits in preparation for

mine construction at the La India Project.

- Raised aggregate gross proceeds of

£4,000,000 before expenses through a placing of 9,523,810 new

ordinary shares at a price of 42p per placing share, including a

directors and CFO subscription for 4,871,414 new ordinary

shares.

- Selected Hanlon Engineering &

Associates (“Hanlon”) of Tucson, Arizona, a wholly owned subsidiary

company of GR Engineering Services Limited as the Lead Engineer to

develop a Feasibility Study level of design for a new processing

plant around Condor’s recently acquired new SAG Mill. Hanlon will

be responsible for the engineering designs, the capital cost and

operating costs of the processing plant.

- Provided an update on the

Feasibility Study on the La India Project on 19 October.

- Appointed H&P Advisory Limited

(Hannam & Partners) as joint broker to the Company, alongside

SP Angel Corporate Finance LLP.

- Raised aggregate gross proceeds of

£4.1 million before expenses through a placing of 11,714,286 Units

(each Unit comprising of one Ordinary Share and one half of one

Ordinary Share purchase warrant) at a price of 35p per Unit,

including a directors & CFO subscription of 2,972,144

Units.

- Announced the

completion of 2,511m of geotechnical drilling for its Feasibility

Study for the La India Project.

POST PERIOD HIGHLIGHTS

- On 10 March,

2022 the Company announced that all assay results had been received

for 8.004m infill drilling at the La Mestiza open pit at the La

India Project. The results of the infill drilling programme were

consistent with previous drilling grades and widths, demonstrating

good continuity in gold mineralization between adjacent drill holes

in the high-grade zones and therefore adding confidence to the

geological model. The drilling was designed to upgrade the existing

open pit gold mineral resource to the indicated category for the

potential inclusion in a future Feasibility Study of the Company’s

fully permitted La India Project.

CONDOR GOLD PLC

CHAIRMAN’S STATEMENT FOR THE YEAR ENDED

31 DECEMBER 2021

Dear Shareholder,

I am pleased to present Condor Gold Plc’s (“Condor”, the

“Company” or the “Group”, www.condorgold.com or if you are viewing

from Canada ca.condorgold.com) annual report for the 12-month

financial year to 31 December 2021. It has been a transformational

year for the Company with the completion of all technical studies

at La India Project required for a Feasibility Level Study (“FS

Study”) on the La India open pit utilising the new SAG Mill package

acquired by Condor in March 2021. The La India Project has been

materially de-risked and is nearing a construction ready status. A

FS Study increases the confidence of the Project, incorporating a

Feasibility Level engineering design, and +/- 15% capital and

operating costs. This in turn will facilitate Project financing

ahead of Project construction. Condor staff and our contractors at

Hanlon Engineering, Tierra Group International, SGS Lakefield

Laboratories and SRK Consulting (UK and USA) have been diligently

pursuing the supporting work for the study for over a year and have

made substantial headway in completion of that work, such that all

technical studies are complete save the final analysis, despite the

challenges of logistics, market conditions, and of course, the

impact of the coronavirus pandemic on the ability to travel.

The Company has fully permitted 3 open pits for extraction and

has the master permit to construct and operate a mine. The

Company’s twin strategy remains the construction and operation of a

base case processing plant with capacity of up to 2,800 tonnes per

day (“tpd”) capable of producing approximately 100,000 oz gold per

annum, significantly increasing this production capacity, and

proving a major Gold District at the 588km² La India Project, in

Nicaragua.

During 2021 the Company informed the Ministry of the Environment

and Natural Resources (“MARENA”) that it had commenced construction

and fulfilled the conditions of an Environmental Permit granted for

the development, construction, and operation of an open pit mine, a

2,800 tpd or 1.0 Mt per annum CIP processing plant and associated

infrastructure at the La India Project, Nicaragua (the “EP”).

Condor has 8,583Kt at 3.3g/t gold for 903,000 oz gold in the

Indicated Mineral Resource category and 1,901Kt at 3.6g/t gold for

220,000 oz gold in the Inferred Mineral Resource category permitted

for extraction from 3 open pits: La India, America and Mestiza.

Production from permitted open pit material is estimated at 100,000

oz gold p.a. for 7 to 8 years.

The La India Project has a Mineral Resource totalling 9.85 Mt at

3.6 g/t gold for 1,140,000 oz gold in the Indicated category and

8.48 Mt at 4.3 g/t gold for 1,179,000 oz gold in the Inferred

category. It was last updated in January 2019, was prepared by SRK

Consulting (UK) Limited (“SRK”) and uses the terminology,

definitions and guidelines given in the Canadian Institute of

Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral

Resources and Mineral Reserves (May 2014). The total open pit

Mineral Resource is 8.58 Mt at a grade of 3.3 g/t gold, for 902,000

oz gold in the Indicated category and 3.01 Mt at a grade of 3.0 g/t

gold, for 290,000 oz gold in the Inferred category. Total

underground Mineral Resources are 1.27 Mt at a grade of 5.8 g/t

gold, for 238,000 oz gold in the Indicated category and 5.47 Mt at

a grade of 5.1 g/t gold, for 889,000 oz gold in the Inferred

category. The intention is to permit the underground Mineral

Resource after open pit mining begins.

During 2021 the Company has been focused on de-risking La India

Project by advancing and completing several technical and

engineering studies for the FS Study, some of which are a condition

of the EP. The following progress has been made:

- A new geological model to FS level

has been completed. It includes a lithological, weathering and

structural model. The updated model incorporates approximately

3,500 m of infill drilling completed in 2021.

- The Tailings Storage Facility

(“TSF”) and 2 water retention ponds have been fully designed and

engineered with drawings one step short of “issued for

construction”, which is beyond a FS level detail of design. Tierra

Group Inc, of Denver, Colorado has completed site visits and is

conducting the engineering studies. 23 geotechnical drill holes and

55 geotechnical test pits have been completed.

- The stormwater attenuation

structure at La Simona has been designed to FS level.

- The design of the site wide water

balance (“SWWB”), including a surface water management plan was

awarded during 2020 to SRK Consulting (UK) Limited (“SRK”). SRK’s

work includes the area of the permitted La India, America and

Mestiza open pits. The ultimate objective of the exercise is to

produce engineering plans for the installation of the physical

components of a water management system, including the piping,

pumping and structural requirements that will satisfy Nicaraguan

authorities and at the same time meet the design standards for a

feasibility study. The SWWB will include consideration of the pit

dewatering contributions i.e. subsurface hydrology. SRK’s remit

includes an emphasis on training and capacity building for the

local Condor team to ensure full ownership and facilitate

implementation and sustainability of the SWWB. A hydrologist from

SRK completed a 4 week site visit in early 2021. A SWWB to FS Study

level has been completed.

- Hydrogeology / pit water management

- Condor successfully intercepted the deepest level of the

1950s-era underground mine workings, providing confidence that the

said workings are a suitable collection point to draw down ground

water levels and support depressurization of the pit slopes. A test

borehole close to the historical mineshaft was drilled in November

and additional boreholes were drilled to the south and are possible

locations for the long-term pumping station.

- The processing plant designs to FS

level have been completed by Hanlon Engineering (owned by GR

Engineering Services in Australia) using the new SAG Mill packaged

purchased by Condor in March 2021. The processing plant designed

has been laid out with the ability to double capacity from

2,300tpd.

- Site preparation and clearance of

11 hectares around the location of the processing plant has been

completed.

- Metallurgical testwork to FS level

has been completed.

- Pit Geotechnical – approximately

2,800 m of geotechnical drilling was completed in 2021. Pit angles

to FS level have been received and designed by SRK. This involved

oriented core drilling, followed by televiewer logging.

- Mine and waste dump schedules for a

number of mining scenarios have been completed to a level that can

be submitted to MARENA. The FS level mine and waste dump schedules

are underway.

- The power studies have been

progressed and completed to FS level. Several meetings have been

held with the Ministry of Energy and Mines. National grid

electricity pylons are located 700 meters from the processing

plant. The Nicaraguan Government is building a new electricity

sub-station 12km from the processing plant; designs for supplying

grid power via the new sub-station are underway.

- MARENA has written to the Company

confirming that the final designs for the domestic wastewater

treatment system for the offices and accommodation blocks at La

India comply with MARENA’s technical and environmental requirements

and the final designs are approved.

- An updated forestry inventory has

been completed. The compensation plan under the local law is to

replace every tree removed with 10 new trees. Condor has a tree

nursery which currently has approximately 6,200 trees.

- Under the terms of the EP, the

Company has to purchase or have legal agreements in place for the

land required for the mine site infrastructure. Offers have been

made to all land owners. The Company has now purchased 98% of the

land in and around the permitted La India open pit mine site area

and is close to completing one of the main conditions of the EP and

significantly de-risking the Project. The Company has purchased

land totalling 822 hectares in and around the permitted La India

open pit mine site infrastructure. In addition, the Company can

also demonstrate physical possession for approximately 18 years on

the land covering the Mestiza open pit, has purchased 98% of this

land and has claimed ownership over 303 hectares in this area. The

Company has ownership of 96 hectares of land in the area of the

America open pit. The Company has spent approximately US$4.3

million on buying land during the last 6 years.

In September 2021, Condor Gold announced the key findings of a

technical report on the La India Gold Project prepared by SRK. This

technical report (the “Technical Report”) presented the results of

a strategic mining study to Preliminary Economic Assessment (“PEA”)

standards completed on the Project in 2021. The strategic study

covers two scenarios: Scenario A, in which the mining is undertaken

from four open pits, termed La India, America, Mestiza and Central

Breccia Zone (“CBZ”), which targets a plant feed rate of 1.225

million tonnes per annum (“Mtpa”); and Scenario B, where the mining

is extended to include three underground operations at La India,

America and Mestiza, in which the processing rate is increased to

1.4 Mtpa. The 2021 Technical Report was issued in October 2021and

filed on SEDAR and the Company’s websites for public disclosure to

NI 43-101 standards.

Highlights 1.225 Mtpa PEA La India Open Pit + Feeder

Pits:

- Internal Rate of Return (“IRR”) of

58% and a post-tax Net Present Value (“NPV”) of US$302 million, at

a discount rate of 5% and gold price of US$1,700/oz.

- Average annual production of

~120,000 oz of gold over the initial 6 years of production.

- 862,000 oz of gold produced over 9

year Life of Mine (“LOM”).

- Initial capital requirement of

US$153 million (including contingency).

- Pay back period 12 months.

- All-in Sustaining Costs of US$813

per oz gold.Robust Base Case presents an IRR of 48% and a post-tax

NPV of US$236 million at a discount rate of 5% and gold price of

US$1,550/oz.

Highlights: 1.4Mtpa PEA Open Pit + Underground

Operations:

- IRR of 54% and a post-tax NPV of

US$418 million, after deducting upfront capex, at a discount rate

of 5% and gold price of US$1,700/oz.

- Average annual production of

~150,000 oz of gold over the initial 9 years of production.

- 1,469,000 oz of gold produced over

12-year Life Of Mine (“LOM”).

- Initial capital requirement of

US$160 million (including contingency), where the underground

development is funded through cash flow.

- Pay back period 12 months.

- All-in Sustaining Costs of US$958

per oz gold over LOM.

- Robust Base Case presents an IRR of

43% and a post-tax NPV of US$312 million at a discount rate of 5%

and gold price of US$1,550/oz.

The highlight of the 2021 Technical Report is a post-tax, post

upfront capital expenditure NPV of US$418 million, with an IRR of

54% and 12 month pay-back period, assuming a US$1,700 per oz gold

price, with average annual production of 150,000 oz gold per annum

for the initial 9 years of gold production. The open pit mine

schedules have been optimised from designed pits, bringing higher

grade gold forward resulting in average annual production of

157,000 oz gold in the first 2 years from open pit material with

underground mining funded out later out of cashflow.

Condor completed a 3,370 m infill drilling programme on La India

starter pits by June 2021. The starter pits are designed pits

containing 445Kt at 4.17g/t gold for 59,700 oz gold using a 2.0g/t

gold cut-off. The starter pits have a maximum depth of 35m and have

a relatively low strip ratio. The drill program within the La India

starter pits closes-up the sample density to 25 metre by 25 metre

spacing and is the final drilling ahead of extraction. Mining the

higher grade pits early will bring forward cashflow, shorten the

payback period and enhance project economics. Highlights from the

infill drilling are:

- 22.05 m (21.6 m true width) at 6.48

g/t gold from 24.75 m drill depth including 15.35 m (15.0 m true

width) at 8.68 g/t gold from 24.75 m drilled depth (drill hole

LIDC413).

- 60.60 m (54.5 m true width) at 1.98

g/t gold from 4.15 m drill depth, including 5.75 m (5.2 m true

width) at 16.88 g/t gold from 42.55 m drill depth in drill hole

LIDC452 located between the two proposed starter pits.

- 16.00 m (15.7 m true width) at 5.30

g/t gold from 18.35 m drill depth, including 5.90 m (5.8 m true

width) at 12.35 g/t gold from 22.10 m drilled depth (drill hole

LIDC416).

Condor completed 8,004 m infill drilling on La Mestiza open pit

by November 2021. The drilling programme has tightened drill

spacing to 25 m along strike and 50 m down-dip in the zones that

have the potential to support open pit mine development. The

drilling is expected to upgrade the existing open pit gold mineral

resource to the indicated category for the potential inclusion in

future pre-feasibility or feasibility studies. La Mestiza open pit

has an open pit mineral resource of 92 kt at 12.1 g/t gold for

36,000 oz gold in the Indicated category and 341 kt at 7.7 g/t gold

for 85,000 oz gold in the in the Inferred category. Highlights from

the infill drill on Mestiza open pit are:

- 6.3 m true width at 6.84 g/t gold

from 31.45 m (drill hole LIDC568), approximately 50 m below surface

outcrop (which occurs on a rise).

- 4.1 m true width at 15.23 g/t gold

from 47.80 m (drill hole LIDC514) approximately 40 m below

surface.

- 3.6 m true width at 29.1 g/t gold

from 105.70 m (drill hole LIDC471) approximately 85 m below

surface.

Mineral resource expansion drilling during 2021 focused on the

Cacao deposit were a 3,500m exploration drill programme has been a

success. A 10 metre plus true width mineralised zone including the

main Cacao vein has been confirmed for a strike length of

approximately 1,000 m beneath and extending to the East of the

current Cacao area, which contains a combined open pit and

underground Mineral Resource of 662 Kt at 2.8 g/t gold for 60,000

oz gold. Drill hole CCDC033 intercepted 14.9 m true width at

3.94g/t gold beneath the existing mineral resource, and 700 m along

strike of this intercept, drill hole CCDC028 intercepted 32.9 m

true width at 0.38g/t gold. Cacao is interpreted as a fully

preserved epithermal gold system due to the sinter on the surface

and its preservation in a downthrown block. The current round of

drilling has been interpreted to be clipping the top of the gold

mineralising system with the gold grade increasing at depth. It is

highly significant that a wide, greater than 10 m true width,

mineralised zone for a strike length of 1,000 m, open along strike

and down dip, has been identified with grades increasing at

depth.

The Company remains convinced that the La India Project is a

major gold district with the potential for significant future

discoveries. Condor’s geologists have identified two major

north-northwest-striking mineralised basement feeder zones

traversing the Project, the “La India Corridor”, which hosts 90% of

Condor’s gold mineral resource and the “Andrea Los Limones

Corridor”. Numerous geophysics, soil geochemistry and surface rock

chips indicate the possibility for further mineralisation along

strike.

Another exciting target is Andrea East (about 8.0 km north of La

India), which is now drill-ready and shows excellent grades at

surface. It is a high priority for drilling. Trenches along it

demonstrate significant width and grades. Best intercepts are

observed at LICT15 (4.0 m at 1.79 g/t gold), LICT20 (5.6 m at 1.65

g/t gold) and LICT21 (3.0 m at 3.6 g/t gold). Grab samples give up

to 9.7 g/t gold. Vein textures are very similar to La India and

very encouraging.

The Company continues to enhance its social engagement and

activities in the community, thereby maintaining our social licence

to operate. Condor has strengthened its community team and

stepped-up social activities and engagement programmes. The main

local focus is the drinking water programme, implemented in April

2017. A total of 740 families are currently benefiting from the

program and currently receive five-gallon water dispensers each

week. In May 2021, the Company installed a water purification plant

manufactured in Israel at a cost of approximately US$200,000 to

double the drinking water provided to the local communities.

In January 2018 Condor initiated ‘Involvement Programmes’, which

now extend to 6 groups in the local village to benefit communities

which may be affected by the mine. Taking the Elderly Group as an

example, a committee of 6 people has been formed. The Company

allocates monthly support to the Elderly Group, which decides how

this money is spent to benefit the elderly in the Community.

Condor continues to have very constructive meetings with key

Ministries that granted the EP for the La India, La Mestiza and

America open pits. The Company has been operating in Nicaragua

since 2006 and, as a responsible gold exploration and development

company, continues to add value to the local communities and

environment by generating sustainable socio-economic and

environmental benefits. The new mine would potentially create

approximately 1,000 jobs during the construction period, with

priority to be given to the local community. The upfront capital

cost of approximately US$125 million will have a significant

positive impact on the economy. The Government and local

communities will benefit significantly from future royalties and

taxes.

As of the date of this document, the ability of the Company to

operate has not been materially affected by the on-going Covid-19

pandemic. The situation is kept under close review by management

and the Board; certain measures have and will be taken as

appropriate to ensure the health and safety of employees in this

regard and to reduce the potential spread of the virus within the

local community.

In October 2021 the Company announced it had raised £4.1 million

by way of a private placement of new ordinary shares. (See RNS of

29 October 2021 for details).

Turning to the financial results for the year 2021, the Group’s

loss for the year was £2,330,003 (2020: £1,309,992). The Company

raised a total of £11,459,817 million after expenses during the

financial period (2020: £8,303,939). The net cash balance of the

Group at 31 December 2021 was £2,072,046 (2020: £4,159,391).

The October 2021 Technical Report has demonstrated open pit

production of 120,000 oz gold per annum for an initial 6 years or

150,000 oz gold per annum for 9 years from a combination of open

pit and underground material. The pay-back period of 12 months for

both production scenarios is highly attractive. The PEA open pit

all-in sustaining costs of US$813 per oz gold is very attractive in

the context of the current gold price. The open pit scenario has

robust economics and presents an IRR of 48% and a post-tax NPV of

US$236 million at a discount rate of 5% and gold price of

US$1,550/oz.

The primary purpose of the FS is to secure debt to finance the

upfront capital cost of approximately US$125M for stage 1 of

construction. The FS Study has been conducted solely on La India

open pit, however the plan is to mine from the 3 permitted pits to

achieve a quick pay back and target 100,000 oz gold production per

annum before expanding to 150,000 oz gold per annum by adding the

underground material to the mine plan.

The outlook for 2022 remains bright. The La India Project is

substantially de-risked and nearing a construction-ready status. A

FS Study is due in the first half of 2022, the Project is fully

permitted for construction and extraction with a target of 100,000

oz gold p.a. in stage 1. A new SAG Mill has been purchased and is

in a warehouse in Managua. The Project economics are robust with

low AISC, a high IRR and a payback period of 12 months.

M L ChildChairman & CEO

Date: 29 March 2022

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOMEFOR THE YEAR ENDED 31 DECEMBER

2021

| |

Notes |

|

Year Ended |

|

|

Year Ended |

|

| |

|

|

31.12.21 |

|

|

31.12.20 |

|

| |

|

|

£ |

|

|

£ |

|

|

Administrative expenses |

|

|

(2,330,003 |

) |

|

(1,750,395 |

) |

| Gain on

disposal of project |

|

|

- |

|

|

439,228 |

|

| |

|

|

|

|

|

| Operating

loss |

5 |

|

(2,330,003 |

) |

|

(1,311,167 |

) |

| |

|

|

|

|

|

| Finance

income |

4 |

|

- |

|

|

1,175 |

|

| |

|

|

|

|

|

| Loss before

income tax |

|

|

(2,330,003 |

) |

|

(1,309,992 |

) |

| |

|

|

|

|

|

| Income tax

expense |

6 |

|

- |

|

|

- |

|

| |

|

|

|

|

|

| Loss

for the year |

|

|

(2,330,003 |

) |

|

(1,309,992 |

) |

| |

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

| Other

comprehensive income to be reclassified to profit or loss in

subsequent periods: |

|

|

|

|

|

| Currency

translation differences |

|

|

(119,937 |

) |

|

(1,615,168 |

) |

|

Other comprehensive (loss) / income for the

year |

|

|

(119,937 |

) |

|

(1,615,168 |

) |

| |

|

|

|

|

|

|

Total comprehensive loss for the year |

|

|

(2,449,940 |

) |

|

(2,925,160 |

) |

| |

|

|

|

|

|

| Loss

attributable to: |

|

|

|

|

|

|

Non-controlling interest |

|

|

- |

|

|

- |

|

| Owners of

the parent |

|

|

(2,330,003 |

) |

|

(1,309,992 |

) |

| |

|

|

(2,330,003 |

) |

|

(1,309,992 |

) |

| |

|

|

|

|

|

|

Total comprehensive loss attributable to: |

|

|

|

|

|

|

Non-controlling interest |

|

|

- |

|

|

- |

|

| Owners of

the parent |

|

|

(2,449,940 |

) |

|

(2,925,160 |

) |

| |

|

|

(2,449,940 |

) |

|

(2,925,160 |

) |

|

Earnings per share expressed in pence per

share: |

|

|

|

|

|

| Basic and

diluted (in pence) |

8 |

|

(1.70 |

) |

|

(1.21 |

) |

| |

|

|

|

|

|

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF FINANCIAL

POSITIONAS AT 31 DECEMBER 2021

|

|

Notes |

31.12.21 |

|

|

31.12.20 |

|

| |

|

£ |

|

|

£ |

|

| ASSETS: |

|

|

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

|

|

| Property, plant and

equipment |

9 |

7,473,433 |

|

|

3,067,397 |

|

| Intangible assets |

10 |

28,100,980 |

|

|

22,089,314 |

|

| |

|

|

|

|

| |

|

35,574,413 |

|

|

25,156,711 |

|

| CURRENT

ASSETS |

|

|

|

|

| Trade and other receivablesCash

and cash equivalents |

12 |

775,6932,072,046 |

|

|

114,4094,159,391 |

|

| |

|

|

|

|

| |

|

2,847,739 |

|

|

4,273,800 |

|

| |

|

|

|

|

| TOTAL

ASSETS |

|

38,422,152 |

|

|

29,430,511 |

|

| |

|

|

|

|

| |

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

| Trade and other payables |

14 |

248,176 |

|

|

266,412 |

|

| |

|

|

|

|

| |

|

|

|

|

| TOTAL

LIABILITIES |

|

248,176 |

|

|

266,412 |

|

| |

|

|

|

|

| NET CURRENT

ASSETS |

|

2,599,563 |

|

|

4,007,388 |

|

| |

|

|

|

|

| NET ASSETS |

|

38,173,976 |

|

|

29,164,099 |

|

| |

|

|

|

|

| |

|

|

|

|

| SHAREHOLDERS’ EQUITY

ATTRIBUTABLE TO OWNERS OF THE PARENT |

|

|

|

|

|

|

| Called up share capital |

15 |

29,326,143 |

|

|

23,732,526 |

|

| Share premium |

|

42,528,627 |

|

|

37,175,626 |

|

| Exchange difference reserve |

|

(2,482,038 |

) |

|

(2,362,101 |

) |

| Retained earnings |

|

(31,198,756 |

) |

|

(29,381,952 |

) |

| |

|

|

|

|

| |

|

38,173,976 |

|

|

29,164,099 |

|

| |

|

|

|

|

| Non-controlling interest |

|

- |

|

|

- |

|

| |

|

|

|

|

| TOTAL

EQUITY |

|

38,173,976 |

|

|

29,164,099 |

|

The financial statements were approved and authorised for issue

by the Board of directors on 29 March 2022 and were signed on its

behalf by:

M L Child - ChairmanCompany No: 05587987

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITYAS AT 31 DECEMBER 2021

| |

Share Capital |

Share premium |

Exchange difference reserve |

Retained earnings |

Total |

Non-Controlling Interest |

Total Equity |

|

| |

£ |

£ |

£ |

£ |

£ |

£ |

£ |

|

| At

1 January 2020 |

18,932,704 |

33,953,693 |

|

(746,933 |

) |

(28,354,144 |

) |

23,785,320 |

|

- |

23,785,320 |

|

|

| Comprehensive income: |

|

|

|

|

|

|

|

|

| Loss for the year |

- |

- |

|

- |

|

(1,309,992 |

) |

(1,309,992 |

) |

- |

(1,309,992 |

) |

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

| Currency translation

differences |

- |

- |

|

(1,615,168 |

) |

- |

|

(1,615,168 |

) |

- |

(1,615,168 |

) |

|

| |

|

|

|

|

|

|

|

|

| Total comprehensive income |

- |

- |

|

(1,615,168 |

) |

(1,309,992 |

) |

(2,925,160 |

) |

- |

(2,925,160 |

) |

|

| |

|

|

|

|

|

|

|

|

| New shares issued |

4,799,822 |

3,444,143 |

|

- |

|

- |

|

8,243,965 |

|

- |

8,243,965 |

|

|

| Issue costs |

- |

(222,210 |

) |

- |

|

- |

|

(222,210 |

) |

- |

(222,210 |

) |

|

| Share based payment |

- |

- |

|

- |

|

282,184 |

|

282,184 |

|

- |

282,184 |

|

|

| Total transactions with owners,

recognised directly in equity |

4,799,822 |

3,221,933 |

|

- |

|

282,184 |

|

8,303,939 |

|

- |

8,309,939 |

|

|

| |

|

|

|

|

|

|

|

|

| At 31 December 2020 |

23,732,526 |

37,175,626 |

|

(2,362,101 |

) |

(29,381,952 |

) |

29,164,099 |

|

- |

29,164,099 |

|

|

| |

|

|

|

|

|

|

|

|

| Comprehensive income: |

|

|

|

|

|

|

|

|

| Loss for the year |

- |

- |

|

- |

|

(2,330,003 |

) |

(2,330,003 |

) |

- |

(2,330,003 |

) |

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

| Currency translation

differences |

- |

- |

|

(119,937 |

) |

- |

|

(119,937 |

) |

- |

(119,937 |

) |

|

| |

|

|

|

|

|

|

|

|

| Total comprehensive income |

- |

- |

|

(119,937 |

) |

(2,330,003 |

) |

(2,449,940 |

) |

- |

(2,449,940 |

) |

|

| |

|

|

|

|

|

|

|

|

| New shares issued |

5,593,617 |

5,366,126 |

|

- |

|

- |

|

10,959,743 |

|

- |

10,959,743 |

|

|

| Issue costs |

- |

(13,125 |

) |

- |

|

- |

|

(13,125 |

) |

- |

(13,125 |

) |

|

| Share based payment |

- |

- |

|

- |

|

513,199 |

|

513,199 |

|

- |

513,199 |

|

|

| |

|

|

|

|

|

|

|

|

| Total transactions with owners,

recognised directly in equity |

5,593,617 |

5,353,001 |

|

- |

|

513,199 |

|

11,459,817 |

|

- |

11,459,817 |

|

|

| |

|

|

|

|

|

|

|

|

| At 31 December 2021 |

29,326,143 |

42,528,627 |

|

(2,482,038 |

) |

(31,198,756 |

) |

38,173,976 |

|

- |

38,178,976 |

|

|

Share premium reserve represents the amounts

subscribed for share capital in excess of the nominal value of the

shares issued, net of cost of issue.

The exchange difference reserve is a separate component of

Shareholders’ equity in which the exchange differences, arising

from translation of the results and financial positions of foreign

operations that are included in the Group’s Consolidated Financial

Statements, are reported.

Retained earnings represent the cumulative net gains and losses

recognised in the consolidated income statement.

CONDOR GOLD PLC

COMPANY STATEMENT OF FINANCIAL

POSITIONAS AT 31 DECEMBER 2021

|

|

Notes |

31.12.21 |

|

31.12.20 |

| |

|

£ |

|

£ |

| ASSETS: |

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

| Property, plant and

equipment |

9 |

4,309,955 |

|

- |

| Investments |

11 |

751,977 |

|

751,977 |

| Other receivables |

12 |

39,511,480 |

|

32,260,491 |

| |

|

44,573,412 |

|

33,012,468 |

| CURRENT

ASSETS |

|

|

|

|

| Trade and other receivables |

12 |

33,329 |

|

30,656 |

| Cash and cash equivalents |

|

1,956,467 |

|

4,045,574 |

| |

|

1,989,796 |

|

4,076,230 |

| |

|

|

|

|

| TOTAL

ASSETS |

|

46,563,208 |

|

37,088,698 |

| |

|

|

|

|

|

LIABILITIES: |

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

| Trade and other payables |

14 |

169,456 |

|

183,786 |

| |

|

|

|

|

| |

|

|

|

|

| TOTAL

LIABILITIES |

|

169,456 |

|

183,786 |

| |

|

|

|

|

| NET CURRENT

ASSETS |

|

1,820,340 |

|

3,892,444 |

| |

|

|

|

|

| NET ASSETS |

|

46,393,752 |

|

36,904,912 |

| |

|

|

|

|

| |

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

| Called up share capital |

15 |

29,326,143 |

|

23,732,526 |

| Share premium |

|

42,528,627 |

|

37,175,626 |

| Retained earnings |

|

(25,461,018) |

|

(24,003,240) |

| |

|

|

|

|

| TOTAL

EQUITY |

|

46,393,752 |

|

36,904,912 |

The loss for the financial year dealt with in the financial

statement of the parent company was £1,970,977 (2020:

£1,347,955).

The financial statements were approved and authorised for issue

by the Board of directors on March 2022 and were signed on its

behalf by:

M L Child - ChairmanCompany No: 05587987

CONDOR GOLD PLC

COMPANY STATEMENT OF CHANGES IN

EQUITYAS AT 31 DECEMBER 2021

| |

Share capital |

Share premium |

Retained earnings |

Total |

| |

£ |

£ |

£ |

£ |

| |

|

|

|

|

| At

1 January 2020 |

18,932,704 |

33,953,693 |

|

(22,937,469 |

) |

29,948,928 |

|

| |

|

|

|

|

| Comprehensive income: |

|

|

|

|

| Loss for the period |

- |

- |

|

(1,347,955 |

) |

(1,347,955 |

) |

| |

|

|

|

|

| Total comprehensive income |

- |

- |

|

(1,347,955 |

) |

(1,347,955 |

) |

| |

|

|

|

|

| New shares issued |

4,799,822 |

3,444,143 |

|

- |

|

8,243,965 |

|

| Issue costs |

- |

(222,210 |

) |

- |

|

(222,210 |

) |

| Share based payment |

- |

- |

|

282,184 |

|

282,184 |

|

| |

|

|

|

|

| Total transactions with owners

recognised directly in equity |

4,799,822 |

3,221,933 |

|

282,184 |

|

8,303,939 |

|

| |

|

|

|

|

| At 31 December 2020 |

23,732,526 |

37,175,626 |

|

(24,003,240 |

) |

36,904,912 |

|

| |

|

|

|

|

| Comprehensive income: |

|

|

|

|

| Loss for the period |

- |

- |

|

(1,970,977 |

) |

(1,970,977 |

) |

| |

|

|

|

|

| Total comprehensive income |

- |

- |

|

(1,970,977 |

) |

(1,970,977 |

) |

| |

|

|

|

|

| New shares issued |

5,593,617 |

5,366,126 |

|

- |

|

10,959,743 |

|

| Issue costs |

- |

(13,125 |

) |

- |

|

(13,125 |

) |

| Share based payment |

- |

- |

|

513,199 |

|

513,199 |

|

| |

|

|

|

|

| Total transactions with owners

recognised directly in equity |

5,593,617 |

5,353,001 |

|

513,199 |

|

11,459,817 |

|

| |

|

|

|

|

| At 31 December 2021 |

29,326,143 |

42,528,627 |

|

(25,461,018 |

) |

46,393,752 |

|

Share premium reserve represents the amounts subscribed for

share capital in excess of the nominal value of the shares issued,

net of cost of issue.

Retained earnings represent the cumulative net gains and losses

recognised in the Company’s income statement.

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF CASH

FLOWS FOR THE YEAR ENDED 31 DECEMBER

2021

| |

|

Year Ended |

|

Year-Ended |

|

|

|

31.12.21 |

|

|

31.12.20 |

|

| |

|

£ |

|

£ |

| Cash flows from operating

activities |

|

|

|

|

| Loss before tax |

|

(2,330,003 |

) |

|

(1,309,992 |

) |

| Share based payment |

|

513,199 |

|

|

282,184 |

|

| Depreciation |

|

88,264 |

|

|

53,699 |

|

| Exchange differences |

|

78,873 |

|

|

(287,276 |

) |

| Finance income |

|

- |

|

|

(1,175 |

) |

| |

|

(1,649,667 |

) |

|

(1,262,560 |

) |

| |

|

|

|

|

| (Increase) / Decrease in trade

and other receivables |

|

(661,284 |

) |

|

28,870 |

|

| Increase / (Decrease) in trade

and other payables |

|

(18,236 |

) |

|

(490,690 |

) |

| |

|

|

|

|

| Net cash used in operating

activities |

|

(2,329,187 |

) |

|

(1,724,380 |

) |

| |

|

|

|

|

| Cash flows from investing

activities |

|

|

|

|

| Purchase of tangible fixed assets

(1) |

|

(2,370,879 |

) |

|

(2,570,054 |

) |

| Purchase of intangible fixed

assets |

|

(6,188,725 |

) |

|

(2,472,661 |

) |

| Interest received |

|

- |

|

|

1,175 |

|

| |

|

|

|

|

| Net cash used in investing

activities |

|

(8,559,604 |

) |

|

(5,041,540 |

) |

| |

|

|

|

|

| Cash flows from financing

activitiesNet proceeds from share issue |

|

8,801,446 |

|

|

8,021,755 |

|

| |

|

|

|

|

| Net cash from financing

activities |

|

8,801,446 |

|

|

8,021,755 |

|

| |

|

|

|

|

| Increase / (Decrease) in cash and

cash equivalents |

|

(2,087,345 |

) |

|

1,255,835 |

|

| |

|

|

|

|

| Cash and cash equivalents at

beginning of year |

|

4,159,391 |

|

|

2,903,556 |

|

| |

|

|

|

|

| Cash and cash equivalents at end

of year |

|

2,072,046 |

|

|

4,159,391 |

|

|

(1) Includes the purchase of a SAG Mill, part of

which was paid for by shares of the

Company. |

CONDOR GOLD PLC

COMPANY STATEMENT OF CASH

FLOWSFOR THE YEAR ENDED 31 DECEMBER

2021

| |

|

Year Ended |

|

Year Ended |

|

|

|

31.12.21 |

|

|

31.12.20 |

|

| |

|

£ |

|

£ |

| Cash flows

from operating activities |

|

|

|

|

| Loss before tax |

|

(1,970,977 |

) |

|

(1,347,955 |

) |

| Share based

payment |

|

513,199 |

|

|

282,184 |

|

| Depreciation |

|

- |

|

|

15 |

|

| Finance income |

|

- |

|

|

(1,175 |

) |

| |

|

(1,457,778 |

) |

|

(1,006,931 |

) |

| |

|

|

|

|

| (Increase) / Decrease

in trade and other receivables |

|

(2,673 |

) |

|

(7,806 |

) |

| Increase / (Decrease)

in trade and other payables |

|

(14,330 |

) |

|

3,712 |

|

| |

|

|

|

|

| Net cash used in

operating activities |

|

(1,474,781 |

) |

|

(1,071,025 |

) |

| |

|

|

|

|

| Cash flows

from investing activities |

|

|

|

|

| Purchase of tangible

fixed assets (1) |

|

(2,164,783 |

) |

|

- |

|

| Interest

received |

|

- |

|

|

1,175 |

|

| Loans to

subsidiaries |

|

(7,250,989 |

) |

|

(5,242,566 |

) |

| |

|

|

|

|

| Net cash used in

investing activities |

|

(9,415,772 |

) |

|

(5,241,391 |

) |

| |

|

|

|

|

| Cash flows

from financing activities |

|

|

|

|

|

|

| Proceeds from share

issue |

|

8,801,446 |

|

|

8,021,755 |

|

| |

|

|

|

|

| Net cash from

financing activities |

|

8,801,446 |

|

|

8,021,755 |

|

| |

|

|

|

|

| Increase / (Decrease)

in cash and cash equivalents |

|

(2,089,107 |

) |

|

1,709,339 |

|

| |

|

|

|

|

| Cash and cash

equivalents at beginning of year |

|

4,045,574 |

|

|

2,336,235 |

|

| |

|

|

|

|

| Cash and cash

equivalents at end of year |

|

1,956,467 |

|

|

4,045,574 |

|

|

(1) Includes

the purchase of a SAG Mill, part of which was paid for by shares of

the Company. |

For further information please visit www.condorgold.com or

contact:

| Condor Gold plc |

Mark Child, Chairman and CEO+44

(0) 20 7493 2784 |

|

| |

|

|

| Beaumont Cornish Limited |

Roland Cornish and James

Biddle+44 (0) 20 7628 3396 |

|

| |

|

|

| SP Angel Corporate Finance

LLP |

Ewan Leggat +44 (0) 20 3470

0470 |

|

| |

|

|

| H&P Advisory Limited |

Andrew Chubb and Nelish Patel+44

(0) 20 7907 8500 |

|

| |

|

|

| BlytheRay |

Tim Blythe and Megan Ray+44 (0)

20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006

and dual listed on the TSX in January 2018. The Company is a gold

exploration and development company with a focus on Nicaragua.

On 25 October 2021 Condor announced the filing

of a Preliminary Economic Assessment Technical Report (“PEA”) for

its La India Project, Nicaragua on SEDAR https://www.sedar.com. The

highlight of the technical study is a post-tax, post upfront

capital expenditure NPV of US$418 million, with an IRR of 54% and

12 month pay-back period, assuming a US$1,700 per oz gold price,

with average annual production of 150,000 oz gold per annum for the

initial 9 years of gold production. The open pit mine schedules

have been optimised from designed pits, bringing higher grade gold

forward resulting in average annual production of 157,000 oz gold

in the first 2 years from open pit material and underground mining

funded out of cashflow.

In August 2018, the Company announced that the

Ministry of the Environment in Nicaragua had granted the

Environmental Permit (“EP”) for the development, construction and

operation of a processing plant with capacity to process up to

2,800 tonnes per day at its wholly-owned La India gold Project (“La

India Project”). The EP is considered the master permit for mining

operations in Nicaragua. Condor has purchased a new SAG Mill, which

has mainly arrived in Nicaragua. Site clearance and preparation is

at an advanced stage.

Environmental Permits were granted in April and

May 2020 for the Mestiza and America open pits respectively, both

located close to La India. The Mestiza open pit hosts 92 Kt at a

grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated

Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold

(85,000 oz contained gold) in the Inferred Mineral Resource

category. The America open pit hosts 114 Kt at a grade of 8.1 g/t

gold (30,000 oz) in the Indicated Mineral Resource category and 677

Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral

Resource category. Following the permitting of the Mestiza and

America open pits, together with the La India Open Pit Condor has

1.12 M oz gold open pit Mineral Resources permitted for

extraction.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Qualified Persons

The technical and scientific information in this

press release has been reviewed, verified and approved by Andrew

Cheatle, P.Geo., who is a “qualified person” as defined by NI

43-101 and Gerald D. Crawford, P.E., who is a “qualified person” as

defined by NI 43-101 and is the Chief Technical Officer of Condor

Gold plc.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarised or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, October 2021”, dated October

22, 2021 with an effective date of September 9, 2021 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Qualified Persons responsible for the Technical Report are Dr Tim

Lucks of SRK Consulting (UK) Limited, and Mr Fernando Rodrigues, Mr

Stephen Taylor and Mr Ben Parsons of SRK Consulting (U.S.) Inc. Mr

Parsons assumes responsibility for the MRE, Mr Rodrigues the open

pit mining aspects, Mr Taylor the underground mining aspects and Dr

Lucks for the oversight of the remaining technical disciplines and

compilation of the report.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are ‘forward-looking information’

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: Developmment

Plans for the La India Project, Mineral Reserves and Resources at

La India Project. Forward-looking information is often, but not

always, identified by the use of words such as: "seek",

"anticipate", "plan", "continue", “strategies”, “estimate”,

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", “could”, “might”, “will” and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks; estimation of

mineralisation, resources and reserves; environmental, health and

safety regulations of the resource industry; competitive

conditions; operational risks; liquidity and financing risks;

funding risk; exploration costs; uninsurable risks; conflicts of

interest; risks of operating in Nicaragua; government policy

changes; ownership risks; permitting and licencing risks; artisanal

miners and community relations; difficulty in enforcement of

judgments; market conditions; stress in the global economy; current

global financial condition; exchange rate and currency risks;

commodity prices; reliance on key personnel; dilution risk; payment

of dividends; as well as those factors discussed under the heading

“Risk Factors” in the Company’s annual information form for the

fiscal year ended December 31, 2020 dated March 31, 2021, available

under the Company’s SEDAR profile at www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

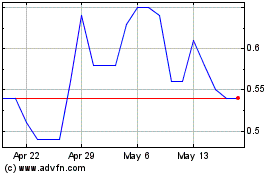

Condor Gold (TSX:COG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2023 to Dec 2024