CD&R and Permira announce they have obtained all regulatory clearances necessary for the closing of the proposed acquisition of a majority stake in Exclusive Networks and the subsequent launch of a simplified tender offer

21 November 2024 - 7:13AM

Business Wire

Regulatory News:

Exclusive Networks SA (Paris:EXN):

On 24 July 2024, CD&R and Everest UK HoldCo Limited, an

entity controlled by the Permira funds and the majority shareholder

of Exclusive Networks, announced the formation of a consortium with

Olivier Breittmayer, the founder of Exclusive Networks, (together,

the “Consortium”) for the purpose of acquiring (directly or

indirectly, by way of sales and contributions), through a dedicated

entity (“BidCo”), the shares of Exclusive Networks held by

Everest UK HoldCo Limited and Olivier Breittmayer. This stake

represents 66.7% of the share capital and 66.7% of the theoretical

voting rights of Exclusive Networks1. The offer price stands at

€18.96 per share following payment of the exceptional distribution

of €5.29 per share (the “Exceptional Distribution” and the

“Acquisitions”).

CD&R and Everest UK HoldCo Limited announce today that they

have received the last regulatory clearance necessary for the

closing of the Acquisitions and the subsequent launching of a

simplified mandatory tender offer for the remaining shares of

Exclusive Networks.

The completion of the Acquisitions remains subject to the

payment of the Exceptional Distribution approved by the

shareholders’ general meeting of Exclusive Networks held on 31

October 2024.

Exclusive Networks will issue a press release to inform the

market of the payment date of the Exceptional Distribution in due

course.

Shortly after the payment of the Exceptional Distribution and

the subsequent closing of the Acquisitions, BidCo will launch a

simplified mandatory tender offer on the remaining shares of

Exclusive Networks at a price of €18.96 per share (ex- Exceptional

Distribution of €5.29 per share attached) (the “Offer”).

BidCo will subsequently request the implementation of a squeeze-out

if the legal conditions are met at the end of the Offer.

Subject to the closing of the Acquisitions and, following the

filing of the Offer, obtaining the AMF’s clearance of the Offer, it

is currently envisaged that the Offer may be opened in January or

February 2025.

It is reminded that, on July 23, 2024, the Board of Directors of

Exclusive Networks unanimously welcomed the Offer without prejudice

to the reasoned opinion to be issued by the Board following receipt

of the fairness opinion from Finexsi, appointed as independent

expert.

This press release has been prepared for information purposes

only. It does not constitute an offer to purchase or a solicitation

to sell Exclusive Networks shares in any country, including France.

There is no certainty that the simplified tender offer mentioned

above will be filed or opened. The dissemination, publication or

distribution of this press release may be subject to specific

regulations or restrictions in certain countries. Accordingly,

persons in possession of this press release are required to inform

themselves about and to comply with any local restrictions that may

apply.

About CD&R

Founded in 1978, CD&R is a leading private investment firm

with a strategy of generating strong investment returns by building

more robust and sustainable businesses through the combination of

skilled investment experience and deep operating capabilities. In

partnership with the management teams of its portfolio companies,

CD&R takes a long-term view of value creation and emphasizes

positive stewardship and impact. The firm invests in businesses

that span a broad range of industries, including industrial,

healthcare, consumer, technology and financial services end

markets. CD&R is privately owned by its partners and has

offices in New York and London. For more information, please visit

www.cdr-inc.com and follow the firm's activities through LinkedIn

and @CDRBuilds on X/Twitter.

About Permira

Permira is a global investment firm that backs successful

businesses with growth ambitions. Founded in 1985, the firm advises

funds across two core asset classes, private equity and credit,

with total committed capital of approximately €80bn.

The Permira private equity funds make both long-term majority

(Buyout) and minority (Growth Equity) investments in five key

sectors: Technology, Consumer, Healthcare, Services and Climate.

The Permira credit funds have provided businesses with flexible

financing solutions across both Private and Liquid Credit products

for nearly 20 years.

The Permira funds have an extensive track record in technology

investing, having invested more than $23 billion in c.80 companies

across enterprise cloud adoption, cybersecurity, SaaS, fintech,

digital commerce and online marketplaces. The Permira funds have

previously supported and helped scale some of the largest and

fastest-growing technology businesses globally, including, Genesys,

TeamViewer, Zendesk, McAfee, Mimecast, Carta, G2, Sysdig, Sonar,

Mirakl and others.

Permira employs over 500 people in 16 offices across Europe, the

United States and Asia. For more information, visit www.permira.com

or follow us on LinkedIn.

1 Based on a total number of theoretical voting rights as of 31

October 2024 of 91,670,286.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120821560/en/

The Consortium: Teneo

ExclusiveNetworks@teneo.com

UK Rob Yates +44 (0)7715 375443

France Alexandre Dechaux +33 6 17 96 61 41

CD&R Emma Chandra echandra@cdrllp.com +44 (0)7518

352758

Permira Vanessa Maydon / James Williams

media@permira.com

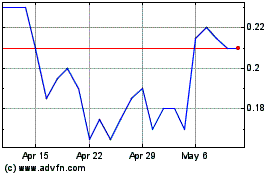

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Dec 2023 to Dec 2024