Sprott Physical Uranium Trust Announces Filing of New US$1.5 Billion Preliminary Base Shelf Prospectus and Results of Consideration of Structural Changes

30 December 2023 - 12:00AM

Sprott Asset Management LP (“Sprott Asset Management” or the

“Manager”), on behalf of the Sprott Physical Uranium Trust (TSX:

U.UN and U.U) (the “Trust”), a closed-ended trust created to invest

and hold substantially all of its assets in physical uranium, today

announced that the Trust has filed a new US$1.5 billion preliminary

base shelf prospectus with securities regulatory authorities in

each of the provinces and territories of Canada. The Trust also

announced the voluntary withdrawal of its final short form base

shelf prospectus dated September 7, 2023 concurrently with the

filing of the new preliminary base shelf prospectus.

As disclosed in the new preliminary base shelf

prospectus, the Trust has now completed its previously announced

consideration of the introduction of a redemption feature, the

implementation of limits on future treasury issuances of new trust

units and other measures with the objective of having the trust

units trade more consistently with net asset value (“NAV”). These

considerations were, in part, the result of discussions with staff

at the Ontario Securities Commission regarding the Trust and its

physical uranium holdings, as well as feedback from investors

regarding the Trust and its operations.

Following these considerations, the Trust has

determined that it will not implement a redemption feature at this

time due to changes in market dynamics. Since September 2023, the

Trust has traded more closely with its NAV, negating the expected

benefit of a redemption feature. Furthermore, after careful

analysis, the Manager, on behalf of the Trust, has determined that

the cost and effort to secure the necessary unitholder approval to

implement a redemption feature would represent an unwanted

distraction for the Trust at a time when interest in nuclear energy

and uranium are expected to accelerate due to government pledges to

expand nuclear energy. In addition, in connection with the final

clearance of the Trust’s new base shelf prospectus the Trust

expects to deliver undertakings to Canadian securities regulatory

authorities pursuant to which the Trust will agree to purchase not

more than 9.0 million pounds of uranium in the spot market (meaning

purchases for cash with a timeline to delivery of 12 months or

less) during any calendar year for the duration of the new base

shelf prospectus and to use certain commercially reasonable efforts

to appropriately manage its purchases of uranium on the spot market

during each annual period. Such undertakings will terminate upon

withdrawal or termination of the new base shelf prospectus.

About Sprott Asset Management and the

Trust

Important information about the Trust, including

its investment objectives and strategies, applicable management

fees, and expenses, can be found on its website at www.sprott.com.

Commissions, management fees, or other charges and expenses may be

associated with investing in the Trust. The performance of the

Trust is not guaranteed, its value changes frequently and past

performance is not an indication of future results.

Forward-Looking Statements

This press release contains forward-looking

information within the meaning of applicable Canadian securities

laws (“forward-looking statements”). Forward-looking statements in

this press release include, without limitation, statements

regarding the acceleration of interest in nuclear energy and

uranium, the final clearance of the Trust’s new base shelf

prospectus and the delivery and termination of the undertakings to

Canadian securities regulatory authorities. With respect to the

forward-looking statements contained in this press release, the

Trust has made numerous assumptions regarding, among other things:

the uranium and nuclear energy market and the Trust’s ability to

obtain final clearance of its new base shelf prospectus. While the

Trust considers these assumptions to be reasonable, these

assumptions are inherently subject to significant business,

economic, competitive, market and social uncertainties and

contingencies. Additionally, there are known and unknown risk

factors that could cause the Trust's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements contained in this press release. A

discussion of risks and uncertainties facing the Trust appears in

the Trust’s annual information form for the year ended December 31,

2022, which is available under the Trust’s profile at

www.sedarplus.ca. All forward-looking statements herein are

qualified in their entirety by this cautionary statement, and the

Trust disclaims any obligation to revise or update any such

forward-looking statements or to publicly announce the result of

any revisions to any of the forward-looking statements contained

herein to reflect future results, events or developments, except as

required by law or stock exchange rules.

Contact:

Glen WilliamsManaging PartnerInvestor and

Institutional Client RelationsDirect:

416-943-4394gwilliams@sprott.com

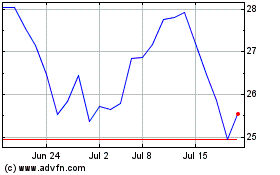

Sprott Physical Uranium (TSX:U.UN)

Historical Stock Chart

From Nov 2024 to Dec 2024

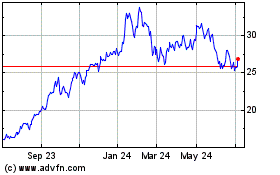

Sprott Physical Uranium (TSX:U.UN)

Historical Stock Chart

From Dec 2023 to Dec 2024