Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF)

today announced results for its third quarter of fiscal 2022 ended

June 30, 2022. In addition, Exco announced a quarterly dividend of

$0.105 per common share which will be paid on September 30, 2022 to

shareholders of record on September 16, 2022. The dividend is an

“eligible dividend” in accordance with the Income Tax Act of

Canada.

|

|

Three Months EndedJune 31 |

Nine Months Ended June 31 |

|

(in $ thousands except per share amounts) |

|

|

|

|

|

|

2022 |

2021 |

2022 |

2021 |

| Sales |

$129,250 |

$114,967 |

$349,532 |

$354,729 |

| Net income for the period |

$5,563 |

$8,682 |

$13,397 |

$31,332 |

| Earnings per share:Basic and

Diluted – Reported |

$0.14 |

$0.22 |

$0.34 |

$0.80 |

|

EBITDA |

$14,594 |

$15,221 |

$36,479 |

$54,777 |

“We continued to advance our aggressive growth

agenda this quarter, completing the acquisition of Halex Extrusion

Dies and making solid progress with our various capital projects”,

said Darren Kirk, Exco’s President and CEO. “Our results

demonstrate Exco’s ability to navigate through very challenging

market conditions while benefiting from the electric vehicle

revolution and worldwide movement towards reducing emissions”

Consolidated sales for the third quarter ended

June 30, 2022 were $129.3 million compared to $115.0 million in the

same quarter last year – an increase of $14.3 million, or 12%.

Excluding foreign exchange rate movements, consolidated sales in

the quarter were higher by 10% compared to the prior year and

higher by 1% year-to-date.

The Automotive Solutions segment reported sales

of $64.6 million in the third quarter – an increase of $3.6

million, or 6% from the prior year quarter. Excluding foreign

exchange rate movements, segment revenues were higher by $2.6

million, or 4% for the quarter. Segment sales in the quarter were

primarily influenced by vehicle production volumes in North

American and Europe. IHS Markit estimates volumes increased 12% in

North America and declined 5% in Europe compared to the prior year

quarter. Segment sales were also negatively influenced by

unfavorable vehicle mix, partially offset by ongoing key program

launches for new and existing products as well as certain pricing

actions taken to protect margins. While industry vehicle production

volumes have shown some signs of improvement, they remain below the

level of consumer demand due to supply chain disruptions (including

the global semiconductor shortage), broad labour availability

challenges, logistical constraints and ongoing COVID lockdown

measures in China. European volumes are incrementally affected by

localized supply chain challenges on that continent due to the

Russian invasion of Ukraine. Nonetheless, HIS Markit expects North

American and European production to grow through the second half of

calendar 2022, which is expected to benefit segment results.

Quoting opportunities have strengthened across the segment’s

various businesses, which, together with new and ongoing product

launches, are expected to support continued gains in Exco’s content

per vehicle.

The Casting and Extrusion segment reported sales

of $64.7 million for the third quarter – an increase of $10.7

million or 20%, from the same period last year. Foreign exchange

rate changes increased sales $1.5 million in the quarter. The

Company’s new European facilities (Halex) contributed $9.0 million

of sales in the quarter, reflecting two months of activities.

Demand for our extrusion tooling (ie dies, dummy blocks, stems,

etc) and associated capital equipment (die ovens, containers, etc)

remained strong due to both industry growth and ongoing market

share gains. Demand for extrusion tools covers many industrial

sectors including building and construction, large truck, electric

vehicles, and many green energy sectors, all of which are focused

on reducing energy intensity and reducing emissions. In

anticipation of these trends intensifying, Exco has been increasing

its manufacturing footprint in local markets in recent years

including the acquisition of Halex in Europe. Management also

remains focused on standardizing manufacturing processes, enhancing

engineering depth and centralizing support functions across its

various plants. These initiatives have reduced lead times, enhanced

product quality, expanded product breadth and increased capacity,

all of which has supported market share gains.

In the die-cast market, which primarily serves

the automotive industry, demand has remained suppressed due to

lower vehicle production volumes, which in turn, is due mainly to

broader supply chain constraints. These constraints have been

amplified by customer inventory destocking activity in recent

quarters, particularly in the large mould segment, which has faced

significantly lower rebuild work than typical. Demand and order

flow for new moulds, associated tooling (shot sleeves, rods, rings,

tips, etc) and even rebuild work however has recently picked up as

industry vehicle production recovers and new electric vehicles and

more efficient internal combustion engine/ transmission platforms

are launched. In addition, demand for Exco’s industry leading

additive (3D printed) tooling has continued to gain significant

traction as customers focus on greater efficiency as the size and

complexity of die cast tooling continues to increase. Sales in the

quarter were also aided by price increases, which were implemented

in order to protect margins from higher input costs. With respect

to quoting activity, longer lead time items continue to see

elevated demand for future activity (particularly large moulds) and

inventories and backlog continue to grow which is expected to bode

well for sales through the remainder of fiscal 2022 and into fiscal

2023.

Consolidated net income for the third quarter

was $5.6 million or basic and diluted earnings of $0.14 per share

compared to $8.7 million or $0.22 per share in the same quarter

last year – a decrease of net income of $3.1 million. The

consolidated effective income tax rate of 24% in the current

quarter increased from 12% from the prior year. The change in

income tax rate in the quarter was impacted by fiscal 2021 SRED tax

credits booked in the third quarter last year, nondeductible losses

from our Castool Morocco facility in fiscal 2022, geographic

distribution, and foreign tax rate differentials

The Automotive Solutions segment reported pretax

profit of $4.8 million in the third quarter a decrease of $0.3

million from the prior year quarter. The segment’s lower pretax

profit was due to unfavorable market driven product mix changes,

higher raw material, logistics and labour costs, the reversal of

certain bad debt accruals last year, partially offset by certain

pricing actions taken. Reduced industry vehicle production

continued to cause inefficiencies within our operations. While

customer orders and releases stabilized compared to prior quarters,

sporadic and unreliable customer releases continued to impact

production, increasing overhead and direct labour costs. These

factors were intensified as we retained slack labour in

anticipation of higher demand in the quarters ahead. Inflationary

pressure continues to be a challenge in this segment particularly

on petroleum-based products (resins, plastics, rubber), energy,

freight and labour. Management remains focused on improving the

efficiency of its operations and reducing its overall cost

structure. Pricing discipline remains a focus and actions are being

taken on current programs where possible, though there is typically

a lag of a few quarters before the impact is realized. As well, new

program awards are priced to reflect management’s expectations for

higher future costs.

The Casting and Extrusion segment reported $4.8 million of

pretax profit in the third quarter – a decrease of $3.0 million

from the same quarter last year. The lower pretax profit was

primarily driven by reduced activity for rebuild work in the Large

Mould group coupled with shipments of new moulds. New mould

programs can often have low to negative margins at the onset due to

front-end inefficiencies that are improved as subsequent moulds are

delivered. As well, profitability was negatively impacted by raw

material and labour cost inflation, unfavorable market driven

product mix shifts, reduced labour availability and higher overtime

costs across the three business units. Start-up losses of Castool’s

plant in Morocco (which opened in November 2021), and new heat

treatment operations in Newmarket also negatively impacted

profitability, mainly due to non-cash depreciation of plant and

equipment. Segment pre-tax profitability however benefited from

contributions from the acquisition of Halex and was higher

sequentially for the second consecutive quarter. New business

awards across the quarter remained very strong, particularly for

structural die-cast components and those for electric vehicle

platforms. The segment ended the quarter with backlogs approaching

historic high levels. Management remains focused on taking pricing

action where possible to preserve margins, reducing its overall

cost structure and improving manufacturing efficiencies. Such

activities together with sales efforts are expected to improve

segment profitability in future quarters.

Consolidated EBITDA for the third quarter

totaled $14.6 million compared to $15.2 million in the same quarter

last year – a decrease of $0.6 million. For the quarter, EBITDA as

a percentage of sales decreased to 11.3% in the current period

compared to 13.2% the prior year driven by a reduction in segment

margins in both the Casting & Extrusion segment (15% compared

to 21%) and the Automotive Solutions segment (10% compared to

11%).

Exco generated cash from operating activities of

$14.1 million during the quarter and $9.9 million of Free Cash Flow

after $3.5 million in Maintenance Fixed Asset Additions. This cash

flow, together with cash on hand was more than sufficient to fund

fixed assets for growth initiatives of $12.0 million and $4.1

million of dividends. Exco utilized $60 million of its credit

facility to fund its investment in Halex. The growth capital

expenditure initiatives include: a) new Castool production

facilities in Morocco and Mexico. The Moroccan facility opened in

November 2021 and the Mexican facility which began construction in

the second quarter. b) Investment in new heat treatment equipment

in the tooling group to increase capacity, reduce emissions and

enable us to in-source most of our requirements. c) Investments in

the Large Mould group to upgrade its capabilities to handle moulds

of extreme sizes which we expect will be increasingly demanded by

most traditional and new OEMs. d) Investment in additional 3D

printing machinery in our tooling group to meet strong customer

demands. e) Expansion of two of our production facilities in the

Automotive Solutions group to provide added capacity for awarded

programs. Exco ended the quarter with $65 million in

net indebtedness. The company has $33.9 million in available

liquidity under its credit facility and $26.6 million of balance

sheet cash, continuing its practice of maintaining a very strong

balance sheet and liquidity position.

Outlook

Despite current macro-economic challenges,

including tightening monetary conditions, the overall outlook is

very favorable across Exco’s segments into the medium term.

Consumer demand for automotive vehicles is currently outstripping

supply in most markets, which are constrained by a shortage of

semiconductor chips and, to a lesser extent, other raw materials,

components and availability of labour. Dealer inventory levels are

near record lows, while average transaction prices for both new and

used vehicles are at record highs and the average age of the

broader fleet has continued to increase to an all-time high. This

bodes well for higher levels of future vehicle production and the

sales opportunity of Exco’s various automotive components and

accessories once supply chains normalize. In addition, OEM’s are

increasingly looking to the sale of higher margin accessory

products as a means to enhance their own levels of profitability.

Exco’s Automotive Solutions segment derives a significant amount of

activity from such products and is a leader in the prototyping,

development and marketing of the same. Moreover, the rapid movement

towards an electrified fleet for both passenger and commercial

vehicles is enticing new market entrants into the automotive market

while causing traditional OEM incumbents to further differentiate

their product offerings, all of which is driving above average

opportunities for Exco.

With respect to Exco’s Casting and Extrusion

segment, the intensifying global focus on environmental

sustainability is creating significant growth drivers that are

expected to persist through at least the next decade. Automotive

OEMs are looking to light-weight metals such as aluminum to reduce

vehicle weight and reduce carbon dioxide emissions. This trend is

evident regardless of powertrain design - whether internal

combustion engines, electric vehicles or hybrids. As well, a

renewed focus on the efficiency of OEMs in their own manufacturing

process is creating higher demand for advanced tooling that can

contribute towards their profitability and sustainability goals.

Certain new EV manufacturers have adopted the approach of utilizing

much larger die cast machines to cast entire sub-frames of vehicles

out of an aluminum based alloy rather than assemble numerous pieces

of separately stamped and welded pieces of ferrous metal. Exco

expects traditional OEMs will ultimately follow this trend and is

positioning its operations to capitalize accordingly. Beyond the

automotive industry, Exco’s extrusion tooling supports diverse end

markets which are also seeing increased demand for aluminum driven

by environmental trends, including energy efficient buildings,

solar panels, etc.

On the cost side, inflationary pressures have

intensified in recent quarters while prompt availability of various

input materials, components and labour has become more challenging.

We are offsetting these dynamics through various efficiency

initiatives and taking pricing action where possible although there

is typically several quarters of lag before the counter measures

are evident.

The Russian invasion of Ukraine has added

additional uncertainty to the global economy in recent months. And

while Exco has essentially no direct exposure to either of these

countries, Ukraine does feed into the European automotive markets

and Europe has significant dependence on Russia for its energy

needs.

Exco itself is also looking inwards with respect

to ESG and sustainability trends to ensure its own operations are

sustainable. We are investing significant capital to improve the

efficiency and capacity of our own operations while lowering our

own carbon footprint. In the first quarter we released our first

Sustainability Report on our corporate website which is available

at: www.excocorp.com/leadership/sustainability/.

Exco is currently targeting a compounded average

annual growth rate (excluding acquisitions) of approximately 10%

for revenues and slightly higher levels for EBITDA and Net Income

through fiscal 2026, which is expected to produce an annual EPS of

roughly $1.90 by the end of this timeframe. This target is expected

to be achieved through the launch of new programs, general market

growth, and also market share gains consistent with the Company’s

operating history. Capital investments will remain elevated in the

balance of the fiscal year in order to position the Company for the

significant growth opportunities we see. Capital expenditures are

expected to exceed $55 million for fiscal 2022.

For further information and prior year

comparison please refer to the Company’s Third Quarter Financial

Statements in the Investor Relations section posted at

www.excocorp.com. Alternatively, please refer to www.sedar.com.

Non-IFRS Measures: In this News

Release, reference may be made to EBITDA, EBITDA Margin, Pretax

Profit, Free Cash Flow and Maintenance Fixed Asset Additions which

are not measures of financial performance under International

Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as

earnings before interest, taxes, depreciation, amortization and

other expenses and EBITDA Margin as EBITDA divided by sales. Exco

calculates Pretax Profit as segmented earnings before other

income/expense, interest and taxes. Free Cash is calculated

as cash provided by operating activities less interest paid and

Maintenance Fixed Asset Additions. Maintenance Fixed Asset

Additions represents investment in fixed assets that are required

to continue current capacity levels. EBITDA, EBITDA Margin, Pretax

Profit and Free Cash Flow are used by management, from time to

time, to facilitate period-to-period operating comparisons and we

believe some investors and analysts use these measures as well when

evaluating Exco’s financial performance. These measures, as

calculated by Exco, do not have any standardized meaning prescribed

by IFRS and are not necessarily comparable to similar measures

presented by other issuers.

Quarterly Conference Call –

July 29, 2022 at 10:30 a.m. (Toronto time):

To access the listen only live audio webcast,

please log on to www.excocorp.com, or

https://edge.media-server.com/mmc/p/x9fpqsmi a few minutes before

the event. Those interested in participating in the

question-and-answer conference call may register at

https://register.vevent.com/register/BI3526160340204f7ea2ca7e205c624f44

to receive the dial-in numbers and unique PIN to access the call.

It is recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

For those unable to participate on July 29, 2022, an archived

version will be available on the Exco website until August 13,

2022.

| |

Source: |

Exco

Technologies Limited (TSX-XTC) |

| |

Contact: |

Darren Kirk, President and CEO |

| |

Telephone: |

(905) 477-3065 Ext. 7233 |

| |

Website: |

http://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier

of innovative technologies servicing the die-cast, extrusion and

automotive industries. Through our 20 strategic locations in

9 countries, we employ approximately 5,000 people and service a

diverse and broad customer base.

Notice To Reader: Forward Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws. We may use words such as "anticipate",

"may", "will", "should", "expect", "believe", "estimate", “5-year

target” and similar expressions to identify forward-looking

information and statements especially with respect to growth,

outlook and financial performance of the Company's business units,

contribution of our start-up business units, contribution of

awarded programs yet to be launched, margin performance, financial

performance of acquisitions, liquidity, operating efficiencies,

improvements in, expansion of and/or guidance or outlook as to

future revenue, sales, production sales, margin, earnings, earnings

per share, including the outlook for 2026, are forward-looking

statements. These forward-looking statements include known and

unknown risks, uncertainties, assumptions and other factors which

may cause actual results or achievements to be materially different

from those expressed or implied. These forward-looking statements

are based on our plans, intentions or expectations which are based

on, among other things, the current improving global economic

recovery from the COVID-19 pandemic and containment of any future

or similar outbreak of epidemic, pandemic, or contagious diseases

that may emerge in the human population, which may have a material

effect on how we and our customers operate our businesses and the

duration and extent to which this will impact our future operating

results, the impact of the Russian invasion of Ukraine on the

global financial, energy and automotive markets, including

increased supply chain risks, assumptions about the number of

automobiles produced in North America and Europe, production mix

between passenger cars and trucks, the number of extrusion dies

required in North America and South America, the rate of economic

growth in North America, Europe and emerging market countries,

investment by OEMs in drivetrain architecture and other initiatives

intended to reduce fuel consumption and/or the weight of

automobiles in response to rising climate risks, raw material

prices, supply disruptions, economic conditions, inflation,

currency fluctuations, trade restrictions, energy rationing in

Europe, our ability to integrate acquisitions, our ability to

continue increasing market share, or launch of new programs and the

rate at which our current and future greenfield operations in

Mexico and Morocco achieve sustained profitability. Readers are

cautioned not to place undue reliance on forward-looking statements

throughout this document and are also cautioned that the foregoing

list of important factors is not exhaustive. The Company will

update its disclosure upon publication of each fiscal quarter's

financial results and otherwise disclaims any obligations to update

publicly or otherwise revise any such factors or any of the

forward-looking information or statements contained herein to

reflect subsequent information, events or developments, changes in

risk factors or otherwise. For a more extensive discussion of

Exco's risks and uncertainties see the 'Risks and Uncertainties'

section in our latest Annual Report, Annual Information Form

("AIF") and other reports and securities filings made by the

Company. This information is available at www.sedar.com or

www.excocorp.com.

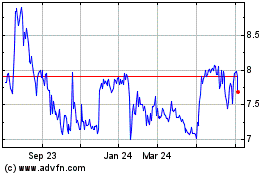

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Nov 2024 to Dec 2024

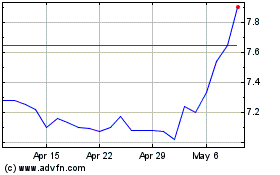

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Dec 2023 to Dec 2024