Exco Technologies Limited (TSX-XTC) today

announced results for its first quarter ended December 31, 2023. In

addition, Exco announced a quarterly dividend of $0.105 per common

share which will be paid on March 28, 2024 to shareholders of

record on March 14, 2024. The dividend is an “eligible dividend” in

accordance with the Income Tax Act of Canada.

|

|

Three Months EndedDecember 31 |

| (in $

thousands except per share amounts) |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

| Sales |

$ |

156,710 |

|

|

$ |

139,093 |

|

| Net income for the period |

$ |

5,642 |

|

|

$ |

4,523 |

|

| Earnings per share: Basic and

Diluted |

$ |

0.15 |

|

|

$ |

0.12 |

|

|

EBITDA |

$ |

18,061 |

|

|

$ |

15,181 |

|

“We achieved year over year growth in both

revenues and earnings again this quarter despite navigating through

difficult market conditions and pushing ahead with our various

investment initiatives,” said Darren Kirk, Exco’s President and

CEO. “I want to thank all Exco employees for their hard work and

commitment to working safely”.

Consolidated sales for the first quarter ended

December 31, 2023 were $156.7 million compared to $139.1 million in

the same quarter last year – an increase of $17.6 million, or 13%.

Foreign exchange rate movements increased sales $0.4 million in the

quarter primarily due to the strengthening EURO compared to the

Canadian dollar.

The Automotive Solutions segment reported sales

of $83.0 million in the first quarter – an increase of $12.8

million, or 18% from the same quarter last year. There was

virtually no impact of foreign exchange on sales for the quarter.

The sales increase was driven by new program launches and higher

vehicle production volumes. Combined North American and European

vehicle production was up approximately 5% compared to a year ago.

The revenue impact of the UAW strike action which was resolved by

late October was approximately $2 million. Adjusting for the strike

impact, sales were up at all four of the segment’s locations

compared to the prior year quarter. Looking forward, industry

growth may be tempered by rising interest rates, elevated vehicle

average transaction prices, rising dealer inventory levels, and

emerging indicators of a global recession. Vehicle sales however

remain encouraging (particularly in North America), dealer

inventory levels are well below historical norms and OEM incentives

are rising. Exco’s sales volumes will nonetheless benefit from

recent and future program launches that are expected to provide

ongoing growth in our content per vehicle. Quoting activity also

remains encouraging and we believe there is ample opportunity to

achieve our targeted growth objectives.

The Casting and Extrusion segment reported sales

of $73.7 million in the quarter – an increase of $4.9 million, or

7% from the same period last year. Similar to the automotive

segment, there was virtually no foreign exchange impact in the

quarter. Demand for our extrusion tooling was lower in the quarter

as the continued impact of higher interest rates and recessionary

conditions in certain end markets such as building and construction

and recreational vehicles caused an overall reduction in tooling

demand from extruders. Demand for extrusion tooling for automotive

and sustainable energy markets remains strong and growing, but the

building and construction market is the largest driver of extrusion

tooling. Demand for certain capital equipment sold by Castool

within the extrusion markets (such as containers and die ovens)

remains firm as extruders focus on various efficiency and

sustainability initiatives. Exco’s Management remains focused on

standardizing manufacturing processes, enhancing engineering depth

and centralizing critical support functions across its various

plants. As well, Management is focused on developing the benefits

of its new greenfield locations in Morocco and Mexico which provide

the opportunity to gain market share in Europe and Latin America

through better proximity to local customers. These initiatives have

reduced lead times, enhanced product quality, expanded product

breadth and increased capacity. In the die-cast market, which

primarily serves the automotive industry, demand and order flow for

new moulds, associated consumable tooling (shot sleeves, rods,

rings, tips, etc.) and rebuild work increased as industry vehicle

production recovers and new electric vehicles and more efficient

internal combustion engine/transmission platforms are launched. In

addition, demand for Exco’s additive (3D printed) tooling continues

its strong contribution as customers focus on greater efficiency

with the size and complexity of die-cast tooling continuing to

increase with the rising adoption of giga-presses. Sales in the

quarter were also aided by price increases, which were implemented

to protect margins from higher input costs. Quoting activity

remains robust and our backlog for die cast moulds remains at

record levels.

The Company’s first quarter consolidated net

income increased to $5.6 million or earnings of $0.15 per share

compared to $4.5 million or earnings of $0.12 per share in the same

quarter last year. The effective income tax rate was 23.6% in the

current quarter compared 22.7% in the same quarter last year. The

change in income tax rate in the quarter was impacted by geographic

distribution and foreign tax rate differentials.

The Automotive Solutions segment reported pretax

profit of $8.1 million in the quarter – an increase of $0.9

million, or an increase of 12% over the same quarter last year. The

increase in pretax profit is largely attributable to higher sales

and better absorption of overheads. Production volumes continue to

experience challenges with supply chain constraints but the impact

to our operations of these factors continues to decline, leading to

the improved scheduling of labour and reduced expedited shipping

costs. Together with higher volumes from new program launches, this

has allowed the segment to benefit from improved efficiencies and

better absorption of fixed costs. Offsetting these factors were

higher raw material prices, rising labour costs in all

jurisdictions and foreign exchange headwinds. Labour costs in

Mexico have been particularly challenging in recent years and will

see added pressure in fiscal 2024 given the significant rise in

minimum wage levels. Although production volumes have largely

stabilized from a macroeconomic and global perspective, volumes in

the quarter were impacted by the UAW strike action and December

holiday shutdowns at certain OEMs. These shutdowns reduced

profitability as labour levels were maintained and production

inefficiencies were incurred for specific parts and programs. Apart

from these specific impacts, Management is cautiously optimistic

that its overall cost structure should improve margins in coming

quarters. Pricing discipline remains a focus and action is being

taken on current programs where possible, though there is typically

a lag of a few quarters before the impact is realized. As well, new

program awards are priced to reflect management’s expectations for

higher future costs.

The Casting and Extrusion segment reported $3.6

million of pretax profit in the quarter – an increase of $1.7

million or 88% from the same quarter last year. The pretax profit

improvement is due to higher sales volumes, program pricing

improvements, favorable product mix and efficiency initiatives

within the Large Mould group; improved efficiency in the Extrusion

die business, including improvements at Halex and the elimination

of prior year one-time outsourcing costs needed at several

extrusion operations while in-house heat treatment equipment was

replaced. As well, there was improved absorption and efficiencies

at Castool’s heat treatment operation, stabilizing raw material and

labour costs, and lower Castool Morocco start up costs. Offsetting

these cost improvements were cash start-up losses at Castool’s new

operations in Mexico and a $0.8 million increase in segment

depreciation associated with recent capital expenditures.

Management remains focused on reducing its overall cost structure

and improving manufacturing efficiencies and expects such

activities together with its sales efforts should lead to improved

segment profitability over time.

The Corporate segment in the first quarter

recorded expenses of $2.2 million compared to $1.5 million last

year due to higher foreign exchange losses relating to the

strengthening Canadian dollar on balance sheet accounts, as well as

higher short and long-term incentive plan costs. As a result of the

foregoing, consolidated EBITDA in the quarter was $18.1 million

(11.5% of sales) compared to $15.2 million (10.9% of sales) last

year.

Operating cash flow before net changes in

working capital was $16.5 million in the quarter compared to $14.2

million in the prior year quarter. The $2.3 million improvement was

driven by a $1.1 million increase in net income, a $1.0 million

increase in depreciation and amortization, and a $0.4 million

increase in interest expense. Non-cash working capital consumed

$3.6 million of cash in the quarter compared to $3.4 million in the

same quarter last year. The non-cash working capital movements were

driven by lower accounts payable and accruals partially offset by

accounts receivable collections. Investment in fixed assets of

$11.9 million compared to $7.4 million in the prior year quarter.

Included in the current quarter was $4.2 million in growth capital.

The increased total investment related to timing of equipment

purchases and the completion of major projects. Exco ended the

quarter with $99.7 million in net debt. The Company had $36.9

million in available liquidity under its banking facilities at

December 31, 2023.

Outlook

In late fiscal 2021, Exco announced it was

targeting a compounded average annual growth rate (excluding

acquisitions) of approximately 10% for revenues and slightly higher

levels for EBITDA and Net Income through fiscal 2026, which was

anticipated to produce approximately $750 million annual revenue,

$120 million annual EBITDA and annual EPS of roughly $1.90 by the

end of this timeframe. Exco has made significant progress towards

achieving these targets since they were announced and continues to

believe its revenue and EBITDA targets remain obtainable. However,

management has since revised its EPS target lower – to

approximately $1.50 – to reflect the significant rise in interest

rates as well as elevated levels of depreciation due to higher than

planned capital expenditures associated with future growth

initiatives. These revenue, EBITDA and revised EPS targets are

expected to be achieved through the launch of new programs, general

market growth, and also market share gains consistent with the

Company’s operating history. Capital expenditures are expected to

be approximately $48 million for fiscal 2024.

Despite current macro-economic challenges,

including tightening monetary conditions and strike-related

production shut-downs in some North American OEM plants in

September and October 2023, the overall outlook is very favorable

across Exco’s segments into the medium term. Consumer demand for

automotive vehicles remains robust in most markets, despite supply

constraints, a worldwide shortage of semiconductor chips and, to a

lesser extent, availability of other raw materials, components and

labour. Dealer inventory levels have been increasing, while average

transaction prices for both new and used vehicles are near record

highs and the average age of the broader fleet has continued to

increase. This bodes well for higher levels of future vehicle

production and the sales opportunity of Exco’s various automotive

components and accessories as supply chains normalize. In addition,

OEM’s are increasingly looking to the sale of higher margin

accessory products as a means to enhance their own levels of

profitability. Exco’s Automotive Solutions segment derives a

significant amount of activity from such products and is a leader

in the prototyping, development and marketing of the same.

Moreover, the rapid movement towards an electrified and hybrid

fleet for both passenger and commercial vehicles is enticing new

market entrants into the automotive market while causing

traditional OEM incumbents to further differentiate their product

offerings, all of which is driving above average opportunities for

Exco.

With respect to Exco’s Casting and Extrusion

segment, the intensifying global focus on environmental

sustainability has created significant growth drivers that are

expected to persist through at least the next decade. Automotive

OEMs are utilizing light-weight metals such as aluminum, in

particular, to reduce vehicle weight and reduce carbon dioxide

emissions. This trend is evident regardless of powertrain design -

whether internal combustion engines, electric vehicles or hybrids.

As well, a renewed focus on the efficiency of OEMs in their own

manufacturing process is creating higher demand for advanced

tooling that can enhance their profitability and sustainability

goals. Certain OEM manufacturers have begun utilizing much larger

die cast machines to cast entire vehicle sub-frames using

aluminum-based alloy rather than stamping, welding, and assembling

separate pieces of ferrous metal. Exco is in discussions with

several traditional OEMs and their tier providers who appear likely

to follow this trend. Accordingly, Exco is positioning its

operations to capitalize on these changes. Beyond the automotive

industry, Exco’s extrusion tooling supports diverse industrial end

markets which are also seeing increased demand for aluminum driven

by environmental trends, including energy efficient buildings,

solar panels, etc.

On the cost side, inflationary pressures have

intensified post COVID while prompt availability of various input

materials, components and labour has become more challenging. The

intensity of these dynamics have generally moderated in recent

quarters with the exception of labour costs in Mexico, which

continue to see significant increases. We are offsetting these

dynamics through various efficiency initiatives and taking pricing

action where possible although there is typically several quarters

of lag before the counter measures yield results.

The Russian invasion of Ukraine and the

Israeli/Palestine conflict have added additional uncertainty to the

global economy. And while Exco has essentially no direct exposure

to these countries, Ukraine does feed into the European automotive

market and Europe has traditionally depended on Russia for its

energy needs. Similarly, the conflict in the Middle East creates

the potential for a renewed rise in the price of oil and other

commodities as well as logistics costs and could weigh on consumer

sentiment.

Exco itself is also looking inwards with respect

to ESG and sustainability trends to ensure its operations are

sustainable. We are investing significant capital to improve the

efficiency and capacity of our operations while lowering our carbon

footprint. Our Sustainability Report is available on our corporate

website at: www.excocorp.com/leadership/sustainability/.

For further information and prior year

comparison please refer to the Company’s First Quarter Financial

Statements in the Investor Relations section posted at

www.excocorp.com. Alternatively, please refer to

www.sedarplus.ca.

Non-IFRS Measures: In this News Release,

reference may be made to EBITDA, EBITDA Margin, Pretax Profit, Free

Cash Flow and Maintenance Fixed Asset Additions which are not

defined measures of financial performance under International

Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as

earnings before interest, taxes, depreciation and amortization and

EBITDA Margin as EBITDA divided by sales. Exco calculates Pretax

Profit as segmented earnings before other income/expense, interest

and taxes. Free Cash Flow is calculated as cash provided by

operating activities less interest paid and Maintenance Fixed Asset

Additions. Maintenance Fixed Asset Additions represents

management’s estimate of the investment in fixed assets that are

required for the Company to continue operating at current capacity

levels. Given the Company’s elevated planned capital spending on

fixed assets for growth initiatives (including additional

Greenfield locations, energy efficient heat treatment equipment and

increased capacity) through the near term, the Company has modified

its calculation of Free Cash Flow to include Maintenance Fixed

Assets and not total fixed asset purchases. This change is meant to

enable investors to better gauge the amount of generated cash flow

that is available for these investments as well as acquisitions

and/or returns to shareholders in the form of dividends or share

buyback programs. EBITDA, EBITDA Margin, Pretax Profit and Free

Cash Flow are used by management, from time to time, to facilitate

period-to-period operating comparisons and we believe some

investors and analysts use these measures as well when evaluating

Exco’s financial performance. These measures, as calculated by

Exco, do not have any standardized meaning prescribed by IFRS and

are not necessarily comparable to similar measures presented by

other issuers.

Quarterly Conference Call –

Thursday February 1, 2024 at 10:00am (Toronto time):

To access the listen only live audio webcast,

please log on to www.excocorp.com, or

https://edge.media-server.com/mmc/p/h4ntxy9c a few minutes before

the event. Those interested in participating in the

question-and-answer conference call may register at

https://register.vevent.com/register/BIe7f88b004fdf421bbb953189681d8f51

to receive the dial-in numbers and unique PIN to access the call.

It is recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

For those unable to participate on February 1, 2024, an archived

version will be available on the Exco website until February 15,

2024.

| |

Source: |

Exco

Technologies Limited (TSX-XTC) |

| |

Contact: |

Darren Kirk, President and CEO |

| |

Telephone: |

(905) 477-3065 Ext. 7233 |

| |

Website: |

http://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier

of innovative technologies servicing the die-cast, extrusion and

automotive industries. Through our 21 strategic locations in 9

countries, we employ approximately 5,000 people and service a

diverse and broad customer base.

Notice To Reader: Forward Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws. We may use words such as "anticipate",

"may", "will", "should", "expect", "believe", "estimate", “5-year

target” and similar expressions to identify forward-looking

information and statements especially with respect to growth,

outlook and financial performance of the Company's business units,

contribution of our start-up business units, contribution of

awarded programs yet to be launched, margin performance, financial

performance of acquisitions, liquidity, operating efficiencies,

improvements in, expansion of and/or guidance or outlook as to

future revenue, sales, production sales, margin, earnings, earnings

per share, including the revised outlook for 2026, are

forward-looking statements. These forward-looking statements

include known and unknown risks, uncertainties, assumptions and

other factors which may cause actual results or achievements to be

materially different from those expressed or implied. These

forward-looking statements are based on our plans, intentions or

expectations which are based on, among other things, the current

improving global economic recovery from the COVID-19 pandemic and

containment of any future or similar outbreak of epidemic,

pandemic, or contagious diseases that may emerge in the human

population, which may have a material effect on how we and our

customers operate our businesses and the duration and extent to

which this will impact our future operating results, the impact of

the Russian invasion of Ukraine on the global financial, energy and

automotive markets, including increased supply chain risks,

assumptions about the demand for and number of automobiles produced

in North America and Europe, production mix between passenger cars

and trucks, the number of extrusion dies required in North America

and South America, the rate of economic growth in North America,

Europe and emerging market countries, investment by OEMs in

drivetrain architecture and other initiatives intended to reduce

fuel consumption and/or the weight of automobiles in response to

rising climate risks, raw material prices, supply disruptions,

economic conditions, inflation, currency fluctuations, trade

restrictions, energy rationing in Europe, our ability to integrate

acquisitions, our ability to continue increasing market share, or

launch of new programs and the rate at which our current and future

greenfield operations in Mexico and Morocco achieve sustained

profitability. Readers are cautioned not to place undue reliance on

forward-looking statements throughout this document and are also

cautioned that the foregoing list of important factors is not

exhaustive. The Company will update its disclosure upon publication

of each fiscal quarter's financial results and otherwise disclaims

any obligations to update publicly or otherwise revise any such

factors or any of the forward-looking information or statements

contained herein to reflect subsequent information, events or

developments, changes in risk factors or otherwise. For a more

extensive discussion of Exco's risks and uncertainties see the

'Risks and Uncertainties' section in our latest Annual Report,

Annual Information Form ("AIF") and other reports and securities

filings made by the Company. This information is available

at www.sedarplus.ca or www.excocorp.com.

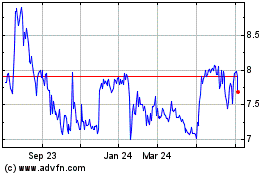

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Nov 2024 to Dec 2024

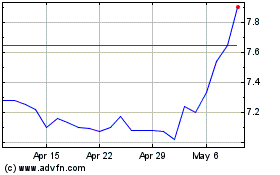

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Dec 2023 to Dec 2024