Apollo Silver Corp. (“

Apollo” or

the “

Company”) (TSX.V:APGO, OTCQB:APGOF,

Frankfurt:6ZF0) is pleased to report results for barite flotation

test work and quality analysis, completed as part of its 2022

Metallurgical Test Program (the “2022 Test Program”) for the

Waterloo silver-barite deposit. The 2022 Test Program is an initial

investigation in the metallurgical process response of

silver-barite mineralized rock at the Calico Silver Project

(“Calico” or the “Project”), located in San Bernardino County,

California.

HIGHLIGHTS

- Concentrate with up to 94.6% barite produced by flotation.

- Barite concentrate meets or exceeds the standards for chemical

and physical specifications for drilling fluids for use in the

petroleum industry as defined by the American Petroleum Institute

(“API”).

“These results confirm that barite has the

potential to make a meaningful contribution to development

potential at Calico,” commented Apollo’s President and CEO Tom

Peregoodoff. “In addition to its potential as a meaningful

by-product credit, the production of a salable barite product has

the potential to make a material reduction in the waste produced

from future silver mining operations. Barite pricing is typically

strongly impacted by transportation costs and Calico’s proximity to

the major rail transportation hub at Barstow significantly opens up

the potential market for Calico sourced barite.”

ABOUT BARITE

In the 2022 Final List of Critical Minerals,

published by the U.S. Geological Survey (“USGS”), barite was

identified as one of many minerals which “…play a significant role

in our national security, economy, renewable energy development and

infrastructure.” The list was produced as the result of a mandate

of the Energy Act of 2020, which was to identify minerals deemed

essential to the economic or national security of the U.S. and

which is vulnerable to supply chain disruption. Barite is critical

for domestic metallurgical applications in the energy industry,

with 90% of the barite sold in the U.S. used as a weighting agent

in petroleum drilling. According to the USGS 2022 Mineral Commodity

Report, the U.S. has an estimated net import reliance of more than

75% as a percentage of consumption and over half of that total is

imported from China.

BARITE QUALITY

Barite quality analysis was completed at SPL

Inc., (formerly Ana-Lab Corp.) in Kilgore, Texas, to determine if

the concentrate produced met the API chemical and physical

specifications for use as drilling fluids for the petroleum

industry. The API is responsible for setting the quality

requirements for all barite sold into the U.S. market. Results of

this analysis are shown in Table 1 and demonstrate that the

concentrate meets the API 13A (Barite 4.1) specification as defined

in 2020.

Table 1: API Specifications and Barite

Concentrate Quality Analysis Results for the Waterloo Deposit,

Calico Project.

|

Category |

API Specification |

Test Result |

|

Density |

4.1 g/ml (minimum) |

4.19 g/ml |

|

Water soluble alkaline earths (as calcium) |

250 mg/kg (maximum) |

125.434 mg/kg |

|

Residue greater than 75 microns (200 mesh) |

3% (maximum) |

0.1% |

|

|

|

|

BARITE FLOTATION

As part of the 2022 Test Program (see news

release February 23, 2023) several bulk flotation tests were

completed on Waterloo silver-barite mineralized material to

determine if a barite concentrate could be produced. Historical

work by American Smelting and Refining Company (“ASARCO”)

identified the potential to produce a salable barite concentrate,

so the 2022 Test Program aimed to reproduce and improve upon these

results. All barite related processing was performed at McClelland

Laboratories, Inc. (“McClelland”) of Sparks, Nevada.

Using 12 kg of composite 005, which had a

calculated initial barite content of 18% (based on X-ray

diffraction results) five tests were conducted to produce barite

concentrates via flotation using Aero 845 promoter and sodium

silicate as reagents. For the first four tests, flotation

conditions and reagent additions were based on historical

metallurgical testing reports of work done by ASARCO at Waterloo

and Superior at Langtry. Material was initially stage-ground to 80%

passing 212 microns, using a laboratory ball mill. These four tests

were conducted on 1 kg charges with a laboratory scale flotation

unit at 1,200 rpm at 33% percent solids by mass. Following these, a

fifth test using 8 kg of material was conducted using the indicated

optimum reagent additions. Rougher flotation was conducted in five

stages, with equally divided incremental additions of Aero 845 at

each stage. Rougher concentrate from the first three stages was

subjected to two stages of cleaner flotation to produce the final

concentrate. AEROFROTH 65 (polygycol) frother was used as needed

throughout each test. Flotation products were all dried and

analyzed for barium (by fused-disc X-ray fluorescence) and silver

(by four acid digestion/ICP), with barite content calculated by

McClelland based on reported barium content.

Table 2: Barite Flotation Test

Results for the Waterloo Deposit, Calico Project.

|

Test |

Reagent Addition, kg/t |

Recovery*, % of Total |

2nd Cl. Conc. Grade |

Head Grade% BaSO4 |

Head GradeAg g/t |

|

AERO 845 |

Sodium Silicate |

BaSO4 (%) |

Ag (%) |

Mass |

BaSO4 (%) |

Ag (ppm) |

Calculated |

Assayed |

Calculated |

Assayed |

|

F-1 |

0.225 |

1.0 |

93.0 |

47.2 |

37.8 |

86.9 |

196 |

17.6 |

15.7 |

122 |

124 |

|

F-2 |

0.225 |

0.0 |

92.0 |

57.4 |

39.7 |

86.7 |

489 |

18.0 |

15.7 |

150 |

124 |

|

F-3 |

0.075 |

1.0 |

73.9 |

38.4 |

27.2 |

94.6 |

260 |

17.9 |

15.7 |

123 |

124 |

|

F-4 |

0.075 |

0.0 |

83.6 |

41.0 |

30.0 |

91.9 |

278 |

17.8 |

15.7 |

126 |

124 |

|

F-5 |

0.075 |

1.0 |

82.5 |

31.7 |

23.8 |

81.9 |

252 |

15.6 |

15.7 |

117 |

124 |

*Recovery to combined 5-stage rougher

concentrate

Further test work has been recommended to

optimize the barite circuit and to determine the best method for

integrating with cyanidation for silver extraction. This work would

involve further flotation testing to better optimize procedures and

include evaluation of barite flotation from cyanide tails and/or

evaluation of concentrate cyanidation for silver recovery.

Additionally, testing of other technologies is warranted (gravity

concentration, attrition scrubbing) for separation of barite. A

review of the results by Apollo’s Qualified Person for the 2022

Test Program, Eric Hill P.E., PMP, recommended that a preliminary

case study be completed for the salability of a barite

concentrate.

HISTORICAL ASARCO BARITE

ESTIMATE

In 1979, ASARCO calculated an estimate of barite

in the Waterloo deposit. The estimate reported a total of 33.9

million tonnes of mineralized rock in the deposit at a grade of

13.4% barite for a total of 4.5 million tonnes of barite at a grade

of 93%. They assumed a 50% recovery and a cost of $70 per short ton

of barite concentrate. Please refer to Table 1 for these results,

which are reported here as documented in the original documents.

The reader is cautioned not to treat this historical

estimate or any part of it as a current mineral resource or

reserve. An independent Qualified Person has not completed

sufficient work to classify this as a current mineral resource or

reserve and therefore the Company is not treating the historical

estimate as a current mineral resource or mineral reserve.

Table 3: ASARCO (1979) Waterloo

historical silver and barite mineral reserve at 25 g/t silver

cut-off

|

Tonnage |

Average Grade |

Contained Metal |

|

Tons(Mst) |

Tonnes (Mt) |

Grade-Silver(g/t) |

Grade-Silver(opt) |

Grade-Barite(%) |

Barite(Mt) |

Silver(Moz) |

Silver (AgEq) (Moz) |

|

37.2 |

33.7 |

92.9 |

2.71 |

13.4 |

4.5 |

100.9 |

146.5 |

|

|

|

|

|

|

|

|

|

Reference to the historical reserves at the

Waterloo Property prepared by ASARCO refer to an internal company

document prepared by ASARCO, dated 1979 (unpublished) which the

Company is in possession of. Historical reserves are reported here

as documented in the original documents. The historical

reserves were calculated prior to the implementation of the current

Canadian Institute of Mining’s (“CIM”) standards for mineral

resource estimation (as defined by the CIM Definition Standard on

Mineral Resources and Ore Reserves dated May 10, 2014) as required

by NI 43-101 and has no comparable resource classification. The

reader is cautioned not to treat them, or any part of them, as

current mineral resources or reserves. An

independent Qualified Person has not completed sufficient work to

classify these estimates as current mineral resources or reserves

and therefore the Company is not treating the historical estimate

as a current mineral resources or mineral

reserves. The reliability of the

historical estimate is considered reasonable, reliable, and

relevant to be included here in that they demonstrated simply the

barite mineral potential of the Waterloo Property. This historical

resource estimate has been superseded by the Calico Silver Project

current mineral resource estimate, announced March 6, 2023.

SAMPLING AND QUALITY ASSURANCE/QUALITY

CONTROL

Whole-core PQ-diameter diamond drill core used

in the 2022 Test Program was collected by Pan American in 2012 and

was drilled by Diversified Drilling, of Anaheim, CA. Core was

logged (lithology, alteration, mineralization and geotechnical),

and photographed in detail by Pan American. The drill core was

separated into 2 m intervals and crushed to -1.5 inch by

McClelland. The material has been securely stored by McClelland in

Sparks, Nevada, since that time. In 2022, each interval was

thoroughly blended and split in half. One half split of each

interval was crushed to -1.7 mm and a 250 g split was taken using a

rotary-type splitter. The 250 g splits were pulverized to better

than 90% passing 106 microns. Major elements, including BaO, were

analyzed using fused-disc X-ray fluorescence (“XRF”) (method

ME-XRF26) with analyses completed at ALS-Reno. Barite content of

composite samples prior to flotation test work was calculated by

McClelland based on XRF reported BaO content. Barite content of the

composites was confirmed by X-ray diffraction analysis conducted by

The Mineral Lab. Silver content in the barite concentrates was

determined by McClelland using a four-acid digestion procedure with

ICP-OES finish. McClelland maintains its own comprehensive

guidelines to ensure best practices in sample preparation and is an

ISO 17025 certified facility. API testing of barite concentrate was

completed by SPL Inc. (“SPL”), of Kilgore Texas, an analytical

testing laboratory providing testing for petroleum and related

products analysis, among other services, since 1944. Results of

testing by SPL meet the requirements of the Environmental

Protection Agency’s National Environmental Laboratory Accreditation

Conference. All sample shipments were under strict chain of custody

documentation.

The 2022 Metallurgical Test Program was overseen

and reviewed by Jared Olsen, P.E., a professional metallurgist at

McClelland, and Eric Hill, P.E., PMP, whom was a professional

metallurgist at Samuel Engineering Inc., and was Apollo’s

Independent Qualified Person for metallurgy, in cooperation with

Derek Loveday, of Stantec Consulting Ltd., Apollo’s Independent

Qualified Person for mineral resources.

ABOUT THE PROJECT

Location

The Project is located in San Bernardino County,

California and comprises the adjacent Waterloo and Langtry

properties which total 2,950 acres. The Project is 15 km (9 miles)

from the city of Barstow and has an extensive private gravel road

network spanning the property. There is commercial electric power

within 5 km (3 miles) of the Project.

Geology

and Mineralization

The Calico Project is situated in the southern

Calico Mountains of the Mojave Desert, in the south-western region

of the Basin and Range tectonic province. This 15 km (9 mile) long

northwest- southeast trending mountain range is dominantly composed

of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks

and dacitic intrusions. Mineralization at Calico comprises

high-level low-sulfidation silver-dominant epithermal vein-type,

stockwork-type and disseminated-style associated with

northwest-trending faults and fracture zones and mid-Tertiary

(~19-17 Ma) volcanic activity. Calico represents a district-scale

mineral system endowment with approximately 6,000 m (19,685 ft) in

mineralized strike length controlled by the Company. Silver and

gold mineralization are oxidized and hosted within the sedimentary

Barstow Formation and the upper volcaniclastic units of the

Pickhandle formation along the contact between these units.

The 2023 MRE for the Calico Project comprises

110 million ounces (“Moz”) silver in 34.2 million tonnes (“Mt”) at

an average grade of 100 grams per tonne (“g/t”) silver (Measured

and Indicated categories); 0.72 Moz silver in 0.3 Mt at an average

grade of 77 g/t silver (Inferred category); and 70,000 oz gold in

4.5 Mt at an average grade of 0.5 g/t gold (Inferred category), all

on the Waterloo Property. In addition, the Langtry Property holds

50 Moz silver in 19.3 Mt at an average grade of 81 g/t silver. The

Langtry MRE remains unchanged from that defined in the 2022 MRE.

For more information, please see the news release dated March 6,

2023 and the N.I. 43-101 Technical Report titled “NI 43-101

Technical Report for the Mineral Resource Estimate of the Calico

Silver Project, San Bernardino County, California, USA,” dated

April 20, 2023 (with an effective date of February 8, 2023).

QUALIFIED PERSONS

The scientific and technical information

contained in this news release as related to the 2022 Metallurgical

Test Program was reviewed and approved by Jared Olson, P.E.,

Metallurgist and Vice President of Operations at McClelland

Laboratories, Inc., and Cathy Fitzgerald, M.Sc., P.Geo., Apollo’s

Vice President of Exploration and Resource Development for the

Company. Mr. Olson and Ms. Fitzgerald are Qualified Persons as

defined by the Canadian Securities Administrators National

Instrument 43-101 Standards of Disclosure for Minerals Projects.

Mr. Olson is a registered Professional Engineer in Nevada. Ms.

Fitzgerald is a registered Professional Geoscientist in British

Columbia, Canada.

Please visit www.apollosilver.com for

further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Tom Peregoodoff Chief Executive Officer

About

Apollo Silver

Corp.

Apollo Silver Corp. has assembled an experienced

and technically strong leadership team who have joined to advance

world class precious metals projects in tier-one jurisdictions. The

Company is focused on advancing its portfolio of two significant

silver exploration and resource development projects, the Calico

Project, in San Bernardino County, California and Silver District

Project in La Paz County, Arizona.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary

Statement Regarding

“Forward-Looking”

Information

This news release includes “forward-looking

statements” and “forward-looking information” within the meaning of

Canadian securities legislation. All statements included in this

news release, other than statements of historical fact, are

forward-looking statements including, without limitation,

statements with respect to the potential of the Calico Project; the

potential for identification of gold and barite resources at

Calico; geological interpretations; the potential to expand the

resource estimate and upgrade its confidence level, including

prospective mineralization on strike and at depth. Forward-looking

statements include predictions, projections and forecasts and are

often, but not always, identified by the use of words such as

“anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”,

“target”, “budget” and “intend” and statements that an event or

result “may”, “will”, “should”, “could” or “might” occur or be

achieved and other similar expressions and includes the negatives

thereof.

Forward-looking statements are based on the

reasonable assumptions, estimates, analysis, and opinions of the

management of the Company made in light of its experience and its

perception of trends, current conditions and expected developments,

as well as other factors that management of the Company believes to

be relevant and reasonable in the circumstances at the date that

such statements are made. Forward-looking information is based on

reasonable assumptions that have been made by the Company as at the

date of such information and is subject to known and unknown risks,

uncertainties and other factors that may have caused actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward-looking information, including but not limited to:

risks associated with mineral exploration and development; metal

and mineral prices; availability of capital; accuracy of the

Company’s projections and estimates; realization of mineral

resource estimates, interest and exchange rates; competition; stock

price fluctuations; availability of drilling equipment and access;

actual results of current exploration activities; government

regulation; political or economic developments; environmental

risks; insurance risks; capital expenditures; operating or

technical difficulties in connection with development activities;

personnel relations; contests over title to properties; changes in

project parameters as plans continue to be refined; and impact of

the COVID-19 pandemic. The estimate of mineral resources may be

materially affected by environmental, permitting, legal, title,

taxation, sociopolitical, marketing, or other relevant issues. The

quantity and grade of reported inferred mineral resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these inferred mineral resources as an

indicated or measured mineral resource and it is uncertain if

further exploration will result in upgrading them to an indicated

or measured mineral resource category. Forward-looking statements

are based on assumptions management believes to be reasonable,

including but not limited to the price of silver, gold and barite;

the demand for silver, gold and barite; the ability to carry on

exploration and development activities; the timely receipt of any

required approvals; the ability to obtain qualified personnel,

equipment and services in a timely and cost-efficient manner; the

ability to operate in a safe, efficient and effective matter; and

the regulatory framework regarding environmental matters, and such

other assumptions and factors as set out herein. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that forward-looking statements will prove to be

accurate and actual results, and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward looking

information contained herein, except in accordance with applicable

securities laws. The forward-looking information contained herein

is presented for the purpose of assisting investors in

understanding the Company’s expected financial and operational

performance and the Company’s plans and objectives and may not be

appropriate for other purposes. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

For further information, please contact:

Tom Peregoodoff

Chief Executive Officer

Telephone: +1 (604) 428-6128

tomp@apollosilver.com

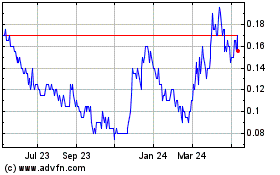

Apollo Silver (TSXV:APGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

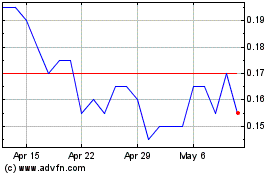

Apollo Silver (TSXV:APGO)

Historical Stock Chart

From Feb 2024 to Feb 2025