CF Energy Corp. (TSX-V: CFY) (“CF Energy” or the “Company”,

together with its subsidiaries, the “Group”), an energy provider in

the People’s Republic of China (the ”PRC” or “China”), announces

that the Company has filed its unaudited condensed interim

consolidated financial results for the three-month period ended

March 31, 2024.

Results for the three-month period

ended March 31, 2024 (“Q1 2024”)

Continuing Operations

| |

|

|

|

|

|

|

|

|

|

|

|

In millions |

Q1 2024 |

|

Q1 2023 |

|

Change |

|

% |

|

Q1 2024 |

|

Q1 2023 |

|

Change |

|

|

|

(except for % figures) |

RMB |

|

RMB |

|

RMB |

|

|

|

CAD |

|

CAD |

|

CAD |

|

|

|

Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

149.0 |

|

93.8 |

|

55.2 |

|

59 |

% |

28.0 |

|

18.5 |

|

9.5 |

|

|

|

Gross Profit |

32.7 |

|

28.2 |

|

4.5 |

|

16 |

% |

6.1 |

|

5.6 |

|

0.5 |

|

|

|

Gross Profit Margin |

21.9 |

% |

30.1 |

% |

-8.2 |

% |

|

|

|

|

|

|

|

|

Net Profit |

9.9 |

|

4.2 |

|

5.7 |

|

136 |

% |

1.9 |

|

0.8 |

|

1.1 |

|

|

|

Adjusted net Profit [Non-IFRS] |

9.9 |

|

1.4 |

|

8.5 |

|

581 |

% |

1.9 |

|

0.2 |

|

1.7 |

|

|

|

EBITDA |

29.6 |

|

20.6 |

|

9.0 |

|

44 |

% |

5.6 |

|

4.1 |

|

1.5 |

|

|

|

Adjusted EBITDA [Non-IFRS] |

29.6 |

|

17.8 |

|

11.8 |

|

66 |

% |

5.6 |

|

3.5 |

|

2.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue in Q1 2024 was RMB149.0 million (approx.

CAD28.0 million), an increase of RMB55.2 million (approx. CAD9.5

million), or 59%, from RMB93.8 million (approx. CAD18.5 million)

for the three-month period ended March 31, 2023 (“Q1 2023”).

Gross profit in Q1 2024 was RMB32.7 million

(approx. CAD6.1 million), an increase of RMB4.5 million (CAD0.5

million) or 16% from RMB28.2 million (approx. CAD5.6 million) in Q1

2023. Overall Gross profit margin in Q1 2024 was 21.9%, a decrease

of 8.2 percentage points from 30.1% in Q1 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions |

Q1 2024 |

|

Q1 2023 |

|

Change |

|

% |

|

Q1 2024 |

|

Q1 2023 |

|

Change |

|

|

|

(except for % figures) |

RMB |

|

RMB |

|

RMB |

|

|

|

CAD |

|

CAD |

|

CAD |

|

|

|

Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

Net profit for the period |

9.9 |

|

4.2 |

|

5.7 |

|

136 |

% |

1.9 |

|

0.8 |

|

1.1 |

|

|

|

Non-recurring/non-operating items |

|

|

|

|

|

|

|

|

|

|

|

Fair value change on derivative financial instrument |

- |

|

(2.0 |

) |

2.0 |

|

-100 |

% |

- |

|

(0.4 |

) |

0.4 |

|

|

|

Government financial assistance |

- |

|

(0.8 |

) |

0.8 |

|

-100 |

% |

- |

|

(0.2 |

) |

0.2 |

|

|

|

Adjusted net profit for the period (Non-IFRS) |

9.9 |

|

1.4 |

|

8.5 |

|

581 |

% |

1.9 |

|

0.2 |

|

1.7 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net profit in Q1 2024 was RMB9.9 million

(approx. CAD1.9 million), an increase of RMB5.7 million (approx.

CAD1.1 million) from RMB4.2 million (approx. CAD0.8 million) in Q1

2023. Net profit in Q1 2024 included non-recurring/non-operating

items. On a comparable basis, after excluding the fair value change

on derivative financial instrument of RMB nil million (Q1 2023:

fair value gain of RMB2.0 million, approx. CAD0.4 million) and the

government financial assistance of RMB nil million (Q1 2023 RMB0.8

million, approx. CAD0.2 million), the adjusted net profit in Q1

2024 (non-IFRS) remained at RMB9.9 million (approx. CAD1.9

million), an increase of RMB8.5 million (approx. CAD1.7 million) or

581% from adjusted net gain of RMB1.4 million (approx. CAD0.2

million) in Q1 2023.

Basic earnings per share (“EPS”) in Q1 2024 from

continuing operations was RMB0.18 (CAD0.03) (basic and diluted) per

share. Adjusted EPS in Q1 2024 was RMB0.15 (CAD0.03) (basic and

diluted) per share (non-IFRS).

| |

|

|

|

|

|

|

|

|

|

|

|

In millions |

Q1 2024 |

|

Q1 2023 |

|

Change |

|

% |

|

Q1 2024 |

|

Q1 2023 |

|

Change |

|

|

|

(except for % figures) |

RMB |

|

RMB |

|

RMB |

|

|

|

CAD |

|

CAD |

|

CAD |

|

|

|

Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

EBITDA for the period |

29.6 |

|

20.6 |

|

9.0 |

|

44 |

% |

5.6 |

|

4.1 |

|

1.5 |

|

|

|

Non-recurring/non-operating items |

|

|

|

|

|

|

|

|

|

|

|

Fair value change on derivative financial instrument |

- |

|

(2.0 |

) |

2.0 |

|

-100 |

% |

- |

|

(0.4 |

) |

0.4 |

|

|

|

Government financial assistance |

- |

|

(0.8 |

) |

0.8 |

|

-100 |

% |

- |

|

(0.2 |

) |

0.2 |

|

|

|

Adjusted EBITDA for the period (Non-IFRS) |

29.6 |

|

17.8 |

|

11.8 |

|

66 |

% |

5.6 |

|

3.5 |

|

2.1 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) in Q1 2024 was RMB29.6

million (approx. CAD5.6 million), an increase of RMB9.0 million

(approx. CAD1.5 million), or 44%, from RMB20.6 million (approx.

CAD4.1 million) in Q1 2023. EBITDA in Q1 2024 included

non-recurring/non-operating items. On a comparable basis, after

excluding the fair value change on derivative financial instrument

of RMB nil million (Q1 2023 fair value gain RMB2.0 million, approx.

CAD0.4 million) and the government financial assistance of RMB nil

million (Q1 2023 RMB0.8 million, approx. CAD0.2 million), the

adjusted EBITDA in Q1 2024 (non-IFRS) was RMB29.6 million (approx.

CAD5.6 million), an increase of RMB11.8 million (approx. CAD2.1

million), or 66%, from RMB17.8 million (approx. CAD3.5 million) in

Q1 2023.

Company Outlook

The natural gas industry faces a variety of

challenges ranging from regulatory impacts to market dynamics, and

in the competitive and shifting landscape, we must evolve to

embrace the changes and plan ahead.

Distributed Smart Energy Ecosystem – What We

Achieved:

CF Energy Corp. has developed from a traditional

natural gas company into a comprehensive energy solutions provider

that aims to incorporate its smart energy system and battery

swapping network via energy storage technology to create a highly

integrated and efficient framework for sustainable energy

management.

CF Energy’s Haitang Bay integrated smart energy

project and Meishan project are examples of standalone distributed

energy system with advanced grid technologies that enable real-time

monitoring and responsive energy distribution based on demand and

supply conditions. Through ice storage technology, the Haitang Bay

integrated smart energy system was founded.

We have entered the field of electrochemical

energy storage for cost reduction and energy conservation through

the mode of battery swapping in new energy vehicles. The CF Energy

battery swap station network in Sanya already successfully provides

an energy storage and distribution network for the EV taxis in

Sanya city.

Distributed Smart Energy Ecosystem – What We Are

Currently Doing:

The company is working with partners in the IoT

(internet of things), and cloud services field to create an

efficient EMS (energy management system) that connects the

standalone distributed smart energy systems with various energy

storage technologies (including battery storage). - IoT Devices and

Sensors are deployed across all components of the energy

system—solar panels, energy storage units, battery swapping

stations, and consumer endpoints. They collect real-time data on

energy production, storage levels, battery health, and consumption

patterns. Using historical data and machine learning models, the

EMS can predict demand spikes, potential system disruptions, and

optimal energy production schedules. This helps in preemptive

management, reducing wastage, and increasing system

reliability.

Distributed Smart Energy Ecosystem – Vision Moving

Forward:

The Company envisions the smart energy

centralized cooling for hotels, battery swap stations, and operates

as a virtual power plant with active end user participation. The

combined energy capacity from the cooling system, battery swap

stations, and possibly additional storage units, can act as a

virtual power plant, providing grid services such as peak shaving,

load balancing, and frequency regulation.

The Company is working to integrate a demand

response system where hotels and other end users can opt-in to

adjust their energy usage during peak periods in response to

incentives. For example, shifting non-essential power usage to

off-peak hours. EV owners can charge their vehicles during off-peak

hours to benefit from lower rates and reduce grid strain during

high-demand periods. Alternatively, V2G (Vehicle to Grid) concept

allows EVs to return energy to the grid during peak times,

effectively using the vehicle’s battery as a grid resource.

Furthermore, utilizing a platform for energy trading that allows

surplus energy (from renewable sources and stored energy) to be

sold back to the grid or shared among participants will add

additional revenue stream and encouraging sustainable practices.

The integration must connect all components through a smart grid

that enables two-way communication between the energy providers and

consumers.

The unaudited condensed interim consolidated

financial results and Management’s Discussion and Analysis

(MD&A) can be downloaded from www.sedarplus.com or from the

Company's website at www.cfenergy.com.

About CF Energy Corp. (Previously known

as: Changfeng Energy Inc.)

CF Energy Corp. is a Canadian public company

currently traded on the Toronto Venture Exchange (“TSX-V”) under

the stock symbol “CFY”. It is an integrated energy provider and

natural gas distribution company (or natural gas utility) in the

PRC. CF Energy strives to combine leading clean energy technology

with natural gas usage to provide sustainable energy to its

customer base in the PRC.

CONTACT INFORMATION

Corporate Investment

RelationsInvestor.relations@changfengenergy.cn

Charles WangExecutive Assistant to CEO & Chair of the

Boardzhaoyu.wang@changfengenergy.cn

Frederick WongDirector of the

Boardfred.wong@changfengenergy.cn

Mike LiuVP Capital Marketmike.liu@changfengenergy.cn

Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking statements and forward-looking

information (collectively, “Forward-Looking Statements”). All

statements, other than statements of historical fact, included or

incorporated by reference in this document are Forward-Looking

Statements, including statements regarding activities, events or

developments that the Company expects or anticipates may occur in

the future (including, without limitation, no significant

adjustments to the gas selling price and charges for related

services imposed by the relevant PRC government, the tourism

industry continues to recover from COVID-19 impact and no delay in

the development of the electric vehicle battery swap stations or

the Haitang Bay Integrated Smart Energy Project). These

Forward-Looking Statements can be identified by the use of

forward-looking words such as “will”, “expect”, “intend”, “plan”,

“estimate”, “anticipate”, “believe” or “continue” or similar words

or the negative thereof. No assurance can be given that the plans,

intentions or expectations or assumptions upon which these

Forward-Looking Statements are based will prove to be correct and

such Forward-Looking Statements included in this news release

should not be unduly relied upon. Although management believes that

the expectations represented in such Forward-Looking Statements are

reasonable, there can be no assurance that such expectations will

prove to be correct. Such Forward-Looking Statements are not a

guarantee of performance and involve known and unknown risks,

uncertainties, assumptions and other factors that may cause the

actual results, performance or achievements to differ materially

from the anticipated results, performance or achievements or

developments expressed or implied by such Forward-Looking

Statements. These factors include, without limitation, no

significant and continuing adverse changes in general economic

conditions or conditions in the financial, tourism, and gas

distribution and electric vehicle markets or delays in the

development of key projects. Readers are cautioned that all

Forward-Looking Statements involve risks and uncertainties,

including those risks and uncertainties detailed in the Company’s

filings with applicable Canadian securities regulatory authorities,

copies of which are available at www.sedar.com. The Company urges

readers to carefully consider those factors. The Forward-Looking

Statements included in this news release are made as of the date of

this document and the Company disclaims any intention or obligation

to update or revise any Forward-Looking Statements, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities legislation. This news

release does not constitute an offer to sell or solicitation of an

offer to buy any of the securities described herein and accordingly

undue reliance should not be put on such. This news release

contains future oriented financial information and financial

outlook information (collectively, "FOFI") (including, without

limitation, statements regarding expected average production), and

are subject to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraph. The FOFI has

been prepared by management to provide an outlook of the Company's

activities and results, and such information may not be appropriate

for other purposes. The Company and management believe that the

FOFI has been prepared on a reasonable basis, reflecting

management's reasonable estimates and judgments, however, actual

results of operations of the Company and the resulting financial

results may vary from the amounts set forth herein. Any FOFI speaks

only as of the date on which it is made, and the Company disclaims

any intent or obligation to update any FOFI, whether as a result of

new information, future events or results or otherwise, unless

required by applicable laws.

Non-IFRS Financial

Measures.

This news release contains financial terms that

are not considered in the International Financial Reporting

Standards ("IFRS"): EBITDA, Adjusted EBITDA and Adjusted Net

Profit. These financial measures, together with measures prepared

in accordance with IFRS, provide useful information to investors

and shareholders, as management uses them to evaluate the operating

performance of the Company. The Company's determination of these

non-IFRS measures may differ from other reporting issuers, and

therefore are unlikely to be comparable to similar measures

presented by other companies. Further, these non-IFRS measures

should not be considered in isolation or as a substitute for

measures of performance or cash flows prepared in accordance with

IFRS. These financial measures are included because management uses

this information to analyze operating performance and liquidity.

Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

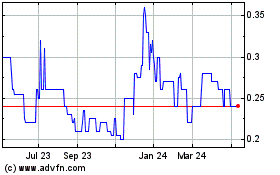

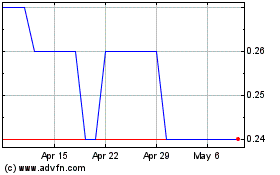

CF Energy (TSXV:CFY)

Historical Stock Chart

From Nov 2024 to Dec 2024

CF Energy (TSXV:CFY)

Historical Stock Chart

From Dec 2023 to Dec 2024