U.K. Real-Estate Funds Reopen After Brexit Shut Down

13 September 2016 - 12:00AM

Dow Jones News

Some U.K. real-estate funds have started thawing out after the

post-Brexit freeze.

Asset manager Columbia Threadneedle Investments on Monday said

its U.K. property fund would reopen later this month. The

London-based firm had shut down trading in early July when

investors were rushing to pull their money out after Britain voted

to leave the European Union.

Earlier this month, asset management firm Canada Life lifted the

suspension of redemptions on its U.K. real-estate fund. And U.K.

fund manager Aberdeen Asset Management PLC reopened its property

fund in mid-July, having taken a slightly different approach after

Brexit, suspending its fund for a short time and charging a steep

fee if an investor still insisted on pulling money out.

Some of the biggest U.K. property funds remain shut, including

those at Standard Life Investments Ltd., Aviva Investors and

M&G Investments. In August, Aviva told investors it wouldn't

reopen its fund for at least another six months.

But the reopening of even a few funds signals that investors'

concerns about the impact on U.K. property market have eased since

the EU referendum in late June, when the property market was hit

hard. In addition to funds suspending trade, shares of listed

landlords sank, deals collapsed, and completed sales were done at a

discount.

So far, the market has held up better than some property experts

had expected. The discounts on sales haven't been as big as they

were in previous market downturns. Shares have rebounded.

The stability has been reason enough for some asset managers to

resume business.

"Any effects of the Brexit vote on the overall U.K. economy,

negative or otherwise, will take many months if not years to

transpire, and sometime after that for the property market," said

Don Jordison, managing director of property at Columbia

Threadneedle Investments, in a prepared statement.

Open-ended funds have been popular with investors because they

offer real-estate returns without the volatility that comes with

owning the shares of listed real-estate companies. A fund's price

is based on monthly appraisals of the property owned by the

fund.

Yet these funds often face criticism over their structure: they

promise investors the ability to withdraw their money daily even

though property assets like office buildings or shopping malls can

take months to sell.

This has proved problematic in times of market stress. After

Brexit, asset managers decided to freeze their property funds to

sell property.

Aberdeen reopened after setting up new procedures for pricing

redeemed units. If investors wanted to take money out, they needed

to pay a 17% fee. During that period, the firm sold properties,

often at steep discounts, to fund redemptions.

The exit fee at Aberdeen has since been reduced to 5%. Columbia

Threadneedle sold, or agreed to sell, 25 properties for £ 167

million ($221.5 million) since July, it said. On average, the sale

prices were 1% less than the valuation before Brexit.

At the time of the suspension, Columbia Threadneedle's fund had

been worth £ 1.3 billion. The property fund will reopen for trading

on Sept. 26 without redemption penalties, it said.

Elizabeth Pfeuti also contributed to this article

Write to Art Patnaude at art.patnaude@wsj.com

(END) Dow Jones Newswires

September 12, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

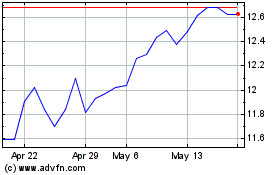

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

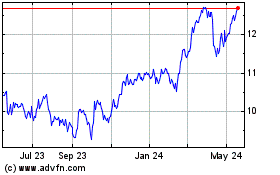

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Jan 2024 to Jan 2025