Form 8-K - Current report

30 January 2025 - 8:37AM

Edgar (US Regulatory)

false

0001688126

0001688126

2025-01-23

2025-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 23, 2025

The

Crypto Company

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-55726 |

|

46-4212105 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 23823

Malibu Road, #50477, Malibu, CA |

|

90265 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(424)

228-9955

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

January 23, 2025 (the “Effective Date”), the Crypto Company (the “Company”) entered into a consulting agreement

(the “Consulting Agreement”) with YWRC Holdings, Inc. (the “Consultant”). The Consulting Agreement has an initial

term of six months, commencing on the Effective Date. The Consultant received a one-time engagement fee on the Effective Date

and is eligible to receive a monthly fee for its services during the term of the Consulting Agreement in accordance with the

terms and conditions of the Consulting Agreement, totaling up to a cumulative $1,015. In addition, the Consultant will receive an

award of 4.99% of the Company’s common stock, par value $0.001 per share (the “Common Stock”), subject to the Consultant’s

continued compliance with the terms of the Consulting Agreement; provided, Consultant will be eligible to receive an additional equity

award at the 12-month anniversary of the Effective Date to ensure that Consultant hold as total equity interest equal to 4.99% of the

fully diluted outstanding shares of the Company. Consultant shall not sell, transfer, or otherwise dispose of more than 5% of the total

trading volume of the Company Common Stock, as traded on the applicable stock exchange or market, during any calendar month, calculated

based on the total trading volume during the previous calendar month. The Company may terminate the Consulting Agreement at any time

with at least 30 days’ prior written notice. The Consultant will be an independent contractor of the Company, and as such, the

Consultant is not entitled to participate in any Company employee benefit plans.

The

foregoing description of the Consulting Agreement is not complete and is qualified in its entirety by reference to the text of such document,

which is filed as Exhibit 10.1 hereto and which is incorporated herein by reference.

On

January 27, 2025, the Company and AJB Capital Investments LLC entered into a Second Amendment dated as of October 10, 2024 (“Second

Amendment”), to that certain Promissory Note dated as of August 28, 2024 (“Promissory Note”). The First Amendment to

the Promissory Note dated as of October 1, 2024 (“First Amendment”), amends the Promissory Note,

to increase the principal amount of the Promissory Note from $120,000 to $142,000. The Second Amendment to the Promissory Note

amends the Promissory Note, as amended by the First Amendment, to increase the principal amount

of the Promissory Note from $142,000 to $157,556, provided, however, that the $15,556 of

additional principal carries an original issue discount of $1,556 withheld from the Company to cover monitoring costs associated with

the Promissory Note.

The

foregoing description of the Second Amendment to the Promissory Note is not complete and is qualified in its entirety by reference to

the text of such document, which is filed as Exhibit 10.2 hereto and which is incorporated herein by reference.

On

January 27, 2025 (the “Advance Date”), the Company entered into a Promissory Note with

Ronald Levy, the Company’s, Chief Executive Officer, Chief Operating Officer and Secretary, to obtain an advance in the amount

of $15,000 (the “Loan”) for the aforementioned Consultant engagement fee. The Loan bears interest at the rate of 5% per annum,

with a maturity date four months from the Advance Date.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

| * |

Certain

of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Company agrees

to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

THE

CRYPTO COMPANY |

| Date: |

January

29, 2025 |

|

|

| |

By: |

/s/

Ron Levy |

| |

Name:

|

Ron

Levy |

| |

Title: |

Chief

Executive Officer, Chief Operating Officer and Secretary |

Exhibit

10.1

CONSULTING

AGREEMENT

This

CONSULTING AGREEMENT (this “Agreement”) is made effective as of January 23, 2025 (the “Effective Date”),

by and between The Crypto Company (the “Company”) and YWRC Holdings, Inc. (“Consultant”), for the

purpose of setting forth the terms and conditions by which the Company will engage the Consultant to perform services for the Company

on a temporary basis (such services, the “Services”). The Company and Consultant may be referred to herein individually

as “Party” or collectively as “Parties.”

| |

1.1. |

Project

Assignment. Consultant hereby agrees to perform the Services for the Company as described in Exhibit A hereto (the “Project

Assignment”). The Project Assignment will be subject to the terms and conditions of this Agreement. |

| |

|

|

| |

1.2. |

Services.

The manner and means by which Consultant chooses to complete the Services are in Consultant’s sole discretion and control.

Consultant acknowledges that time is of the essence in performing the Services. Consultant will remain fully liable to the Company

for the performance by all permitted assignees, including their respective employees, independent contractors, agents or representatives

of Consultant (each, an “Authorized Representative”). Consultant will perform the Services, and provide the results

thereof, with commercially reasonable efforts. Consultant shall furnish, at Consultant’s own expense, the materials, equipment,

and other resources necessary to perform the Services. |

| |

|

|

| |

1.3. |

Compensation

and Invoicing. In consideration of Consultant performing the Services, the Company will pay Consultant consulting fees as set

forth in the Project Assignment attached as Exhibit A hereto. |

| 2. |

Confidential

Information. |

| |

2.1. |

Definition.

During the term of this Agreement and thereafter, the Parties agree to protect the confidentiality of certain Confidential Information.

As used herein, the term “Confidential Information” of a Party shall mean any and all non-public information disclosed

by such Party (the “Disclosing Party”) to the other Party (the “Receiving Party”), which may

include without limitation sales, cost and other unpublished financial information, product and business plans, business projections,

pricing, and marketing data, business, financial, technical and other information, user manuals, forecasts, analyses, software and

processes, which information is marked or indicated at the time of disclosure or observation as being “Confidential”

or “Proprietary,” or which would be deemed by a reasonable person to be confidential or proprietary in nature. |

| |

2.2. |

Restrictions

on Use and Disclosure. Each of the Receiving Parties will take reasonable precautions to (i) not use or permit the use of the

Disclosing Party’s Confidential Information in any manner or for any purpose not expressly set forth in this Agreement, (ii)

hold such Confidential Information in confidence and protect it from unauthorized use and disclosure, and (iii) not disclose such

Confidential Information to any third parties. Consultant’s use of the Company’s Confidential Information is strictly

limited to use in providing the Services. The Company’s use of Consultant’s Confidential Information is strictly

limited to receiving the benefit of the Services. The Receiving Party will protect the Disclosing Party’s Confidential

Information from unauthorized use, access or disclosure in the same manner as the Receiving Party protects its own confidential information

of a similar nature, but in no event will it exercise less than reasonable care. Consultant shall have the right to disclose

Confidential Information only to those Authorized Representatives having a need to know such information. Consultant shall take all

reasonable steps to keep the Confidential Information confidential and to prevent its Authorized Representatives from prohibited

or unauthorized disclosure or use of the Confidential Information. Confidential Information does not include information that the

Receiving Party can establish by competent proof (i) is or becomes a part of the public domain through no act or omission of the

Receiving Party, (ii) is disclosed to the Receiving Party by a third party without restrictions on disclosure, (iii) was in the Receiving

Party’s lawful possession without obligation of confidentiality prior to the disclosure and was not obtained by the Receiving

Party either directly or indirectly from the Disclosing Party, or (iv) is independently developed by the Receiving Party without

any access to or use of Confidential Information, as demonstrated by files in existence at the time Receiving Party independently

developed that information. In addition, this section will not be construed to prohibit disclosure of Confidential Information

to the extent that such disclosure is required by law or valid order of a court or other governmental authority; provided, however,

that the Receiving Party will first have given notice to the Disclosing Party and will have made a reasonable effort to avoid and/or

minimize the extent of such disclosure and obtain a protective order requiring that the Confidential Information so disclosed be

used only for the purposes for which the order was issued. |

| |

|

|

| |

2.3. |

Third-Party

Information. Consultant will not disclose or otherwise make available to the Company in any manner any confidential information

received by Consultant under obligations of confidentiality from a third party. |

| |

|

|

| |

2.4. |

Mandate

for Disclosure. During the term of this Agreement, the Company agrees to disclose to the Consultant the total amount of funding,

the sources of such funding, and the timing of each investment received in relation to the Project Assignment. This information shall

be provided to the Consultant within five (5) business days following the closure of any funding or capital raising event. The Company

shall ensure that such disclosures are accurate, complete, and provided in a timely manner to enable the Consultant to perform the

Services effectively under the terms of this Agreement. |

| |

|

|

| |

2.5. |

Right

to Request Additional Information. The Consultant shall reserve the right to reasonably request from the Company any additional

information related to the capital raised as detailed under the Project Assignment. Upon such a reasonable request, the Company agrees

to provide the requested information within five (5) business days. This information may include, but is not limited to, detailed

financial statements, proof of capital transactions, and communications related to the funding efforts. |

| |

3.1. |

Work

Product; Assignment. Other than with respect to Consultant’s Background IP (as defined below), Consultant agrees that the

Company will be the sole and exclusive owner of all right, title and interest in and to all ideas, inventions, works of authorship,

work product, materials, and other deliverables conceived, made, developed, reduced to practice, or worked on by Consultant, alone

or in conjunction with others (i) in the course of providing the Services for the Company following the execution of this Agreement,

and (ii) after the term of the Agreement if resulting or directly derived from Confidential Information, and all patent, copyright,

trademark, trade secret and other intellectual property rights therein, whether now known or hereafter recognized in any jurisdiction

(collectively, “Work Product”). Consultant hereby irrevocably assigns to the Company all of Consultant’s

right, title and interest in and to the Work Product. Consultant agrees to execute all documents and other instruments

reasonably necessary to confirm such assignment. Consultant hereby waives any applicable moral rights in the Work Product. Consultant

will promptly disclose to the Company any and all Work Product. Consultant agrees to keep and maintain adequate and current records

(in the form of notes, sketches, drawings or in any other form that may be required by the Company) of all Work Product and results

thereof and such records will be available to and remain the sole property of the Company at all times. Consultant will

ensure that each of its employees and agents who will create Work Product, have access to any Company Confidential Information or

perform any Services has entered into a binding written agreement that protects the Company’s rights and interests to at least

the same degree as set forth in this Agreement. |

| |

|

|

| |

3.2. |

Background

IP License. Consultant hereby grants to the Company a non-exclusive, royalty-free, fully paid perpetual, irrevocable, worldwide

right and license, with right of sublicense, under and to Consultant’s Background IP (as defined below) for the purpose of

developing, marketing, selling and supporting products and services of the Company or its affiliates or subsidiaries, either directly

or through multiple tiers of distribution, but not for the purpose of licensing Background IP separately from products and services

of the Company or its affiliates or subsidiaries. For purposes of this Agreement, “Background IP” means any and

all technology and intellectual property rights that do not constitute Work Product and that are owned by Consultant or are licensed

by a third party to Consultant with a right to sublicense, and which exist prior to the date of this Agreement or which are developed

independently by Consultant outside of the Services but are used in provision of the Services or are applicable to the Work Product.

To the extent practicable, Consultant agrees to specifically describe and identify in each Project Assignment any material Background

IP applicable to the project that Consultant intends to use to perform the applicable Services. |

| 4. | Representations

and Warranties. |

| |

4.1. |

Consultant

represents and warrants that: |

| |

|

|

|

| |

|

(i) |

Consultant

has the right to enter into this Agreement, to grant the rights granted herein, and to perform fully all of Consultant’s obligations

under this Agreement. |

| |

|

|

|

| |

|

(ii) |

Consultant

entering into this Agreement with the Company and Consultant’s performance of the Services do not and will not conflict

with or result in any breach or default under any other agreement to which Consultant is subject. |

| |

|

|

|

| |

|

(iii) |

Consultant

has the required skill, experience, and qualifications to perform the Services, Consultant shall perform the Services in a professional

and workmanlike manner in accordance with generally recognized industry standards for similar services, and Consultant shall devote

sufficient resources to ensure that the Services are performed in a timely and reliable manner. |

| |

|

|

|

| |

|

(iv) |

Consultant

shall perform the Services in compliance with all applicable federal, state, and local laws and regulations, including by maintaining

all licenses, permits, and registrations required to perform the Services. |

| |

|

|

|

| |

|

(v) |

The

Work Product will be free and clear of all liens, claims, encumbrances or demands of third parties, including any claims by any such

third parties of any right, title or interest in or to the Work Product. The Company will receive good and valid title to all Work

Product. Consultant further represents and warrants that, if applicable, each Authorized Representative performing Services under

this Agreement on behalf of Consultant has executed an agreement with Consultant whereby all right, title and interest in and to

Consultant’s Background IP and Work Product created by such individual has been effectively assigned to Consultant. |

| |

|

|

|

| |

|

(vi) |

The

Services, the Work Product, and the Background IP licensed under this Agreement comply with all applicable United States and foreign

laws and regulations in all material respects, and that all Work Product will conform to the specifications agreed by the Parties

for such Work Product. |

| |

|

|

|

| |

|

(vii) |

The

Work Product and the use of Work Product in the products and services of the Company do not and will not infringe or misappropriate

the intellectual property rights of any third party; (ii) Consultant has all necessary rights to license the Background IP, and to

assign all Work Product to the Company; and (iii) Consultant’s engagement by the Company pursuant to this Agreement does not

and will not breach any agreement with any third party (including any former employer or client), and that Consultant has not entered

into and will not enter into any agreement, either written or oral, in conflict with Consultant’s obligations under this Agreement.

|

| |

4.2. |

Term

and Termination. This Agreement will commence on the Effective Date and will continue until completion of the Project Assignment

as such End Date is specified on Exhibit A, unless earlier terminated in accordance with this Agreement, including termination

for convenience (the “Term”). |

| |

4.3. |

Termination

for Cause. Either Party may terminate this Agreement immediately in the event the other Party has materially breached the Agreement

and failed to cure such breach within 30 days after notice by the non-breaching party is given. Either Party may also

terminate this Agreement or the Project Assignment, effective immediately upon written notice, if the other Party (i) admits in writing

its inability to pay its debts generally as they become due; (ii) makes a general assignment for the benefit of its creditors; (iii)

institutes proceedings, or has proceedings instituted against it seeking relief or reorganization under any laws relating to bankruptcy

or insolvency; or (iv) has a court of competent jurisdiction appoint a receiver, liquidator, or trustee over all or substantially

all of such other party’s property or provide for the liquidation of such other party’s property or business affairs. |

| |

|

|

| |

4.4. |

Termination

for Convenience. The Company reserves the right to terminate this Agreement without cause, for any reason, by providing the Consultant

with thirty (30) calendar days’ written notice. In the event of termination under this provision, the Company shall compensate the

Consultant on a pro-rata basis for any fees accrued and payable for services rendered up to and including the effective date of termination.

Any payments or shares previously disbursed to the Consultant, as set forth in Exhibit A, shall be considered non-retractable and

shall remain with the Consultant. However, any payments or shares outlined in Exhibit A that have not yet been received by the Consultant

shall be immediately forfeited. |

| |

|

|

| |

4.5. |

Upon

expiration or termination of this Agreement for any reason, or at any other time upon the Company’s written request, you shall

promptly after such expiration or termination: |

| |

(i) |

Deliver

to the Company all deliverables (whether complete or incomplete) and all materials, equipment, and other property provided for Consultant’s

use by the Company. |

| |

|

|

| |

(ii) |

Deliver

to the Company all tangible documents and other media, including any copies, containing, reflecting, incorporating, or based on the

Company’s Confidential Information. |

| |

|

|

| |

(iii) |

Permanently

delete all Confidential Information stored electronically in any form, including on computer systems, networks, and devices such

as cell phones. |

| |

4.6. |

Execution

of the Closing Agreement. Upon the End Date of the Project Assignment or upon termination of this Agreement, whichever occurs

first, the Company and Consultant will execute a Closing Agreement, which will be provided separately. A duly authorized representative

of the Company and Consultant shall sign the Closing Agreement, which acknowledges the completion of the Services provided under

this Agreement and confirms compliance with all respective obligations as outlined herein and under the terms set forth in the Closing

Agreement. This execution is intended to ensure a formal and clear conclusion of the business relationship established by this Agreement

and to address any post-termination obligations. |

| |

5. |

Independent

Contractor. Consultant’s relationship with the Company will be that of an independent contractor and nothing in this Agreement

should be construed to create a partnership, joint venture, or employer-employee relationship. Consultant is not the agent of the

Company and is not authorized to make any representation, warranty, contract, or commitment on behalf of the Company. Neither Consultant

nor any of its Authorized Representatives, if applicable, will be entitled to any of the benefits which the Company may make available

to its employees, such as group insurance, profit-sharing or retirement benefits. Consultant will be solely responsible for all tax

returns and payments required to be filed with or made to any federal, state or local tax authority with respect to Consultant’s

performance of the Services (and those of its Authorized Representatives, if applicable) and receipt of fees under this Agreement.

The Company will regularly report amounts paid to Consultant by filing applicable documents as required by law. Consultant agrees

to accept exclusive liability for complying with all applicable state and federal laws governing self-employed individuals, including

obligations such as payment of taxes, social security, disability and other contributions based on fees paid to Consultant under

this Agreement. |

| |

|

|

| |

6. |

LIMITATION

OF LIABILITY. NEITHER PARTY WILL NOT BE LIABLE TO THE OTHER PARTY FOR ANY INDIRECT, CONSEQUENTIAL, INCIDENTAL, PUNITIVE OR SPECIAL

DAMAGES AS A RESULT OF ANY BREACH OF THIS AGREEMENT, INCLUDING, BUT NOT LIMITED TO, ANY LOST PROFITS, PHYSICAL INJURY, LOST BUSINESS

OPPORTUNITY OR COST SAVINGS. THIS EXCLUSION OF CONSEQUENTIAL DAMAGES UNDER THIS SECTION WILL APPLY REGARDLESS OF THE FORM

OF ACTION, WHETHER IN CONTRACT OR TORT, INCLUDING NEGLIGENCE, STRICT LIABILITY, BREACH OF CONTRACT OR BREACH OF WARRANTY, AND INDEPENDENT

OF ANY FAILURE OF ESSENTIAL PURPOSE OF ANY LIMITED WARRANTY OR OTHER REMEDIES PROVIDED UNDER THIS AGREEMENT. EITHER PARTY’S

TOTAL CUMULATIVE LIABILITY UNDER THIS AGREEMENT FROM ANY AND ALL CAUSES OF ACTION AND UNDER ALL THEORIES OF LIABILITY SHALL NOT EXCEED

AN AMOUNT EQUAL TO THE FEES PAID BY, OR DUE FROM, CLIENT TO SERVICE PROVIDER PURSUANT TO THIS AGREEMENT. |

| |

|

|

| |

7. |

Indemnity.

|

| |

|

|

| |

7.1. |

Company

Indemnification Obligations. The Company shall indemnify, defend and hold Consultant and its officers, agents, directors, employees

and contractors (“Contractor Indemnified Parties”) harmless from and against any and all liabilities, losses,

damages, costs and expenses (including without limitation reasonable attorneys’ fees) related to any third party claim, suit,

action or proceeding (collectively, “Claims”) arising out of or resulting from (i) a violation by the Company

of any law, regulatory requirement, judgment, order or decree, or (ii) infringement or misappropriation of any kind by Consultant’s

use of any materials provided by the Company hereunder (“Company Materials”), except to the extent such Claim

is caused by any use, modification or alteration of such materials by or on behalf of Consultant in a manner not authorized under

this Agreement. |

| |

|

|

| |

7.2. |

Consultant

Indemnification Obligations. Consultant hereby agrees to defend, indemnify and hold the Company and its affiliates, successors,

assigns and its and their directors, officers, employees, and agents (“Company Indemnified Parties”) harmless from and

against any and all liabilities, losses, damages, deficiencies, actions, judgments, interest, awards, penalties, fines, costs and

expenses of whatever kind (including without limitation reasonable attorneys’ fees) related to any claim, suit, action or proceeding

arising out of or resulting from: (i) the negligence, willful misconduct or material breach of any obligation hereunder, (ii) breach

of any representation or warranty by Consultant in performing Services for the Company under this Agreement, or (iii) bodily injury,

death of any person, or damage to real or tangible personal property resulting from Consultant’s acts or omissions. |

| |

|

|

| |

7.3. |

The

Company may satisfy such indemnity (in whole or in part) by way of deduction from any payment due to Consultant. |

| |

8.1. |

Assignment.

The Parties’ rights and obligations under this Agreement will bind and inure to the benefit of their respective successors,

heirs, executors, administrators and permitted assigns. The Company may freely assign this Agreement, and Consultant expressly agrees

that any intellectual property rights licensed to the Company, including any rights to Background IP, are transferable to the Company’s

assignees without Consultant’s consent. Consultant will not assign this Agreement or Consultant’s rights or obligations

hereunder without the prior written consent of the Company. Any such purported assignment not in accordance with this Section 9.1

will be null and void and a material breach of this Agreement. |

| |

|

|

| |

8.2. |

No

Warranty. All Confidential Information is provided “AS IS,” without any warranty of any kind. |

| |

|

|

| |

8.3. |

Remedies.

In the event Consultant breaches or threatens to breach Section 2 of this Agreement, Consultant hereby acknowledges and agrees that

money damages would not afford an adequate remedy and that the Company shall be entitled to seek a temporary or permanent injunction

or other equitable relief restraining such breach or threatened breach from any court of competent jurisdiction without the necessity

of showing any actual damages, and without the necessity of posting any bond or other security. Any equitable relief shall be in

addition to, not in lieu of, legal remedies, monetary damages, or other available forms of relief. |

| |

|

|

| |

8.4. |

Governing

Law; Jurisdiction. The rights and obligations of the Parties under this Agreement will be governed in all respects by the laws

of Nevada without regard to conflict of law principles. Consultant agrees that, upon the Company’s request, all disputes arising

hereunder will be adjudicated solely in the state and federal courts having jurisdiction over disputes arising in Nevada and Company

and Consultant hereby agree to consent to the personal jurisdiction of such courts. |

| |

|

|

| |

8.5. |

Notices.

Any notices required or permitted hereunder will be given to the appropriate Party in writing and will be delivered by personal delivery,

electronic mail, facsimile transmission or by certified or registered mail, return receipt requested, and will be deemed given upon

personal delivery, three days after deposit in the mail, or upon acknowledgment of receipt of electronic transmission. Notices will

be sent to the addresses, electronic mail or facsimile information set forth at the end of this Agreement or such other address,

electronic mail or facsimile information as either Party may specify in writing. |

| |

8.6. |

Entire

Agreement. This Agreement and the Project Assignments included herein constitute the Parties’ final, exclusive and complete

understanding and agreement with respect to the subject matter hereof, and supersede all prior and contemporaneous understandings

and agreements relating to its subject matter. In the event of any conflict between this Agreement and any Project Assignment, this

Agreement will govern unless a statement in the Project Assignment expressly supersedes a term in this Agreement. If any term or

provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability

shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any

other jurisdiction. |

| |

|

|

| |

8.7. |

Waiver

and Modification. This Agreement may not be waived, modified or amended unless mutually agreed upon in writing by both Parties.

|

| |

|

|

| |

8.8. |

Severability.

In the event any provision of this Agreement is found to be legally unenforceable, such unenforceability will not prevent enforcement

of any other provision of this Agreement. |

| |

|

|

| |

8.9. |

Counterparts.

This Agreement may be executed in two or more counterparts by facsimile or other reliable electronic reproduction (including, without

limitation, transmission by pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com),

each of which will be considered an original, but all of which together will constitute one and the same instrument. |

[Signature

Page Follows]

Approved

by:

| YWRC

Holdings, INC. |

The

Crypto Company |

| By: |

By: |

| Name: |

Name:

|

| Title: |

Title:

|

| Date: |

Date: |

| Email: |

Email: |

| Address: |

Address: |

Exhibit 10.2

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

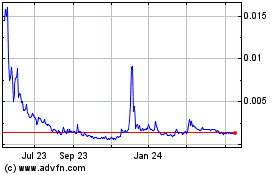

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Jan 2025 to Feb 2025

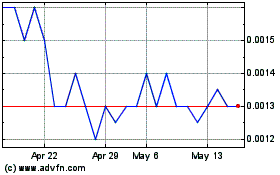

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Feb 2024 to Feb 2025