0001510964falseNovember 15, 2024 00015109642024-11-152024-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2024

CV SCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

000-54677 |

80-0944970 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

9530 Padgett Street, Suite 107 San Diego, California |

|

92126 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (866) 290-2157

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On November 15, 2024, CV Sciences, Inc. (the “Company”) entered into a definitive Stock Purchase Agreement (the “Purchase Agreement”) by and among the Company, Extract Labs, Inc., a Colorado corporation (“Extract Labs”), Craig Henderson (“Henderson”), and Higher Love Wellness Company, LLC (“HLWC” and together with Henderson, the “Sellers”), pursuant to which the Company will purchase all of the outstanding shares of Extract Labs from the Sellers (the “Acquisition”). Extract Labs is a leading manufacturer and distributor of premium cannabinoid products including gummies, topicals, and tinctures. The Acquisition is anticipated to close during the first quarter of 2025. Closing of the transaction is subject to customary conditions.

In consideration for the Acquisition, at closing, the Company (i) will make a cash payment of $400,000 to the Sellers, less a $20,000 holdback (the “Holdback Amount”), less certain assumed indebtedness and less certain transaction expenses, subject to certain other adjustments provided for in the Purchase Agreement (the “Closing Payment”), and (ii) will issue to the Sellers a number of shares of the Company's common stock with an aggregate value equal to $1,000,000 less certain assumed indebtedness, based on the trailing 60 day volume weighted average price (“VWAP”) of such common stock as of the trading day prior to the closing date (the “Closing Shares”) . The Closing Payment will be subject to adjustment, upward or downward, to the extent Extract Labs’ net working capital as of the closing is greater than or less than $880,000. Additionally, the Company shall be entitled to recover from the Sellers an amount equal to the unpaid balance of all accounts receivable that were included in the Extract Labs final working capital statement, to the extent they remain uncollected 90 days after the determination of the final working capital statement.

In addition to the consideration payable at closing, and as further consideration for the Acquisition, the Sellers shall be entitled to receive up to two additional earnout payments payable in shares of restricted common stock of the Company (the “Earnout Amount”). The Earnout Amounts shall be based on Extract Labs’ Net Revenue (as defined in the Purchase Agreement) generated during the 12-month period following the closing date (for the first calculation period) or 24-month period following the closing date (for the second calculation period) and will be calculated as follows:

•If Extract Labs’ Net Revenue is at least $4,600,000 in the relevant calculation period, then the Earnout Amount for such period will be $300,000.

•If Extract Labs’ Net Revenue is at least $4,300,000 but less than $4,600,000 in the relevant calculation period, then the Earnout Amount for such period will be $200,000.

•If Extract Labs’ Net Revenue is at least $4,000,000 but less than $4,300,000 in the relevant calculation period, then the Earnout Amount for such period will be $100,000.

•If Extract Labs’ Net Revenue is at least $3,500,000 but less than $4,000,000 in the relevant calculation period, then the Earnout Amount for such period will be $50,000.

•If Extract Labs’ Net Revenue is less than $3,500,000 in the relevant calculation period, then the Earnout Amount for such period will be $0.

The shares issuable for each earnout payment, if any, shall be issued within 10 business days after the final determination of Extract Labs’ Net Revenue for each 12-month period following the closing date, as determined in accordance with the Purchase Agreement. The number of restricted shares of common stock of the Company issuable for each earnout payment, shall be determined based upon the thirty-day VWAP of the Company's common stock as of the 12-month anniversary of the closing date (for the first calculation period) or 24-month anniversary of the closing date (for the second calculation period).

The Sellers agreed that they will not, on any single trading day sell, transfer or otherwise dispose of any shares of Company common stock, including the shares issuable at closing, in an aggregate amount exceeding the greater of (i) 15% of the of the Company’s common stock sold in the aggregate based on the greater of the current or proceeding trading day, and (ii) $3,000 in gross value.

Subject to certain limitations, the Sellers and the Company have agreed to indemnify each other for losses arising from certain breaches of the Purchase Agreement and certain other liabilities.

The Purchase Agreement contains customary termination rights for each of Extract Labs and the Company, including the right to terminate if the transactions contemplated by the Purchase Agreement have not been completed by January

15, 2025. In the Purchase Agreement, Extract Labs and the Company have made customary representations and warranties and have agreed to customary covenants relating to the Acquisition. From the date of the Purchase Agreement until the closing, Extract Labs is required to conduct its business in the ordinary course of business consistent with past practices and to comply with certain covenants regarding the operation of its business.

Additionally, for a period of up to three years following the closing date, Henderson shall be prohibited from engaging in certain competitive and/or solicitation activities within the United States, as more particularly set forth in the Purchase Agreement.

Extract Labs leases an approximately 28,450 square foot building (the “Building”) from 1399 Horizon LLC (“Horizon”), which is wholly-owned by Henderson. Extract Labs is the guarantor of approximately $4 million of indebtedness of Horizon that is secured by a deed of trust on the Building (the “Loan”). At the closing of the Acquisition, Extract Labs will enter into a new 3-year lease (with the option to extend for up to three years) with Horizon. Following the closing of the Acquisition, Henderson and Horizon will jointly and severally indemnify Extract Labs against liability under its guarantee of the Loan, and Henderson will pledge his membership interest in Horizon to Extract Labs as security for such indemnification obligations and Extract Labs’ guarantee of the Loan.

The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete, and is qualified in its entirety by reference to the complete text of such Purchase Agreement, a copy of which will be filed as an exhibit to the Company’s next periodic report.

Item 3.02 Unregistered Sales of Equity Securities

The information set forth in Item 1.01 of this Current Report on Form 8-K (this “Current Report”) regarding the issuance of the Closing Shares and the Earnout Amount is incorporated by reference into this Item 3.02.

The issuance of the shares of the Company’s common stock in connection with the Acquisition is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on exemptions from the registration requirements of the Securities Act in transactions not involved in a public offering pursuant to Section 4(a)(2) and/or Regulation D of the Securities Act.

Item 7.01 Regulation FD Disclosure

On November 21, 2024, the Company issued a press release announcing the Acquisition. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under Item 7.01 of this Current Report on Form 8-K (“Current Report”), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward Looking Statements

This Current Report, including Exhibit 99.1 attached hereto, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Current Report, including statements regarding the Purchase Agreement, the Acquisition, business strategy, and plans are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition, projections, assumptions and estimates of the Company’s future performance and the future performance of the markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Current Report are only predictions. These forward-looking statements speak only as of the date of this Current Report and are subject to a number of risks, uncertainties and assumptions. The events and circumstances reflected in such forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

CV SCIENCES, INC. |

|

|

|

|

Date: November 21, 2024 |

|

By: |

/s/ Joseph Dowling |

|

|

|

Joseph Dowling |

|

|

|

Chief Executive Officer |

CV Sciences, Inc. Enters Into Definitive Agreement to Acquire Extract Labs

San Diego, CA - November 21, 2024 (GLOBE NEWSWIRE) - CV Sciences, Inc. (OTCQB:CVSI) (the “Company”, “CV Sciences”, “our”, “us” or “we”), a preeminent consumer wellness company specializing in hemp extracts and other proven science-backed, natural ingredients and products, today announced that it has entered into a definitive agreement (the “Purchase Agreement”) to acquire Extract Labs, Inc. (“Extract Labs”), a leading manufacturer and distributor of premium cannabinoid products including gummies, topicals and tinctures. Extract Labs branded products are sold through a range of sales channels from B2B to B2C. Extract Labs has operational flexibility allowing low to large minimum order quantity (“MOQ”) production runs, allowing for efficient use of capital and the ability to increase speed to market for new product development. Extract Labs is GMP-certified and FDA-registered. The acquisition is expected to create the opportunity to increase our sales to current and new clients. In addition, we intend to in-source production of certain of our key products.

“We are thrilled that Extract Labs and its employees are joining CV Sciences as another milestone in our transition to a thriving health and wellness company. The acquisition synergies are expected to increase our revenue and customer base, allow us to leverage our key assets, optimize operations and processes, and drive long-term growth and shareholder value. Extract Labs is a stand-alone profitable business and our plan is to increase its existing revenue base and further leverage its existing capacity,” said Joseph Dowling, Chief Executive Officer of CV Sciences. “In addition, we are planning to in-source the manufacturing of select +PlusCBD™ branded products providing an opportunity for meaningful cost savings. Extract Labs manufacturing capability will provide us with greater control over our supply chain and accelerate our new product development cycle.”

The total consideration for the acquisition of Extract Labs payable at closing, consists of (i) a cash payment of $400,000 (the “Closing Payment”), less the amount of certain holdbacks and adjustments, and (ii) the issuance of shares of CV Sciences' common stock valued at $1,000,000 based on the sixty day volume weighted average price (“VWAP”) of CV Sciences' common stock.

In addition to the consideration payable at closing, and as further consideration for the acquisition, the Extract Labs sellers will be eligible to receive up to $600,000 of additional shares of CV Sciences’ common stock if Extract Labs satisfies certain revenue targets during the two 12-month periods following the closing date. Such shares will be issued based on the thirty day VWAP of CV Sciences’ common stock as of the end of each such 12-month period and will be calculated as follows:

•If Extract Labs’ Net Revenue is at least $4,600,000 in the relevant calculation period, then the Extract Labs Earnout Amount for such period will be $300,000.

•If Extract Labs’ Net Revenue is at least $4,300,000 but less than $4,600,000 in the relevant calculation period, then the Extract Labs Earnout Amount for such period will be $200,000.

•If Extract Labs’ Net Revenue is at least $4,000,000 but less than $4,300,000 in the relevant calculation period, then the Extract Labs Earnout Amount for such period will be $100,000.

•If Extract Labs’ Net Revenue is at least $3,500,000 but less than $4,000,000 in the relevant calculation period, then the Extract Labs Earnout Amount for such period will be $50,000.

•If Extract Labs’ Net Revenue is less than $3,500,000 in the relevant calculation period, then the Extract Labs Earnout Amount for such period will be $0.

The acquisition is expected to close during the first quarter of 2025. Closing of the transaction is subject to customary conditions precedent. On November 21, 2024, CV Sciences, Inc. filed a Current Report on Form 8-K which includes a description of the material terms of the transaction. Investors are encouraged to read such filing in its entirety.

About CV Sciences, Inc.

CV Sciences, Inc. (OTCQB:CVSI) is a consumer wellness company specializing in nutraceuticals and plant-based foods. The Company's hemp extracts and other proven, science-backed, natural ingredients and products are sold through a range of sales channels from B2B to B2C. The Company's +PlusCBD™ branded products are sold at select retail locations throughout the U.S. and are the top-selling brands of hemp extracts in the natural products market,

according to SPINS, the leading provider of syndicated data and insights for the natural, organic and specialty products industry. With a commitment to science, +PlusCBD™ product benefits in healthy people are supported by human clinical research data, in addition to three published clinical case studies available on PubMed.gov. +PlusCBD™ was the first hemp extract supplement brand to invest in the scientific evidence necessary to receive self-affirmed Generally Recognized as Safe (GRAS) status. The Company's Cultured FoodsTM brand provides a variety of 100% plant-based food products. Committed to crafting nutritious and flavorful alternatives, Cultured FoodsTM caters to individuals seeking vegan, gluten-free, or flexitarian options for a wholesome and satisfying culinary experience. In addition, the Company owns Elevated Softgels, a manufacturer of encapsulated softgels and tinctures for the supplement and nutrition industry. CV Sciences, Inc. has primary offices and facilities in San Diego, California, Grand Junction, Colorado, and Warsaw, Poland. The Company also operates a drug development program focused on developing and commercializing CBD-based novel therapeutics. Additional information is available from OTCMarkets.com or by visiting www.cvsciences.com.

Forward Looking Statements

This press release may contain certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and is subject to the Safe Harbor created by those sections. This material contains statements about expected future events and/or financial results that are forward-looking in nature and subject to risks and uncertainties. Such forward-looking statements by definition involve risk and uncertainties. CV Sciences does not undertake any obligation to publicly update any forward-looking statements, except as required by applicable law. As a result, investors should not place undue reliance on such forward-looking statements.

Contact Information

ir@cvsciences.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

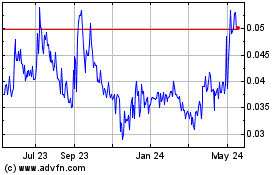

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Jan 2025 to Feb 2025

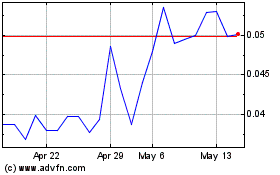

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Feb 2024 to Feb 2025