Vancouver, British Columbia, Canada -- June 8, 2023 --

InvestorsHub NewsWire -- Defiance Silver

Corp.(TSXV:

DEF) (OTCQX:

DNCVF) (FSE: D4E) (WKN: A1JQW5) ("Defiance" or

the "Company") is pleased to provide an update on

the recently completed drill program. Results from drill holes

DDSA-23-64, DDSA-23-65, DDSA-23-66 and 66A are reported in this

release. The Company is awaiting assay results from DDSA-23-67

through DDSA-23-72, an additional six drill holes.

Drilling encountered the highest-grade and widest-width

mineralization ever drilled at the San Acacio project. Drill hole

DDSA-23-66 returned the widest width drilled to

date: 41.83 m of 157.30 g/t Ag (from

225.60 m to 267.43 m) including 15.96 metres of 379.90

g/t Ag (from 251.47 m to 267.43 m). Within this

interval is a sub-interval grading 5510 g/t

Ag or 6014 g/t AgEq from

265.54 m to 265.80 m. The company is extremely encouraged by these

results, which validate the hypothesis that additional very

high-grade mineralization is present in the Veta Grande camp.

Chris Wright, Chairman & CEO, stated: "We are extremely

encouraged by the continued success of our drilling campaigns at

the San Acacio project. As a result of diligent targeting and

modeling work, leading to multiple successful phases of drilling,

our technical team has been able to further demonstrate the

continued potential to outline a large mineral system within the

historical San Acacio mine area on the Veta Grande vein system. We

look forward to reporting additional results as they become

available to the company."

Highlights:

-

DDSA-23-66 - Returned the widest width and highest

grade that the company has drilled to date at the Zacatecas

District project. Drilling returned an intercept

of 41.83 m (from 225.60 m to 267.43 m)

of 157.30 g/t Ag or 169 g/t

AgEq. This interval returned high-grade sub-intervals

including 15.96 m (from 251.47 m to

267.43 m) of 379.90 g/t

Ag or 407 g/t AgEq. Included in

this intercept is 3.43 m (from 251.47 m

to 254.90 m) of 653.38 g/t

Ag or 684 g/t

AgEq and 1.00 m (from

264.80 m to 265.80 m) of 2350 g/t

Ag or 2500 g/t AgEq with a

very high-grade sub-interval from 265.54 m to 265.80 m

of 5510 g/t Ag or 6014 g/t

AgEq. This hole encountered historical workings in

two locations (from 238.60 m to 240.00 m and 254.90 m to 260.30 m)

for which a zero value was applied to the composited results.

Additional drilling in this area is planned to follow up on these

exceptional results.

-

DDSA-23-66A - Intercepted 9.86 m of

98.52 g/t Ag (from 260.00 m to 269.86 m) or 116 g/t

AgEq, including an interval of 1.54

m of 467.40 g/t Ag (from

264.34 m to 265.88 m) or 529 g/t AgEq.

-

DDSA-23-64 - Encountered two significant zones of appreciable

silver grade: 4.80

m of 349.37 g/t Ag (from

236.72 m to 241.52 m) or 376 g/t

AgEq including 1.32

m of 1264 g/t Ag (from

239.07 m to 240.39 m) or 1358 g/t

AgEq and 3.21

mof 200.05 g/t Ag (from 256.22

m to 259.43 m) or 243 g/t AgEq.

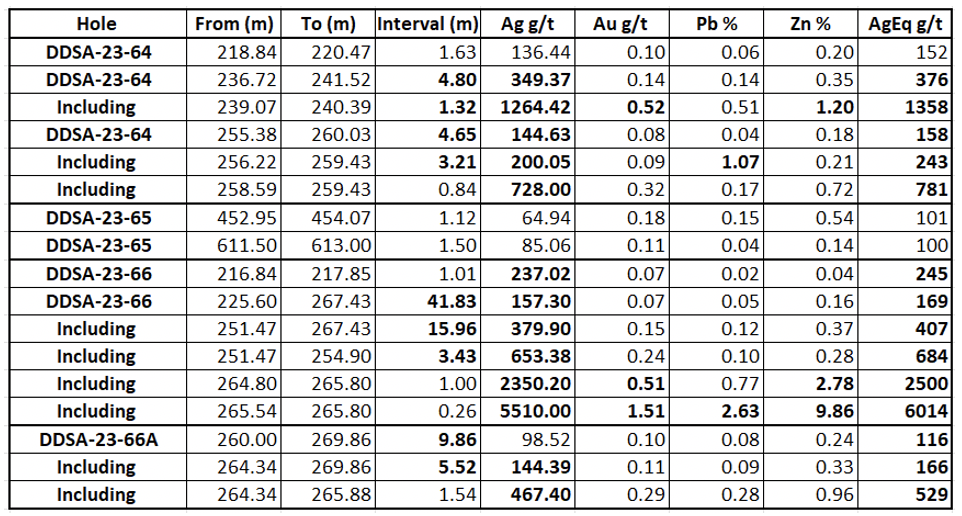

Select table of

results:

Table 1. Silver equivalent is calculated using the following

formula: Silver-Equivalent (AgEq) = [(Au_ppm x 64.18635)+(Ag_ppm x

0.784156)+(Pb_ppm x 20.94389)+(Zn_ppm x 24.69174)]/ 0.784156. Metal

price assumptions are Au: $1996.42, Ag: $24.39, Pb: $0.95, Zn:

$1.12. A 30-day metal price average is used to determine USD metal

prices, and 100% recovery has been assumed for all metals. At this

stage of the project, reliable metallurgy has yet to be completed,

and the reader is cautioned that 100% recoveries are never

achieved. True thickness is assumed to be 50%-80% of downhole

width.

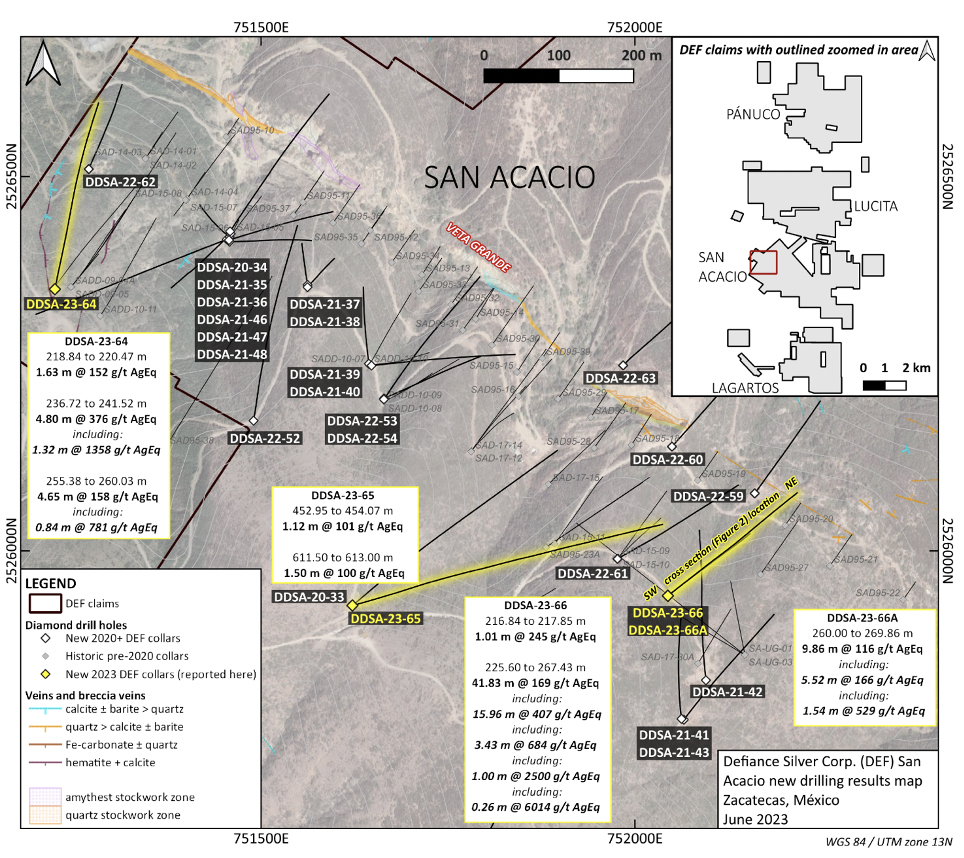

Plan Map of

Drilling at the San Acacio Project:

Figure 1. Plan map of drilling at

the San Acacio project. Holes reported in this release are shown in

yellow. Coordinates are in UTM WGS84 Zone 13N.

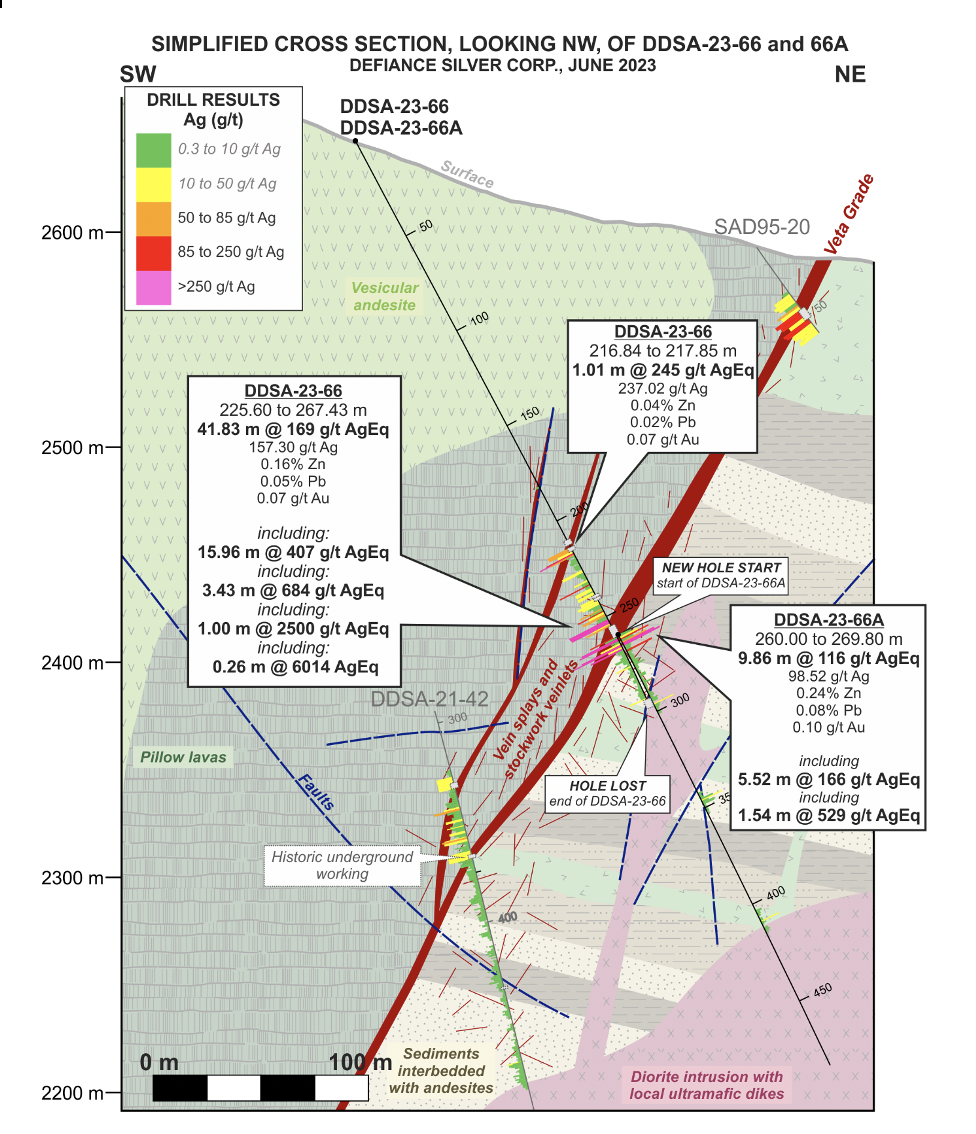

Cross Section of DDSA-23-66 and 66A:

Figure 2. Cross-section showing the

results of holes DDSA-23-66 and 66A.

Discussion of Results:

DDSA-23-64 was drilled near the northwest

boundary of the San Acacio property (Figure 1) to test and better

define hanging wall veinlet zones that typically contain high-grade

silver in this part of the property. Three hanging wall veinlet

zones with silver mineralization, including two with appreciable

width, were intersected in this hole. These intercepts and their

structural data will be used to constrain the mineralized hanging

wall zones for the upcoming resource update.

The upper zone from 218.84 m to 220.47 m returned 136.44 g/t Ag or

152 g/t AgEq, while the lower zones

intersected 4.80

m of 349.37 g/t Ag (from

236.72 m to 241.52 m) or 376 g/t

AgEq including 1.32

m of 1264 g/t Ag (from

239.07 m to 240.39 m) or 1358 g/t

AgEq and 3.21

m of 200.05 g/t Ag (from

256.22 m to 259.43 m) or 243 g/t

AgEq within a wider zone

of 4.65m of 144.63 g/t Ag

or 158 g/t AgEq (from 255.38 m to 260.03

m). The main Veta Grande structure was intersected at 392.54 m, and

while mineralized, contained lower grades than the hanging-wall

splays.

DDSA-23-65 was drilled in the central

zone of the San Acacio resource area and specifically targeted an

apparent high-grade hanging wall structure previously tagged in an

historical underground drill hole (Figure 1). Hole DDSA-23-65

intersected several splay zones, including 1.12

m at 101 g/t

AgEq from 452.95 m to 454.07 m.

Historical drilling appears to have drilled along a narrow splay

zone rather than perpendicular to the splay structure.

Additionally, the Veta Grande structure was encountered below these

splay zones, and intersected a zone of anomalous silver

including 1.50 m at 100 g/t

AgEq.

DDSA-23-66 was drilled in the eastern portion

of the San Acacio resource area near the zone with the deepest

known historical workings (Figures 1 and 2). This hole was designed

as an infill hole within the resource area and a structural hole to

increase the confidence of both the locations and grades of the

hanging wall splays and the Veta Grande structure in this zone.

High grades were encountered in both the hanging wall splays and in

the Veta Grande structure itself. This hole drilled the widest

mineralized interval and the highest silver grade to date in

historical and recent diamond drilling at San Acacio.

Several historical workings within the reported intervals were

encountered in this hole (from 238.60 m to 240.00 m and from 254.90

m to 260.30 m); regardless, the grades and widths intersected in

this hole support the hypothesis that significant mineralized

material and bonanza grades remain within the historical San

Acacio mine area. The reported interval includes 41.83

m (from 225.60 m to 267.43 m) of 157.30

g/t Ag or 169 g/t AgEq, and several sub-intervals, as

highlighted above, including 15.96

m (from 251.47 m to 267.43 m)

of 379.90 g/t Ag or 407 g/t

AgEq, and a very high-grade sub-interval from 265.54

m to 265.80 m of 5510 g/t Ag or 6014 g/t

AgEq. Metal values for the composited intervals that

include the empty historic workings were calculated using zero

grade for the downhole widths that returned no material. The hole

was lost in an old mine tunnel beneath the Veta Grande at 297.10 m

and re-entered as DDSA-23-66A.

DDSA-23-66A is the continuation of

DDSA-23-66, with core drilling started from 260 m down hole,

bypassing the working where DDSA-23-66 was lost. This hole

intersected a similar interval of the main Veta Grande structure

and high-grade footwall veinlets, with 9.86

m of 98.52 g/t Ag (from 260.00 m to 269.86 m)

or 116 g/t AgEq and includes an interval

of 1.54 m of 467.40 g/t Ag (from 264.34

m to 265.88 m) or 529 g/t AgEq.

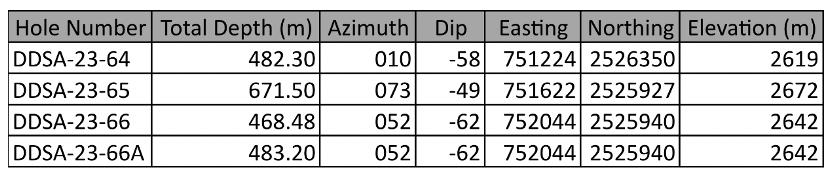

Collar Information for Reported Drill

Holes:

Table 2. Drill collar details. All coordinates in WGS84 UTM Zone

13N.

Discussion of QAQC and Analytical

Procedure:

Samples were selected based on the lithology, alteration, and

mineralization characteristics; sample size ranges from 0.25 – 2m

in width. All altered and mineralized intervals were sent for

assay. One blank, one standard, and one duplicate were included

within every twenty samples. Standard materials are certified

reference materials [CRMs] from OREAS and contain a range of Ag,

Au, Cu, Pb, and Zn values. Blanks, standards, and duplicates did

not detect any issues with the analytical results.

Samples were analyzed by ALS Chemex Laboratories. Sample

preparation was performed at the Zacatecas, Mexico, prep facility,

and analyses were performed at the Vancouver, Canada, analytical

facility. All elements except Au and Hg were analyzed by a

multi-element geochemistry method utilizing a four-acid digestion

followed by ICP-MS detection [ME-MS61m]; mercury was analyzed after

a separate aqua regia digest by ICP-MS. Overlimit assays for Ag,

Pb, and Zn were conducted using the OG62 method (multi-acid digest

with ICP-AES/AAS finish). Gold was measured by fire-assay with an

ICP-AES finish [50g sample, Au-ICP22].

About Defiance Silver Corp.

Defiance Silver Corp. (DEF | TSX Venture Exchange; DNCVF | OTCQX;

A1JQW5 | Frankfurt) is an exploration company advancing the

district-scale San Acacio Deposit, located in the historic

Zacatecas Silver District and the Tepal Gold/Copper Project in

Michoacán state, Mexico. Defiance is managed by a team of proven

mine developers with a track record of exploring, advancing, and

developing several operating mines and advanced resource projects.

Defiance’s corporate mandate is to expand the San Acacio and Tepal

projects to become premier Mexican silver and gold deposits.

Mr. George Cavey, P. Geo, is a Qualified Person within the meaning

of National Instrument 43-101 and has approved the technical

information concerning the Company’s material mineral properties

contained in this press release.

On behalf of Defiance Silver Corp.

“Chris Wright”

Chairman of the Board

For more information, please contact: Investor Relations at +1

(604) 343-4677 or via email at info@defiancesilver.com.

www.defiancesilver.com

Suite 2900-550 Burrard

Street

Vancouver, BC V6C 0A3

Canada

Tel: +1 (604) 343-4677

Email: info@defiancesilver.com

Disclaimer

Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution Regarding Forward-Looking

Information

Information contained in this news

release which are not statements of historical facts may be

“forward-looking information” for the purposes of Canadian

securities laws. Such forward-looking information

involves risks, uncertainties and other factors that could cause

actual results, performance, prospects, and opportunities to differ

materially from those expressed or implied by such forward looking

information. The words “believe”, “expect”,

“anticipate”, “contemplate”, “plan”, “intends”, “continue”,

“budget”, “estimate”, “may”, “will”, “schedule”, “understand” and

similar expressions identify forward-looking

information. These forward-looking statements relate to,

among other things: the Company’s expectations regarding the

ability of the Mining Bureau of Mexico City to reinstate ownership

of the concessions to the Company, cooperation with the Mining

Bureau relating to such reinstatement and the potential for any

successful solution resulting therefrom.

Forward-looking information is

necessarily based upon a number of estimates and

assumptions that, while considered reasonable by Defiance, are

inherently subject to significant technical, political, business,

economic and competitive uncertainties and contingencies. Known and

unknown factors could cause actual results to differ materially

from those projected in the forward-looking information. Factors

and assumptions that could cause actual results or events to differ

materially from current expectations include, among other things:

the inability of the Company to regain possession of its

concessions; political risks associated with the Company’s

operations in Mexico; the failure of the Mining Bureau in Mexico

City to take any coercive action to reinstate ownership of the

concessions to the Company; and the inability of the Company and

its subsidiaries to enforce their legal rights in certain

circumstances. For additional risk factors, please see the

Company’s most recently filed Management Discussions & Analysis

for its quarter ended March 31, 2021 available on SEDAR at

www.sedar.com.

There can be no assurances that

forward-looking information and statements will prove to be

accurate, as many factors and future events, both known and unknown

could cause actual results, performance or achievements to vary or

differ materially from the results, performance or achievements

that are or may be expressed or implied by such forward-looking

statements contained herein or incorporated by reference.

Accordingly, all such factors should be considered carefully when

making decisions with respect to Defiance, and prospective

investors should not place undue reliance on forward looking

information. Forward-looking information in this news release is

made as at the date hereof. The Company assumes no obligation to

update or revise forward-looking information to reflect changes in

assumptions, changes in circumstances or any other events affecting

such forward-looking information, except as required by applicable

law.

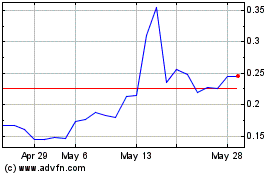

Defiance Silver (QX) (USOTC:DNCVF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Defiance Silver (QX) (USOTC:DNCVF)

Historical Stock Chart

From Feb 2024 to Feb 2025