GulfSlope Energy Awarded 21 Leases in Offshore Gulf of Mexico Sale 231

19 June 2014 - 10:00PM

Marketwired

GulfSlope Energy Awarded 21 Leases in Offshore Gulf of Mexico Sale

231

HOUSTON, TX--(Marketwired - Jun 19, 2014) - GulfSlope Energy

(OTCQB: GSPE) today announced that the Company has received notice

of award and has completed all requirements for 21 offshore lease

blocks for which it was the high bidder at offshore lease sale 231,

central Gulf of Mexico, conducted by the Bureau of Ocean Energy

Management (BOEM). With the conclusion of the lease award

process, the Company now controls 98,941 acres covering 17

prospects, previously identified by the Company. The blocks

are located on the outer shelf and upper slope of the offshore Gulf

of Mexico, in water depths of less than 1000′. The sum of the high

bids was $7,319,217 on the leases awarded to the Company.

The blocks awarded and the

corresponding bonus amounts paid are:

| |

|

|

|

Vermilion South Addition Block 375 |

|

$155,551 |

|

Vermilion South Addition Block 393 |

|

$155,511 |

|

Garden Banks Area Block 173 |

|

$808,808 |

| South

Marsh Island South Addition Block 183 |

|

$118,811 |

| South

Marsh Island South Addition Block 187 |

|

$808,808 |

|

Eugene Island South Addition Block 371 |

|

$155,551 |

|

Eugene Island South Addition Block 378 |

|

$404,404 |

|

Eugene Island South Addition Block 390 |

|

$404,404 |

|

Eugene Island South Addition Block 395 |

|

$155,511 |

|

Eugene Island South Addition Block 397 |

|

$404,404 |

| Ship

Shoal South Addition Block 328 |

|

$606,606 |

| Ship

Shoal South Addition Block 335 |

|

$155,551 |

| Ship

Shoal South Addition Block 336 |

|

$707,707 |

| Ship

Shoal South Addition Block 348 |

|

$155,511 |

| Ewing

Bank Area Block 870 |

|

$225,522 |

| Ewing

Bank Area Block 904 |

|

$

50,055 |

| Ewing

Bank Area Block 914 |

|

$225,522 |

| Ewing

Bank Area Block 948 |

|

$155,511 |

| Green

Canyon Area Block 4 |

|

$

50,055 |

| Green

Canyon Area Block 5 |

|

$606,606 |

| Grand

Isle South Addition 103 |

|

$808,808 |

| |

|

|

The BOEM rejected our apparent

high bid on Ship Shoal Area Block 282 and this block will not be

awarded.

John N. Seitz, Chairman and

CEO, stated that, "With these final lease block awards, GulfSlope

has amassed a significant and attractive prospect portfolio in a

portion of the Gulf of Mexico that our team understands quite

well. We invested over 14,000 technical man hours in

preparation for the lease sale, utilizing over 1 million acres of

3D seismic data reprocessed to cutting edge technologies. We

are very pleased with the outcome of our technical work and a

bidding strategy that resulted in our capture of 90% of what we

sought at the lease sale. The coming months will see us

complete our technical work and begin the process of planning for

an exploration drilling campaign that we expect to commence in

2015."

GulfSlope's internal estimate

of potential recoverable resources associated with the 21 awarded

blocks is approximately 2 billion BOE. We have contracted the

petroleum consulting firm of DeGolyer and MacNaughton to perform an

independent assessment of the potential recoverable resources and

expect to release the results at a later date.

Use of Non-GAAP Financial

Measures; Forward-looking statements

The information in this press release may contain

forward‐looking statements about the business, financial condition

and prospects of the Company. Forward-looking statements can be

identified by the use of forward-looking terminology such as

"believes," "projects," "expects," "may," "goal," "estimates,"

"should," "plans," "targets," "intends," "could," or "anticipates,"

or the negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy or objectives.

Forward-looking statements relate to anticipated or expected

events, activities, trends or results. Because forward-looking

statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties.

Forward-looking statements in the press release include, without

limitation, the Company's expectations of oil and oil equivalents,

barrels of oil and gas resources in an underexplored region and

other resource information. The SEC permits oil and gas companies,

in their filings with the SEC, to disclose only proved, probable

and possible reserves, i.e. Items 1201 through 1208 of

Regulations S-K ("SEC Oil and Gas Industry Disclosures"). The

estimates of recoverable resources used in the press release do not

comply with the SEC Oil and Gas Industry Disclosures, nor should it

be assumed that any recoverable resources will be classified as

proved, probable or possible reserves consistent with the SEC Oil

and Gas Industry Disclosures. Recoverable resources estimates

are undiscovered, highly speculative resources estimated where

geological and geophysical data suggest the potential for discovery

of petroleum but where the level of proof is insufficient for a

classification as reserves or contingent resources. In

addition, recoverable resources have a great amount of uncertainty

as to their existence, and economic and legal

feasibility. Although the Company believes that the

expectations reflected in forward-looking statements are

reasonable, there can be no assurances that such expectations will

prove to be accurate. Security holders are cautioned that such

forward-looking statements involve risks and uncertainties. The

forward-looking statements contained in the press release speak

only as of the date of the press release, and the Company expressly

disclaims any obligation or undertaking to report any updates or

revisions to any such statement to reflect any change in the

Company's expectations or any change in events, conditions or

circumstances on which any such statement is based. Certain factors

may cause results to differ materially from those anticipated by

some of the statements made in the press release. Please carefully

review our filings with the SEC as we have identified many risk

factors that impact our business plan. U.S. Investors are urged to

consider closely the disclosures in our Forms 10-K, 10-Q, 8-K and

other filings with the SEC, which can be electronically accessed

from our website or the SEC's website at http://www.sec.gov/.

Contact the company for enquires: Brady Rodgers Vice President

Brady.rodgers@gulfslope.com 281.918.4110

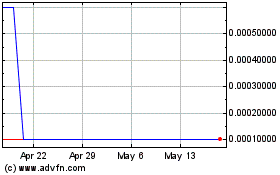

Gulfslope Energy (CE) (USOTC:GSPE)

Historical Stock Chart

From Mar 2025 to Apr 2025

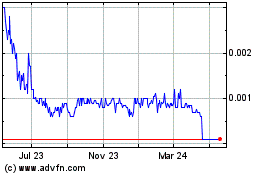

Gulfslope Energy (CE) (USOTC:GSPE)

Historical Stock Chart

From Apr 2024 to Apr 2025