UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

MGT Capital Investments, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

55302P202

(CUSIP Number)

Elias Fernandez Sanchez

102 NE 103rd Street

Miami, FL 33138

(646) 981-8999

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Various

(Date of Event Which Requires Filing of this

Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

Note: Schedules filed

in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 55302P202 |

13D |

Page 2 of 9 |

| 1 |

|

Name of Reporting Person

Minerset Farms Inc. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a): ☐ (b): ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

OO |

| 5 |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Item

2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

with

|

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

96,000,000 shares of Common Stock |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

96,000,000 shares of Common Stock |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

96,000,000 shares of Common Stock |

| 12 |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

Not Applicable |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

9.3% |

| 14 |

|

Type of Reporting Person

CO |

| CUSIP No. 55302P202 |

13D |

Page 3 of 9 |

| 1 |

|

Name of Reporting Person

Minerset International Ltd |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a): ☐ (b): ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

OO |

| 5 |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Item

2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

with |

|

7 |

|

Sole Voting Power

|

| |

8 |

|

Shared Voting Power

96,000,000 shares of Common Stock |

| |

9 |

|

Sole Dispositive Power

|

| |

10 |

|

Shared Dispositive Power

96,000,000 shares of Common Stock |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

96,000,000 shares of Common Stock |

| 12 |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

Not Applicable |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

9.3% |

| 14 |

|

Type of Reporting Person

HC |

| CUSIP No. 55302P202 |

13D |

Page 4 of 9 |

| 1 |

|

Name of Reporting Person

Kosmo Investments Pte. Ltd |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a): ☐ (b): ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

OO |

| 5 |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Item

2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Singapore |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

with |

|

7 |

|

Sole Voting Power

|

| |

8 |

|

Shared Voting Power

96,000,000 shares of Common Stock |

| |

9 |

|

Sole Dispositive Power

|

| |

10 |

|

Shared Dispositive Power

96,000,000 shares of Common Stock |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

96,000,000 shares of Common Stock |

| 12 |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

Not Applicable |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

9.3% |

| 14 |

|

Type of Reporting Person

HC |

| CUSIP No. 55302P202 |

13D |

Page 5 of 9 |

| 1 |

|

Name of Reporting Person

Elias Fernandez Sanchez |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a): ☐ (b): ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

OO |

| 5 |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Item

2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Spain |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

with

|

|

7 |

|

Sole Voting Power

|

| |

8 |

|

Shared Voting Power

96,000,000 shares of Common Stock |

| |

9 |

|

Sole Dispositive Power

|

| |

10 |

|

Shared Dispositive Power

96,000,000 shares of Common Stock |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

96,000,000 shares of Common Stock |

| 12 |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

Not Applicable |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

9.3% |

| 14 |

|

Type of Reporting Person

IN |

| CUSIP No. 55302P202 |

13D |

Page 6 of 9 |

Item 1. Security and Issuer.

This statement on Schedule

13D relates to the common stock, $0.001 par value per share (the “Common Stock”), of MGT Capital Investments, Inc.

(the “Issuer”). The address of the principal executive offices of the Issuer is 2076 Foster Mill Drive, LaFayette,

GA 30728.

Item 2. Identity and Background.

(a) This Schedule 13D is

being filed by Minerset Farms LLC (“Minerset Farms”), Minerset International Ltd (“International”),

Kosmo Investments Pte. Ltd. (“Kosmo”) and Elias Fernandez Sanchez (“Fernandez”, and together with

the foregoing persons and entities, collectively, the “Reporting Persons”) pursuant to their agreement

to the joint filing of this Schedule 13D, attached as an exhibit hereto (the “Joint Filing Agreement”).

As of the date of this statement,

Minerset Farms is the record owner of 96,000,000 shares of Common Stock. International, Kosmo and Fernandez directly (whether through

ownership interest or position) or indirectly may be deemed to control Minerset Farms, and may be deemed to have shared voting and investment

power with respect to the shares of Common Stock owned by Minerset Farms.

(b) The address of each of

the Reporting Persons is 102 NE 103rd Street, Miami, FL 33138.

(c) The name, business address,

present principal occupation or employment and citizenship of the directors, executive officers and control persons of the Reporting Person

is set forth on Schedule A hereto.

(d) None of the Reporting

Persons has been convicted in a criminal proceeding during the last five years.

(e) None of the Reporting

Persons has been party to any civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such

proceeding was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws, or finding any violation with respect to such laws during the last five years.

(f) Minerset Farms is formed

under the laws of Delaware; International is formed under the laws of the British Virgin Islands; Kosmo is formed under the laws of Singapore;

and Fernandez is a citizen of Spain.

Item 3. Source and Amount of Funds or Other

Consideration.

The Reporting Persons acquired

the shares of Common Stock held by the Reporting Persons in accordance with the terms of a Property Lease Agreement, dated March 16, 2023

(the “Lease”), Partnership Agreement dated March 16, 2023 (the “Partnership Agreement”), and Modifications

to Property Lease and Partnership Agreements, dated November 27, 2023 (the “Modification” and, together with the Lease

and the Partnership Agreement, the “Agreements”), to which Minerset Farms and the Issuer are parties. On April 30,

2024, the Issuer issued 54,000,000 shares of Common Stock to Minerset Farms pursuant to the terms of the Agreements.

Item 4. Purpose of Transaction.

The acquisition of Common

Stock of MGT Capital Investments, Inc.

The Reporting Persons acquired

the securities described in this Schedule 13D pursuant to the terms of the Agreements for investment purposes and intend to review such

investment in the Issuer on a continuing basis. Any actions the Reporting Persons might undertake may be made at any time and from time

to time without prior notice and will be dependent upon the Reporting Persons’ review of numerous factors, including, but not limited

to: an ongoing evaluation of the Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s

securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities;

and other future developments.

The Reporting Persons may

acquire additional securities of the Issuer, or retain or sell all or a portion of the securities then held, in the open market or in

privately negotiated transactions. In addition, the Reporting Persons may engage in discussions with management, the Issuer’s board

of directors, and stockholders of the Issuer and other relevant parties or encourage, cause or seek to cause the Issuer or such persons

to consider or explore extraordinary corporate transactions, such as: a merger, reorganization or take-private transaction that could

result in the de-listing or de-registration of the Common Stock; sales or acquisitions of assets or businesses; changes to the

capitalization or dividend policy of the Issuer; or other material changes to the Issuer’s business or corporate structure, including

changes in management or the composition of the Board.

Other than as described above,

the Reporting Persons do not currently have any plans or proposals that relate to, or would result in, any of the matters listed in Items

4(a)–(j) of Schedule 13D, although, depending on the factors discussed herein, the Reporting Persons may change their purpose or

formulate different plans or proposals with respect thereto at any time.

| CUSIP No. 55302P202 |

13D |

Page 7 of 9 |

Item 5. Interest in Securities of the Issuer.

The responses to this Item

5 and the information on the cover pages hereto are based on 1,037,170,903 shares of Common Stock outstanding, as described in the Issuer’s

Current Report on Form 8-K dated April 30, 2024.

The information set forth

in Items 2, 3 and 6 of this Schedule 13D and the cover pages of this Schedule 13D is hereby incorporated by reference into this Item 5.

(a) – (b)

As a result of the transactions

described in Item 4 of this Schedule 13D, the Reporting Persons have shared beneficial ownership of 96,000,000 shares of Common Stock,

which represents 9.3% beneficial ownership of the Issuer’s Common Stock.

| (c) | Except as described in Items 3 and 4, the Reporting Persons have not effected any transactions during

the past 60 days. |

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

Pursuant to the Partnership

Agreement, Issuer agreed to issue 500,000 shares of Common Stock monthly for each Space (as defined in the Lease) within 5 days of Rental

Payment (as defined in the Lease) pursuant to the Lease. At each one-year anniversary of the effective date of the Lease, the Company

shall issue additional shares equal to the total amount issued in the previous 12-month period. Holdings has the option to invest up to

One Million US Dollars ($1,000,000.00) into the Issuer in the form of a convertible note, convertible into Common Stock that equals 25%

of the pro-forma, post-issuance shares. The Agreements are filed as exhibits hereto, and the foregoing description is subject to the terms

of the Agreements.

Except as set forth herein,

the Reporting Persons do not have any contracts, arrangements, understandings or relationships (legal or otherwise) with any person with

respect to any securities of the Issuer, including, but not limited to, any contracts, arrangements, understandings or relationships concerning

the transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees

of profits, division of profits or losses, or the giving or withholding of proxies.

Item 7. Materials to be Filed as Exhibits

| CUSIP No. 55302P202 |

13D |

Page 8 of 9 |

SIGNATURES

After reasonable inquiry

and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this Schedule 13D is true,

complete and correct.

Date: May 30, 2024

| |

MINERSET FARMS INC. |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: President |

| |

|

| |

|

| |

Minerset International Ltd |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: CEO |

| |

|

| |

|

| |

Kosmo Investments Pte. Ltd |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: CEO |

| |

|

| |

|

| |

|

| |

S/ ELIAS FERNANDEZ SANCHEZ |

| |

Elias Fernandez Sanchez, individually |

| CUSIP No. 55302P202 |

13D |

Page 9 of 9 |

SCHEDULE A

Directors, Executive

Officers and Control Persons of the Reporting Person

| Name |

Position |

Citizenship |

Present Principal

Occupation |

Business Address |

| Elias Fernandez Sanchez |

Director and CEO of Minerset Farms, Inc., Minerset International Ltd and Kosmo Investments Pte. Ltd |

Spain |

CEO of Minerset Farms, Inc., Minerset International Ltd and Kosmo Investments Pte. Ltd |

102 NE 103rd Street, Miami, FL 33138 |

Exhibit

99.1

Joint Filing Agreement

This

will confirm the agreement by and among all the undersigned that the Statement on Schedule 13D filed on or about this date and any further

amendments thereto with respect to beneficial ownership by the undersigned of the Common Stock, par value $0.001 per share (the “Common

Stock”) of MGT Capital Investments, Inc., a Delaware corporation (the “Issuer”), and such other securities

of the Issuer and its affiliates that the undersigned may acquire or dispose of from time to time. This agreement is being filed on behalf

of each of the undersigned in accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934.

The

undersigned further agree that each party hereto is responsible for timely filing of such Statement on Schedule 13D and any further amendments

thereto, and for the completeness and accuracy of the information concerning such party contained therein, provided that no party is responsible

for the completeness and accuracy of the information concerning the other party, unless such party knows or has reason to believe that

such information is inaccurate. The undersigned further agree that this Agreement shall be included as an Exhibit to such joint filing.

This

agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument.

IN

WITNESS WHEREOF, the parties hereto have caused this Joint Filing Agreement to be duly executed as of the 30th day of May, 2024.

| |

MINERSET FARMS INC. |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: President |

| |

|

| |

|

| |

Minerset International Ltd |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: CEO |

| |

|

| |

|

| |

Kosmo Investments Pte. Ltd |

| |

|

| |

|

| |

By: /S/ ELIAS FERNANDEZ SANCHEZ |

| |

Name: Elias Fernandez Sanchez |

| |

Title: CEO |

| |

|

| |

|

| |

|

| |

/S/ ELIAS FERNANDEZ SANCHEZ |

| |

Elias Fernandez Sanchez, individually |

Exhibit

99.2

Partnership

Agreement

This

Partnership Agreement (this “Agreement”), dated March 16, 2023 (“Effective Date”), is entered into between MGT

Capital Investments, Inc., a Delaware corporation (the “Company”), and Minerset Holdings LLC, a Delaware limited liability

company (“Minerset”), and together with Company, the “Parties,” and each, a “Party.”

WHEREAS,

Company is interested in expanding its Bitcoin mining business by, among other things, increasing the utilization of its owned facility

in LaFayette, Georgia;

WHEREAS,

Minerset and/or an affiliated company has containers and miners ready for immediate deployment; and,

WHEREAS,

Both Parties desire to execute a lease agreement substantially in the form of Exhibit A attached (the “Lease”).

NOW,

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

1. Issuance

of common stock of the Company. In consideration of the performance by Tenant under the Lease agreement, Company shall issue to Minerset

500,000 shares of MGT Capital Investments, Inc. common stock monthly for each Space within 5 days of Rental Payment pursuant to the Lease.

At each one-year anniversary of the Effective Date of the Lease, the Company shall issue to Minerset additional shares equal to the total

amount issued in the previous 12-month period.

2. Minerset

capital investment. In consideration of the performance by the Landlord under the Lease, Minerset has the option to invest up to One

Million US Dollars ($1,000,000.00) into the Company in the form of a convertible note, convertible into Company common stock that equals

25% of the pro-forma, post-issuance shares. The convertible note will have warrant coverage and terms substantially similar to the Company’s

currently outstanding $1.5 million Convertible Note, as more fully described in the Company’s Form 8-K filed with the SEC on September

14, 2022. With the consent of the Company, the cash investment can be substituted all or partially with equipment and infrastructure

improvements to enable the Company to add 10 MW to its available electrical power capacity.

3.

Term and termination. This Agreement is effective as of the Effective Date for a period of twenty-four (24) months and shall terminate

simultaneously with the Lease.

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective

officers thereunto duly authorized.

| Minerset

Holdings LLC |

|

MGT

Capital Investments, Inc. |

| |

|

|

|

|

| By: |

|

|

By: |

|

| Name: |

|

|

Name: |

Robert

Ladd |

| Title: |

|

|

Title: |

President

and CEO |

| Email

for Notices: |

|

Email

for Notices: rladd@mgtci.com |

| Address: |

|

|

Address: |

150

Fayetteville Street, Suite 1110, |

| |

|

|

|

Raleigh,

NC 27601 |

Exhibit

99.3

Property

Lease Agreement

This

Property Lease Agreement (this “Agreement” or “Lease”), dated March 16, 2023 (“Effective Date”),

is entered into between MGT Capital Investments, Inc., a Delaware corporation (“Landlord”), and Minerset Farms Inc., a Delaware

corporation (“Tenant”), and together with Landlord, the “Parties,” and each, a “Party.”

WHEREAS,

Landlord is in the business of, among other things, mining Bitcoin and providing services to manage and operate bitcoin mining business

on behalf of the owners of bitcoin mining hardware;

WHEREAS,

Landlord owns a 6 acre property at 2076 Foster Mill Drive, LaFayette, GA 30728 suited for the purpose of mining Bitcoin and other cryptocurrencies,

complete with electrical and internet infrastructure (the “Property”);

WHEREAS,

Tenant desires to lease portions of the property to conduct Tenant’s cryptocurrency mining operations, which shall include, from

time to time, mining with Tenant’s equipment or the equipment of Tenant’s customers, or managing the equipment of third parties.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

| 1. | Lease

of Premises. Landlord, in consideration of the covenants and agreements to be performed by

Tenant, and upon the terms and conditions hereinafter stated, does hereby agree to rent and

lease unto Tenant, and Tenant does hereby rent and lease from Landlord, such usable space

on which Tenant may deploy a shipping container, not to exceed 40 feet in length and 8 feet

in height (each, a “Space”). Landlord agrees to provide a stable footing for

each Space, internet connectivity, running water, and access from a Landlord’s transformer

to the Tenant’s containers in a capacity not to exceed 1.0 MW of power load per Space.

The Property contains 10.0 MW of available power load with sufficient available capacity

to support the Tenant’s operations in all Spaces during the Term of the Lease. Tenant

will have 24/7 access to common facilities, such as security cameras, repair facility, restroom,

trash disposal, parking, and other similar areas within the Property, with the specific exclusion

of the IT room, unless authorized by Landlord. |

| 2. | Term

and Termination. This Lease is effective as of the Effective Date for a period of twenty-four

(24) months. During the Term, in the event of an escalation of the Electric Rate to more

than $0.065 per kWh, Tenant has a 30-day decision window (the “Window”) to determine

whether to keep operating or to cease mining. Rental Payments will be suspended during this

Window. |

| 3. | Rental

Payments. For each Space, Tenant agrees to pay $5,000 per month in advance (“Rent).

Rent shall commence as each Space is energized from the transformer. In addition, Tenant

shall remit to Landlord a refundable security deposit of $5,000 prior upon execution of this

Lease (“Security Deposit”). Security deposit shall be promptly refunded to the

Tenant at of the termination of this Lease, with adjustments for any amounts due to Landlord

under the Lease. This Lease will be binding on both parties for Eight (8) Spaces with exclusive

rights to 4 transformers, with an additional Two (2) Spaces available to Tenant under the

same terms and conditions of this lease. |

| 4. | Electricity

Payments. As further memorialized in Appendix A, Tenant agrees to pay, pre-pay, hedge, or

otherwise insulate Landlord from the economic risk of electricity consumed by the Tenant.

Any deposits required by the City of LaFayette or other entities will be satisfied by Tenant,

and Tenant will retain ownership rights of any such deposits. Tenant shall be solely responsible

for negotiating and paying its electricity usage charges, whether by direct payment to the

electricity provider or by pass-through payments to Landlord. In no event shall Landlord

be financially liable for electricity consumed by Tenant. Notwithstanding anything in this

Section 4, Failure by the Tenant to pay Electricity Payments will permit Landlord to shut

off electricity supply to the Tenant without notice. |

| 5. | Operating

Expenses. Landlord agrees to provide one site manager during business hours, in addition

to paying for fees relating to internet connectivity, water, landscaping and common area

maintenance. Landlord shall also pay for repairs needed to perform its services under this

lease. Tenant agrees it is responsible for all entry and exit moving expenses (including,

but not limited, to labor and materials to enable the electrical connection of Tenant containers,

and rental of heavy equipment such as forklifts and crane), as well as ongoing labor requirements

beyond the one site manager. Landlord will use best commercial efforts to locate local contractors

and equipment at Tenant’s request. |

| 6. | Service

Level Agreement. Unless requested by Tenant during a Window period, or otherwise required

for safety purposes, Landlord shall maintain 24/7 availability of its Property and services

provided to the Spaces, including electricity, water and internet connectivity. In the event

these services are unavailable to the Tenant for a period cumulatively totalling over 5 hours

in any month a pro-rata credit of the Rental Payment shall be given to Tenant. |

| 7. | Use

Rules. Landlord acknowledges and agrees that the Tenant shall have the right to use the Property

for conducting its cryptocurrency mining operations as well as for general administrative

and maintenance office space purposes. |

| (a) | Landlord

shall maintain in good order and repair, subject to normal wear and tear and subject to casualty

and condemnation, the Property and Spaces, and the Property’s parking facilities, the

public areas and the landscaped areas. Notwithstanding the foregoing obligation, the cost

of any repairs or maintenance to the foregoing necessitated by the intentional acts or negligence

of Tenant or agents, will be borne solely by Tenant. Landlord is not required to make any

repairs or improvements to the Property except structural repairs necessary for safety and

tenantability. |

| (b) | Tenant

covenants and agrees that it will take good care of the Property and Spaces and all alterations,

additions and improvements thereto and will keep and maintain the same in good condition

and repair, except for normal wear and tear. Tenant shall at once report, in writing, to

Landlord any defective or dangerous condition known to Tenant. To the fullest extent permitted

by law, Tenant hereby waives all rights to make repairs at the expense of Landlord or in

lieu thereof to vacate the Property as may be provided by any law, statute or ordinance now

or hereafter in effect. Landlord has no obligation and has made no promise to alter, remodel,

improve, repair, decorate or paint the Property or any part thereof, except as specifically

and expressly herein set forth. |

| 9. | Landlord’s

Right of Entry. It is expressly understood that Landlord will occupy the Property, and its

agents, employees and independent contractors will have the right to enter the Property at

any time. |

| 10. | Insurance.

Tenant shall procure at its expense and maintain throughout the Lease Term a policy or policies

of special form/all risk insurance insuring the full replacement cost of its furniture, fixtures,

equipment, supplies, and other property owned, leased, held or possessed by it and contained

in the Property, together with the excess value of the improvements and betterments to the

Property, and worker’s compensation insurance as required by applicable law. Tenant

shall also procure at its expense and maintain throughout the Lease Term a policy or policies

of commercial general liability insurance, insuring Tenant, Landlord and any other Person

designated by Landlord, against any and all liability for injury to or death of a person

or persons and for damage to property occasioned by or arising out of any construction work

being done on the Property, or arising out of the condition, use, or occupancy of the Property,

or in any way occasioned by or arising out of the activities of Tenant or any of Tenant’s

Agents in the Property, with the limits of such policy or policies to be in combined single

limits for both damage to property and personal injury and in amounts not less than One Million

Dollars ($1,000,000.00) for each occurrence and an aggregate of not less than Two Million

Dollars ($2,000,000.00). An umbrella policy can be used to satisfy this limit requirement.

Landlord shall procure at its expense and maintain throughout the Lease Term a policy or

policies of special form/all risk insurance insuring the full replacement cost of its furniture,

fixtures, equipment, supplies, and other property owned, leased, held or possessed by it

and contained in the Property together with the excess value of the improvements and betterments

to the Property, and worker’s compensation insurance as required by applicable law. |

| 11. | Representations

and Warranties of Tenant. Tenant hereby represents and warrants as of the date hereof to

Landlord as follows: |

| (a) | Organization;

Authority. Tenant is an entity duly incorporated or formed, validly existing and

in good standing under the laws of the jurisdiction of its incorporation or formation with

full right, corporate, partnership, limited liability company or similar power and authority

to enter into and to consummate the transactions contemplated by the Agreement and otherwise

to carry out its obligations hereunder and thereunder. The execution and delivery of the

Agreement and performance by Tenant have been duly authorized by Tenant. This Lease together

with any affiliated documents have been duly executed by Tenant and, when delivered by Tenant

in accordance with the terms hereof, will constitute the valid and legally binding obligation

of Tenant, enforceable against it in accordance with its terms, except: (i) as limited by

general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium

and other laws of general application affecting enforcement of creditors’ rights generally;

(ii) as limited by laws relating to the availability of specific performance, injunctive

relief or other equitable remedies; and (iii) insofar as indemnification and contribution

provisions may be limited by applicable law. |

| (b) | Experience

of Tenant. Tenant, either alone or together with its representatives or general partner,

has such knowledge, sophistication, and experience in business and financial matters so as

to be capable of evaluating the merits and risks of the prospective investment in this Agreement. |

| (c) | Certain

Transactions and Confidentiality. Other than consummating the transactions contemplated

hereunder, Tenant has not directly or indirectly, nor has any Person acting on behalf of

or pursuant to any understanding with Tenant, such as a managing member of Tenant, executed

any purchases or sales, including Short Sales, of the securities of Landlord during the period

commencing as of the time that Tenant first received a term sheet (written or oral) from

Landlord or any other Person representing Landlord setting forth the material terms of the

transactions contemplated hereunder and ending immediately prior to the execution hereof.

Tenant has maintained the confidentiality of all disclosures made to it in connection with

this transaction (including the existence and terms of this transaction). |

| 12. | Representations

and Warranties of Landlord. Landlord hereby makes the following representations and warranties

to Tenant as of the date hereof: |

| (a) | Organization,

Good Standing and Qualification. Landlord is a corporation duly organized, validly existing

and in good standing under the laws of the State of Delaware and has full corporate power

and authority to conduct its business. |

| (b) | Authorization;

Enforceability. Landlord has all corporate right, power and authority to enter into this

Agreement and to consummate the transactions contemplated hereby. All corporate action on

the part of Landlord, its directors and stockholders necessary for the authorization, execution,

delivery and performance of this Agreement by Landlord. This Agreement has been duly executed

and delivered by Landlord and constitutes a legal, valid and binding obligation of Landlord,

enforceable against Landlord in accordance with its terms, except: (i) as limited by general

equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and

other laws of general application affecting enforcement of creditors’ rights generally;

and, (ii) as limited by laws relating to the availability of specific performance, injunctive

relief or other equitable remedies. |

| (c) | Licenses.

Landlord and its subsidiaries have sufficient licenses, permits and other governmental

authorizations currently required for provision of the Services contemplated herein and are

in all material respects in compliance therewith. |

| (d) | Landlord

is not aware of any material defect on the Property that would affect the health and safety

of an ordinary person or any environmental hazard on or affecting the Property that would

affect the health or safety of an ordinary person. |

| (e) | Landlord

covenants that Tenant will enjoy possession and use of the leased premises free from material

interference. |

| 13. | Limitation

of Liability. |

| a. | IN

NO EVENT SHALL ANY PARTY BE LIABLE FOR ANY CONSEQUENTIAL, INDIRECT, INCIDENTAL, SPECIAL,

EXEMPLARY, PUNITIVE, OR ENHANCED DAMAGES, LOST PROFITS OR REVENUES OR DIMINUTION IN VALUE,

ARISING OUT OF, OR RELATING TO, OR IN CONNECTION WITH ANY BREACH OF THIS AGREEMENT, REGARDLESS

OF (A) WHETHER SUCH DAMAGES WERE FORESEEABLE, (B) WHETHER OR NOT SUCH PARTY WAS ADVISED OF

THE POSSIBILITY OF SUCH DAMAGES, (C) THE LEGAL OR EQUITABLE THEORY (CONTRACT, TORT OR OTHERWISE)

UPON WHICH THE CLAIM IS BASED, AND (D) THE FAILURE OF ANY AGREED OR OTHER REMEDY OF ITS ESSENTIAL

PURPOSE. |

| b. | IN

NO EVENT SHALL LANDLORD’S AGGREGATE LIABILITY ARISING OUT OF OR RELATED TO THIS AGREEMENT,

WHETHER ARISING OUT OF OR RELATED TO BREACH OF CONTRACT, TORT (INCLUDING NEGLIGENCE) OR OTHERWISE,

EXCEED THE AGGREGATE AMOUNTS PAID TO LANDLORD FOR THE SERVICES PROVIDED HEREUNDER. |

| 14. | Indemnification.

Each Party shall indemnify, defend and hold harmless the other Party and its officers, directors,

employees, agents, affiliates, successors and permitted assigns (collectively, “Indemnified

Party”) against any and all losses, damages, liabilities, deficiencies, claims, actions,

judgments, settlements, interest, awards, penalties, fines, costs, or expenses of whatever

kind, including reasonable attorneys’ fees, fees and the costs of enforcing any right

to indemnification under this Agreement, incurred by an Indemnified Party relating to any

claim of a third party arising out of or occurring in connection with the gross negligence

or wilful misconduct of either Party. Neither Party shall enter into any settlement without

the Indemnified Party’s prior written consent. |

| 15. | Entire

Agreement.

This Agreement, including and together with any related exhibits, schedules, attachments

and appendices, constitutes the sole and entire agreement of the Parties with respect to

the subject matter contained herein, and supersedes all prior and contemporaneous understandings,

agreements, representations and warranties, both written and oral, regarding such subject

matter. |

| 16. | Notices.

All notices, requests, consents, claims, demands, waivers and other communications under

this Agreement must be in writing and to the other Party at its email address or address

set forth on the signature page hereto (or to such other address that the receiving Party

may designate from time to time in accordance with this Section). Unless otherwise agreed

herein, all notices may be delivered by personal delivery, nationally recognized overnight

courier, certified or registered mail or email. Except as otherwise provided in this Agreement,

a notice is effective only (a) on receipt by the receiving Party, and (b) if the Party giving

the Notice has complied with the requirements of this Section. |

| 17. | Severability.

If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction,

such invalidity, illegality or unenforceability shall not affect any other term or provision

of this Agreement or invalidate or render unenforceable such term or provision in any other

jurisdiction. Upon a determination that any term or provision is invalid, illegal or unenforceable,

the Parties shall negotiate in good faith to modify this Agreement to effect the original

intent of the Parties as closely as possible in order that the transactions contemplated

hereby be consummated as originally contemplated to the greatest extent possible. |

| 18. | Amendments.

No amendment to or modification of or rescission, termination or discharge of this Agreement

is effective unless it is in writing and signed by each Party. |

| 19. | Waiver.

No waiver by any party of any of the provisions of this Agreement shall be effective unless

explicitly set forth in writing and signed by the Party so waiving. Except as otherwise set

forth in this Agreement, no failure to exercise, or delay in exercising, any rights, remedy,

power or privilege arising from this Agreement shall operate or be construed as a waiver

thereof, nor shall any single or partial exercise of any right, remedy, power or privilege

hereunder preclude any other or further exercise thereof or the exercise of any other right,

remedy, power or privilege. |

| 20. | Cumulative

Remedies.

All rights and remedies provided in this Agreement are cumulative and not exclusive, and

the exercise by either Party of any right or remedy does not preclude the exercise of any

other rights or remedies that may now or subsequently be available at law, in equity, by

statute, in any other agreement between the Parties or otherwise. |

| 21. | Assignment.

Tenant shall not assign, transfer, delegate or subcontract any of its rights or obligations

under this Agreement without the prior written consent of Landlord. Landlord may at any time

assign, transfer, delegate or subcontract any or all of its rights or obligations under this

Agreement subject to Tenant’s prior written consent, not to be unreasonably withheld.

Any purported assignment, transfer, delegation or subcontract in violation of this Section

shall be null and void. No assignment, transfer, delegation or subcontract shall relieve

Tenant of any of its obligations hereunder. |

| 22. | Successors

and Assigns.

This Agreement is binding on and inures to the benefit of the Parties to this Agreement and

their respective permitted successors and permitted assigns. |

| 23. | No

Third-Party Beneficiaries.

This Agreement benefits solely the Parties to this Agreement and their respective permitted

successors and assigns and nothing in this Agreement, express or implied, confers on any

other Person any legal or equitable right, benefit or remedy of any nature whatsoever under

or by reason of this Agreement. |

| 24. | Landlord

shall not, by virtue of this Lease, in any way or for any purpose, be deemed to be a partner

of Tenant in the conduct of Tenant’s business upon, within or from the Premises or

otherwise, or a joint venturer or a member of a joint enterprise with Tenant, and vice-versa.

. |

| 25. | Choice

of Law;

Venue.

This Agreement, including all exhibits, schedules, attachments and appendices attached to

this Agreement and thereto, and all matters arising out of or relating to this Agreement,

are governed by, and construed in accordance with, the laws of the State of Delaware, United

States of America, without regard to the conflict of laws provisions thereof to the extent

such principles or rules would require or permit the application of the laws of any jurisdiction

other than those of the State of Delaware. Each Party hereby irrevocably submits to the exclusive

jurisdiction of the state and federal courts sitting in the State of Delaware for the adjudication

of any dispute hereunder or in connection herewith or with any transaction contemplated hereby

or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit,

action or proceeding, any claim that it is not personally subject to the jurisdiction of

any such court, that such suit, action or proceeding is improper or is an inconvenient venue

for such proceeding. Each Party hereby irrevocably waives personal service of process and

consents to process being served in any such suit, action or proceeding by mailing a copy

thereof via registered or certified mail or overnight delivery (with evidence of delivery)

to such Party at the address in effect for notices to it under this Agreement and agrees

that such service shall constitute good and sufficient service of process and notice thereof.

Nothing contained herein shall be deemed to limit in any way any right to serve process in

any other manner permitted by law. If either Party shall commence an action, suit or proceeding

to enforce any provisions of this Agreement, the prevailing Party in such action, suit or

proceeding shall be reimbursed by the other Party for its reasonable attorneys’ fees

and other costs and expenses incurred in connection with the investigation, preparation and

prosecution of such action or proceeding unless the Parties have specific arrangement in

that regard in a settlement thereof. |

| 26. | Waiver

of Jury Trial.

Each Party acknowledges and agrees that any controversy that may arise under this Agreement,

including exhibits, schedules, attachments and appendices attached to this Agreement, is

likely to involve complicated and difficult issues and, therefore, each such Party irrevocably

and unconditionally waives any right it may have to a trial by jury in respect of any legal

action arising out of or relating to this Agreement, including any exhibits, schedules, attachments

or appendices attached to this Agreement, or the transactions contemplated hereby. |

| 27. | Counterparts.

This Agreement may be executed in counterparts, each of which is deemed an original, but

all of which together are deemed to be one and the same agreement. A signed copy of this

Agreement delivered by facsimile, email or other means of electronic transmission is deemed

to have the same legal effect as delivery of an original signed copy of this Agreement. |

| 28. | Force

Majeure.

Any delay or failure by either Party to perform its obligations under this Agreement will

be excused to the extent that the delay or failure was caused directly by an event beyond

such Party’s control, without such Party’s fault or negligence and that by its

nature could not have been foreseen by such Party or, if it could have been foreseen, was

unavoidable (which events may include natural disasters, embargoes, explosions, riots, wars,

acts of terrorism, strikes, labor stoppages or slowdowns or other industrial disturbances,

and shortage of adequate power or transportation facilities). |

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective

officers thereunto duly authorized.

| Tenant:

Minerset Farms Inc. |

|

Landlord:

MGT Capital Investments, Inc. |

| |

|

|

|

|

| By: |

|

|

By: |

|

| Name: |

|

|

Name: |

Robert

Ladd |

| Title: |

|

|

Title: |

President

and CEO |

| Email

for Notices: |

|

Email

for Notices: rladd@mgtci.com |

| Address: |

|

|

Address: |

150

Fayetteville Street, Suite 1110, |

| |

|

|

|

Raleigh,

NC 27601 |

[SIGNATURE

PAGE TO PROPERTY LEASE AGREEMENT]

ApPENDIX

A

(to

Property lease agreement dated march 16, 2023)

Pursuant

to Section 4 herein, Tenant agrees to pay, pre-pay, hedge, or otherwise insulate Landlord from the economic risk of electricity consumed

by the Tenant. Any deposits required by the City of LaFayette or other entities will be satisfied by Tenant, and Tenant will retain ownership

rights of any such deposits. Tenant shall be solely responsible for negotiating and paying its electricity usage charges, whether by

direct payment to the electricity provider or by pass-through payments to Landlord. In no event shall Landlord be financially liable

for electricity consumed by Tenant. Notwithstanding anything in this Section 4, Failure by the Tenant to pay Electricity Payments

will permit Landlord to shut off electricity supply to the Tenant without notice.

Landlord

acknowledges that any funds received from Tenant designated “Electricity Deposit” (“Deposit”) shall be promptly

remitted to Landlord’s Letter of Credit account in favor of the City of LaFayette held at Bank of LaFayette (the “Account”).

The

terms and conditions of any Deposit shall be governed by the terms of the Account, and generally require a written release by the City

of LaFayette to retake unencumbered ownership of the funds.

Landlord

further acknowledges that Deposit funds received from Tenant shall be offset on the Landlord’s books and records with a corresponding

liability owed to Tenant. Landlord shall take no actions to circumvent the intent that Deposit funds are the property of the Tenant.

It

is acknowledged by the Parties that the amount of Deposit required may vary from time to time, and the Tenant has responsibility for

timely action to reflect any changes.

It

is finally acknowledged by the Parties that on or about the Effective Date, Tenant has or will wire $228,913, reflecting the initial

Deposit negotiated between Tenant and the City of LaFayette for 5 MW of electrical usage. Landlord represents that the entire amount

has been deposited into the Account for the purposes herein.

Exhibit 99.4

MODIFICATIONS TO PROPERTY LEASE and PARTNERSHIP

AGREEMENTS

This MODIFICATIONS TO PROPERTY LEASE and

PARTNERSHIP AGREEMENTS (this “Modification”), dated November 27, 2023, is by and between MGT Capital Investments, Inc.,

a Delaware corporation (“Landlord”), Minerset Holdings LLC, a Delaware limited liability company

(“Minerset”), and Minerset Farms Inc., a Delaware corporation (“Tenant”), together the

“Parties,” and each, a “Party.”

WHEREAS, Landlord, Minerset,

and Tenant are Parties to that certain Property Lease Agreement, and that certain Partnership Agreement, each dated March 16, 2023, (the

“Lease” and the “Partnership Agreement,” respectively);

WHEREAS, it is agreed by all

Parties that as of the date herein, a total of eleven (11) Spaces and four and one-half (4.5) 2,500 KVA transformers owned by Landlord

are being occupied, exceeding the terms of the Lease;

WHEREAS, it is acknowledged

by all Parties that as of the date herein, Tenant would like to utilize all such capacity in the foregoing sentence for its cryptocurrency

mining operations (the “Excess”);

WHEREAS, it is acknowledged

by all Parties that on the date herein, Landlord executed the

Transfer and Closing Account and Letter of Credit Request with the Bank of LaFayette (the “Transfer Request”), attached

hereto as Appendix A.

WHEREAS, it is further acknowledged by both Parties

that Tenant has arranged to pay directly, and to guaranty such payment, its electricity consumption with the City of LaFayette; and,

WHEREAS, Landlord and Tenant desire to modify the Lease and Partnership

Agreement as set forth below.

NOW, THEREFORE, in consideration of the foregoing

and the mutual promises of the Parties, and other good and valuable consideration, the undersigned agree as follows:

| 1. | Tenant will be responsible for all costs required for using the Excess, with the sole exception that Landlord has provided concrete

(and/or iron rail) footings, internet connectivity and water connections for the three new Spaces. |

| 2. | Landlord will allow Tenant to place and occupy a 40-foot office trailer on property located between the IT Room and the Repair Facility

near the fence line, provided, however, that Tenant activities related to such trailer are conducted at the sole expense of Tenant, and

do not interfere with Landlord activities. |

| 3. | Tenant is responsible for the costs of bringing usable electricity to the Excess Spaces. Electricity available to Tenant shall be

restricted to a load of approximately 2.0 MW for Transformers 3 and 4, and 1.5 MW for Transformer 5. |

| 4. | Tenant warrants the work performed by its subcontractors, including but not limited to, electrical work, and agrees to pay to Landlord

costs of any repair or replacement of Landlord property caused by Tenant or its subcontractors. Without the effect of limiting the scope

of this Section 4, it is acknowledged by the Parties that the capacity expansions of Transformers 3 and 4 were effected without manufacturer-

recommended busbar extensions. |

| 5. | Tenant shall pay to Landlord $5,000.00 upon execution of this Modification as an addition to the Security Deposit already paid. |

| 6. | Tenant shall pay to Landlord $5,000.00 upon execution of this Modification as full payment for use of the Excess during the months

August 2023 through November 2023. |

| 7. | Tenant shall pay Landlord $45,000.00 in total monthly Rental Payments in advance beginning on December 1, 2023. |

| 8. | The following shall be incorporated at the end of Appendix A of the Lease: |

| a. | It is further acknowledged by the Parties that on or about November 16, 2023 Landlord has executed the Transfer Request, and Tenant

has received direct ownership of $251,737.47 from the Bank of LaFayette for the sole use of Tenant. Tenant will immediately wire $21,417.00

to Landlord, reflecting Landlord’s pro rata share of Transfer Request. |

| 9. | The Parties agree that all past references to Minerset shall be replaced with Tenant, and future references shall also refer to Tenant. |

| 10. | The Parties agree that Section 2 of the Partnership Agreement is not binding on either party. |

| 11. | Landlord agrees to continue the issuance to Tenant of 4,000,000 shares of MGTI monthly pursuant to the Partnership Agreement beginning

on December 1, 2023. |

| 12. | This Modification may be executed in counterparts (including by facsimile or pdf signature pages or other means of electronic transmission)

each of which shall be deemed an original but all of which together will constitute one and the same instrument. |

| 13. | All capitalized terms shall retain definitions in the Lease and Partnership Agreement. |

| 14. | All other terms in the Lease and Partnership Agreement remain unchanged. |

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties hereto have caused

this Modification to be duly executed as of the date first above written.

| |

MGT CAPITAL INVESTMENTS, INC. |

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

Robert Ladd |

|

| |

Title: |

President and CEO |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

MINERSET FARMS INC. |

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

Elias Fernandez |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

MINERSET HOLDINGS LLC |

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

Elias Fernandez |

|

| |

Title: |

Manager |

|

[Signature Page to Modification to Property Lease Agreement,

date November 27, 2023]

EXHIBIT A

Transfer and Closing Account and Letter of Credit Request

| Date: |

November 16, 2023 |

| |

|

| Account owner: |

MGT Capital Investments, Inc. |

| |

1862 Thesy Drive |

| |

Melbourne, FL 32940 |

| |

|

| Account Number: |

463034 |

| |

|

| Account Balance: |

$251,737.47 |

| |

|

| Financial Institution: |

The Bank of LaFayette |

| |

P.O. Box 1149 |

| |

LaFayette, GA 30728 |

| |

|

| Lender Contact: |

Julie Carter |

| |

jcarter@bankoflafayette.com |

| |

706.638.2520 |

I, Robert Ladd, authorize the Bank of LaFayette to issue an official

check for the remaining balance of MGT Capital’s above referenced account to Minerset Farm Inc. Please close the account referenced

above and Letter of Credit 1009380.

| |

|

|

|

| Robert Ladd, President MGT Capital Investments, Inc. |

|

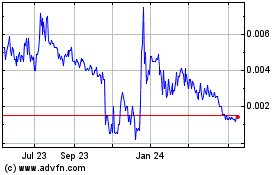

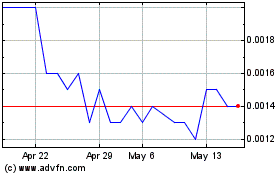

MGT Capital Investments (CE) (USOTC:MGTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

MGT Capital Investments (CE) (USOTC:MGTI)

Historical Stock Chart

From Feb 2024 to Feb 2025