false

0001122020

0001122020

2024-09-19

2024-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of earliest event reported: September 19, 2024

PCS

Edventures!, Inc.

(Exact

name of registrant as specified in its charter)

N/A

(Former

name or address, if changed since last report)

| Idaho |

|

000-49990 |

|

82-0475383 |

(State

or Other Jurisdiction

Of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

11915

W. Executive Drive, Suite 101

Boise,

Idaho 83713

(Address

of Principal Executive Offices, Including Zip Code)

(208)

343-3110

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter or Rule 12b-2 of the Securities and Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

References

In

this Current Report, references to “PCS Edventures!, Inc.,” “PCS,” the “Company,” “we,”

“our,” “us” and words of similar import, refer to PCS Edventures!, Inc., an Idaho corporation, which is the Registrant.

Forward-Looking

Statements

This

Current Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”); Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and the Private Securities

Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the following words: “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would,” or the negative of these terms or other comparable terminology, although

not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results

and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking

statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties

and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information

expressed or implied by the forward-looking statements in this Current Report. We cannot assure you that the forward-looking statements

in this Current Report will prove to be accurate, and therefore, prospective investors are encouraged not to place undue reliance on

forward-looking statements. You should carefully read this Current Report completely, and it should be read and considered with all other

reports or registration statements filed by us with the United States Securities and Exchange Commission (the “SEC”). Other

than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may

change in the future.

Cautionary

Statement

Summaries

of all agreements or other documents referenced herein or attached hereto and incorporated herein by reference or otherwise, do not purport

to be all inclusive of the terms, conditions and other provisions of such agreements or documents, and accordingly, all such summaries

are modified in their entirety to the referenced agreements or documents that accompany this Current Report in Section 9, Item 9.01 hereof.

Section

1 – Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement.

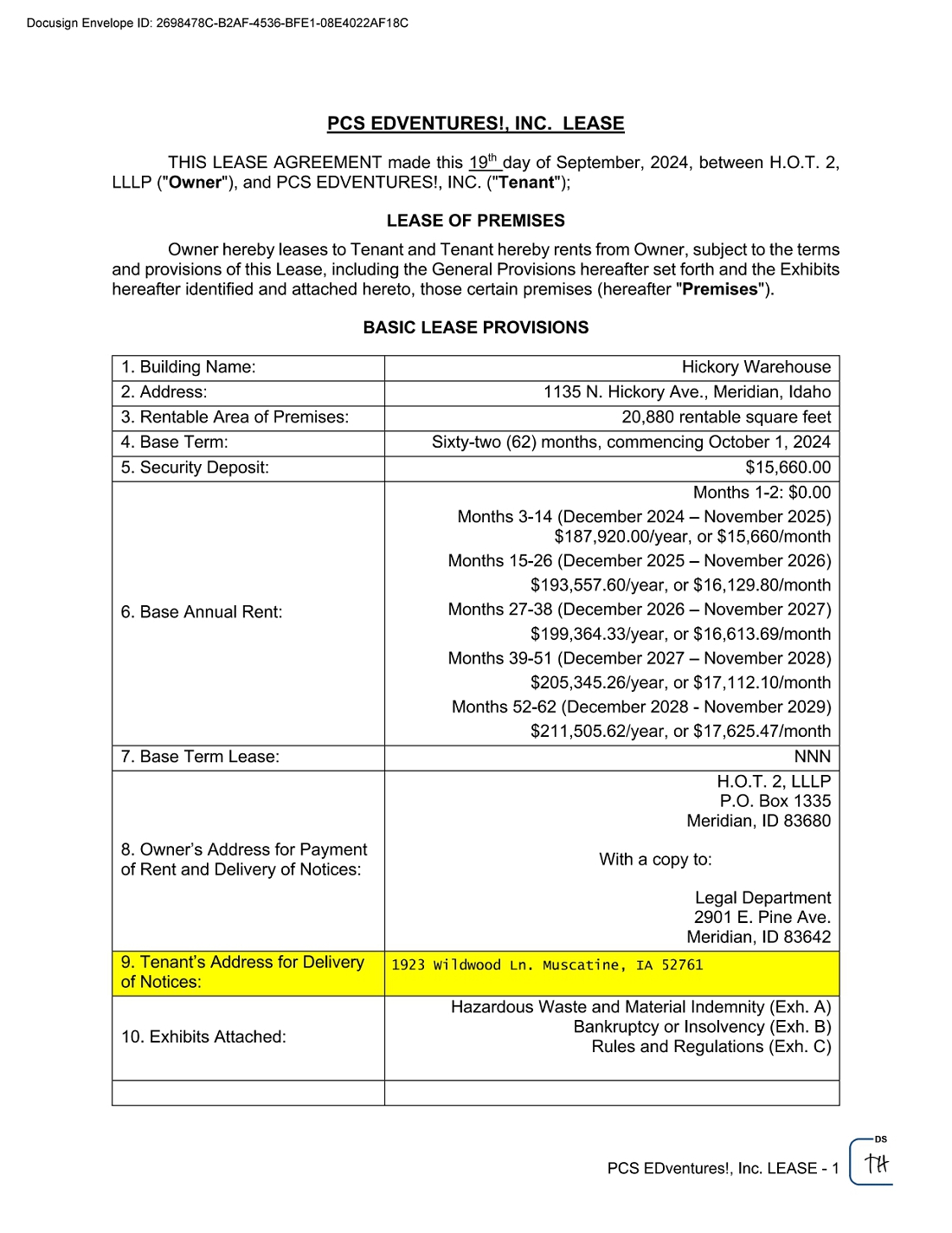

On

September 19, 2024, the Company entered into a sixty-two (62) month Lease Agreement of the “Premises” known as the “Hickory

Warehouse” (the “Lease Agreement”), which is located at 1135 N. Hickory Avenue, in Meridian, Idaho, and which Premises

are comprised of approximately 20,880 rentable square feet. The Lease Agreement is with H.O.T.2, LLLP (the “Owner”). A copy

of the Lease Agreement accompanies this Current Report and is incorporated herein by reference. See Section 9, Item 9.01 hereof.

The

new premises will house our Fulfillment, Research and Development, Quality Control and Photography and Video Creation operations. We

will ship from this location and receive raw materials into this location. We will also perform the kitting necessary to produce our

final products at this facility. We plan to lease a separate office facility to house our executive management, product development,

sales and marketing departments.

The

Lease Agreement provides that there is no charge to the Company for the first two (2) months of the lease term. The following are the

payments due under the remainder of the Lease Agreement: Months three (3) to fourteen (14), December 2024 to November 2025-$187,920 divided

into monthly payments of $15,660; Months fifteen (15) to twenty-six (26), December 2025 to November 26-$193,557.60 divided into monthly

payments of $16,129.80; Months twenty-seven (27) to thirty-eight (38), December 2026 to November 2027-$199,364.33 divided into monthly

payments of $16,613.69; Months thirty-nine (39) to fifty-one (51), December 2027 to November 2028-$ 205,345.26 divided into monthly payments

of $17,112.10; and Months fifty-two (52) to sixty-two (62), December 2028 to November 2029-$211,505.62 divided into monthly payments

of $17,625.47.

We

have an option to extend the Lease Agreement for two (2) additional five (5) year terms, with the yearly rent for each successive year

being one hundred and three percent (103%) of the rent for the preceding year, provided we give the Owner one hundred and eighty (180)

days written notice of our intention to extend the Lease Agreement; however, the Owner may reject the option to extend by giving us ninety

(90) days’ notice prior to the end of the initial lease term.

Under

the Lease Agreement, we: (i) are liable for our pro rata share of all operating expenses of the Premises; (ii) are entitled to use the

common areas in the building that comprises the leased facilities, along with the land common area surrounding the building, including

the parking areas; (iii) are responsible for all costs and expenses, including but not limited to property taxes and property insurance

attendant to the Premises; (iv) shall provide and maintain insurance with a carrier satisfactory to the Owner, which covers the Owner

and us, of comprehensive liability insurance of not less than $1,000,000 per person and per occurrence and property damage liability

insurance of not less than $1,000,000 per accident or occurrence, with a deductible of not more than $10,000; (v) shall be responsible

for all repair or replacement of any plate glass on the Premises; (vi) shall comply with the laws of the State of Idaho in the event

we install any above-ground or below-ground storage tanks for the storage of petroleum products; (vii) shall maintain the Premises in

good order and repair at our own expense; and (viii) shall indemnify and hold the Owner harmless for and against all actions, claims,

costs, damages or expense of any kind, including reasonable attorney’s fees, which may be brought against the Owner, or which the

Owner may incur by reason of our negligence or willful conduct or that of our employees, agents or others engaged by us.

The

Lease Agreement also contains various provisions regarding Alterations to the Premises; eminent domain; assignment and subletting; subordination

and financing; default and related remedies; surrender of the Premises; and various miscellaneous provisions on the Owner’s right

of entry, our quite enjoyment of the Premises, other tenants, confidentiality, no waiver of rights, notices, limitation of Owner’s

liability, holding over, attorney’s fees and costs, construction, succession, estoppel, warranty regarding our financial statements,

notice of ADA violations, severability, force majeure, no recording, article headings, modification and entire agreement. Reference is

made to the “Cautionary Statement” above and the Lease Agreement that accompanies this Current Report, and this summary is

modified in its entirety to such references.

Section

9 - Financial Statements and Exhibits.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

PCS

Edventures!, Inc. |

| |

|

|

| Date:

September 25, 2024 |

By: |

/s/

Michael Bledsoe |

| |

|

Michael

Bledsoe |

| |

|

President,

Director and Principal Financial Officer |

Exhibit

99

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

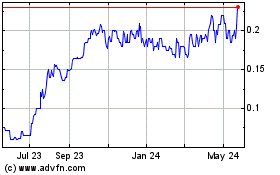

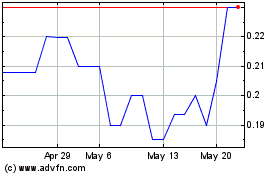

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Oct 2024 to Nov 2024

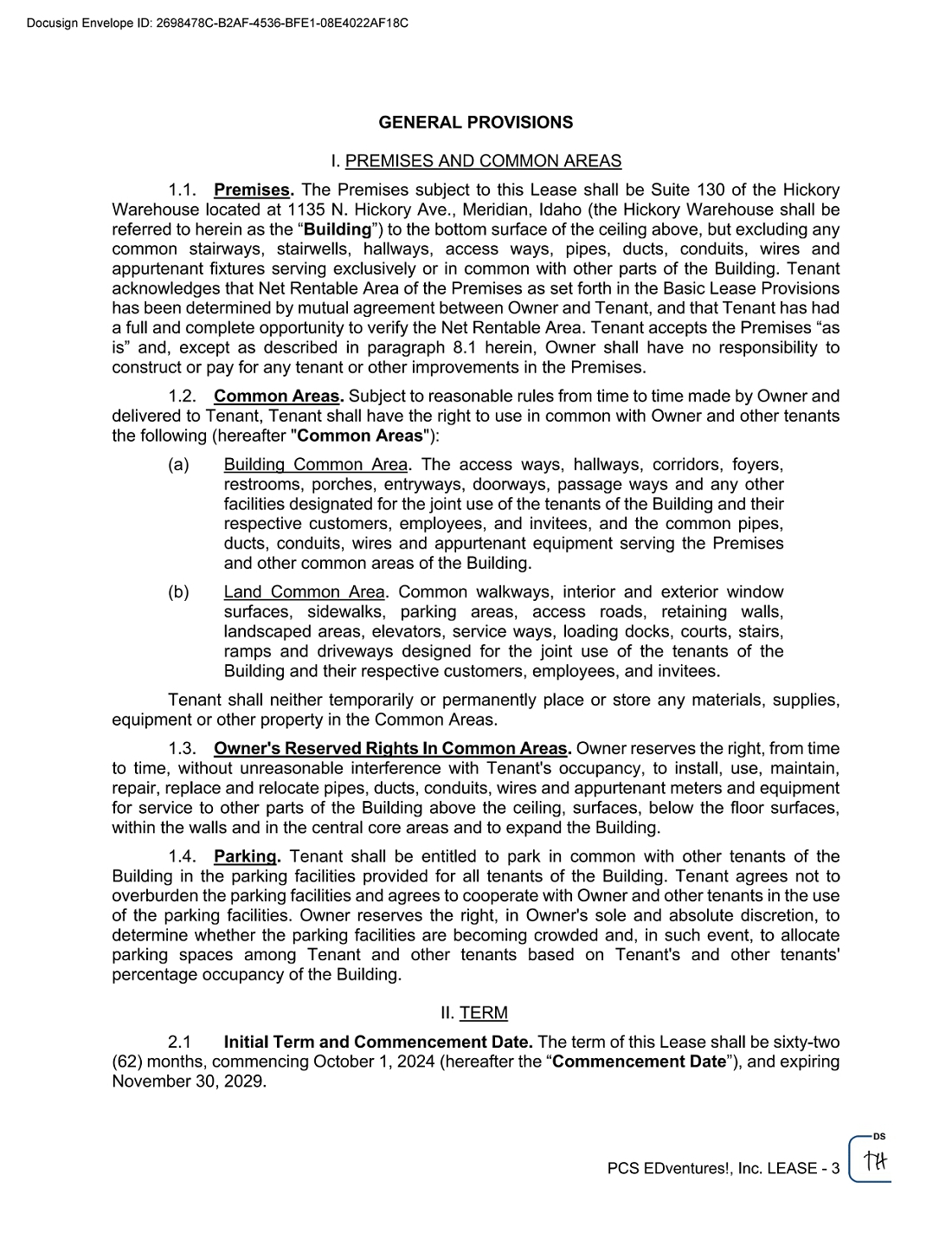

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Nov 2023 to Nov 2024