false

--03-31

2025

Q1

0001122020

0001122020

2024-04-01

2024-06-30

0001122020

2024-08-14

0001122020

2024-06-30

0001122020

2024-03-31

0001122020

2023-04-01

2023-06-30

0001122020

us-gaap:CommonStockMember

2023-03-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001122020

us-gaap:RetainedEarningsMember

2023-03-31

0001122020

2023-03-31

0001122020

us-gaap:CommonStockMember

2024-03-31

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001122020

us-gaap:RetainedEarningsMember

2024-03-31

0001122020

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001122020

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001122020

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001122020

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001122020

us-gaap:CommonStockMember

2023-06-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001122020

us-gaap:RetainedEarningsMember

2023-06-30

0001122020

2023-06-30

0001122020

us-gaap:CommonStockMember

2024-06-30

0001122020

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001122020

us-gaap:RetainedEarningsMember

2024-06-30

0001122020

PCSV:MichelleFisherMember

2023-03-17

2023-03-17

0001122020

PCSV:MichelleFisherMember

2023-03-17

0001122020

PCSV:MichelleFisherMember

2024-05-07

2024-05-07

0001122020

PCSV:MichelleFisherMember

2024-05-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2024

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from________ to________

Commission

File No. 000-49990

PCS

EDVENTURES!, INC.

(Exact

name of Registrant as specified in its charter)

| Idaho |

|

82-0475383 |

| (State

or Other Jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

11915

West Executive Drive, Suite 101

Boise,

Idaho 83713

(Address

of Principal Executive Offices)

(208)

343-3110

(Registrant’s

telephone number, including area code)

N/A

(Former

name, former address and former fiscal year,

if

changed since last report)

Indicate

by check mark whether the Registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

| |

|

|

|

| Emerging growth company ☐ |

|

|

|

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate

by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not

applicable.

APPLICABLE

ONLY TO CORPORATE ISSUERS

Indicate

the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date:

August

14, 2024: 124,483,494 shares of Common Stock

Forward-Looking

Statements

This

Quarterly Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In

some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking

statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or

by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the

statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity,

performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in

this Quarterly Report. We cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate, and

therefore, prospective investors are encouraged not to place undue reliance on forward-looking statements. You should carefully read

this Quarterly Report completely, and it should be read and considered with all other reports filed by us with the United States Securities

and Exchange Commission (the “SEC”) that are contained in the SEC Edgar Archives. Other than as required by law, we undertake

no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

Documents

Incorporated by Reference

See

Part II, Other Information, Item 6, Exhibits.

PCS

EDVENTURES!, Inc.

FORM

10-Q

FOR

THE QUARTERLY PERIOD ENDED JUNE 30, 2024

INDEX

PART

I –FINANCIAL INFORMATION

PART

I – FINANCIAL INFORMATION

Item

1. Condensed Financial Statements

The

Condensed Financial Statements of the Registrant required to be filed with this 10-Q Quarterly Report were prepared by management and

commence below, together with related notes. In the opinion of management, the Condensed Financial Statements fairly present the financial

condition of the Registrant.

(This

space intentionally left blank.)

PCS

EDVENTURES!, INC.

Condensed

Balance Sheets

| | |

June 30, 2024 (Unaudited) | | |

March 31, 2024 (Audited) | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 2,652,716 | | |

$ | 1,329,708 | |

| Accounts receivable, net of allowance for doubtful accounts of $34,204 | |

| 1,598,556 | | |

| 1,675,859 | |

| Prepaid expenses | |

| 490,852 | | |

| 394,091 | |

| Inventory, net | |

| 2,040,338 | | |

| 2,025,483 | |

| Total Current Assets | |

| 6,782,462 | | |

| 5,425,141 | |

| | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Lease Right-of-Use Asset | |

| 245,557 | | |

| 273,905 | |

| Deposits | |

| 6,300 | | |

| 6,300 | |

| Property and equipment, net | |

| 69,211 | | |

| 43,739 | |

| Deferred tax asset | |

| 2,541,259 | | |

| 2,541,259 | |

| Total Noncurrent Assets | |

| 2,862,327 | | |

| 2,865,203 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 9,644,789 | | |

$ | 8,290,344 | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 219,332 | | |

$ | 100,853 | |

| Payroll liabilities and accrued expenses | |

| 282,553 | | |

| 229,970 | |

| Deferred revenue | |

| 82,870 | | |

| 14,549 | |

| Lease Liability, current portion | |

| 63,321 | | |

| 70,782 | |

| Total Current Liabilities | |

| 648,076 | | |

| 416,154 | |

| | |

| | | |

| | |

| Lease Liability, net of current portion | |

| 196,205 | | |

| 218,373 | |

| Total Noncurrent Liabilities | |

| 196,205 | | |

| 218,373 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 844,281 | | |

| 634,527 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| Preferred stock, no par value, 20,000,000 authorized shares, no shares issued and outstanding | |

| - | | |

| - | |

| Common stock, no par value, 150,000,000 authorized shares, 124,733,494 and 124,733,494 shares issued and outstanding | |

| - | | |

| - | |

| Additional Paid-in Capital | |

| 40,570,459 | | |

| 40,570,459 | |

| Accumulated deficit | |

| (31,769,951 | ) | |

| (32,914,642 | ) |

| Total Stockholders’ Equity | |

| 8,800,508 | | |

| 7,655,817 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 9,644,789 | | |

$ | 8,290,344 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS EDVENTURES!, INC.

Condensed

Statements of Operations (unaudited)

| | |

2024 | | |

2023 | |

| | |

For the three months ended June 30, | |

| | |

2024 | | |

2023 | |

| REVENUE | |

$ | 3,159,923 | | |

$ | 2,605,281 | |

| | |

| | | |

| | |

| COST OF SALES | |

| 1,198,435 | | |

| 1,004,070 | |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 1,961,488 | | |

| 1,601,211 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Salaries and wages | |

| 518,287 | | |

| 446,276 | |

| General and administrative expenses | |

| 320,019 | | |

| 294,834 | |

| Total Operating Expenses | |

| 838,306 | | |

| 741,110 | |

| OPERATING INCOME | |

| 1,123,182 | | |

| 860,101 | |

| | |

| | | |

| | |

| OTHER INCOME | |

| | | |

| | |

| Interest income | |

| 21,509 | | |

| 277 | |

| Net Other Income | |

| 21,509 | | |

| 277 | |

| | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | |

| NET INCOME | |

$ | 1,144,691 | | |

$ | 860,378 | |

| | |

| | | |

| | |

| Net Income per common share: | |

| | | |

| | |

| Basic | |

$ | 0.01 | | |

$ | 0.01 | |

| Fully Diluted | |

$ | 0.01 | | |

$ | 0.01 | |

| | |

| | | |

| | |

| Weighted Average number of shares outstanding | |

| | | |

| | |

| Basic | |

| 124,733,494 | | |

| 125,732,479 | |

| Fully diluted | |

| 124,733,494 | | |

| 125,732,479 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Condensed

Statement of Stockholders’ Equity

(Unaudited)

| | |

# of

Common Shares O/S | | |

Common Stock | | |

Additional Paid-in Capital | | |

Accumulated Deficit | | |

Stockholders’ Equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at 3/31/2023 | |

| 125,732,479 | | |

| - | | |

$ | 40,635,392 | | |

($ | 37,355,830 | ) | |

$ | 3,279,562 | |

| Net Income | |

| - | | |

| - | | |

| - | | |

$ | 860,378 | | |

$ | 860,378 | |

| Balance at 6/30/2023 | |

| 125,732,479 | | |

| - | | |

$ | 40,635,392 | | |

($ | 36,495,452 | ) | |

$ | 4,139,940 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at 3/31/2024 | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

($ | 32,914,642 | ) | |

$ | 7,655,817 | |

| Balance | |

| 124,733,494 | | |

| - | | |

$ | 40,570,459 | | |

($ | 32,914,642 | ) | |

$ | 7,655,817 | |

| Net Income | |

| - | | |

| - | | |

| - | | |

$ | 1,144,691 | | |

| 1,144,691 | |

| Balance at 6/30/2024 | |

| 124,733,494 | | |

| | | |

$ | 40,570,459 | | |

($ | 31,769,951 | ) | |

$ | 8,800,508 | |

| Balance | |

| 124,733,494 | | |

| | | |

$ | 40,570,459 | | |

($ | 31,769,951 | ) | |

$ | 8,800,508 | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Condensed

Statements of Cash Flows

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

For the three months ended June 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net Income | |

$ | 1,144,691 | | |

| 860,378 | |

| Depreciation and amortization | |

| 4,360 | | |

| 2,367 | |

| Amortization of right of use asset | |

| 28,348 | | |

| 24,803 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| (Increase) decrease in accounts receivable | |

| 77,303 | | |

| (553,329 | ) |

| (Increase) decrease in prepaid expenses | |

| (96,761 | ) | |

| (341,901 | ) |

| (Increase) decrease in inventories | |

| (14,855 | ) | |

| 154,653 | |

| (Increase) decrease in other current assets | |

| - | | |

| (3 | ) |

| (Decrease) increase in accounts payable and accrued liabilities | |

| 171,062 | | |

| 133,014 | |

| Increase (decrease) in lease liability | |

| (29,629 | ) | |

| (24,802 | ) |

| Increase (decrease) in unearned revenue | |

| 68,321 | | |

| 354,032 | |

| Net Cash Provided by Operating Activities | |

| 1,352,840 | | |

| 609,212 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Cash paid for purchase of fixed assets | |

| (29,832 | ) | |

| (7,687 | ) |

| Net Cash Used by Investing Activities | |

| (29,832 | ) | |

| (7,687 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| - | | |

| - | |

| Net Cash Used by Financing Activities | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net Increase (Decrease) in Cash | |

| 1,323,008 | | |

| 601,525 | |

| Cash at Beginning of Period | |

| 1,329,708 | | |

| 442,657 | |

| Cash at End of Period | |

| 2,652,716 | | |

| 1,044,182 | |

| | |

| | | |

| | |

| Cash paid for taxes | |

$ | 10,963 | | |

$ | 2,696 | |

| Cash paid for interest | |

$ | - | | |

$ | - | |

The

accompanying notes are an integral part of these condensed financial statements.

PCS

EDVENTURES!, INC.

Notes

to the Condensed Financial Statements

June

30, 2024

(Unaudited)

NOTE

1 - DESCRIPTION OF BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Description

of Business

The

condensed financial statements presented are those of PCS Edventures!, Inc., an Idaho corporation (the “Company,” “PCS,”

“PCSV,” “we,” “our,” “us” or similar words), incorporated in 1994, in the State of Idaho.

PCS specializes in experiential, hands-on, K12 education and drone technology. PCS has extensive experience and intellectual property

(“IP”) that includes drone hardware, product designs, and K-12 curriculum content. PCS continually develops new educational

products based upon market needs that the Company identifies through its sales and customer networks.

Our

products facilitate STEM (Science, Technology, Engineering, and Math) education by providing engaging activities that demonstrate STEM

concepts and inspire further STEM studies, with the goal of ultimately leading students to pursue STEM career pathways. Due to our exceptionally

detailed curriculum, our products are easy to teach and do not require a teaching degree or experience to administer.

Our

educational products are developed from both in-house efforts and contracted services. They are marketed through reseller channels, direct

sales efforts, partner networks, and web-based channels.

PCS

has developed and sells a variety of STEM education products into the K12 market, which can be categorized as follows:

These

camps are for the informal learning market and are designed to be highly engaging for students while easily administered by the instructor.

The Company offers approximately thirty (30) different enrichment programs and typically develops at least two (2) new programs each

year. Some of the more popular programs include Rockin’ Robots; Build a Better World; Summer Camp Classics; Pirate Camp; Flight

and Aerodynamics; Science of the Human Body; and Claymation.

| |

2. |

Discover

Series Products |

These

products are designed for the makerspace environment and include engaging STEM activities that motivate students to pursue educational

pathways toward STEM careers. The Discover Series includes Discover Engineering; Discover Robotics & Physics; Discover Robotics

& Programming; and Discover STEM.

These

products are designed for the grade school market and use the Company’s proprietary bricks (which are Lego compatible) and curriculum

to engage students to explore, imagine, and create within a STEM education framework. The Company offers a variety of grade-specific

BrickLAB products.

| |

4. |

Discover

Drones, Add-on Drone Packages and Ala Carte Drone Items |

These

products are designed around using drones as a platform for STEM education and career exploration. These titles include the Discover

Drones series of Products; Discover Drones Indoor Coding Bundle; Discover Drones Indoor Racing Add-On; Discover Drones Outdoor Practice

Add-on; and all the spare parts and ala carte drone items offered in the Company’s comprehensive drone packages.

| |

5. |

STEAMventures

BUILD Activity Book |

These

series of activity books are designed for the K-3 market and ideal for a distance-learning environment. The series includes twelve (12)

different issues. Instructor guides and/or family engagement guides are included. The Company also provides the necessary bricks for

the builds in the activity books as a separate, but related product.

| |

6. |

Professional

Development Training |

The

Company offers professional development trainings, for a fee, to educators who are implementing the Company’s products in their

classroom.

The

Company intends to continue developing STEM education products that address demand from large markets.

Interim

Financial Information

The

accompanying unaudited condensed financial statements have been prepared in accordance with Generally Accepted Accounting Principles

(“GAAP”) for interim financial information and pursuant to the rules and regulations of the U.S. Securities and Exchange

Commission (SEC). Accordingly, the accompanying unaudited condensed financial statements do not include all of the information and notes

required by GAAP for complete financial statements. In the opinion of management, all adjustments and reclassifications considered necessary

in order to make the financial statements not misleading and for a fair and comparable presentation have been included and are of a normal

recurring nature. Operating results for the three ended June 30, 2024, are not necessarily indicative of the results that may be expected

for the year ending March 31, 2024, or any future periods. The accompanying unaudited condensed financial statements should be read in

conjunction with the Company’s Annual Report on Form 10-K for the year ended March 31, 2024, filed with the SEC on June, 28, 2024.

Use

of Estimates

The

preparation of these condensed financial statements in conformity with GAAP requires management to make estimates and assumptions that

affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Company’s significant estimates include reserves related to accounts receivable and inventory, the valuation allowance related

to deferred tax assets, the valuation of equity instruments, and debt discounts.

Revenue

Recognition

The

Company accounts for revenue in accordance with FASB ASC 606, “Revenue from Contracts with Customers,” which we adopted on

April 1, 2018. Revenue amounts presented in our condensed financial statements are recognized net of sales tax, value-added taxes, and

other taxes. Amounts received as prepayment on future products or services are recorded as unearned revenues and recognized as income

when the product is shipped, or service performed.

The

Company had deferred revenue of $82,870 as of June 30, 2024, related to contractual commitments with customers where the performance

obligation will be satisfied within the fiscal year ended March 31, 2025. The revenue associated with these performance obligations is

recognized as the obligation is satisfied. The Company had $14,549 of deferred revenue as of March 31, 2024.

Most

of our contracts with customers contain transaction prices with fixed consideration; however, some contracts may contain variable consideration

in the form of discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, penalties, and other similar

items. When a contract includes variable consideration, we evaluate the estimate of variable consideration to determine whether the estimate

needs to be constrained; therefore, we include the variable consideration in the transaction price only to the extent that it is probable

that a significant reversal of the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable

consideration is subsequently resolved. We recognize revenue when we satisfy a performance obligation by transferring control over a

product or service to a customer. This can result in recognition of revenue over time as we perform services or at a point in time when

the deliverable is transferred to the customer, depending on an evaluation of the criteria for over time recognition in FASB ASC 606.

For certain fixed-fee per transaction contracts, such as delivering training courses or conducting workshops, revenue is recognized during

the period in which services are delivered in accordance with the pricing outlined in the contracts.

Net

Earnings (Loss) Per Share of Common Stock

The

Company calculates net income (loss) per share in accordance with ASC 260, Earnings Per Share (“ASC 260”). Under ASC 260,

basic net income (loss) per common share is calculated by dividing net income (loss) by the weighted-average number of common shares

outstanding during the reporting period. The weighted average number of shares of common stock outstanding includes vested restricted

stock awards. Diluted net income (loss) per share (“EPS”) reflects the potential dilution that could occur assuming exercise

of all dilutive unexercised stock options and warrants. The dilutive effect of these instruments was determined using the treasury stock

method. Under the treasury stock method, the proceeds received from the exercise of stock options and restricted stock awards, the amount

of compensation cost for future service not yet recognized by the Company, and the amount of tax benefits that would be recorded as income

tax expense when the stock options become deductible for income tax purposes are all assumed to be used to repurchase shares of the Company’s

common stock.

Common

stock outstanding reflected in the Company’s balance sheets includes restricted stock awards outstanding. Securities that may participate

in undistributed net income with common stock are considered participating securities. The computation of diluted earnings per share

does not assume exercise or conversion of securities that would have an anti-dilutive effect. The following schedules presents the calculation

of basic and diluted net income per share:

SCHEDULE

OF BASIC AND DILUTED NET INCOME

| | |

2024 | | |

2023 | |

| | |

For the Three Months ended June 30, | |

| | |

2024 | | |

2023 | |

| Net Income per common Share: | |

| | | |

| | |

| Basic | |

$ | 0.01 | | |

$ | 0.01 | |

| Diluted | |

$ | 0.01 | | |

$ | 0.01 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Basic | |

| 124,733,494 | | |

| 125,732,479 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding Fully Diluted | |

| 124,733,494 | | |

| 125,732,479 | |

Net

income for the three (3) months ended June 30, 2024, and 2023, was $1,144,691 and $860,378, respectively.

Recently

Issued Accounting Pronouncements

The

Company has reviewed recent accounting pronouncements and has determined that they will not significantly impact the Company’s

results of operations or financial position.

NOTE

2 – BUSINESS CONDITION

As

of June 30, 2024, the Company had $2.65 million in cash; $2.04 million in inventory; $0.43 million in prepaid inventory; and $1.60 million

in accounts receivable, with no debt. Management strongly believes that the Company can sustain its operations over the course of the

next twelve (12) months with the cash it has on hand, and with the revenue and associated profit generated from the sales expected over

the course of the next twelve (12) months, especially given the Company’s relatively large inventory, accounts receivable, and

prepaid inventory balances.

NOTE

3 – ACCOUNTS RECEIVABLE

In

the Company’s normal course of business, the Company provides credit terms to its customers, which generally range from net fifteen

(15) to thirty (30) days. The Company performs ongoing credit evaluations of its customers. The Company established an allowance for

doubtful accounts of $34,204 at June 30, 2024, and March 31, 2024.

NOTE

4 - PREPAID EXPENSES

Prepaid

expenses for the periods are as follows:

SCHEDULE

OF PREPAID EXPENSES

| | |

June 30, 2024 | | |

March 31, 2024 | |

| Prepaid insurance | |

$ | 4,366 | | |

$ | 10,915 | |

| Prepaid tradeshows | |

| 14,615 | | |

| 25,046 | |

| Prepaid inventory | |

| 429,596 | | |

| 319,977 | |

| Prepaid software | |

| 25,314 | | |

| 17,254 | |

| Prepaid other | |

| 16,961 | | |

| 20,899 | |

| Total Prepaid Expenses | |

$ | 490,852 | | |

$ | 394,091 | |

NOTE

5 - COMMON AND PREFERRED STOCK TRANSACTIONS

The

Company has 150,000,000 authorized shares of common stock, no par value. At June 30, 2024, and March 31, 2024, the total common shares

issued and outstanding was 124,733,494.

During

the three (3) months ended June 30, 2024, the Company had no option expense.

During

the three (3) months ended June 30, 2024, the Company did not issue any shares of common stock.

During

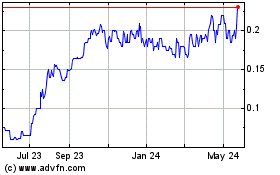

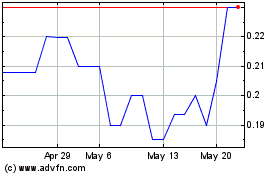

the three (3) months ended June 30, 2024, the Company entered into an agreement to repurchase 250,000 shares common stock at $0.195 per

share for total consideration of $48,750. At June 30, 2024, this transaction had not yet been finalized; however, see NOTE 8 –

SUBSEQUENT EVENTS, below.

The

Company has 20,000,000 authorized shares of preferred stock. As of June 30, 2024, and March 31, 2024, there were no preferred shares

issued or outstanding.

NOTE

6 – PAYROLL LIABILITIES & ACCRUED EXPENSES

Accrued

expenses for the periods are as follows:

SCHEDULE OF ACCRUED EXPENSES

| | |

June 30, 2024 | | |

March 31, 2024 | |

| Payroll liabilities | |

$ | 203,405 | | |

$ | 165,087 | |

| Sales tax payable | |

| 31,402 | | |

| 9,969 | |

| State income tax payable | |

| 32,761 | | |

| 39,929 | |

| Production printer accrued expenses | |

| 14,985 | | |

| 14,985 | |

| Total | |

$ | 282,553 | | |

$ | 229,970 | |

NOTE

7 - RELATED PARTY TRANSACTIONS

The

Company had no related party transactions during the fiscal year ended March 31, 2024, nor during the quarter ended June 30, 2024.

NOTE

8 - SUBSEQUENT EVENTS

On

March 17, 2023, Michelle Fisher, our Director of Curriculum, exercised 250,000 performance options and purchased 250,000 shares of “restricted”

Rule 144 common stock at $0.02 per share, for total consideration of $5,000. In April of 2024, Ms. Fisher approached the Company about

selling her shares back to the Company. On May 7, 2024, an agreement was reached in which the Company committed to purchase 250,000 shares

of “restricted” Rule 144 stock from Ms. Fisher at $0.195 per share in a private transaction. This transaction was finalized

on July 12, 2024, and the shares have been cancelled subsequent to June 30, 2024.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary

Statements for Purposes of “Safe Harbor Provisions” of the Private Securities Litigation Reform Act of 1995:

Except

for historical facts, all matters discussed in this Annual Report, which are forward-looking, involve a high degree of risk and uncertainty.

Certain statements in this Annual Report set forth management’s intentions, plans, beliefs, expectations, or predictions of the

future based on current facts and analyses. When we use the words “believe,” “expect,” “anticipate,”

“estimate,” “intend,” or similar expressions, we intend to identify forward-looking statements. You should not

place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated in such statements,

due to a variety of factors, risks, and uncertainties. Potential risks and uncertainties include, but are not limited to, competitive

pressures from other companies within the Educational Industries, economic conditions in the Company’s primary markets, exchange

rate fluctuation, reduced product demand, increased competition, inability to produce required capacity, unavailability of financing,

government action, weather conditions and other uncertainties, including those detailed in our SEC filings. We assume no duty to update

forward-looking statements to reflect events or circumstances after the date of such statements.

The

following discussion should be read in conjunction with Item 1, Condensed Financial Statements, in Part I of this Quarterly Report.

Overview

of Current and Planned Operations

PCS

Edventures!, Inc. sells STEM / STEAM products to educational and recreational entities serving youth. At this time, we do not attempt

to align our products to fit in the classroom setting although we are aware that some of our customers use our products to fill enrichment

time blocks in the classroom during formal school time. Classroom curriculum must align with specific state standards to be considered

for use. Each state has their own unique set of standards, making classroom curriculum development a state by-state endeavor.

On

the other hand, out of school programs are not subject to a state governmental standard alignments, although these programs often require

that educational programs align with various sets of state or national educational standards. This difference makes it easier to penetrate

out-of-school programs, as more freedoms exist for curriculum development. We focus our efforts on these out-of-school programs, which

include summer school, summer camps, YMCA programs, Boys and Girls club programs, and various other programs offered outside of the classroom,

at all times of the year, that are too numerous to list. Oftentimes, these programs are sponsored, administered, and/or supported by

local school districts, and we employ considerable efforts to build relationships with these types of school districts to provide desired

programing for their out-of-school programs. The majority of the time, the out-of-school programs offered are funded with grants; however,

some programs are run on a for-profit basis. The Company sells to all of these types of entities.

We

offer professional development training for instructors using our products; and typically charge a fee for this service, with the fee

primarily covering our expenses. Management does not view this service as a profit center, but rather as a customer service component

of our products that adds to its uniqueness and value in the marketplace, and as a market development endeavor to build out the Company’s

addressable market.

The

nature of our target market produces considerable seasonality for the Company’s revenue. The quarters ended June 30 and September

30 tend to be the peak of this seasonality (with the quarter ended March 31 being close to these quarters), while the quarter ended December

31 tends to be the low point of our seasonality. The Table below reflects this seasonality.

| | |

Quarterly Revenue $ | |

| Quarter Ended | |

2021 | | |

2022 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| | |

| |

| March 31 | |

| 648,743 | | |

| 1,445,594 | | |

| 2,521,470 | | |

| 2,262,772 | |

| June 30 | |

| 1,062,127 | | |

| 1,391,785 | | |

| 2,605,281 | | |

| 3,159,923 | |

| September 30 | |

| 993,458 | | |

| 1,243,662 | | |

| 3,767,326 | | |

| | |

| December 31 | |

| 566,473 | | |

| 1,847,659 | | |

| 459,087 | | |

| | |

The

Company, through winning a competitive “Request For Proposal,” added the Air Force Junior Reserve Officers’ Training

Corp (“AFJROTC”) as a customer in the second half of calendar year 2022. The Company experienced elevated sales due to the

fulfillment of the AFJROTC orders for the quarters ended December 31, 2022, March 31, 2023, and September 30, 2023. One of the AFJROTC

revenue quarters was December 31, 2022, which corresponds with the lowest seasonal revenue quarter, so the effects of seasonality in

2022 was not as readily apparent as in other calendar years. The table below removes the AFJROTC revenue to highlight the seasonality

that the Company experiences.

| | |

Quarterly Revenue Less Air Force JROTC Revenue | |

| Quarter Ended | |

2021 | | |

2022 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| | |

| |

| March 31 | |

| 648,743 | | |

| 1,445,594 | | |

| 1,247,835 | | |

| 2,262,772 | |

| June 30 | |

| 1,062,127 | | |

| 1,391,785 | | |

| 2,605,281 | | |

| 3,159,923 | |

| September 30 | |

| 993,458 | | |

| 1,243,662 | | |

| 2,501,410 | | |

| | |

| December 31 | |

| 566,473 | | |

| 458,239 | | |

| 459,087 | | |

| | |

During

the quarter ended December 31, the Company focuses on product development, restocking inventory, and general planning for the next year.

Sales and marketing activities remain fairly constant throughout the year.

Results

of Operations

Revenue

For

the quarter ended June 30, 2024, our revenue was $3,159,923. For the quarter ended June 30, 2023, our revenue was $2,605,281. The increase

in revenue was due to our strategy of soliciting larger customers. The table below shows customer transactions by size for the periods

indicated.

Number

of Customer Transactions by size

| | |

>$1

million | | |

>$500,000 | | |

> $100,000 | | |

> $50,000 | | |

> $25,000 | | |

> $10,000 | |

| Three months ended June 30, 2022 | |

| 0 | | |

| 0 | | |

| 3 | | |

| 7 | | |

| 12 | | |

| 24 | |

| Three months ended June 30, 2023 | |

| 0 | | |

| 0 | | |

| 6 | | |

| 12 | | |

| 19 | | |

| 42 | |

| Three months ended June 30, 2024 | |

| 0 | | |

| 0 | | |

| 8 | | |

| 13 | | |

| 26 | | |

| 50 | |

We

believe that we can continue to experience success in soliciting larger customers, but we can offer no assurances that success will be

certain, nor can we offer any numerical framework in describing the success that may occur. Risk factors include anything that would

negatively affect educational funding in the United States; finding and retaining employees that meet our high standards; and anything

that would negatively affect our supply chain of critical components.

Cost

of Sales

We

strive to have a cost of sales that is less than 40% of revenue. We price our products once per year, at the beginning of the calendar

year, and maintain that pricing level throughout the year. During inflationary environments, when the price level of the Company’s

raw materials is increasing, the Company must absorb that negative impact to gross margins until it can reprice its products at the beginning

of the next calendar year. This repricing analysis considers the current pricing level of materials, as well as the likely increase in

those levels in the year ahead. We attempt to incorporate shipping costs into the cost of raw materials, but oftentimes during the course

of the year, we are compelled to ship in a more expedient manner, which is more expensive than our baseline assumptions.

For

the quarter ended June 30, 2024, our cost of sales was $1,198,435, or 37.9% of revenue. For the quarter ended June 30, 2023, our cost

of sales was $1,004,070, or 38.5% of revenue. For any given quarter, and especially in low revenue quarters, the cost of sales can vary

significantly from our desired 40% or less of revenue. However, for any given year, the calculation is relevant and desired to be 40%

or less of revenue.

Factors

affecting cost of sales include:

| Helps

sub 40% cost of sales |

Impedes

sub 40% cost of sales |

| Higher

revenue |

Higher

inflation |

| Larger

order size |

Expedited

shipping |

| Ability

to take advantage of volume discounts |

Quality

issues with raw materials |

Operating

Expenses

Operating

expenses are divided into two (2) categories – salary + wages, and general + administrative. Salary and wages tend to increase

over time as the Company has been increasing its number of employees, and we expect to continue to do so in the future. Also, the Company

desires to retain employees over the long term, which requires periodic increases in compensation as their value to the Company increases.

The

Company also has a discretionary quarterly bonus program based on qualified revenue. Qualified revenue is defined as revenue where there

are no reseller fees or other price adjustments associated with that revenue. Thus, all reseller sales are disqualified from the discretionary

quarterly bonus calculation, as are other miscellaneous transactions where the Company did not receive a full margin. During quarters

with higher revenue, salaries and wages will increase all other things equal.

Salary

and wages were $518,287 for the quarter ended June 30, 2024. For the quarter ended June 30, 2023, salaries and wages were $446,276. Salaries

and wages increased during the quarter ended June 30, 2024, as compared to the quarter ended June 30, 2023, due to the facts that i)

the Company had two (2) more employees as of June 30, 2024, versus June 30, 2023; ii) inflation has been elevated; and iii) the Company’s

overall performance has been improving, thus increasing employee bonus amounts.

General

and administrative expenses include all operating expenses outside of salaries and wages. These include the following categories:

| |

1. |

Advertising

and marketing expenses |

| |

2. |

Trade

show and travel expenses |

| |

3. |

Product

development expenses |

| |

4. |

Finance

charges |

| |

5. |

Contract

labor expenses |

| |

6. |

Lease

expenses |

| |

7. |

Insurance

premiums |

| |

8. |

Workers’

compensation expenses |

| |

9. |

Office

supplies and repairs |

| |

10. |

Professional

expenses |

| |

11. |

Licenses |

| |

12. |

State

sales tax expenses |

| |

13. |

Office

and warehouse infrastructure expenses |

Most

of these expenses are not correlated with changes in revenue, but they tend to increase over time. General and administrative expenses

were $320,019 for the quarter ended June 30, 2024. For the quarter ended June 30, 2023, general and administrative expenses were $294,834.

The

Company currently leases a 10,000 square foot facility which ends in October of 2024. We are currently looking for new space, with the

expectation that we need approximately double the amount of space we currently occupy to accommodate our needs in achieving our growth

expectations. This will cause general and administrative expenses to increase noticeably, as will the additional expenses associated

with being an SEC “reporting company” under the Exchange Act.

Other

Income

Interest

income was the sole source of other income for the quarters ending June 30, 2024, and 2023. For the quarter ended June 30, 2024, other

income was $21,509. For the quarter ended June 30, 2023, other income was $277. The Company’s surplus cash is invested in a “Vanguard”

money market fund that invests exclusively in repurchase agreements and short-term U.S. government securities. The ticker symbol of this

fund is “VMFXX.”

Net

Income Before Tax

For

the three (3) months ended June 30, 2024, net income before tax was $1,144,691 versus $860,378 for the three (3) months ended June 30,

2023. Higher revenue and higher gross margin during the quarter ended June 30, 2024, versus those for the quarter ended June 30, 2023,

were responsible for the variance in net income before taxes.

Taxes

The

Company has a significant tax-loss carry-forward asset, which arose due to past losses. At March 31, 2024, the Company had net operating

losses of approximately $9.2 million that may be offset against future taxable income. The federal and state net operating losses and

tax credits expire in years beginning in 2026.

Prior

to fiscal year 2023, the Company offset its potential tax benefit from the operating loss carry-forwards with a valuation allowance in

the same amount. As it became clear that the Company will more likely than not use its tax loss carry-forward amounts, the valuation

allowance was partially removed for the fiscal year ended March 31, 2023, such that the tax benefit recognized by us in fiscal year 2023

was $1,011,466. The valuation allowance was fully removed as of March 31, 2024, resulting in a tax benefit of $1,529,793 for fiscal year

2024.

Net

Income

With

the large net operating losses that can be used to offset taxable income, net income is the same as net income before tax for the reporting

periods shown.

Liquidity

and Capital Resources

Cash

Flow from Operations

For

the three (3) months ended June 30, 2024, cash provided by operations was $1,352,840 compared to cash provided by operations of $609,211

for the three (3) months ended June 30, 2023.

As

of June 30, 2024, total current assets were $6,782,462 and total current liabilities were $648,076, resulting in working capital of 6,134,386.

As of March 31, 2024, total current assets were $5,425,141 and total current liabilities were $416,154, resulting in working capital

of $5,008,987. The Company had a current ratio as of June 30, 2024, of 10.5 compared to a current ratio of 13.0 as of March 31, 2024.

As

of June 30, 2024, we had $2,652,716 in cash and cash equivalents compared to $1,329,708 in cash as of March 31, 2024. The improvements

in working capital and cash on hand are due to a significant increase in net income during the quarter ending June 30, 2024.

Cash

Flow from Investing Activities

For

the three (3) months ended June 30, 2024, cash used by investing activities was $29,832 compared to cash used by investing activities

of $7,687 for the three (3) months ended June 30, 2023. We purchased a forklift for the warehouse for $26,829 during the quarter ended

June 30, 2024, which accounts for the majority of the difference between the two (2) periods.

Cash

Flow from Financing Activities

For

the three (3) months ended June 30, 2024, and 2023, we did not have any cash flows from financing activities.

Off-Balance

Sheet Arrangements

We

had no Off-Balance Sheet Arrangements during the three (3) month periods ended June 30, 2024, and 2023.

Item

3. Quantitative and Qualitative Disclosures about Market Risk.

The

Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act, and is not required to provide the information required

under this item.

Item

4. Controls and Procedures.

We

maintain disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act that are designed to ensure

that material information relating to us is made known to the officers who certify our financial reports and to other members of senior

management and the Board of Directors. These disclosure controls and procedures are designed to ensure that information required to be

disclosed in our reports that are filed or submitted under the Exchange Act are recorded, processed, summarized, and reported within

the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls

and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under

the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers,

or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

Management,

with the participation of our Chief Executive Officer and our President who acts as our Principal Financial Officer, have evaluated the

effectiveness, as of June 30, 2024, of our disclosure controls and procedures. Based on that evaluation, our Chief Executive Officer

and Principal Financial Officer concluded that our disclosure controls and procedures were not effective as of June 30, 2024, because

of inadequate control and expertise over preparation of the preliminary financial statements and schedules for our auditor’s review,

resulting in some minor errors in applying “Accounting Standards Codifications” used in the United States to organize and

present accounting standards and principles. Management has concluded that we will take appropriate action to add additional expertise

to assist us in the preparation of our future interim financial statements for our auditor’s review to ameliorate this weakness.

Management acknowledges that as a smaller reporting entity, it is difficult to have adequate accounting staff to perform appropriate

additional reviews of the financial statements.

Changes

in Internal Control over Financial Reporting

Management

has contracted with additional expertise to assist us in the preparation of our future interim financial statements to ameliorate any

internal control weakness and to assist us in designing and implementing a system of adequate controls over the preparation of our financial

statements and schedules. There have been no other actions or changes in our internal control over financial reporting during the quarter

ended June 30, 2024, that have materially affected, or are reasonably likely to materially affect, our internal control over financial

reporting.

PART

II - OTHER INFORMATION

Item

1. Legal Proceedings.

None.

Item

1A. Risk Factors.

The

Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act, and is not required to provide the information required

under this Item.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item

3. Defaults Upon Senior Securities.

None.

Item

4. Mine Safety Disclosures.

None;

not applicable.

Item

5. Other Information.

No

director or Section 16 officer adopted or terminated a trading arrangement intended to satisfy the affirmative defense conditions of

Rule 10b5-1(c) or a “non-Rule 10b5–1” trading arrangement during the periods reported in this Quarterly Report.

Item

6. Exhibits.

(a)

Index of Exhibits

| Exhibit

No. |

|

Identification

of Exhibit |

|

Location

if other than attached hereto |

| 3.1 |

|

Second Amended and Restated Articles of Incorporation dated October 2, 2006 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.2 |

|

Articles of Amendment dated April 12, 2012 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.3 |

|

Articles of Amendment dated September 25, 2014 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.4 |

|

Articles of Amendment dated September 25, 2015 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.5 |

|

Articles of Amendment dated September 23, 2016 |

|

Attached

to our Form 10 filed October 3, 2023 |

| 3.6 |

|

Third Amended Bylaws |

|

Attached

to our Form 10 filed October 3, 2023 |

| 31.1 |

|

Certification Pursuant to Section 302 of the Sarbanes-Oxley Act provided by Todd R. Hackett, Chief Executive Officer and Chairman |

|

Attached

hereto |

| 31.2 |

|

Certification Pursuant to Section 302 of the Sarbanes-Oxley Act provided by Michael J. Bledsoe, President, Principal Financial Officer |

|

Attached

hereto |

| 32 |

|

Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 provided by Todd R. Hackett, Chief Executive Officer and Chairman of the Board of Directors, and Mike J. Bledsoe, President and Principal Financial Officer |

|

Attached

hereto |

| |

|

|

|

|

| 101.INS |

|

XBRL

Instance Document |

|

|

| 101.PRE |

|

XBRL

Taxonomy Extension Presentation Linkbase |

|

|

| 101.LAB |

|

XBRL

Taxonomy Extension Label Linkbase |

|

|

| 101.DEF |

|

XBRL

Taxonomy Extension Definition Linkbase |

|

|

| 101.CAL |

|

XBRL

Taxonomy Extension Calculation Linkbase |

|

|

| 101.SCH |

|

XBRL

Taxonomy Extension Schema |

|

|

Form

10A-1 Registration Statement filed with the SEC on November 15, 2023.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

PCS

EDVENTURES!, INC.

| Dated:

August 14, 2024 |

By: |

/s/

Todd R. Hackett |

| |

|

Todd

R. Hackett |

| |

|

Chief

Executive Officer and |

| |

|

Chairman

of the Board of Directors |

| |

|

|

| Dated:

August 14, 2024 |

By: |

/s/

Michael J. Bledsoe |

| |

|

Michael

J. Bledsoe |

| |

|

President,

Principal Financial Officer and Director |

Exhibit 31.1

CERTIFICATION PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Todd R. Hackett, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q

of PCS Edventures!, Inc.;

2. Based on my knowledge, this report does not contain

any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements,

and other financial information included in this report, fairly present in all material respects the financial condition, results of operations

and cash flows of the Registrant as of, and for, the periods presented in this report;

4. The Registrant other certifying officer(s) and

I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f) and 15d-15(f)) for the Registrant

and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s most recent fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

5. The Registrant’s other certifying officer(s)

and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Registrant’s auditors

and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions);

| |

a) |

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: |

August 14, 2024 |

|

By: |

/s/

Todd R. Hackett |

| |

|

|

|

Todd R. Hackett, Chief Executive Officer and Chairman |

Exhibit 31.2

CERTIFICATION PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Michael J. Bledsoe, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q

of PCS Edventures!, Inc.;

2. Based on my knowledge, this report does not contain

any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements,

and other financial information included in this report, fairly present in all material respects the financial condition, results of operations

and cash flows of the Registrant as of, and for, the periods presented in this report;

4. The Registrant other certifying officer(s) and

I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f) and 15d-15(f)) for the Registrant

and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d) |

disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s most recent fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

5. The Registrant’s other certifying officer(s)

and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the Registrant’s auditors

and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions);

| |

a) |

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: |

August 14, 2024 |

|

By: |

/s/ Michael J. Bledsoe |

| |

|

|

|

Michael J. Bledsoe, President and Principal Financial Officer |

Exhibit 32

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of PCS

Edventures!, Inc. (the “Registrant”) on Form 10-Q for the period ending June 30, 2024, as filed with the Securities and

Exchange Commission on the date hereof (the “Quarterly Report”), we, Todd R. Hackett, Chief Executive Officer, and

Michael J. Bledsoe, President and Principal Financial Officer of the Registrant, certify, pursuant to 18 U.S.C. Section 1350, as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1) The Quarterly Report fully

complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained

in the Quarterly Report fairly presents, in all material respects, the financial condition and result of operations of the Registrant.

| Date: |

August 14, 2024 |

|

By: |

/s/ Todd R. Hackett |

| |

|

|

|

Todd R. Hackett, Chief Executive Officer and Chairman |

| Date: |

August 14, 2024 |

|

By: |

/s/ Michael J. Bledsoe |

| |

|

|

|

Michael J. Bledsoe, President and Principal Financial Officer |

v3.24.2.u1

Cover - shares

|

3 Months Ended |

|

Jun. 30, 2024 |

Aug. 14, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

10-Q

|

|

| Amendment Flag |

false

|

|

| Document Quarterly Report |

true

|

|

| Document Transition Report |

false

|

|

| Document Period End Date |

Jun. 30, 2024

|

|

| Document Fiscal Period Focus |

Q1

|

|

| Document Fiscal Year Focus |

2025

|

|

| Current Fiscal Year End Date |

--03-31

|

|

| Entity File Number |

000-49990

|

|

| Entity Registrant Name |

PCS

EDVENTURES!, INC.

|

|

| Entity Central Index Key |

0001122020

|

|

| Entity Tax Identification Number |

82-0475383

|

|

| Entity Incorporation, State or Country Code |

ID

|

|

| Entity Address, Address Line One |

11915

West Executive Drive

|

|

| Entity Address, Address Line Two |

Suite 101

|

|

| Entity Address, City or Town |

Boise

|

|

| Entity Address, State or Province |

ID

|

|

| Entity Address, Postal Zip Code |

83713

|

|

| City Area Code |

(208)

|

|

| Local Phone Number |

343-3110

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

| Entity Small Business |

true

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

124,483,494

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12