false

0000315545

0000315545

2024-07-11

2024-07-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 11, 2024

PROVECTUS

BIOPHARMACEUTICALS, INC.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-36457 |

|

90-0031917 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 800

S. Gay Street, Suite 1610, Knoxville, TN 37929 |

| (Address

of Principal Executive Offices) (Zip Code) |

| (866)

594-5999 |

| (Registrant’s

Telephone Number, Including Area Code) |

| N/A |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

The

information set forth in Item 2.03 is incorporated by reference into this Item 1.01.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On

July 11, 2024, the board of directors (the “Board”) of Provectus Biopharmaceuticals, Inc. (the “Company”) approved

a Financing Term Sheet (the “2024 Term Sheet”), which sets forth the terms under which the Company will use its best efforts

to arrange for financing of a maximum of $10,000,000 (the “2024 Financing”).

Pursuant

to the 2024 Term Sheet, a 2024 Note (defined below) will convert into shares of the Company’s Series D-1 Convertible Preferred

Stock, par value $0.001 per share (“Series D-1 Preferred Stock”) within twelve months of the issue date of the 2024 Note,

subject to certain exceptions.

The

2024 Financing

Subject

to the terms and conditions of the 2024 Term Sheet, the Company will use its best efforts to arrange for the 2024 Financing, which amounts

will be obtained in several tranches. The proceeds from the 2024 Financing will be used to fund the Company’s drug discovery and

development program, as currently constituted and envisioned, and to fund the Company’s general and administrative expenses.

Structure

of the Financing

The

2024 Financing will be in the form of an unsecured convertible loan (the “Loan”) from various investors (collectively, the

“Investors”) that will be evidenced by convertible promissory notes (individually, a “2024 Note” and collectively,

the “2024 Notes”). In addition to customary provisions, the 2024 Note contains the following provisions:

(i)

The Loan will bear interest at the rate of eight percent (8%) per annum on the outstanding principal amount of the Loan that has been

funded to the Company;

(ii)

The Loan shall be due and payable in full on the earliest of: (i) the date upon which an event of default occurs and is continuing; (ii)

a change of control of the Company; or (iii) twelve months after the issue date of a 2024 Note; and

(iii)

The outstanding principal amount and interest payable under the Loan is convertible at the Investor’s option as follows:

(a)

The Loan is voluntarily convertible into shares of the Company’s Series D-1 Preferred Stock at any time while the Loan is outstanding

at a price per share equal to $2.8620;

(b)

The Loan is automatically convertible into shares of the Company’s Series D-1 Preferred Stock twelve months after the issue date

of a 2024 Note at a price per share equal to $2.8620; and

(c)

The Series D-1 Preferred Stock is convertible into ten (10) shares of the Company’s common stock, par value $0.001 per share;

The

form of the 2024 Note is attached hereto as Exhibit 4.1 and is incorporated herein by reference.

The 2024 Term Sheet is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Closing

of the 2022 Financing

Pursuant

to the approval of the 2024 Financing by the Board, the Board approved the closing of the financing that the Board approved on September

20, 2022 (the “2022 Financing”) and that was filed with the SEC in the Form 8-K dated September 26, 2022. The 2022 Financing

was in the form of an unsecured convertible loan from various investors that were evidenced by convertible promissory notes (collectively,

the “2022 Notes”). As of July 11, 2024, the Company had received 2022 Notes totaling $4,865,500.

The

Company believes the issuance of the 2022 Notes was exempt, and the issuance of the 2024 Notes will be exempt, from the registration

requirements of the Securities Act of 1933, as amended (the “Securities Act”), by virtue of Section 4(a)(2) of the Securities

Act (or Rule 506 of Regulation D promulgated thereunder) as transactions not involving a public offering.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

The

information set forth in Item 2.03 is incorporated by reference into this Item 3.02.

| Item

9.01 |

Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

July 17, 2024

| |

PROVECTUS

BIOPHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/

Heather Raines |

| |

|

Heather

Raines, CPA |

| |

|

Chief

Financial Officer (Principal Financial Officer) |

Exhibit

4.1

THIS

UNSECURED CONVERTIBLE PROMISSORY NOTE (THIS “NOTE”) HAS NOT BEEN REGISTERED OR QUALIFIED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED (“ACT”), OR THE SECURITIES LAWS OF ANY STATE AND MAY NOT BE OFFERED OR SOLD UNLESS

REGISTERED AND QUALIFIED PURSUANT TO THE APPLICABLE PROVISIONS OF FEDERAL AND STATE SECURITIES LAWS OR UNLESS AN EXEMPTION FROM SUCH

REGISTRATION AND QUALIFICATION APPLIES. THEREFORE, NO SALE OR TRANSFER OF THIS NOTE SHALL BE MADE, NO ATTEMPTED SALE OR TRANSFER SHALL

BE VALID, AND THE ISSUER SHALL NOT BE REQUIRED TO GIVE ANY EFFECT TO ANY SUCH TRANSACTION UNLESS (A) SUCH TRANSACTION HAS BEEN DULY REGISTERED

UNDER THE ACT AND QUALIFIED OR APPROVED UNDER APPROPRIATE STATE SECURITIES LAWS OR (B) THE ISSUER HAS FIRST RECEIVED AN OPINION OF COUNSEL

SATISFACTORY TO IT THAT SUCH REGISTRATION, QUALIFICATION OR APPROVAL IS NOT REQUIRED.

UNSECURED

Convertible Promissory NOTE

(this “Note”)

FOR

VALUE RECEIVED, the undersigned Provectus Biopharmaceuticals, Inc., a Delaware corporation (the “Borrower”), hereby

promises to pay to the order of [●] (the “Lender”) at the Lender’s address located at [●] or at

such other place as the Lender may designate to the Borrower in writing from time to time, the principal sum set forth in Paragraph

A below, or, if less, so much thereof as is outstanding hereunder, in lawful money of the United States of America and in immediately

available funds, and to pay interest on said principal sum or the unpaid balance thereof, in like money at said office. This Note is

issued as a part of a series of similar notes (collectively, the “Notes”) to be issued to several lenders (collectively,

the “Lenders”) as part of a single financing round (the “2024 Financing Round”) pursuant to the

Financing Term Sheet approved by the Board of Directors of the Borrower on July 11, 2024. Capitalized terms used in this Note but not

immediately defined shall have the meanings set forth in Paragraph L below.

This

Note shall have a principal amount of [●] and no/00 Dollars ($[●]).

| Unsecured Convertible Promissory Note | 1 | |

Subject

to Paragraph I, interest on this Note shall accrue on the outstanding principal amount hereof at a rate equal to eight percent

(8%) per annum, calculated on the basis of a 365-day year, commencing on the date of this Note (the “Interest Rate”).

| C. |

Payment

Terms; Prepayment. |

Payments

on this Note shall be applied in the following order: first to accrued but unpaid interest and second to principal. If any payment on

this Note becomes due and payable on a day other than a Business Day, the payment date thereof shall be extended to the next succeeding

Business Day. Principal and interest under this Note may be pre-paid in whole or in part at any time without premium or other prepayment

charge.

| D. |

Events

of Default; Remedies. |

(i)

The Borrower shall be deemed to be in default under this Note if (each of the following events is referred to in this Note as an “Event

of Default”): (a) any action commenced by or against the Borrower under the Federal Bankruptcy Code, or other statute for the

relief of creditors, which is not dismissed within sixty (60) days, or (b) liquidation of the Borrower.

(ii)

Upon the occurrence and during the continuance of an Event of Default, the Lender, at the Lender’s option, may (a) allow this Note

to remain outstanding and continue to accrue interest at the Interest Rate, or (b) declare the outstanding principal balance of and all

accrued but unpaid interest on this Note to be immediately due and payable.

This

Note may be used to fund the Borrower’s discovery and drug development program as currently conducted and as modified in the future

by the Board of Directors and for general corporate and administrative expenses approved by the Board of Directors.

(i)

Voluntary Conversion; Series D-1 Shares. The Lender, at the Lender’s option, may elect to convert all of the Outstanding

Amount of this Note at any time into Series D-1 Shares. If the Lender elects to effect a conversion of this Note into Series D-1 Shares,

the Lender shall: (a) deliver a copy of the fully executed notice of conversion in the form attached hereto as Exhibit A (a “Notice

of Conversion”) to the Borrower and (b) surrender or cause to be surrendered this Note with delivery of the Notice of Conversion.

On the Voluntary Conversion Date, the Borrower shall issue and deliver to the Lender confirmation of the number of Series D-1 Shares

that have been issued to the Lender upon conversion of this Note, which number of Series D-1 Shares shall be calculated by dividing the

Outstanding Amount on the Voluntary Conversion Date by the Conversion Price. The Lender shall be treated for all purposes as the record

holder of such Series D-1 Shares at 12:01 am Eastern Time on the Voluntary Conversion Date and such Series D-1 Shares shall be issued

and outstanding as of such date.

| Unsecured Convertible Promissory Note | 2 | |

(ii)

Automatic Conversion; Series D-1 Shares. The Outstanding Amount of this Note will automatically convert into Series D-1 Shares

on the Automatic Conversion Date. On the Automatic Conversion Date, the Lender shall surrender or cause to be surrendered this Note to

the Borrower. On the Automatic Conversion Date, the Borrower shall issue and deliver to the Lender confirmation of the number of Series

D-1 Shares that have been issued to the Lender upon conversion of this Note, which number of Series D-1 Shares shall be calculated by

dividing the Outstanding Amount on the Automatic Conversion Date by the Conversion Price. The Lender shall be treated for all purposes

as the record holder of such Series D-1 Shares at 12:01 am Eastern Time on the Automatic Conversion Date and such Series D-1 Shares shall

be issued and outstanding as of such date.

(iii)

Conversion Mechanics.

(1)

No Fractional Shares. No fractional Series D-1 Shares are to be issued upon the conversion of this Note, but instead of any fraction

of a Series D-1 Share which would otherwise be issuable, the fraction of such Series D-1 Share shall be rounded up to the nearest whole

share.

(2)

Insufficient Series D-1 Shares. Notwithstanding the foregoing, if this Note is converted under the terms hereof and the number

of authorized but unissued Series D-1 Shares are insufficient to permit the conversion of the Outstanding Amount in full, the Borrower

will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued Series D-1

Shares to such number of shares as shall be sufficient for such purposes. Until the Borrower is able to effectuate such corporate action,

Series D-1 Shares shall be issued to the Lender in an amount equal to the amount of authorized but unissued Series D-1 Shares available

for issuance, and the portion of the Outstanding Amount that remains unissued shall continue to be outstanding principal and accrued

but unpaid interest of the Note.

(3)

Conversion of Series D-1 Shares. Conversion of Series D-1 Shares into shares of common stock, par value $0.001 per share (“Common

Stock”), of the Borrower shall be governed by the Certificate of Designation of Preferences, Rights and Limitations of Series D-1

Convertible Preferred Stock (the “Series D-1 Certificate of Designation”). One Series D-1 Share shall be convertible into

ten (10) shares of Common Stock of the Borrower, subject to any terms, conditions, and adjustments as provided in the Series D-1 Certificate

of Designation.

(4)

Adjustments to the Conversion Price. The Conversion Price shall be adjusted proportionally for any increase or decrease in the

number of outstanding Series D-1 Shares resulting from a stock split, reverse stock split, stock dividend, reclassification, recapitalization,

merger, consolidation, or any similar such change affecting the Series D-1 Shares without receipt of consideration by the Borrower.

| Unsecured Convertible Promissory Note | 3 | |

(iv)

Termination; Limitation on Multiple Elections. This Note shall automatically terminate immediately following the earliest to occur

of: (a) the Voluntary Conversion Date (provided that the number of authorized but unissued Series D-1 Shares are sufficient to permit

the conversion of the Outstanding Amount in full); (b) the Automatic Conversion Date (provided that the number of authorized but unissued

Series D-1 Shares are sufficient to permit the conversion of the Outstanding Amount in full); or (c) the date on which the entire Outstanding

Amount of this Note is paid or prepaid in accordance with the terms hereof. For sake of clarity, the Lender shall not be entitled to

convert or exchange less than the entire Outstanding Amount of this Note under Paragraph F unless the number of authorized but unissued

Series D-1 Shares are insufficient to permit the conversion of the Outstanding Amount in full pursuant to Paragraph F(iii)(2).

This

Note, including interest and principal, shall be due and payable in full (i) on such date upon which an Event of Default occurs and is

continuing, (ii) upon a Change of Control of the Borrower, or (iii) twelve months after the issue date of this Note, which is [●]

[●], 202[●], the earliest of such dates being the “Maturity Date.”

| H. |

Cumulative

Remedies; No Waiver. |

The

Lender’s rights and remedies under this Note are cumulative and in addition to all rights and remedies provided by applicable law

from time to time. The exercise or direction to exercise by the Lender of any right or remedy shall not constitute a cure or waiver of

any default, nor invalidate any notice of default or any act done pursuant to any such notice, nor prejudice the Lender in the exercise

of any other rights or remedy. No waiver of any default shall be implied from any omission by the Lender to take action on account of

such default if such default persists or is repeated. No waiver of any default shall affect any default other than the default expressly

waived, and any such waiver shall be operative only for the time and to the extent stated. No waiver of any provision of this Note shall

be construed as a waiver of any subsequent breach of the same provision. The consent of the Lender to any act by the Borrower requiring

further consent or approval shall not be deemed to waive or render unnecessary the Lender’s consent to or approval of any subsequent

act. The Lender’s acceptance of the late performance of any obligation shall not constitute a waiver by the Lender of the right

to require prompt performance of all further obligations. The Lender’s acceptance of any performance following the sending or filing

of any notice of default shall not constitute a waiver of the Lender’s right to proceed with the exercise of remedies for any unfulfilled

obligations, and the Lender’s acceptance of any partial performance shall not constitute a waiver by the Lender of any rights relating

to the unfulfilled portion of the applicable obligation.

| Unsecured Convertible Promissory Note | 4 | |

Nothing

herein contained, nor any transaction related hereto, shall be construed or so operate as to require the Borrower to pay interest in

an amount or at a rate greater than the maximum allowed by applicable law. Should any interest or other charged paid by the Borrower

result in computation or earning of interest in excess of the maximum legal rate of interest permitted under the law in effect while

said interest is being earned, then any and all of that excess shall be and is waived by the Lender, and all that excess shall be automatically

credited against and in reduction of the principal balance, and any portion of the excess that exceeds the principal balance shall be

paid by the Lender to the Borrower so that under no circumstances shall the Borrower be required to pay interest in excess of the maximum

rate allowed by applicable law.

| J. |

Jurisdiction;

Waiver of Jury Trial. |

(i)

This Note shall be governed by the internal laws of the State of TENNESSEE except to the extent

superseded by Federal law. THE BORROWER HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION OF ANY STATE OR FEDERAL COURT LOCATED IN

Knox COUNTY, Tennessee AND WAIVES ANY OBJECTION

BASED ON FORUM NON CONVENIENS WITH REGARD TO ANY ACTIONS, CLAIMS, DISPUTES OR PROCEEDINGS RELATING TO THIS NOTE, OR ANY TRANSACTION RELATING

TO OR ARISING FROM THIS NOTE, OR ENFORCEMENT AND/OR INTERPRETATION OF ANY OF THE FOREGOING. Nothing

herein shall limit the Lender’s right to bring proceedings against the Borrower in the competent courts of any other jurisdiction.

(ii)

THE BORROWER AND THE LENDER HEREBY KNOWINGLY, VOLUNTARILY, AND INTENTIONALLY WAIVE THE RIGHT EITHER MAY HAVE TO A TRIAL BY JURY IN RESPECT

OF ANY LITIGATION BASED HEREON OR ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS NOTE OR ANY COURSE OF CONDUCT, COURSE OF DEALING,

STATEMENTS (WHETHER WRITTEN OR VERBAL) OR ACTIONS OF EITHER PARTY. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE BORROWER AND THE LENDER

FOR ENTERING INTO THIS AGREEMENT.

(i)

TIME IS OF THE ESSENCE WITH RESPECT TO THIS NOTE.

(ii)

Any term of this Note may be amended or waived only with the written consent of the Company and the Requisite Lenders. Any amendment

or waiver effected in accordance with this paragraph shall be binding upon the Borrower and each Lender, regardless of whether he, she,

or it has given its written consent. Notwithstanding the foregoing, (a) if any amendment or waiver materially and adversely treats one

or more Lenders in a manner that is disproportionate to such treatment of all other Lenders solely with respect to their respective rights

as holders of the Notes, such amendment or waiver shall also require the written consent of the Lenders disproportionately treated, and

(b) no amendment or waiver of this Note shall change the principal amount outstanding without the consent of the Lender. This paragraph

of the Note may not be amended without the written consent of the Company and all Lenders.

| Unsecured Convertible Promissory Note | 5 | |

(iii)

The Borrower hereby waives presentment for payment, demand, notice, protest, notice of protest and notice of dishonor.

(iv)

Notwithstanding anything herein to the contrary, the Lender may not institute any action to collect this Note or any other action with

respect to this Note or payment hereunder without the prior consent of the Requisite Lenders. A single Lender may be designated by the

Requisite Lenders to institute any such action on behalf of all Lenders, and Lender agrees and acknowledges that such designated Lender

shall serve as the representative of all Lenders in a single action. Such Lender shall be indemnified and held harmless from and against

any and all costs, expenses, fees, and liabilities which it may incur in connection with pursuing such action and shall have no liability

whatsoever to the other Lenders for any actions taken or omitted in good faith in connection therewith. Any Lender taking action in contravention

of this paragraph shall indemnify the Borrower, its directors, officers, and representatives for all losses, costs, and expenses (including

attorneys’ fees) incurred in connection therewith.

The

following terms used in this Note shall have the following meanings:

“Automatic

Conversion Date” means the date which is the date of twelve months after the issue date of this Note. For the avoidance of

doubt, the Automatic Conversion Date is [●] [●], 202[●].

“Board

of Directors” means the Board of Directors of the Borrower.

“Business

Day” means each Monday, Tuesday, Wednesday, Thursday, or Friday on which banking institutions are not authorized or obligated

by law, regulation or executive order to close in Knoxville, Tennessee.

“Change

of Control” means, unless otherwise approved in writing by the PRH Group, the occurrence after the date hereof of any of (a)

an acquisition after the date hereof by an individual or legal entity or “group” (as described in Rule 13d 5(b)(1) promulgated

under the 1934 Act) of effective control (whether through legal or beneficial ownership of capital stock of the Borrower, by contract

or otherwise) of in excess of 33% of the voting securities of the Borrower (other than by means of conversion or exercise of Series D

and D-1 Shares and any other securities issued together with such Series D and D-1 Shares), (b) the Borrower merges into or consolidates

with any other Person, or any Person merges into or consolidates with the Borrower and, after giving effect to such transaction, the

stockholders of the Borrower immediately prior to such transaction own less than 66% of the aggregate voting power of the Borrower or

the successor entity of such transaction, (c) the Borrower sells or transfers all or substantially all of its assets to another Person

and the stockholders of the Borrower immediately prior to such transaction own less than 66% of the aggregate voting power of the acquiring

entity immediately after the transaction, (d) a replacement at one time or within a one year period of more than one half of the members

of the Board of Directors on the date hereof, or (e) the execution by the Borrower of an agreement to which the Borrower is a party or

by which it is bound, providing for any of the events set forth in clauses (a) through (d) above.

| Unsecured Convertible Promissory Note | 6 | |

“Controls”

(including the terms “controlling”, “controlled by”, and “under common control with”) means the possession,

direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership

of voting securities, by contract or otherwise.

“Conversion

Price” means $2.8620.

“Outstanding

Amount” means (a) the outstanding principal amount of this Note, plus (b) all accrued and unpaid interest.

“Person”

means an individual, corporation, partnership, limited liability company, trust, business trust, association, joint stock company, joint

venture, sole proprietorship, unincorporated organization, governmental authority or any other form of entity not specifically listed

herein.

“PRH

Group” means that group of investors led by Ed Pershing, Dominic Rodrigues, and Bruce Horowitz pursuant to the terms of the

Amended and Restated Confidential Definitive Financing Commitment Term Sheet dated effective March 19, 2017 by and between the Borrower,

Dominic Rodrigues, and Bruce Horowitz

“Requisite

Lenders” means the Lenders holding Notes that represent at least a majority of the outstanding principal amounts of all of

the Notes issued by the Borrower as part of the 2024 Financing Round.

“Series

D-1 Shares” means shares of Series D-1 Convertible Preferred Stock, par value $0.001 per share, of the Borrower.

“Voluntary

Conversion Date” means the date which is three (3) Business Days following the date the Notice of Conversion is delivered to

the Borrower.

[Signatures

contained on next page.]

| Unsecured Convertible Promissory Note | 7 | |

| |

BORROWER: |

| |

|

| |

Provectus

Biopharmaceuticals, Inc. |

| |

|

| |

Name: |

Heather

Raines, CPA |

| |

Title: |

Chief

Financial Officer |

| Unsecured Convertible Promissory Note | 8 | |

Exhibit

A

Form

of Notice of Conversion

(See

Attached)

NOTICE

OF CONVERSION

The

undersigned hereby irrevocably elects to convert (the “Conversion”) $__________ principal amount of the Convertible

Note plus $_________ accrued and unpaid interest on such principal amount into Series D-1 Shares of Provectus Biopharmaceuticals, Inc.

(the “Company”) according to the conditions of the Unsecured Convertible Promissory Note dated [●], 202[●],

as of the date written below. No fee will be charged to the Lender for the conversion.

The

undersigned represents and warrants that it understands that all offers and sales by the undersigned of the Series D-1 Shares issuable

to the undersigned upon Conversion of this Unsecured Convertible Promissory Note shall be made pursuant to registration of such securities

under the Securities Act of 1933, as amended (the “Act”), or pursuant to an exemption from registration under the Act.

| |

Date of Conversion:____________________________ |

| |

|

| |

Applicable Conversion Price:____________________ |

| |

|

| |

Number of Conversion Securities |

| |

to be Issued:__________________________________ |

| |

Signature: |

|

| |

Name: |

|

| |

Address: |

|

| |

|

|

| |

|

|

| |

|

|

ACKNOWLEDGED

AND AGREED:

| PROVECTUS BIOPHARMACEUTICALS, INC. |

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| Date: |

|

|

Exhibit

10.1

FINANCING

TERM SHEET

BY

PROVECTUS

BIOPHARMACEUTICALS, INC.

DATED

EFFECTIVE: July 18, 2024

The

following is a summary of the terms and conditions of a proposed financing plan (the “Plan”) developed by Provectus

Biopharmaceuticals, Inc. (the “Company”). The Plan was approved by the Board of Directors of the Company (the “Board”)

on July 18, 2024.

| Total Financing Commitment |

|

This Financing Term Sheet (the “2024 Term Sheet”)

envisions that the Company shall use its best efforts to arrange for a financing of a maximum of $10 million (the “2024 Financing”),

which amounts may be provided in several tranches. |

| Structure of the Financing |

|

The structure of the 2024 Financing shall be in the form of

an unsecured convertible loan (the “Loan”) from various investors (collectively, the “Investors”).

The Loan shall be evidenced by one or more convertible promissory notes (the “2024 Notes”) from the Company to each

Investor. |

| |

|

The 2024 Notes may voluntarily or automatically convert into

shares of Series D-1 Convertible Preferred Stock of the Company on or before twelve (12) months after the issue date of a 2024 Note,

subject to certain exceptions. |

| |

|

In addition to customary provisions, the 2024 Notes shall contain

the following provisions: |

| (i) | that

the Loan will bear unsecured; |

| (ii) | that

the Loan will bear interest at the rate of eight percent (8%) per annum on the outstanding

principal amount of the Loan that has been funded to the Company; |

| (iii) | that

in the event there is a change of control of the Company’s Board, the term of the 2024

Note shall be accelerated and all amounts due under the 2024 Note shall be immediately due

and payable at the Investor’s option; and |

| (iv) | that

the principal amount of the Loan and interest payable under the Loan, at the Investor’s

option, shall be paid pack, converted into shares of the Company’s Series D-1 Convertible

Preferred Stock, a series of preferred stock designated by the Board, at a price per share

equal to $2.8620 (where the preferred stock shall be convertible into ten [10] shares of

the Company’s Common Stock), or, in the event there is a future financing of the Company,

converted into the equity securities and/or debt instruments of such financing. |

| Use of Proceeds |

|

The proceeds from the 2024 Financing shall be used to fund

the Company’s drug discovery and development program, as currently constituted, and envisioned, and to fund the Company’s

general and administrative expenses. |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

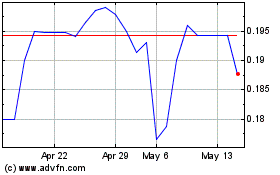

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Nov 2023 to Nov 2024