TIDMCLI

RNS Number : 4524T

CLS Holdings PLC

15 November 2023

PRESS RELEASE

Release date: 15 November 2023

Embargoed until: 07:00

CLS Holdings plc ("CLS", the "Company" or the "Group")

Trading Update for the period 1 July 2023 to 14 November

2023

Fredrik Widlund, Chief Executive of CLS, commented:

"Our business is trading well, and we are making good progress

on our strategic priorities. Leasing activity has increased

substantially, with 93 deals securing GBP10.2 million of annual

rent at 9.1% above ERV signed in the 9 months to 30 September. The

Group is also benefiting from its high proportion of index-linked

leases and a strong performance in our student and hotel

operations. Underlying vacancy is stable. Consequently, the Board

remains confident that the Group will meet its earnings

expectations for the full year.

"Our 2023 refinancing activity is substantially complete and we

have made further progress with refinancing our loans maturing in

2024. The Group has over GBP120 million of cash and undrawn

facilities.

"We are seeing an improving lettings market and some early signs

that the economic headwinds impacting the office sector are

moderating. CLS is well positioned to continue to execute its

operational and asset management initiatives and deliver long term

shareholder value."

A summary of our key operational and financial metrics is set

out below:

Vacancy, lettings and occupancy (as at 30 September 2023)

CLS' deal activity in the first three quarters of 2023 is

tracking significantly higher compared with last year and we expect

this to continue throughout Q4 2023 with the UK performing

particularly strongly since the summer. Rental growth is evident in

all our markets for the right quality offices and floor plate

sizes.

Between 1 July and 30 September 2023, we signed 24 leasing deals

securing GBP2.4 million of annual rent, over 50% higher than the

same period last year, at 6.2% above ERV. The most significant

transactions were a 10-year lease with Hays Recruitment at Apex

Tower and a lease extension with the Borough of Hammersmith and

Fulham at the Clockwork Building, both in the UK.

Between 1 January 2023 and 30 September 2023, we have now signed

93 deals securing GBP10.2 million of annual rent, over 70% higher

than the same period last year, at 9.1% above ERV. The most

significant transaction was at Kruppstrasse (The Brix), in Essen

where we secured a 30-year lease with the City of Essen for EUR3.0

million annually.

The renewals for the 9-months to 30 September 2023 were 2.3%

ahead of previously contracted rent. Index-linked lease increases

for the 9-months to 30 September 2023 were 7.0% in Germany, 5.1% in

France and 11.4% at Spring Gardens in the UK. Since 30 September

2023, we have also secured a 10-year lease renewal with Honda at

Reflex, Bracknell for GBP1.1 million of annual rent, which is above

the previously contracted rent per sq. ft.

The high occupancy levels continue in our Student and Hotel

accommodation in Vauxhall with the student accommodation fully let

for the current academic year and the hotel achieving record

revenues.

Our underlying vacancy from 30 June to 30 September 2023 was

stable but total vacancy increased slightly driven mainly by the

completion of refurbishments now available to let following our

extensive capex programme in 2023 to ensure the portfolio meets

tenants' requirements and sustainability measures.

-- EPRA vacancy rates (Based on 30 June 2023 ERVs):

Group: 9.9% (30 June 2023: 9.2%)

UK: 13.2% (30 June 2023: 12.5%)

Germany: 6.8% (30 June 2023: 6.2%)

France: 7.4% (30 June 2023: 6.8%)

Disposals

The sale of Westminster Tower exchanged in the first half of

2023 and we expect it to complete for GBP40.8 million, 1.2% ahead

of valuation, to Third.i on 30 November 2023.

In addition, we have agreed heads of terms for the sale of a

further four properties for GBP51.2 million, on average 13.1% below

half-year valuation. We expect at least three of these to exchange

before year-end.

If all these five disposals complete, then pro-forma LTV at 30

June 2023, assuming no other changes, would have fallen from 45.1%

to 43.0%.

Liquid resources, financing and rent collection

The Group's balance sheet remains resilient and well positioned

to meet any economic headwinds with cash of over GBP72 million as

at 30 September 2023 and GBP50 million of committed undrawn

Revolving Credit Facilities ('RCFs'). In October and November, we

replaced existing, shorter term facilities with a GBP30 million

3+1+1 year RCF and a GBP20 million 2+1 year RCF respectively.

All 2023 refinancing activity has been completed but for one

remaining loan of GBP24.8 million due in December 2023 which is

currently well advanced with terms agreed. This will complete by

year end.

As at 30 June 2023, we had 10 loans totaling GBP183.7 million at

a 46% property LTV which were due to expire in 2024. We have agreed

extensions for two loans until 2025 and one loan is for Westminster

Tower, for which the sale is due to complete shortly. As a

consequence, we have GBP93.6 million across seven loans at a 42%

property LTV which require refinancing in 2024 and we are already

well advanced with those loans which are due to expire before June

2024.

As at 30 September 2023, our average cost of debt was 3.50% and

80% of total debt was fixed or subject to interest rate caps.

By close on 14 November 2023, we had received 96% of Q4

contractual rents due (2022: 97%) and f or the first three quarters

of 2023, we have now received 99% of contractual rents due (2022:

98%).

Developments and refurbishments

We are nearing the end of our programme of significant

refurbishments to improve the quality of our properties to attract

tenants and drive rental income. We expect capital expenditure to

drop from c.GBP50 million in 2023 to around GBP30 million in

2024.

The lettings of the refurbishment of Park Avenue in Lyon and the

development of The Coade in Vauxhall, which were completed earlier

in the year, are progressing well. At Park Avenue, 7 out of 10

floors are let with 1 floor completed in the period and with terms

out for a further 1 floor and at The Coade we now have one tenant

in occupation and terms out for lettings on two further floors.

"Artesian", 9 Prescot Street, London, our 98,000 sq. ft fully

refurbished and electrified art deco building in Aldgate, was

successfully launched on 1 November 2023 with over 130 agents in

attendance. Viewings and enquiries have increased since the

launch.

Sustainability

In line with our Net Zero Carbon Pathway, we expect to have

completed more than 100 carbon saving projects by the end of 2023

which will save over an estimated 1,000 tonnes of CO2 emissions per

annum making our properties fit for a net zero future. This

includes installing a further 90 kWp of solar PV panels. Our

electric vehicle charging network is now up and running in the UK

with 53 charging points across many of our UK properties to help

tenants with electric vehicle fleet transition.

Our sustainability progress was recognised with EPRA

Sustainability Best Practices Recommendations Gold in 2023, up from

Silver in 2022. We have also maintained our GRESB award of 4 green

stars.

-ends-

For further information, please contact:

CLS Holdings plc

(LEI: 213800A357TKB2TD9U78)

www.clsholdings.com

Fredrik Widlund, Chief Executive Officer

Andrew Kirkman, Chief Financial Officer

+44 (0)20 7582 7766

Liberum Capital Limited

Richard Crawley

Jamie Richards

+44 (0)20 3100 2222

Panmure Gordon

Hugh Rich

+44 (0)20 7886 2733

Berenberg

Matthew Armitt

Richard Bootle

+44 (0)20 3207 7800

Edelman Smithfield (Financial PR)

Alex Simmons

Hastings Tarrant

+44 (0)20 3047 2546

Forward-looking statements

This document may contain certain 'forward-looking statements'.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances.

Actual outcomes and results may differ materially from those

expressed or implied by such forward-looking statements. Any

forward-looking statements made by or on behalf of CLS speak only

as of the date they are made and no representation or warranty is

given in relation to them, including as to their completeness or

accuracy or the basis on which they were prepared. Except as

required by its legal or statutory obligations, the Company does

not undertake to update forward-looking statements to reflect any

changes in its expectations with regard thereto or any changes in

events, conditions or circumstances on which any such statement is

based. Information contained in this document relating to the

Company or its share price, or the yield on its shares, should not

be relied upon as an indicator of future performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFVDLRLSLIV

(END) Dow Jones Newswires

November 15, 2023 02:00 ET (07:00 GMT)

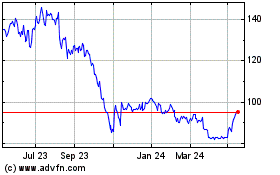

Cls (LSE:CLI)

Historical Stock Chart

From Mar 2025 to Apr 2025

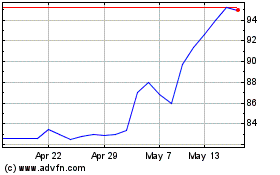

Cls (LSE:CLI)

Historical Stock Chart

From Apr 2024 to Apr 2025