Revolving credit facility

29 November 2002 - 10:12PM

UK Regulatory

RNS Number:4638E

Compagnie de Saint-Gobain

29 November 2002

press release

Compagnie de Saint-Gobain signs

a EUR1.2 billion revolving credit facility

Compagnie de Saint-Gobain announces that the syndication of its EUR1.0 billion

5-year syndicated loan Facility has been closed successfully. The

transaction was well oversubscribed allowing Saint-Gobain to increase the size

of the Facility to EUR1.2 billion. The Facility was signed on November 28, 2002.

The purpose of the Facility is to refinance the existing $1.0 billion syndicated

facility arranged in April 1996 and maturing in April 2003. The Facility will be

used for Commercial Paper backstop and general financing purposes. The Facility

is expected to remain undrawn and will provide the Saint-Gobain Group with an

increased reserve of liquidity for the next 5 years.

The Facility has been supported by a strong group of 19 international banks,

underlying Saint-Gobain's appeal in the debt capital markets. This support also

reflects Saint-Gobain sound financial structure and its ability to generate an

important and regular cash flow.

BNP Paribas, Credit Lyonnais, and JPMorgan were appointed as Mandated Lead

Arrangers. BNP Paribas and JPMorgan acted as Joint-Bookrunner. Credit Lyonnais

acted as Documentation and Facility Agent.

November 28, 2002

Investor Relations Department

Tel. : Florence TRIOU-TEIXEIRA +33 1 47 62 45 19 - mailto : florence.triou@saint-gobain.com

Tel. : Claire MOSES +33 1 47 62 32 36 - mailto : claire.moses@saint-gobain.com

Fax : +33 1 47 62 50 62

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRILFILLELAFIF

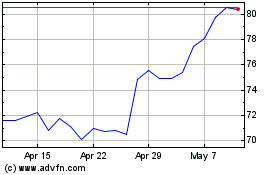

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

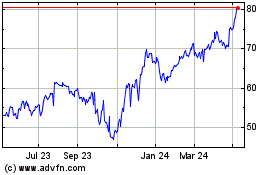

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024